Principles for Navigating Big Debt Crises by Ray Dalio

Welcome to the Value Sense Blog, your resource for insights on the stock market! You're reading a book review written by the valuesense.io team.

On our platform, you'll find stock research and insights across all sectors. Dive into our research products and learn more about our unique approach at valuesense.io

We offer over 360+ automated stock ideas, a free AI-powered stock screener, interactive stock charting tools, and more than 10 intrinsic value models — all designed to help investors find undervalued growth opportunities.

Book Overview

Ray Dalio, the founder of Bridgewater Associates, is one of the most influential investors and macroeconomic thinkers of our time. With decades of experience managing the world’s largest hedge fund, Dalio has become renowned for his systematic approach to economic cycles and risk management. “Principles for Navigating Big Debt Crises” is a product of his deep study of history and practical experience in the financial markets. Dalio’s background, which includes steering Bridgewater through multiple crises and pioneering risk parity strategies, gives him a unique vantage point on the subject of debt cycles and economic downturns.

Published in 2018, “Principles for Navigating Big Debt Crises” came at a time when the memory of the 2008 financial crisis was still fresh, and policymakers and investors were searching for frameworks to prevent or mitigate future systemic shocks. The book is both a response to the intellectual vacuum that often follows major crises and a comprehensive manual for understanding, anticipating, and managing the cycles that shape economies. Dalio’s work draws from a vast array of historical case studies, including the Great Depression, Weimar Germany’s hyperinflation, and the 2008 crisis, to distill universal principles that can guide decision-makers in turbulent times.

The central theme of the book is the inevitability and predictability of debt cycles. Dalio argues that by studying the recurring patterns of debt accumulation, deleveraging, and crisis, investors and policymakers can better anticipate risks and respond effectively. The book’s purpose is to demystify the mechanics of debt crises, provide a clear template for their phases, and offer actionable strategies for navigating them. Dalio’s approach is both analytical and practical, combining rigorous historical analysis with prescriptive principles that can be applied in real time.

This book is considered a classic in the field of macroeconomics and investing because it bridges the gap between academic theory and practical application. Unlike many economic treatises that remain theoretical, Dalio’s work is grounded in real-world examples and is written with the practitioner in mind. It is essential reading for investors, policymakers, financial analysts, and anyone seeking to understand the forces that drive economic booms and busts. The book’s accessibility and depth make it suitable for both experienced professionals and those new to macroeconomic investing.

What sets “Principles for Navigating Big Debt Crises” apart from other investment books is its systematic, template-driven approach to economic history. Dalio’s use of archetypes, visual frameworks, and step-by-step breakdowns of crisis management provide readers with tools that can be directly applied to investment decisions and policy formulation. The inclusion of detailed case studies, practical checklists, and clear explanations of complex phenomena ensures that readers leave with not just knowledge, but a working toolkit for navigating uncertainty. Dalio’s insistence on learning from history, combined with his emphasis on adaptable principles, makes this book invaluable in a world where financial crises are inevitable but need not be catastrophic.

Key Themes and Concepts

“Principles for Navigating Big Debt Crises” is built around several interlocking themes that run throughout the book. Dalio’s analysis is not just a chronological recounting of economic events, but a thematic exploration of the forces that drive debt accumulation, crisis, and recovery. By identifying these core themes, readers can better understand how to anticipate and respond to the dynamics of credit and debt in modern economies.

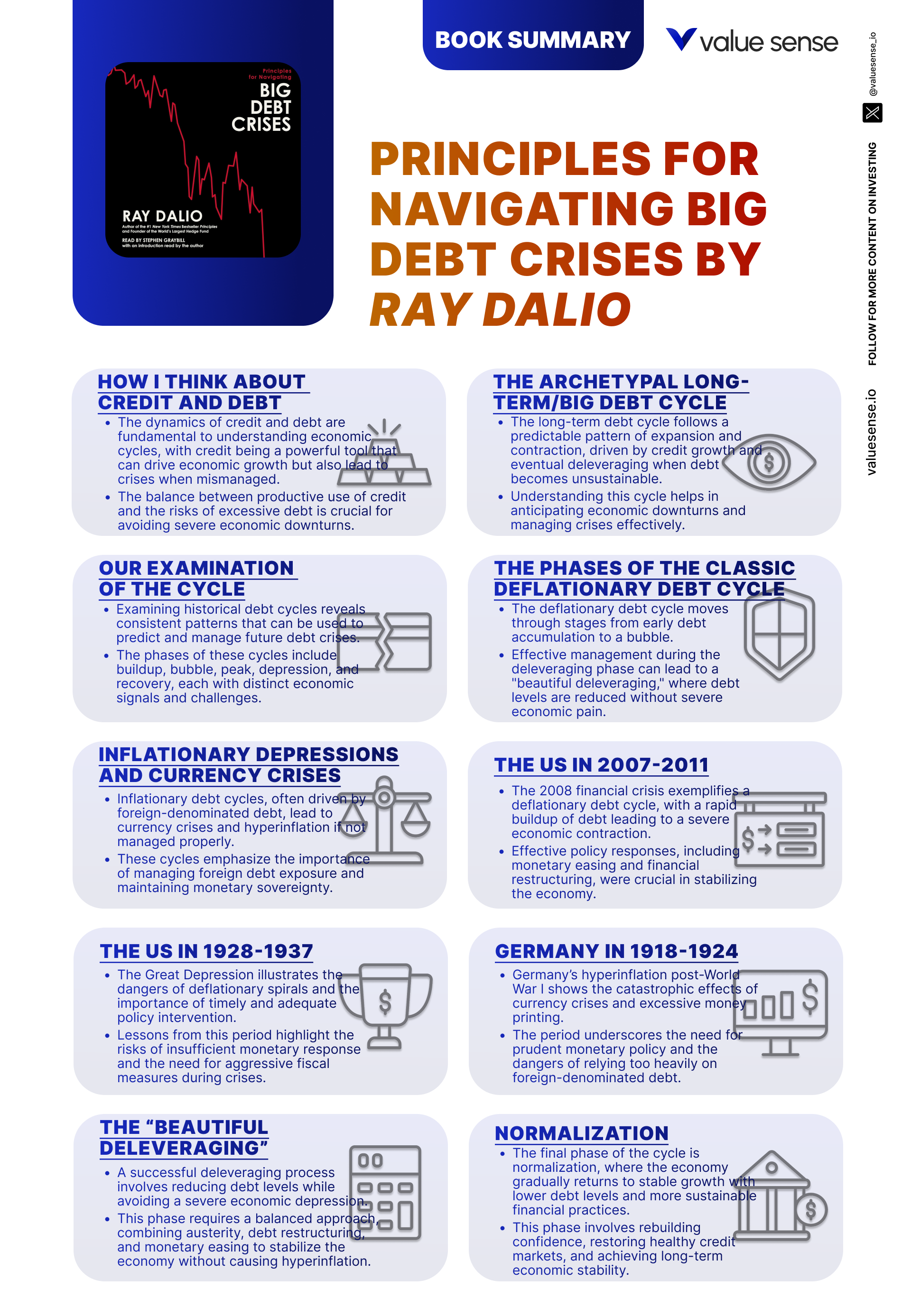

The book’s major themes include the cyclical nature of debt, the pivotal role of monetary policy, the dichotomy between inflationary and deflationary crises, the value of historical case studies, the concept of “Beautiful Deleveraging,” and the application of practical principles in economic policy and investment strategy. Each theme is woven through multiple chapters, illustrated with concrete examples, and tied back to actionable insights for investors and policymakers.

- Debt Cycles: Dalio’s central thesis is that debt cycles are fundamental to understanding economic history and forecasting future crises. He explains how economies move through predictable phases: debt accumulation, the topping out of the cycle, and eventual deleveraging. The book details how credit expansion fuels growth but also sows the seeds of instability. Dalio uses clear diagrams and historical data to show how private and public debt levels interact, and why ignoring these cycles leads to repeated policy mistakes. For investors, recognizing where we are in the debt cycle is critical for risk management and identifying market opportunities.

- Monetary Policy: The book delves deeply into the role of central banks and monetary authorities in managing debt crises. Dalio explains how tools like interest rate manipulation, quantitative easing, and money printing can either stabilize economies or exacerbate imbalances. He explores how policy responses differ in inflationary versus deflationary environments, and how the timing and scale of intervention can determine the severity of a crisis. Investors learn to watch central bank actions as leading indicators and to anticipate the market impact of policy shifts.

- Inflation vs. Deflation: A recurring theme is the distinction between inflationary and deflationary depressions. Dalio analyzes the causes, symptoms, and outcomes of both types of crises, highlighting the different policy tools required for each. For example, deflationary cycles often require aggressive monetary easing, while inflationary crises may demand fiscal restraint and currency management. Understanding this dichotomy helps investors position portfolios for changing macroeconomic conditions and avoid common pitfalls.

- Case Studies: Dalio’s use of detailed historical case studies is a cornerstone of his approach. By examining events like the US Great Depression, the 2008 financial crisis, and Weimar Germany’s hyperinflation, he extracts universal lessons about the progression and resolution of debt crises. These case studies provide practical reference points for recognizing early warning signs and effective interventions. For investors, they serve as a playbook for navigating similar situations in the future.

- Beautiful Deleveraging: One of the book’s most influential concepts is “Beautiful Deleveraging,” which refers to a balanced approach to reducing debt without triggering economic collapse. Dalio explains how a mix of austerity, debt restructuring, money printing, and wealth transfers can achieve deleveraging while maintaining growth and social stability. This theme is particularly relevant for policymakers and investors seeking to understand how economies can recover from high debt loads without severe pain.

- Economic Policy and Strategy: The final major theme is the application of historical insight and economic principles to real-world policy and investment strategy. Dalio advocates for a systematic, principle-based approach to crisis management, emphasizing the importance of adaptability, data-driven decision-making, and humility in the face of uncertainty. For investors, this means building portfolios and strategies that are resilient to a wide range of macroeconomic scenarios.

- Risk Management and Predictive Analysis: Throughout the book, Dalio stresses the importance of risk management, scenario planning, and predictive analysis. By understanding the indicators that precede crises—such as rising debt-to-income ratios, unsustainable asset bubbles, and tightening credit conditions—investors and policymakers can take preemptive action. Dalio provides tools and checklists for monitoring economic health and adjusting strategies as conditions evolve.

Book Structure: Major Sections

Part 1: Understanding Debt Cycles

This section, encompassing Chapters 1 through 5, lays the groundwork for the entire book by introducing the concept of debt cycles and their crucial role in shaping economic outcomes. Dalio begins by defining credit and debt, explaining how their expansion and contraction drive economic growth and downturns. The section then explores the phases of debt cycles—early expansion, bubble formation, peak, and eventual contraction—using both theoretical frameworks and historical context to illustrate these dynamics.

Key concepts covered include the mechanics of credit creation, the psychological drivers of borrowing and lending, and the systemic risks that accumulate during periods of excessive leverage. Dalio uses data and examples from various economies to show how similar patterns repeat over time, regardless of specific circumstances. He highlights how the accumulation of private and public debt can lead to unsustainable situations, setting the stage for crisis. The section also underscores the importance of recognizing early warning signs, such as rapid credit growth and asset price inflation.

For investors, this foundational knowledge is indispensable. Understanding debt cycles enables more accurate macroeconomic forecasting, better risk assessment, and the identification of critical inflection points in markets. Investors can use these insights to adjust asset allocation, hedge against downturns, and capitalize on opportunities during different phases of the cycle. Practical tools such as monitoring debt-to-GDP ratios and credit spreads are introduced as ways to track the health of the economic system.

In today’s world of high debt levels and frequent market volatility, the lessons from this section are more relevant than ever. With governments and central banks increasingly intervening in credit markets, investors must understand the underlying cycles to avoid being blindsided by sudden reversals. Dalio’s framework provides a timeless lens for interpreting current events, from sovereign debt concerns in emerging markets to the buildup of corporate leverage in developed economies.

Part 2: The Archetypal Big Debt Cycle

Chapters 6 through 10 comprise this section, where Dalio presents the archetypal model of the big debt cycle—a template that distills the common features of major debt crises throughout history. The section methodically breaks down the stages of the cycle: the early expansion, the bubble phase, the peak, the subsequent depression, and finally, the recovery. Dalio also introduces the concept of “Beautiful Deleveraging,” a balanced process that mitigates the pain of deleveraging while promoting growth.

Dalio provides detailed economic indicators for each phase, such as rising asset valuations during bubbles, tightening credit conditions at the peak, and the collapse of asset prices during depressions. He discusses how monetary and fiscal policy responses can either alleviate or worsen the crisis depending on their timing and magnitude. This section is rich with charts and real-world examples, making it easy to map current events onto the archetypal cycle. The “Beautiful Deleveraging” concept is particularly emphasized, showing how a combination of austerity, debt restructuring, and monetary easing can restore balance.

Investors can directly apply these lessons by learning to identify which phase of the debt cycle the economy is currently in. This knowledge informs portfolio strategy, such as when to reduce risk exposure, increase liquidity, or selectively invest in distressed assets. Dalio’s framework also helps investors anticipate policy moves and position themselves ahead of market reactions. Practical steps include tracking leading indicators like credit growth, interest rates, and government intervention levels.

With the global economy facing persistent low interest rates and high debt burdens, understanding the archetypal debt cycle is essential for navigating today’s complex markets. The principles in this section are highly relevant for interpreting central bank actions, such as quantitative easing, and for understanding the risks and opportunities in both developed and emerging markets. Dalio’s systematic approach offers a roadmap for investors and policymakers alike.

Part 3: Case Studies of Debt Crises

This section, spanning Chapters 11 through 15, brings theory to life by analyzing major historical debt crises. Dalio examines the US Great Depression, the 2008 financial crisis, and Germany’s Weimar Republic hyperinflation, among others. These case studies are meticulously detailed, providing a granular look at the causes, progression, and resolution of each crisis. Dalio uses these examples to validate his archetypal model and extract lessons that are universally applicable.

The case studies highlight common patterns, such as the buildup of unsustainable debt, the triggering of crises by external shocks, and the varied policy responses that shape recovery. Dalio dissects the interplay between monetary policy, fiscal measures, and social dynamics, showing how political decisions can either stabilize or destabilize economies. He also examines the role of market psychology, including panic selling and loss of confidence, in amplifying downturns. Data from these episodes, such as GDP contractions, unemployment spikes, and inflation rates, provide concrete benchmarks for comparison.

For investors, these case studies are invaluable for scenario planning and risk assessment. By studying how different asset classes performed during past crises, investors can better prepare their portfolios for similar events in the future. The section also offers practical checklists for recognizing early warning signs and for evaluating the effectiveness of policy responses. Investors are encouraged to adopt a historical perspective, using past crises as a guide for present-day decision-making.

In a world where economic shocks can emerge rapidly and with little warning, the ability to learn from history is a critical edge. Dalio’s case studies provide a template for assessing current risks, such as sovereign debt crises in Europe or currency instability in emerging markets. The lessons from this section are as relevant today as they were in the past, offering a playbook for navigating uncertain times.

Part 4: Managing Debt Crises

Chapters 16 through 20 focus on the practical aspects of managing debt crises, with an emphasis on policy responses and economic interventions. Dalio discusses the toolkit available to governments and central banks, including monetary easing, fiscal stimulus, debt restructuring, and austerity measures. The section also explores the trade-offs and unintended consequences of different approaches, highlighting the importance of timing and coordination.

Key concepts include the role of monetary policy in stabilizing economies, the challenges of implementing austerity without triggering social unrest, and the need for wealth redistribution to maintain social cohesion. Dalio provides examples of successful and unsuccessful crisis management from history, illustrating the importance of flexibility and adaptability. He also discusses the limitations of policy tools, such as the diminishing returns of low interest rates and the risks of excessive money printing.

Investors can use these insights to anticipate policy moves and adjust their strategies accordingly. For example, understanding when central banks are likely to intervene can inform decisions about fixed income, currencies, and equities. The section also provides guidance on managing liquidity, hedging against policy missteps, and identifying sectors that are likely to benefit from government support. Practical steps include monitoring policy announcements, analyzing fiscal and monetary trends, and stress-testing portfolios under different scenarios.

As policymakers grapple with unprecedented challenges, from pandemic-driven recessions to geopolitical shocks, the lessons in this section are more relevant than ever. Dalio’s analysis helps investors and decision-makers navigate the complex interplay between economic fundamentals and policy interventions, providing a framework for managing risk and seizing opportunities in volatile markets.

Part 5: Lessons and Principles

The final major section, covering Chapters 21 through 25, distills the key lessons and principles derived from the study of debt crises. Dalio synthesizes insights from previous sections into actionable guidance for policymakers, investors, and business leaders. The focus is on developing resilience, embracing historical analysis, and applying systematic strategies to navigate economic downturns.

Core principles include the importance of diversification, the value of maintaining liquidity, and the need for humility in the face of uncertainty. Dalio emphasizes the role of scenario planning, stress testing, and adaptive decision-making in building robust portfolios and policies. The section also highlights the dangers of complacency and the critical need to learn from history to avoid repeating past mistakes. Dalio’s checklist approach provides a practical toolkit for crisis management and long-term success.

For investors, these lessons translate into concrete actions: building diversified portfolios, maintaining cash reserves, and regularly reviewing risk exposures. The section also encourages ongoing education and the use of data-driven analysis to inform decisions. Practical steps include setting up regular portfolio reviews, using historical analogs to test strategies, and staying informed about macroeconomic trends.

In a rapidly changing world, the principles outlined in this section offer a timeless guide for navigating uncertainty. Dalio’s emphasis on resilience, adaptability, and continuous learning is particularly relevant for investors seeking to thrive in both good times and bad. The lessons from this section are a valuable resource for anyone committed to long-term financial success.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Deep Dive: Essential Chapters

Chapter 1: How I Think about Credit and Debt

This opening chapter is foundational, as it sets the intellectual stage for the entire book. Dalio meticulously explains the difference between credit and debt, and why understanding these concepts is essential for anyone attempting to navigate financial markets or economic cycles. He argues that credit, when used wisely, can be a powerful engine for economic growth, but when abused, it becomes the root cause of economic instability and crisis. The chapter outlines the mechanisms by which credit expansion leads to both booms and busts, emphasizing the cyclical nature of borrowing and lending.

Dalio uses clear analogies and straightforward language to demystify complex financial concepts. For example, he likens credit to a double-edged sword that can boost productivity but also create vulnerabilities if not managed prudently. He provides data on historical credit expansions and contractions, illustrating how periods of rapid credit growth are often followed by painful deleveraging. Notable quotes include, “Credit is the fuel that powers economic engines, but too much fuel can cause an explosion.” Dalio also examines the psychological drivers of credit cycles, such as optimism during booms and fear during busts.

Investors can apply the lessons from this chapter by closely monitoring credit growth in both public and private sectors. Concrete steps include tracking debt-to-GDP ratios, analyzing trends in consumer and corporate borrowing, and assessing the sustainability of credit-fueled growth. Dalio’s framework encourages investors to be cautious during periods of exuberant lending and to prepare for potential downturns by maintaining liquidity and hedging risk.

Historically, the failure to understand the dangers of excessive credit has led to major crises, from the Great Depression to the 2008 financial meltdown. Dalio’s emphasis on the cyclical nature of credit is a reminder that what appears to be stable growth can quickly unravel if underlying debt dynamics are ignored. In today’s environment of rising global debt, this chapter remains as relevant as ever, offering a timeless warning against complacency.

Chapter 2: The Template for the Archetypal Long-Term/Big Debt Cycle

This chapter is critical because it introduces Dalio’s archetypal model of the long-term debt cycle—a framework that underpins the entire book. Dalio breaks down the cycle into distinct phases: the early expansion, the bubble, the top, the depression, and the recovery. Each phase is characterized by specific economic indicators, such as credit growth, asset price inflation, and shifts in monetary policy. By providing a template, Dalio enables readers to map real-world events onto a predictable pattern.

Dalio supports his model with extensive historical data, including charts that track debt levels, GDP growth, and interest rates across multiple crises. He quotes, “While every debt cycle is unique, the patterns are remarkably consistent.” The chapter includes case studies from the US, Europe, and Asia, demonstrating how the archetypal cycle has played out in different contexts. Dalio also highlights the role of central banks in influencing the trajectory of the cycle through interest rate changes and liquidity injections.

For investors, the practical application is clear: by identifying which phase of the debt cycle the economy is currently in, they can adjust their strategies accordingly. Steps include increasing defensiveness during bubble phases, building liquidity ahead of downturns, and seeking opportunities during recoveries. Dalio’s template also serves as a tool for stress testing portfolios and for anticipating policy responses during different stages of the cycle.

The historical context of this chapter is particularly relevant given the recurring nature of debt crises. Dalio’s archetypal model has been validated by events such as the 1980s Latin American debt crisis, the Asian financial crisis of the late 1990s, and the 2008 global financial meltdown. By providing a universal template, Dalio equips readers with a powerful tool for navigating future crises.

Chapter 4: The Phases of the Classic Deflationary Debt Cycle

This chapter is essential for understanding how deflationary debt cycles, such as those experienced during the Great Depression, unfold. Dalio methodically outlines the stages of a deflationary cycle: the early expansion, the bubble, the peak, the depression, and the recovery. He emphasizes the role of falling asset prices, declining demand, and tightening credit in driving deflationary spirals. The chapter provides a granular analysis of the economic indicators that signal each phase, such as rising unemployment and falling consumer prices.

Dalio uses historical data from the 1930s and other deflationary episodes to illustrate his points. He quotes, “Deflationary debt cycles are characterized by a vicious circle of declining demand, falling prices, and rising real debt burdens.” The chapter includes charts showing the collapse of asset prices, the contraction of credit, and the impact on GDP. Dalio also examines the policy responses that have been used to combat deflation, such as aggressive monetary easing and fiscal stimulus.

Investors can use the insights from this chapter to position portfolios defensively during deflationary periods. Concrete steps include increasing allocations to high-quality government bonds, reducing exposure to leveraged assets, and maintaining liquidity. Dalio’s analysis also encourages investors to monitor indicators such as credit spreads, consumer price indices, and central bank policy statements for early signs of deflationary risk.

The lessons from this chapter are highly relevant given the persistent risk of deflation in developed economies, especially in the aftermath of financial crises. The experience of Japan’s “lost decades” and the policy responses to the 2008 crisis serve as modern examples of the challenges posed by deflationary debt cycles. Dalio’s framework provides a roadmap for navigating these environments.

Chapter 5: Inflationary Depressions and Currency Crises

This chapter is critical for understanding the dynamics of inflationary depressions, which often occur in economies with high levels of foreign-denominated debt or weak institutions. Dalio explains how inflationary pressures can spiral into currency crises, leading to a collapse in purchasing power and social stability. The chapter details the mechanisms by which excessive money printing, loss of confidence, and capital flight can trigger hyperinflation.

Dalio provides examples from Weimar Germany, Latin America, and other economies that have experienced inflationary depressions. He writes, “Inflationary depressions are marked by a collapse in currency value, soaring prices, and widespread social unrest.” The chapter includes data on hyperinflation episodes, exchange rate collapses, and the impact on real incomes. Dalio also examines the policy mistakes that often precede these crises, such as delayed fiscal adjustment and unrestrained monetary expansion.

Investors can apply the lessons from this chapter by monitoring indicators such as inflation rates, currency movements, and central bank credibility. Concrete steps include diversifying into hard assets like gold, reducing exposure to local currency debt, and hedging against currency risk. Dalio’s framework also encourages vigilance in emerging markets, where institutional weaknesses can amplify inflationary pressures.

Historically, inflationary depressions have devastated economies and destroyed wealth, as seen in Zimbabwe, Argentina, and Venezuela. The lessons from this chapter are particularly relevant in an era of unprecedented monetary expansion and growing concerns about inflation. Dalio’s analysis provides a guide for protecting portfolios in such environments.

Chapter 6: The Spiral from a More Transitory Inflationary Depression to Hyperinflation

This chapter is crucial for understanding how moderate inflation can escalate into runaway hyperinflation. Dalio examines the triggers that cause inflationary depressions to spiral out of control, such as loss of confidence in the currency, political instability, and the inability of policymakers to enact credible reforms. The chapter provides a step-by-step breakdown of how inflation expectations become unanchored, leading to a self-reinforcing cycle of currency depreciation and price increases.

Dalio draws on historical examples, including Weimar Germany and more recent cases like Zimbabwe, to illustrate the transition from high inflation to hyperinflation. He quotes, “Once confidence in the currency is lost, hyperinflation becomes almost impossible to stop.” The chapter includes charts showing the exponential rise in prices and the collapse of currency values during hyperinflation episodes. Dalio also discusses the social and political consequences of hyperinflation, such as loss of savings and social unrest.

Investors can use the insights from this chapter to identify early warning signs of hyperinflation, such as rapid money supply growth, widening fiscal deficits, and capital flight. Concrete steps include diversifying into foreign currencies, increasing allocations to inflation-protected assets, and reducing exposure to vulnerable economies. Dalio’s framework also highlights the importance of monitoring policy credibility and political stability.

The historical context of this chapter is especially relevant in emerging markets and in developed economies facing rising inflation risks. The lessons from past hyperinflation episodes provide a cautionary tale for policymakers and investors alike, emphasizing the need for credible policy and proactive risk management.

---

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

---

Chapter 8: Case Study: The US in 2007–2011

This chapter is a deep dive into the 2008 financial crisis, one of the most significant economic events of the modern era. Dalio provides a detailed analysis of the causes, progression, and resolution of the crisis, drawing on firsthand experience as the head of Bridgewater Associates. The chapter examines the buildup of leverage in the housing and financial sectors, the collapse of major institutions, and the unprecedented policy responses that followed.

Dalio uses data on mortgage debt, housing prices, and bank balance sheets to illustrate the scale of the crisis. He quotes, “The 2008 crisis was a classic example of a debt-fueled bubble bursting, followed by a painful deleveraging.” The chapter includes timelines of key events, such as the failure of Lehman Brothers, the implementation of TARP, and the Federal Reserve’s aggressive monetary easing. Dalio also analyzes the impact of these policies on asset prices and economic recovery.

Investors can apply the lessons from this chapter by recognizing the warning signs of asset bubbles and excessive leverage. Steps include monitoring credit growth, evaluating the sustainability of asset price increases, and stress testing portfolios for downside risk. Dalio’s analysis also underscores the importance of maintaining liquidity and being prepared for policy interventions during crises.

The 2008 crisis remains a defining event for modern investors, shaping attitudes toward risk, regulation, and central bank policy. Dalio’s firsthand perspective provides unique insights into the dynamics of the crisis and the lessons that remain relevant today. The chapter serves as a playbook for navigating future market disruptions.

Chapter 9: Case Study: Germany in 1918–1924

This chapter examines the hyperinflation that devastated Weimar Germany in the aftermath of World War I. Dalio provides a detailed account of the economic conditions that led to hyperinflation, including war reparations, fiscal deficits, and political instability. The chapter analyzes the policy responses, such as money printing and price controls, and their ultimate failure to restore stability.

Dalio uses data on inflation rates, currency depreciation, and social indicators to paint a vivid picture of the crisis. He writes, “Germany’s hyperinflation was a textbook case of how monetary and fiscal mismanagement can destroy an economy.” The chapter includes personal accounts of the impact on ordinary citizens, such as the loss of savings and the breakdown of social order. Dalio also examines the eventual resolution of the crisis through currency reform and international support.

Investors can use the lessons from this chapter to identify the risks of unchecked fiscal and monetary expansion. Concrete steps include diversifying into hard assets, monitoring fiscal sustainability, and being wary of economies with weak institutions. Dalio’s analysis also highlights the importance of political stability and credible policy in maintaining economic confidence.

The Weimar hyperinflation remains a cautionary tale for policymakers and investors, especially in an era of rising government debt and unconventional monetary policy. The chapter’s lessons are applicable to both emerging and developed markets facing similar risks today.

Chapter 10: Managing Debt Crises

This chapter is a practical guide to managing debt crises, drawing on the lessons of history and Dalio’s own experience. Dalio outlines the policy tools available to governments and central banks, including monetary easing, fiscal stimulus, debt restructuring, and wealth redistribution. He emphasizes the importance of balancing austerity with measures to support growth and social stability.

Dalio provides examples of successful and unsuccessful crisis management, citing data on GDP contraction, unemployment, and asset price recovery. He writes, “Effective crisis management requires a combination of timely intervention, flexibility, and a willingness to make difficult choices.” The chapter includes checklists for policymakers, such as assessing debt sustainability, coordinating policy responses, and communicating clearly with markets.

For investors, the practical application is to anticipate policy moves and adjust portfolios accordingly. Steps include monitoring central bank actions, evaluating the impact of fiscal measures, and stress testing portfolios for different policy scenarios. Dalio’s analysis also encourages investors to remain flexible and to hedge against policy mistakes.

The historical context of this chapter is highly relevant given the ongoing challenges faced by policymakers in the wake of the 2008 crisis and the COVID-19 pandemic. Dalio’s framework provides a roadmap for navigating future crises and for building resilient investment strategies.

Chapter 11: The Beautiful Deleveraging

This chapter introduces the concept of “Beautiful Deleveraging,” a balanced approach to reducing debt that avoids the extremes of depression and hyperinflation. Dalio explains how a combination of austerity, debt restructuring, money printing, and wealth transfers can restore balance to the economy while maintaining growth and social stability.

Dalio uses historical examples, such as the US recovery from the Great Depression and the post-2008 period, to illustrate successful deleveraging. He writes, “Beautiful Deleveraging is achieved when the right mix of policy tools is used to reduce debt burdens without causing excessive pain.” The chapter includes charts showing the interplay between inflation, growth, and debt reduction. Dalio also examines the risks of getting the balance wrong, such as triggering renewed downturns or runaway inflation.

Investors can apply the lessons from this chapter by monitoring policy mixes and adjusting portfolios for different deleveraging scenarios. Steps include diversifying across asset classes, maintaining liquidity, and being alert to shifts in policy direction. Dalio’s framework also encourages investors to look for opportunities in distressed assets during periods of successful deleveraging.

The concept of “Beautiful Deleveraging” is particularly relevant in today’s high-debt environment, where policymakers are seeking ways to reduce leverage without derailing growth. Dalio’s analysis provides a blueprint for navigating these challenges and for building resilient investment strategies.

Chapter 12: In Summary

This final key chapter synthesizes the main insights and principles from the book, serving as a concise guide for navigating debt crises. Dalio recaps the importance of understanding debt cycles, the role of monetary and fiscal policy, and the value of historical analysis. He emphasizes the need for adaptability, humility, and data-driven decision-making in managing risk and seizing opportunities.

Dalio distills the book’s lessons into actionable principles, such as maintaining diversification, building liquidity, and regularly stress testing portfolios. He writes, “The best way to navigate debt crises is to learn from history, remain flexible, and apply systematic principles to decision-making.” The chapter includes checklists and frameworks for both policymakers and investors, ensuring that readers leave with practical tools for future crises.

For investors, the takeaway is to build resilient portfolios, stay informed about macroeconomic trends, and be prepared to adapt strategies as conditions evolve. Dalio’s summary also encourages ongoing education and the use of data-driven analysis to inform decisions. Practical steps include setting up regular portfolio reviews, using historical analogs to test strategies, and staying alert to early warning signs.

The timeless wisdom distilled in this chapter is a valuable resource for anyone seeking to thrive in uncertain environments. Dalio’s emphasis on learning from history, embracing adaptability, and applying systematic principles is as relevant today as it was in past crises.

Practical Investment Strategies

- Debt Cycle Positioning: Investors should assess where the economy is within the debt cycle by tracking indicators such as credit growth, debt-to-GDP ratios, and asset price inflation. Action steps include reducing risk exposure in late-cycle environments, increasing liquidity ahead of downturns, and seeking distressed opportunities during deleveraging phases. Use macroeconomic dashboards and historical analogs to inform decisions, and regularly adjust asset allocation as new data emerges.

- Monitoring Central Bank Policy: Closely follow central bank actions, including interest rate changes, quantitative easing, and policy guidance. Use central bank minutes, economic forecasts, and market expectations to anticipate shifts in monetary policy. Implement strategies such as duration management in fixed income portfolios, currency hedging, and tactical allocation to sectors sensitive to policy changes. Stay alert to potential policy mistakes that could trigger market volatility.

- Inflation and Deflation Hedging: Build portfolios that are resilient to both inflationary and deflationary shocks. For inflation protection, allocate to real assets such as commodities, TIPS, and real estate. For deflationary environments, focus on high-quality government bonds, cash, and defensive equities. Use scenario analysis to test portfolio performance under different macroeconomic conditions, and adjust exposures as risks evolve.

- Diversification Across Asset Classes and Geographies: Reduce concentration risk by diversifying holdings across equities, fixed income, commodities, and alternative assets. Include exposure to both developed and emerging markets to capture opportunities and hedge against localized crises. Use tools like correlation matrices and stress testing to ensure true diversification, and rebalance portfolios regularly to maintain target allocations.

- Liquidity Management: Maintain sufficient liquidity to meet obligations and take advantage of market dislocations. Set aside cash reserves and invest in highly liquid instruments that can be quickly converted to cash. Establish lines of credit or backup liquidity facilities if appropriate. Monitor liquidity conditions in markets and be prepared to act swiftly during periods of stress.

- Scenario Planning and Stress Testing: Regularly conduct scenario analysis to assess the impact of different macroeconomic shocks on portfolio performance. Use historical crises as templates for stress tests, and identify vulnerabilities in current holdings. Develop contingency plans for severe downturns, including predefined rules for de-risking or rebalancing. Incorporate both quantitative models and qualitative judgment in the process.

- Monitoring Early Warning Indicators: Set up dashboards to track key economic and financial indicators, such as credit spreads, yield curves, volatility indices, and leading economic indicators. Use these tools to detect early signs of stress and to inform tactical adjustments. Combine quantitative signals with qualitative assessments, such as market sentiment and policy developments, to build a comprehensive risk monitoring system.

- Opportunistic Investing in Distressed Assets: During crisis periods, be prepared to allocate capital to undervalued or distressed assets. Develop criteria for identifying high-quality opportunities, such as strong balance sheets, resilient cash flows, and strategic market positioning. Use rigorous due diligence and risk controls to avoid value traps. Consider private credit, distressed debt, and special situations funds as vehicles for capturing outsized returns during recoveries.

Modern Applications and Relevance

The principles outlined in “Principles for Navigating Big Debt Crises” are profoundly relevant in today’s investment landscape. Since the book’s publication, the world has witnessed unprecedented monetary and fiscal interventions, particularly in response to the COVID-19 pandemic. Central banks have pushed interest rates to historic lows, engaged in large-scale asset purchases, and governments have run massive deficits. These policies have driven global debt levels to new highs, echoing the patterns Dalio describes in his archetypal debt cycles.

One of the most significant changes since Dalio’s analysis is the scale and coordination of policy responses. The rapid deployment of stimulus in 2020-2021 helped avert a global depression but also raised concerns about future inflation and financial stability. Dalio’s framework for understanding the trade-offs between monetary easing, fiscal stimulus, and long-term debt sustainability is invaluable for interpreting these developments. Investors can use his principles to anticipate the potential consequences of prolonged low rates, expanding central bank balance sheets, and rising public debt.

What remains timeless is the cyclical nature of debt and the importance of historical perspective. Dalio’s insistence on learning from past crises is as relevant today as ever, especially as markets grapple with new forms of risk, such as geopolitical tensions, supply chain disruptions, and technological disruption. The book’s emphasis on systematic risk management, diversification, and scenario planning provides a solid foundation for navigating uncertainty in any era.

Modern examples of Dalio’s principles in action include the European sovereign debt crisis, the emerging market currency shocks of the past decade, and the ongoing debate over inflation versus deflation risks. Investors who adopted Dalio’s approach during the 2020 market turmoil—maintaining liquidity, diversifying across asset classes, and monitoring policy responses—were better positioned to weather the storm and capitalize on the subsequent recovery. The resurgence of inflation in 2021-2022, and the resulting shifts in central bank policy, further underscore the need for adaptable, principle-based strategies.

To adapt Dalio’s classic advice to current conditions, investors must remain vigilant, flexible, and data-driven. This means continuously updating risk assessments, staying informed about macroeconomic trends, and being prepared to pivot strategies as new information emerges. The lessons from “Principles for Navigating Big Debt Crises” are not just historical curiosities—they are essential tools for thriving in a world where debt cycles, policy interventions, and market volatility are constants.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Implementation Guide

- Assess Current Debt Cycle Position: Begin by evaluating where the economy is within the debt cycle. Use macroeconomic dashboards to track credit growth, debt-to-GDP ratios, asset price inflation, and central bank policy. Establish a baseline assessment of systemic risk and identify early warning signals of cycle transitions. This step should be updated quarterly or as significant new data becomes available.

- Develop a Strategic Asset Allocation Framework: Based on your assessment of the debt cycle, construct a diversified portfolio tailored to current and anticipated macroeconomic conditions. Allocate assets across equities, fixed income, real assets, and alternatives, adjusting weights to reflect risk and opportunity. Set target allocations for different phases of the cycle (e.g., more cash and bonds in late-cycle, more equities and distressed assets during recovery). Review and rebalance allocations semi-annually or as market conditions change.

- Incorporate Scenario Analysis and Stress Testing: Regularly test your portfolio against a range of macroeconomic scenarios, including deflationary and inflationary shocks, policy missteps, and market dislocations. Use historical crises as templates for stress tests, and identify vulnerabilities in your holdings. Update scenarios annually or when major economic or policy shifts occur. Develop contingency plans for severe downturns, including predefined rules for de-risking or rebalancing.

- Establish a Risk Monitoring and Review Process: Set up dashboards to monitor key indicators such as credit spreads, yield curves, volatility indices, and policy announcements. Schedule monthly or quarterly portfolio reviews to assess risk exposures, performance, and alignment with strategic objectives. Implement stop-loss or risk control mechanisms as appropriate. Document findings and action items from each review to ensure accountability and continuous improvement.

- Maintain Liquidity and Flexibility: Ensure that a portion of your portfolio is allocated to highly liquid assets, such as cash, short-term government bonds, or money market instruments. This provides the flexibility to respond quickly to market dislocations and take advantage of distressed opportunities. Review liquidity buffers quarterly and adjust as needed based on changing risk assessments and liquidity conditions in markets.

- Continuously Educate and Adapt: Stay informed about macroeconomic trends, policy developments, and emerging risks by following reputable sources, reading economic research, and participating in professional networks. Allocate time each month for ongoing education, such as reading books, attending webinars, or engaging with investment communities. Be willing to adapt strategies as new information and analysis become available.

- Leverage Historical Analysis and Checklists: Use historical case studies and Dalio’s checklists to inform decision-making. Before making major portfolio changes or responding to market shocks, consult relevant historical analogs to avoid repeating past mistakes. Incorporate checklists for risk assessment, policy evaluation, and crisis management into your investment process.

- Engage in Peer Review and Collaborative Decision-Making: Consider forming or joining investment groups or committees to review strategies, share insights, and challenge assumptions. Schedule regular meetings (monthly or quarterly) to discuss macroeconomic outlook, portfolio positioning, and risk management. Use collaborative decision-making to minimize biases and improve outcomes over time.

--- ---

10+ Free intrinsic value tools

For investors looking to find a stock's fair value, our analytics team has you covered with intrinsic value tools:

📍 Free Intrinsic Value Calculator

📍 Reverse DCF & DCF value tools

📍 Peter Lynch Fair Value Calculator

📍 Ben Graham Fair Value Calculator

📍 Relative Value tool

...and plenty more.

🔍 Explore all these tools for free on the Value Sense platform and start discovering what your favorite stocks are really worth.

FAQ: Common Questions About Principles for Navigating Big Debt Crises

1. Who should read “Principles for Navigating Big Debt Crises”?

This book is essential reading for investors, policymakers, financial analysts, economists, and anyone interested in understanding the forces that drive economic booms and busts. Dalio’s systematic approach makes complex macroeconomic concepts accessible and practical, providing tools that benefit both seasoned professionals and those new to the field. Its lessons are especially valuable for those responsible for managing portfolios or making policy decisions in uncertain environments.

2. How does Ray Dalio’s approach differ from other books on financial crises?

Dalio’s approach is unique in its use of archetypal models, detailed case studies, and practical checklists. Rather than focusing solely on theory, he provides a step-by-step template for understanding and navigating debt cycles, supported by extensive historical data. The book bridges the gap between academic economics and real-world investing, making it both comprehensive and actionable for readers.

3. Can the principles in the book be applied to current market conditions?

Absolutely. The principles Dalio outlines are designed to be timeless and adaptable, providing a framework for interpreting current economic trends and policy actions. Investors can use his debt cycle analysis, scenario planning, and risk management strategies to navigate today’s high-debt, low-interest-rate environment. The book’s emphasis on adaptability and historical perspective is particularly relevant in the face of modern economic challenges.

4. What is “Beautiful Deleveraging,” and why is it important?

“Beautiful Deleveraging” is Dalio’s term for a balanced approach to reducing debt that avoids triggering severe recessions or runaway inflation. It involves a mix of austerity, debt restructuring, money printing, and wealth transfers to restore economic stability while maintaining growth. This concept is important because it provides a roadmap for policymakers and investors to manage high debt levels without causing excessive pain or instability.

5. How can individual investors use the lessons from the book in their own portfolios?

Individual investors can apply Dalio’s lessons by monitoring debt cycles, diversifying portfolios, maintaining liquidity, and conducting regular scenario analysis. The book provides concrete tools for risk assessment, portfolio construction, and adapting strategies to changing macroeconomic conditions. By following Dalio’s principles, investors can build resilience and improve their chances of thriving in both calm and turbulent markets.