Ray Dalio - Bridgewater Associates, Lp Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

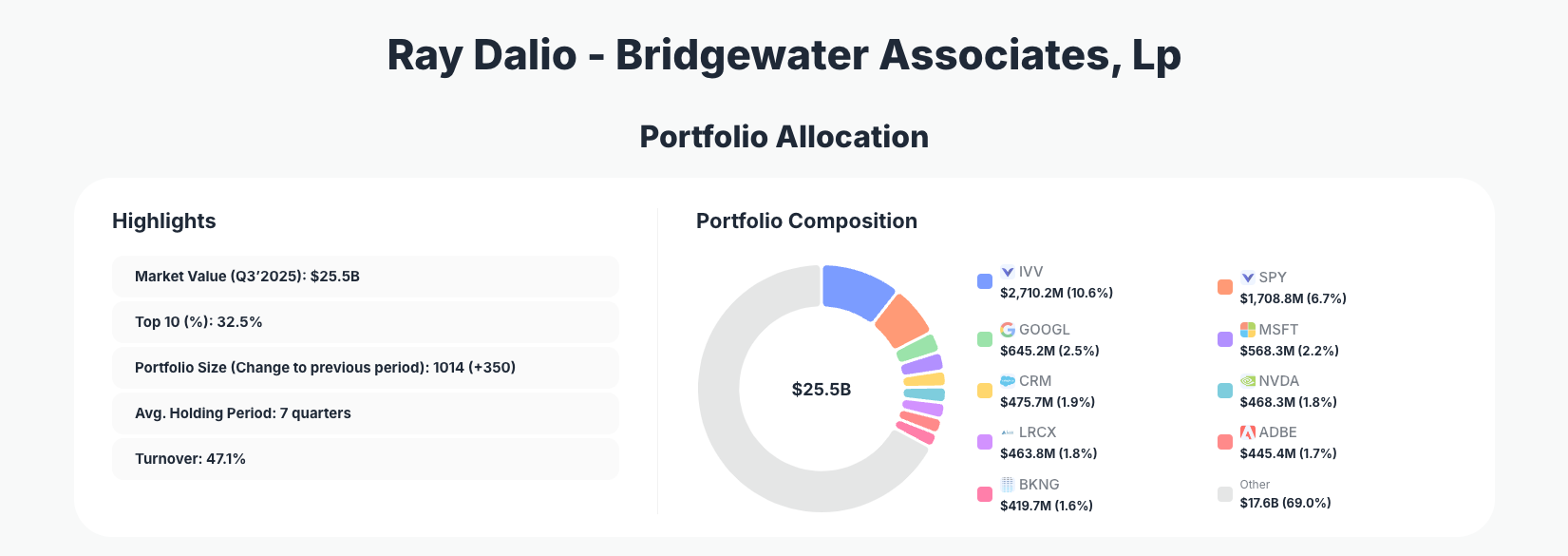

Ray Dalio, founder of Bridgewater Associates, showcases his signature macro-driven adaptability in the latest 13F filing. His $25.5B Q3 2025 portfolio reflects high turnover with bold additions to broad market ETFs alongside strategic trims in mega-cap tech names, signaling a pivot toward diversified market exposure amid economic uncertainty.

Portfolio Overview: Diversified Scale with Macro Precision

Portfolio Highlights (Q3’2025): - Market Value: $25.5B - Top 10 Holdings: 32.5% - Portfolio Size: 1014 +350 - Average Holding Period: 7 quarters - Turnover: 47.1%

Bridgewater's $25.5B portfolio stands out for its massive scale, holding over 1,000 positions—a +350 increase from the prior quarter—while maintaining a relatively modest top 10 concentration of just 32.5%. This structure embodies Ray Dalio's risk parity philosophy, balancing broad diversification across hundreds of names with tactical bets in key areas. The 47.1% turnover rate underscores an active management style, far higher than many peers, reflecting Bridgewater's quantitative models responding to shifting macro conditions like interest rates and geopolitical tensions.

The average holding period of 7 quarters suggests a blend of medium-term convictions and opportunistic trades, allowing the fund to adapt without excessive churn. With positions spanning ETFs, tech giants, and semiconductors, the Bridgewater portfolio prioritizes liquidity and beta exposure over concentrated stock picks. This approach suits institutional-scale investing, where minimizing drawdowns through diversification is paramount, yet the recent +350 position additions hint at heightened opportunity-seeking in fragmented markets.

Top Holdings Breakdown: ETF Power Plays and Selective Tech Bets

The portfolio leads with heavy ETF allocations, as ISHARES TR commands 10.6% after a massive Add 75.31% $2,710.2M, positioning Bridgewater for broad equity upside. Similarly, SPDR S&P 500 ETF TR holds 6.7% following a minor Reduce 1.73% $1,708.8M, maintaining core S&P exposure. Tech reductions dominate changes, with Alphabet Inc. (GOOGL) trimmed 52.61% to 2.5% $645.2M and Microsoft Corporation (MSFT) cut 36.03% to 2.2% $568.3M.

Adds reveal bullishness on software and semis: Salesforce, Inc. (CRM) boosted Add 22.41% to 1.9% $475.7M, while NVIDIA Corporation (NVDA) was sharply reduced 65.28% to 1.8% $468.3M, possibly locking in AI gains. Lam Research Corporation (LRCX) doubled down with Add 111.38% to 1.8% $463.8M, betting on chip equipment demand. Adobe Inc. (ADBE) saw Add 73.09% to 1.7% $445.4M, and Booking Holdings Inc. (BKNG) edged up Add 2.07% to 1.6% $419.7M.

Beyond the top ranks, GE Vernova Inc. (GEV) was reduced 16.34% to 1.6% $400.4M, rounding out active moves in industrials and energy transition plays. This mix of ETF ramps, tech profit-taking, and selective growth adds paints a picture of tactical rebalancing.

What the Portfolio Reveals

Bridgewater's Q3 moves highlight a macro hedge fund's response to volatility: - ETF Emphasis for Risk Parity: Massive adds to ISHARES TR and S&P trackers suggest de-risking via broad beta, reducing single-stock volatility. - Tech Sector Pruning: Deep cuts in GOOGL, MSFT, and NVDA indicate profit-taking after AI rallies, freeing capital for undervalued pockets. - Semiconductor and Software Selectivity: Bold adds in LRCX and ADBE point to conviction in supply chain enablers over end-user hype. - High Turnover as Macro Signal: 47.1% churn and +350 positions reflect models anticipating economic shifts, prioritizing liquidity.

Geographic focus remains U.S.-centric, with no overt dividend chase but clear risk management through scale.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| ISHARES TR | $2,710.2M | 10.6% | Add 75.31% |

| SPDR S&P 500 ETF TR | $1,708.8M | 6.7% | Reduce 1.73% |

| Alphabet Inc. | $645.2M | 2.5% | Reduce 52.61% |

| Microsoft Corporation | $568.3M | 2.2% | Reduce 36.03% |

| Salesforce, Inc. | $475.7M | 1.9% | Add 22.41% |

| NVIDIA Corporation | $468.3M | 1.8% | Reduce 65.28% |

| Lam Research Corporation | $463.8M | 1.8% | Add 111.38% |

| Adobe Inc. | $445.4M | 1.7% | Add 73.09% |

| Booking Holdings Inc. | $419.7M | 1.6% | Add 2.07% |

This table underscores Bridgewater's lack of extreme concentration—none exceed 11%—enabling risk spreading across 1,014 positions. The ETF duo alone accounts for over 17%, providing efficient market beta, while tech trims like NVDA's 65% cut demonstrate disciplined profit realization. Adds in LRCX 111% and ADBE 73% show targeted conviction without overexposure, aligning with Dalio's principles of balanced bets.

Investment Lessons from Ray Dalio's Bridgewater Approach

- Embrace Diversification at Scale: With 1,014 positions, Bridgewater proves true risk parity requires breadth, not just a handful of winners—retail investors can mimic via low-cost ETFs.

- High Turnover for Macro Adaptation: 47.1% churn teaches monitoring economic cycles over buy-and-hold rigidity; adjust when models signal shifts.

- Profit-Take Aggressively: Drastic NVDA and GOOGL reductions highlight securing gains post-rallies, avoiding recency bias.

- Beta via ETFs as Foundation: 17%+ in broad trackers like ISHARES TR shows efficient core exposure, layering alpha on top.

- Position Sizing Reflects Conviction: Doubling LRCX precisely where models see edge, without chasing crowded trades.

Looking Ahead: What Comes Next?

Bridgewater's high turnover and +350 new positions suggest ample dry powder for further macro pivots, especially if rate cuts accelerate. ETF builds position the fund for S&P upside, while tech trims create flexibility for undervalued cyclicals or emerging AI infrastructure. In a 2026 landscape of potential recession risks, current semis exposure via LRCX sets up for capex cycles, with software adds like ADBE hedging enterprise spending. Watch for commodity or fixed-income tilts if inflation reemerges—Dalio's models thrive on such dislocations.

FAQ about Ray Dalio Bridgewater Portfolio

Q: What drove Bridgewater's biggest Q3 2025 changes?

A: Key moves included Add 75.31% to ISHARES TR 10.6% for broad exposure and sharp reductions like 65.28% in NVDA, reflecting macro profit-taking amid tech valuations.

Q: Why is Bridgewater's portfolio so large and diversified?

A: At 1,014 positions and 32.5% top 10 concentration, it embodies risk parity—spreading bets to minimize drawdowns, unlike concentrated stock-pickers, suiting Bridgewater's quant-driven macro strategy.

Q: What sectors dominate Bridgewater's top holdings?

A: ETFs lead (17%+ combined), followed by tech like GOOGL, MSFT, semis (LRCX), and software (CRM, ADBE).

Q: How can I track and follow Ray Dalio's Bridgewater portfolio?

A: Monitor quarterly 13F filings on the SEC site or use ValueSense's superinvestor tracker at https://valuesense.io/superinvestors/bridgewater for real-time analysis, historical changes, and visualizations—note the 45-day reporting lag means positions may evolve post-filing.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!