Philippe Laffont - Coatue Management Llc Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

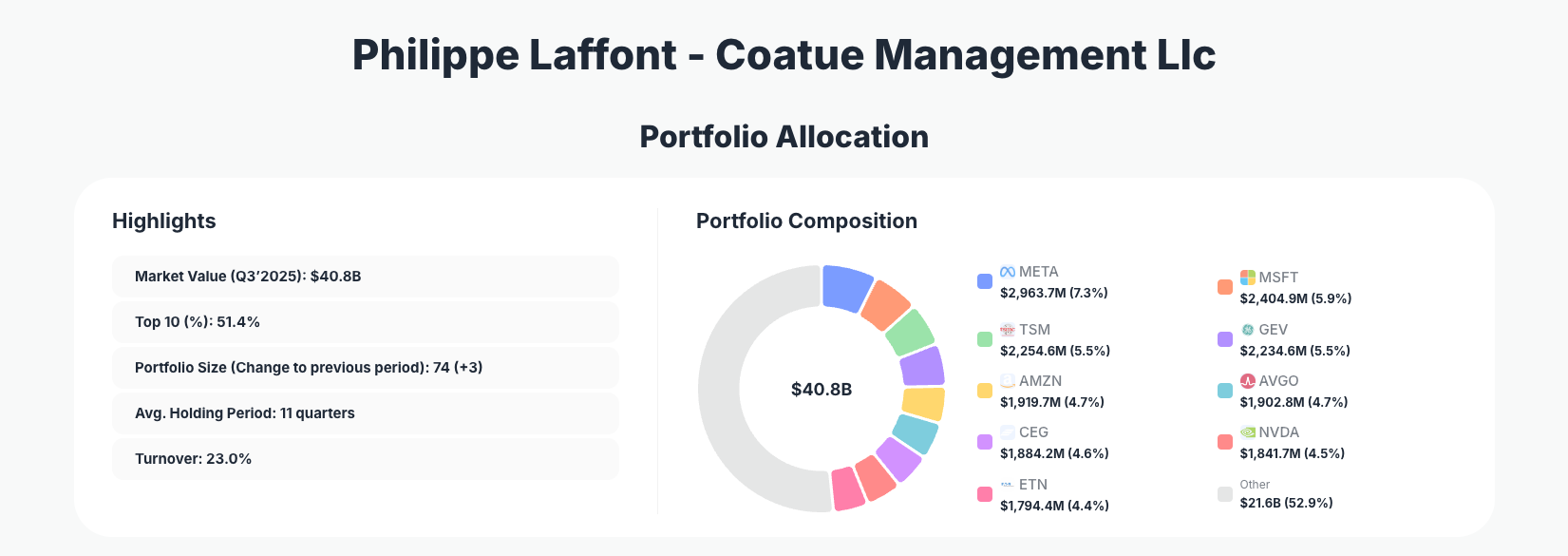

Philippe Laffont - Coatue Management Llc leans even further into large-cap technology and semiconductor leaders in his latest 13F update. His Q3’2025 portfolio shows $40.8B in U.S. equity positions, with more than half of assets concentrated in just ten names—anchored by aggressive additions to Meta Platforms, Microsoft, and a tripling of exposure to Alphabet, while tactically trimming winners like NVIDIA and Amazon.

The Big Picture: Coatue’s Focused Growth Engine

Portfolio Highlights (Q3’2025): - Market Value: $40.8B

- Top 10 Holdings: 51.4%

- Portfolio Size: 74 +3 positions

- Average Holding Period: 11 quarters

- Turnover: 23.0%

Coatue’s portfolio is both diversified across 74 positions and sharply concentrated at the top, with 51.4% of capital in the 10 largest holdings. This barbell structure—many smaller ideas but a tight core of high-conviction winners—fits Laffont’s reputation as a tech-focused growth investor who is willing to size up his best research. The 11-quarter average holding period underscores that these are not quick trades but medium‑ to long‑term thematic bets held through cycles.

With a 23.0% turnover rate in Q3’2025, Coatue’s portfolio shows meaningful but not frenetic activity. Laffont is clearly refining exposures—adding aggressively to select compounders like Microsoft and Alphabet, while trimming positions like NVIDIA and Amazon to manage risk and redeploy capital. This balance of conviction and risk control is a hallmark of Coatue’s process.

The modest expansion to 74 +3 positions suggests that Coatue is selectively adding new ideas at the margin, but not diluting its core. The result is a strategy centered on a handful of global technology and infrastructure franchises, complemented by smaller satellite positions that can scale if they prove themselves.

Top Holdings Analysis: Tech Platforms, Chips, and Critical Infrastructure

The Q3’2025 13F shows a tight cluster of 10–11 major holdings where most of the action occurred. These names define the current shape of the Coatue portfolio and highlight Laffont’s priorities.

The portfolio is led by Meta Platforms, Inc. (META) at 7.3% of assets, where Laffont chose to Add 9.65% to an already major position, taking it to $2,963.7M and 4,035,717 shares. This shows continued conviction in Meta’s core social platforms, advertising engine, and AI‑driven engagement.

Microsoft Corporation (MSFT) sits close behind at 5.9% of the portfolio. Coatue Add 18.07%, lifting its stake to 4,643,050 shares worth $2,404.9M. This sizable increase signals strong belief in Microsoft’s cloud, AI, and enterprise software dominance, likely viewing it as a relatively lower‑risk compounder within big tech.

Taiwan Semiconductor Manufacturing Company Limited (TSM) accounts for 5.5% of the portfolio at $2,254.6M and 8,072,536 shares, with a small Add 0.05%. Even this marginal top‑up shows Laffont’s intent to maintain full exposure to the world’s most critical semiconductor foundry, central to AI, smartphones, and data centers.

Industrial and energy transition exposure appears through GE Vernova Inc. (GEV) at 5.5%, where Coatue chose to Reduce 3.22% to 3,634,166 shares worth $2,234.6M. This trim suggests risk management or profit‑taking while keeping the name as a core holding in energy and grid infrastructure.

In consumer and cloud, Amazon.com, Inc. (AMZN) stands at 4.7%, with Laffont opting to Reduce 13.93% to 8,743,095 shares valued at $1,919.7M. The sizable cut may reflect valuation discipline after strong performance, reallocating to other high‑conviction ideas.

Semiconductor and networking champion Broadcom Inc. (AVGO) also holds 4.7% of the portfolio, where Coatue Add 2.13% to 5,767,559 shares and $1,902.8M in value. This incremental addition expresses confidence in Broadcom’s diversified chip and software stack, a key beneficiary of data‑center and AI build‑outs.

On the energy side, Constellation Energy Corporation (CEG) represents 4.6% of assets at $1,884.2M and 5,725,963 shares, though Coatue chose to Reduce 3.35%. This suggests Laffont is still constructive on nuclear and low‑carbon power, but dialing back position size after strong gains or to rebalance sector exposure.

AI leader NVIDIA Corporation (NVDA) is a key 4.5% holding. Coatue notably Reduce 14.08% here, leaving 9,870,743 shares worth $1,841.7M. After a massive run in AI chips, this trim likely reflects both valuation sensitivity and portfolio risk management while still maintaining substantial exposure.

Industrial and electrical equipment play Eaton Corporation plc (ETN) accounts for 4.4% of the portfolio. Coatue Add 2.28%, owning 4,794,777 shares valued at $1,794.4M. This speaks to a structural bet on electrification, grid modernization, and infrastructure spending.

Rounding out the major changes, Alphabet Inc. (GOOGL) now represents 4.3% of assets after a dramatic Add 259.14% to 7,221,115 shares worth $1,755.5M. This is one of the most aggressive moves in the filing, pointing to renewed confidence in Alphabet’s search, cloud, and AI monetization potential.

Together, these 10–11 names define the risk and return profile of the Coatue portfolio: mega‑cap tech platforms, leading chip and hardware enablers, and critical infrastructure beneficiaries of AI, electrification, and energy transition.

What the Portfolio Reveals About Laffont’s Current Strategy

Several clear strategic themes emerge from Q3’2025 positioning:

- Platform‑centric tech dominance

Large additions to META, MSFT, and GOOGL suggest a strong preference for global software and internet platforms that control distribution, data, and user engagement. These businesses often enjoy network effects, recurring revenue, and significant pricing power. - AI and semiconductor backbone exposure

Holdings in TSM, AVGO, and a still‑large stake in NVDA show Coatue is deeply aligned with the infrastructure layer of AI and cloud computing. Small adds and trims fine‑tune risk rather than changing the thesis. - Energy transition and electrification

Positions in GEV, CEG, and ETN highlight a multi‑year view on grid modernization, nuclear power, and increased electricity demand from data centers and EVs. - Active risk management within a growth framework

Trims in AMZN, NVDA, GEV, and CEG show Laffont is not a “set and forget” investor. He is willing to crystallize gains or reduce concentration even in names he still likes, reallocating into ideas with better risk‑reward. - Global but U.S.-listed focus

While names like TSM and ETN add international business exposure, the portfolio is built mainly around U.S.-listed mega‑caps, simplifying liquidity and execution.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Meta Platforms, Inc. (META) | $2,963.7M | 7.3% | Add 9.65% |

| Microsoft Corporation (MSFT) | $2,404.9M | 5.9% | Add 18.07% |

| Taiwan Semiconductor Manufacturing Company Limited (TSM) | $2,254.6M | 5.5% | Add 0.05% |

| GE Vernova Inc. (GEV) | $2,234.6M | 5.5% | Reduce 3.22% |

| Amazon.com, Inc. (AMZN) | $1,919.7M | 4.7% | Reduce 13.93% |

| Broadcom Inc. (AVGO) | $1,902.8M | 4.7% | Add 2.13% |

| Constellation Energy Corporation (CEG) | $1,884.2M | 4.6% | Reduce 3.35% |

| NVIDIA Corporation (NVDA) | $1,841.7M | 4.5% | Reduce 14.08% |

| Eaton Corporation plc (ETN) | $1,794.4M | 4.4% | Add 2.28% |

The top nine disclosed positions alone account for 46.1% of assets, and the full top‑10 list (including the undisclosed #1 in this slice of data) totals 51.4% of the portfolio. This level of concentration means overall performance will be heavily driven by a handful of mega‑cap tech and infrastructure names, a deliberate choice by Coatue to back its highest‑conviction research.

Within this group, Laffont is clearly rotating capital toward software and internet platforms (META, MSFT) and selectively de‑risking from the most extended AI and e‑commerce winners (NVDA, AMZN). The presence of industrials and energy names (GEV, CEG, ETN) adds a differentiated cyclical and policy‑driven component to what might otherwise be a pure tech fund.

Investment Lessons from Philippe Laffont’s Coatue Strategy

Several practical principles for individual investors emerge from the Q3’2025 Coatue portfolio:

- Concentrate in your best ideas

More than half of assets sit in 10 names. When Laffont has conviction—like in META, MSFT, or TSM—he sizes those positions meaningfully rather than spreading capital too thin. - Let winners run, but trim when risk builds

Cuts in NVDA and AMZN show that you can still like a company while deciding the position has become too large or too expensive. Rebalancing doesn’t mean abandoning the thesis. - Use incremental changes to refine exposure

Moves like Add 0.05% in TSM or Add 2.13% in AVGO illustrate how small adjustments can keep a portfolio aligned with evolving views without wholesale shifts. - Think in themes, not tickers

Across the book you see coherent themes: AI infrastructure, energy transition, electrification, and software platforms. Even trims and adds are executed within those frameworks, which helps maintain strategic clarity. - Holding period discipline matters

An 11‑quarter average holding period implies ideas are underwritten on a multi‑year basis. That mindset can help investors look past short‑term volatility and focus on compounding.

Looking Ahead: What Comes Next for Coatue?

Based on the current shape of the Coatue portfolio, several forward‑looking implications stand out:

- AI and cloud remain central

Large positions in MSFT, GOOGL, META, TSM, AVGO, and NVDA suggest Coatue expects continued investment in data centers, AI workloads, and digital advertising. - Potential rotation within winners

The significant increases in GOOGL and MSFT alongside trims in NVDA and AMZN may continue if relative valuations diverge, with Coatue favoring names where growth and price remain best aligned. - Energy and infrastructure optionality

Continued stakes in GEV, CEG, and ETN position the portfolio for upside if policy support and capital spending on grids, nuclear, and electrification accelerate. - Room for new ideas

With 74 positions and moderate turnover, there is still capacity for Coatue to seed emerging themes—whether in software, cybersecurity, or next‑generation hardware—without disrupting the core.

Investors following Laffont should watch upcoming 13F filings for signs of further rotation within AI, any new bets in early‑stage tech themes, and changes in exposure to cyclical infrastructure names.

FAQ about Philippe Laffont – Coatue Portfolio

Q: What were the biggest changes in Coatue’s Q3’2025 portfolio?

The most notable changes were sizable additions to Microsoft (Add 18.07%), Meta (Add 9.65%), and especially Alphabet (Add 259.14%), alongside meaningful reductions in Amazon (Reduce 13.93%) and NVIDIA (Reduce 14.08%).

Q: How concentrated is Philippe Laffont’s portfolio?

As of Q3’2025, the top 10 holdings represent 51.4% of the $40.8B portfolio, with 74 +3 total positions. This means roughly half of assets are in a small group of high‑conviction names, while the remainder is spread across smaller ideas.

Q: What is Coatue’s average holding period and turnover?

The average holding period is 11 quarters, indicating that positions are often held for several years. Turnover for Q3’2025 was 23.0%, reflecting active but not overly frequent trading as Laffont tunes exposures.

Q: Which sectors or themes dominate Coatue’s holdings?

The largest positions cluster in technology and communication services—names like META, MSFT, GOOGL, TSM, AVGO, and NVDA. There is also significant exposure to energy transition and electrification via GEV, CEG, and ETN.

Q: How can I track Philippe Laffont’s portfolio going forward?

You can follow Coatue’s holdings via quarterly 13F filings, which U.S. institutional managers must submit within 45 days after each quarter‑end. Because of this 45‑day reporting lag, positions may have changed by the time they are disclosed. Platforms like ValueSense aggregate these filings, visualize trends, and provide ongoing analysis—visit Coatue’s portfolio page on ValueSense to monitor updates, top holdings, and historical changes.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!