Ruane Cunniff - Ruane, Cunniff & Goldfarb L.p. Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

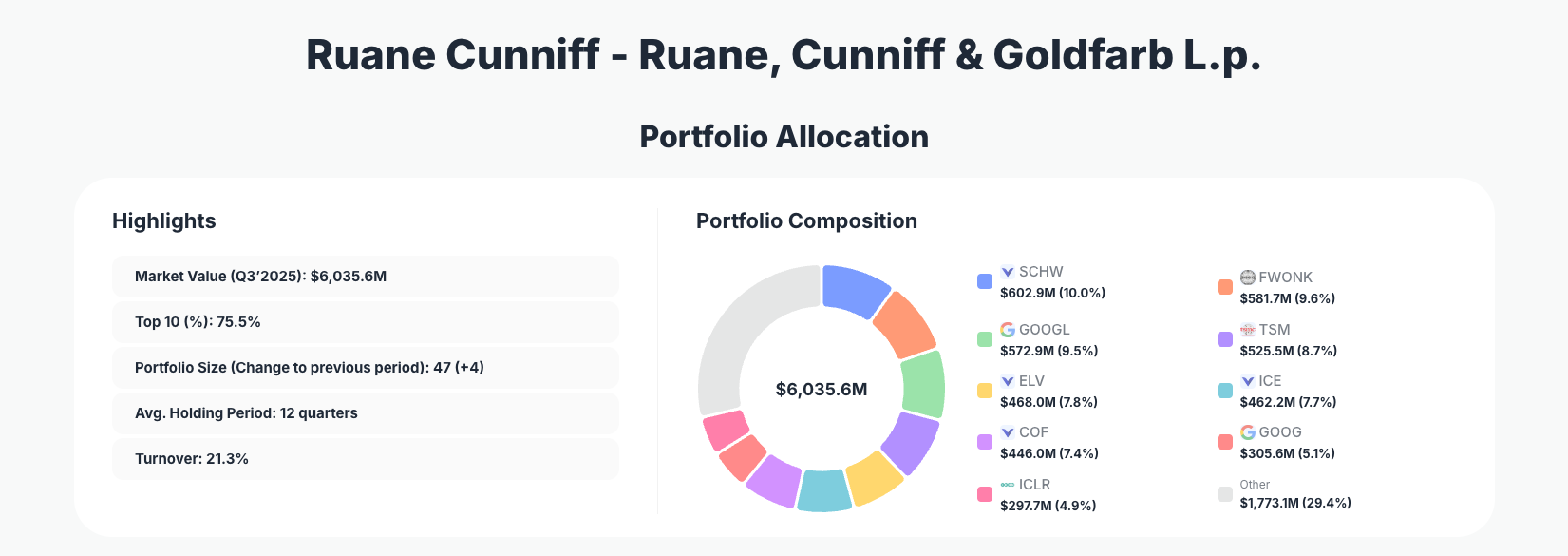

Ruane Cunniff - Ruane, Cunniff & Goldfarb L.p. maintains its reputation for disciplined, long-term value investing through methodical portfolio adjustments in their latest 13F filing. Their $6B Q3 2025 portfolio showcases a highly concentrated strategy, with the top 10 holdings commanding 75.5% of assets amid a portfolio expansion to 47 positions and notable trims across key names like SCHW and TSM.

Portfolio Overview: Concentrated Conviction with Disciplined Tweaks

Portfolio Highlights (Q3’2025): - Market Value: $6,035.6M - Top 10 Holdings: 75.5% - Portfolio Size: 47 +4 - Average Holding Period: 12 quarters - Turnover: 21.3%

The Ruane Cunniff portfolio exemplifies a classic concentrated value approach, where over three-quarters of the $6 billion in assets are committed to just 10 names despite growing the overall position count to 47. This balance reflects a core philosophy of high-conviction bets on quality businesses while maintaining diversification in smaller holdings. The average holding period of 12 quarters underscores patience, with 21.3% turnover indicating active management without excessive trading.

Recent changes reveal fine-tuning rather than wholesale shifts: significant reductions in several top positions suggest profit-taking or risk management in a volatile market, paired with selective additions like healthcare and safety plays. Portfolio growth by four positions hints at opportunistic expansion into undervalued names outside the core. Track these dynamics live on their ValueSense superinvestor page, where 13F updates provide quarter-over-quarter insights.

This structure positions Ruane Cunniff to weather economic uncertainty, blending tech semiconductors, financial services, and healthcare for resilient growth exposure.

Top Holdings Breakdown: Trims in Tech Giants, Fresh Bets on Health and Safety

The portfolio's core remains heavily tilted toward proven compounders, starting with The Charles Schwab Corporation (SCHW) at 10.0% after a Reduce 4.29% trim, signaling caution on brokerage valuations amid rate shifts. Formula One Group (FWONK) holds steady at 9.6% with a minor Reduce 0.75%, maintaining entertainment moat exposure. Alphabet Inc. (GOOGL) weighs in at 9.5% following a Reduce 0.41%, complemented by sister class GOOG at 5.1% (Reduce 2.45%), showing nuanced big-tech positioning.

Semiconductor strength persists via Taiwan Semiconductor Manufacturing Company Limited (TSM) at 8.7% despite a Reduce 1.88%, highlighting AI tailwinds. A bold new entry, Elevance Health Inc. (ELV) at 7.8% marked "Buy," adds healthcare stability. Financial infrastructure shines with Intercontinental Exchange, Inc. (ICE) at 7.7% (Reduce 0.93%) and Capital One Financial Corporation (COF) at 7.4% (Reduce 0.89%). ICON Public Limited Company (ICLR) rounds out the top tier at 4.9% with a Reduce 0.42%, while recent mover MSA Safety Incorporated (MSA) surged Add 79.68% to also claim 4.9%, betting on industrial safety amid global risks.

These adjustments blend reduction in overweights with opportunistic buys, prioritizing quality amid sector rotations.

What the Portfolio Reveals About Ruane Cunniff's Strategy

Ruane Cunniff's moves signal a strategy favoring quality compounders with durable moats over speculative growth, evident in trims to high-flyers like TSM and Alphabet while initiating ELV for defensive healthcare exposure. Sector focus spans financial services (SCHW, ICE, COF), technology/semiconductors (GOOGL, GOOG, TSM), and emerging healthcare/industrials (ELV, ICLR, MSA), balancing cyclical and secular trends.

Geographic concentration leans U.S.-centric with international flavor via TSM and FWONK, mitigating domestic policy risks. The 21.3% turnover and 12-quarter hold average emphasize patient risk management, trimming winners to fund conviction adds like MSA's 79.68% boost. No overt dividend chase, but holdings like SCHW and COF offer yields alongside growth. Overall, this reveals adaptive value investing: capitalize on AI/data themes while hedging via resilient sectors.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| The Charles Schwab Corporation (SCHW) | $602.9M | 10.0% | Reduce 4.29% |

| Formula One Group (FWONK) | $581.7M | 9.6% | Reduce 0.75% |

| Alphabet Inc. (GOOGL) | $572.9M | 9.5% | Reduce 0.41% |

| Taiwan Semiconductor Manufacturing Company Limited (TSM) | $525.5M | 8.7% | Reduce 1.88% |

| Elevance Health Inc. (ELV) | $468.0M | 7.8% | Buy |

| Intercontinental Exchange, Inc. (ICE) | $462.2M | 7.7% | Reduce 0.93% |

| Capital One Financial Corporation (COF) | $446.0M | 7.4% | Reduce 0.89% |

| Alphabet Inc. (GOOG) | $305.6M | 5.1% | Reduce 2.45% |

| ICON Public Limited Company (ICLR) | $297.7M | 4.9% | Reduce 0.42% |

This table underscores extreme concentration, with the top 10 devouring 75.5% of the portfolio—SCHW alone at 10% anchors financials, while Alphabet's dual classes add 14.6% tech heft. Trims dominate (8 of 10), averaging ~1.5% reductions, suggesting valuation discipline post-rally, offset by ELV's fresh buy for balance.

Such focus amplifies returns from winners but heightens stock-specific risk; the +4 positions to 47 provide a buffer. Ruane Cunniff's approach thrives on deep research into these names, turning concentration into alpha via long holds.

Investment Lessons from Ruane Cunniff's Value Discipline

- Trim winners selectively: Reductions in SCHW 4.29%, TSM 1.88%, and GOOG 2.45% show profit-taking preserves capital without abandoning moats.

- Long holding periods drive returns: 12-quarter average reflects conviction—patient capital beats trading noise.

- Quality moats over cheapness: Bets on TSM, Alphabet, and ELV prioritize durable advantages in semis, search, and health.

- Active position sizing matters: MSA's 79.68% add and portfolio growth to 47 +4 demonstrate opportunistic scaling.

- Balance concentration with diversification: 75.5% in top 10, yet 37 smaller positions mitigate blowups.

Looking Ahead: What Comes Next?

With 21.3% turnover and trims freeing ~$200M+ (rough estimate from reductions), Ruane Cunniff holds dry powder for deployments amid moderating inflation and AI hype. Potential targets: undervalued financials or healthcare post-trims, or semis if TSM dips. Current positioning—tech/financials/health—sets up for 2026 growth if rates stabilize, with MSA signaling industrials rotation.

Market volatility from elections/geopolitics favors their quality tilt; watch Q4 13F for ELV scaling or new safety/industrial bets. Track Ruane Cunniff's portfolio on ValueSense for real-time updates.

FAQ about Ruane Cunniff Portfolio

Q: What are the most significant changes in Ruane Cunniff's Q3 2025 13F filing?

A: Key moves include Reduce 4.29% in SCHW 10.0%, Buy in ELV 7.8%, Add 79.68% in MSA 4.9%, and trims across TSM 1.88%, GOOG 2.45%, alongside minor reductions in FWONK, GOOGL, ICE, COF, and ICLR.

Q: Why does Ruane Cunniff maintain such high portfolio concentration?

A: Their 75.5% top-10 weighting stems from a value investing philosophy emphasizing deep research on high-conviction names like SCHW and Alphabet, allowing outsized returns while smaller positions add diversification.

Q: What sectors dominate Ruane Cunniff's strategy?

A: Financial services (SCHW, ICE, COF ~25%), technology/semiconductors (Alphabet, TSM ~23%), healthcare (ELV, ICLR ~13%), and niche like motorsports (FWONK) and safety (MSA), blending growth and resilience.

Q: How can I track and follow Ruane Cunniff's portfolio?

A: Monitor quarterly 13F filings on the SEC site or use ValueSense's superinvestor tracker at https://valuesense.io/superinvestors/ruane-cunniff for real-time analysis, historical changes, and visualizations—note the 45-day reporting lag means positions may evolve post-filing.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!