Understanding the general (quality) rating in Value Sense: A unified measure of investment potential

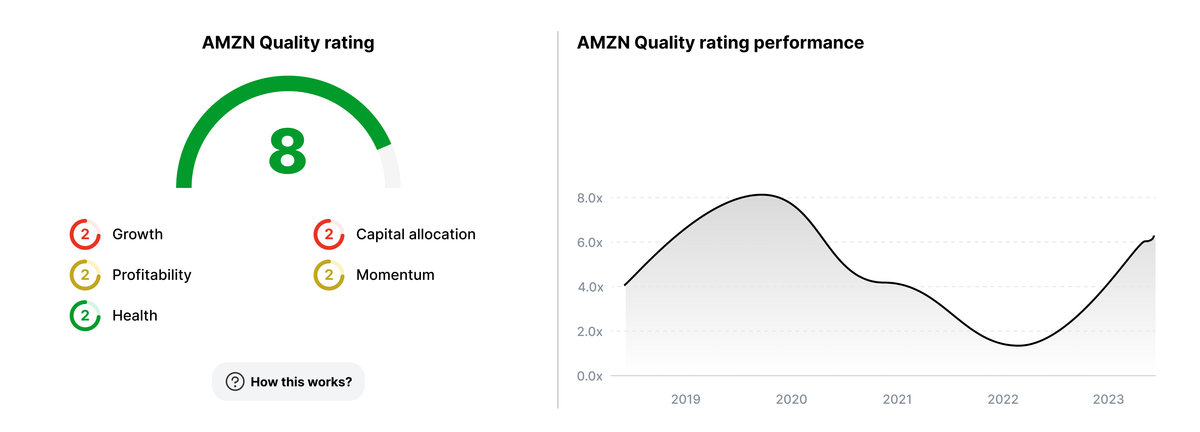

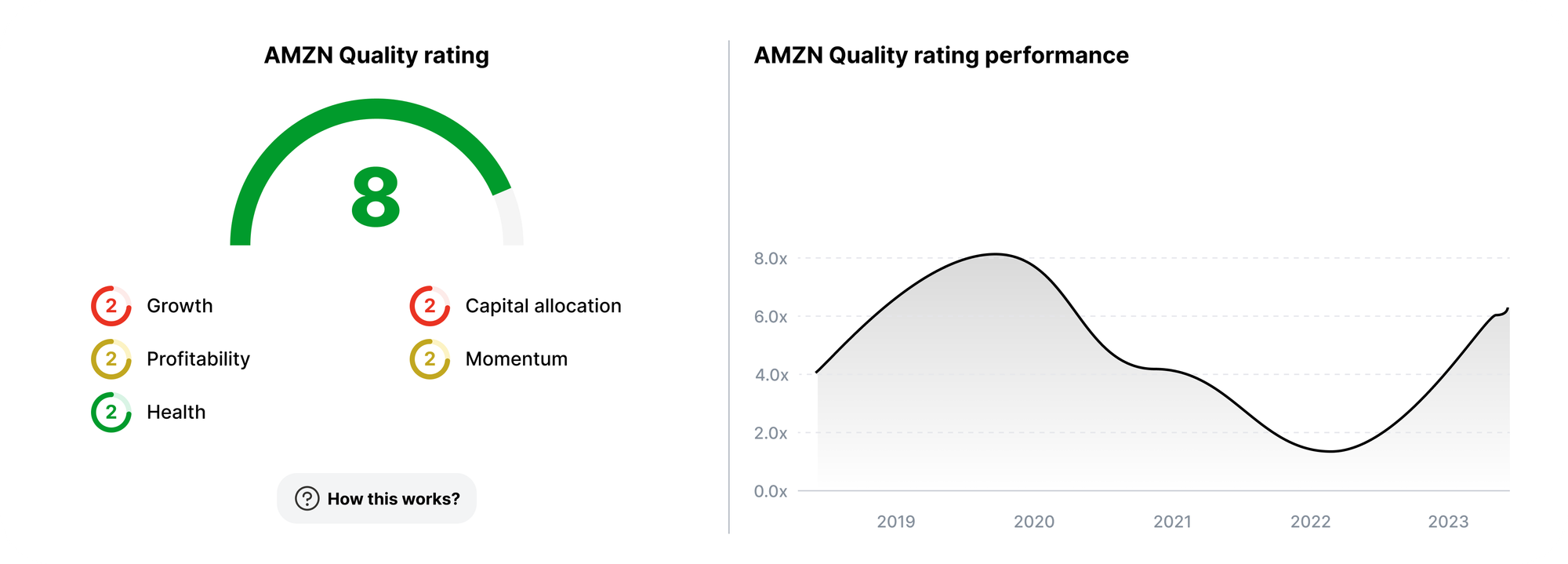

In the complex world of value investing, one question often arises: How can I assess a company's overall quality at a glance? At Value Sense, we’ve developed a robust scoring system to empower investors with actionable insights. Our general (quality) rating serves as a single, unified measure of a company's overall financial and operational excellence. Here's how it works and why it matters.

The building blocks of the quality rating

The quality rating isn’t just a number; it’s a calculated synthesis of multiple critical dimensions of a company’s performance. This rating is composed of sub-ratings across six key pillars, each representing a unique aspect of business health and success. These pillars and their respective weights in the overall quality rating are:

- Growth (20%): Evaluates a company’s historical and projected ability to expand its revenue, earnings, and cash flows.

- Profitability (25%): Assesses the company’s efficiency in generating profits relative to its costs and revenues.

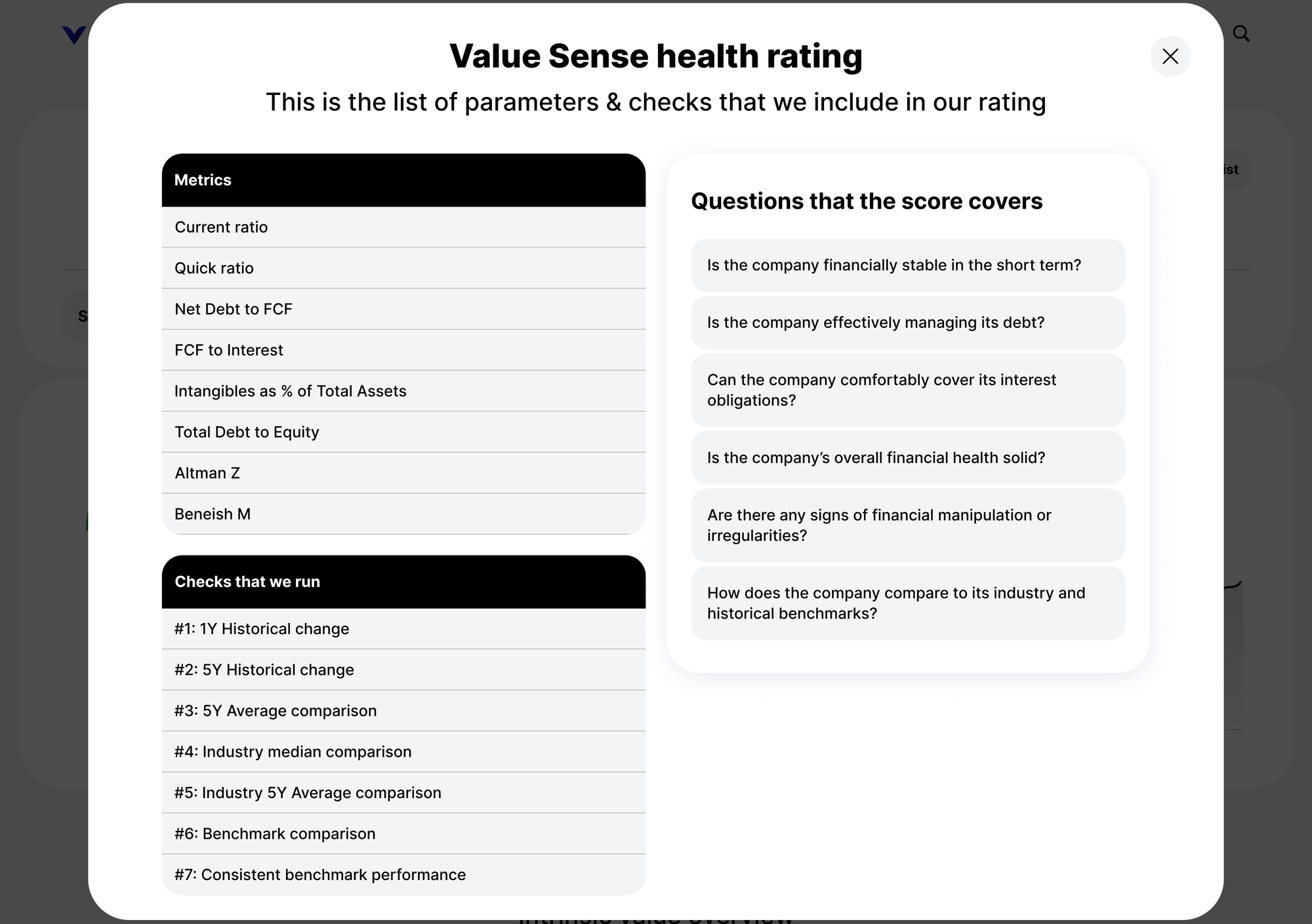

- Health (25%): Analyzes the financial stability of a company, focusing on metrics such as debt levels, liquidity, and insolvency risk.

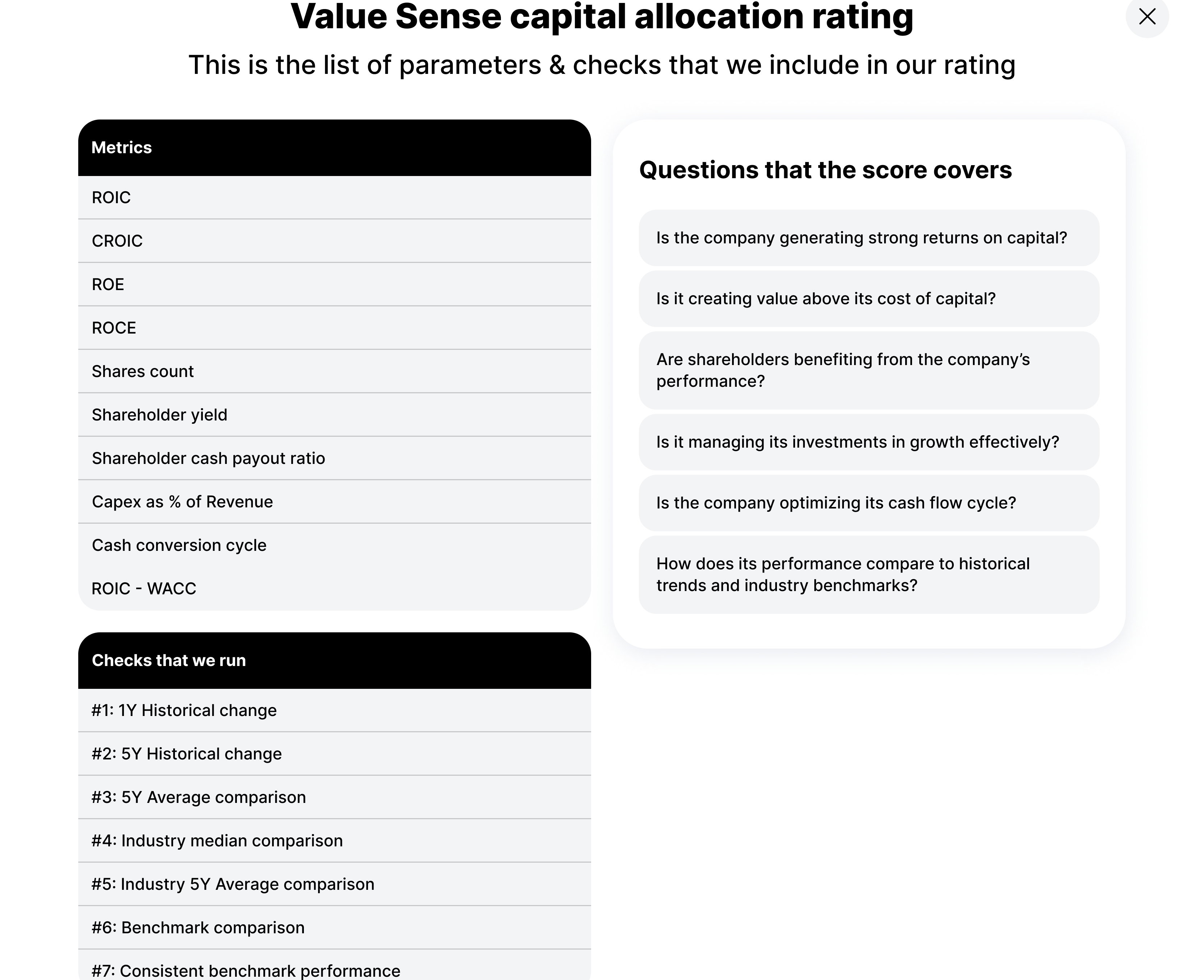

- Capital allocation (20%): Looks at how effectively the company deploys its capital to create shareholder value.

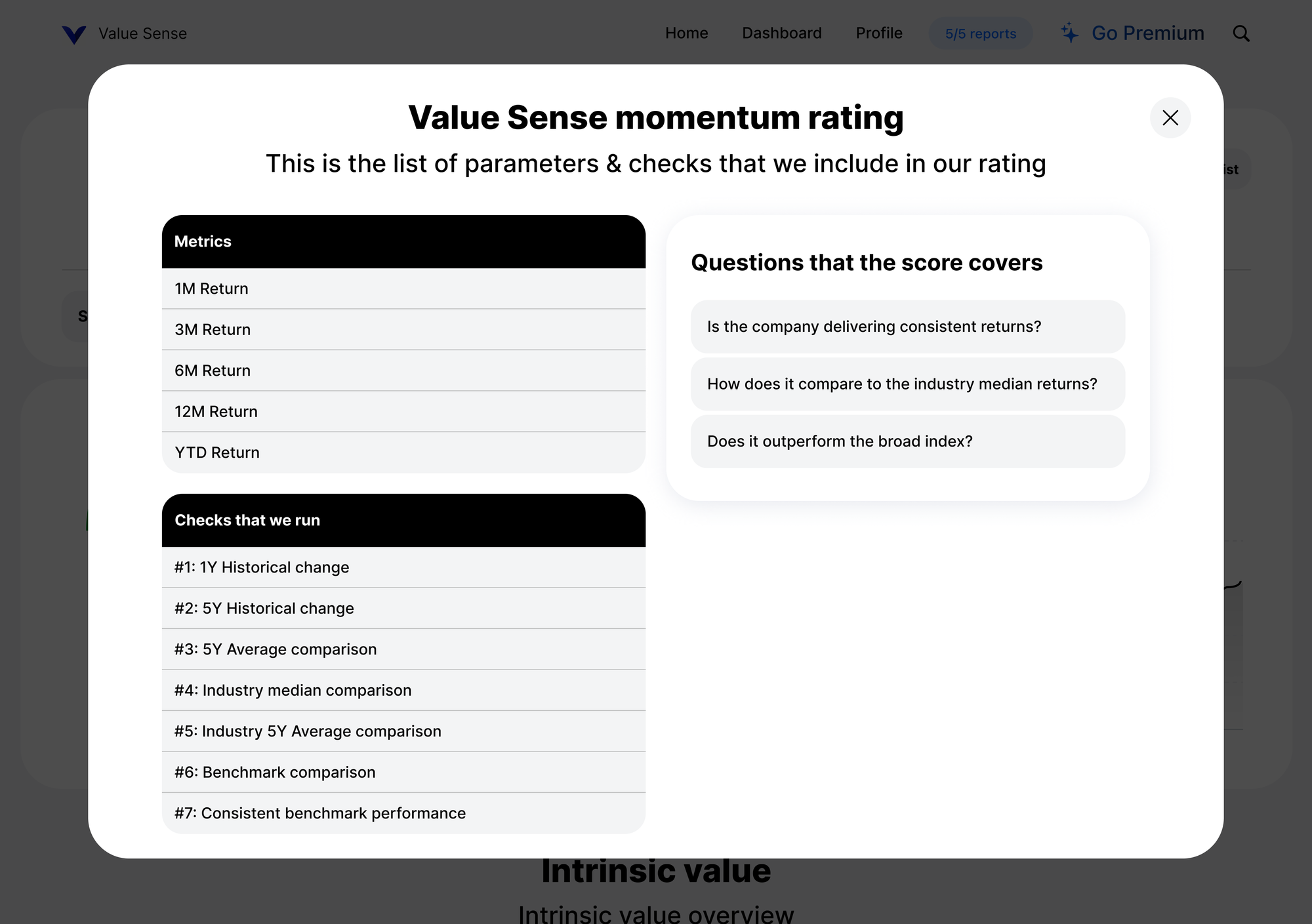

- Momentum (10%): Captures trends in the company’s stock price performance over different timeframes.

Why do these pillars matter?

Each pillar in our scoring system provides unique insights into the company's fundamentals:

- Growth ensures that the company has potential for future expansion, crucial for long-term investments.

- Profitability reflects the company’s ability to generate value from its operations, a key indicator of competitive advantage.

- Health focuses on the company’s resilience in challenging environments.

- Capital allocation measures management's competence in using resources effectively.

- Momentum gives a snapshot of company stock price performance and its ability to outperform the market.

By combining these sub-ratings, the quality rating represents a holistic view of the company’s strength as an investment.

The methodology behind the rating

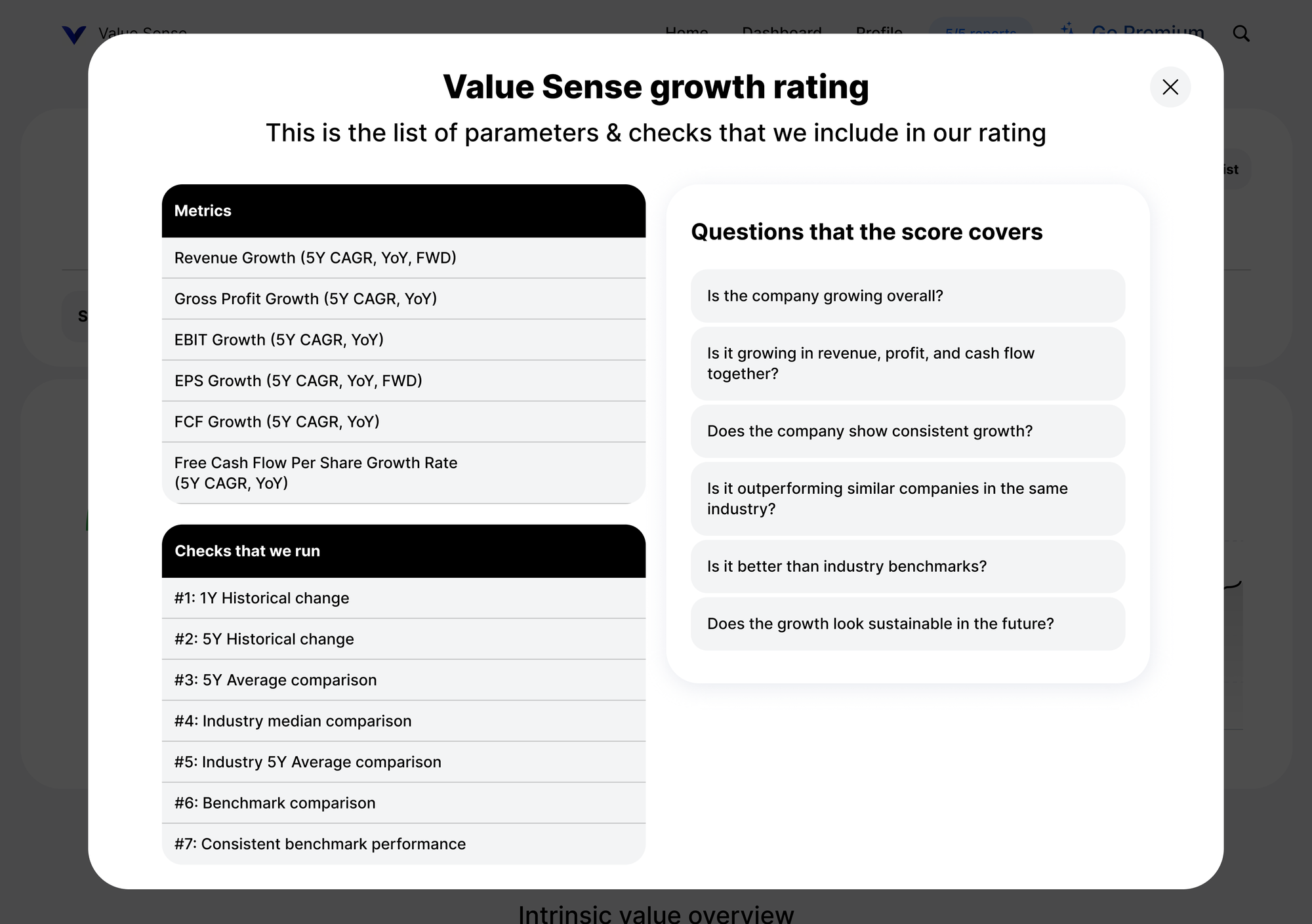

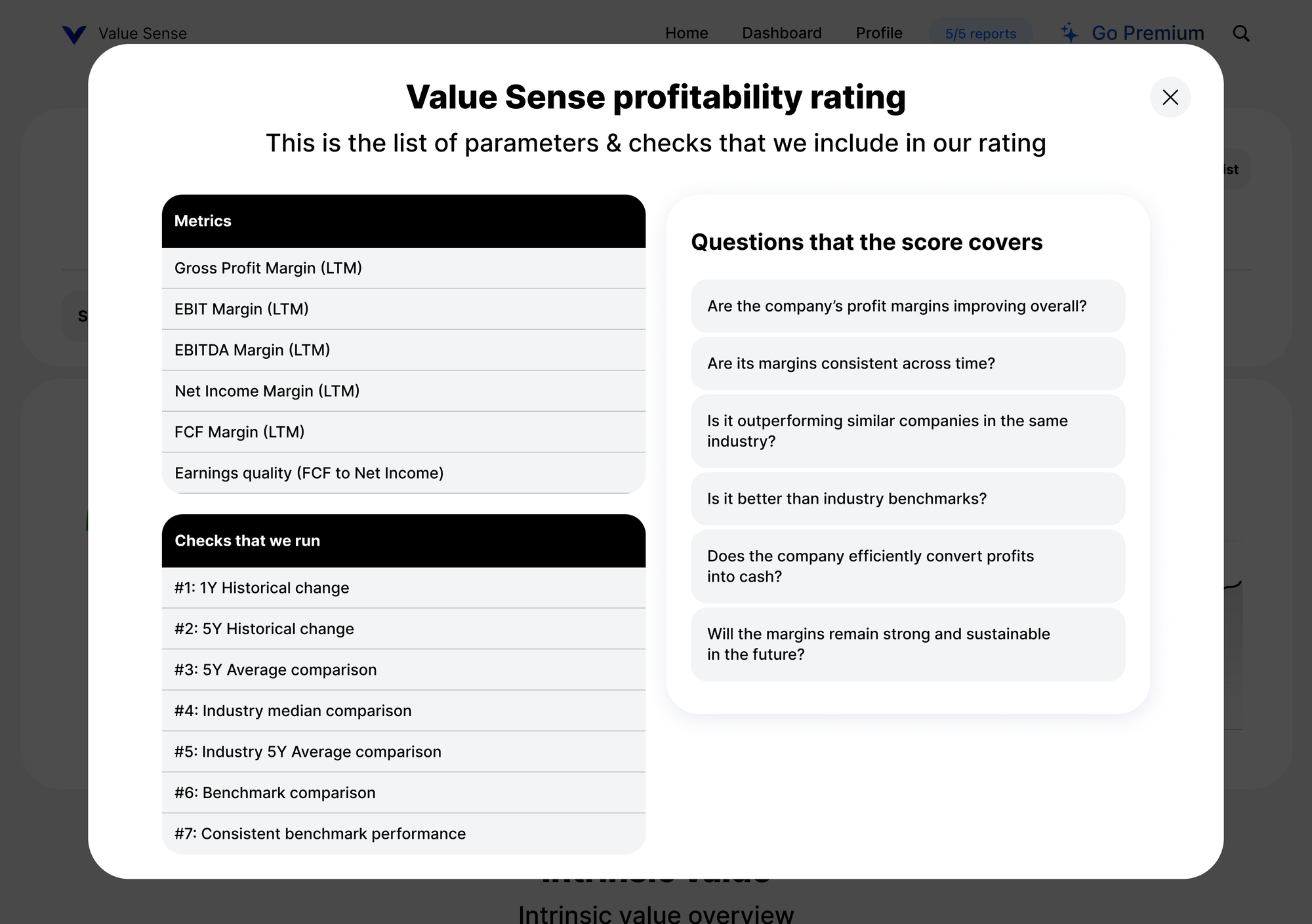

Each section’s score is calculated using a weighted blend of industry-standard metrics. For example:

- Growth incorporates metrics like revenue growth, EBIT growth, and EPS growth over multiple periods (5Y CAGR, YoY, and forward projections).

- Profitability focuses on gross, EBIT, EBITDA, and net income margins alongside free cash flow metrics.

- Health includes debt ratios, Altman Z-scores, and other solvency metrics.

- Capital allocation evaluates shareholder returns, capital efficiency (ROIC, ROE, CROIC), and reinvestment policies.

- Momentum considers returns across 1-month, 3-month, 6-month, and 12-month timeframes.

By assigning a weight to each metric and normalizing across industries, we ensure that the final quality score is both accurate and comparable.

Why the quality score matters for investors

The general (quality) score provides a single, easy-to-understand indicator of a company’s investment attractiveness. For seasoned investors, it serves as a starting point for deeper research. For beginners, it simplifies complex financial data into a clear narrative, helping them make smarter decisions faster.

Moreover, our scoring system aligns with Value Sense’s mission: making value investing accessible, data-driven, and actionable for everyone.

What’s next?

At Value Sense, we believe in transparency and empowerment. Each section of the quality rating is accompanied by detailed popups explaining how ratings are calculated and what they represent. As we continue to refine and expand our platform, we remain committed to providing tools that help you make informed, confident investment decisions.

Your financial future deserves nothing less.