Poor Charlie's Almanack by Charles T. Munger, edited by Peter D. Kaufman

Welcome to the Value Sense Blog, your resource for insights on the stock market! You're reading a book review written by the valuesense.io team.

On our platform, you'll find stock research and insights across all sectors. Dive into our research products and learn more about our unique approach at valuesense.io

We offer over 360+ automated stock ideas, a free AI-powered stock screener, interactive stock charting tools, and more than 10 intrinsic value models — all designed to help investors find undervalued growth opportunities.

Book Overview

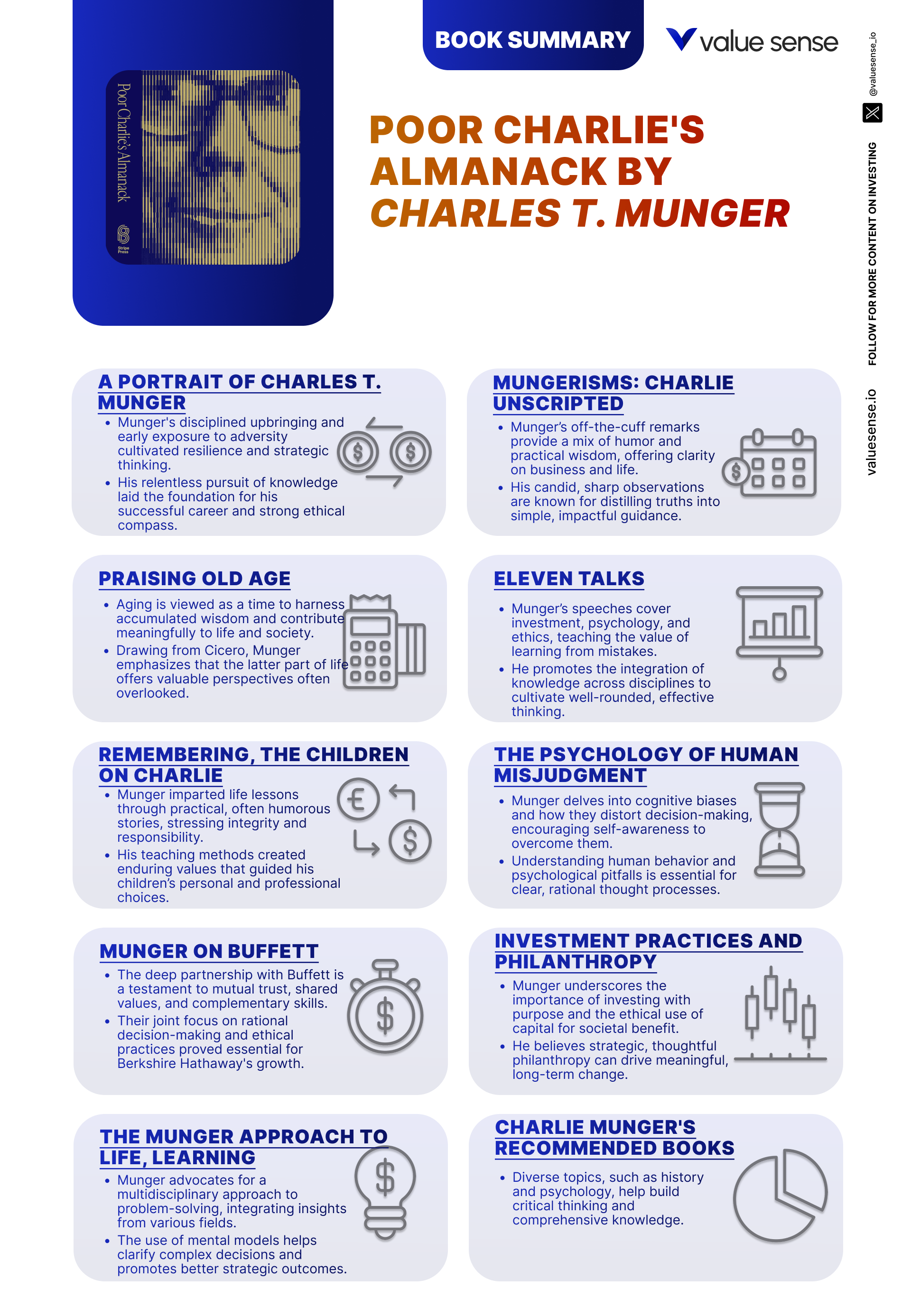

“Poor Charlie’s Almanack” is a unique compendium of the wit, wisdom, and investing philosophy of Charles T. Munger, the legendary vice chairman of Berkshire Hathaway and Warren Buffett’s long-time business partner. Edited by Peter D. Kaufman, the book is more than a simple biography or investment manual—it’s a curated mosaic of speeches, essays, anecdotes, and reflections that together reveal the inner workings of one of the most original minds in finance. Munger’s influence on the investment world is profound, not just for his financial acumen, but for his insistence on multidisciplinary thinking, ethical rigor, and relentless intellectual curiosity.

First published in 2005, “Poor Charlie’s Almanack” arrived at a time when the investing world was still digesting the dot-com bust, and the value investing approach championed by Buffett and Munger was regaining prominence. The book’s title is a nod to Benjamin Franklin’s “Poor Richard’s Almanack,” signaling Munger’s admiration for Franklin’s practical wisdom and polymathic approach. The historical context is critical: Munger’s reflections span decades of market cycles, regulatory changes, and technological disruption, offering readers a long-term perspective that transcends fads and short-term thinking.

The main theme of the book is the cultivation of “worldly wisdom”—the idea that successful investing and decision making require knowledge drawn from a broad array of disciplines, including psychology, economics, mathematics, and history. Munger’s purpose is not to provide a formula for stock picking, but to foster the habits of mind that lead to sound judgment and rational action. He shares his own journey, mistakes, and learning processes, making the book as much about personal development as it is about finance.

“Poor Charlie’s Almanack” is considered a classic because it bridges the gap between theory and practice, offering timeless insights that apply equally to investing, business, and life. Its unique structure—part memoir, part investment treatise, part philosophical meditation—sets it apart from more conventional finance books. Munger’s candor, humor, and intellectual humility make the material accessible and engaging, while the depth of his analysis rewards careful study. The book’s lasting importance lies in its ability to instill a mindset of continuous improvement, ethical conduct, and critical thinking.

This book is essential reading for investors, business leaders, students, and anyone interested in decision making at the highest level. It is especially valuable for those seeking to move beyond rote formulas and develop a deeper understanding of the forces that drive markets and human behavior. What makes “Poor Charlie’s Almanack” truly unique is its multidisciplinary approach, blending investment wisdom with lessons from psychology, history, and philosophy. It offers a blueprint for building not just wealth, but a life of integrity, curiosity, and intellectual fulfillment.

Key Themes and Concepts

Throughout “Poor Charlie’s Almanack,” several key themes emerge that define both Charlie Munger’s worldview and his approach to investing. These themes are interwoven across chapters, speeches, and essays, providing readers with a cohesive framework for decision making and personal development. Munger’s core concepts—lifelong learning, rationality, ethics, multidisciplinary thinking, investment discipline, and psychological insight—are not just theoretical ideals, but practical tools for navigating complex markets and life’s challenges.

By examining these recurring themes, readers gain insight into the mental models that underpin Munger’s success. Each theme is illustrated with vivid examples, memorable quotes, and actionable advice, making the book a treasure trove for those seeking to improve their investing acumen and general reasoning skills. The following are the central themes that run through the almanack, each offering a lens through which to interpret Munger’s wisdom and apply it to real-world situations.

- Lifelong Learning: Munger’s commitment to continuous self-education is a foundational theme in the book. He argues that the world is constantly changing, and only those who keep learning will stay ahead. For Munger, learning is not confined to formal education; it’s a lifelong pursuit that involves reading widely, seeking out new experiences, and learning from mistakes. He famously says, “In my whole life, I have known no wise people who didn’t read all the time—none, zero.” This theme is evident in his reflections on aging, his admiration for polymaths like Benjamin Franklin, and his insistence that investors must constantly update their mental models. Practically, this means dedicating time each day to reading, exposing oneself to new disciplines, and reflecting critically on one’s own decisions.

- Rational Decision Making: Central to Munger’s philosophy is the application of clear, logical thinking to all decisions—especially investment decisions. He warns against the dangers of emotion, groupthink, and cognitive biases, advocating instead for a rigorous, step-by-step approach to problem solving. In chapters such as “Practical Thought About Practical Thought” and “The Psychology of Human Misjudgment,” Munger dissects the mental errors that derail rationality. He encourages investors to use checklists, invert problems (“All I want to know is where I’m going to die so I’ll never go there”), and cultivate skepticism toward easy answers. This theme has practical implications for portfolio construction, risk assessment, and business strategy, urging investors to slow down, question assumptions, and base decisions on evidence rather than emotion.

- Ethics and Integrity: Munger’s insistence on ethical behavior is a recurring motif, both in his personal anecdotes and his analysis of financial scandals. He views integrity not just as a moral imperative, but as a practical necessity for long-term success. In chapters like “The Great Financial Scandal of 2003” and his commencement addresses, Munger details the catastrophic consequences of ethical lapses, from regulatory failures to reputational ruin. He advises investors and business leaders to act honestly, avoid conflicts of interest, and build reputations that can withstand scrutiny. For Munger, “It takes years to build a reputation and seconds to ruin it.” This theme is especially relevant in today’s environment of heightened regulatory oversight and public skepticism toward Wall Street.

- Multidisciplinary Approach: Perhaps Munger’s most distinctive contribution is his advocacy for “worldly wisdom”—the integration of knowledge from multiple disciplines. He argues that the most successful investors and decision makers are those who draw from psychology, mathematics, engineering, biology, and more. In his words, “If you only have a hammer, every problem looks like a nail.” This approach is manifest in his critiques of academic economics, his analysis of human behavior, and his investment strategies. Practically, this means cultivating a broad intellectual toolkit, seeking out diverse perspectives, and resisting the temptation to rely on a single framework. Munger’s multidisciplinary mindset enables him to spot patterns, avoid pitfalls, and capitalize on opportunities that others miss.

- Investment Philosophy: The book outlines Munger’s investment philosophy, which is grounded in long-term thinking, risk management, and value investing. He eschews speculation and market timing in favor of careful analysis, patience, and the pursuit of high-quality businesses. Munger emphasizes the importance of understanding intrinsic value, maintaining a margin of safety, and resisting the urge to chase fads. His advice to charitable foundations and individual investors alike is to focus on durable businesses with strong management and sustainable competitive advantages. This theme is operationalized through case studies, portfolio construction advice, and reflections on Berkshire Hathaway’s success.

- Human Psychology: Understanding the quirks and pitfalls of human psychology is, for Munger, essential to both investing and life. He devotes significant attention to the study of cognitive biases, misjudgment, and irrational behavior. In “The Psychology of Human Misjudgment,” Munger catalogs dozens of psychological tendencies that can lead to poor decisions, from overconfidence to social proof to loss aversion. He urges readers to become students of psychology, not just to avoid their own mistakes, but to anticipate the errors of others. This theme has direct application to market behavior, negotiation, and leadership, equipping investors with tools to navigate the emotional rollercoaster of markets.

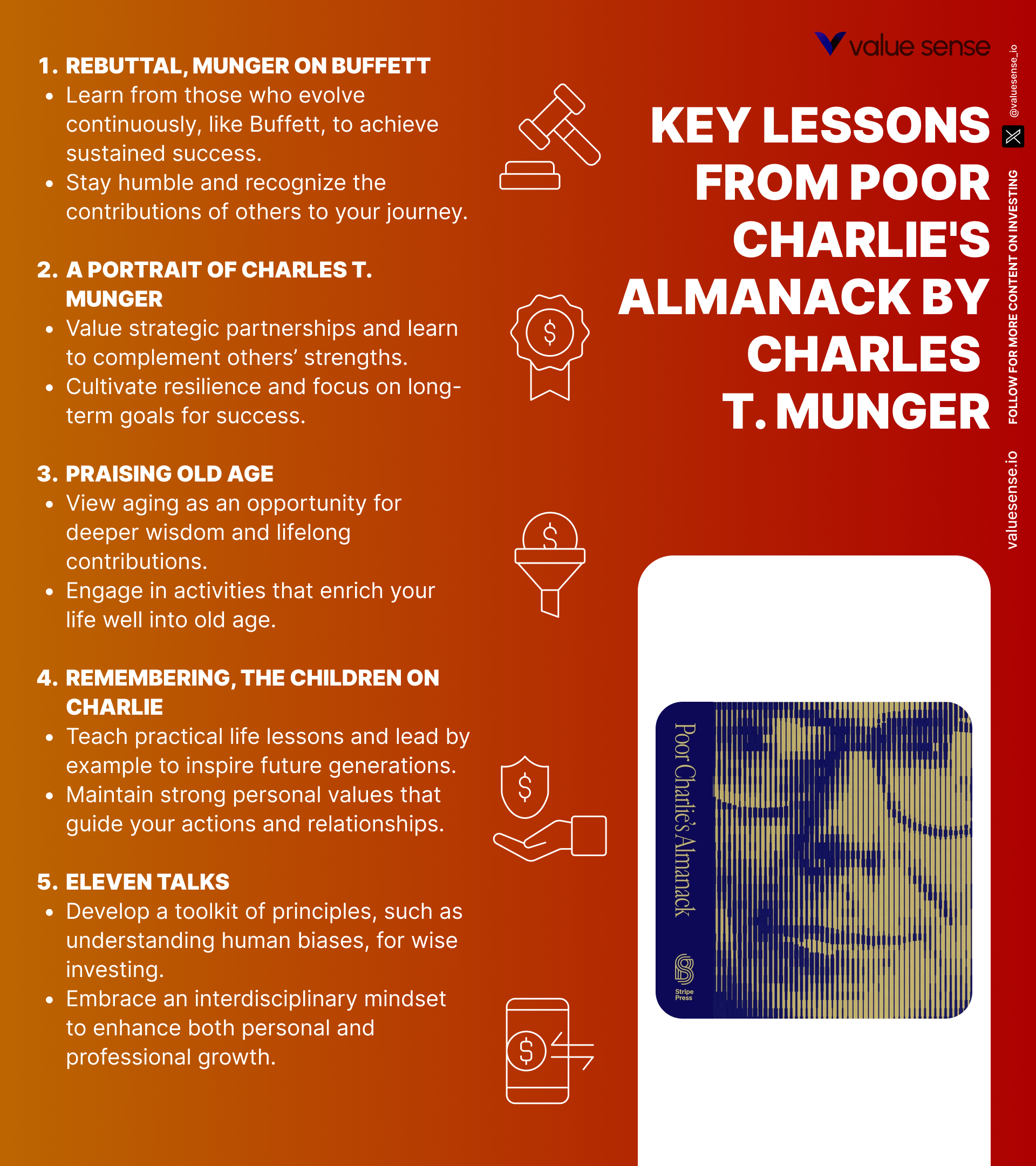

Book Structure: Major Sections

Part 1: Foundations of Wisdom

This section, encompassing Chapters 1 through 3, lays the groundwork for understanding Charlie Munger’s worldview. It introduces his early life, key influences, and the philosophical underpinnings that guide his approach to investing and decision making. The unifying theme is the pursuit of wisdom—both practical and philosophical—as the essential foundation for a successful and meaningful life.

Within these chapters, readers are given a detailed portrait of Munger’s formative years, his intellectual heroes (notably Benjamin Franklin and Cicero), and the experiences that shaped his character. Munger reflects on the process of aging, the value of learning from history, and the importance of cultivating virtues such as patience, humility, and curiosity. He shares anecdotes about his family, education, and early career, illustrating how these experiences contributed to his evolving philosophy. The section also introduces the idea that wisdom is cumulative and that each lesson learned—whether from success or failure—adds to one’s mental toolkit.

For investors, these insights underscore the importance of self-awareness, reflection, and the willingness to question one’s own assumptions. Munger’s emphasis on lifelong learning and character development provides a template for building the habits that lead to sound decision making. Practical application involves dedicating time to reading, seeking mentors, and embracing mistakes as opportunities for growth.

In today’s fast-paced, information-saturated environment, the lessons from this section are more relevant than ever. The ability to synthesize knowledge, remain humble, and adapt to change is critical not just for investors, but for anyone seeking to navigate uncertainty. Munger’s reflections offer reassurance that wisdom is accessible to all who are willing to pursue it with diligence and openness.

Part 2: Investment Philosophy and Practices

Chapters 4 through 6 form the heart of Munger’s investment philosophy, detailing his approach to practical thinking, risk management, and the stewardship of capital, particularly for charitable foundations. The unifying theme is disciplined, rational investment grounded in a deep understanding of both businesses and human nature.

In these chapters, Munger elaborates on the importance of clear, logical thought processes, the avoidance of cognitive biases, and the necessity of long-term thinking. He discusses the pitfalls of speculation, the value of patience, and the need for rigorous analysis. The section also features Munger’s advice to charitable foundations, emphasizing prudent asset allocation, the dangers of short-termism, and the importance of aligning investments with organizational mission and values. He shares case studies from Berkshire Hathaway and other successful enterprises, illustrating the practical application of his principles.

For investors, the actionable takeaways include developing a checklist-based approach to decision making, focusing on intrinsic value rather than market noise, and maintaining a disciplined temperament. Munger’s insistence on a margin of safety and his disdain for financial engineering provide a counterpoint to the riskier strategies that often dominate headlines.

This section’s relevance is heightened in an era of market volatility and financial innovation. Munger’s principles offer a sturdy framework for navigating uncertainty, avoiding fads, and building portfolios that can withstand shocks. His guidance for charitable foundations is particularly timely, given the growing importance of responsible investing and the need to balance returns with social impact.

Part 3: Psychology and Human Behavior

Chapters 7 through 9 delve into the psychological factors that influence decision making, from cognitive biases to the dynamics of financial scandals and the limitations of academic economics. The unifying theme is the recognition that human behavior—often irrational and error-prone—is a critical variable in both investing and life.

Munger meticulously catalogs the psychological tendencies that lead to misjudgment, such as overconfidence, social proof, and loss aversion. He analyzes high-profile financial scandals, dissecting the ethical failures and regulatory lapses that enabled them. The critique of academic economics highlights the disconnect between theoretical models and real-world behavior, advocating for a more pragmatic, multidisciplinary approach. These chapters are rich with examples—from Wall Street excesses to corporate governance failures—that illustrate the consequences of ignoring psychological and ethical realities.

Investors can apply these lessons by cultivating self-awareness, using checklists to counteract biases, and designing systems that minimize the impact of human error. Munger’s advice is to study psychology not just as an academic subject, but as a practical tool for anticipating and avoiding common pitfalls.

In the context of today’s behavioral finance revolution and ongoing corporate scandals, this section’s insights are indispensable. Understanding the psychological drivers of markets and organizations is essential for risk management, leadership, and ethical decision making. Munger’s analysis encourages a proactive approach to identifying and mitigating behavioral risks.

Part 4: Worldly Wisdom and Multidisciplinary Thinking

The final section, covering Chapters 10 and 11, encapsulates Munger’s advocacy for a multidisciplinary approach to problem solving. The theme here is the integration of diverse fields of knowledge—psychology, economics, law, engineering—to develop a comprehensive framework for decision making.

Munger’s speeches and essays in this section highlight the limitations of narrow expertise and the dangers of intellectual siloing. He argues that the most effective decision makers are those who draw on a broad array of mental models, synthesizing insights from multiple disciplines. The section includes his famous commencement address, which distills his philosophy of success, ethics, and lifelong learning into actionable advice for future generations. Munger provides practical examples of how multidisciplinary thinking leads to better investment decisions, more robust risk assessment, and greater adaptability.

For investors, the key is to build a latticework of mental models, seek out knowledge beyond finance, and remain intellectually curious. This means reading widely, engaging with experts from other fields, and constantly updating one’s understanding of the world.

In a world marked by rapid change and increasing complexity, the ability to think across disciplines is more valuable than ever. Munger’s call for worldly wisdom is a blueprint for thriving in uncertain environments, making this section especially relevant for modern investors, entrepreneurs, and leaders.

Deep Dive: Essential Chapters

Chapter 1: A Portrait of Charles T. Munger

This opening chapter is critically important because it sets the stage for the entire book, offering an intimate look at the life and character of Charlie Munger. It provides context for his philosophies, tracing his journey from a modest upbringing in Omaha to his partnership with Warren Buffett at Berkshire Hathaway. The chapter explores the formative experiences and personal values that shaped Munger’s approach to investing, business, and life. Understanding Munger’s background is essential for appreciating the depth and originality of his insights throughout the book.

Specific examples in this chapter include Munger’s early fascination with reading and learning, his time at Harvard Law School, and his formative business ventures before joining forces with Buffett. The narrative details how Munger’s legal training informed his analytical approach, emphasizing the importance of evidence, logic, and ethical reasoning. Memorable quotes, such as “Spend each day trying to be a little wiser than you were when you woke up,” illustrate his commitment to incremental improvement. The chapter also highlights the complementary dynamic between Munger and Buffett, showing how their differing perspectives created a powerful partnership.

Investors can apply the lessons from this chapter by prioritizing lifelong learning, cultivating curiosity, and seeking out diverse experiences. Munger’s emphasis on rational decision making and ethical conduct provides a template for building a successful investment career. Concrete steps include reading widely across disciplines, maintaining humility in the face of uncertainty, and seeking mentors who challenge one’s thinking. The partnership model between Munger and Buffett also offers insights into the value of collaboration and constructive dissent.

Historically, Munger’s journey mirrors the evolution of value investing in the postwar era, as well as the broader shift toward multidisciplinary thinking in finance. His rise from humble beginnings to the heights of the investment world serves as a powerful example of the American meritocratic ideal. The chapter’s lessons remain relevant for modern investors navigating a world of rapid change and increasing complexity, underscoring the enduring value of character, curiosity, and intellectual rigor.

Chapter 3: Munger’s Reflections on Aging

This chapter is critically important because it reveals Munger’s philosophical outlook on life, particularly his approach to aging and self-improvement. Drawing inspiration from Cicero’s writings on old age, Munger explores the virtues of wisdom, patience, and adaptability. He argues that aging should be embraced as an opportunity for growth and reflection, rather than feared or resisted. The chapter provides a window into Munger’s broader worldview, linking personal development to investment success.

Detailed examples include Munger’s reflections on the importance of maintaining intellectual vitality, his daily reading habits, and his admiration for historical figures who remained productive into old age. He discusses the value of learning from past mistakes and the role of humility in personal development. Memorable passages, such as “The best armor of old age is a well-spent life of honest work and accomplishment,” underscore his belief in the cumulative power of good habits. The chapter also addresses the psychological challenges of aging, offering practical advice for staying engaged and resilient.

Investors can apply these lessons by adopting a mindset of continuous self-improvement, regardless of age or experience. Munger’s example encourages readers to seek out new knowledge, reflect on past decisions, and remain open to change. Practical steps include setting aside time each day for reading and reflection, embracing constructive feedback, and viewing setbacks as learning opportunities. The emphasis on historical perspective also suggests the value of studying market history and learning from the successes and failures of others.

In a modern context, Munger’s reflections on aging are especially relevant in an era of longer life expectancies and rapid technological change. His advice to remain curious, adaptable, and humble resonates with investors and professionals facing the challenges of a dynamic world. The chapter’s wisdom extends beyond finance, offering guidance for living a fulfilling and meaningful life at any age.

Chapter 4: Practical Thought About Practical Thought

This chapter is a cornerstone of Munger’s philosophy, highlighting the necessity of clear, rational thinking in both investing and everyday life. It is critically important because it dissects the mechanics of practical thought, exposing the cognitive traps that often derail decision making. Munger’s focus on the discipline of thinking—rather than just the outcomes—sets this chapter apart as a guide for cultivating sound judgment.

Within the chapter, Munger provides detailed examples of how to approach problems systematically, using inversion, checklists, and critical questioning. He warns against the dangers of confirmation bias, overconfidence, and the tendency to seek easy answers. Notable quotes include, “Invert, always invert,” and his admonition to avoid fooling oneself. The chapter is rich with anecdotes from Munger’s own investment decisions, illustrating how rigorous analysis and skepticism can lead to better results. He also references historical case studies, such as the failures of prominent businesses that ignored basic principles of rationality.

Investors can apply these lessons by developing structured decision-making processes, such as using checklists to counteract biases and systematically testing assumptions. Munger’s approach encourages readers to slow down, question their own reasoning, and seek disconfirming evidence. Practical steps include documenting investment theses, regularly reviewing decisions, and learning from both successes and failures. The emphasis on process over outcome is especially valuable for managing risk and avoiding costly mistakes.

The historical context of this chapter is the evolution of behavioral finance and the growing recognition of cognitive biases in decision making. Munger’s insights predate much of the academic literature on these topics, making his advice both prescient and enduring. In today’s world of information overload and rapid decision cycles, the principles outlined in this chapter are more relevant than ever, offering a blueprint for rational action in complex environments.

Chapter 6: Investment Practices of Leading Charitable Foundations

This chapter is critically important because it extends Munger’s investment philosophy to the realm of philanthropy, offering guidance for charitable foundations on optimizing their investment strategies. Munger’s insights are valuable not only for nonprofit leaders, but for any investor concerned with long-term stewardship of capital and responsible risk management.

Specific examples in the chapter include case studies of leading foundations, analysis of asset allocation strategies, and discussions of the unique challenges faced by charitable organizations. Munger emphasizes the importance of aligning investments with mission and values, avoiding unnecessary complexity, and maintaining a long-term orientation. He critiques the tendency toward excessive diversification and short-termism, advocating instead for concentrated investments in high-quality assets. Notable quotes include his assertion that “the wise charitable foundation invests as if it were going to last forever.” The chapter also addresses the ethical responsibilities of fiduciaries, highlighting the need for transparency and accountability.

Investors can apply these lessons by adopting a disciplined approach to portfolio construction, focusing on intrinsic value and margin of safety. For charitable foundations, this means developing clear investment policies, regularly reviewing performance, and resisting the pressure to chase fads or adopt unproven strategies. Practical steps include conducting thorough due diligence, prioritizing quality over quantity, and maintaining a steady hand during market turbulence. Munger’s advice is equally applicable to individual investors seeking to build resilient, purpose-driven portfolios.

The modern relevance of this chapter is underscored by the growing emphasis on responsible investing and the need for nonprofits to balance financial returns with social impact. Munger’s principles offer a roadmap for navigating the complexities of today’s investment landscape, emphasizing the enduring value of prudence, patience, and ethical stewardship.

Chapter 8: The Great Financial Scandal of 2003

This chapter is a pivotal analysis of ethics and integrity in finance, using the financial scandals of the early 2000s as a cautionary tale. It is critically important because it exposes the systemic failures—both ethical and regulatory—that can undermine markets and destroy wealth. Munger’s examination of these events provides lessons not only for investors, but for policymakers, business leaders, and regulators.

Detailed examples include the collapse of major corporations due to accounting fraud, conflicts of interest, and regulatory lapses. Munger dissects the incentives that led executives and advisors to prioritize short-term gains over long-term sustainability, citing high-profile cases such as Enron and WorldCom. Memorable quotes include, “Show me the incentive and I’ll show you the outcome,” highlighting the central role of incentives in shaping behavior. The chapter also explores the failures of auditors, boards, and regulators to detect and address wrongdoing, illustrating the importance of robust corporate governance.

Investors can apply these lessons by conducting thorough due diligence, scrutinizing management incentives, and prioritizing companies with strong cultures of integrity. Practical steps include analyzing compensation structures, reviewing board independence, and monitoring for red flags in financial reporting. Munger’s advice is to avoid businesses that rely on aggressive accounting or have histories of ethical lapses, as these are often precursors to disaster.

The historical context of this chapter is the wave of corporate scandals that rocked markets in the early 2000s, leading to significant regulatory reforms such as the Sarbanes-Oxley Act. The lessons remain relevant in today’s environment of complex financial products and globalized markets, where ethical failures can have far-reaching consequences. Munger’s analysis underscores the timeless importance of integrity and the need for vigilant oversight.

---

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

---

Chapter 9: Academic Economics

This chapter is critically important because it challenges the assumptions and limitations of academic economics, advocating for a more practical, multidisciplinary approach to understanding markets. Munger’s critique is both incisive and constructive, offering a roadmap for bridging the gap between theory and practice.

Specific examples include Munger’s analysis of economic models that fail to account for human behavior, the limitations of equilibrium-based thinking, and the dangers of ignoring real-world data. He highlights the disconnect between academic research and practical investing, citing cases where reliance on flawed models led to significant losses. Memorable quotes include, “It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent.” The chapter also discusses the value of integrating insights from psychology, history, and other disciplines into economic analysis.

Investors can apply these lessons by remaining skeptical of overly complex models, focusing on empirical evidence, and seeking out diverse perspectives. Practical steps include studying market history, learning from behavioral finance, and questioning assumptions that lack real-world validation. Munger’s advice is to prioritize practicality and adaptability over theoretical elegance, building a toolkit that reflects the messy realities of markets.

The modern relevance of this chapter is evident in the ongoing debates about the usefulness of economic models, especially in the wake of financial crises that exposed their shortcomings. Munger’s multidisciplinary approach offers a way forward for investors and policymakers seeking to navigate uncertainty and complexity with greater confidence.

Chapter 10: USC Gould School of Law Commencement Address

This chapter is a distillation of Munger’s life philosophy, delivered as a commencement address to law graduates. It is critically important because it encapsulates his core values—ethics, lifelong learning, and broad-based education—offering timeless advice for personal and professional success.

In the address, Munger shares anecdotes from his own life, emphasizing the importance of integrity, humility, and intellectual curiosity. He advises graduates to “develop into lifelong self-learners through voracious reading; cultivate curiosity and strive to become a little wiser every day.” The speech highlights the dangers of narrow specialization and the benefits of a multidisciplinary education. Munger also discusses the role of ethics in building a successful career, warning that “the safest way to try to get what you want is to try to deserve what you want.” The chapter is rich with quotable lines and practical wisdom, making it a favorite among readers.

Investors and professionals can apply these lessons by prioritizing character development, seeking out diverse learning opportunities, and building reputations for honesty and reliability. Practical steps include reading widely, engaging with mentors, and making decisions that align with long-term values rather than short-term gain. Munger’s emphasis on integrity and lifelong learning provides a foundation for enduring success in any field.

The historical context of this address is the increasing complexity and specialization of modern careers, which often leads to siloed thinking and ethical blind spots. Munger’s advice is a powerful antidote, encouraging readers to cultivate broad perspectives and unwavering ethical standards. The chapter’s lessons are as relevant today as ever, offering guidance for navigating the challenges of a rapidly changing world.

Chapter 11: The Psychology of Human Misjudgment

This chapter is arguably the most influential in the book, providing a comprehensive analysis of the cognitive biases and psychological pitfalls that lead to poor decision making. It is critically important because it equips readers with the tools to recognize and counteract the mental errors that can undermine both investing and everyday life.

Munger systematically catalogs dozens of psychological tendencies, such as confirmation bias, social proof, authority bias, and loss aversion. He illustrates each with vivid examples from history, business, and personal experience. Notable quotes include, “The human mind is a lot like the human egg, in that the human egg has a shut-off device. When one sperm gets in, it shuts down so the next one can’t get in. The human mind works the same way.” The chapter is filled with practical strategies for overcoming these biases, such as using checklists, seeking out disconfirming evidence, and cultivating skepticism. Munger’s analysis draws on research from psychology, neuroscience, and behavioral economics, making it a multidisciplinary tour de force.

Investors can apply these lessons by building systems that minimize the impact of bias, such as documenting investment decisions, regularly reviewing outcomes, and fostering a culture of constructive dissent. Practical steps include learning about common biases, training oneself to recognize them in real time, and using structured processes to counteract their effects. Munger’s advice is to become a student of psychology, not just for personal improvement, but to anticipate the mistakes of others and capitalize on market inefficiencies.

The historical context of this chapter is the emergence of behavioral finance as a critical field, challenging the rational actor model that dominated classical economics. Munger’s insights predate much of the academic literature, making him a pioneer in the application of psychology to investing. The chapter’s lessons remain indispensable in today’s world of information overload, social media, and rapid decision cycles, providing a roadmap for rational action in an irrational world.

Practical Investment Strategies

- Develop a Latticework of Mental Models: Munger’s core strategy is to build a “latticework” of mental models drawn from multiple disciplines. Start by identifying key models from psychology, economics, mathematics, engineering, and biology. Dedicate time each week to studying these models, using resources such as books, lectures, and online courses. Create a personal reference guide summarizing each model and its application to investing. Regularly review and update this guide as you encounter new ideas. The goal is to develop the ability to approach problems from multiple angles, increasing the likelihood of sound decisions and reducing the risk of blind spots.

- Use Inversion to Solve Problems: Munger champions the technique of inversion—solving problems by considering the opposite or by asking, “What could cause failure?” For each investment decision, explicitly list potential ways it could go wrong: management failure, regulatory risks, competitive disruption, or flawed assumptions. By identifying and mitigating these risks upfront, you can avoid common pitfalls. Implement this by adding an “inversion” section to your investment memos and checklists, ensuring that you systematically consider negative outcomes before committing capital.

- Implement a Rigorous Checklist Process: To counteract cognitive biases and ensure thorough analysis, develop a comprehensive investment checklist. Include items such as: assessment of business quality, management integrity, financial health, competitive advantage, valuation, and risk factors. Before making any investment, require yourself or your team to complete the checklist and document the rationale for each item. Regularly revisit and refine the checklist based on new lessons and market developments. This process helps standardize decision making, reduce errors, and promote accountability.

- Focus on High-Quality Businesses with Durable Moats: Munger advises investing in companies with sustainable competitive advantages—so-called “moats.” Screen for businesses with strong brands, network effects, cost advantages, or regulatory barriers. Analyze historical return on capital, profit margins, and market share stability. Avoid companies in commoditized or rapidly changing industries unless they possess clear, defensible advantages. Allocate the bulk of your portfolio to a small number of these high-quality businesses, rather than diversifying excessively across mediocre opportunities.

- Maintain a Margin of Safety: Always invest with a margin of safety by purchasing assets below their intrinsic value. Use conservative assumptions when estimating intrinsic value, incorporating a buffer for unforeseen risks. Apply this principle by setting strict buy and sell criteria, refusing to chase overvalued stocks, and being willing to hold cash when opportunities are scarce. The margin of safety protects against analytical errors, market volatility, and unexpected events, ensuring long-term capital preservation.

- Embrace Patience and Long-Term Thinking: Munger’s approach is rooted in patience and the willingness to wait for the right opportunities. Resist the urge to trade frequently or react to short-term market noise. Set clear long-term goals for your portfolio and review performance on an annual or semi-annual basis rather than daily. Use periods of market volatility to add to high-conviction positions, and avoid selling quality assets due to temporary setbacks. This discipline allows compounding to work in your favor and reduces the impact of transaction costs and taxes.

- Prioritize Ethical and Transparent Management: Invest only in companies led by honest, competent, and shareholder-oriented management teams. Review proxy statements, compensation structures, and insider ownership to assess alignment of interests. Avoid companies with histories of ethical lapses, aggressive accounting, or opaque disclosures. Engage with management through earnings calls, investor days, and direct communication to evaluate their candor and strategic vision. Strong governance reduces the risk of scandal and enhances long-term value creation.

- Integrate Behavioral Finance Insights: Recognize and mitigate the influence of cognitive biases—such as overconfidence, anchoring, and herd mentality—on your decision making. Use journaling to track your investment decisions and emotional states, identifying patterns of error over time. Foster a culture of constructive dissent within your investment team, encouraging challenge and debate. Study behavioral finance literature and incorporate lessons into your processes, such as using pre-mortems to anticipate potential failures. This awareness helps you avoid costly mistakes and capitalize on market inefficiencies created by the errors of others.

Modern Applications and Relevance

The principles outlined in “Poor Charlie’s Almanack” remain highly relevant in today’s rapidly evolving investment landscape. Since the book’s publication, markets have become more globalized, technology-driven, and information-saturated, presenting both new opportunities and new risks. Yet, the core tenets of Munger’s philosophy—lifelong learning, rationality, ethics, and multidisciplinary thinking—have only grown in importance as investors grapple with greater complexity and uncertainty.

One major change since Munger’s era is the proliferation of algorithmic trading, passive investing, and alternative assets. While these developments have increased market efficiency, they have also introduced new forms of risk, such as flash crashes and crowded trades. Munger’s advice to focus on fundamentals, avoid herd behavior, and maintain a margin of safety is a powerful antidote to the temptations of short-term speculation and technological hype. His emphasis on understanding the underlying business, rather than relying on quantitative models alone, is especially pertinent in an age of “big data” and machine learning.

The book’s focus on behavioral finance is also more relevant than ever. Social media, rapid news cycles, and the democratization of trading platforms have amplified the psychological biases that Munger warns against. Investors today must be even more vigilant in recognizing the influence of emotion, groupthink, and misinformation on market behavior. Tools such as checklists, journaling, and systematic decision making—championed by Munger—are essential for maintaining discipline and objectivity in a noisy environment.

At the same time, the rise of ESG (Environmental, Social, and Governance) investing and the growing demand for corporate responsibility echo Munger’s insistence on ethics and integrity. Investors are increasingly seeking companies with strong cultures, transparent governance, and sustainable business models. Munger’s lessons on the catastrophic consequences of ethical lapses are a timely reminder of the importance of reputation and trust in building long-term value.

Modern examples abound of Munger’s principles in action. The success of technology giants like Apple and Alphabet reflects the power of durable moats and patient capital. The collapse of high-flying startups with weak governance or unsustainable business models illustrates the dangers of ignoring fundamentals. Investors who have thrived in recent decades—such as those who avoided the dot-com bubble, the 2008 financial crisis, or the meme stock mania—have often done so by adhering to the timeless wisdom found in “Poor Charlie’s Almanack.”

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Implementation Guide

- Begin with Self-Assessment and Education: Start by conducting an honest assessment of your current knowledge, skills, and biases. Identify gaps in your understanding of key disciplines such as accounting, psychology, and economics. Set aside dedicated time each week for reading and self-education, focusing on both foundational texts (e.g., “The Intelligent Investor,” behavioral finance literature) and current market analysis. Create a personal development plan with specific learning goals and timelines, tracking your progress over time.

- Build Your Latticework of Mental Models: Over the next three to six months, systematically study the core mental models outlined by Munger. For each model, write a summary of its key concepts, real-world applications, and limitations. Discuss these models with peers or mentors to deepen your understanding and identify areas for further exploration. Incorporate new models as you encounter them, aiming to build a comprehensive, multidisciplinary toolkit.

- Construct a Disciplined Investment Portfolio: Apply Munger’s principles by screening for high-quality businesses with durable competitive advantages, strong management, and attractive valuations. Limit your portfolio to 10-20 well-researched positions, ensuring adequate diversification without diluting conviction. Allocate capital based on your highest-conviction ideas, while maintaining a margin of safety in each investment. Review your portfolio quarterly to assess performance, identify mistakes, and make incremental improvements.

- Establish Ongoing Decision-Making Processes: Implement a rigorous checklist for all investment decisions, covering business quality, management integrity, financial health, valuation, and risk factors. Document your investment theses and regularly review outcomes to identify patterns of error or success. Schedule periodic reviews—monthly for tactical decisions, quarterly for portfolio performance, and annually for strategic reassessment. Use these reviews to refine your processes, update your knowledge, and stay aligned with your long-term goals.

- Pursue Continuous Improvement and Community Engagement: Commit to lifelong learning by staying current with market developments, academic research, and emerging trends. Attend industry conferences, participate in investment forums, and seek out mentors who challenge your thinking. Regularly revisit your mental models and investment checklist, incorporating new insights and lessons learned. Share your knowledge with others, fostering a culture of curiosity, humility, and intellectual generosity. Leverage resources such as Value Sense’s stock research, screeners, and intrinsic value models to enhance your ongoing development and investment performance.

10+ Free intrinsic value tools

For investors looking to find a stock's fair value, our analytics team has you covered with intrinsic value tools:

📍 Free Intrinsic Value Calculator

📍 Reverse DCF & DCF value tools

📍 Peter Lynch Fair Value Calculator

📍 Ben Graham Fair Value Calculator

📍 Relative Value tool

...and plenty more.

🔍 Explore all these tools for free on the Value Sense platform and start discovering what your favorite stocks are really worth.

FAQ: Common Questions About Poor Charlie's Almanack

1. What is the main message of “Poor Charlie’s Almanack”?

The main message of “Poor Charlie’s Almanack” is that success in investing and life comes from cultivating “worldly wisdom”—a broad, multidisciplinary understanding of the world—combined with rational decision making, ethical conduct, and a commitment to lifelong learning. Charlie Munger emphasizes the importance of integrating knowledge from diverse fields, recognizing and counteracting cognitive biases, and maintaining integrity in all endeavors. The book offers practical frameworks and mental models for making better decisions and building lasting value.

2. How does Munger’s approach to investing differ from Warren Buffett’s?

While both Munger and Buffett are value investors, Munger’s approach is distinguished by his emphasis on multidisciplinary thinking and psychological insight. He encourages looking beyond traditional financial analysis to incorporate lessons from psychology, history, and other sciences. Munger is also more willing to invest in high-quality businesses at fair prices, rather than insisting on deep value bargains. His influence has helped Berkshire Hathaway evolve from a pure value investor to a quality-focused, long-term owner of exceptional businesses.

3. What are some practical ways to apply Munger’s mental models?

Practical application of Munger’s mental models includes building a personal “latticework” of key concepts from various disciplines, using checklists to guide investment decisions, and employing inversion to anticipate potential failures. Investors should regularly study new fields, reflect on their own biases, and seek out diverse perspectives. Applying these models means approaching each problem from multiple angles, rigorously testing assumptions, and learning from both successes and mistakes.

4. Is “Poor Charlie’s Almanack” suitable for beginner investors?

Yes, the book is accessible to beginners, though its depth and breadth make it valuable for experienced investors as well. Munger’s clear writing, practical examples, and emphasis on fundamental principles provide a solid foundation for anyone new to investing. Beginners will benefit from the focus on critical thinking, ethics, and lifelong learning, while more advanced readers will appreciate the nuanced analysis and multidisciplinary insights.

5. How can investors use the lessons from “Poor Charlie’s Almanack” in today’s markets?

Investors can use Munger’s lessons by focusing on high-quality businesses, maintaining a margin of safety, and resisting the urge to follow market fads or emotional impulses. The book’s emphasis on rationality, ethics, and continuous improvement is particularly relevant in today’s volatile, information-rich environment. By applying Munger’s mental models, checklists, and multidisciplinary approach, investors can make better decisions, avoid common pitfalls, and build resilient portfolios for the long term.