Rule of 40 Stocks August 2025: Best Growth-Efficiency Plays

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

The Rule of 40 has quietly become one of the most reliable ways to separate the winners from the pretenders in today's growth stock market. After digging through thousands of companies using ValueSense's screening tools, we've identified the stocks that are absolutely crushing it on this metric in August 2025.

What we found might surprise you. While everyone's been obsessing over AI hype and meme stocks, some companies have been quietly building incredible businesses that grow fast AND make money. NVIDIA's sitting at a ridiculous 137.4% Rule of 40 score, and Palantir just hit 89.1% - numbers that would have seemed impossible just a few years ago.

What Makes Rule of 40 Actually Work

Here's the thing about the Rule of 40 - it's stupidly simple, which is exactly why it works. You take a company's revenue growth rate, add their free cash flow margin, and if it hits 40% or higher, you've probably found something interesting.

The math: Revenue Growth (%) + FCF Margin (%) ≥ 40%

But here's what most people miss: this isn't just about hitting a magic number. It's about finding companies that have figured out how to grow without lighting money on fire. A company can grow at 80% and lose 40% margins and still pass. Or they can grow at 10% with 30% margins. Both work, but they tell completely different stories about the business.

The sweet spot? Companies that can do both - grow fast AND make money. Those are the ones that tend to make investors very happy over time.

You can watch our complete analysis of this comparison in our YouTube video tutorial, where we demonstrate live how to use ValueSense tools for Rule of 40 analysis.

The Absolute Legends: Top Rule of 40 Performers

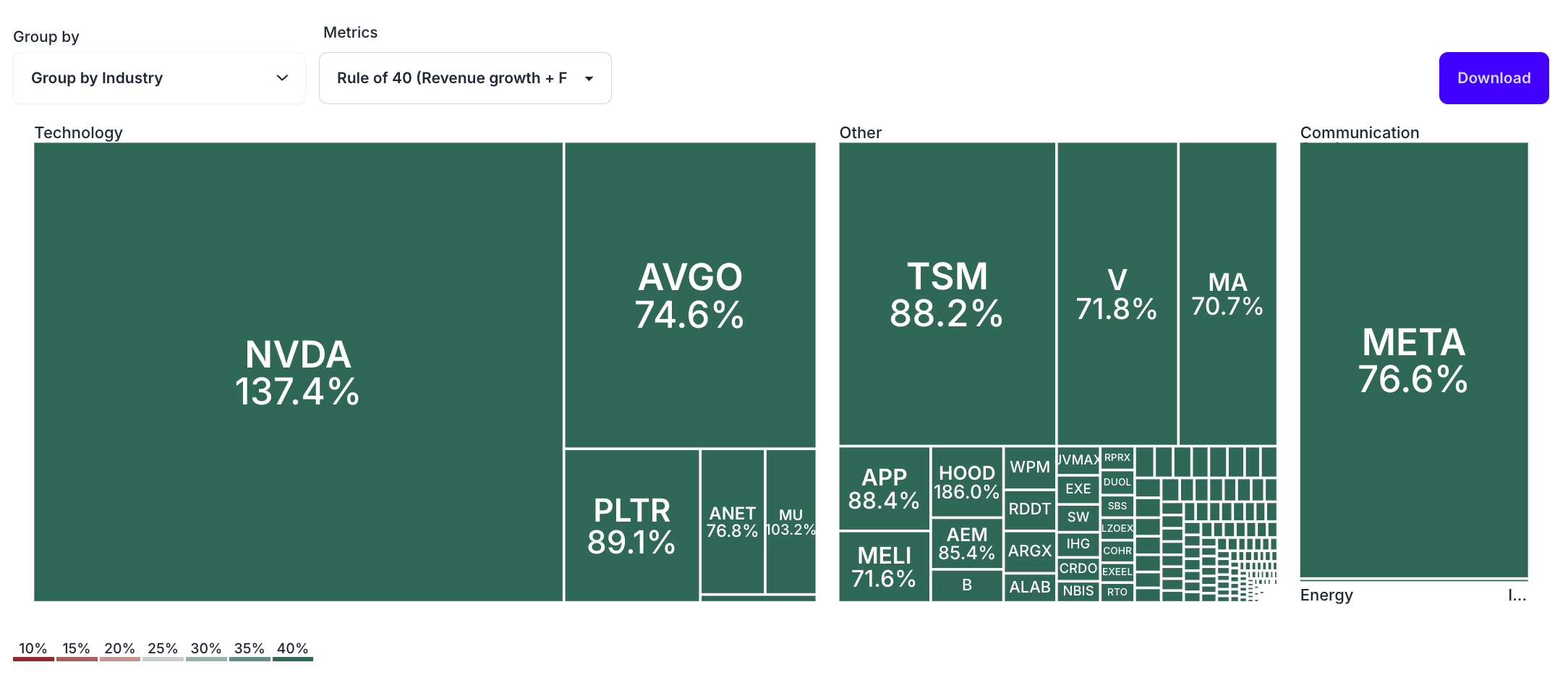

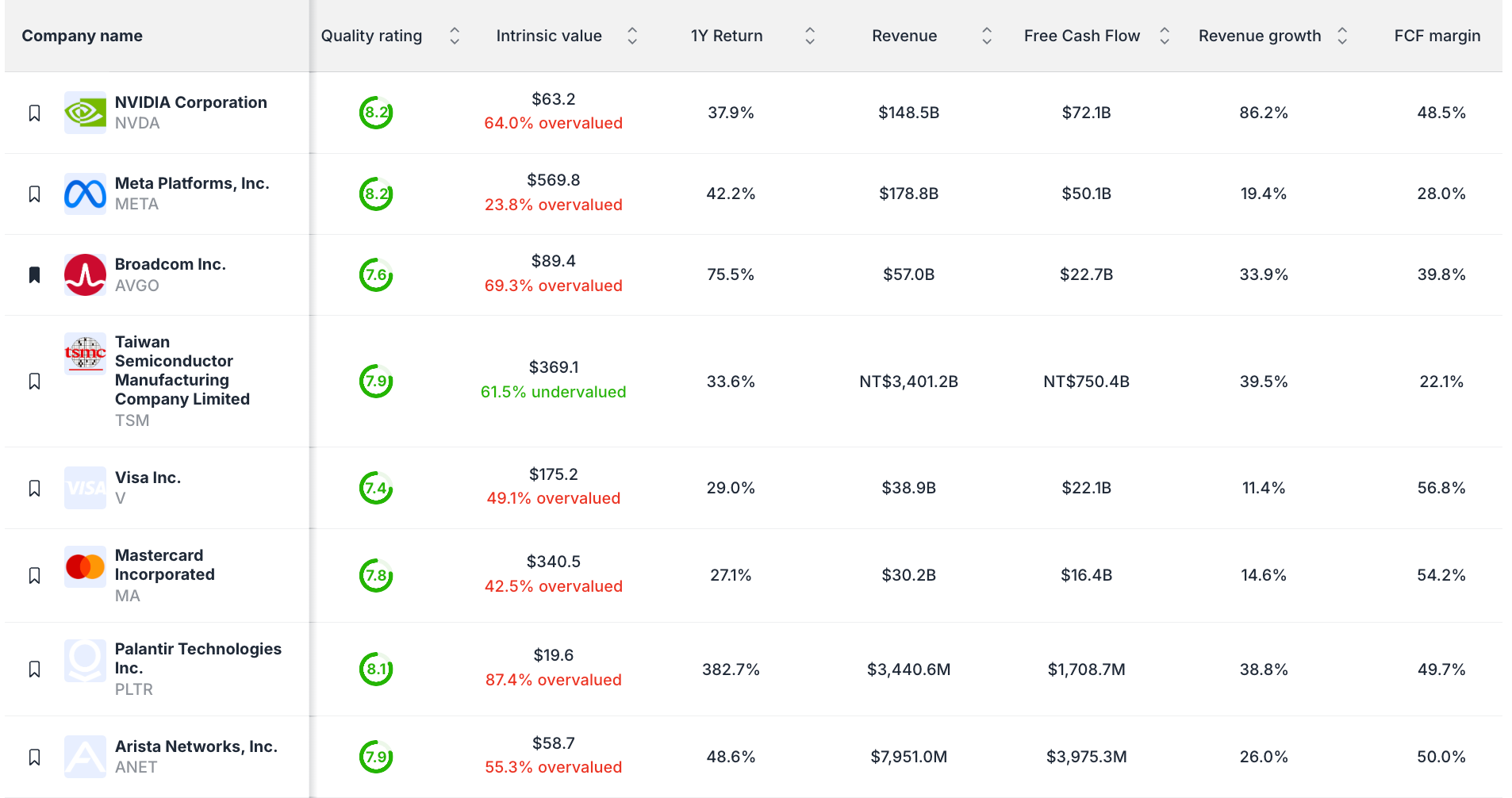

After screening for companies with "Legendary" Rule of 40 scores (above 70%), we found some genuinely impressive businesses. Here's what the numbers actually look like:

| Sector | Company | Ticker | Rule of 40 Score | Performance Level |

|---|---|---|---|---|

| Technology | NVIDIA Corporation | NVDA | 137.4% | 🔥 Exceptional |

| Technology | Palantir Technologies | PLTR | 89.1% | 🔥 Legendary |

| Technology | Taiwan Semiconductor | TSM | 88.2% | 🔥 Legendary |

| Technology | Broadcom Inc. | AVGO | 74.6% | 🔥 Legendary |

| Technology | Arista Networks | ANET | 76.8% | 🔥 Legendary |

| Technology | Micron Technology | MU | 69.2% | ✅ Strong |

| Communication | Meta Platforms | META | 76.6% | 🔥 Legendary |

| Financial Services | Visa Inc. | V | 71.8% | 🔥 Legendary |

| Financial Services | Mastercard Inc. | MA | 70.7% | 🔥 Legendary |

| Other Sectors | Advanced Micro Devices | AMD | 68.4% | ✅ Strong |

| Other | Applied Materials | AMAT | 62.1% | ✅ Good |

| Other | Marvell Technology | MRVL | 58.9% | ✅ Good |

| Other | KLA Corporation | KLAC | 55.7% | ✅ Good |

| Energy | Various smaller companies | - | 45-55% | ⚠️ Average |

| Industrials | Various companies | - | 35-45% | ⚠️ Below Average |

| Consumer | Most companies | - | 20-35% | ❌ Poor |

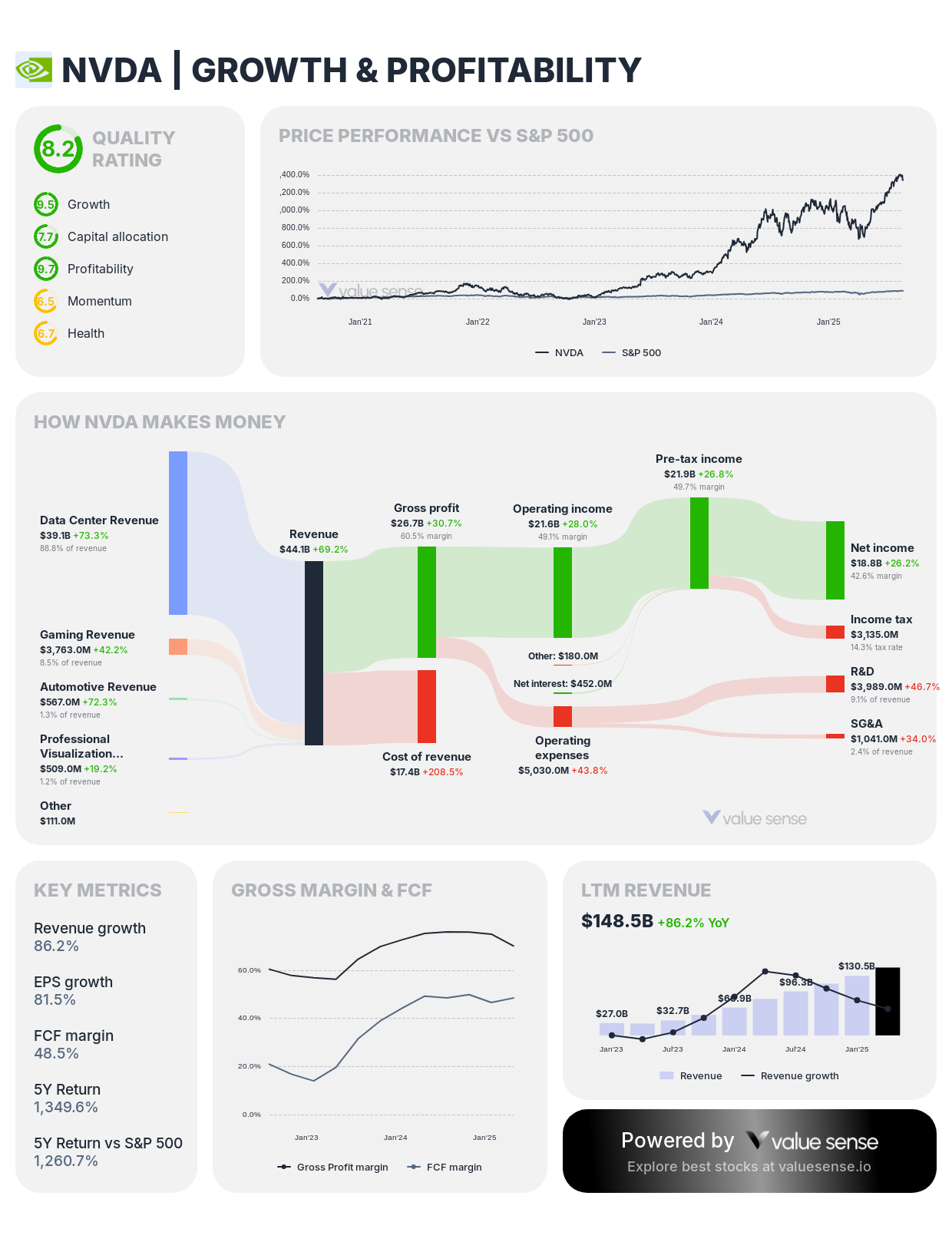

NVIDIA - The 137.4% Monster

Look, we all know NVIDIA's story by now. But their Rule of 40 score of 137.4% is just bonkers. Here's the breakdown:

- Revenue growth: 86.2% (yeah, eighty-six percent)

- FCF margin: 48.5%

- Gross margins: 70.1%

- They're making $72.1B in free cash flow on $148.5B revenue

The crazy part isn't just that they're growing this fast - it's that they're incredibly profitable while doing it. Most companies this size are happy with 10-15% growth. NVIDIA's over here growing like a startup while printing money like a mature tech giant.

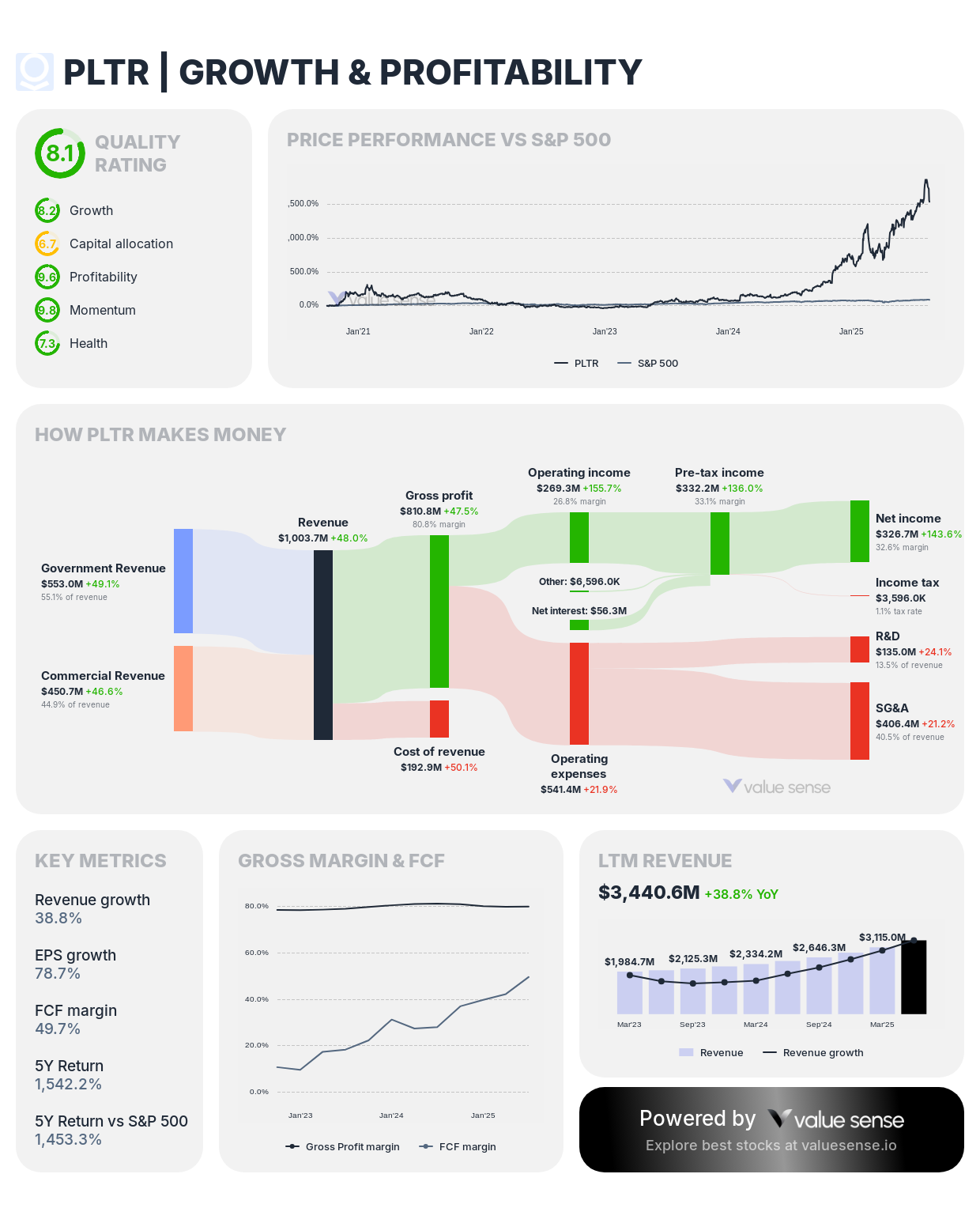

Palantir - The 89.1% Comeback Kid

Remember when everyone said Palantir was just a government contractor with fancy software? Their 89.1% Rule of 40 score says otherwise:

- Revenue growth: 38.8%

- FCF margin: 49.7%

- Gross margins: 80.0%

- Earnings quality: 221.2% (their cash flow is better than their reported earnings)

What's wild is how they've completely flipped the script. A few years ago, they were burning cash and growing slowly. Now they're growing fast AND generating serious cash. That's the kind of business transformation that creates generational wealth for shareholders.

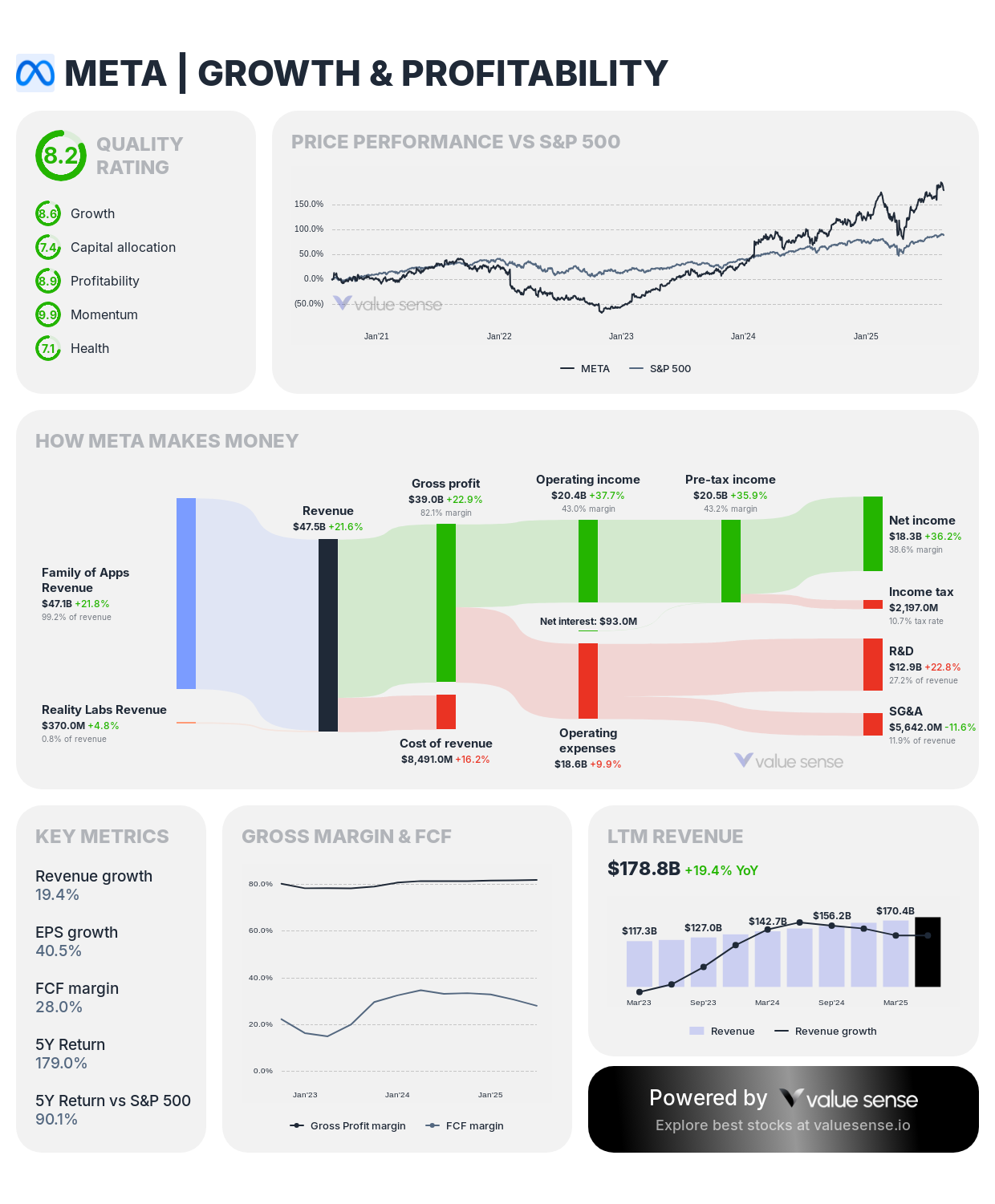

Meta - The 76.6% Efficiency Machine

Meta at 76.6% Rule of 40 shows what happens when a mature tech company gets serious about efficiency:

- Revenue: $178.8B (massive scale)

- FCF margin: 28.0%

- Still growing at 19.4% despite their size

- Generated $50.1B in free cash flow last year

For a company this big to maintain nearly 20% growth while generating 28% FCF margins? That's impressive execution.

Where the Real Money Lives: Sector Breakdown

The heat map tells the whole story about where Rule of 40 excellence actually exists:

Technology completely dominates. NVIDIA (137.4%), Palantir (89.1%), TSM (88.2%), and Broadcom (74.6%) are all crushing it. This isn't coincidence - software and semiconductors have business models that can scale efficiently.

Payment companies are quietly excellent. Visa (71.8%) and Mastercard (70.7%) don't get the headline attention, but they're printing money with incredible consistency. Network effects plus pricing power equals beautiful Rule of 40 scores.

Everything else is mostly mediocre. The heat map shows plenty of green in tech and payments, but other sectors are struggling to hit even basic Rule of 40 thresholds.

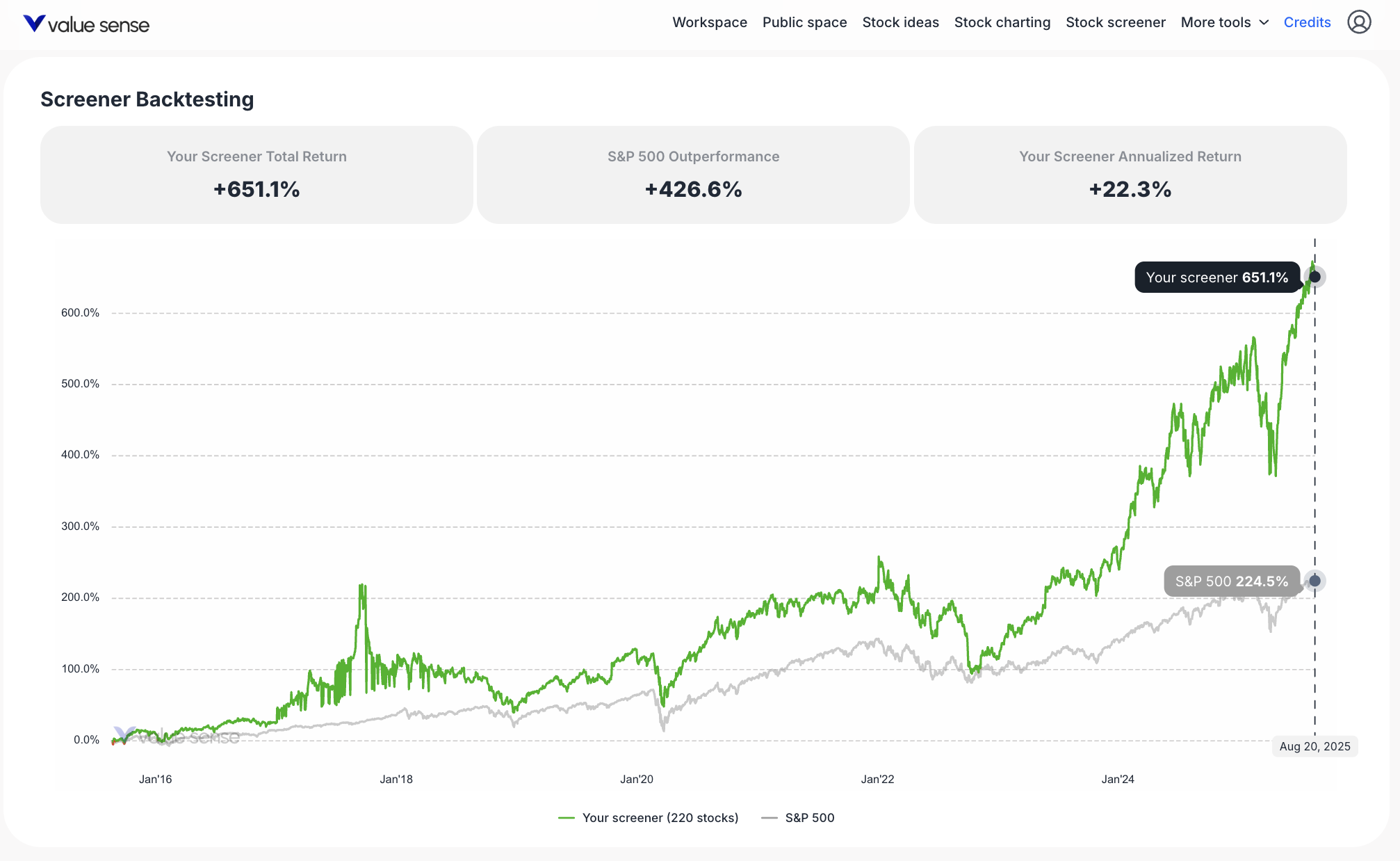

The Numbers Don't Lie: Backtesting Results

We ran the numbers on Rule of 40 investing going back to 2016, and honestly, the results are kind of absurd:

- Total return: +651.1% vs S&P 500's +224.5%

- Outperformance: +426.6% over nearly a decade

- Annualized return: 22.3%

That's not a typo. High Rule of 40 stocks delivered 22.3% annual returns over 9+ years. The S&P 500 did fine at around 12%, but Rule of 40 leaders absolutely crushed it.

The chart shows steady outperformance through multiple market cycles. Even during the 2018 selloff and 2020 crash, Rule of 40 stocks recovered faster and went on to new highs.

What Actually Works: Building a Rule of 40 Portfolio

Based on what we're seeing, here's how to actually implement this:

Core positions (50-60%: Focus on the legendary performers - NVIDIA, Palantir, TSM. These companies have proven they can maintain exceptional Rule of 40 scores over time.

Steady performers (30-40%): Companies like Meta, Visa, and Mastercard that consistently deliver 70%+ Rule of 40 scores without the volatility of pure growth plays.

Watch list (10%): Companies approaching Rule of 40 excellence that might break through with the next quarter or two of strong execution.

The Valuation Reality Check

Here's where it gets tricky. Most of these Rule of 40 champions aren't cheap:

- Palantir: 87.4% overvalued according to DCF models

- NVIDIA: 64.0% overvalued

- Broadcom: 69.3% overvalued

The exception is TSM at 61.5% undervalued, which makes it particularly interesting.

But here's the thing - great businesses often look expensive right up until they're not. If a company can maintain 80%+ Rule of 40 performance, it's probably worth paying up for. The backtesting suggests these premium valuations work out over time.

What Could Go Wrong

Growth deceleration: Companies with 80%+ revenue growth can't maintain those rates forever. When growth slows, Rule of 40 scores can collapse quickly.

Margin pressure: Competition, economic downturns, or operational issues can crush FCF margins, destroying Rule of 40 performance.

Market rotation: When growth goes out of favor (like it did in 2022), even great Rule of 40 stocks can get hammered.

Valuation compression: These companies trade at premium multiples. If sentiment shifts, the valuations can compress fast.

How to Actually Monitor This Stuff

Quarterly check-ins: Rule of 40 scores can change dramatically quarter to quarter. Don't get too hung up on single-quarter moves, but watch for trends.

Competitive dynamics: Pay attention to how Rule of 40 scores compare within industries. Relative performance matters as much as absolute scores.

Quality metrics: Look beyond Rule of 40 to things like cash conversion rates, customer retention, and competitive positioning.

The Bottom Line

Rule of 40 investing isn't magic, but it's been remarkably effective at identifying companies that know how to grow profitably. The 22.3% annual returns over the past decade speak for themselves.

NVIDIA's 137.4% score might be unsustainable, but companies like Visa and Mastercard have been delivering solid Rule of 40 performance for years. Palantir's transformation from cash burner to 89.1% Rule of 40 champion shows what's possible when management focuses on the right metrics.

The key is finding companies that can maintain these scores over time, not just hit them once. Based on our analysis, focusing on Rule of 40 leaders has been one of the most reliable ways to beat the market over the past decade.

Whether that continues depends on whether these companies can keep executing. But given the track record, it's probably worth paying attention to what the Rule of 40 is telling us about business quality.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 Rule of 40 Explained: The Ultimate SaaS Stock Analysis Guide

📖 Tesla Stock Forecast: Is TSLA Undervalued or Overvalued?

📖 Best Undervalued Dividend Stocks Under $50