Pfizer Undervalued Post-COVID: Pharmaceutical Giant’s Future Value

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

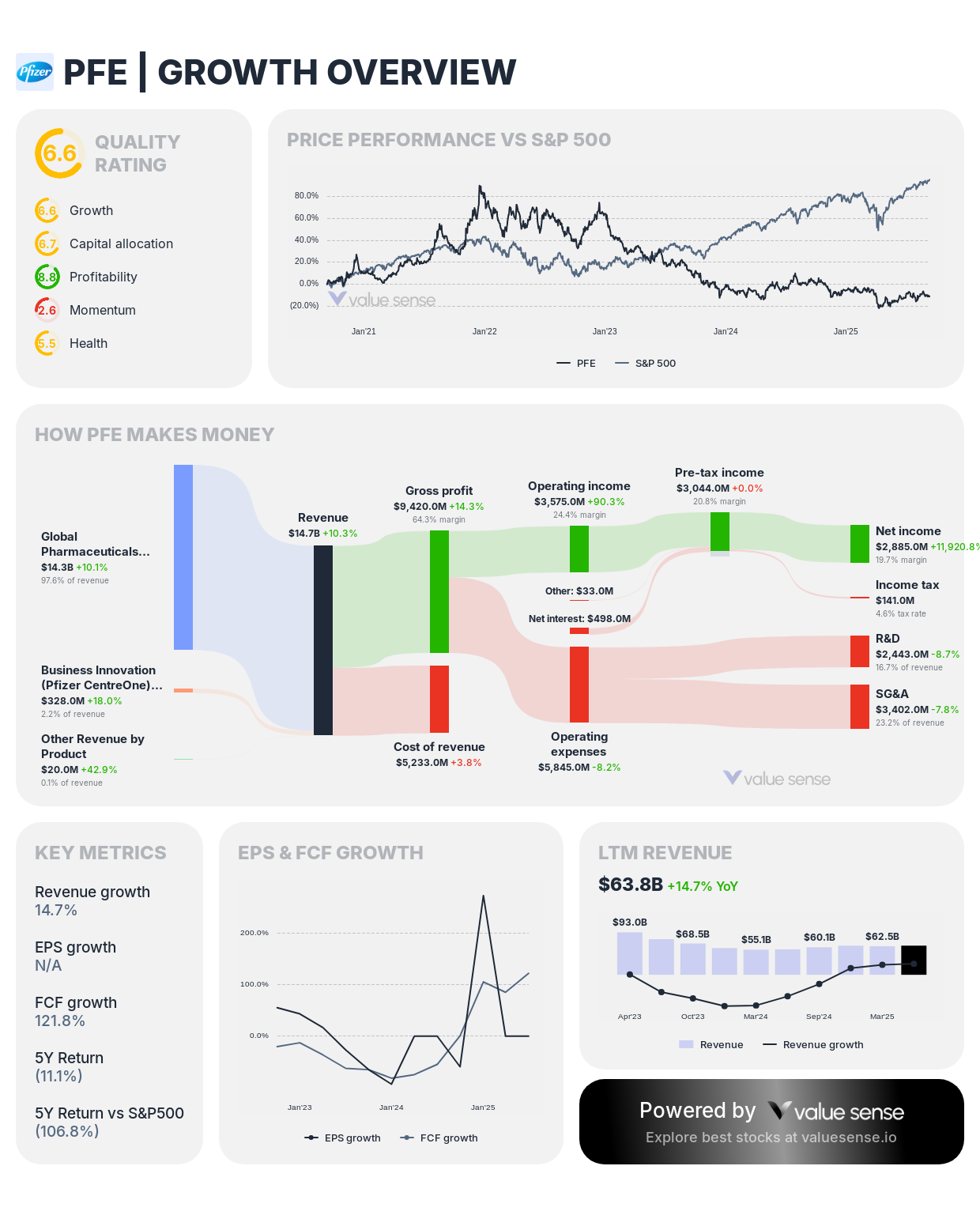

Pfizer Inc. (NYSE: PFE) remains one of the world’s leading pharmaceutical companies, boasting a diverse portfolio of vaccines, specialty medicines, and innovative treatments. After the COVID-19 pandemic delivered unprecedented revenue growth and elevated market valuations, Pfizer faces a critical transition. Despite normalization from pandemic highs, the company’s robust pipeline, improving operational efficiencies, and strategic initiatives underpin a strong case that Pfizer is undervalued in 2025, offering compelling opportunities for value and income-focused investors.

Market Position and Recent Performance

- Market capitalization approximately $140 billion as of mid-2025

- Share price near $25, down roughly 60% from 2021 peaks associated with COVID vaccine sales

- Price-to-Earnings (P/E) ratio near 13 trailing, forward P/E around 8.5, signaling undervaluation relative to expected earnings growth and peer pharma companies

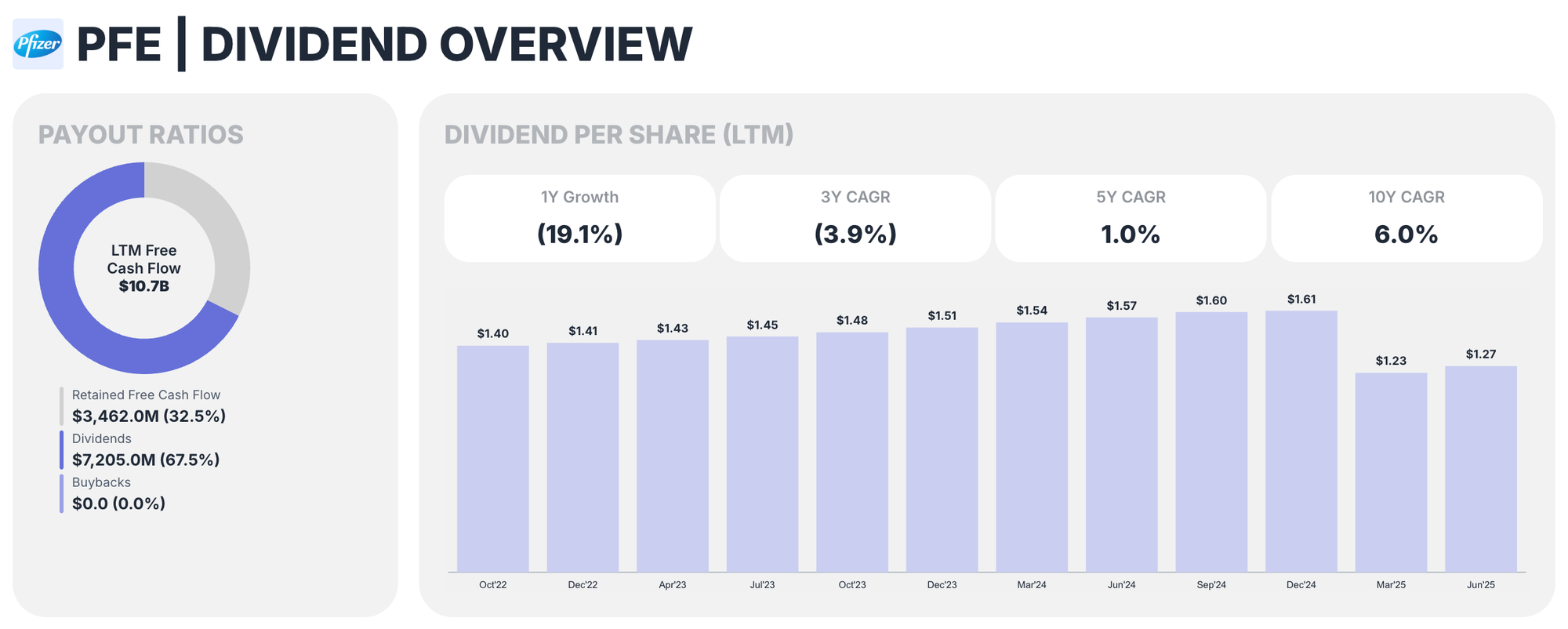

- Dividend yield remains elevated around 5.2%, supported by strong free cash flow and disciplined capital allocation

In Q1 and Q2 2025, Pfizer posted strong results with revenues around $13.7B and $14.7B, respectively, beating analyst expectations. The company reaffirmed 2025 revenue guidance in the range of $61B to $64B, reflecting operational resilience despite headwinds from the U.S. Medicare Part D inflation reduction changes and declining COVID product sales.

Growth Drivers and Pipeline Outlook

While COVID vaccine and therapeutic revenues have plateaued, Pfizer’s broader portfolio shows promising growth trajectories:

- The Vyndaqel family of medicines for rare diseases grew over 30% operationally, driving increased sales in U.S. and international markets

- Oncology and hospital products, including Eliquis, Comirnaty (COVID vaccine), and Paxlovid antiviral treatments, contributed substantially despite market normalizations

- R&D investments focus on gene therapy, oncology, rare diseases, and emerging modalities, complemented by significant pipeline progress and recent acquisitions strengthening long-term prospects

The company projects operating margin expansion aided by ongoing cost savings programs expected to deliver $4.5B in net savings by the end of 2025 and additional productivity gains through 2027. Manufacturing optimization initiatives will further enhance margins.

Financial Discipline and Shareholder Returns

Pfizer demonstrates disciplined capital management:

- Returned nearly $5B to shareholders in dividends in the first half of 2025

- Plans to maintain dividend growth while investing in high-ROI pipeline projects and operational excellence

- Cost realignment programs targeting $4B+ net savings contribute to improved profit margins and EPS growth

- Share repurchase programs help offset dilution and improve per-share metrics

Valuation Analysis and Analyst Insights

- Pfizer trades near historic lows, with forward P/E between 8 and 9, compared to industry averages often above 15

- Analyst price targets average between $28 and $33, indicating 12–30% upside potential from current prices

- Long-term price forecasts near $40+ reflect confidence in pipeline maturation and successful commercial execution

- Earnings per share guidance for 2025 adjusted EPS ranges $2.80–$3.10, with expected operational EPS growth of 10–18% year over year

Pfizer’s risk-adjusted valuation compares favorably to peers, making it a compelling value buy in a typically defensive sector.

Risks and Challenges

- Patent expirations on major drugs like Eliquis may pressure revenues beyond 2027

- Regulatory environment remains uncertain, particularly around drug pricing reforms and Medicare Part D adjustments

- COVID product revenues remain volatile and unlikely to return to early pandemic highs

Nonetheless, Pfizer’s diverse portfolio and strong R&D mitigations limit downside risk relative to many pharmaceutical peers.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 Visa Stock Analysis: Undervalued Digital Payments Growth Story

📖 Procter & Gamble Undervalued: Consumer Staples Dividend Champion

📖 Which Gold Mining Stocks Are Undervalued in September 2025

📖 Adobe Stock Analysis: Undervalued Creative Software Monopoly

FAQ

Q: Why is Pfizer considered undervalued in 2025?

A: Market pricing reflects normalization from COVID surges, patent and regulatory pressures, but Pfizer’s stable cash flow, growth medicines, dividend yield, and cost savings forecast higher intrinsic value.

Q: How sustainable is Pfizer’s dividend?

A: Pfizer’s 7% yield is supported by strong FCF and is augmented by targeted cost savings and robust pipeline investments.

Q: What key products drive Pfizer’s growth?

A: Rare disease treatments like Vyndaqel, oncology drugs, novel antivirals, and sustained vaccine revenues underpin growth and revenue diversification.

Pfizer presents a classic value opportunity in 2025: a pharmaceutical leader with high-quality earnings, attractive dividends, and improving operational efficiency priced for pessimism. For investors seeking resilient income with long-term growth catalysts, Pfizer’s undervaluation and strategic transformation make it a compelling buy in today’s market.