Richard Pzena - Pzena Investment Management Llc Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

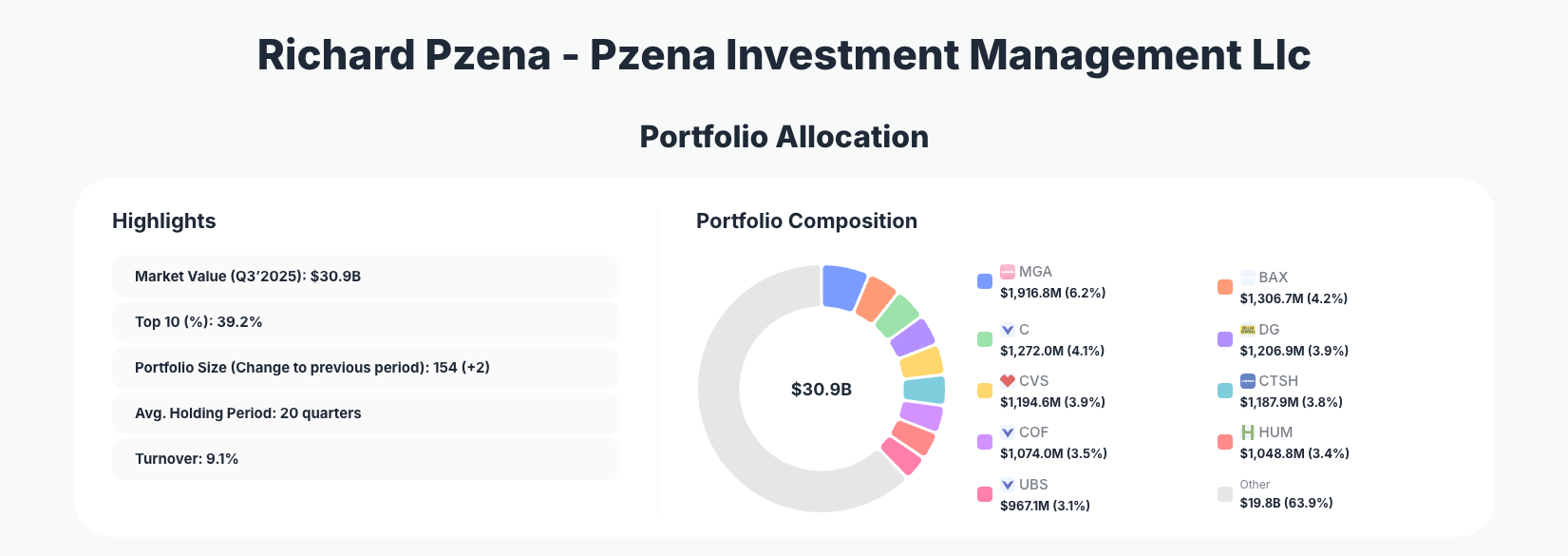

Richard Pzena, founder of Pzena Investment Management, exemplifies disciplined value investing through precise portfolio adjustments. His $30.9B Q3 2025 portfolio showcases a balanced approach across 154 positions, with notable increases in healthcare and tech like BAX while trimming financials such as C, signaling confidence in undervalued recovery plays amid market volatility.

Portfolio Overview: Disciplined Diversification with Long-Term Conviction

Portfolio Highlights (Q3 2025): - Market Value: $30.9B - Top 10 Holdings: 39.2% - Portfolio Size: 154 +2 - Average Holding Period: 20 quarters - Turnover: 9.1%

Pzena Investment Management's Q3 2025 portfolio reflects a classic value-oriented strategy, maintaining a broad base of 154 positions while keeping the top 10 at a moderate 39.2% concentration. This setup allows for significant exposure to high-conviction ideas without over-reliance on any single name, a hallmark of Pzena's approach to risk management in volatile markets. The low turnover of 9.1% underscores patience, with holdings averaging 20 quarters—over five years—demonstrating commitment to intrinsic value realization over short-term trading.

The addition of just two new positions brings the total to 154, suggesting selective expansion rather than aggressive repositioning. This measured evolution in the portfolio aligns with Pzena's philosophy of buying distressed but fundamentally sound businesses, waiting for market recognition. At $30.9B, the scale enables meaningful stakes while the diversification mitigates sector-specific risks, positioning the fund well for economic uncertainty.

Top Holdings: Healthcare Boosts and Financial Trims Dominate Changes

The Pzena portfolio features active management in its upper echelons, starting with Magna International Inc. (MGA) at 6.2% after a modest Reduce 1.47%. Healthcare shines through Baxter International Inc. (BAX), boosted by Add 45.89% to 4.2%, signaling strong conviction in medical devices amid sector recovery. Financials saw trims, including Citigroup Inc. (C) Reduce 7.68% to 4.1%, alongside Dollar General Corporation (DG) at 3.9% (Reduce 1.45%) and CVS Health Corporation (CVS) Reduce 5.39% to 3.9%.

Tech and services also drew attention, with Cognizant Technology Solutions Corporation (CTSH) Add 1.49% to 3.8%, while Capital One Financial Corporation (COF) faced Reduce 6.81% to 3.5%. Humana Inc. (HUM) holds at 3.4% post-Reduce 1.12%, and UBS GROUP AG trimmed 3.74% to 3.1%. Beyond the top 10, Skyworks Solutions, Inc. (SWKS) gained Add 0.53% to 3.1%, rounding out a mix of opportunistic adds in tech and healthcare against broader reductions in cyclicals and financials.

What the Portfolio Reveals

Pzena's Q3 moves highlight a value strategy favoring quality businesses trading below intrinsic worth, with clear sector rotations. Key themes include:

- Healthcare Emphasis: Massive 45.89% add to BAX and steady HUM exposure point to bets on undervalued medtech and insurance amid post-pandemic normalization.

- Financial Caution: Reductions in C 7.68%, COF 6.81%, and UBS suggest wariness of banking sector headwinds like interest rates and regulation.

- Tech Opportunism: Small adds to CTSH and SWKS indicate selective pursuit of IT services and semiconductors at discounts.

- Retail and Auto Stability: Minor trims in DG and MGA maintain core consumer and manufacturing exposure without panic selling.

- Risk Management: Low 9.1% turnover and 20-quarter hold average prioritize patience, with 39.2% top-10 concentration balancing conviction and diversification.

This positioning reveals a defensive value tilt, prioritizing cash-generative firms with recovery potential over high-flyers.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Magna International Inc. | $1,916.8M | 6.2% | Reduce 1.47% |

| Baxter International Inc. | $1,306.7M | 4.2% | Add 45.89% |

| Citigroup Inc. | $1,272.0M | 4.1% | Reduce 7.68% |

| Dollar General Corporation | $1,206.9M | 3.9% | Reduce 1.45% |

| CVS Health Corporation | $1,194.6M | 3.9% | Reduce 5.39% |

| Cognizant Technology Solutions Corporation | $1,187.9M | 3.8% | Add 1.49% |

| Capital One Financial Corporation | $1,074.0M | 3.5% | Reduce 6.81% |

| Humana Inc. | $1,048.8M | 3.4% | Reduce 1.12% |

| UBS GROUP AG | $967.1M | 3.1% | Reduce 3.74% |

The table underscores Pzena's balanced concentration, with no single holding exceeding 6.2% and the top 10 comprising 39.2% of the $30.9B portfolio. This structure allows outsized bets like the 45.89% BAX add without excessive risk, while trims in financials like C and COF free capital for perceived better opportunities. The pattern—adds in healthcare/tech, reductions elsewhere—demonstrates active reallocation toward undervalued sectors, maintaining stability across 154 names.[1]

Investment Lessons from Richard Pzena's Value Approach

Pzena's Q3 portfolio embodies timeless value principles tailored to his forensic style:

- Patience Pays: 20-Quarter Holds: Average tenure of five years shows conviction in buying cheap quality, waiting for rerating rather than chasing momentum.

- Selective Concentration: 39.2% in top 10 balances high-conviction (e.g., BAX add) with 154-position diversification to weather volatility.

- Trim Winners, Boost Value: Reductions in MGA and financials fund adds in recovering names like CTSH, enforcing discipline.

- Sector Rotation on Fundamentals: Shifts from banks to healthcare reflect deep analysis of intrinsic value gaps, not macro bets.

- Low Turnover Discipline: 9.1% rate avoids transaction costs, preserving compounding in proven holdings.

These lessons highlight Pzena's edge: rigorous bottom-up research driving measured, conviction-based adjustments.

Looking Ahead: What Comes Next?

Pzena's low 9.1% turnover and +2 positions suggest ample dry powder within the $30.9B base for opportunistic buys, especially if markets correct. Recent adds like BAX 45.89% and SWKS position the portfolio for healthcare and tech rebounds, while financial trims hedge rate risks. In uncertain 2026 conditions—potential slowdowns, election volatility—Pzena's focus on undervalued cyclicals like DG sets up for mean reversion. Expect continued trims in overvalued areas to fund deeper value plays, leveraging the 20-quarter hold patience for superior returns.

FAQ about Richard Pzena Portfolio

Q: What are the most significant changes in Pzena's Q3 2025 13F filing?

A: Key moves include a massive Add 45.89% to Baxter International (BAX) at 4.2%, alongside smaller adds to CTSH 1.49% and SWKS 0.53%. Notable reductions hit financials like Citigroup (C) 7.68% and COF 6.81%, reflecting reallocation to healthcare and tech value.

Q: Why does Pzena maintain such a large portfolio size with moderate top-10 concentration?

A: At 154 positions and 39.2% in the top 10, Pzena's structure diversifies risk while allowing conviction bets like MGA 6.2%. This suits his value strategy of harvesting multiple undervalued opportunities without overexposure.[1]

Q: What sectors dominate Pzena's Q3 2025 portfolio?

A: Financials, healthcare, consumer defensive, and tech lead, with boosts to healthcare (BAX, HUM) offsetting financial trims. Auto (MGA) and retail (DG) provide cyclical balance.

Q: How can I track and follow Richard Pzena's portfolio changes?

A: Monitor quarterly 13F filings on the SEC site or use ValueSense's superinvestor tracker at https://valuesense.io/superinvestors/pzena-investment for real-time analysis, historical data, and visualizations. Note the 45-day reporting lag means positions may evolve post-filing.[1][2]

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!