Richer, Wiser, Happier by William Green

Welcome to the Value Sense Blog, your resource for insights on the stock market! You're reading a book review written by the valuesense.io team.

On our platform, you'll find stock research and insights across all sectors. Dive into our research products and learn more about our unique approach at valuesense.io

We offer over 360+ automated stock ideas, a free AI-powered stock screener, interactive stock charting tools, and more than 10 intrinsic value models — all designed to help investors find undervalued growth opportunities.

Book Overview

“Richer, Wiser, Happier” by William Green is a sweeping exploration of the philosophies, strategies, and life lessons of the world’s most successful investors. William Green, a seasoned financial journalist, has spent decades interviewing legendary figures in the investment world, including the likes of Warren Buffett, Charlie Munger, Sir John Templeton, Mohnish Pabrai, and many others. His unique access and insightful questioning have allowed him to distill the rare wisdom of these titans into a narrative that is both accessible and deeply instructive. Green’s career as a writer and editor at publications such as Time, Fortune, Forbes, and The New Yorker provides him with the credibility and narrative skill to weave complex ideas into compelling stories.

The book was published in 2021, a period marked by extraordinary market volatility, the rise of retail investors, and a renewed debate about the relevance of traditional investing principles in a world dominated by technology stocks and speculative bubbles. Against this backdrop, Green’s work stands out for its emphasis on timeless truths and the human side of investing. Rather than focusing solely on technical analysis or market predictions, “Richer, Wiser, Happier” delves into the mindsets, habits, and values that underpin enduring investment success.

At its core, the book is about much more than making money. Green sets out to answer a broader question: What can we learn from great investors not just about wealth, but about living a meaningful, fulfilling life? He argues that the same qualities that lead to investment success—discipline, patience, humility, and a willingness to learn from mistakes—are equally vital in the pursuit of happiness and personal growth. Through interviews, anecdotes, and rigorous analysis, Green uncovers how these investors think, how they make decisions under uncertainty, and how they find purpose beyond the accumulation of wealth.

“Richer, Wiser, Happier” is widely regarded as a modern classic because it bridges the gap between investment strategy and personal philosophy. It’s a book that appeals to both seasoned investors and newcomers, offering practical guidance as well as inspiration. Readers will find actionable strategies for navigating markets, but also profound insights into character, resilience, and the art of living well. The book’s unique value lies in its blend of storytelling, rigorous research, and psychological depth—qualities that set it apart from more formulaic investment guides.

This is an essential read for anyone serious about investing, as well as those seeking wisdom on how to lead a richer and more purposeful life. Green’s ability to extract universal lessons from the lives of extraordinary investors makes this book a valuable resource for professionals, DIY investors, and lifelong learners alike. Whether you are looking to improve your financial acumen or searching for guidance on personal fulfillment, “Richer, Wiser, Happier” offers a roadmap grounded in real-world experience and enduring truths.

Key Themes and Concepts

Throughout “Richer, Wiser, Happier,” William Green weaves together a tapestry of themes that transcend traditional investing advice. The book’s structure allows readers to see not only how great investors think about markets, but also how they approach life, decision-making, and legacy. Green’s interviews and research reveal that the most successful investors share a set of core beliefs and habits that shape both their portfolios and their personal lives.

The main themes that run through the book include the power of cloning proven strategies, the necessity of independent thinking, the enduring value of patience and selectivity, the pitfalls of behavioral biases, and the importance of living with integrity and purpose. By grouping insights from multiple investors and chapters, Green demonstrates that these themes are not isolated concepts but interlocking principles that reinforce one another.

Below, we explore the book’s seven central themes, each illustrated with examples from the text and practical applications for investors seeking not just financial success, but a richer, wiser, and happier life.

- Cloning Successful Strategies: Green highlights that many top investors, including Mohnish Pabrai, have achieved extraordinary results by systematically studying and replicating the approaches of legends like Warren Buffett. This “cloning” is not mere imitation—it involves deep analysis, adaptation, and a willingness to learn from the best. The book shows how cloning reduces the need to reinvent the wheel, lowers error rates, and increases the probability of success. For investors, this means identifying proven strategies, understanding their underlying logic, and applying them with discipline. Green provides examples of how Pabrai’s use of Buffett’s frameworks—such as focusing on high-quality businesses with durable moats—led to market-beating returns, and how cloning can be applied to both investing and life decisions.

- Independent Thinking and Contrarianism: A recurring message is that superior results require the courage to think independently and sometimes go against the crowd. Figures like Sir John Templeton thrived by investing in unpopular markets or sectors, often when fear or pessimism was rampant. Green explores how successful investors develop conviction, resist herd mentality, and embrace the discomfort of standing alone. This theme is illustrated with stories of investors who bought during crises and reaped long-term rewards. For readers, the application is clear: cultivate independent analysis, question consensus, and be willing to act when others hesitate.

- Value Investing Principles: The book delves deeply into the core tenets of value investing—margin of safety, intrinsic value, and long-term orientation. Green explains how these principles, championed by Buffett, Munger, and others, serve as a compass for navigating uncertainty and avoiding overvaluation traps. The margin of safety, for example, acts as a buffer against mistakes and unpredictable events. Through case studies and anecdotes, Green demonstrates how applying these principles leads to more resilient portfolios and better risk-adjusted returns. Investors are encouraged to focus on businesses with strong fundamentals, buy at a discount, and remain patient for value to be realized.

- Behavioral Finance: One of the book’s most impactful themes is the recognition of psychological biases—such as overconfidence, loss aversion, and confirmation bias—that sabotage investment performance. Green draws on both academic research and investor interviews to show how even the smartest minds are vulnerable to emotional decision-making. He offers practical strategies for mitigating these biases, such as pre-committing to rules, seeking disconfirming evidence, and cultivating humility. The message: mastering one’s own psychology is as important as mastering financial analysis.

- Life Lessons from Investing: Beyond markets, Green shows that investing is a powerful metaphor for personal growth. The qualities that produce financial success—integrity, patience, adaptability, and resilience—are equally vital in life. The book features stories of investors who overcame adversity, learned from failure, and prioritized lifelong learning. Green argues that the pursuit of wealth, when guided by strong values, can foster deeper fulfillment and character development. Readers are encouraged to view setbacks as opportunities for growth and to approach both investing and life as continuous learning journeys.

- Philanthropy and Legacy: Many of the investors profiled in the book view wealth as a tool for positive impact. Green explores how figures like Buffett and Pabrai integrate philanthropy into their lives, using their resources to address social challenges and build lasting legacies. The book discusses strategies for effective giving, the psychological benefits of generosity, and the importance of aligning wealth with purpose. For investors, this theme is a reminder that success is not measured solely by financial returns, but by the positive difference one makes in the world.

- Continuous Learning and Adaptation: Green emphasizes that the best investors are perpetual students. They read voraciously, seek diverse perspectives, and adapt to changing circumstances. The book is filled with examples of investors who evolved their strategies in response to new information or market conditions. This theme encourages readers to remain intellectually curious, humble, and open to change—traits that are essential not only for investment success, but for personal growth and happiness.

Book Structure: Major Sections

Part 1: Investment Philosophy and Mindset

This thematic section, encompassing the first three chapters, sets the stage by exploring the foundational philosophies and mindsets shared by the world’s most successful investors. Green brings readers into the thought processes of figures like Mohnish Pabrai and Sir John Templeton, illustrating how independent thinking and a willingness to be different are crucial for outsized returns. The unifying theme here is that mindset—not just technical skill—separates great investors from the merely good.

Key concepts include the power of cloning proven strategies, the importance of thinking for oneself, and the psychological resilience required to stick with one’s convictions in the face of market volatility or skepticism. Green details how Pabrai’s deliberate imitation of Warren Buffett’s methods led to remarkable results, while Templeton’s contrarian bets—such as buying into markets others had abandoned—demonstrated the rewards of independent analysis. The chapters also explore the mental habits that help investors avoid common pitfalls, such as groupthink and emotional overreaction.

For investors, the practical takeaway is to cultivate a mindset that values learning from the best while also trusting one’s own analysis. This means being willing to study and adapt the methods of top performers, but also developing the courage to act independently when the crowd is wrong. Green’s stories provide actionable examples, such as creating checklists based on successful investors’ criteria or deliberately seeking out contrarian opportunities.

In the modern context, this section is more relevant than ever. With information more accessible and markets more interconnected, the temptation to follow the herd is strong. Yet, as Green shows, true outperformance comes from those willing to stand apart—whether by cloning proven strategies with discipline or by making bold, independent bets when others are fearful. These lessons are timeless, offering a foundation for both new and experienced investors navigating today’s complex financial landscape.

Part 2: Principles of Value Investing

Chapters four through six coalesce around the core principles of value investing, a philosophy that has produced some of the greatest fortunes in history. Green dives deep into the concepts of margin of safety, intrinsic value, and the discipline of patience and selectivity. The section reveals how these timeless principles form the backbone of successful investment strategies, providing a systematic approach to managing risk and capturing opportunity.

The section highlights how investors like Buffett and Munger apply the margin of safety principle to every decision, insisting on buying assets at a significant discount to their intrinsic value. Green uses case studies to demonstrate how patience—waiting for the right pitch—and selectivity—focusing only on high-quality opportunities—are essential for avoiding costly mistakes and compounding wealth over time. He also addresses the dangers of overconfidence and the importance of humility in valuation work.

For practical application, investors are encouraged to rigorously analyze potential investments, calculate conservative intrinsic values, and only act when a substantial margin of safety exists. Green suggests developing a checklist of value investing criteria, maintaining a watchlist of potential buys, and resisting the urge to chase hot trends or overpay for growth. The discipline to wait for truly exceptional opportunities is a recurring theme.

Today, with markets often characterized by speculation and short-termism, the value investing principles discussed here remain a bulwark against hype and herd behavior. Green’s synthesis of these ideas provides both a practical toolkit and a philosophical anchor for investors seeking to build resilient portfolios in any market environment.

Part 3: Behavioral Finance and Decision Making

This section, covering chapters seven through nine, delves into the psychological traps that ensnare even experienced investors. Green explores the science of behavioral finance, drawing on both academic research and real-world investor stories to illustrate how cognitive biases—overconfidence, loss aversion, confirmation bias—can lead to costly mistakes. The unifying message is that self-awareness and rationality are essential for long-term success.

Green provides vivid examples of investors who fell prey to their own emotions, as well as those who developed systems to counteract bias. He discusses practical tools, such as pre-commitment strategies, decision journals, and the cultivation of humility, that help investors make more rational choices. The section also examines the role of temperament, showing how emotional discipline can be more important than IQ in determining investment outcomes.

Investors can apply these insights by implementing structured decision-making processes, seeking disconfirming evidence, and regularly reviewing past decisions to identify patterns of bias. Green emphasizes the value of learning from mistakes and creating an environment that encourages honest self-assessment. Tools like checklists, scenario analysis, and group feedback are recommended for minimizing bias-driven errors.

In an era of information overload and rapid market movements, the lessons from behavioral finance are more relevant than ever. Green’s synthesis helps investors recognize their own blind spots and build decision-making frameworks that withstand the pressures of modern markets. Mastering one’s own psychology, he argues, is a competitive edge that endures regardless of market cycles.

Part 4: Life Lessons from Investing

Chapters ten through twelve expand the book’s focus beyond finance, highlighting the broader life lessons that investing imparts. Green argues that the habits and virtues cultivated through successful investing—integrity, patience, adaptability, and continuous learning—are equally vital for personal fulfillment and growth. This section brings together stories of investors who overcame adversity, learned from failure, and built lives rich in meaning as well as money.

Key concepts include the centrality of integrity, the necessity of lifelong learning, and the importance of balancing personal and professional priorities. Green profiles investors who maintained their principles even under pressure and who viewed setbacks as opportunities for self-improvement. The section also explores the role of humility and gratitude in sustaining long-term happiness and resilience.

For readers, these chapters offer a blueprint for integrating investment wisdom into daily life. Green encourages the cultivation of habits such as regular reading, openness to new ideas, and deliberate reflection on values and goals. The message is that financial success, when grounded in strong character and purpose, leads to deeper satisfaction and well-being.

In today’s fast-paced, results-driven world, the lessons from this section are a timely reminder that wealth is only one dimension of a meaningful life. Green’s stories inspire readers to pursue excellence not just in markets, but in relationships, learning, and personal growth—making this section as relevant for life as it is for investing.

Part 5: Philanthropy and Legacy

This thematic section, spanning chapters thirteen to fifteen, explores how great investors think about giving back and building a legacy that transcends wealth. Green examines the motivations and strategies behind the philanthropic efforts of figures like Buffett and Pabrai, revealing how generosity and purpose can amplify both personal fulfillment and societal impact.

The section discusses the psychological benefits of philanthropy, the importance of aligning giving with personal values, and the practical challenges of making a meaningful difference. Green provides examples of investors who have structured their giving for maximum impact, whether through foundations, direct donations, or innovative social enterprises. He also addresses the tension between wealth accumulation and the desire to leave a positive mark on the world.

For investors, the practical application is to view wealth as a tool for service and to think intentionally about the legacy they wish to create. Green encourages readers to develop a giving strategy that reflects their passions, to seek out opportunities for high-impact philanthropy, and to involve family and community in the process. The section also offers guidance on balancing personal enjoyment of wealth with the responsibility to give back.

In a world increasingly focused on social responsibility and sustainability, the lessons from this section are highly relevant. Green’s exploration of philanthropy and legacy challenges readers to broaden their definition of success, integrating financial achievement with a commitment to making the world better for future generations.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Deep Dive: Essential Chapters

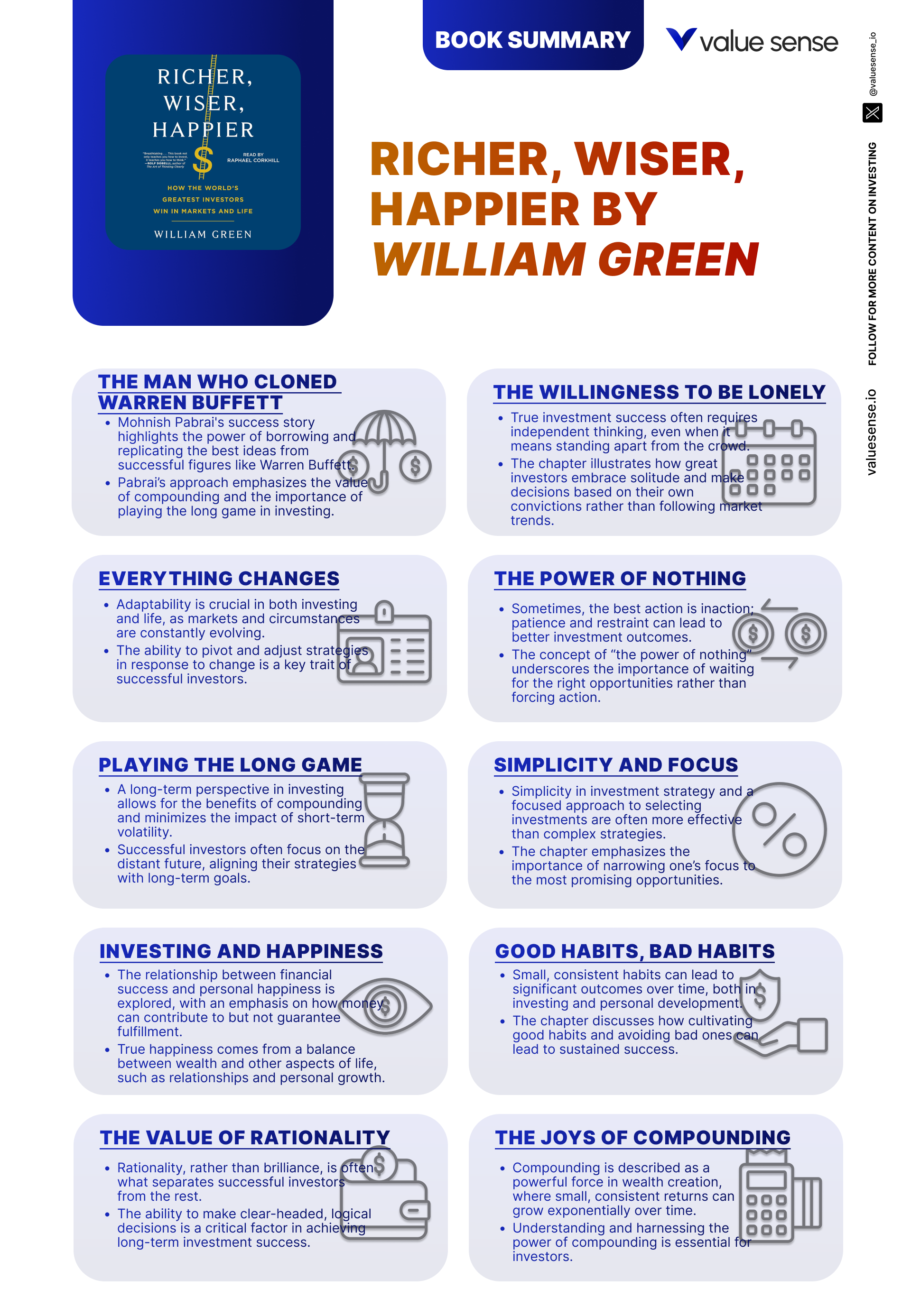

Chapter 1: The Man Who Cloned Warren Buffett

This opening chapter is critically important because it introduces the central idea of “cloning” as a path to investment success. Green uses Mohnish Pabrai’s journey as a case study, showing how Pabrai openly and systematically modeled his investment approach on Warren Buffett’s methods. The chapter sets the tone for the book by demonstrating that extraordinary results can often be achieved not by inventing something new, but by faithfully adopting proven strategies, adapting them to one’s own context, and executing with discipline. Green emphasizes that cloning is not about blind imitation, but about understanding the rationale behind successful approaches and applying them intelligently.

Green provides detailed examples of Pabrai’s process, such as his use of Buffett’s “checklist investing” and his focus on high-quality businesses with sustainable competitive advantages (moats). He quotes Pabrai’s mantra, “Heads I win, tails I don’t lose much,” highlighting the importance of asymmetric risk-reward bets. The chapter includes data on Pabrai’s fund performance, which consistently outperformed benchmarks by sticking to Buffett’s principles. Green also recounts how Pabrai attended Berkshire Hathaway meetings, studied Buffett’s letters, and even structured his fund’s fee model to mirror Buffett’s early partnerships.

Investors can apply these lessons by identifying successful investors whose strategies resonate with their own temperament and studying those approaches in depth. Concrete steps include reading annual letters, analyzing investment theses, and creating personal checklists based on proven criteria. Green suggests that cloning can be extended beyond investing to other areas of life—career decisions, business strategies, and even personal habits—by seeking out best practices and adapting them to individual circumstances.

Historically, the concept of cloning has been a powerful force in finance, from the spread of value investing principles to the popularization of index funds. In the modern era, with vast information available online, the challenge is not access but discernment. Green’s portrayal of Pabrai’s success through cloning is a reminder that humility—recognizing that others may have solved problems better than we can—is a competitive advantage. The chapter’s lessons remain highly relevant in a world where investors often chase novelty at the expense of proven wisdom.

Chapter 2: The Willingness to Be Lonely

This chapter is pivotal because it addresses the psychological and practical challenges of independent thinking, a theme that recurs throughout the book. Green explores how legendary investors like Sir John Templeton built fortunes by going against the crowd, investing in markets or sectors that others had abandoned. The main concept is that superior results often require the courage to be lonely, to hold contrarian views, and to act decisively when others are paralyzed by fear or groupthink. The chapter delves into the emotional resilience needed to withstand criticism and uncertainty.

Green illustrates this theme with stories of Templeton’s investments during times of crisis, such as buying stocks at the outset of World War II or investing in Japanese equities when they were deeply out of favor. He quotes Templeton’s belief that “the time of maximum pessimism is the best time to buy,” and provides data on the outsized returns generated by such contrarian moves. The chapter also discusses the psychological toll of being out of sync with the consensus, including periods of underperformance and self-doubt.

For investors, the practical takeaway is to develop systems for independent analysis and to cultivate the emotional discipline to act on one’s convictions. Steps include conducting fundamental research, documenting investment theses, and setting clear criteria for contrarian bets. Green suggests that building a network of like-minded thinkers and maintaining a long-term perspective can help investors weather periods of isolation or unpopularity.

Historically, many of the greatest investment opportunities have arisen when the crowd was fearful or indifferent—think of Buffett’s investments in American Express during the “salad oil scandal” or Templeton’s global diversification during times of geopolitical turmoil. In today’s world, where social media amplifies consensus and short-term thinking, the willingness to be lonely is more valuable than ever. Green’s insights encourage readers to embrace discomfort as a sign that they may be on the right track.

Chapter 4: Principles of Value Investing

This chapter is foundational because it introduces the core principles that underpin the value investing philosophy—a central pillar of the book. Green explains concepts such as intrinsic value, margin of safety, and the dangers of overpaying for growth. He draws on the teachings of Buffett, Munger, and other luminaries to show how these principles guide investment decisions and protect against catastrophic losses. The chapter argues that value investing is not just a strategy, but a mindset anchored in discipline, skepticism, and long-term orientation.

Green provides concrete examples, such as Buffett’s purchase of Coca-Cola at a time when it was undervalued relative to its future cash flows, and Munger’s insistence on only buying businesses with durable competitive advantages. He includes quotes from Buffett’s annual letters—“Rule No. 1: Never lose money. Rule No. 2: Never forget Rule No. 1”—and data on the long-term outperformance of value strategies. The chapter also addresses common pitfalls, such as chasing “value traps” or underestimating risks.

Investors can apply these lessons by developing skills in business analysis, focusing on companies with predictable earnings, and insisting on a substantial margin of safety before investing. Green recommends using conservative assumptions in valuation models, maintaining discipline during bull markets, and being willing to hold cash when no bargains are available. The chapter advocates for a patient, process-driven approach rather than a search for quick wins.

The principles outlined here have stood the test of time, from Benjamin Graham’s era to the present day. In a world where speculative manias and technological disruption are common, the value investing framework provides a compass for navigating uncertainty. Green’s synthesis of these ideas equips readers with a toolkit that is as relevant for today’s markets as it was for past generations of successful investors.

Chapter 5: Patience and Selectivity

This chapter is crucial because it emphasizes the virtues of patience and selectivity—qualities that are often overlooked in a world obsessed with action and immediacy. Green argues that the best investors are those who wait for the “fat pitch,” investing only when the odds are overwhelmingly in their favor. The chapter explores the discipline required to say no to mediocre opportunities and the psychological challenges of inactivity.

Green illustrates this with stories of investors who sat on the sidelines for years, such as Buffett’s reluctance to invest during periods of market exuberance, and then deployed capital aggressively when bargains appeared. He provides data on the concentrated nature of top-performing portfolios and quotes from investors who attribute their success to the willingness to wait. The chapter also discusses the dangers of overtrading and the temptation to “do something” for the sake of activity.

For practical application, investors are encouraged to create watchlists, set strict investment criteria, and develop the discipline to act only when those criteria are met. Green suggests using checklists to avoid impulsive decisions and to track the quality of opportunities over time. He also recommends embracing periods of inactivity as a sign of discipline, not indecision.

Historically, many of the greatest fortunes have been built by those who waited patiently for rare opportunities—think of Buffett’s investments during the financial crisis or Munger’s concentrated bets on high-quality businesses. In today’s fast-paced markets, where information and trading are instantaneous, the discipline of patience is a powerful edge. Green’s insights challenge readers to redefine success not by the number of trades made, but by the quality and timing of those decisions.

Chapter 7: Behavioral Finance and Decision Making

This chapter is a linchpin of the book, focusing on the psychological biases that undermine rational decision-making. Green synthesizes research from behavioral economics with real-world examples to show how even the most experienced investors are vulnerable to errors such as overconfidence, loss aversion, and confirmation bias. The chapter’s main concept is that self-awareness and structured processes are essential for overcoming these pitfalls.

Green provides examples of investors who implemented decision journals, checklists, and peer review to counteract bias. He quotes Daniel Kahneman and other behavioral economists, highlighting studies that quantify the impact of cognitive errors on investment performance. The chapter includes data on how systematic biases can erode returns and discusses the benefits of humility and skepticism.

Investors can apply these lessons by adopting structured decision-making frameworks, regularly reviewing past decisions, and seeking out dissenting opinions. Green recommends pre-committing to rules, such as maximum position sizes or stop-losses, and using scenario analysis to anticipate potential outcomes. The chapter also encourages the cultivation of emotional discipline through mindfulness and reflection.

In the context of modern markets—where information overload, social media, and algorithmic trading amplify biases—the lessons from behavioral finance are more important than ever. Green’s synthesis equips readers with practical tools for improving decision quality and building resilience against the psychological traps that can derail even the best-laid investment plans.

---

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

---

Chapter 10: Life Lessons from Investing

This chapter is essential because it bridges the gap between financial success and personal fulfillment. Green argues that the qualities developed through investing—integrity, patience, adaptability, and continuous learning—are equally valuable in life. The chapter explores how the pursuit of wealth, when guided by strong values, can lead to deeper satisfaction and personal growth.

Green shares stories of investors who overcame adversity, learned from failure, and maintained their principles in the face of temptation. He includes quotes from Buffett, who attributes much of his happiness to relationships and a sense of purpose, and from Munger, who emphasizes the importance of lifelong learning. The chapter also provides data on the correlation between character traits and long-term success.

For readers, the practical takeaway is to integrate investment wisdom into daily life by cultivating habits such as regular reading, reflection, and goal-setting. Green suggests that setbacks should be viewed as learning opportunities and that personal fulfillment comes from aligning actions with values. The chapter encourages the pursuit of excellence in all domains, not just finance.

Historically, many of the world’s most successful investors have emphasized the importance of character and personal development. In a culture that often equates wealth with happiness, Green’s insights offer a more nuanced perspective—one that values integrity, growth, and the pursuit of meaning as the true measures of a rich life.

Chapter 13: Philanthropy and Legacy

This chapter is particularly important because it explores how great investors think about giving back and building a legacy that endures beyond financial success. Green examines the motivations and strategies behind the philanthropic efforts of figures like Buffett and Pabrai, revealing how generosity and purpose can amplify both personal fulfillment and societal impact.

Green provides examples of large-scale giving, such as Buffett’s commitment to the Giving Pledge and Pabrai’s Dakshana Foundation, which focuses on education for underprivileged children. He quotes Buffett on the psychological rewards of philanthropy and provides data on the impact of strategic giving. The chapter also discusses the challenges of effective philanthropy, including how to measure impact and align giving with personal values.

For investors, the practical application is to view wealth as a tool for service and to develop a giving strategy that reflects their passions and strengths. Green suggests involving family in philanthropic decisions, setting clear goals for impact, and seeking out opportunities for high-leverage giving. The chapter encourages readers to think intentionally about the legacy they wish to create.

In the modern era, where social responsibility is increasingly valued, the lessons from this chapter are highly relevant. Green’s exploration of philanthropy and legacy challenges readers to broaden their definition of success, integrating financial achievement with a commitment to making the world better for future generations.

Chapter 15: Building a Meaningful Life

This chapter is vital because it synthesizes the book’s broader message: that true wealth is measured not just in financial terms, but in the richness of one’s life and relationships. Green explores how successful investors balance professional achievements with personal fulfillment, and how they create lives that are purposeful and meaningful.

Green shares stories of investors who prioritized family, pursued passions outside of finance, and maintained a sense of perspective even amid great success. He quotes Munger on the importance of loving what you do, and Buffett on the value of relationships and reputation. The chapter also provides data on the diminishing returns of wealth beyond a certain point and discusses strategies for building a balanced life.

For readers, the practical takeaway is to define success on one’s own terms, set goals that reflect personal values, and allocate time and resources to what matters most. Green suggests regular reflection on life priorities, the cultivation of gratitude, and the pursuit of activities that bring joy and meaning. The chapter encourages a holistic approach to wealth, one that integrates financial, emotional, and social well-being.

In a world where achievement is often narrowly defined, Green’s insights offer a refreshing perspective. The stories and lessons in this chapter inspire readers to pursue not just financial success, but a life that is truly rich in every sense of the word.

Practical Investment Strategies

- Cloning Proven Investment Approaches: Identify a handful of legendary investors whose philosophies align with your temperament and goals. Study their annual letters, interviews, and portfolio decisions in detail. Create a personal checklist of their key criteria (e.g., focus on companies with durable moats, avoid overleveraged businesses, insist on a margin of safety). Implement these criteria when screening stocks and making buy/sell decisions. Regularly review your approach to ensure you are adapting rather than blindly copying, and adjust for your own risk tolerance and market context.

- Implementing Margin of Safety Analysis: For every investment, estimate the intrinsic value using conservative assumptions about future cash flows, growth rates, and discount rates. Only consider buying when the current price offers at least a 25-40% discount to your calculated intrinsic value. Use tools such as discounted cash flow models or ValueSense’s intrinsic value calculators. Document your assumptions and revisit them periodically to ensure they remain valid as new information emerges.

- Developing a Watchlist and Practicing Selectivity: Maintain a dynamic watchlist of high-quality companies that meet your investment criteria but are not currently trading at attractive valuations. Set target buy prices based on your margin of safety analysis. Exercise patience by waiting for market downturns or company-specific events that create temporary mispricings. Avoid the temptation to lower your standards or chase momentum during bull markets.

- Counteracting Behavioral Biases: Use decision journals to record the rationale behind each investment decision, including the data and assumptions involved. After a set period (e.g., quarterly or annually), review your decisions to identify patterns of bias, such as overconfidence or confirmation bias. Incorporate structured checklists and pre-commitment strategies (e.g., never invest more than 10% in a single position) to minimize emotional errors. Seek out dissenting opinions and challenge your own assumptions before making major decisions.

- Concentrated Portfolio Construction: Rather than diversifying across dozens of mediocre ideas, focus on building a concentrated portfolio of your highest-conviction investments. Limit your holdings to 10-20 positions, allocating more capital to your best ideas while managing risk through position sizing and diversification across sectors or geographies. Monitor each position closely and be willing to exit if the original thesis weakens or valuation becomes stretched.

- Continuous Learning and Adaptation: Dedicate time each week to reading widely—annual reports, investor letters, books, and academic research. Attend conferences, webinars, or online forums to engage with other investors and challenge your thinking. Regularly update your investment process based on new insights or changing market conditions. Treat mistakes as learning opportunities, documenting what went wrong and how you can improve in the future.

- Integrating Philanthropy and Purpose: As your portfolio grows, set aside a percentage of annual profits for charitable giving or impact investing. Identify causes that resonate with your values and research the most effective ways to contribute. Involve family or trusted advisors in giving decisions to multiply impact and create a shared sense of purpose. Document your philanthropic goals and progress, and periodically revisit your strategy to ensure alignment with your evolving values and resources.

- Building Personal Resilience: Develop routines that support mental and emotional well-being, such as regular exercise, mindfulness practices, and time spent with family or in nature. Recognize that investing is a marathon, not a sprint, and prioritize habits that sustain long-term performance. Set boundaries to prevent burnout, and cultivate relationships with mentors or peers who can provide support and accountability during challenging periods.

Modern Applications and Relevance

“Richer, Wiser, Happier” is especially relevant in today’s rapidly evolving investment landscape. While the book draws on timeless principles, Green’s insights are remarkably applicable to the challenges and opportunities facing modern investors. The democratization of information, proliferation of low-cost trading platforms, and rise of algorithmic trading have made markets more accessible—but also more competitive and prone to speculative excess.

One of the book’s central arguments is that the core habits of successful investors—discipline, patience, independent thinking—are more valuable than ever in an age of information overload. For example, the temptation to chase meme stocks or speculative cryptocurrencies can be counteracted by adhering to value investing principles and focusing on intrinsic value. The margin of safety concept remains a powerful antidote to the risks of overvaluation and market hype.

At the same time, some aspects of investing have changed since the eras of Buffett, Templeton, and others profiled in the book. The speed of information flow, the influence of social media, and the complexity of global markets require investors to be more adaptive and technologically savvy. Green’s emphasis on continuous learning and adaptation is particularly relevant, encouraging investors to supplement traditional analysis with new tools and data sources, such as AI-driven stock screeners or alternative data sets.

Despite these changes, many of the book’s lessons remain timeless. The psychological challenges of investing—fear, greed, herd mentality—are as present today as ever. The need for emotional discipline, humility, and a long-term perspective transcends market cycles and technological shifts. Green’s stories of investors who thrived by sticking to their principles during periods of crisis offer valuable guidance for navigating volatility and uncertainty.

Modern examples abound. During the COVID-19 market crash, investors who adhered to value investing principles and maintained discipline were rewarded as markets rebounded. The philanthropic focus of today’s leading investors, such as the Giving Pledge or impact investing initiatives, echoes the legacy-building themes explored in the book. By adapting classic advice to current conditions—embracing technology, diversifying globally, and prioritizing sustainability—investors can build resilient, purpose-driven portfolios that stand the test of time.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Implementation Guide

- Establish Your Investment Philosophy: Begin by clarifying your core beliefs and objectives. Read widely—starting with the writings of Buffett, Munger, and other value investors—to identify the principles that resonate with you. Document your investment philosophy in a personal statement, outlining your approach to risk, return, time horizon, and decision-making. This foundational step will guide all subsequent actions and help you maintain discipline during periods of uncertainty.

- Develop a Systematic Screening Process (0-3 Months): Create a checklist based on proven criteria—such as strong balance sheets, high returns on capital, durable competitive advantages, and reasonable valuations. Use tools like ValueSense’s AI-powered screener to identify potential investments that meet these standards. Set aside regular time each week to review new ideas, update your watchlist, and refine your criteria based on ongoing learning.

- Construct a Concentrated, High-Conviction Portfolio (3-6 Months): Select your best ideas from the watchlist and build a portfolio of 10-20 positions, allocating more capital to your highest-conviction investments. Use the margin of safety principle to determine entry points, and diversify across sectors or geographies to manage risk. Document the thesis for each holding, including the rationale, expected catalysts, and criteria for exiting the position.

- Implement Ongoing Portfolio Management (Quarterly Review): Schedule quarterly reviews to assess portfolio performance, revisit investment theses, and identify any changes in fundamentals or valuation. Use decision journals to track the outcomes of your choices and to learn from both successes and mistakes. Rebalance the portfolio as needed, trimming positions that have become overvalued or no longer meet your criteria, and adding to those where conviction remains high.

- Commit to Continuous Improvement (Ongoing): Dedicate time for ongoing education—reading books, attending conferences, and engaging with other investors. Regularly review your investment process, seeking feedback from mentors or peers. Update your checklist and screening criteria as you learn from experience and new research. Explore philanthropic opportunities as your portfolio grows, aligning your giving with personal values and long-term goals.

--- ---

10+ Free intrinsic value tools

For investors looking to find a stock's fair value, our analytics team has you covered with intrinsic value tools:

📍 Free Intrinsic Value Calculator

📍 Reverse DCF & DCF value tools

📍 Peter Lynch Fair Value Calculator

📍 Ben Graham Fair Value Calculator

📍 Relative Value tool

...and plenty more.

🔍 Explore all these tools for free on the Value Sense platform and start discovering what your favorite stocks are really worth.

FAQ: Common Questions About Richer, Wiser, Happier

1. What is the main message of “Richer, Wiser, Happier”?

The main message is that the principles and mindsets that lead to investment success—such as discipline, patience, independent thinking, and humility—are also the keys to living a fulfilling and meaningful life. William Green argues that financial wealth is only part of the equation; true happiness comes from integrating values, continuous learning, and a sense of purpose into both investing and daily living.

2. How does the book differ from traditional investment guides?

Unlike many investment books that focus solely on technical strategies or stock picking, “Richer, Wiser, Happier” blends financial wisdom with personal philosophy. It draws on interviews with legendary investors to explore not just how they invest, but how they think, make decisions, and find meaning in life. The book offers both actionable strategies and deeper life lessons, making it relevant for a broad audience.

3. Who are some of the key investors featured in the book?

The book features insights from a range of legendary investors, including Warren Buffett, Charlie Munger, Sir John Templeton, Mohnish Pabrai, Howard Marks, Joel Greenblatt, and many others. William Green distills their philosophies, habits, and stories to illustrate universal principles of investing and personal growth.

4. Is the book suitable for beginner investors?

Yes, the book is accessible to beginners while still offering depth for experienced investors. Green explains complex concepts in clear language and provides practical examples that can be applied regardless of experience level. The focus on mindset and process makes it a valuable resource for anyone seeking to improve both their investment results and their approach to life.

5. How can I apply the lessons from the book to my own investing?

Start by clarifying your investment philosophy, adopting proven principles such as margin of safety and patience, and developing a systematic process for screening and selecting investments. Use checklists, decision journals, and regular reviews to counteract biases and improve decision-making. Integrate personal values and purpose into your financial goals, and commit to continuous learning and adaptation as markets and circumstances change.