What Is Reverse Discounted Cash Flow (DCF) and how to calculate it?

Welcome to Value Sense Blog

At Value Sense we help investors instantly find top-performing stocks and undervalued companies, saving time on research. You can explore our intrinsic value tools at valuesense.io and learn more about our latest stock ideas.

Investing, at its core, is about answering a series of key questions. When you evaluate a business, you narrow these questions down to the most important ones and try to answer them. Despite what academic textbooks may imply, there’s really only one true valuation framework.

As Warren Buffett famously put it:

"The intrinsic value of any business, if you could foresee the future perfectly, is the present value of all cash that will ever be distributed for that business between now and judgment day. And we’re not perfect at estimating that, obviously. But that’s what an investment or a business is all about. You put money in, and you take money out."

Understanding Different Valuation Methods

While there are various ways to value a business, they all stem from this one principle: a company’s intrinsic value is the sum of all future cash flows, discounted to today’s value. The most commonly used approach is multiple-based valuation. However, while pricing stocks with multiples may be easy, valuing them this way lacks transparency. The assumptions you're making often remain hidden, leaving you unclear about what’s really driving the stock’s value.

A discounted cash flow (DCF) model, on the other hand, makes these assumptions explicit, giving you a clearer understanding of what factors influence a company’s value. That said, even DCF models come with challenges—particularly when choosing a discount rate. Despite academic theories, calculating the "right" discount rate can be tricky.

As Ben Franklin wisely noted:

"The learned fool writes his nonsense in better language than the unlearned; but still ’tis nonsense."

At Value Sense, our answer to these challenges is the Reverse DCF. But before we dive into that, let's explore some of the common issues with traditional DCF models.

What is a Discounted Cash Flow (DCF) Model?

A DCF model is a tool that helps investors calculate potential returns by answering key questions about a business. When creating a DCF, investors typically focus on the following:

- Growth Expectations: How fast will the business grow, and for how long?

- Profitability: What will the company’s mature profitability look like, and when will it reach that point?

- Reinvestment Needs: How much will the company need to reinvest before it can start returning cash to investors?

These are just examples of the kinds of assumptions that guide a DCF. For instance, an investor may project:

- Revenue growth at 8% for the next year,

- Normalized cash flow margins, and

- Capital expenditures as a percentage of revenue.

These are all assumptions, and no one can know for sure what the actual numbers will be. Each assumption has a range of possibilities, and the assumptions an investor chooses should match their comfort level and investment strategy. Conservative investors might select more cautious assumptions, while growth-oriented investors may aim higher.

The Problem with Terminal Value

The difficulty with DCF models often comes when projecting far into the future. To simplify this, investors rely on a terminal value, which estimates the company’s value at the end of the forecast period and assumes that cash flows will continue indefinitely.

However, this assumption—that the business will continue operating like a perpetual annuity—masks the uncertainty of the long-term future. Ironically, it may seem more conservative than modeling out each individual year, but it can actually lead to larger assumptions about the company’s future performance. In contrast, explicitly forecasting each year’s cash flow, even up to year 60, could give you more control over those assumptions.

The Solution: Reverse DCF

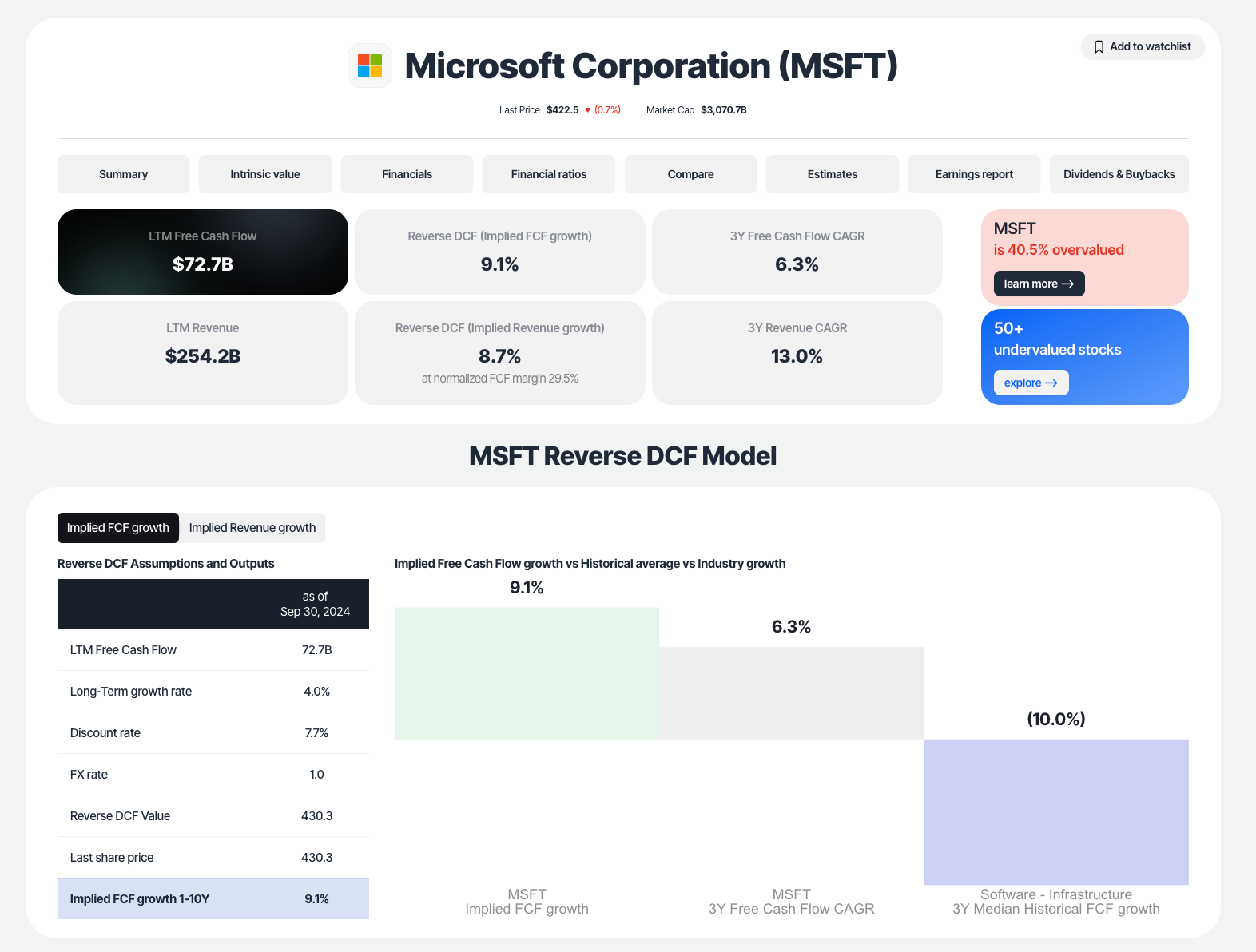

The Reverse DCF simplifies the process by starting with the stock price rather than a predicted value. Instead of forecasting growth and profitability to arrive at a stock price, the Reverse DCF uses the current stock price and works backward to identify the assumptions implied by that price. This allows you to see the expected returns based on different assumptions.

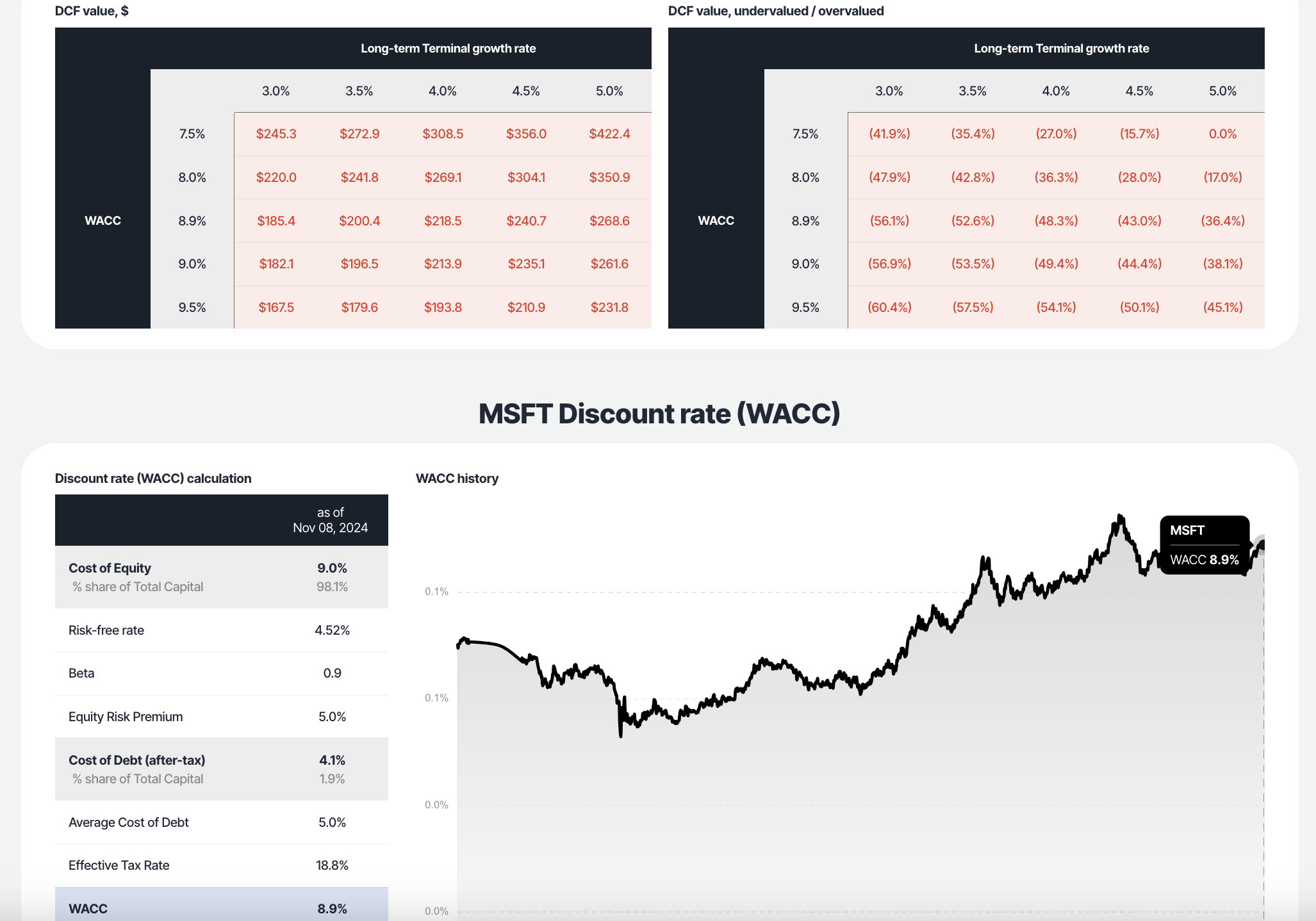

In this way, rather than guessing at a discount rate to estimate intrinsic value, we calculate the discount rate needed to justify the current stock price under various assumptions about growth and profitability.

How Reverse DCF Works

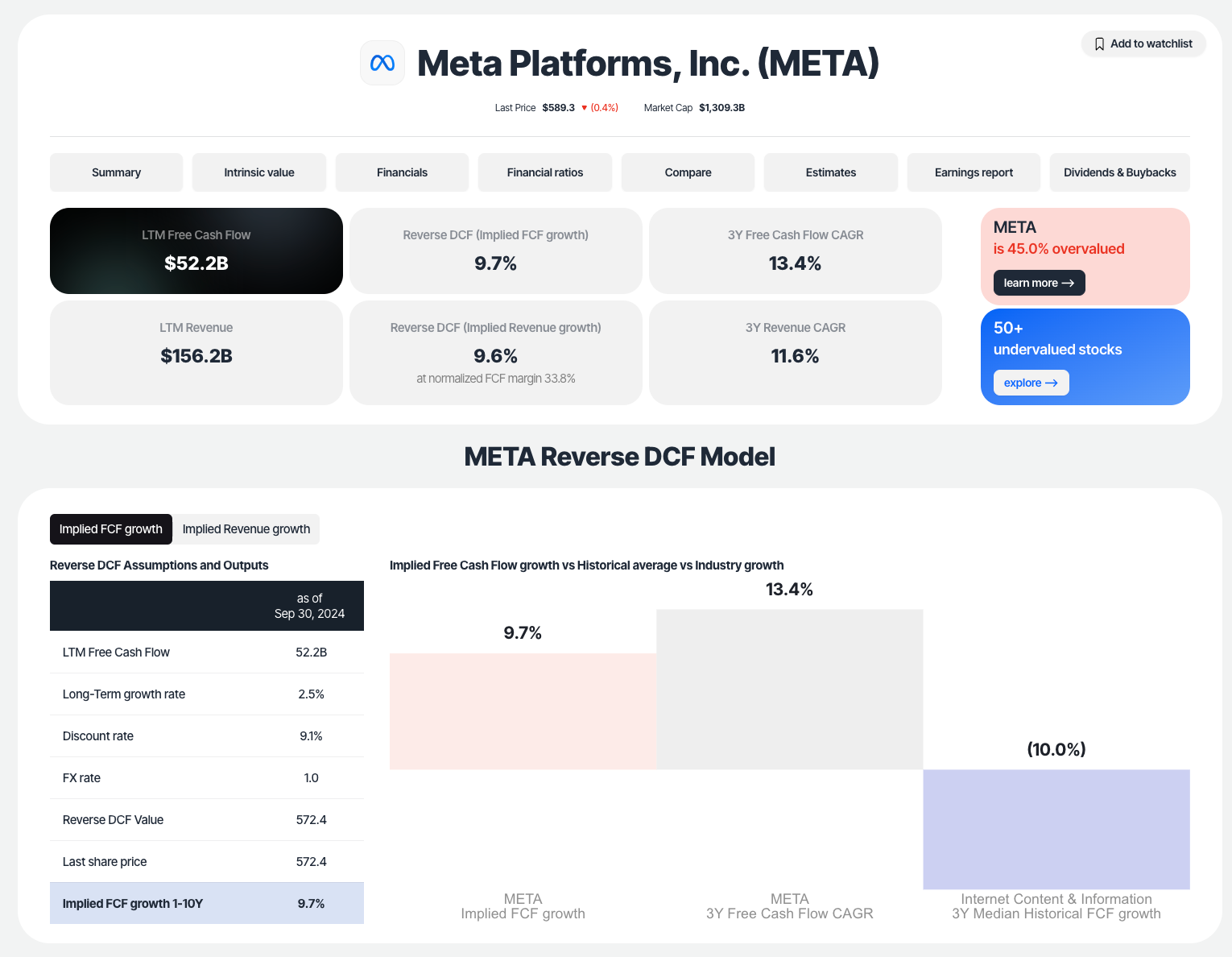

At Value Sense, we typically focus on two main variables that drive a business: growth and profitability. For example, in analyzing Coupang, we looked at Gross Merchandise Value (GMV) growth and EBIT as a percentage of GMV. For Meta, we focused on revenue growth and capital expenditures. These two variables become the foundation of the Reverse DCF.

By adjusting these variables, we can calculate the discount rate—or the expected return—implied by the current stock price. This helps us clarify the range of returns an investor might expect based on different scenarios.

Case Study: Meta's Reverse DCF

To demonstrate how we use the Reverse DCF, let’s look at Meta. In our January 2023 report, instead of asking "What is Meta worth today?", we asked, "What kind of return can an investor expect at today’s price?"

We developed multiple scenarios based on different growth rates and capital expenditures and then calculated the implied discount rate for each. The results showed that even with conservative assumptions, an investor could still expect above-average market returns.

The Advantage of Reverse DCF

The Reverse DCF offers several key benefits:

- It removes the hidden assumptions embedded in multiples or terminal values,

- It provides a clearer understanding of the risks and potential rewards,

- It allows investors to be more conservative and see how that affects their returns.

By framing investment opportunities in terms of expected returns instead of stock prices, the Reverse DCF enables better decision-making.

Final Thoughts

As an investor, your greatest advantage is understanding the assumptions driving your potential returns. The Reverse DCF empowers you to see exactly what kind of returns you can expect based on different assumptions.

Imagine investing as placing a bet on a basketball game: is it easier to guess the exact total score or predict that the score will be above a certain number? The second option is easier to get right, and that's what the Reverse DCF allows you to do. You adjust your assumptions until you're comfortable and then wait for an opportunity that aligns with those expectations.

Patience is essential. Great opportunities often arise when you least expect them and being prepared to act on them is a key trait of successful investors.

Conclusion

The Reverse DCF brings clarity, flexibility, and control over your investment assumptions. By flipping the traditional DCF process, you can better understand the risks and rewards involved in any stock. Take time to explore your assumptions, and remember—investing is about asking the right questions.

How to calculate reverse DCF?

Use Value Sense Free Reverse DCF analysis tool for reverse discounted cash flow stock valuation. Select any stock and instantly calculate a reverse DCF model for free.

also, we have 10+ FREE intrinsic value tools:

- reverse DCF calculator

- earnings growth model

- Peter Lynch charts

- discount rate calculator

- margin of safety calculator

- intrinsic value calculator

- and many more...

For those seeking market opportunities, our analytics team has compiled over 10 exclusive lists of undervalued and high-quality stocks:

Ready to start?

Join 3,500+ value investors worldwide