Procter & Gamble Undervalued: Consumer Staples Dividend Champion

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Procter & Gamble (NYSE: PG) is one of the most recognized and enduring companies in the consumer staples sector. With a portfolio of household brands—from Tide and Pampers to Gillette and Crest—P&G has established itself as a global leader in essentials that people buy regardless of economic conditions. For decades, it has been a model of stability, dividend growth, and defensive strength in equity markets.

Yet, with markets often chasing technology and high-growth stocks, PG stock may be overlooked and undervalued relative to its intrinsic value. For long-term investors, this combination of consumer goods reliability and steady dividend growth makes P&G a high-quality value play among blue chips.

Why Procter & Gamble Matters

Procter & Gamble is more than just a household name; it represents the core of defensive investing, offering factors that appeal to both institutional and retail investors.

- Global brand dominance: More than 20 brands generating over $1 billion each in annual sales.

- Sector resilience: Consumer staples demand remains steady even in recessions.

- Dividend consistency: Over 65 consecutive years of dividend increases.

- Cash flow predictability: High recurring revenue driven by everyday product consumption.

This foundation positions Procter & Gamble as a cornerstone for income-oriented and conservative investors seeking long-term stability.

Is Procter & Gamble Stock Undervalued?

The debate surrounding whether Procter & Gamble is undervalued typically centers on its valuation multiples. PG traditionally trades at a premium because of its defensive moat. However, that premium may look undervalued once cash flow durability and dividend reliability are factored into intrinsic value models.

Valuation Framework

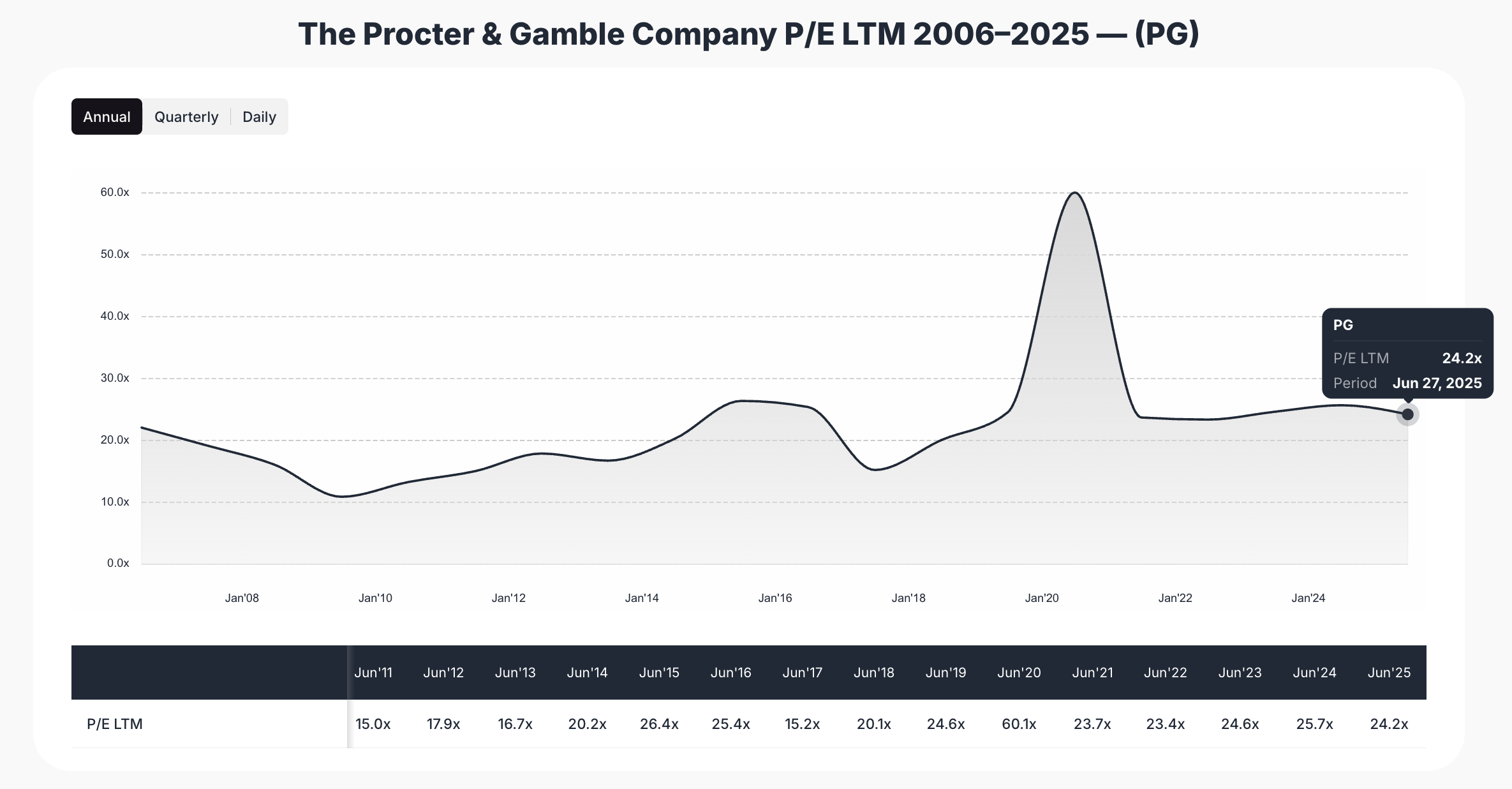

- Price-to-Earnings (P/E): PG trades in line with its historical average (~22–24x earnings). While not “cheap” in absolute terms, this pricing is favorable compared to market uncertainty and high volatility sectors.

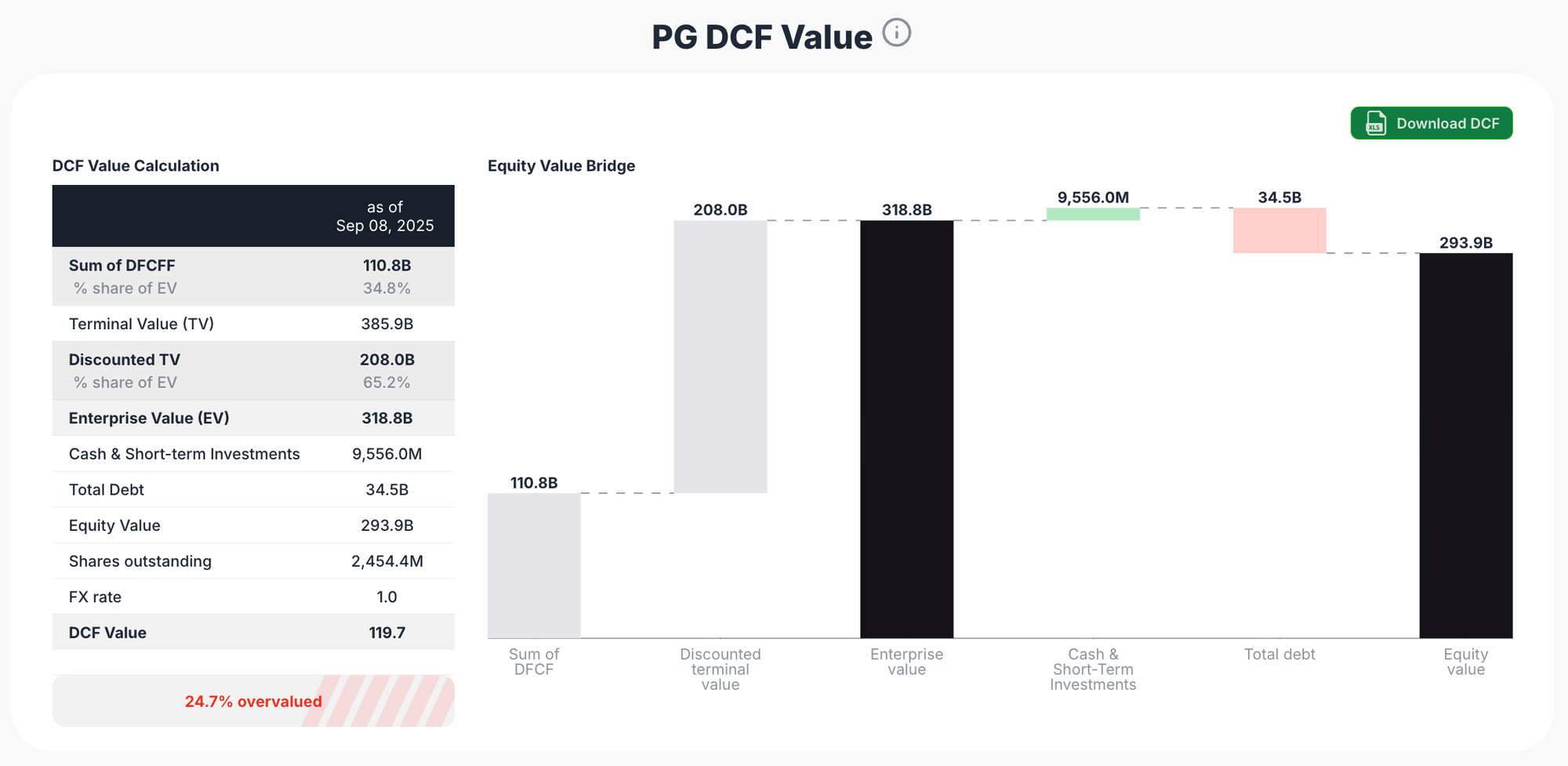

Discounted Cash Flow (DCF): Long-term DCF models, assuming earnings growth of 4–6% and consistent free cash flow conversion, suggest modest but steady upside in PG’s valuation.

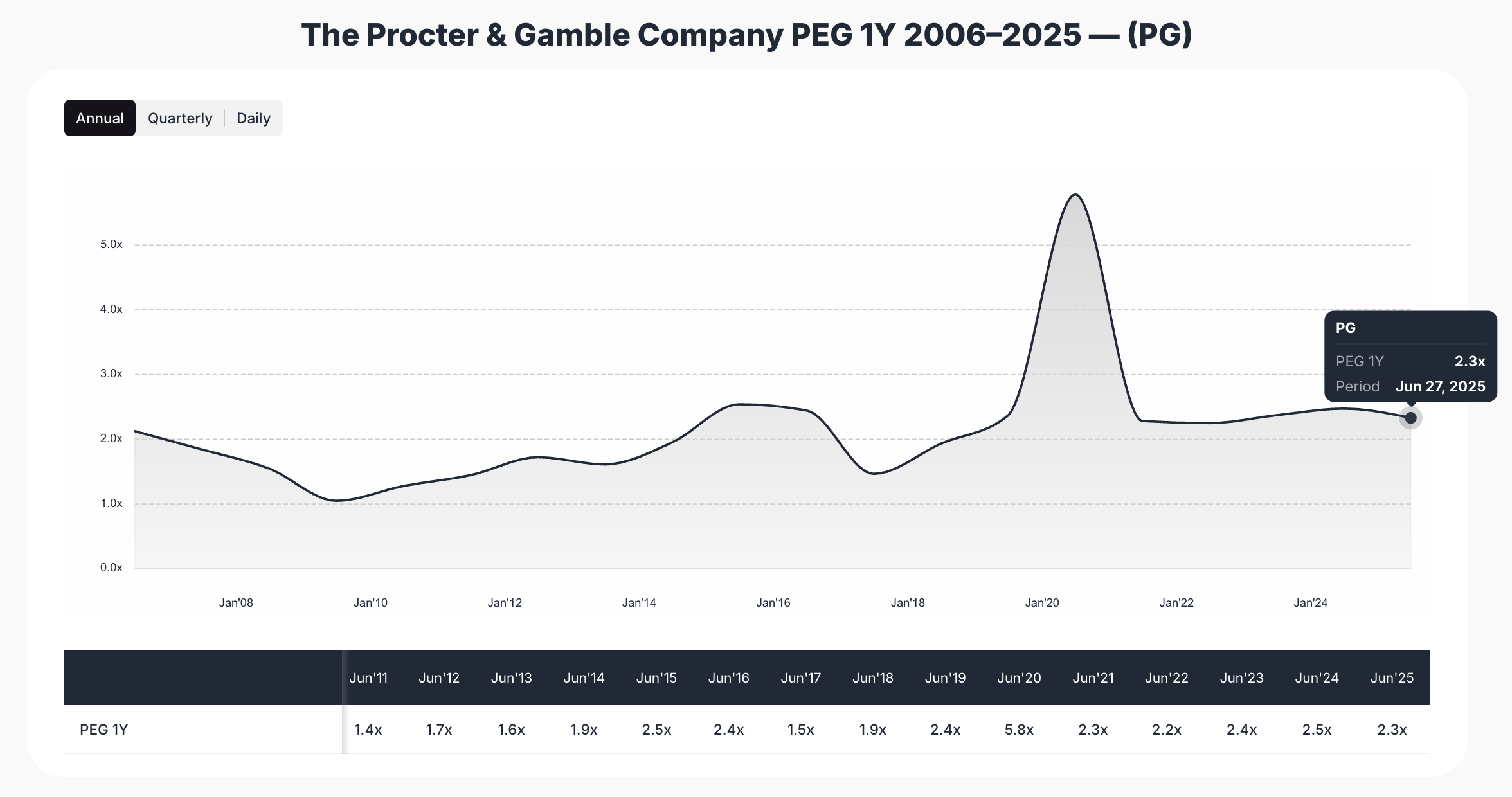

PEG Ratio: Relative to other consumer goods firms, PG’s PEG offers competitive value when adjusted for low volatility and high dividend dependability.

These points suggest that Procter & Gamble may in fact be undervalued when measured by intrinsic value metrics rather than headline multiples.

Dividend Champion Status

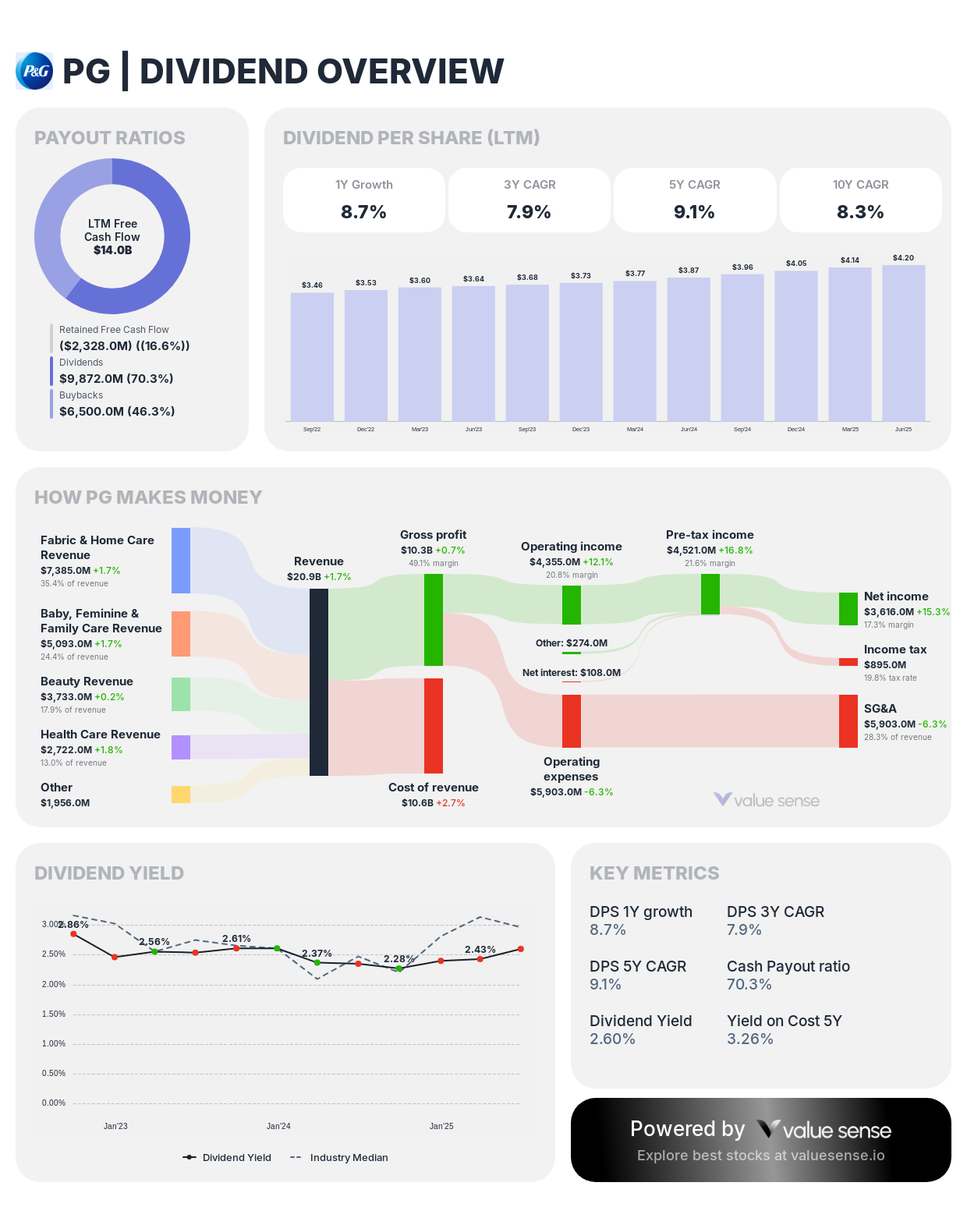

Perhaps the most compelling feature of PG stock is its reputation as a dividend aristocrat and dividend king. With more than six decades of consecutive annual dividend increases, P&G sits among the elite group of companies offering unwavering shareholder returns.

- Current Yield: ~2.5%

- 5-Year Dividend Growth CAGR: ~5%

- Payout Ratio: Supported by durable free cash flow, generally ranging 60–70%

Investors can count on P&G not only for consistent income but also for reliable dividend growth, protecting purchasing power against inflation over the long term.

Consumer Goods as a Value Play

Consumer staples are often dismissed as “boring” investments compared to high-growth technology. However, boring often means dependable—and dependable is where hidden value resides.

Pandemic-era panic buying, inflationary surges, and recent volatility have all underscored the importance of everyday demand durability. P&G’s essentials create a natural inflation hedge: when costs rise, the company passes them through price increases without significant demand destruction.

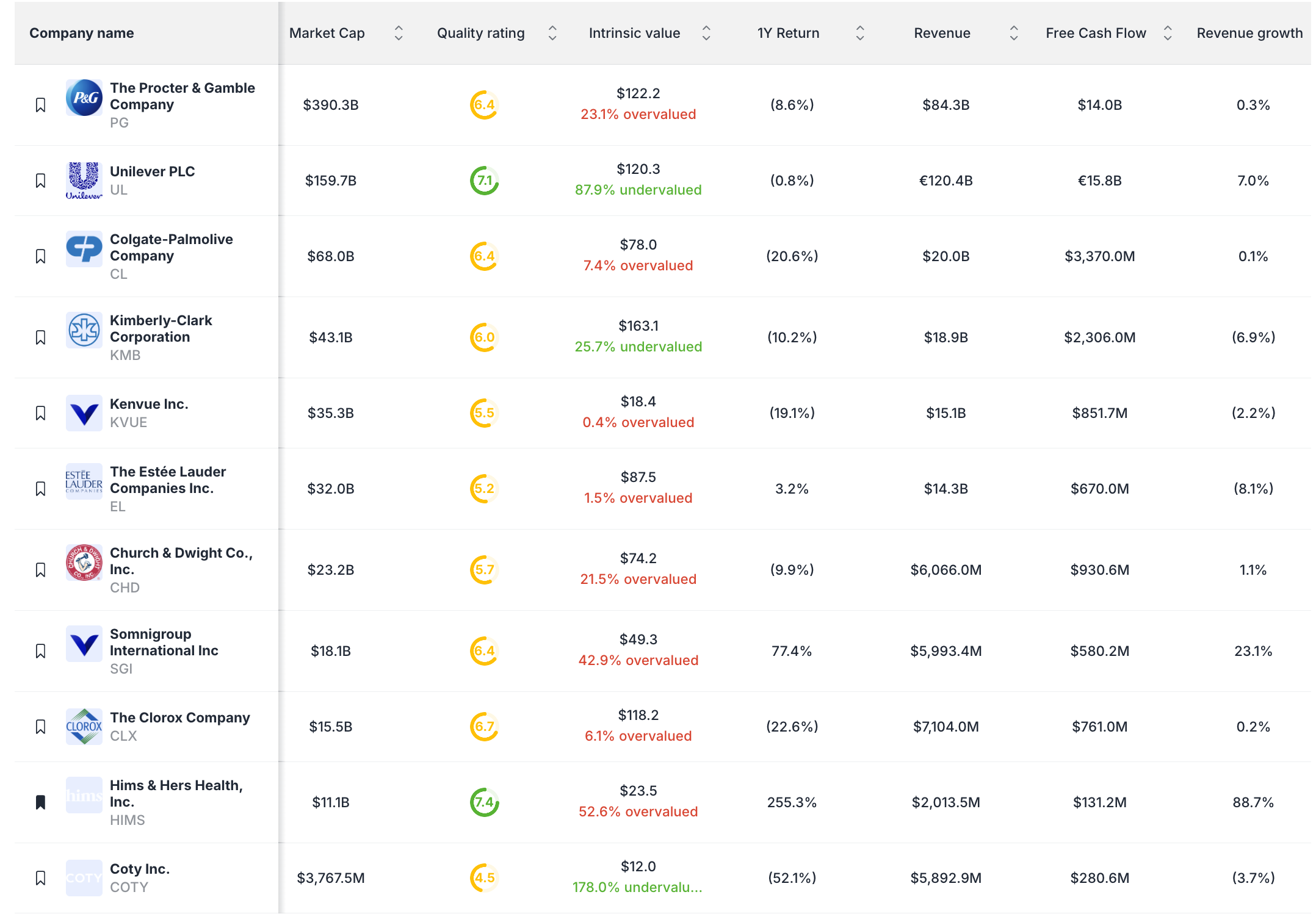

Competitor Comparison

- Colgate-Palmolive (CL): Global reach but slower top-line growth.

- Kimberly-Clark (KMB): Attractive yield but lower brand diversification.

- Unilever (UL): Emerging-markets focus but facing margin pressure.

Relative to these peers, Procter & Gamble’s breadth of brands, size, and operational efficiency suggest superior ability to withstand macroeconomic risks while still delivering shareholder value.

PG Stock Performance and Intrinsic Value Trends

Historical Resilience

Over the past 20 years, PG has delivered steady compounding returns. While tech stocks dominate headlines with explosive gains, PG stock wins on consistency, compounding dividends and capital appreciation steadily through multiple market cycles.

- Dot-Com Bust (2000–2002): Relatively unaffected, highlighting defensive strength.

- Financial Crisis (2008–2009): Revenue declined modestly, but dividend growth continued uninterrupted.

- Pandemic Shock (2020): P&G surged on consumer demand for hygiene and cleaning products.

Forward Value Outlook

Using ValueSense valuation tools:

- DCF estimate: Suggests fair value in the $170–180 range versus recent trading around $155.

- Earnings-based estimate: Indicates built-in safety margin due to stable EPS growth forecasts (~6%).

- EPV (Earnings Power Value): Shows resilience in core consumer demand metrics, reinforcing long-term intrinsic value well above cyclical lows.

This evidence supports the claim that Procter & Gamble remains undervalued as a defensive compounder with built-in downside protection.

Risks to Watch

P&G may be undervalued, but it is not risk-free. Key considerations include:

- Currency exposure: Global operations expose PG to foreign exchange headwinds.

- Input costs: Raw material inflation (pulp, chemicals, packaging) can compress margins.

- Market saturation: Mature markets cap growth potential, requiring acquisitions or product innovation.

- Competition: Private-label products may reduce pricing power in some categories.

Even so, PG’s operational efficiency and brand loyalty help mitigate these risks compared to peers.

Should You Buy PG Stock Now?

If you are a defensive investor, dividend collector, or portfolio builder looking for stability plus modest upside, then Procter & Gamble stock is undervalued relative to its risk-adjusted fundamentals.

PG stock should not be expected to deliver explosive growth, but its consistency, dividend track record, and undervaluation relative to intrinsic cash flow models make it one of the most reliable consumer staples investments available today.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 Salesforce Rule of 40 Analysis: CRM Leader's Growth Efficiency Challenge

📖 UnitedHealth Group Undervalued: Healthcare Insurance

📖 Which Gold Mining Stocks Are Undervalued in September 2025

FAQ

Q: Why is Procter & Gamble considered undervalued?

A: Despite trading at a fair P/E multiple, PG’s consistent cash flow, dividend reliability, and ability to sustain intrinsic value growth suggest upside compared to current pricing.

Q: Is PG stock good for dividends?

A: Yes. With 65+ years of consistent dividend increases, PG is one of the most reliable income stocks, providing both yield and dividend growth protection.

Q: How does PG compare to other consumer goods companies?

A: P&G offers superior brand scale, efficiency, and global presence versus Colgate-Palmolive, Unilever, or Kimberly-Clark, supporting stronger intrinsic valuations.

Q: What is Procter & Gamble’s growth outlook?

A: P&G projects steady 4–6% annual growth, supported by product innovation, pricing power, and emerging-market expansion—sufficient to compound dividends and modest capital appreciation long term.

Final Verdict

Procter & Gamble is not a high-octane growth story—but it doesn’t need to be. For investors seeking safety, dividends, and steady compounding, Procter & Gamble stock looks undervalued against its long-term fundamentals and deserves a place as a consumer staples dividend champion in any diversified portfolio.