Robert Karr - Joho Capital Llc Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

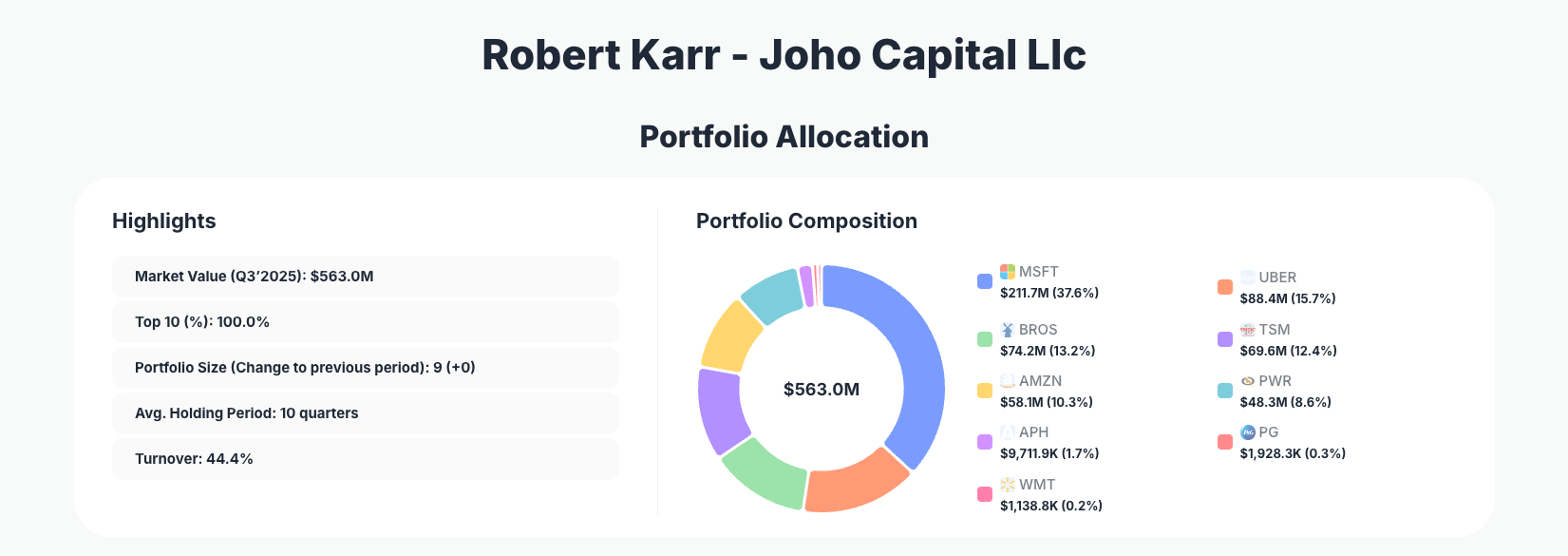

Robert Karr of Joho Capital LLC showcases his signature high-conviction style in the latest 13F filing, with active trims across major positions signaling profit-taking amid tech volatility. His $563.0M portfolio remains ultra-concentrated at just 9 positions, where the top holding still commands over a third of assets despite a significant reduction.

Portfolio Overview: Extreme Concentration with Active Rotation

Portfolio Highlights (Q3 2025): - Market Value: $563.0M - Top 10 Holdings: 100.0% - Portfolio Size: 9 +0 - Average Holding Period: 10 quarters - Turnover: 44.4%

Joho Capital's portfolio exemplifies extreme concentration, with the top 10 holdings—essentially the entire portfolio—accounting for 100% of assets. This approach underscores Robert Karr's philosophy of betting heavily on a handful of high-conviction ideas rather than diversifying broadly, a strategy that amplifies returns when correct but demands precise timing and deep business understanding. The 44.4% turnover rate reveals significant activity this quarter, balancing long-term holds averaging 10 quarters with opportunistic adjustments.

This portfolio structure reflects Karr's focus on technology-driven growth companies capable of scaling massively, even as he trims winners to manage risk. With no new positions added beyond minor buys and the portfolio size stable at 9, the moves suggest disciplined profit-taking rather than aggressive expansion. Tracking these shifts via the Joho Capital portfolio page on ValueSense provides real-time insights into how such concentration plays out across market cycles.

Top Holdings: Tech Core Undergoes Major Trims and Selective Adds

The portfolio's changes this quarter prioritize all positions with notable activity, starting with heavy reductions in core tech names. Microsoft (MSFT) remains the anchor at 37.6% $211.7M, but Karr reduced it by 26.52%, likely locking in gains after strong performance. Uber Technologies (UBER) follows at 15.7% $88.4M with a 9.07% trim, while Dutch Bros (BROS) at 13.2% $74.2M saw a sharper 19.17% cut, possibly reflecting valuation concerns in the coffee chain space.

On the addition side, Amazon (AMZN) exploded with a massive Add 16,359.24% to 10.3% $58.1M, signaling fresh conviction in e-commerce and cloud dominance. Quanta Services (PWR) endured the steepest cut at 49.17% to 8.6% $48.3M, alongside a 45.55% reduction in Procter & Gamble (PG) now at 0.3% $1,928.3K. A new "Buy" emerged in Walmart (WMT) at 0.2% $1,138.8K, dipping into consumer staples.

Stable positions round out the picture, including Taiwan Semiconductor (TSM) at 12.4% $69.6M with No change, maintaining semiconductor exposure. Amphenol (APH) holds steady at 1.7% $9,711.9K with No change, providing industrials diversification. These 9 holdings blend tech heavyweights with selective consumer and infrastructure plays, highlighting Karr's adaptability within a tight focus.

What the Portfolio Reveals

Robert Karr's Q3 moves paint a picture of a manager navigating tech euphoria with discipline: - Tech Sector Dominance: Over 70% in names like MSFT, UBER, AMZN, TSM—betting on AI, cloud, and mobility megatrends despite trims. - Profit-Taking Discipline: Major reductions in winners (MSFT -26.52%, PWR -49.17%) suggest risk management over blind holding. - Opportunistic Scaling: Explosive AMZN add and WMT buy show willingness to pivot into perceived value amid volatility. - Growth Over Value Tilt: Minimal dividend payers like PG trimmed sharply; focus on high-growth scalers. - Global Exposure: TSM adds Taiwan semi risk but critical AI supply chain play.

This reveals a strategy balancing conviction in quality growth with active position sizing to mitigate concentration risks.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Microsoft Corporation | $211.7M | 37.6% | Reduce 26.52% |

| Uber Technologies, Inc. | $88.4M | 15.7% | Reduce 9.07% |

| Dutch Bros Inc. | $74.2M | 13.2% | Reduce 19.17% |

| Taiwan Semiconductor Manufacturing Company Limited | $69.6M | 12.4% | No change |

| Amazon.com, Inc. | $58.1M | 10.3% | Add 16,359.24% |

| Quanta Services, Inc. | $48.3M | 8.6% | Reduce 49.17% |

| Amphenol Corporation | $9,711.9K | 1.7% | No change |

| The Procter & Gamble Company | $1,928.3K | 0.3% | Reduce 45.55% |

| Walmart Inc. | $1,138.8K | 0.2% | Buy |

This table underscores Joho Capital's ultra-concentrated bet on just 9 names, with Microsoft alone at 37.6%—a level of conviction few managers match. The 100% top-10 allocation means every position carries outsized impact, amplified by 44.4% turnover as Karr trims laggards like PWR and PG while scaling AMZN dramatically. Such structure demands flawless stock-picking, but the 10-quarter average hold suggests Karr buys businesses he plans to own long-term, using changes for fine-tuning rather than wholesale shifts.

Investment Lessons from Robert Karr's Joho Capital Approach

- Embrace Extreme Concentration: With 100% in 9 holdings, Karr teaches that true edge comes from deep research on few ideas, not spraying capital across dozens.

- Trim Winners Ruthlessly: Reducing MSFT by 26.52% despite its dominance shows discipline in taking profits to fund better opportunities like AMZN.

- Average Holding Periods Build Wealth: 10 quarters average signals patience—avoid trading noise, focus on business trajectories.

- Position Sizing is Dynamic: Massive AMZN add 16,359.24% and PWR cut -49.17% highlight constant reassessment of conviction levels.

- Tech Growth with Diversification Touches: Core tech bets balanced by infrastructure (PWR, APH) and staples (WMT, PG) manage sector risks.

Looking Ahead: What Comes Next?

Joho Capital's stable 9-position size and high turnover suggest room for new bets if opportunities arise, especially with trims freeing up capital from MSFT and others. The heavy tech tilt positions well for AI and cloud tailwinds, but AMZN's aggressive add hints at e-commerce recovery plays. Watch for further rotations into semis (via TSM) or consumer staples amid economic uncertainty. With no explicit cash mentioned in 13F (which excludes it), the focus remains fully invested, setting up for volatility exploitation in 2026.

FAQ about Robert Karr Joho Capital Portfolio

Q: What drove the major reductions in Microsoft and Quanta Services?

A: Karr reduced MSFT by 26.52% and PWR by 49.17%, likely profit-taking after strong runs and reallocation to higher-conviction names like AMZN, reflecting disciplined risk management in a concentrated book.

Q: Why is Joho Capital's portfolio so concentrated at 100% top 10?

A: Robert Karr favors high-conviction bets on 9 positions, believing broad diversification dilutes edge. This 100% concentration amplifies returns from top ideas like MSFT 37.6% but requires rigorous analysis, as seen in the stable size and 10-quarter holds.

Q: What does the massive Amazon add signal about Karr's strategy?

A: The 16,359.24% add to AMZN (now 10.3%) indicates strong belief in its cloud and e-commerce moats, counterbalancing trims in other tech while pivoting to perceived undervaluation.

Q: How does Joho Capital balance tech risks with other sectors?

A: While tech dominates (MSFT, UBER, TSM, AMZN), touches in infrastructure (PWR, APH) and staples (WMT, PG) provide hedges, with 44.4% turnover enabling tactical shifts.

Q: How can I track Robert Karr's Joho Capital portfolio changes?

A: Follow quarterly 13F filings on the SEC site, filed 45 days after quarter-end—note the lag means positions like the AMZN add may have evolved. Use ValueSense's superinvestor tracker for real-time analysis, visualizations, and historical changes at https://valuesense.io/superinvestors/joho-capital.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!