Robert Vinall - RV Capital GmbH Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

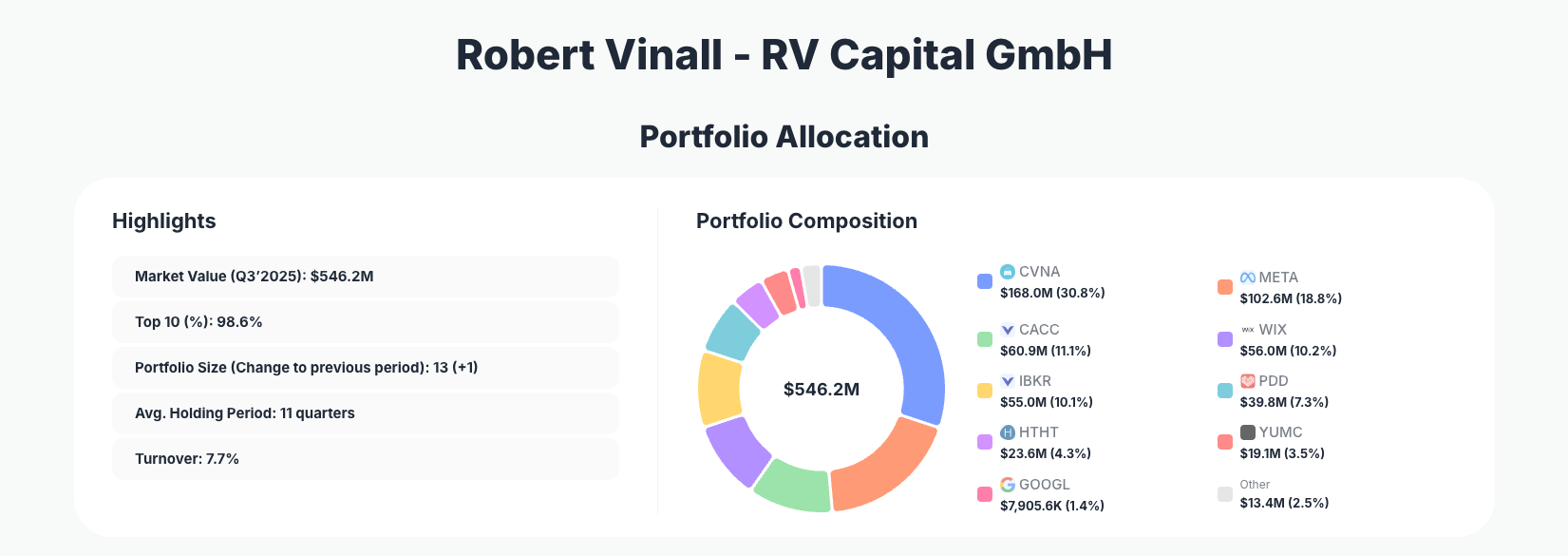

Robert Vinall of RV Capital GmbH maintains his reputation for bold, concentrated bets on high-growth disruptors. His $546.2M portfolio in Q3 2025 shows disciplined trimming across most positions despite strong market performance, with the top 10 holdings commanding 98.6% of assets and turnover at a modest 7.7%.

Portfolio Overview: Extreme Concentration with Surgical Precision

Portfolio Highlights (Q3 2025): - Market Value: $546.2M - Top 10 Holdings: 98.6% - Portfolio Size: 13 +1 - Average Holding Period: 11 quarters - Turnover: 7.7%

RV Capital's portfolio exemplifies ultra-concentrated investing, where nearly all capital is deployed into just 13 positions, with the top holding alone at 30.8%. This approach underscores Vinall's philosophy of deep research into a handful of exceptional businesses rather than broad diversification. The average holding period of 11 quarters signals patience, allowing winners time to compound while the low 7.7% turnover reflects confidence in core convictions amid market volatility.

The portfolio expansion to 13 positions +1 introduces minor diversification without diluting focus, as the top 10 still dominate at 98.6%. Reviewing the full RV Capital portfolio on ValueSense reveals a tilt toward tech-enabled disruptors in consumer, fintech, and platforms—names that have delivered outsized returns but now face profit-taking. This Q3 13F filing highlights Vinall's active management: reducing winners to lock in gains while selectively adding to select names.

Top Holdings: Trims Dominate as Growth Stocks Take Profits

The portfolio remains anchored by Carvana Co. (CVNA) at 30.8% $168.0M, though Vinall reduced this position by 12.76%—likely harvesting gains from the used-car platform's remarkable turnaround. Meta Platforms, Inc. (META) follows at 18.8% $102.6M after a modest Reduce 2.29%, maintaining significant exposure to social media and AI-driven advertising growth. One bright spot is Credit Acceptance Corporation (CACC), boosted by Add 1.16% to 11.1% $60.9M, signaling rising conviction in the subprime auto lender's resilient model.

Further trims appear across key growth names: Wix.com Ltd. (WIX) at 10.2% $56.0M after Reduce 6.81%, Interactive Brokers Group, Inc. (IBKR) at 10.1% $55.0M down Reduce 5.96%, and PDD Holdings Inc. (PDD) at 7.3% $39.8M with a sharp Reduce 10.23%. Chinese exposure continues via H World Group Limited (HTHT) (4.3%, Reduce 8.53%) and Yum China Holdings, Inc. (YUMC) (3.5%, Reduce 9.74%), both trimmed amid geopolitical and economic headwinds.

Rounding out the top tier, Alphabet Inc. (GOOGL) holds steady at 1.4% with No change. Notable activity extends to smaller stakes like Salesforce, Inc. (CRM), newly added at 0.5% with a 56.86% increase $2,602.3K, hinting at emerging interest in enterprise software. The portfolio's +1 position growth suggests opportunistic deployment into the 11th-13th holdings, maintaining overall discipline.

What the Portfolio Reveals

Vinall's Q3 moves paint a picture of profit-taking in high-flyers while nurturing select compounders. Key themes emerge:

- Tech and Platform Dominance: Over 70% in digital platforms like META, WIX, and CVNA, betting on network effects and scalability.

- Fintech Resilience: CACC and IBKR (21% combined) highlight subprime lending and brokerage infrastructure as durable moats.

- China Selectivity: PDD, HTHT, and YUMC (15% total) show targeted exposure to consumer recovery, trimmed for risk management.

- Low Turnover Discipline: 7.7% rate balances conviction with rebalancing, avoiding knee-jerk reactions.

- Growth at Reasonable Prices: Positions favor profitable disruptors over pure speculation, with average 11-quarter holds.

This strategy prioritizes quality growth over broad market beta, using trims to fund conviction adds like CACC and CRM.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Carvana Co. | $168.0M | 30.8% | Reduce 12.76% |

| Meta Platforms, Inc. | $102.6M | 18.8% | Reduce 2.29% |

| Credit Acceptance Corporation | $60.9M | 11.1% | Add 1.16% |

| Wix.com Ltd. | $56.0M | 10.2% | Reduce 6.81% |

| Interactive Brokers Group, Inc. | $55.0M | 10.1% | Reduce 5.96% |

| PDD Holdings Inc. | $39.8M | 7.3% | Reduce 10.23% |

| H World Group Limited | $23.6M | 4.3% | Reduce 8.53% |

| Yum China Holdings, Inc. | $19.1M | 3.5% | Reduce 9.74% |

| Alphabet Inc. | $7,905.6K | 1.4% | No change |

This table underscores RV Capital's hallmark concentration: the top position alone (CVNA) rivals entire diversified portfolios, with the top five at 81%—a structure demanding unshakeable conviction. The predominance of "Reduce" actions (7 of 9) reflects tactical de-risking after strong runs, freeing ~$50M+ in capital from trims while the sole "Add" in CACC boosts a steady performer. At 98.6% in top 10, Vinall accepts volatility for alpha, a high-risk/high-reward bet on his research edge.

Investment Lessons from Robert Vinall's Approach

Vinall's portfolio demonstrates timeless principles tailored to growth-value fusion:

- Extreme Concentration Requires Edge: 98.6% in top 10 demands proprietary insights—Vinall's deep dives into disruptors like CVNA justify the risk.

- Trim Winners, Don't Sell: Reduces average 7-10% lock gains without abandoning theses, preserving long-term upside.

- Patience Pays: 11-Quarter Holds: Avoid churn; let quality compound, as seen in stable GOOGL.

- Selective China Bets: Geographic risks warrant sizing discipline, trimming PDD/HTHT amid macro noise.

- Rebalance for Conviction: Adds like CACC 1.16% and CRM 56.86% show capital rotation to rising favorites.

Looking Ahead: What Comes Next?

With portfolio size up to 13 +1 and low 7.7% turnover, Vinall holds dry powder from trims for opportunistic buys. The freed capital from heavy reduces (CVNA, PDD) positions RV Capital to pounce on dips in tech/fintech amid potential 2026 volatility from elections or AI hype cycles. Current heavy tech tilt sets up well for digital economy tailwinds, but trims signal caution on overvalued winners—watch for adds in undervalued platforms or U.S.-centric fintech. ValueSense tracking at rv-capital will reveal Q4 shifts.

FAQ about Robert Vinall's RV Capital Portfolio

Q: Why the heavy trimming across most top holdings in Q3 2025?

A: Vinall trimmed winners like CVNA 12.76%, PDD 10.23%, and others to book profits after strong gains, maintaining discipline with 7.7% turnover while keeping core convictions intact.

Q: What explains RV Capital's 98.6% concentration in top 10 holdings?

A: This reflects Vinall's high-conviction style, focusing capital on deeply researched growth disruptors like META and IBKR where he sees superior risk/reward over diversification.

Q: What are the key sectors in Vinall's portfolio?

A: Dominated by tech platforms (META, WIX), fintech (CACC, IBKR), and selective China consumer (PDD, HTHT, YUMC), blending U.S. scalability with emerging market recovery plays.

Q: How can I track Robert Vinall's RV Capital portfolio changes?

A: Follow quarterly 13F filings (45-day lag post-quarter-end) via SEC EDGAR, or use ValueSense's superinvestor tracker at https://valuesense.io/superinvestors/rv-capital for visualizations, historical data, and instant alerts on moves.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!