PORSCHE AND VOLKSWAGEN: A Story of Market Manipulation That Could Have Been Written by Shakespeare

This article was written by guest author Alisa Topchiy

Porsche...Porsche... PORSCHE...

A machine that is impossible not to admire—and the company that produces it is now a huge corporation. In 2020, despite the pandemic, Porsche AG sold 272,162 cars, and its value grew to €28.7 billion (≈£22.9 bn). But it was not always so. Back in the last century, despite having iconic status, Porsche AG was still a small, family-owned sports car corporation. Yet somehow, in 2005, the company decided to take over the mighty Volkswagen AG.

Wait, WHAT?

Yes, folks, this is a story of such drama that could have been written by Shakespeare. We’re a long way from Shakespeare, but let’s give it a try.

ACT I

SCENE 1: Porsche starts the VW takeover

The year 2005. Volkswagen is going through hard times. Its net profit from an annual revenue of $118 billion is less than $1.4 billion. The whole company’s gross profit is only $16 billion so there are a lot of people who are keen to buy such a cheap business. But since Volkswagen produces Porsche’s goldmine—the Сayenne—and the company, in general, is an important strategic partner, Porsche decides that it needs to take control of VW before someone else does.

And so Porsche, with its free $6 billion on the account, starts the takeover. The grand plan is, of course, kept secret.

When, on September 25, 2005, Wendelin Wiedeking, Porsche’s chief executive, makes the official announcement that Porsche is buying 20% of VW shares, people are shocked and do not understand what Porsche is up to.

Wiedeking explains:

“With this engagement, we want to secure our business relations with VW and also safeguard in the long term a significant part of our future planning.”

It still sounds strange. But in Germany, there is a law called The Volkswagen Act, which says that all people or legal entities owning more than 20% of Volkswagen shares are entitled to veto major decisions. That is to say, having bought 20% of VW stocks, Porsche has completely secured itself against anyone coming in and stopping production of the Сayenne. However, the entire financial community remains very suspicious of this story.

SCENE 2: Porsche goes on the offensive

August 2006. Porsche has increased its stake to 25% and is actively pressing the government to abolish The Volkswagen Act. The question is, why is it even needed? After all, Germany is now a member of the European Union, which, in addition to a single currency, also shares common laws. These include a law of free movement of capital, which says that those who own 25% or more of a company have the right of veto. However, for Volkswagen, a separate domestic law guaranteed a veto with just 20% of the shares.

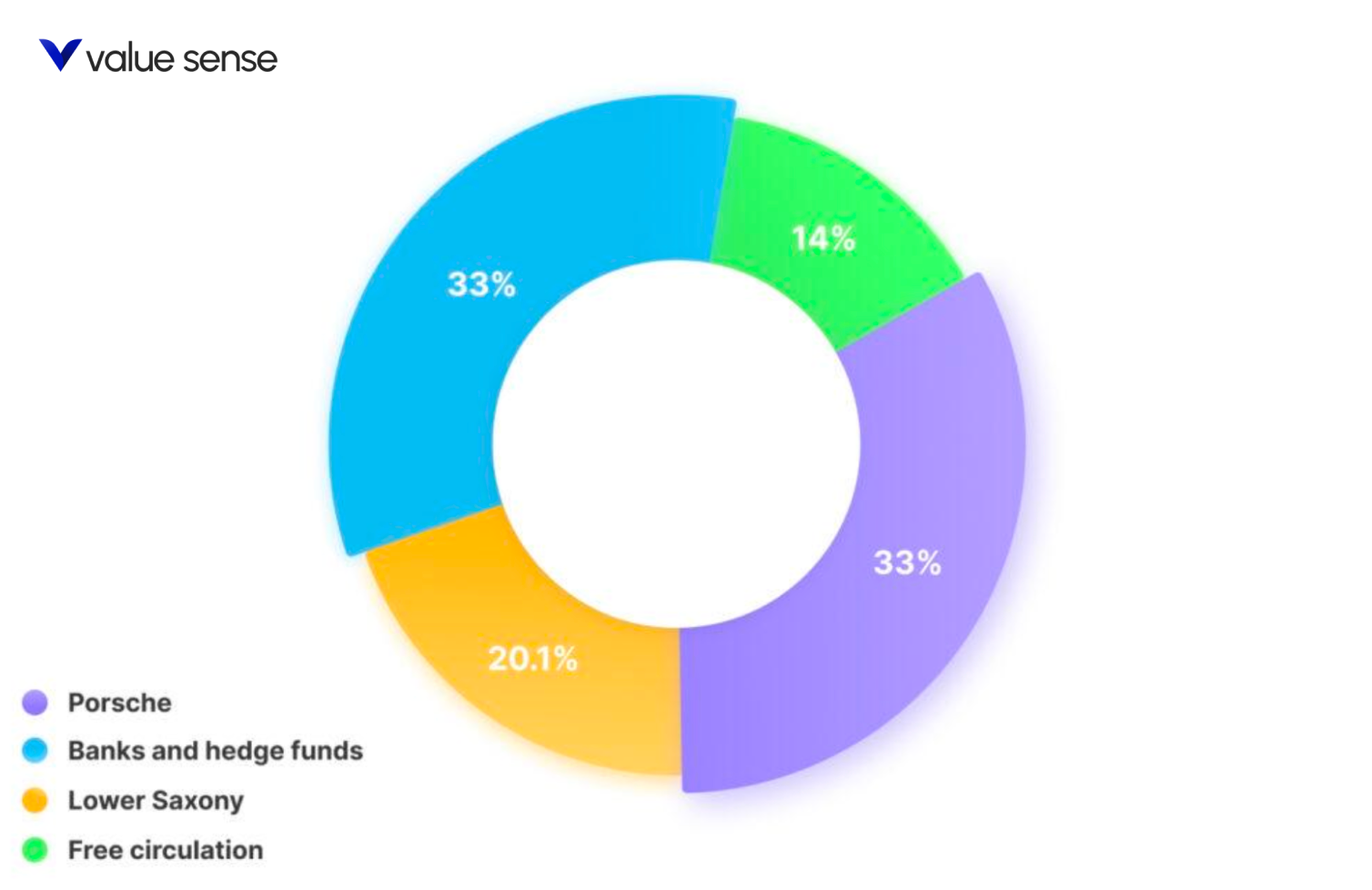

Volkswagen’s home region of Lower Saxony, which owns 20.1% of VW, is to blame. Initially, Volkswagen in its entirety belonged to the region, but the percentage of its share has gradually decreased, until now, it retains only that minimum of 20.1% that keeps the manufacture from being moved anywhere else. So, Lower Saxony is the main obstacle to Porsche conquering Volkswagen.

At all public events, Porsche denies it is trying to seize control of VW. But it continues to increase its share in the company. In November 2006, Porsche already has 29.9% of VW stocks, and by the beginning of 2007, this has reached 31%.

It’s easy to understand that, as the demand for securities grows, the price rises. So, by the time Porsche holds 31% of the shares, their value has doubled. During this same time, the financial performance of VW has not changed in any way. By now, everyone roughly understands what is going on. Together with Porsche, banks and hedge funds begin to buy up shares. The financial market is divided. One half believes shares will continue to grow, since they believe Porsche will continue to buy them. As such, they also begin to buy shares, in order to sell them higher. The other half believe that the shares are overvalued, and since The Volkswagen Act is still in force, Porsche will not be able to take over the company. As soon as Porsche stops buying shares, prices will crash.

So, what is the lay of the land with VW shares in 2007?

Looks interesting!

SCENE 3: VW becomes the most expensive company in the world

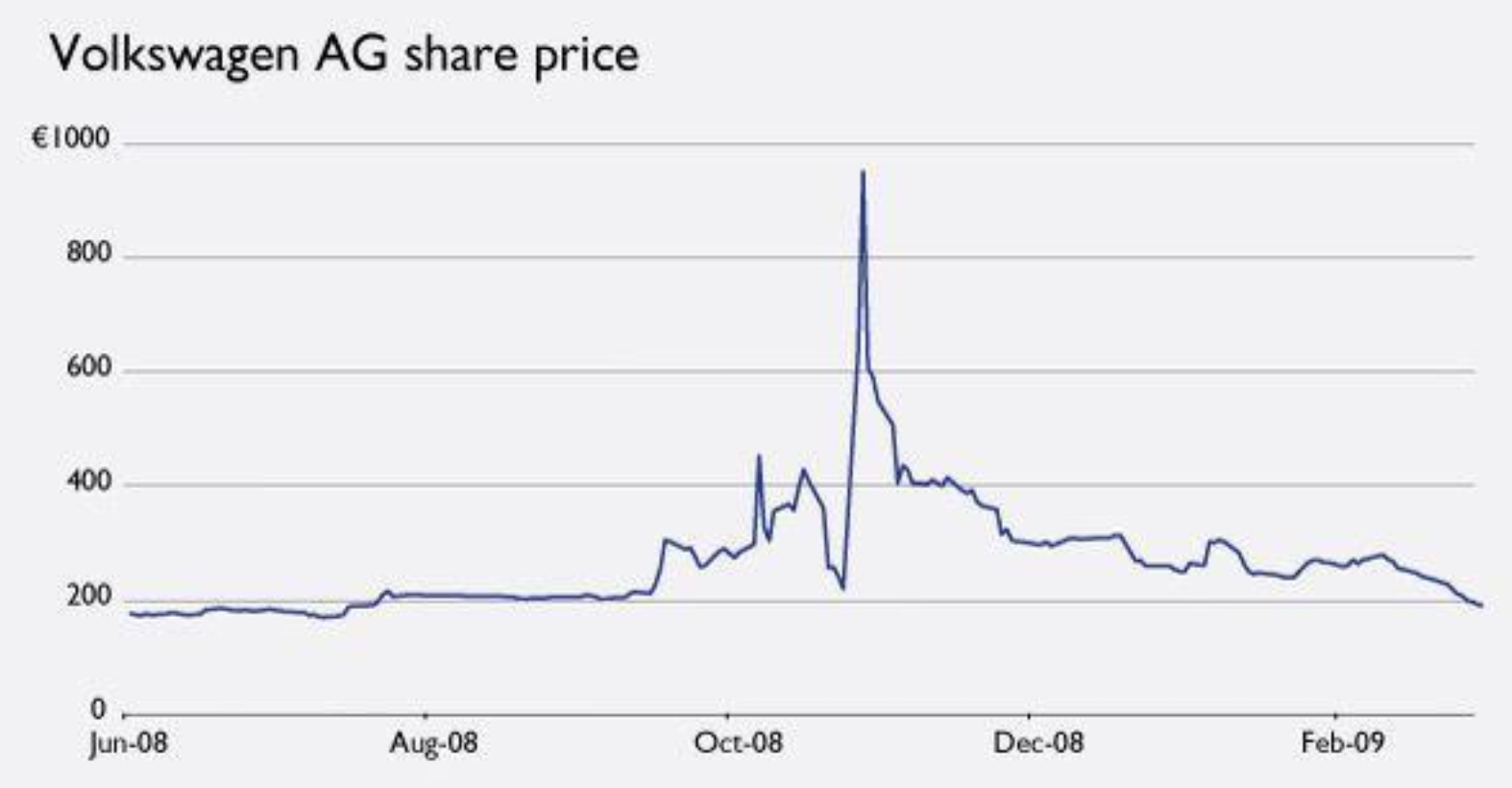

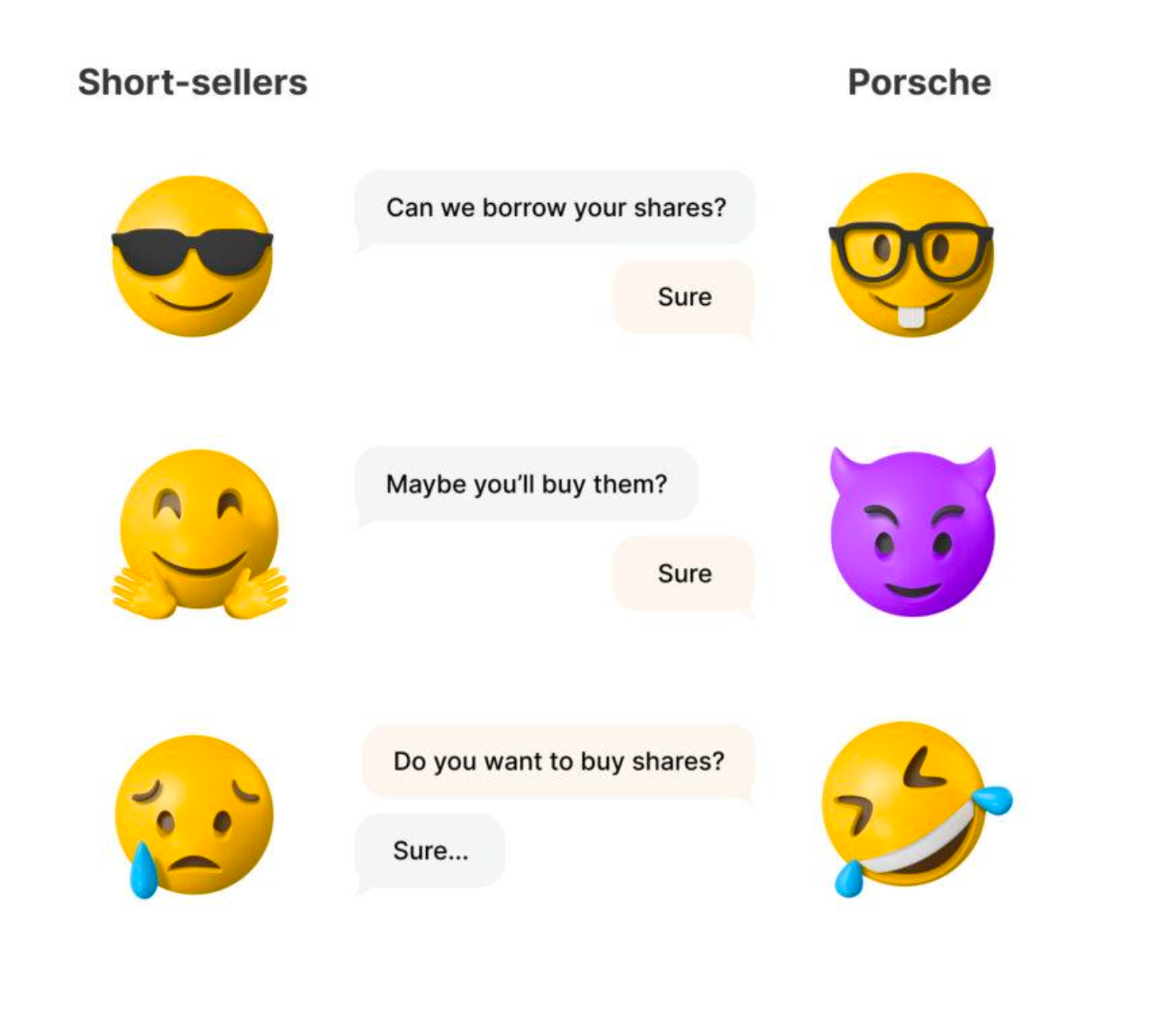

As 2008 dawns, it seems that VW shares are about to collapse. By October 2008, 12.8% of the shares are in debt obligations. The entire market is waiting for a fall: banks, hedge funds, private investors. As soon as Porsche comes out with a statement that they are stopping the purchase of securities, they all believe, the price will immediately fall.

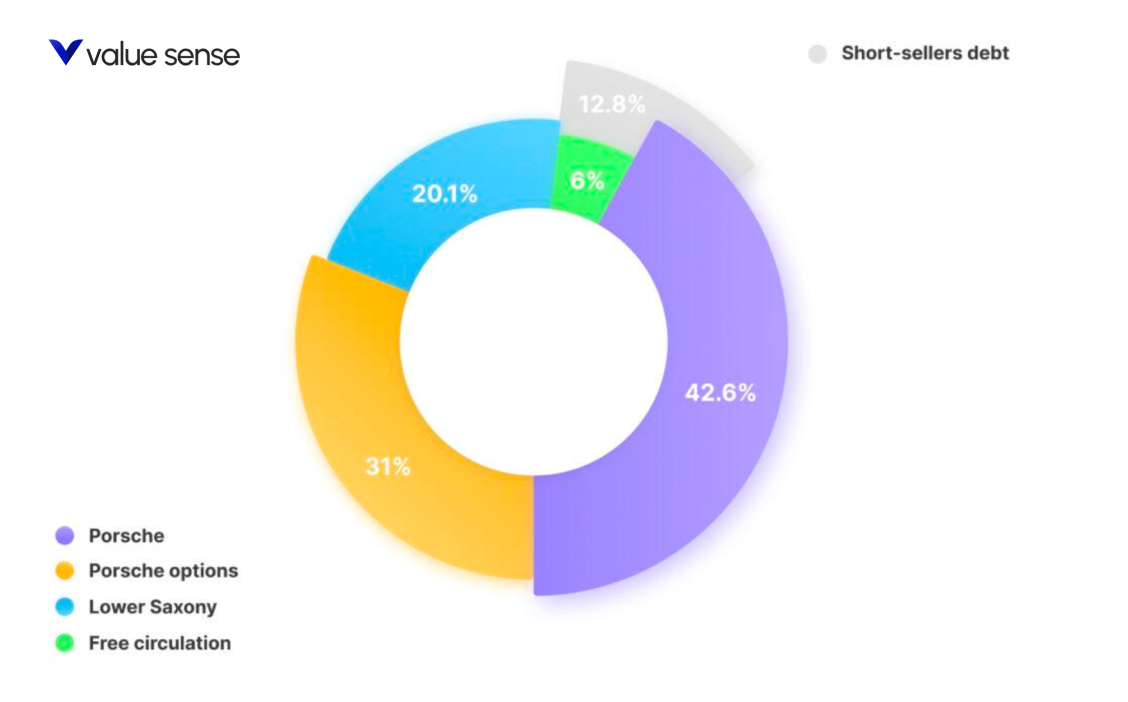

But Porsche holds a press conference, at which, to a wide-eyed public, it announces that it already owns 42% of VW’s securities and has issued options (that is, the intention to buy the paper) for another 31%. And Porsche could fulfill this intention whether the papers go on sale or not. This is the first press conference that makes the intention to take over Volkswagen clear as day. And there is no reason not to believe that Porsche will do it.

So, what do we have? Porsche now owns 42.6% of the shares and it plans to buy another 31%. Lower Saxony still holds its 20.1%. It looks like only 6% of the securities will remain in free circulation, and the short-sellers have to return 12.8% shares. That is, there will not be enough free shares for everyone, and neither Porsche nor Lower Saxony will sell their securities. The strange thing here is that a very large part of these borrowed securities was both taken from and sold to Porsche. So, although the paper has not moved anywhere, a debt obligation of the short-seller to Porsche has been created. In order to return the paper to Porsche, short-sellers need to buy it somewhere—but they can only buy it from Porsche. Porsche can set any price for the paper, demand the return of the debt, and the short-sellers are obliged to buy it.

So, if you think you’ve had a bad day, spare a thought for these poor souls.

As soon as everyone comes to understand this, chaos begins. The share price jumps from $200 to $500 the day after Porsche announces the takeover, and the next day, the price reaches $1,000 per share. For one day, Volkswagen becomes the most expensive company in the world, even though nothing has changed in terms of production.

At the time of the price jump, Porsche dumps 5% of its shares on the market, so that the short-sellers can close their debt obligations, making billions of dollars in the process. There is no exact data, but according to various estimates, Porsche earns between 10 and 13 billion dollars.

Meanwhile, the famous German billionaire Adolf Merckle throws himself under a train that day because he cannot bear the losses he suffered from the transaction. Alas, poor Merckle.

2008: the financial markets are all going crazy, and Porsche is making money hand over fist.

SCENE 4: The Empire Strikes Back

Despite the surplus profit, Porsche’s plan isn’t working, since Lower Saxony still had its 20.1% and Porsche has no money to finish the takeover. It is the perfect moment for Volkswagen to strike back. Ferdinand Karl Piëch, the head of Volkswagen all this time, is waiting in the shadows to attack Porsche at just the right time.

Porsche has bought shares on credit, and by 2008, its debt to 15 banks amounts to $11.9 billion. Despite the tremendous income that Porsche has earned from speculation in securities, it is all only on paper. To get the money, the papers must be sold, and once it starts selling them, the price will begin to fall, so that in the end, they will not be worth anything. On top of all that, Porsche sales have dropped by 27% this year. Sounds like kaput.

Volkswagen has $12 billion in reserves, and if The Volkswagen Act were to be cancelled, this money would solve all of Porsche’s problems. But no one is going to repeal the law. Piëch understands that. With Porsche at a dead end, he injects €1 billion and his personal financial guarantee that he would sort out the debts.

In 2009, at the direction of Piëch, Wiedeking is fired. Porsche now has only two options: go to the bottom or surrender to VW. In the autumn of 2009, VW takes over Porsche for $11.6 billion.

There was never a story more full of pain than the story of Porsche and Volkswagen...

Or perhaps not. Just wait and see...

ACT II

SCENE 1: They were cousins

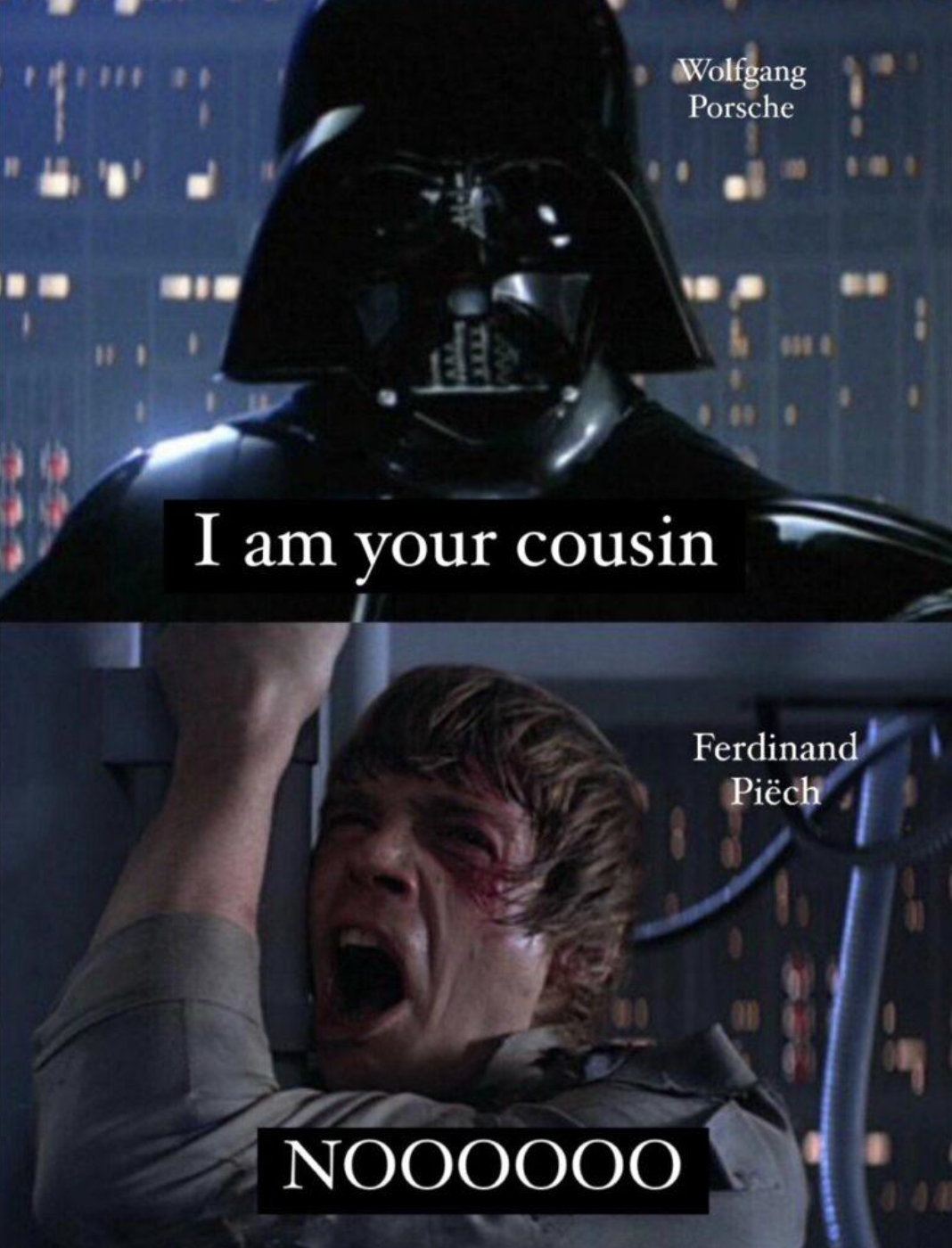

Ferdinand Porsche had two children: Ferry and Louise. Ferry’s son, Wolfgang Porsche is the current head of the Porsche company. And Louise’s son, Ferdinand Piëch was the head of Volkswagen. So, as you may have already guessed, at the time in question, the head of Porsche and the head of Volkswagen are cousins!

The Porsche and Piëch clans are some of the richest and most influential in Germany, but like Montagues and Capulets, they were not very fond of each other. However, according to the rules of the family, the entire business had to be kept in the family. And so, as Wolfgang Porsche and Ferdinand Piëch were both addicted to cars, and each had a 10% share, they each went on to lead the family company.

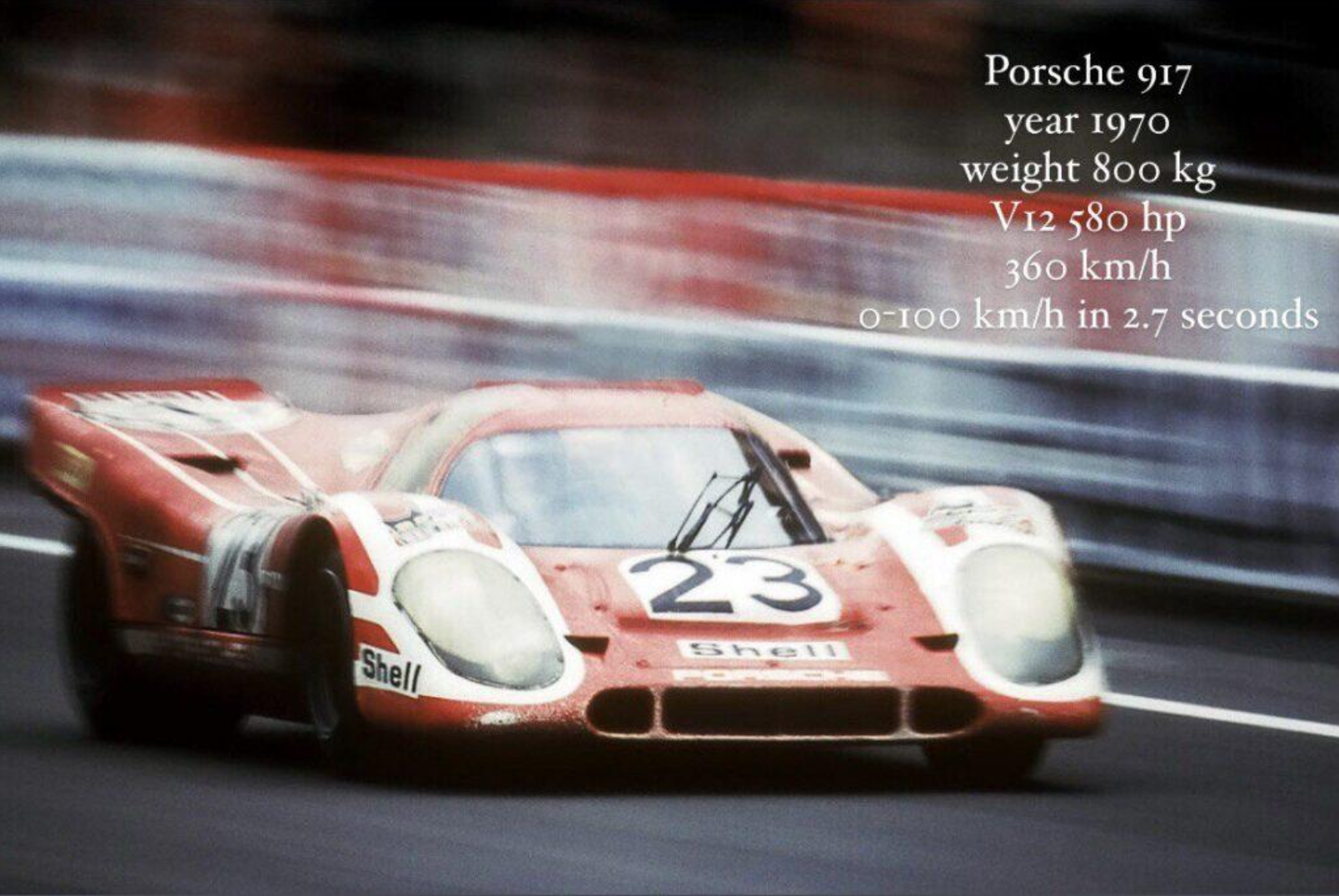

Ferdinand Piëch was a brilliant engineer. He developed the Porsche 917, which in 1970, won the Le Mans. In 1971, the drivers of the Porsche 917 set a track record, and, of course, no one could catch them. The brand gained worldwide fame, and some of the speed records set by the 917 were held for decades.

But Piëch was considered by many he worked with to be something of a reckless dictator. In spite of his victories, the prospect of dancing to the tune of a crazy engineer did not appeal to anyone in the family. What’s more, in 1972, Piëch, a married father of 4 children, had an affair with Marlene Mauer, the wife of his Porsche cousin, Gerard Porsche. At the family council, it was decided that no one from the Piëch branch would participate in the management of the company, and 100% of the voting shares were taken away from them. Left with common stocks, they could only observe, but not make decisions.

As Gerard was Wolfgang’s brother, he wanted the Piëch family to no longer have anything to do with running the company. For Wolfgang, the VW takeover meant taking back under his family’s wing the company that their grandfather had founded (the VW Beetle is the brainchild of Ferdinand Porsche, and he owned the development rights), as well as defeating the Piëch branch. So it was all a family showdown.

SCENE 2: Only one will survive

The year 2009. Two cousins: the dictator Ferdinand Piëch and the intellectual Wolfgang Porsche. One wants to take control of the company from which he was once kicked out, the other wants to make his company an empire and prove that the Porsche branch is greater than the Piëch.

To return to where we left the story: No, Volkswagen did not actually take over Porsche.

Now read on... and read carefully to understand the intrigue!

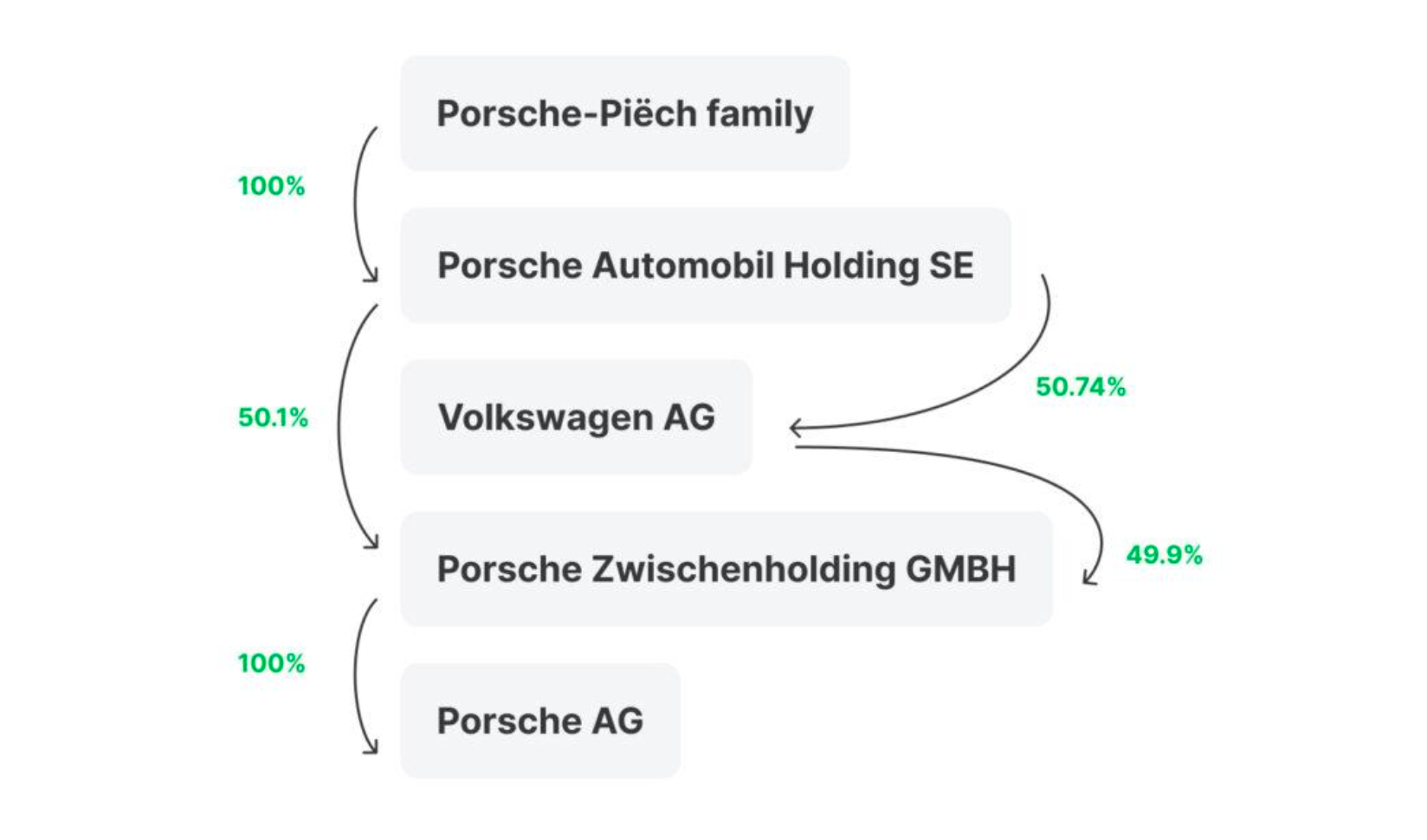

Porsche is a design bureau and manufacturer of sports cars, legally named DR.ING.H.C.F.PORSCHE AKTIENGESELLSCHAFT, or more simply, PORSCHE AG. When Porsche began to buy up VW shares, a separate company was created: PORSCHE AUTOMOBIL HOLDING SE. Shares were bought on the balance sheet of this company. Porsche SE became the 100% owner of Porsche AG (an automobile manufacturing company). At the time of the crisis, Porsche SE owned 50.74% of Volkswagen AG and 100% of Porsche AG.

Porsche later set up another intermediate company: PORSCHE ZWISCHENHOLDING GMBH, to which was given 100% of the manufacturer Porsche AG, itself 100% owned by Porsche SE.

When the merger took place, the controlling stakes in Volkswagen remained with Porsche SE, and VW gave 49.9% to Porsche Zwischenholding, which still controlled 100% of the manufacturer Porsche AG, so that 50.1% of the shares—a controlling stake—remained with Porsche SE.

To put it simply, power over both companies was in the hands of the management company—Porsche SE, which is 100% owned by the Porsche-Piëch family. And at the head of Porsche SE is Wolfgang Porsche. Clever, eh? Shakespeare could hardly have devised greater cunning.

EPILOGUE

Until he resigned the post, four years before his death in 2019, Ferdinand Piëch was just CEO of Volkswagen Group. And Wolfgang Porsche, like the ghost of Hamlet’s father, always stood in the shadows. As it turns out, Wendelin Wiedeking was only a ‘servant’ guided by Wolfgang, like a puppeteer maneuvering a marionette. Wiedeking fulfilled his task, taking upon himself all the laurels and all the sins. His place was then taken by Ferdinand Piëch, who proudly told reporters about his victory, while Wolfgang watched him slyly, knowing he had all the power over the two companies. He returned it to the family, as originally intended.

So, what was it? Genius speculation? The cunning plan of Wolfgang Porsche? A pernicious family conflict? Or guys who just wanted Hollywood to one day make a film about them? Well, it’s up to you to decide, but let’s agree: that was legen... wait for it... dary. LEGENDARY!