Quality Investing by Lawrence A. Cunningham, Torkell T. Eide, and Patrick Hargreaves

Welcome to the Value Sense Blog, your resource for insights on the stock market! You're reading a book review written by the valuesense.io team.

On our platform, you'll find stock research and insights across all sectors. Dive into our research products and learn more about our unique approach at valuesense.io

We offer over 360+ automated stock ideas, a free AI-powered stock screener, interactive stock charting tools, and more than 10 intrinsic value models — all designed to help investors find undervalued growth opportunities.

Book Overview

“Quality Investing: Owning the Best Companies for the Long Term” by Lawrence A. Cunningham, Torkell T. Eide, and Patrick Hargreaves is a modern classic in the realm of value investing. Lawrence Cunningham is well-known for his work on Warren Buffett’s shareholder letters and is a respected professor, author, and investment commentator. Torkell T. Eide and Patrick Hargreaves bring deep experience as professional investors, with backgrounds in asset management and a focus on long-term, quality-oriented portfolios. Their combined expertise lends the book both academic rigor and real-world practicality, making it a standout among contemporary investment literature.

First published in 2016, “Quality Investing” arrived at a time when the investing world was grappling with the aftermath of the global financial crisis and a rapidly changing economic landscape. The book’s timing was significant: value investing had been challenged by the rise of technology-driven growth stocks and the increasing influence of passive investing. Against this backdrop, the authors sought to redefine what it means to be a value investor by focusing not just on cheapness but on quality—companies with durable competitive advantages, strong management, and the ability to compound capital efficiently over time.

The main theme of the book is that the best investment returns come not from chasing bargains, but from patiently owning exceptional businesses. The authors argue that “quality” is a distinct and measurable attribute, encompassing factors such as return on capital, capital allocation discipline, management integrity, and resilience to economic cycles. The book provides a structured framework for identifying, evaluating, and holding these companies, emphasizing the importance of understanding both quantitative metrics and qualitative factors.

“Quality Investing” is considered a must-read for serious investors because it bridges the gap between traditional value investing and the realities of today’s market. Its approach is systematic yet flexible, making it accessible to both individual investors and professionals. The book’s unique value lies in its actionable insights, real-world case studies, and the clarity with which it distinguishes between high-quality and mediocre companies. It stands out by offering a practical playbook for building a resilient, long-term portfolio, grounded in timeless principles but attuned to modern challenges.

This book is particularly valuable for investors seeking to avoid common pitfalls in stock selection and portfolio management. It is also essential reading for anyone interested in understanding how to identify companies that can thrive through various market cycles. Whether you are a seasoned professional, a student of finance, or an individual investor looking to sharpen your edge, “Quality Investing” provides a comprehensive guide to mastering the art of owning the best businesses for the long run.

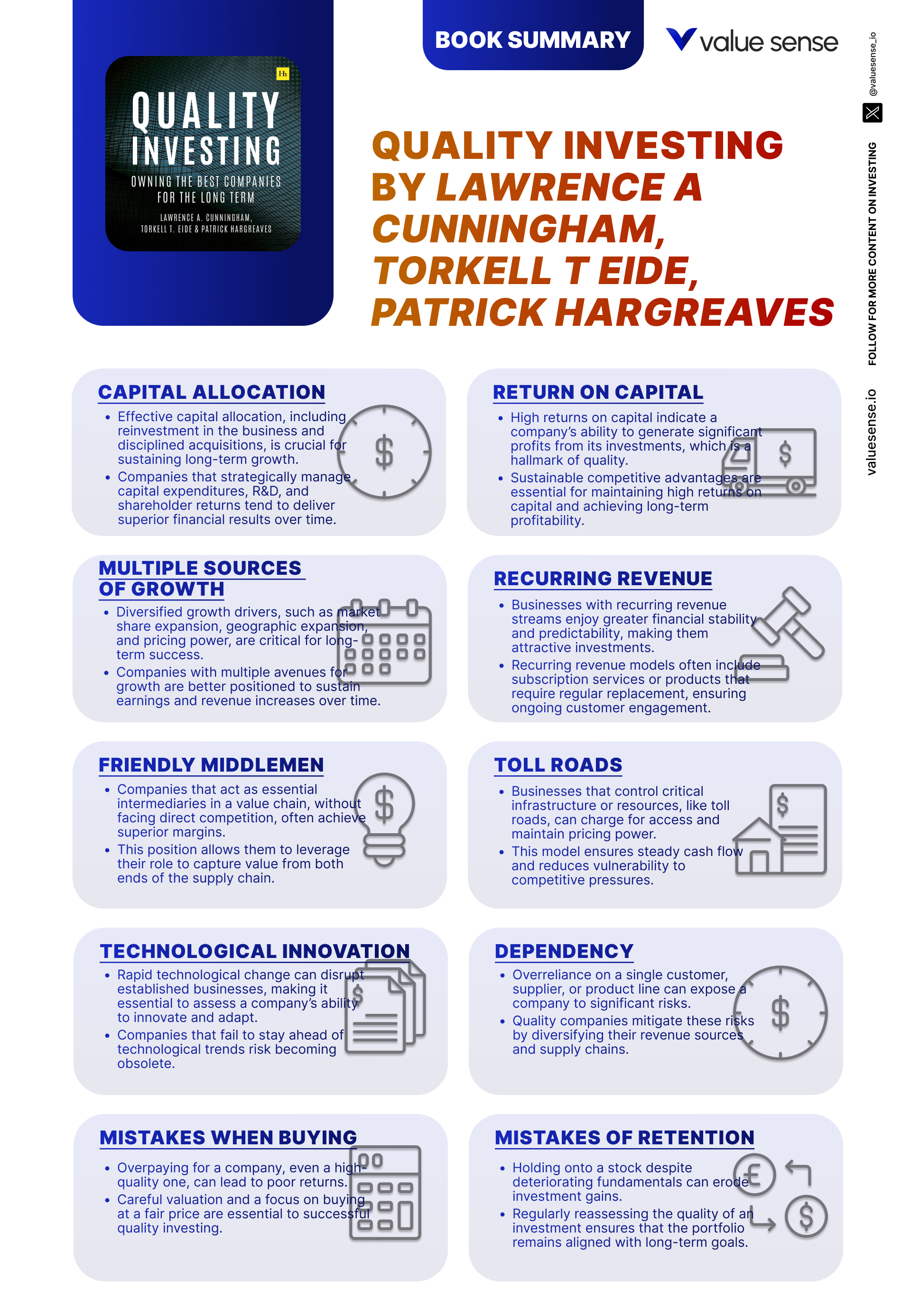

Key Themes and Concepts

At the core of “Quality Investing” are several interwoven themes that define the approach and set it apart from both traditional value and pure growth strategies. The book emphasizes that quality is not a vague or subjective term, but a set of measurable characteristics that, when properly understood, can lead to sustainable investment outperformance. The authors repeatedly stress the importance of looking beyond surface-level metrics to understand the true drivers of business excellence.

The themes presented in the book are not only theoretical but are supported by extensive real-world examples and data. They provide a roadmap for investors seeking to identify companies capable of compounding value over decades. By focusing on these themes, the authors challenge investors to raise their standards and adopt a disciplined, long-term mindset.

- Capital Allocation: Effective capital allocation is the lifeblood of any quality business. The book dedicates significant attention to how top companies deploy their capital—whether through reinvestment, acquisitions, dividends, or buybacks. The authors argue that companies with a proven track record of high return on invested capital (ROIC) and disciplined capital deployment are more likely to generate superior shareholder returns. For example, the book cites companies like Berkshire Hathaway and Unilever, which have consistently reinvested profits in high-return projects. For investors, analyzing a company’s capital allocation history and management’s stated philosophy is essential to predicting future performance.

- Competitive Advantage: One of the most recurring themes is the identification and durability of competitive advantages—often referred to as “moats.” The book details how features like strong brands, network effects, cost leadership, and regulatory barriers contribute to a company’s ability to fend off competitors. It uses examples such as Nestlé’s global brand portfolio and Visa’s network effects to illustrate how these advantages translate into pricing power and recurring revenues. Investors are encouraged to focus on companies whose competitive positions are not only strong but also likely to endure for decades.

- Management Quality: The authors place a premium on the integrity, vision, and execution ability of management teams. They argue that even the best business models can be undermined by poor leadership. The book discusses how to assess management by examining their track record, capital allocation decisions, communication transparency, and alignment with shareholder interests. For instance, the stewardship of leaders like Warren Buffett or Paul Polman (Unilever) is highlighted as a key reason for their companies’ enduring success. Investors should seek out management teams with a history of prudent decision-making and a clear long-term orientation.

- Risk Management: Understanding and mitigating risk is a central pillar of quality investing. The book warns against companies exposed to high cyclicality, technological disruption, or shifting consumer preferences. Through case studies of failures—such as Kodak’s inability to adapt to digital photography—the authors illustrate the dangers of complacency. Investors are advised to focus on companies with diversified revenue streams, adaptable business models, and robust balance sheets. Scenario analysis and stress testing are recommended tools for assessing a company’s resilience to shocks.

- Long-term Growth: The pursuit of sustainable, long-term growth is emphasized over the allure of short-term gains. The authors argue that companies capable of compounding earnings and reinvesting at high rates of return are the true engines of wealth creation. They provide examples of businesses like L’Oréal and Colgate-Palmolive, which have demonstrated consistent growth over decades. Investors are encouraged to look for evidence of continuous innovation, expanding addressable markets, and prudent reinvestment strategies as hallmarks of long-term compounding machines.

- Recurring Revenue Models: A recurring revenue base provides stability and predictability, which are highly prized in quality investing. The book discusses how subscription models, repeat-purchase products, and long-term contracts contribute to business resilience. Companies like Microsoft (with its transition to cloud-based subscriptions) and Reckitt Benckiser (with consumable household products) are highlighted. Investors should assess the proportion of recurring versus transactional revenue to gauge a company’s predictability and downside protection.

- Valuation Discipline: While quality is paramount, the authors caution against overpaying for even the best businesses. The book provides frameworks for assessing intrinsic value, emphasizing the importance of margin of safety. It discusses valuation metrics such as price/earnings, free cash flow yield, and enterprise value to EBITDA, but stresses that these should be contextualized within the company’s growth prospects and quality attributes. Investors are reminded that patience and discipline are essential to avoid the pitfalls of “growth at any price.”

Book Structure: Major Sections

Part 1: Foundations of Quality Investing

The opening section of “Quality Investing” lays the intellectual groundwork for the entire book, focusing on the fundamental attributes that define a quality company. It is primarily anchored in Chapter 1, which introduces readers to the essential building blocks: effective capital allocation, high return on capital, and the critical importance of management quality. This section argues that true quality investing is about much more than finding companies with high historical returns; it’s about understanding the drivers of those returns and the sustainability of a company’s business model.

Key concepts explored here include the difference between companies that generate high returns due to temporary factors and those with enduring advantages. The authors use data and case studies to illustrate how companies with consistently high ROIC and prudent capital allocation outperform over time. They also delve into the qualitative aspects of management—such as vision, integrity, and operational discipline—and how these traits translate into superior long-term results. The section emphasizes that quality is both measurable and observable, and that investors must develop a holistic understanding of what makes a business truly exceptional.

For practical application, investors are advised to develop a rigorous checklist for evaluating potential investments, focusing on both financial metrics and qualitative factors. This includes scrutinizing management’s track record, capital deployment decisions, and the company’s ability to generate cash flow through various market cycles. The authors recommend a long-term perspective, urging investors to look past short-term noise and focus on the underlying drivers of compounding value.

In today’s market, where short-termism and speculation often dominate headlines, the lessons from this section are more relevant than ever. The emphasis on capital allocation and management quality provides a counterweight to the prevailing focus on quarterly earnings and momentum trading. As investors face an increasingly complex and fast-changing landscape, grounding their approach in these foundational principles can help navigate uncertainty and build resilient portfolios.

Part 2: Patterns and Pitfalls

This section, encompassing Chapters 2 and 3, delves into the recurring patterns that distinguish quality companies, as well as the common pitfalls that can undermine even the most promising businesses. The unifying theme is that sustainable success is not accidental; it is the result of identifiable patterns such as recurring revenue, pricing power, and strong brands, balanced against the risks of cyclicality, technological disruption, and shifting customer preferences.

The authors provide detailed examples of companies that have mastered recurring revenue models—such as software-as-a-service providers and consumer staples companies. They illustrate how pricing power and brand strength contribute to superior margins and customer loyalty, using real-world data and case studies. On the flip side, the section warns of pitfalls like overreliance on cyclical industries, failure to innovate, and complacency in the face of changing market dynamics. The book’s analysis of failed companies, such as BlackBerry and Kodak, serves as a sobering reminder of the dangers of ignoring these risks.

Investors are encouraged to systematically analyze business models for evidence of recurring revenues, pricing flexibility, and brand durability. The authors recommend stress-testing assumptions and considering how a company might fare under adverse conditions. They also advise maintaining a healthy skepticism and avoiding companies that rely too heavily on a single product, customer, or market segment.

With industries being disrupted at an unprecedented pace, the insights from this section are especially pertinent. The rise of subscription-based business models and the accelerating impact of technological innovation make it essential for investors to distinguish between fleeting trends and durable patterns. By internalizing these lessons, investors can better position themselves to identify the next generation of compounding machines—and avoid costly mistakes.

Part 3: Implementation Strategies

The third section, centered on Chapter 4, addresses the practical challenges of putting quality investing principles into action. It covers the nuts and bolts of portfolio construction, valuation, mistake avoidance, and the discipline required to hold quality businesses through market volatility. The unifying theme is that even the best strategies can be undermined by poor execution or emotional decision-making.

Key concepts include the importance of resisting short-term market noise, focusing on qualitative factors, and developing a repeatable, disciplined investment process. The authors provide frameworks for assessing intrinsic value, including discounted cash flow analysis and relative valuation multiples, but stress that these should be used in conjunction with a deep understanding of business quality. The section also discusses common mistakes, such as overpaying for quality, failing to sell deteriorating businesses, and succumbing to behavioral biases.

For investors, the practical takeaway is the need to build a robust investment process that incorporates both quantitative screens and qualitative judgment. This includes setting clear criteria for buying, holding, and selling, as well as maintaining a long-term orientation even in the face of short-term volatility. The authors also recommend regular portfolio reviews and scenario analysis to ensure alignment with long-term goals.

In an era of algorithm-driven trading and information overload, the discipline and process orientation advocated in this section are more critical than ever. The ability to filter out noise, stay focused on fundamentals, and avoid common behavioral traps can make the difference between average and outstanding investment performance. The frameworks provided are highly relevant for both individual and institutional investors seeking to implement a quality-focused strategy.

Part 4: Case Studies and Real-World Applications

The final section of the book brings the principles of quality investing to life through detailed case studies and real-world examples. Although this section is not tied to specific chapters, it synthesizes the lessons from earlier parts and demonstrates how they apply in practice. The unifying theme is that theory must be tested against reality, and that the best way to internalize quality investing principles is by studying actual companies—both successes and failures.

The authors present case studies of companies that exemplify quality—such as Nestlé, L’Oréal, and Visa—showing how their business models, capital allocation, and management decisions have led to sustained outperformance. They also analyze failed investments, highlighting the warning signs and mistakes that could have been avoided. These real-world stories provide concrete illustrations of the book’s core concepts and offer valuable lessons for investors seeking to refine their approach.

From a practical standpoint, investors are encouraged to conduct their own case studies, using the frameworks provided in the book to analyze prospective investments. The authors suggest maintaining an “investment journal” to document decisions, lessons learned, and ongoing research. This practice not only sharpens analytical skills but also helps guard against repeating past mistakes.

As markets evolve and new business models emerge, the ability to learn from both triumphs and setbacks becomes increasingly important. The case study approach advocated in this section remains highly relevant, providing a bridge between timeless principles and the ever-changing realities of the investment landscape. By grounding their analysis in real-world examples, investors can build the conviction needed to hold quality companies through thick and thin.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Deep Dive: Essential Chapters

Chapter 1: Building Blocks

This chapter is critically important because it establishes the essential criteria that define a quality company. The authors meticulously lay out the foundational elements—effective capital allocation, high return on capital, and superior management quality—that underpin sustainable business success. By dissecting both financial and non-financial attributes, the chapter moves beyond superficial metrics, urging readers to develop a nuanced understanding of what drives long-term value creation. The concept of “building blocks” serves as the lens through which all subsequent analysis in the book is conducted.

Specific examples in this chapter include companies like Unilever and Berkshire Hathaway, which have demonstrated exceptional capital allocation over decades. The authors provide data on return on invested capital (ROIC), showing how companies with consistently high ROIC outperform their peers. They also quote Warren Buffett’s adage: “The most important decision in evaluating a business is pricing power.” The chapter details how management’s decisions—such as reinvesting profits versus distributing dividends—can make or break a company’s compounding ability. The discussion is supported by charts comparing long-term total shareholder returns across industries, emphasizing the importance of focusing on the right metrics.

Investors can apply these lessons by creating a checklist of key quality indicators, including ROIC, free cash flow generation, capital allocation track record, and management integrity. Concrete steps include analyzing annual reports for evidence of prudent reinvestment, reviewing management’s communication for clarity and long-term orientation, and comparing a company’s metrics to industry benchmarks. The chapter encourages investors to dig deeper than headline numbers, focusing on the underlying drivers of sustainable performance.

Historically, many of the world’s most successful investors—such as Charlie Munger and Tom Gayner—have emphasized the importance of these building blocks. In modern markets, where short-termism is rampant, the ability to identify companies with enduring quality traits provides a significant edge. As technology and globalization reshape industries, the principles outlined in this chapter remain timeless, offering a reliable framework for navigating uncertainty and building wealth.

Chapter 2: Patterns

Chapter 2 is a linchpin of the book because it identifies the recurring patterns that enable companies to deliver exceptional financial results over time. The authors argue that these patterns—such as recurring revenue, pricing power, and brand strength—are not just theoretical ideals, but observable characteristics that can be systematically identified and exploited by investors. By highlighting these patterns, the chapter provides a practical roadmap for spotting high-quality businesses before they become obvious to the broader market.

Detailed examples include companies like Microsoft, which successfully transitioned to a subscription-based model, and Nestlé, whose global brand portfolio has provided decades of pricing power and customer loyalty. The authors present data showing how companies with a high proportion of recurring revenue exhibit lower volatility and higher long-term returns. They quote industry studies demonstrating that businesses with strong brands can command premium pricing and fend off competition. The chapter also examines the role of network effects, using Visa and Mastercard as examples of companies whose value grows as their user base expands.

To apply these insights, investors should focus on identifying companies with stable, recurring revenue streams, strong pricing power, and defensible brands. Actionable steps include analyzing revenue breakdowns in financial statements, assessing customer retention rates, and evaluating brand recognition through third-party surveys. The chapter suggests using tools like Porter’s Five Forces to assess competitive positioning and sustainability of advantages.

In the real-world context, the patterns described in this chapter have proven resilient across multiple market cycles. The shift toward subscription-based and platform business models has only accelerated in recent years, making these insights even more valuable. Companies that master these patterns tend to outperform, regardless of short-term market fluctuations, underscoring the importance of structural advantages in long-term investing.

Chapter 3: Pitfalls

This chapter is essential because it addresses the risks and potential traps that can derail even the most promising investments. The authors stress that recognizing and avoiding pitfalls—such as cyclicality, technological disruption, and changing customer preferences—is just as important as identifying positive patterns. By examining both historical failures and common investor mistakes, the chapter provides a balanced perspective on the challenges of quality investing.

The chapter discusses companies like Kodak and BlackBerry, which failed to adapt to technological change and lost their competitive edge. It presents data on the volatility of cyclical industries, showing how earnings can swing dramatically and mislead investors about underlying quality. The authors quote Peter Lynch’s warning: “Never invest in anything that can eat you,” emphasizing the dangers of complexity and lack of transparency. Case studies illustrate how overreliance on a single product or market can expose companies to existential risks.

Investors can apply these lessons by conducting rigorous risk assessments, including scenario analysis and stress testing. Steps include evaluating a company’s exposure to economic cycles, monitoring technological trends, and assessing customer concentration risk. The chapter advises maintaining diversification and setting clear exit criteria for deteriorating businesses.

Historically, the pitfalls highlighted in this chapter have claimed many high-profile victims, from General Motors to Nokia. In today’s fast-moving markets, the ability to anticipate and mitigate risks is more important than ever. The chapter’s emphasis on humility, skepticism, and continuous learning provides a valuable counterbalance to the optimism that often accompanies quality investing.

Chapter 4: Implementation

Chapter 4 is pivotal because it translates the book’s principles into actionable investment strategies. The authors tackle the practical challenges of implementing a quality investing approach, including portfolio construction, valuation, and behavioral discipline. This chapter is where theory meets practice, offering readers a step-by-step guide to building and managing a portfolio of high-quality businesses.

The authors provide frameworks for intrinsic value estimation, such as discounted cash flow analysis and relative valuation multiples. They discuss the importance of avoiding short-term market influences, emphasizing that patience and discipline are critical to long-term success. The chapter includes examples of common mistakes—such as overpaying for quality, holding onto deteriorating businesses, and reacting emotionally to market swings. Quotes from renowned investors like Seth Klarman and Howard Marks reinforce the importance of process over prediction.

To apply these lessons, investors should develop a disciplined investment process that includes clear criteria for buying, holding, and selling. Steps include conducting thorough due diligence, setting target valuations, and regularly reviewing portfolio holdings for alignment with quality standards. The chapter recommends maintaining an investment journal to document decisions and lessons learned.

In the context of modern markets, where information overload and behavioral biases are rampant, the disciplined approach advocated in this chapter is more relevant than ever. The frameworks provided help investors stay focused on fundamentals and avoid the traps of short-termism. By implementing these strategies, investors can build resilient portfolios capable of weathering market volatility and compounding wealth over time.

Practical Investment Strategies

- Develop a Quality Checklist: Create a comprehensive checklist that includes both quantitative and qualitative factors—such as return on invested capital (ROIC), free cash flow generation, capital allocation history, management integrity, and competitive advantages. Use this checklist as a filter for every potential investment. Review annual reports, management commentary, and industry benchmarks to ensure each company meets your quality standards before adding it to your portfolio.

- Focus on Recurring Revenue Streams: Prioritize companies with a high proportion of recurring revenues, such as subscriptions, consumables, or long-term contracts. Analyze the revenue breakdown in financial statements and assess customer retention rates. Look for evidence of sticky customer relationships and low churn, as these traits provide stability and downside protection in volatile markets.

- Assess Management Quality: Evaluate management teams by reviewing their track record of capital allocation, transparency in communication, and alignment with shareholder interests. Listen to earnings calls, read shareholder letters, and track insider ownership. Favor companies where management has demonstrated a long-term orientation and prudent decision-making, and be wary of those with frequent strategy shifts or excessive compensation schemes.

- Stress-Test for Risks and Pitfalls: Conduct scenario analysis and stress tests to evaluate how a company would fare under adverse conditions, such as economic downturns, technological disruption, or regulatory changes. Use historical data to model potential impacts on earnings and cash flow. Diversify your portfolio to mitigate exposure to any single risk factor, and set clear exit criteria for deteriorating businesses.

- Maintain Valuation Discipline: Even the highest-quality companies are poor investments if bought at excessive valuations. Use valuation frameworks like discounted cash flow (DCF), price/earnings ratios, and free cash flow yield. Compare these metrics to industry peers and historical averages. Always require a margin of safety, and be patient—wait for attractive entry points rather than chasing momentum.

- Build a Concentrated, Long-Term Portfolio: Once you’ve identified a select group of high-quality companies, construct a concentrated portfolio to maximize exposure to your best ideas. Allocate capital based on conviction and risk assessment, but avoid over-diversification. Commit to a long-term holding period, allowing compounding to work in your favor, and resist the urge to trade frequently based on short-term noise.

- Document and Review Investment Decisions: Keep an investment journal to record your rationale for each buy, hold, or sell decision. Include notes on company fundamentals, valuation, and risk factors. Review your journal regularly to identify patterns, learn from mistakes, and refine your process. This discipline will help you avoid repeating errors and improve your analytical skills over time.

- Leverage Modern Tools and Data: Use advanced analytics, screeners, and research platforms (such as those offered by Value Sense) to identify and monitor quality companies. Set up alerts for changes in key metrics, track industry trends, and benchmark your portfolio against relevant indices. Incorporate both quantitative screens and qualitative research to ensure a holistic approach to stock selection.

Modern Applications and Relevance

The principles outlined in “Quality Investing” are remarkably applicable to today’s rapidly evolving markets. In an era dominated by technological disruption, globalization, and unprecedented market volatility, the focus on quality provides a much-needed anchor for investors. The book’s emphasis on recurring revenue, management quality, and competitive advantage is especially relevant as more companies transition to subscription-based models and intangible assets become increasingly important drivers of value.

Since the book’s publication, the rise of mega-cap technology companies such as Apple, Microsoft, and Alphabet has demonstrated the power of compounding in businesses with strong moats and scalable platforms. These companies exemplify many of the book’s core principles—high returns on capital, disciplined capital allocation, and resilient business models. At the same time, the proliferation of passive investing and the explosion of information have made it more challenging to identify underappreciated quality stocks, increasing the importance of rigorous analysis and independent thinking.

What remains timeless is the need for patience, discipline, and a long-term perspective. The book’s warnings against overpaying for quality and succumbing to behavioral biases are as relevant today as ever. While new tools and data sources have made it easier to analyze companies, the fundamentals of quality investing—deep research, understanding of business models, and focus on sustainable advantages—have not changed.

Modern examples abound. The transition of Adobe and Microsoft to subscription models has provided recurring revenue and improved predictability. Consumer staples giants like Procter & Gamble and Nestlé continue to demonstrate the power of brand and scale. Conversely, the collapse of companies like WeWork and Theranos underscores the risks of neglecting fundamentals and chasing hype. Investors who apply the lessons of “Quality Investing” are better equipped to navigate both opportunities and pitfalls in today’s market.

To adapt classic advice to current conditions, investors should leverage modern research tools, stay abreast of technological trends, and maintain a flexible mindset. The core principles of quality investing—capital allocation, competitive advantage, and management integrity—remain the bedrock of successful investing, even as the landscape evolves. By internalizing these lessons, investors can build portfolios that withstand the test of time and deliver superior long-term returns.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Implementation Guide

- Define Your Quality Criteria: Begin by articulating the specific financial and qualitative attributes that constitute a “quality” company in your view. Develop a checklist that includes metrics like ROIC, free cash flow, management track record, and competitive advantages. Use this checklist as the foundation for all investment decisions, ensuring consistency and objectivity in your process.

- Screen and Research Candidates (1-2 weeks): Use stock screeners and research platforms to identify companies that meet your quality criteria. Conduct deep dives into annual reports, earnings calls, and industry analysis to validate your initial findings. Prioritize companies with a history of stable earnings, recurring revenues, and prudent capital allocation.

- Construct a Focused Portfolio (2-4 weeks): Select a limited number of high-conviction ideas—typically 10-20 companies—that represent the best opportunities based on your research. Allocate capital based on conviction, risk assessment, and diversification needs. Avoid over-concentration in any single sector or geographic region, but do not dilute your portfolio with mediocre businesses.

- Establish Ongoing Review and Monitoring (Monthly/Quarterly): Set a regular schedule to review portfolio holdings, update financial models, and reassess each company’s adherence to your quality criteria. Monitor for changes in management, business fundamentals, or industry dynamics. Be prepared to exit positions that no longer meet your standards, and add to those that continue to demonstrate exceptional quality.

- Commit to Continuous Improvement (Ongoing): Keep an investment journal to document your decisions, rationale, and lessons learned. Seek out new resources—books, podcasts, expert interviews, and investment letters—to refine your process. Engage with other quality-focused investors, participate in forums, and attend industry conferences to stay current on best practices and emerging trends.

--- ---

10+ Free intrinsic value tools

For investors looking to find a stock's fair value, our analytics team has you covered with intrinsic value tools:

📍 Free Intrinsic Value Calculator

📍 Reverse DCF & DCF value tools

📍 Peter Lynch Fair Value Calculator

📍 Ben Graham Fair Value Calculator

📍 Relative Value tool

...and plenty more.

🔍 Explore all these tools for free on the Value Sense platform and start discovering what your favorite stocks are really worth.

FAQ: Common Questions About Quality Investing

1. What is the main difference between quality investing and traditional value investing?

Quality investing focuses on owning companies with durable competitive advantages, high returns on capital, and superior management, regardless of whether they appear “cheap” by traditional metrics. In contrast, value investing often emphasizes buying stocks trading below intrinsic value, sometimes at the expense of business quality. The book argues that long-term outperformance comes from holding exceptional businesses rather than simply hunting for bargains.

2. How can investors assess management quality in a company?

Investors can assess management quality by examining the team’s track record in capital allocation, transparency in communication, and alignment with shareholder interests. Key indicators include consistent reinvestment in high-return projects, clear and honest shareholder letters, and significant insider ownership. Reviewing management’s response to past challenges and their long-term strategic vision also provides valuable insights.

3. Why is recurring revenue considered so important in quality investing?

Recurring revenue provides stability and predictability, which are crucial for compounding value over time. Companies with subscription models, repeat-purchase products, or long-term contracts tend to experience less volatility in earnings and are better positioned to withstand economic downturns. The book highlights that a high proportion of recurring revenue is a hallmark of resilient, high-quality businesses.

4. What are some common pitfalls investors should avoid when practicing quality investing?

Common pitfalls include overpaying for quality companies, ignoring signs of deteriorating fundamentals, and underestimating risks such as technological disruption or cyclicality. The book advises rigorous risk assessment, maintaining valuation discipline, and being willing to exit positions when quality standards are no longer met. Emotional decision-making and lack of process discipline are also frequent mistakes.

5. How can the principles of quality investing be adapted to today’s fast-changing markets?

Investors can adapt by leveraging modern research tools, staying informed about technological and industry trends, and maintaining a flexible yet disciplined approach. The core principles—such as focusing on capital allocation, competitive advantage, and management integrity—remain timeless. The key is to combine these fundamentals with ongoing learning and adaptability to new market realities.