Prem Watsa - Fairfax Financial Holdings Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Prem Watsa, often called the "Canadian Warren Buffett" for his value investing prowess at Fairfax Financial Holdings, showcases his disciplined approach in the latest 13F filing. His $2.1B portfolio remains ultra-concentrated with strategic tweaks across commodities, healthcare, and consumer staples, signaling confidence in undervalued assets amid market volatility.

Portfolio Overview: Extreme Concentration with Proven Patience

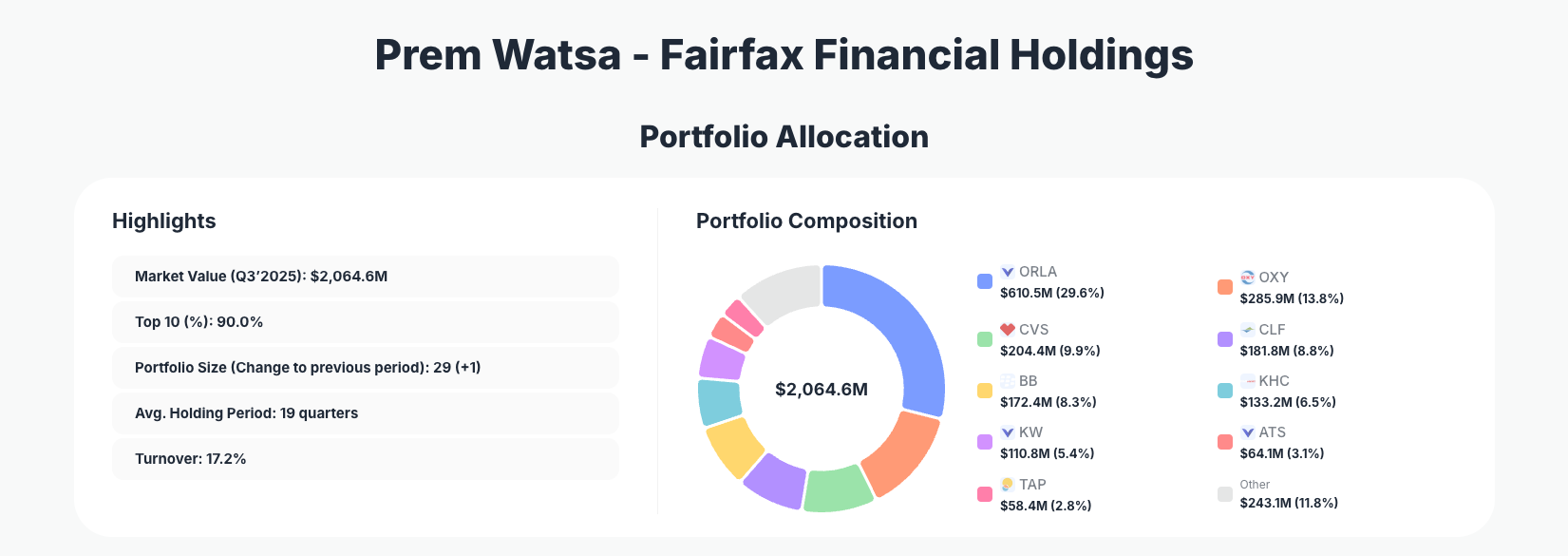

Portfolio Highlights (Q3’2025): - Market Value: $2,064.6M - Top 10 Holdings: 90.0% - Portfolio Size: 29 +1 - Average Holding Period: 19 quarters - Turnover: 17.2%

Prem Watsa's Fairfax Financial portfolio exemplifies value investing at its core, with 90% of the $2.1 billion concentrated in just 10 positions—a hallmark of his high-conviction style. The average holding period of 19 quarters underscores a patient, long-term orientation, avoiding the churn that plagues many funds. Turnover at 17.2% indicates measured activity, focusing adjustments on opportunities rather than reactive trading.

This structure reflects Watsa's philosophy of betting big on deeply understood businesses, particularly in cyclical sectors like mining and energy where he sees mispricings. The addition of one new position brings the total to 29, yet concentration remains king, with the top holding dominating at nearly 30%. Tracking this via ValueSense reveals how such focus has historically delivered outsized returns through market cycles.

The portfolio's evolution in Q3 2025 highlights resilience, maintaining core bets while trimming select names and initiating fresh positions in healthcare and retail—moves that balance risk in an uncertain economic backdrop.

Top Holdings Breakdown: Mining Powerhouse Leads with Tactical Shifts

Recent changes dominate the narrative in Prem Watsa's portfolio, starting with a notable Reduce 13.21% in BlackBerry Limited (BB) (8.3%, $172.4M), signaling profit-taking in tech amid valuation concerns. Counterbalancing this, he boosted Add 4.81% in The Kraft Heinz Company (KHC) (6.5%, $133.2M) and Add 5.87% in Molson Coors Beverage Company (TAP) (2.8%, $58.4M), doubling down on consumer staples for defensive stability.

Further adjustments include Reduce 20.10% in VANGUARD INDEX FUNDS (1.7%, $35.7M), Add 20.53% in Helmerich & Payne, Inc. (HP) (1.3%, $25.9M) for energy drilling exposure, and Add 36.87% in Pfizer Inc. (PFE) (1.1%, $22.7M), tapping healthcare value. New initiations feature Buy in Lululemon Athletica Inc. (LULU) (0.2%, $4.4M), Buy in Dollar Tree, Inc. (DLTR) (0.2%, $4.2M), Reduce 0.82% in Garrett Motion Inc. (GTX) (0.2%, $4.1M), and Buy in BRIGHTSTAR LOTTERY PLC (0.0%, $0.6M).

Complementing these moves, core top holdings like ORLA MINING LTD (29.6%, $610.5M, No change), Occidental Petroleum Corporation (OXY) (13.8%, $285.9M, No change), CVS Health Corporation (CVS) (9.9%, $204.4M, No change), Cleveland-Cliffs Inc. (CLF) (8.8%, $181.8M, No change), Kennedy-Wilson Holdings, Inc. (KW) (5.4%, $110.8M, No change), and ATS Corporation (ATS) (3.1%, $64.1M, No change) provide the bedrock, emphasizing commodities and real estate.

What the Portfolio Reveals About Watsa's Strategy

Watsa's Q3 moves paint a picture of opportunistic value hunting in beaten-down sectors: - Cyclicals with upside: Heavy tilt toward mining (ORLA, CLF) and energy (OXY, HP) bets on commodity recovery. - Defensive staples and healthcare: Additions in KHC, TAP, PFE, and CVS prioritize cash flows in volatile times. - Tech and retail probes: Trims in BB and GTX alongside new buys in LULU/DLTR show selective growth pursuit. - Risk via concentration: 90% in top 10 demands conviction, balanced by 19-quarter holds. - Global diversification: Canadian mining, US energy/healthcare, and minor international plays like BRIGHTSTAR.

This blend underscores a barbell approach: massive core positions in undervalued cyclicals, sprinkled with opportunistic adds in staples and healthcare for ballast.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| ORLA MINING LTD | $610.5M | 29.6% | No change |

| Occidental Petroleum Corporation | $285.9M | 13.8% | No change |

| CVS Health Corporation | $204.4M | 9.9% | No change |

| Cleveland-Cliffs Inc. | $181.8M | 8.8% | No change |

| BlackBerry Limited | $172.4M | 8.3% | Reduce 13.21% |

| The Kraft Heinz Company | $133.2M | 6.5% | Add 4.81% |

| Kennedy-Wilson Holdings, Inc. | $110.8M | 5.4% | No change |

| ATS Corporation | $64.1M | 3.1% | No change |

| Molson Coors Beverage Company | $58.4M | 2.8% | Add 5.87% |

The table reveals extreme concentration, with ORLA MINING LTD alone commanding 29.6%—a bold bet on gold/mining rebound that amplifies upside but heightens volatility. Stable "No change" in OXY, CVS, CLF, KW, and ATS (totaling ~41%) forms a reliable base, while tweaks like BB's reduction and adds to KHC/TAP fine-tune exposure without disrupting the core.

This 90% top-10 weighting demands ironclad thesis conviction, as Watsa deploys capital where margins of safety are widest, accepting short-term swings for long-term compounding.

Investment Lessons from Prem Watsa's Value Approach

- Concentrate ruthlessly in understood cyclicals: ORLA's massive stake shows betting big when valuations scream value.

- Patience pays—hold for 19 quarters average: Low turnover proves time in market trumps timing.

- Trim winners, add to laggards: BB reduction funds KHC/TAP adds, practicing disciplined reallocation.

- Balance offense and defense: Mining/energy bets paired with staples/healthcare weather downturns.

- Opportunistic new buys: Small starters like LULU/DLTR test ideas without overcommitting.

Looking Ahead: What Comes Next?

With portfolio size up to 29 +1 and 17.2% turnover, Watsa has room to deploy amid commodity volatility and potential rate cuts. Cash flexibility (implied by adds) positions him for deeper energy/mining dips or healthcare bargains like PFE expansions. Current cyclicals setup for commodity supercycle gains, while defensives shield against recession risks—watch for bigger stakes in HP or new retail plays if consumer spending softens.

FAQ about Prem Watsa Fairfax Financial Portfolio

Q: What are the most significant changes in Prem Watsa's Q3 2025 portfolio?

A: Key moves include Reduce 13.21% in BlackBerry (BB), Add 4.81% in Kraft Heinz (KHC), Add 5.87% in Molson Coors (TAP), new Buys in Lululemon (LULU) and Dollar Tree (DLTR), plus boosts in Pfizer (PFE) and Helmerich & Payne (HP), reflecting tactical shifts toward staples and healthcare.

Q: Why is Watsa's portfolio so concentrated, with 90% in top 10 holdings?

A: Concentration amplifies returns on high-conviction value bets like ORLA Mining 29.6%, aligning with his "Canadian Buffett" style of owning great businesses at discounts for the long haul, accepting volatility for superior compounding.

Q: What sectors does Prem Watsa favor in this filing?

A: Mining (ORLA, CLF), energy (OXY, HP), healthcare (CVS, PFE), consumer staples (KHC, TAP), and selective tech/retail (BB, LULU, DLTR)—a mix of cyclicals and defensives undervalued by the market.

Q: How can I track and follow Prem Watsa's Fairfax Financial portfolio?

A: Monitor quarterly 13F filings on the SEC site or use ValueSense's superinvestor tracker at https://valuesense.io/superinvestors/fairfax-financial for real-time analysis, historical changes, and visualizations—note the 45-day reporting lag means positions may evolve post-filing.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!