Relative Valuation Multiples: How to Calculate Them

Welcome to Value Sense Blog

At Value Sense we help investors instantly find top-performing stocks and undervalued companies, saving time on research. You can explore our intrinsic value tools at valuesense.io and learn more about our latest stock ideas.

Financial markets are intricate ecosystems shaped by a wide array of factors, from economic trends to shifts in investor sentiment. Navigating this complex environment requires making informed investment decisions, which often involves analyzing the value of financial assets. One commonly used method to evaluate assets is relative valuation, also known as comparable analysis. In this article, we will delve into the significance of relative valuation and offer a comprehensive guide on how to apply it effectively.

Basic Definition of Relative Value

Remember those times when your parents compared your exam results to your more successful sibling or when they told you to be like “Sharma Ji Ka Beta”? Or perhaps that moment when your teacher scolded you for causing a ruckus and compared you to a monkey! Believe it or not, these are examples of relative valuation. Essentially, you take a characteristic (like marks, behavior, or manners in these cases) and compare it to someone else’s to assess where you stand. In financial markets, this idea translates to comparing the valuation of a company with similar or benchmark companies to determine if it’s overvalued, undervalued, or fairly priced in relation to its peers.

Relative valuation is commonly performed using price multiples, such as the Price/Earnings (P/E) or Price/Book (P/B) ratios, or enterprise multiples like Enterprise Value/EBITDA. The core concept is that comparable assets should trade at comparable prices. A great example is pairs trading, which involves comparing closely related stocks, such as two automotive companies. In this strategy, you would buy the stock that appears undervalued and sell short the one that looks overvalued.

Relative Value Method: Pros and Cons

Relative Value Pros:

- Ease and Efficiency: One of the main advantages of relative valuation methods is their simplicity compared to intrinsic valuation techniques like Discounted Cash Flow (DCF). These methods require less time and effort to perform, making them a convenient option for analysts seeking a quick evaluation.

- Less Data-Intensive: Relative valuation requires fewer data inputs compared to more complex methods like DCF, making it particularly useful in cases where financial information is scarce. This is especially advantageous when valuing private companies, where access to detailed financial data is often limited.

- Practical for Public Comparisons: Even when the target company has many publicly traded competitors, relative valuation allows for practical comparisons based on observable market data. It’s easier to apply in markets where peer companies share similar characteristics, making it accessible for a broad range of industries.

- Useful for Market Alignment: Relative valuation is grounded in the idea that market prices can serve as useful indicators of value. This allows investors to quickly see how a company’s pricing compares to its peers, often offering a helpful "sanity check" when used alongside more detailed valuation models like DCF.

Relative Value Cons:

- Imperfect Comparisons: While relative valuation offers a way to compare companies, the comparisons are rarely perfect. Even among firms that operate in the same industry, differences in growth prospects, risk profiles, or operational efficiencies can skew results, leading to less accurate valuations.

- Implicit Assumptions: A significant downside of relative valuation is that, while there are fewer explicit assumptions (e.g., about growth rates or discount factors), it implicitly assumes that market prices are correct or at least provide useful benchmarks. This assumption can be risky, particularly in volatile or inefficient markets.

- Industry Bubbles and Market Bias: Since relative valuation relies on current market prices, it is vulnerable to overvaluation during market bubbles. If an entire industry is overvalued—such as the tech sector during the dot-com bubble—the method may fail to flag inflated valuations.

- Limited Insight into Fundamentals: Unlike intrinsic methods like Discounted Cash Flow, which are rooted in fundamental analysis, relative valuation doesn’t provide deep insights into a company’s underlying financial health. It relies on external comparisons rather than an understanding of how the company's cash flows or earnings potential justify its value.

In summary, the primary benefit of relative valuation methods is their ease of use and efficiency, especially when compared to more complex models. They offer a quick, market-based assessment of value, making them particularly useful for comparative analysis and as a "sanity check" for more detailed methods. However, the downsides include the risk of relying too heavily on market prices, which can lead to misleading conclusions in cases of industry-wide mispricing or market bubbles.

Application

The process of applying relative valuation can be broken down into a few key steps:

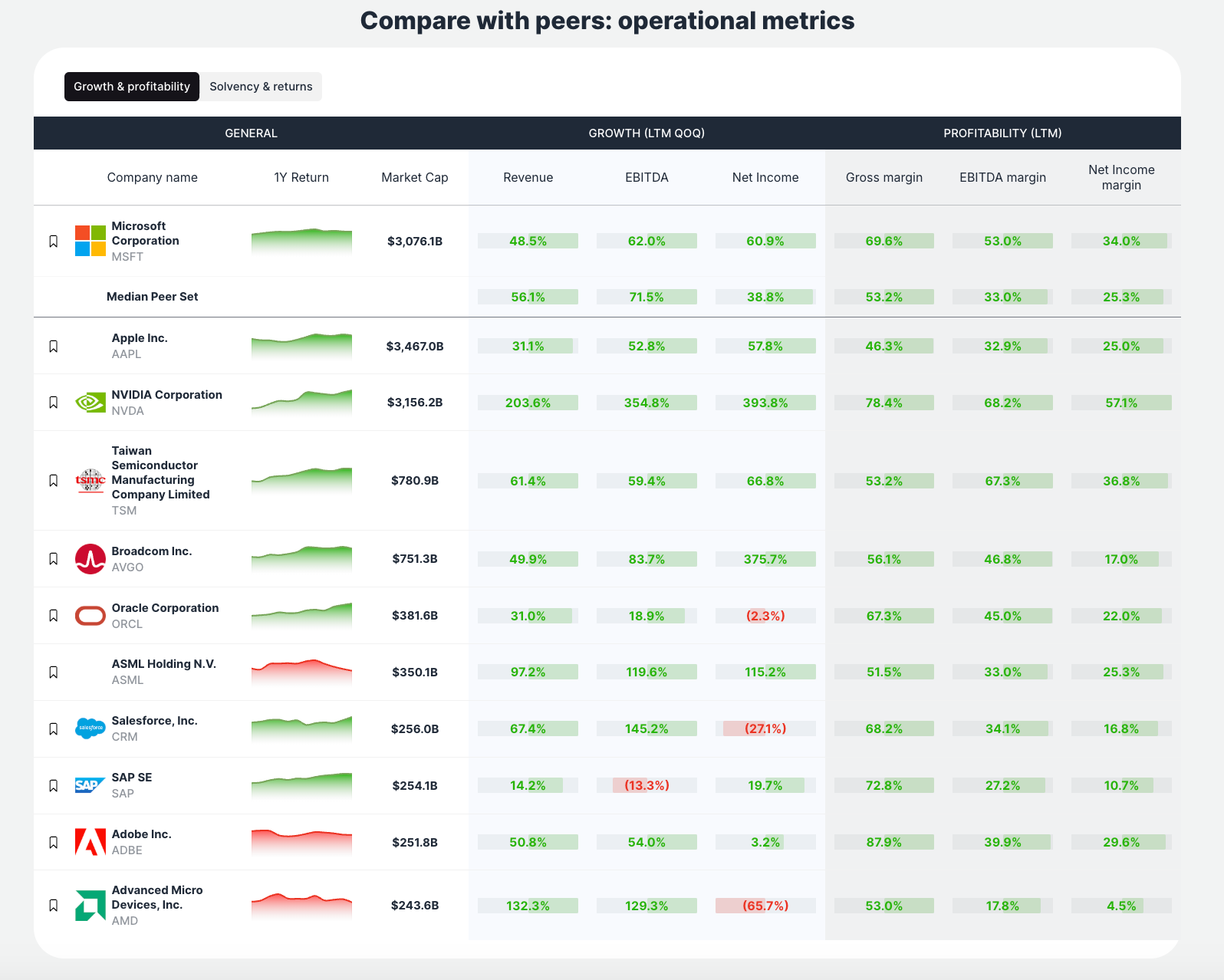

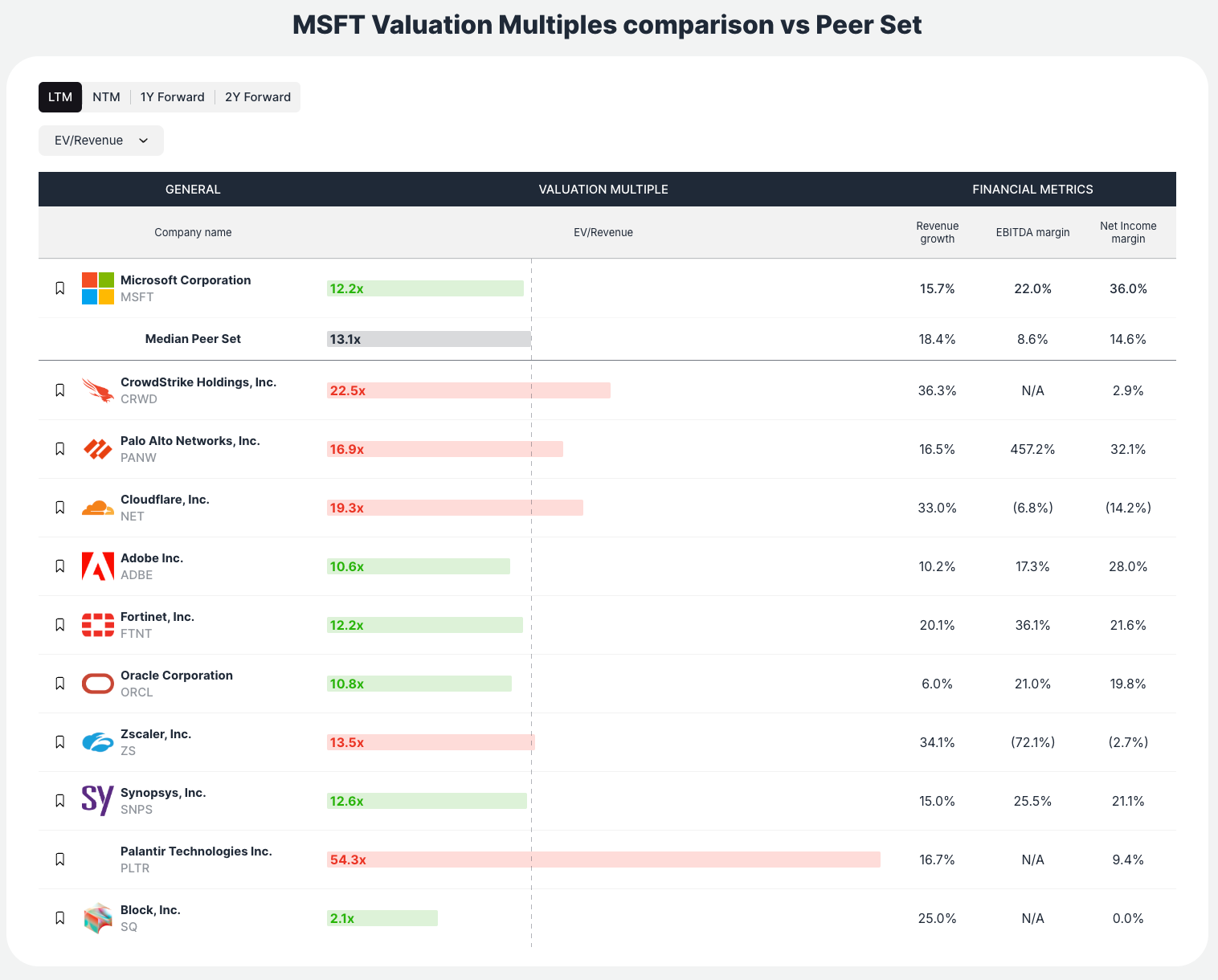

Identify Comparable Companies: The first step is to find companies that are similar to the target company in terms of industry, size, and business model. Tools such as stock screeners or industry databases can help compile a list of relevant firms. Additionally, annual reports and financial statements can provide useful information to identify comparable companies. In some cases, a broader market index may also be used as a benchmark to assess a company's relative valuation.

Gather Financial Data: Once you have identified the comparable companies, the next step is to collect their financial data, as well as that of the target company. This includes key financial metrics such as earnings, revenue, book value, and other performance indicators. Financial reports, regulatory filings, and reliable financial data platforms are typically used to obtain this information.

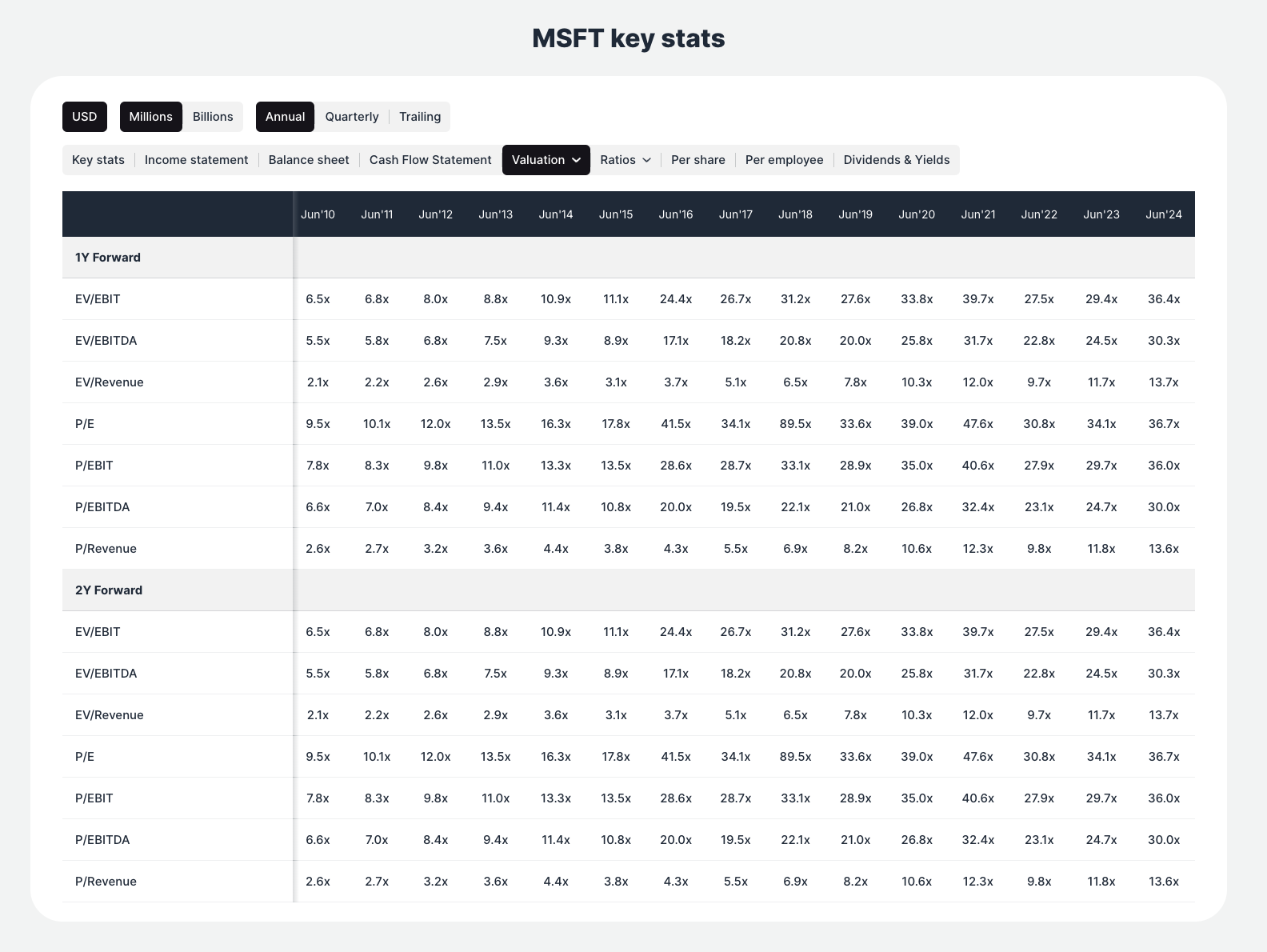

Calculate Relevant Valuation Multiples: With the financial data in hand, you can now calculate the appropriate valuation multiples for both the target company and its industry peers. Common valuation multiples include earnings-based ratios such as Price-to-Earnings (P/E) and Price-to-Book (P/B), but sector-specific metrics can also be useful. For instance, in the telecommunications industry, Average Revenue Per User (ARPU) is a widely used metric, so a Price/ARPU multiple might be applied.

Make Comparisons Using the Multiples: After calculating the relevant multiples, you can compare the target company’s multiples to those of its peers. This comparison helps determine whether the target company is undervalued, overvalued, or fairly valued relative to its competitors. For example, if a target company’s P/E ratio is lower than that of its peers, it may indicate that the company is undervalued. Conversely, a higher multiple may suggest overvaluation.

Concluding Remarks

While relative valuation has its limitations and challenges, it remains a practical and market-driven method to quickly assess the value of an asset. Its simplicity and reliance on observable market data make it a valuable tool in the financial domain.

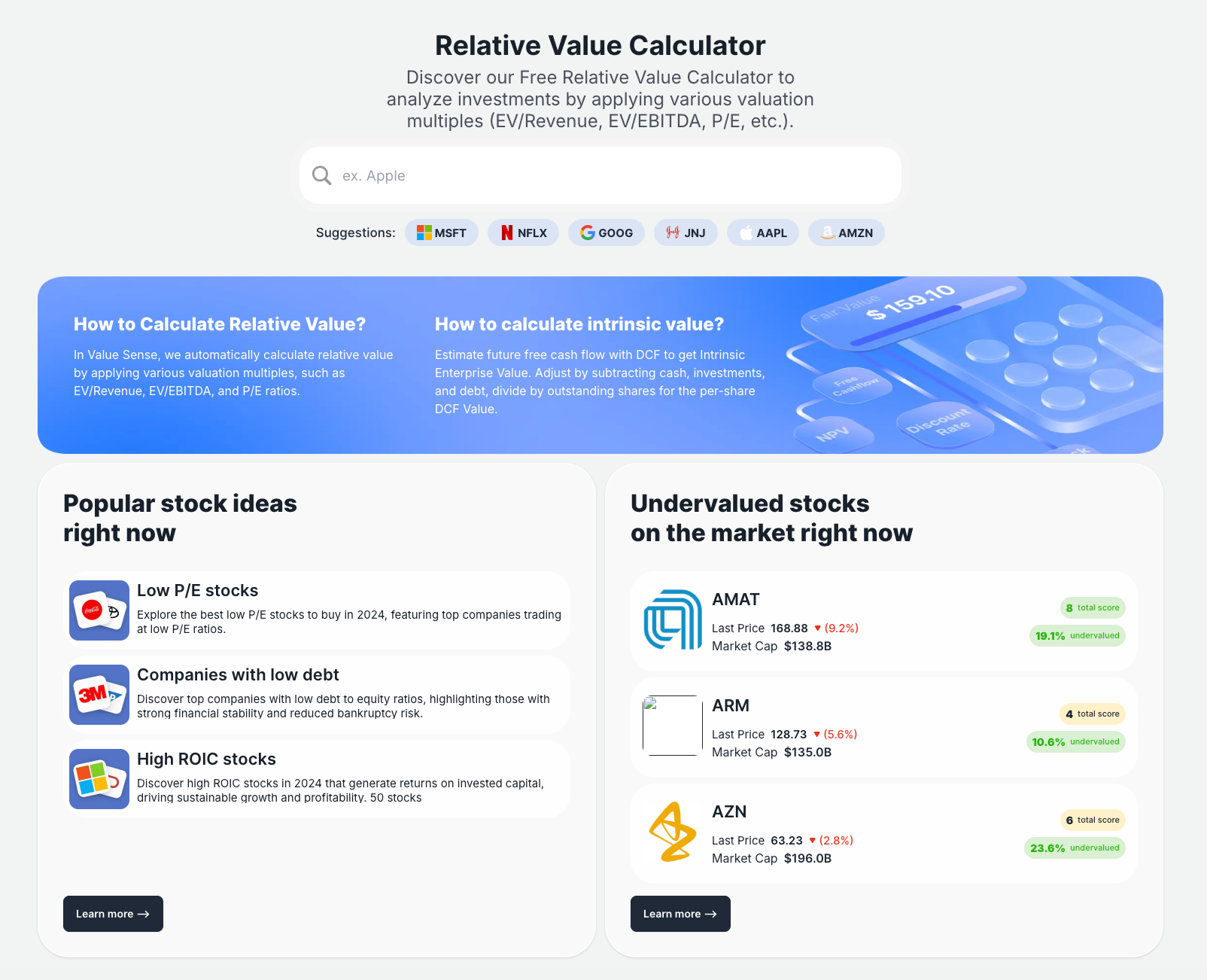

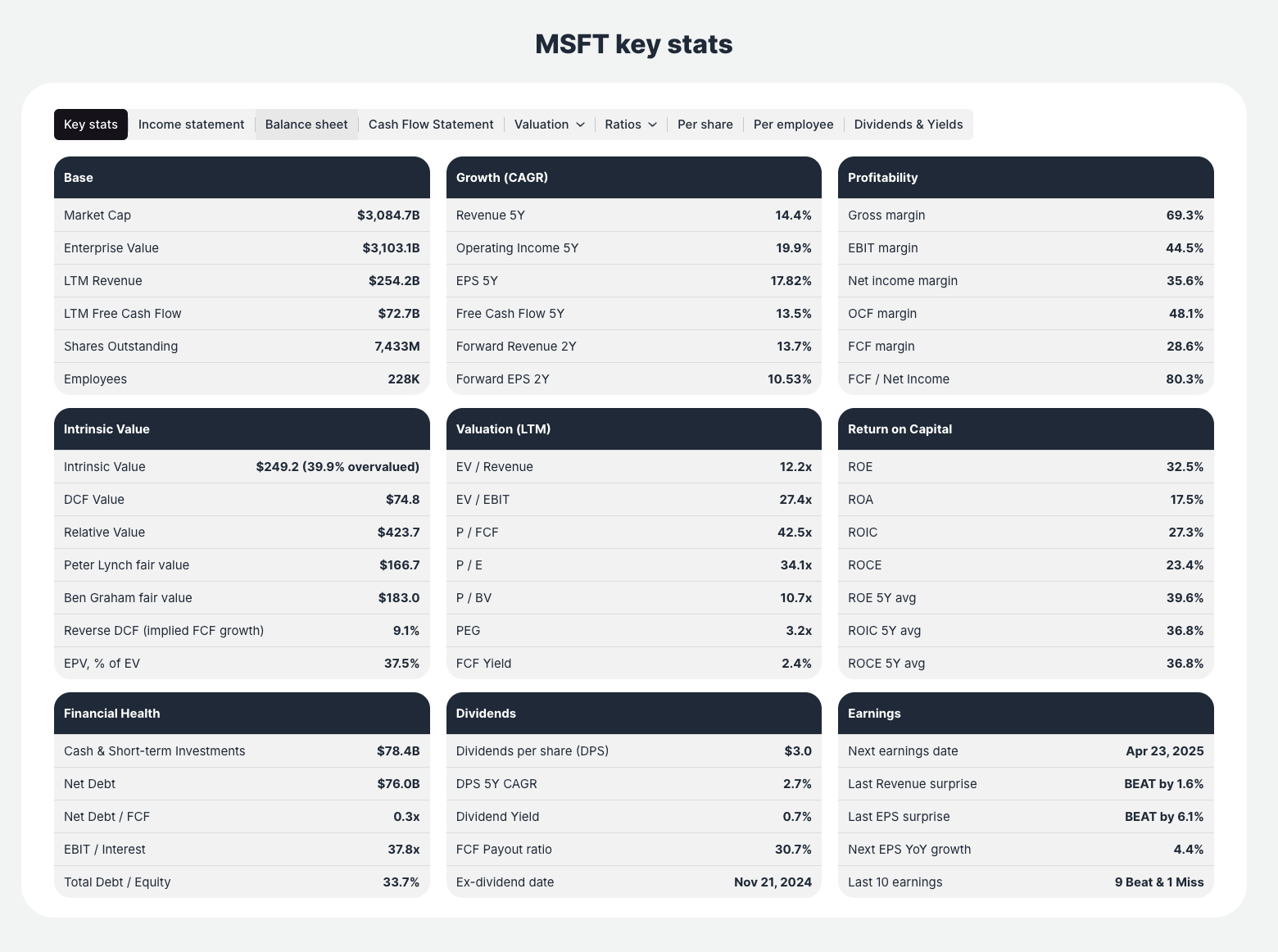

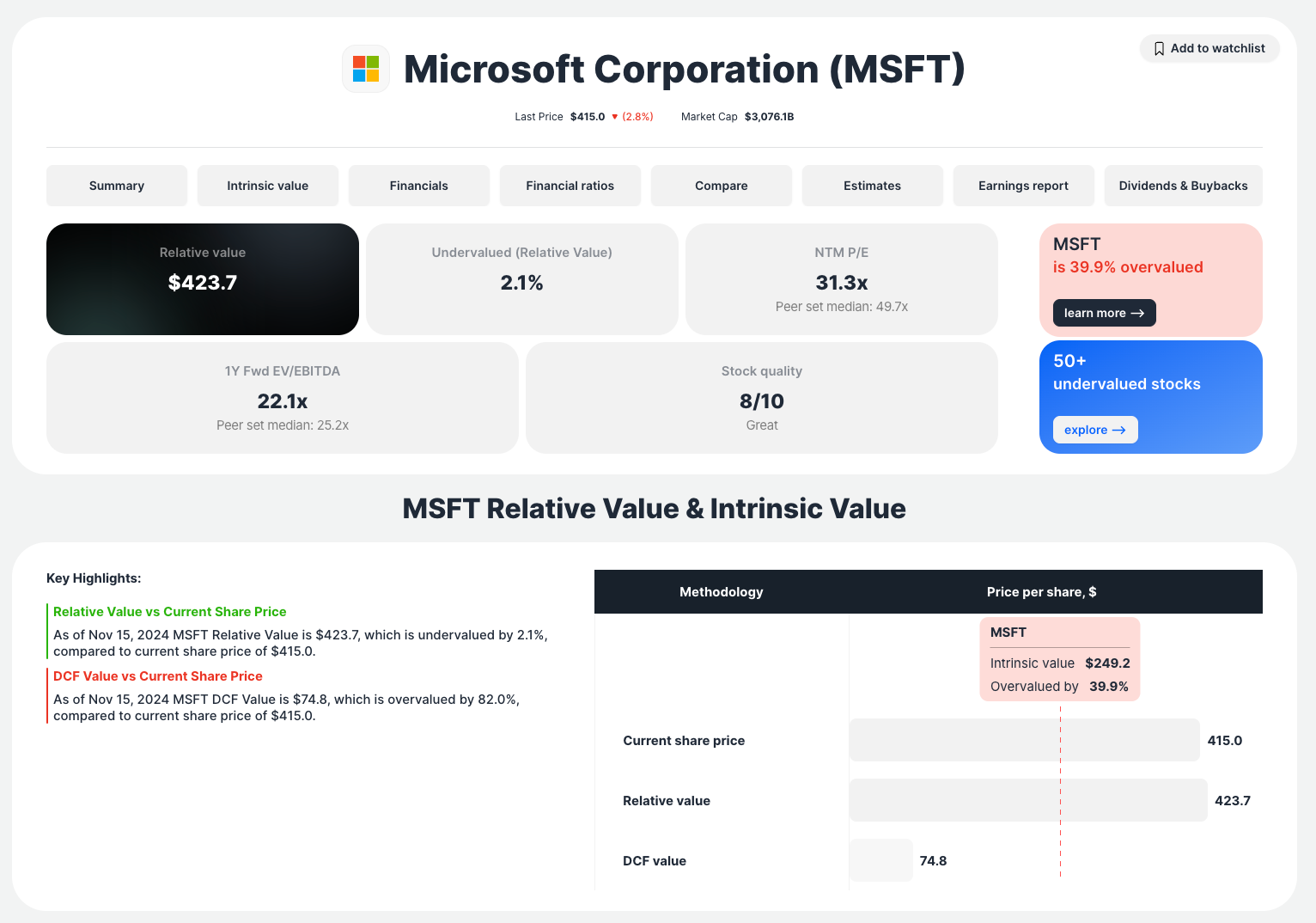

How to calculate Relative Value online? Any Relative Value calculators for stocks?

Use Value Sense Free Relative Value calculator. Select any public company to instantly calculate a fair value and Relative Value online.

We offer 10+ FREE valuation tools to analyze intrinsic value:

- reverse DCF calculator

- earnings growth model

- Peter Lynch charts

- discount rate calculator

- margin of safety calculator

- intrinsic value calculator

For investors seeking opportunities, our analytics team provides comprehensive lists of undervalued companies where the intrinsic value suggests potential undervaluation, combining fundamental analysis with quality metrics:

Ready to start?

Join 3,500+ value investors worldwide

FAQs

- What is relative valuation, and how does it differ from intrinsic valuation?

Relative valuation is a method of valuing an asset by comparing it to similar assets using valuation multiples like Price/Earnings (P/E) or Price/Book (P/B). Unlike intrinsic valuation methods such as Discounted Cash Flow (DCF), which estimate an asset’s value based on its fundamental cash flow projections, relative valuation focuses on observable market prices and external comparisons. - What are the most commonly used valuation multiples in relative valuation?

Some of the most frequently used valuation multiples include:

- Price/Earnings (P/E): Compares the stock price to the company’s earnings per share.

- Price/Book (P/B): Compares the stock price to its book value per share.

- Enterprise Value/EBITDA: Measures a company’s total value relative to its earnings before interest, taxes, depreciation, and amortization.

- Price/Sales (P/S): Used for revenue-focused comparisons, particularly in industries with low earnings.

These multiples may vary based on the industry; for example, sectors like telecommunications may use metrics like Price/ARPU.

- What are the limitations of relative valuation?

The main limitations include:

- Imperfect Comparisons: Even in the same industry, firms can have different growth rates or risk profiles, which can distort results.

- Market Bias: The method relies heavily on current market prices, which may not always reflect true value, especially during bubbles or market inefficiencies.

- Limited Insight into Fundamentals: It doesn’t analyze the intrinsic financial health or cash flow potential of a company.

- How do you identify comparable companies for relative valuation?

To identify comparable companies, look for firms that:

- Operate in the same industry or sector.

- Share similar business models, sizes, and geographic footprints.

- Have comparable growth rates, risk profiles, and operational structures.

Using Value Sense can help refine the list of comparable companies.

- Can relative valuation be applied to private companies?

Yes, relative valuation is particularly useful for private companies where detailed financial data may be limited. By comparing a private firm to publicly traded companies in the same industry, investors can estimate its value based on observable market data and valuation multiples. However, adjustments for size, growth, and risk are often necessary to improve accuracy.