Rule of 40 Explained: The Ultimate SaaS Stock Analysis Guide Using ValueSense

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

The Rule of 40 has become the gold standard for evaluating SaaS companies and growth stocks, separating market winners from underperformers. At ValueSense, we've developed powerful tools to help investors master this critical metric and identify the next generation of high-performing stocks. In this comprehensive guide, we'll show you exactly how to use Rule of 40 analysis to make smarter investment decisions.

What is the Rule of 40? The Foundation of Modern SaaS Analysis

The Rule of 40 is elegantly simple yet incredibly powerful: it's calculated as the sum of revenue growth rate plus free cash flow margin. This metric was developed by venture capitalists to understand how growth balances with profitability in high-growth companies.

Rule of 40 Formula: Revenue Growth Rate (%) + Free Cash Flow Margin (%) ≥ 40%

The beauty of this metric lies in its flexibility. A company growing at 80% can sustain a -40% free cash flow margin and still pass the Rule of 40 test. Conversely, a mature company with 10% growth needs 30% free cash flow margins to achieve the same score.

Why the Rule of 40 Matters for Investors

Growth vs. Profitability Balance: The Rule of 40 helps investors understand whether a company is optimizing the right balance between investing for growth and generating profits.

Sector Comparison: It provides a standardized way to compare companies across different growth stages and business models within the SaaS and technology sectors.

Investment Quality Indicator: Companies consistently scoring above 40% typically command premium valuations and deliver superior stock performance.

Palantir: A Legendary Rule of 40 Success Story

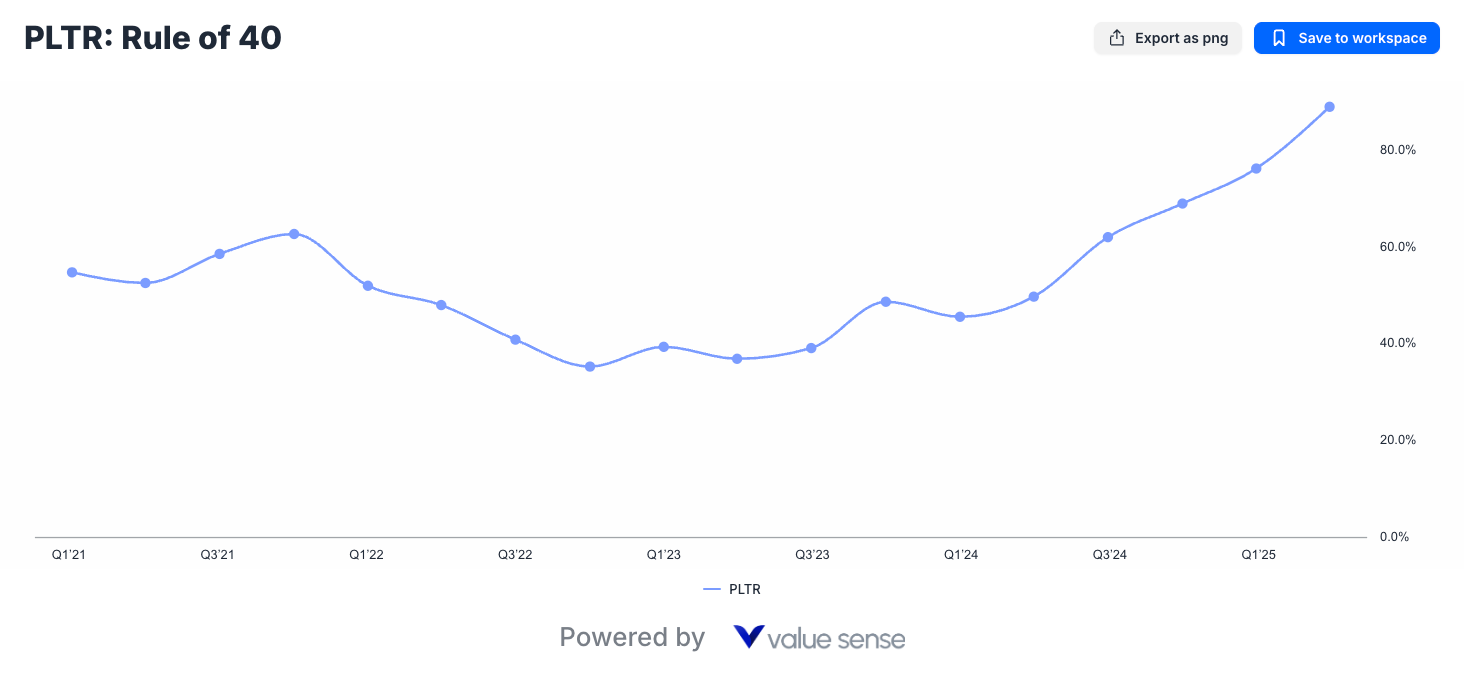

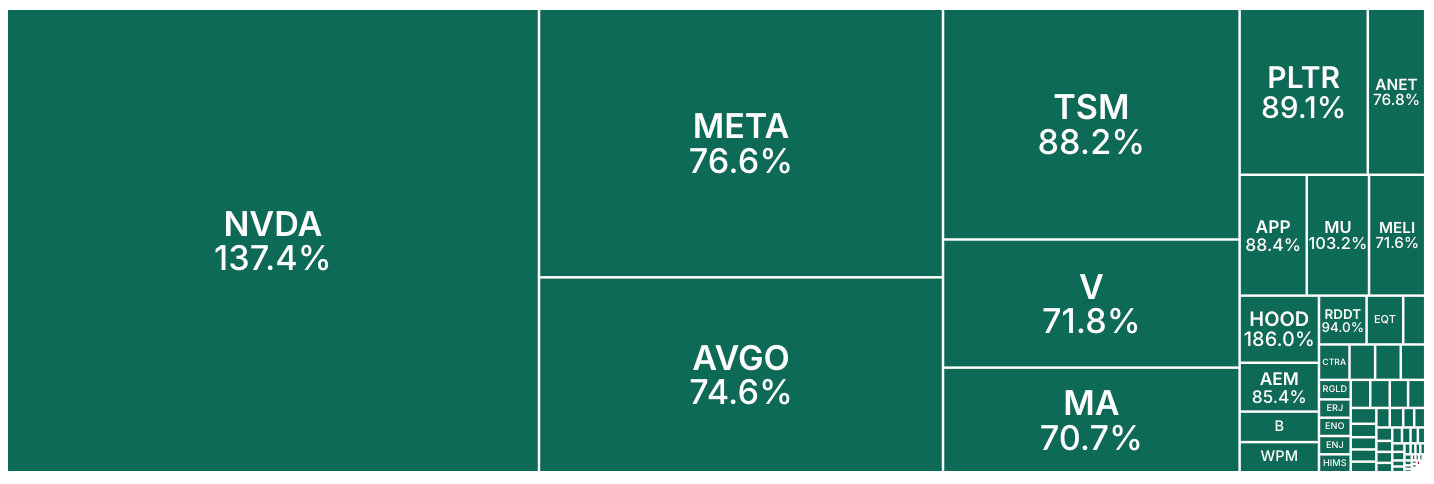

Let's examine Palantir (PLTR) - a company that has achieved what we call a "legendary" Rule of 40 score. Our analysis using ValueSense tools reveals why Palantir stands out in today's market.

Palantir's Extraordinary Rule of 40 Performance

Using ValueSense stock charting, we can visualize Palantir's remarkable transformation:

Q4 2023 Performance:

- Revenue Growth: 16.7%

- Free Cash Flow Margin: Expanding

- Rule of 40 Score: Strong foundation

Recent Quarter Achievement:

- Revenue Growth: Over 34% (more than doubled from Q4 2023)

- Free Cash Flow Margin: Continued expansion

- Rule of 40 Score: Nearly 90% (legendary performance)

This 90% Rule of 40 score places Palantir in the top tier of all public companies. While 40% is considered good, 90% is truly exceptional and demonstrates the company's ability to simultaneously accelerate growth while expanding profitability.

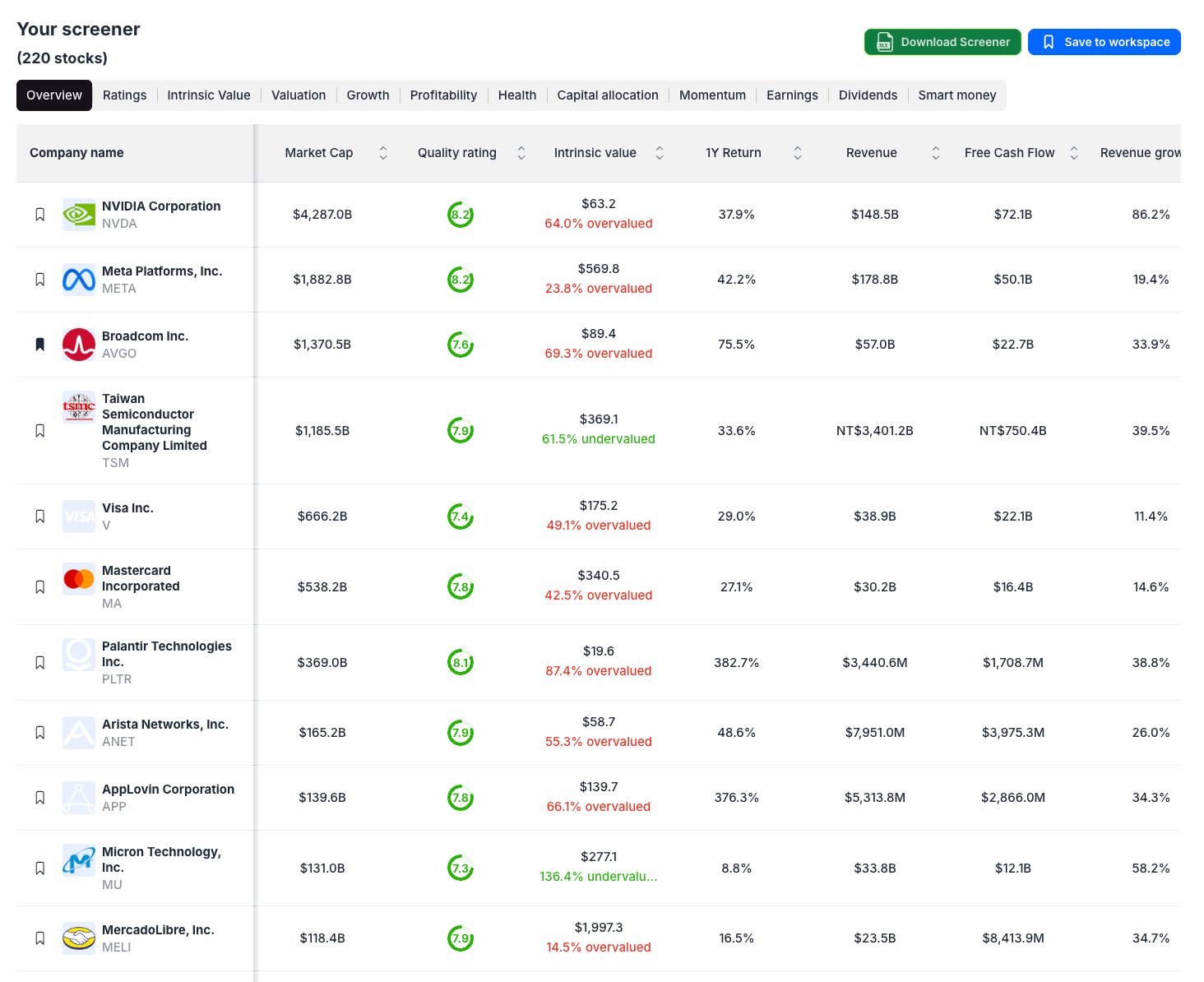

Comparing Palantir to Market Giants

To put Palantir's performance in perspective, let's compare it to NVIDIA (NVDA) - the chip giant that's been driving the AI revolution:

NVIDIA's Rule of 40 Analysis:

- Initially strong Rule of 40 performance

- Recent moderation due to revenue growth deceleration

- Still impressive triple-digit growth, but facing natural maturation

Even NVIDIA, despite its incredible performance, has seen some Rule of 40 decline as growth rates moderate from unsustainable levels. This highlights why Palantir's accelerating Rule of 40 score is so remarkable.

You can watch our complete analysis of this comparison in our YouTube video tutorial, where we demonstrate live how to use ValueSense tools for Rule of 40 analysis.

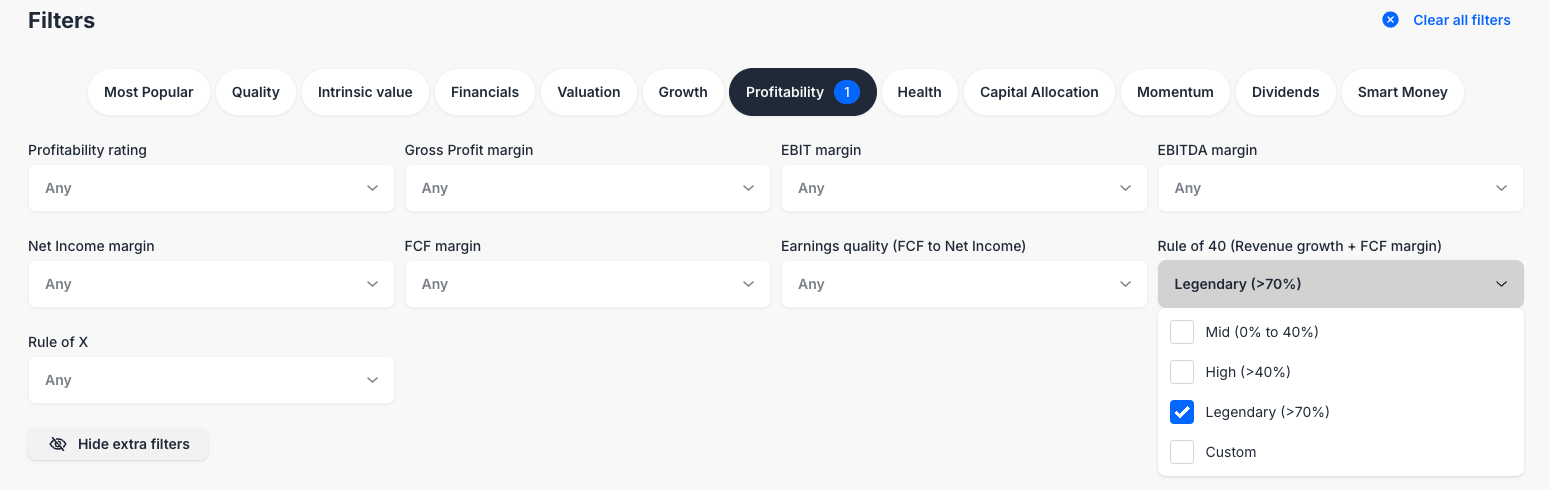

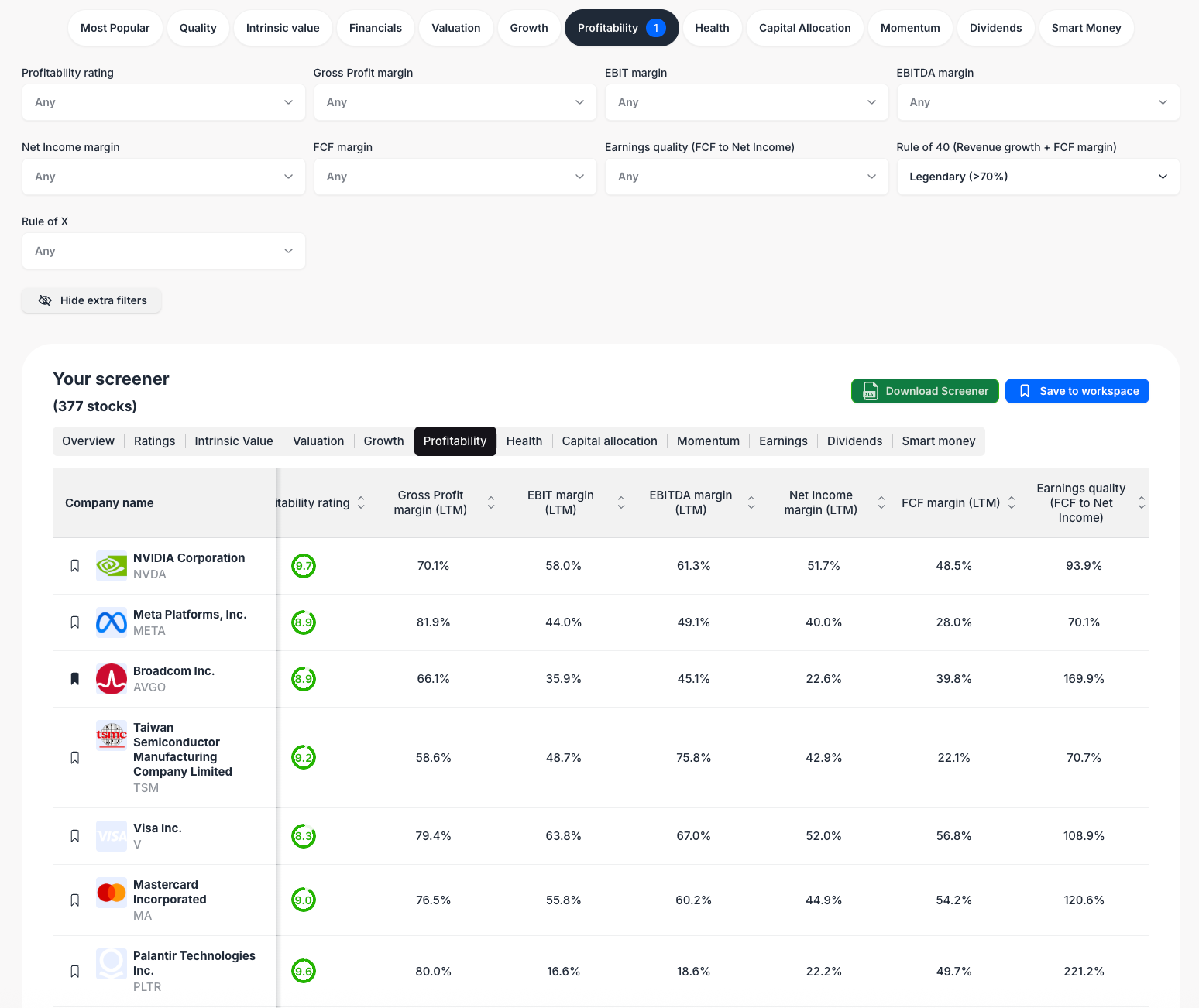

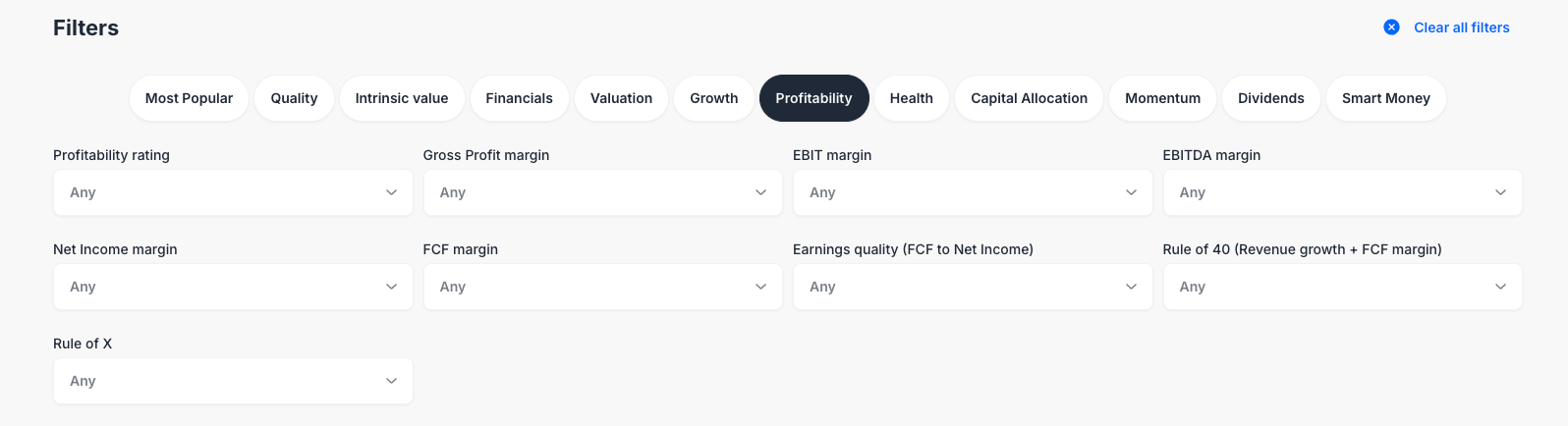

ValueSense Stock Screener: Finding 371 High Rule of 40 Stocks

One of the most powerful applications of Rule of 40 analysis is stock screening. Using ValueSense's advanced stock screener, we can identify companies with exceptional Rule of 40 scores across the entire market.

How to Screen for High Rule of 40 Stocks

Step 1: Access ValueSense Stock Screener Navigate to the profitability filters and expand all available options.

Step 2: Set Rule of 40 Parameters

- Filter for Rule of 40 scores > 70% (legendary territory)

- Apply additional profitability filters as needed

Step 3: Analyze Results Our screening reveals 371 stocks with Rule of 40 scores above 70% - representing approximately 8% of the entire market.

Refining Your Rule of 40 Screen

For more conservative investors, we recommend adding positive free cash flow margin filters:

Enhanced Screening Criteria:

- Rule of 40 > 70%

- Free Cash Flow Margin > 0%

- Result: 22 profitable, high-growth companies

This refined list includes established names alongside emerging growth stories, providing diverse opportunities for different investment styles.

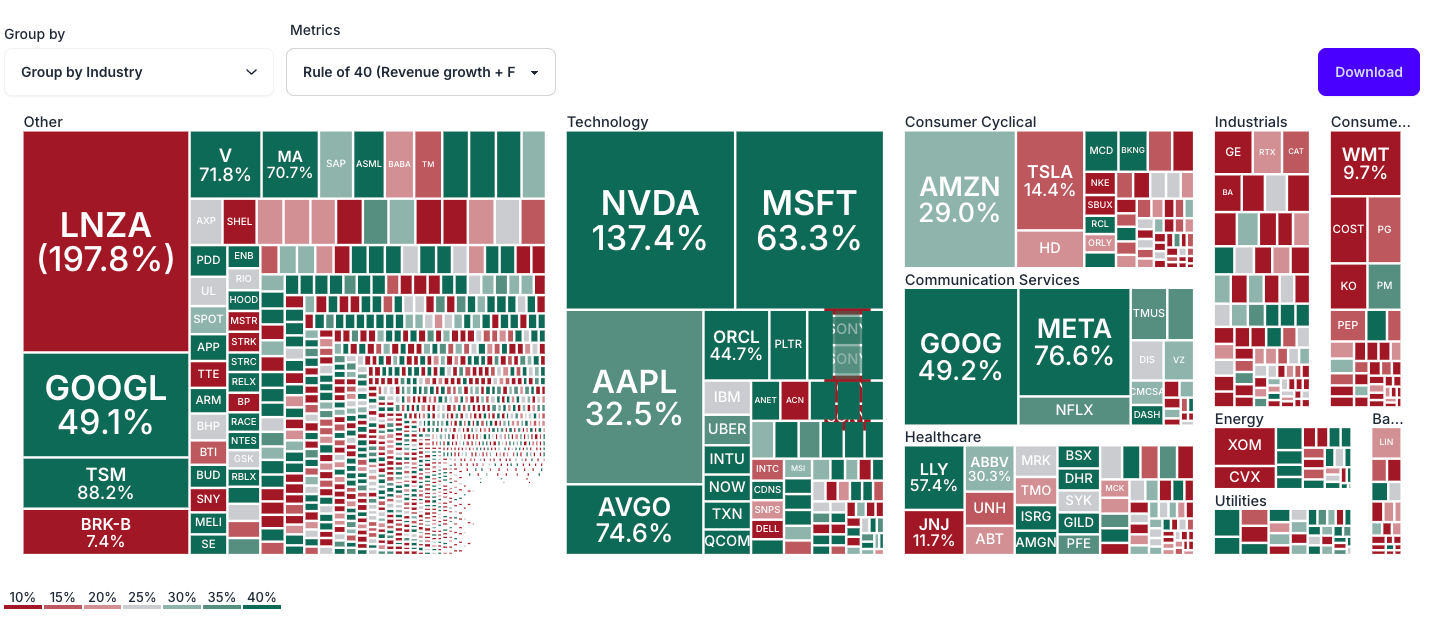

ValueSense Heat Map: Visualizing Rule of 40 Across Markets

The ValueSense heat map feature provides an intuitive way to visualize Rule of 40 performance across entire market indices or custom watchlists.

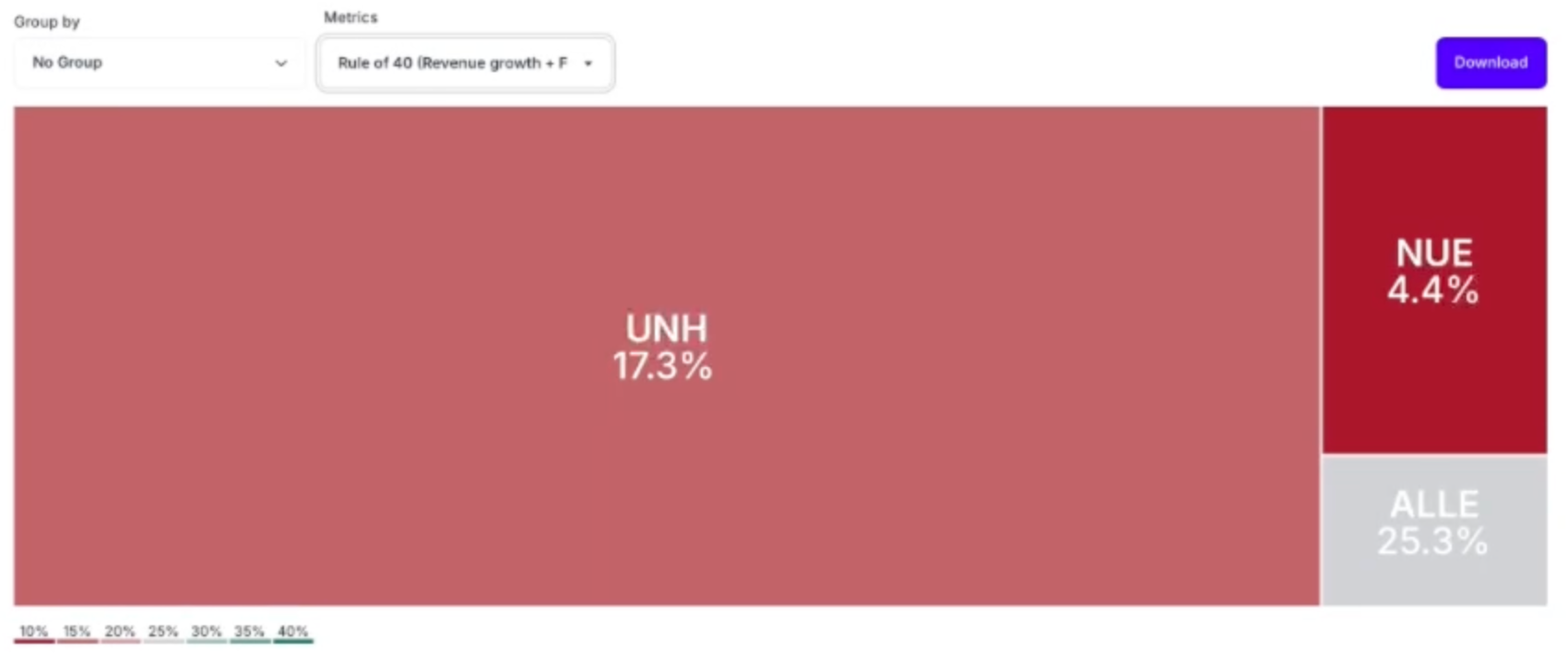

Custom Watchlist Analysis: Warren Buffett's Portfolio

To demonstrate the versatility of Rule of 40 analysis, we examined Warren Buffett's recent stock purchases using our custom heat map feature:

Buffett's Q2 2025 New Buys:

- Most positions cluster around the 40% threshold

- Reflects Buffett's value-oriented approach vs. pure growth investing

- Demonstrates that different investment styles can coexist with Rule of 40 analysis

While Buffett's picks may not excel in Rule of 40 metrics, this comparison illustrates how the metric can provide insights into different investment philosophies.

ValueSense Tools: Your Complete Rule of 40 Analysis Suite

Stock Charting Capabilities

Multi-Company Comparison: Compare Rule of 40 performance across multiple stocks simultaneously.

Time Series Analysis: Track Rule of 40 trends over quarters and years.

Data Export: Download comprehensive financial data including Rule of 40 calculations for offline analysis.

Screening and Discovery

Dynamic Filtering: Real-time screening with adjustable Rule of 40 thresholds.

Comprehensive Metrics: Access to ratings, intrinsic value, profitability, and health metrics alongside Rule of 40 scores.

Market Coverage: Analysis across thousands of stocks with instant updates.

Visualization and Heat Maps

Market Overview: See Rule of 40 performance across entire indices at a glance.

Custom Watchlists: Create personalized heat maps for your specific investment interests.

Interactive Analysis: Drill down from heat maps to detailed individual stock analysis.

Investment Strategy: Implementing Rule of 40 Analysis

Portfolio Construction Using Rule of 40

Core Holdings (40-60% allocation):

- Companies with Rule of 40 scores > 50%

- Consistent score improvement over time

- Strong competitive moats and market positions

Growth Opportunities (20-30% allocation):

- Emerging companies with improving Rule of 40 trends

- Companies approaching the 40% threshold with strong fundamentals

- Sector leaders in high-growth markets

Defensive Positions (10-20% allocation):

- Mature companies with stable Rule of 40 performance

- Strong balance sheets and cash generation

- Market leadership positions

Risk Management Considerations

High Rule of 40 Risks:

- Valuation premiums may not be sustainable

- Growth rates may be unsustainable long-term

- Market sentiment shifts can cause dramatic corrections

Mitigation Strategies:

- Diversification across different Rule of 40 levels

- Regular rebalancing based on score changes

- Attention to fundamental business quality beyond metrics

Backtesting Rule of 40 Strategies

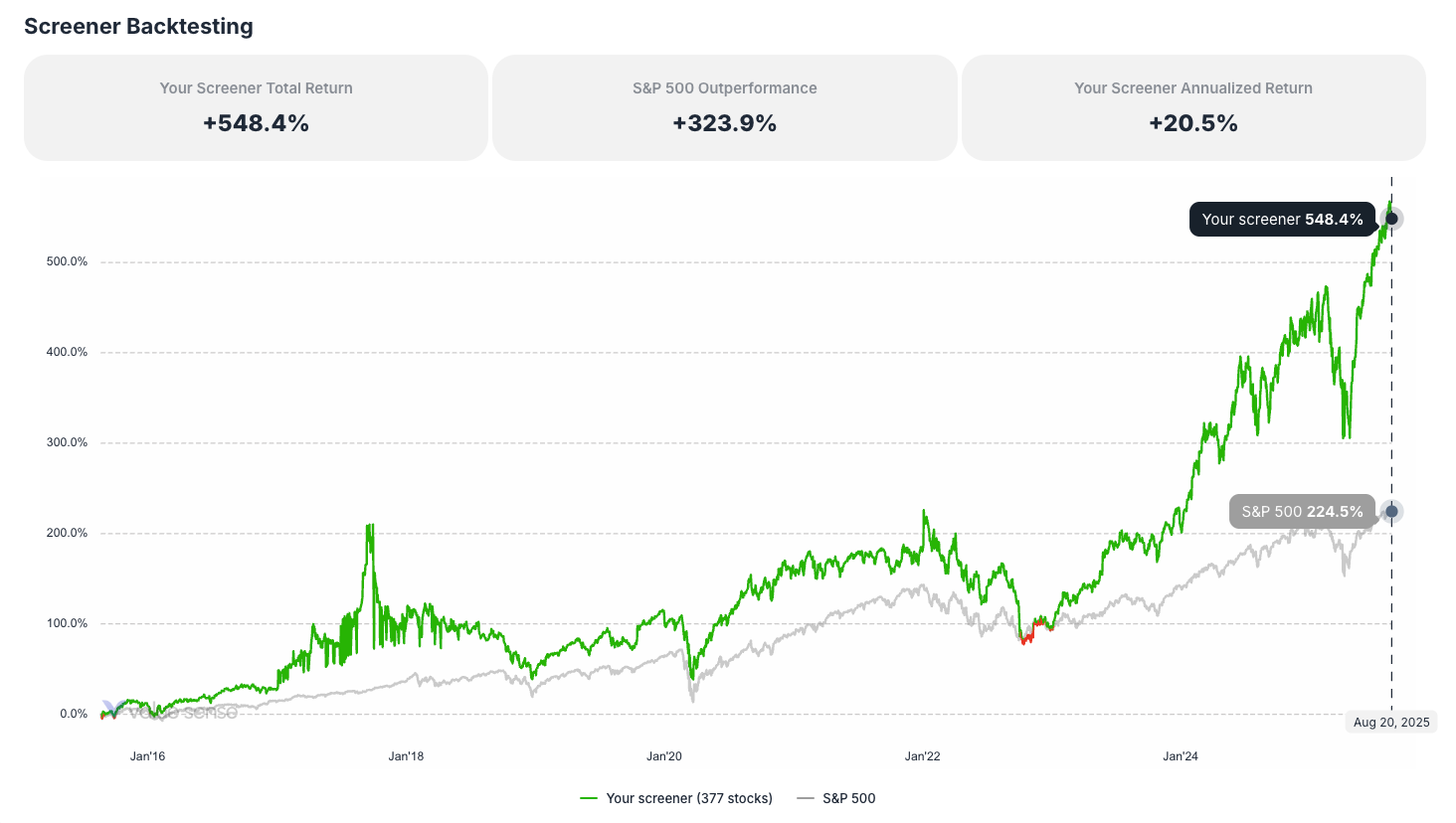

Our ValueSense backtesting reveals compelling evidence for Rule of 40-based investment strategies:

Historical Performance: Stocks with legendary Rule of 40 scores (>70%) have significantly outperformed market indices over multiple time periods.

Survivorship Considerations: While survivorship bias affects historical analysis, the outperformance of high Rule of 40 stocks remains substantial even accounting for this factor.

Market Conditions: Rule of 40 strategies have shown resilience across different market environments, though growth stock corrections can create temporary underperformance.

Common Rule of 40 Mistakes to Avoid

Analysis Pitfalls

Single-Point Analysis: Looking at Rule of 40 scores in isolation without considering trends or context.

Industry Misapplication: Applying SaaS-focused metrics to companies with different business models.

Short-Term Focus: Making investment decisions based on quarterly Rule of 40 fluctuations rather than long-term trends.

Investment Execution Errors

Overconcentration: Allocating too much portfolio weight to high Rule of 40 stocks without adequate diversification.

Timing Issues: Buying at valuation peaks just because Rule of 40 scores are strong.

Ignoring Fundamentals: Focusing solely on Rule of 40 while ignoring other critical business metrics.

Rule of 40 and Market Cycles

Bull Market Dynamics

During bull markets, high Rule of 40 stocks often receive premium valuations as investors chase growth. This creates opportunities but also increases risk of multiple compression.

Bear Market Performance

In market downturns, companies with strong Rule of 40 scores often demonstrate more resilience, as their combination of growth and profitability provides multiple support levels.

Economic Sensitivity

Rule of 40 performance can vary with economic cycles, as both growth rates and margins respond to broader economic conditions.

The Future of Rule of 40 Analysis

Evolving Applications

AI and Machine Learning Integration: Advanced analytics are making Rule of 40 analysis more sophisticated and predictive.

Sector Expansion: The metric is finding applications beyond traditional SaaS companies to other growth-oriented sectors.

Real-Time Analysis: Technology platforms like ValueSense are making real-time Rule of 40 analysis accessible to all investors.

Emerging Considerations

ESG Integration: Combining Rule of 40 analysis with environmental, social, and governance factors for comprehensive evaluation.

Global Application: Adapting Rule of 40 analysis for international markets with different accounting standards and business practices.

Alternative Metrics: Development of sector-specific variations of Rule of 40 for specialized industries.

Conclusion: Mastering Rule of 40 for Investment Success

The Rule of 40 represents one of the most powerful tools in modern equity analysis, providing crucial insights into the balance between growth and profitability that drives long-term stock performance. Companies like Palantir, with their legendary 90% Rule of 40 scores, demonstrate the metric's ability to identify exceptional investment opportunities.

Using ValueSense's comprehensive suite of tools - from stock screening to heat map visualization to detailed charting - investors can implement sophisticated Rule of 40 analysis previously available only to institutional investors. The platform's ability to screen 371 high Rule of 40 stocks and provide detailed comparative analysis makes it an indispensable resource for serious investors.

Whether you're seeking high-growth opportunities, evaluating portfolio positions, or conducting sector analysis, Rule of 40 provides the framework for understanding what separates market winners from underperformers. As we've demonstrated through real examples and practical applications, mastering this metric can significantly enhance your investment decision-making process.

Remember, while Rule of 40 analysis is powerful, it should be combined with other fundamental and technical analysis tools for comprehensive investment evaluation. The goal is not just to find high scores, but to identify companies with sustainable competitive advantages and strong execution capabilities that can maintain superior Rule of 40 performance over time.

Start exploring Rule of 40 analysis today with ValueSense tools, and discover why this metric has become essential for successful technology and growth stock investing in 2025 and beyond.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 Tesla Stock Forecast: Is TSLA Undervalued or Overvalued?

📖 Best Undervalued Dividend Stocks Under $50: August 2025 Picks

📖 Bill Ackman's Portfolio Analysis Q2 2025

📖 Top Rule of 40 stocks