10 Best Safe Stocks for Beginners: Quality Companies - Value Sense 2025

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

The Foundation of Safe Investing for Beginners

Beginning investors require companies that combine financial strength, operational excellence, and predictable business models to build wealth while minimizing downside risk. Our safe stock selection emphasizes three critical metrics that indicate exceptional business quality and sustainable competitive advantages.

Safe Stock Selection Criteria:

- Quality Rating ≥6.5: Indicating strong competitive moats, financial health, and operational excellence

- Return on Invested Capital (ROIC) >20%: Demonstrating exceptional capital efficiency and profitability

- Free Cash Flow Margin >20%: Showing superior cash generation and operational efficiency

These criteria ensure beginning investors focus on companies with proven track records of creating shareholder value through various market cycles while maintaining the financial flexibility to navigate economic uncertainty.

Top 10 Safe Stocks for Beginners - Ranked by ROIC

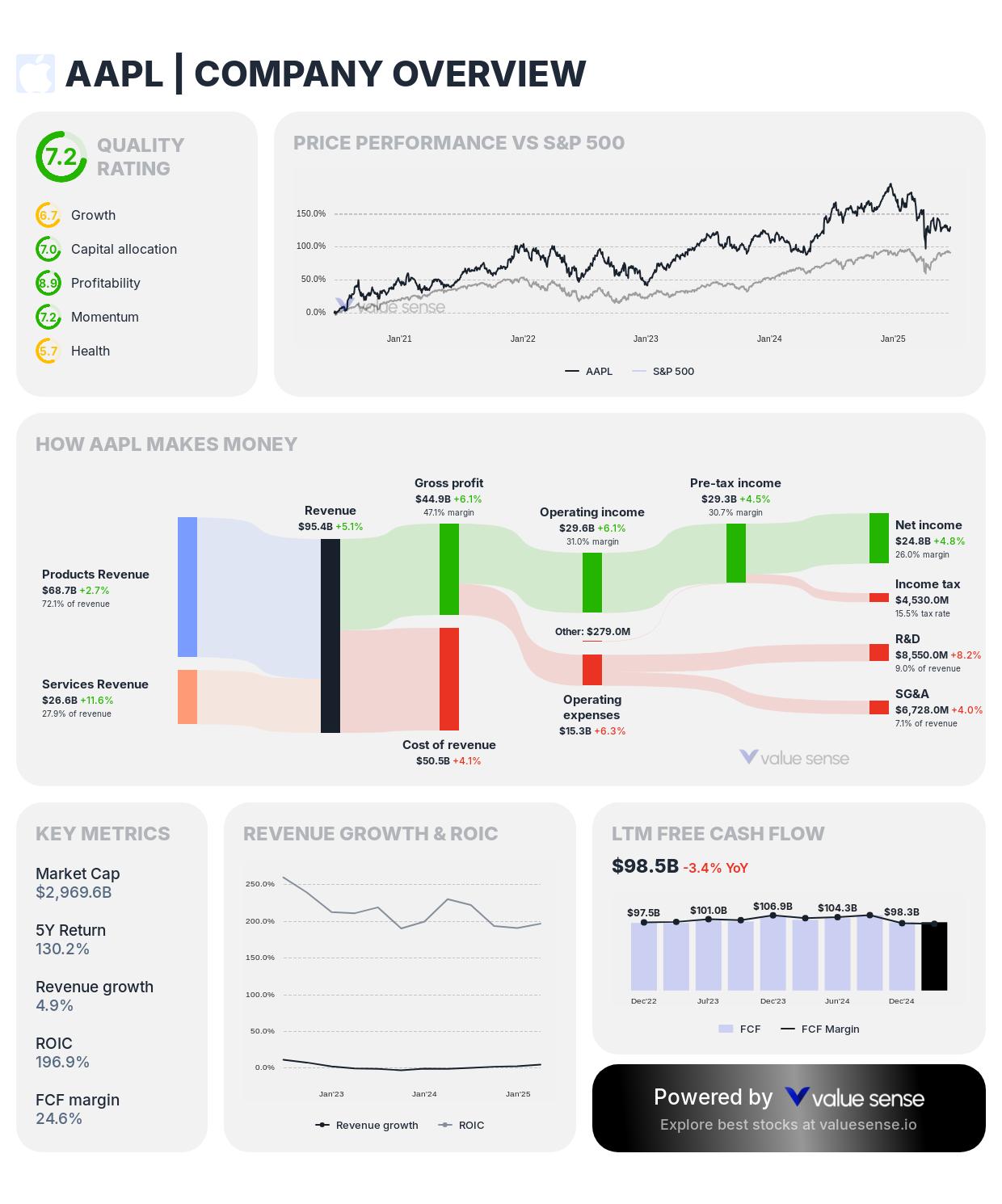

1. Apple Inc. (AAPL) - 196.9% ROIC ⭐

- Quality Rating: 7.2 (Strong)

- ROIC: 196.9%

- FCF Margin: 24.6%

- Intrinsic Value: 77.4% overvalued

- 1-Year Return: (3.8%)

- Revenue: $400.4B

- Free Cash Flow: $98.5B

- Revenue Growth: 4.9%

Investment Thesis: Apple represents the pinnacle of capital efficiency with extraordinary 196.9% ROIC, demonstrating the technology giant's exceptional ability to generate profits from invested capital. Despite trading 77.4% above intrinsic value, Apple's integrated ecosystem, premium positioning, and massive cash generation create defensive characteristics ideal for beginning investors seeking quality exposure to technology innovation.

Why It's Safe for Beginners: Apple's business model combines several safety factors: dominant market position with strong brand loyalty, exceptional cash generation providing financial flexibility, diversified revenue streams across hardware and services, and conservative management with substantial cash reserves. The company's ability to maintain premium pricing and customer loyalty creates predictable cash flows even during economic uncertainty.

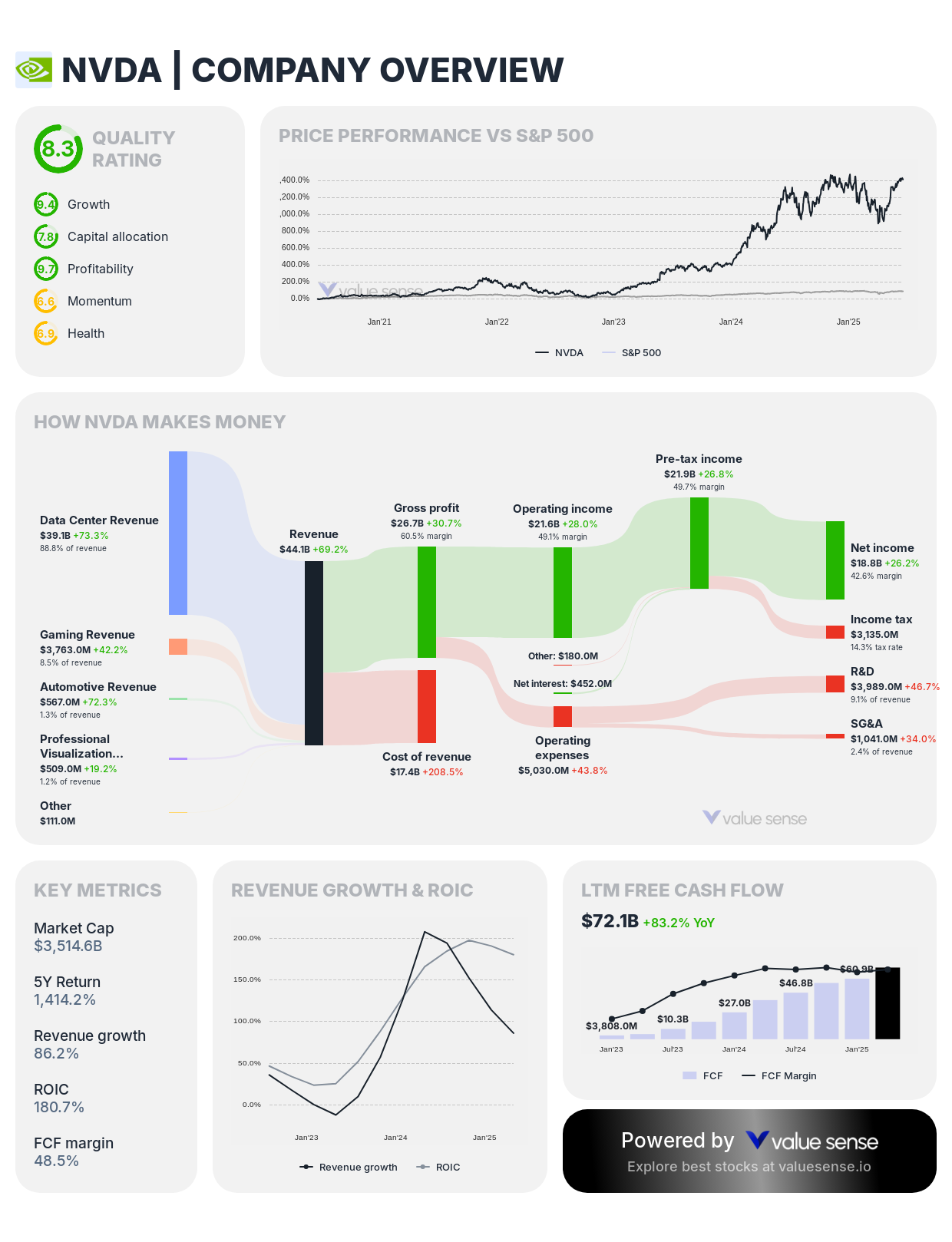

2. NVIDIA Corporation (NVDA) - 180.7% ROIC

- Quality Rating: 8.3 (Exceptional)

- ROIC: 180.7%

- FCF Margin: 48.5%

- Intrinsic Value: 48.8% overvalued

- 1-Year Return: 10.0%

- Revenue: $148.5B

- Free Cash Flow: $72.1B

- Revenue Growth: 86.2%

Investment Thesis: NVIDIA combines exceptional 180.7% ROIC with the highest quality rating (8.3) in our analysis, demonstrating the AI computing leader's superior capital efficiency and competitive positioning. The company's dominant position in artificial intelligence and data center computing creates sustainable competitive advantages that beginning investors can understand and rely upon for long-term wealth creation.

Why It's Safe for Beginners: NVIDIA's safety stems from its technological leadership in rapidly growing AI markets with limited competition, exceptional profitability and cash generation supporting financial stability, platform business model creating switching costs, and essential role in technology infrastructure providing demand visibility. The company's CUDA ecosystem creates a protective moat around its hardware business.

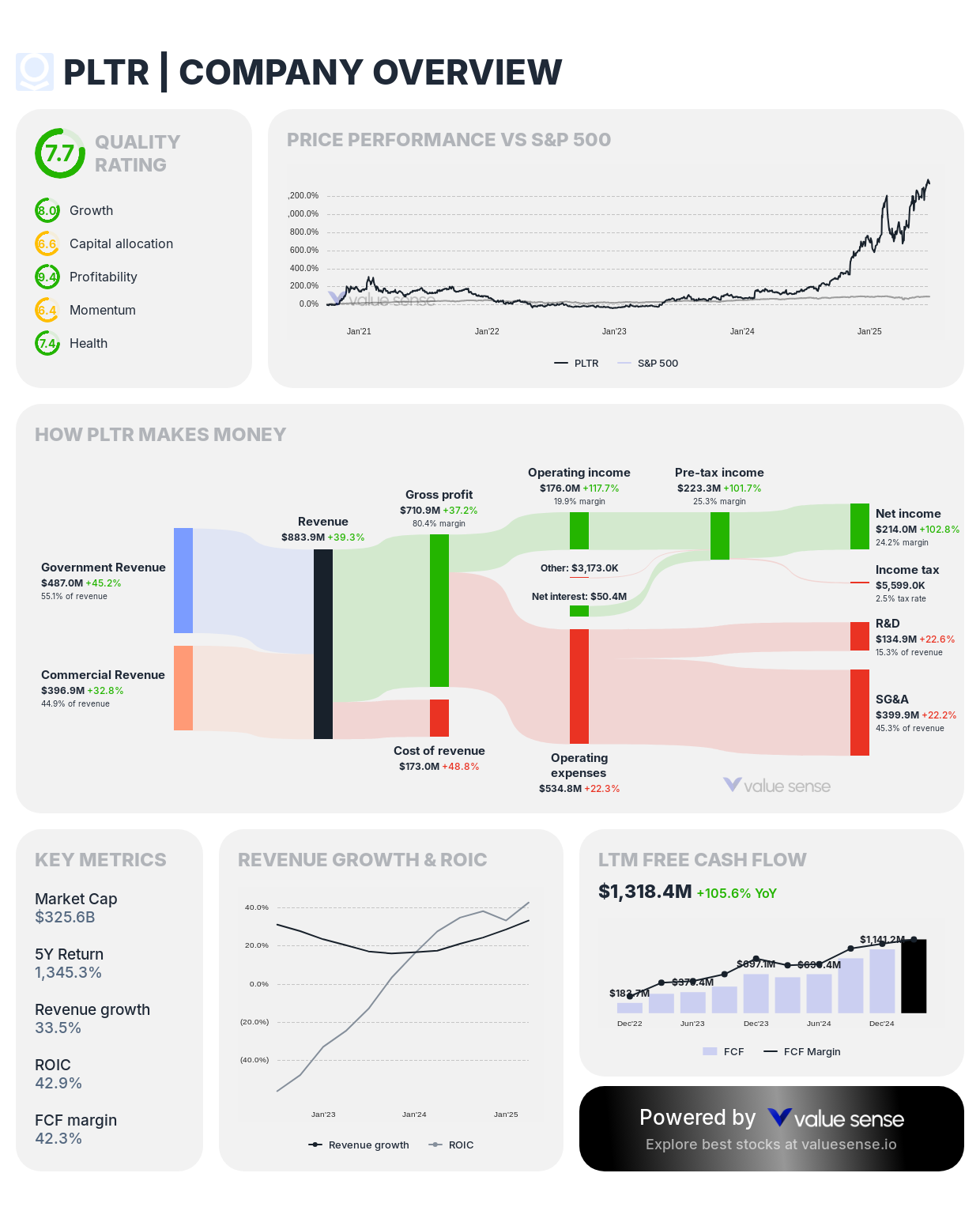

3. Palantir Technologies Inc. (PLTR) - 42.9% ROIC

- Quality Rating: 7.7 (Strong)

- ROIC: 42.9%

- FCF Margin: 42.3%

- Intrinsic Value: 86.5% overvalued

- 1-Year Return: 437.2%

- Revenue: $3,115.0M

- Free Cash Flow: $1,318.4M

- Revenue Growth: 33.5%

Investment Thesis: Palantir demonstrates strong 42.9% ROIC with quality rating of 7.7, reflecting the data analytics company's specialized expertise in government and enterprise applications. Despite significant overvaluation (86.5%), Palantir's mission-critical software and high switching costs create defensive characteristics suitable for beginning investors seeking exposure to data analytics and artificial intelligence themes.

Why It's Safe for Beginners: The company's safety profile includes specialized market position with high barriers to entry, government contracts providing revenue stability, growing enterprise adoption creating multiple revenue streams, and strong balance sheet supporting operational flexibility. Palantir's software becomes deeply integrated into client operations, creating substantial switching costs.

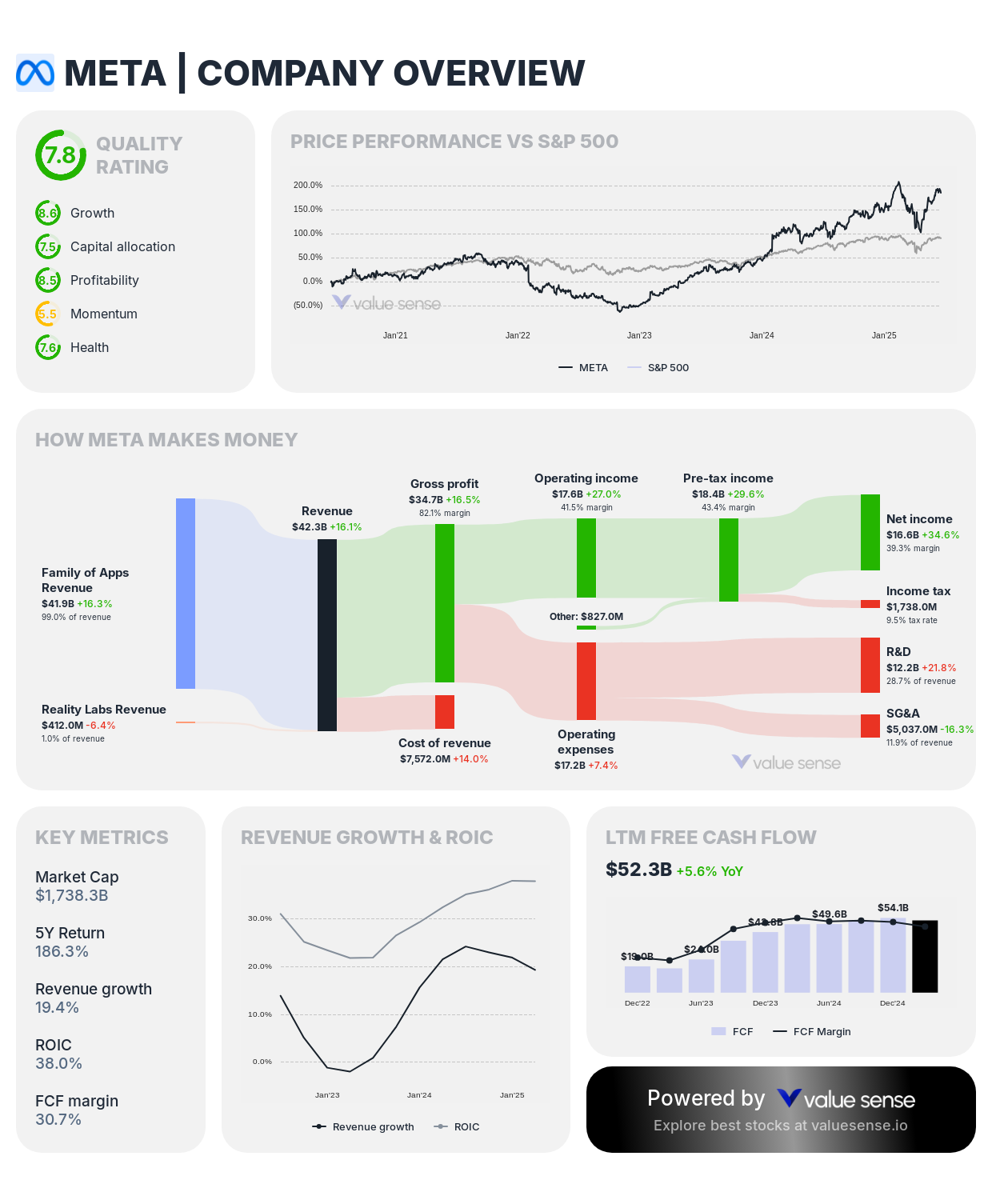

4. Meta Platforms, Inc. (META) - 38.0% ROIC

- Quality Rating: 7.6 (Strong)

- ROIC: 38.0%

- FCF Margin: 30.7%

- Intrinsic Value: 18.9% overvalued

- 1-Year Return: 36.2%

- Revenue: $170.4B

- Free Cash Flow: $52.3B

- Revenue Growth: 19.4%

Investment Thesis: Meta achieves solid 38.0% ROIC with strong quality rating of 7.6, demonstrating the social media leader's exceptional capital efficiency and competitive positioning. Trading at modest 18.9% overvaluation, Meta offers beginning investors exposure to digital advertising and social media platforms with substantial cash generation and operational improvements.

Why It's Safe for Beginners: Meta's safety characteristics include dominant social media platforms with massive user engagement and network effects, diversified revenue streams across multiple platforms, exceptional cash generation providing strategic flexibility, and asset-light business model with substantial operational leverage. The company's data advantages create competitive moats in digital advertising.

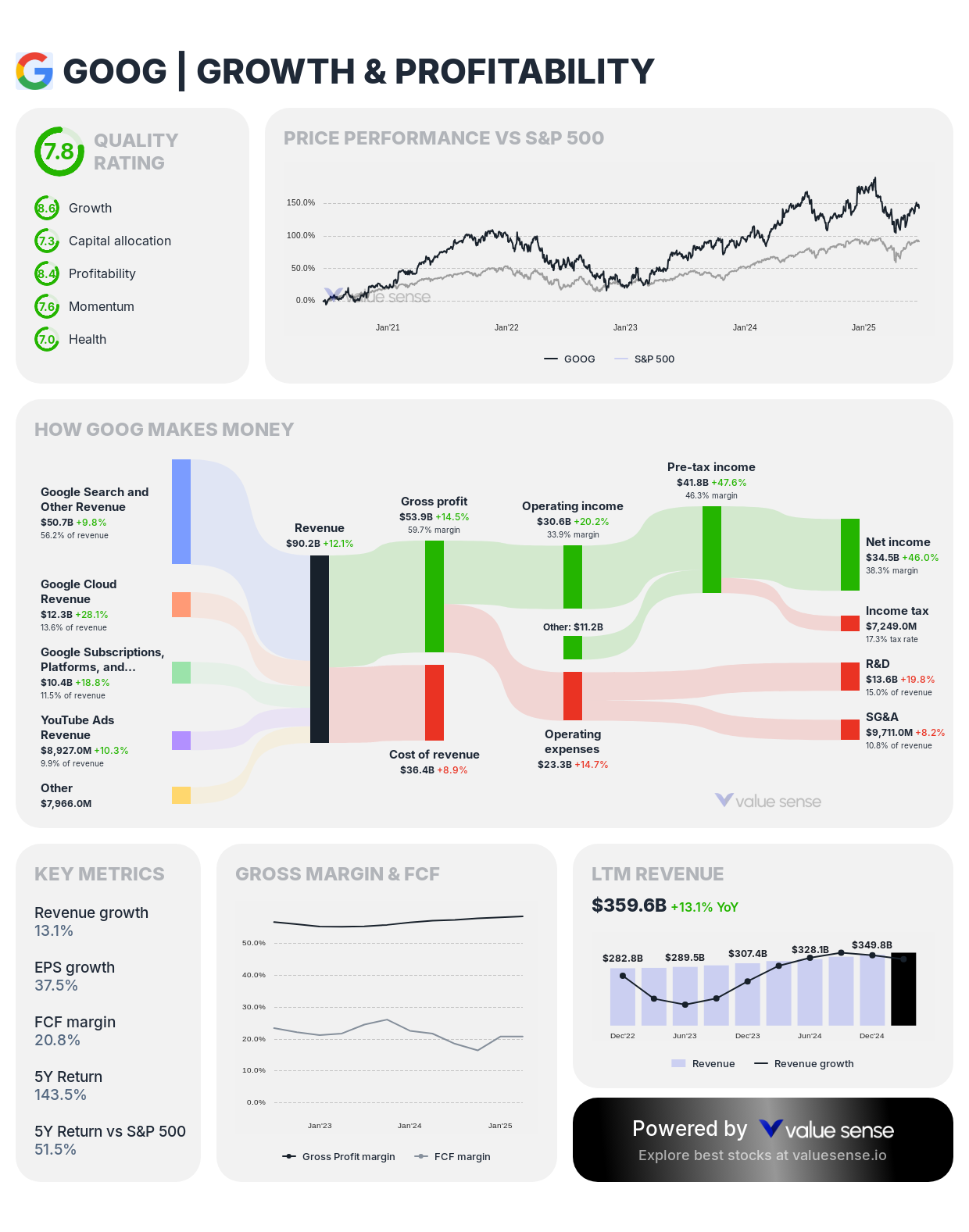

5. Alphabet Inc. (GOOGL) - 35.6% ROIC

- Quality Rating: 7.5 (Strong)

- ROIC: 35.6%

- FCF Margin: 20.8%

- Intrinsic Value: 22.3% undervalued

- 1-Year Return: (5.3%)

- Revenue: $359.6B

- Free Cash Flow: $74.9B

- Revenue Growth: 13.1%

Investment Thesis: Alphabet demonstrates strong 35.6% ROIC with quality rating of 7.5 and attractive 22.3% undervaluation, making it one of the most compelling opportunities for beginning investors. The technology giant's search advertising monopoly and expanding cloud services create predictable cash flows and sustainable competitive advantages ideal for long-term wealth building.

Why It's Safe for Beginners: Alphabet's safety profile includes search advertising monopoly providing exceptional pricing power, diversified revenue streams across search, YouTube, and cloud computing, strong balance sheet supporting strategic investments, and defensive characteristics through essential role in digital infrastructure. The company's data advantages and AI capabilities strengthen its competitive position.

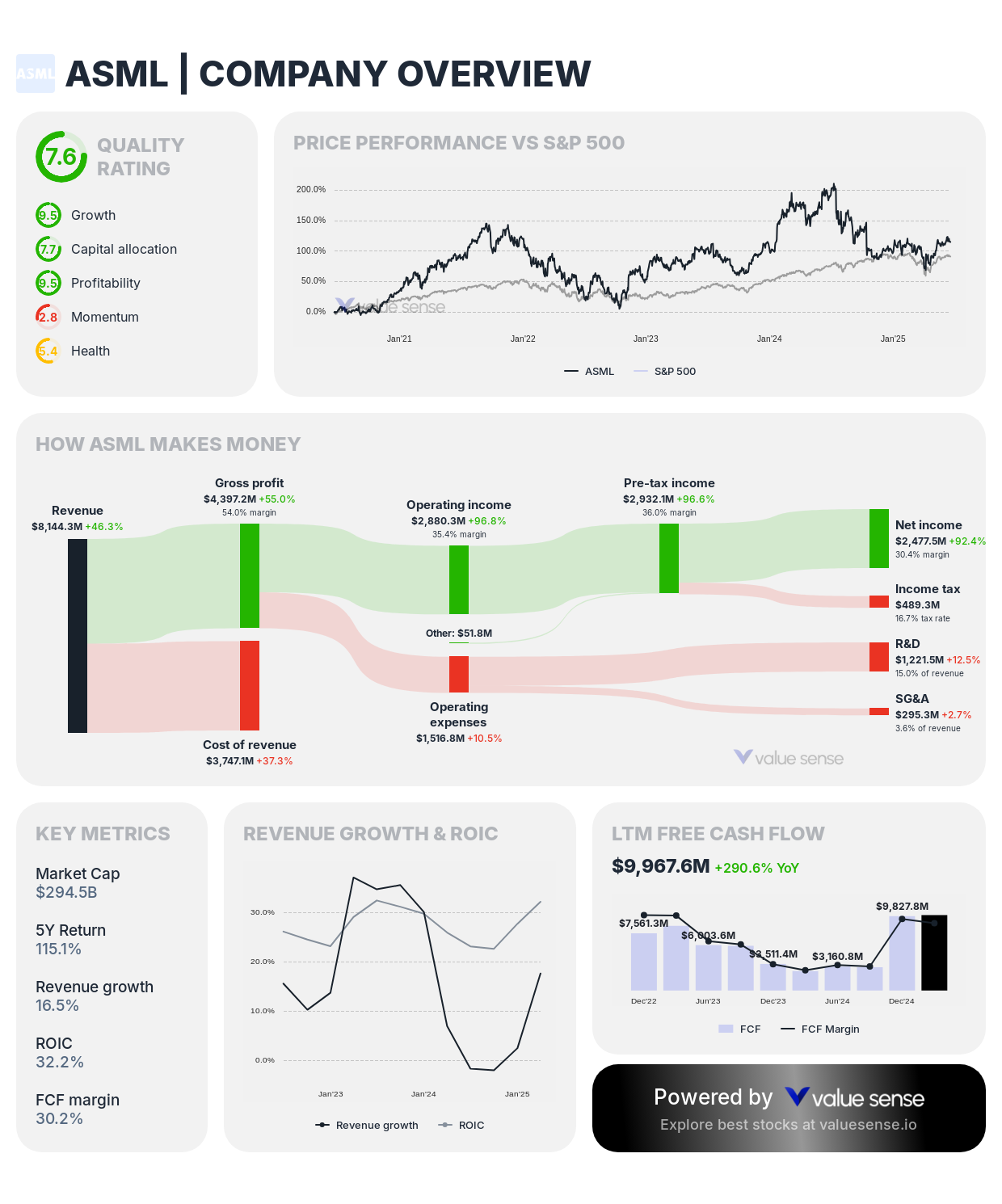

6. ASML Holding N.V. (ASML) - 32.2% ROIC

- Quality Rating: 7.5 (Strong)

- ROIC: 32.2%

- FCF Margin: 30.2%

- Intrinsic Value: 11.4% overvalued

- 1-Year Return: (27.6%)

- Revenue: €30.7B

- Free Cash Flow: €9,285.2M

- Revenue Growth: 17.7%

Investment Thesis: ASML achieves excellent 32.2% ROIC with strong quality rating of 7.5, reflecting the semiconductor equipment company's monopolistic position in extreme ultraviolet (EUV) lithography systems. Trading at modest 11.4% overvaluation, ASML offers beginning investors exposure to semiconductor manufacturing with exceptional competitive moats and predictable demand from global chip producers.

Why It's Safe for Beginners: ASML's safety stems from its monopolistic position in essential semiconductor manufacturing equipment with no viable competitors, long-term customer relationships providing demand visibility, high barriers to entry through technological complexity, and essential role in advanced chip manufacturing supporting long-term growth. The company's technology is irreplaceable in modern semiconductor production.

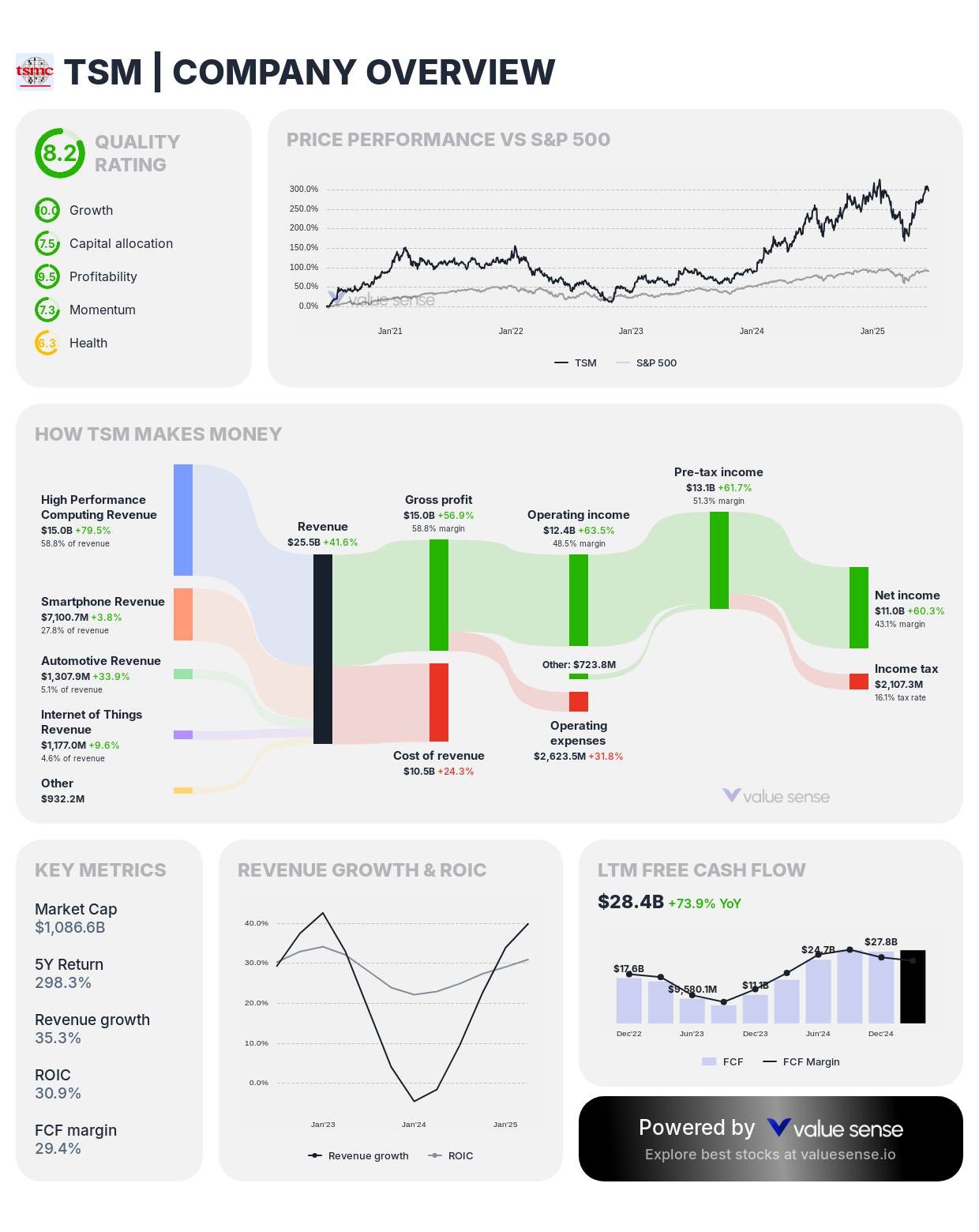

7. Taiwan Semiconductor Manufacturing Company (TSM) - 30.9% ROIC

- Quality Rating: 8.2 (Exceptional)

- ROIC: 30.9%

- FCF Margin: 29.4%

- Intrinsic Value: 141.6% undervalued

- 1-Year Return: 20.1%

- Revenue: NT$3,140.9B

- Free Cash Flow: NT$922.4B

- Revenue Growth: 39.9%

Investment Thesis: TSMC combines excellent 30.9% ROIC with the highest quality rating (8.2) and exceptional 141.6% undervaluation, making it the most attractive opportunity for beginning investors seeking semiconductor exposure. The world's leading foundry provides essential manufacturing services with irreplaceable competitive advantages and substantial cash generation.

Why It's Safe for Beginners: TSMC's safety profile includes global semiconductor foundry leadership with advanced process technology, essential supplier relationships with technology leaders like Apple and NVIDIA, predictable cash flows through long-term customer contracts, and strategic positioning in AI and high-performance computing. The company's technological leadership creates substantial barriers to entry.

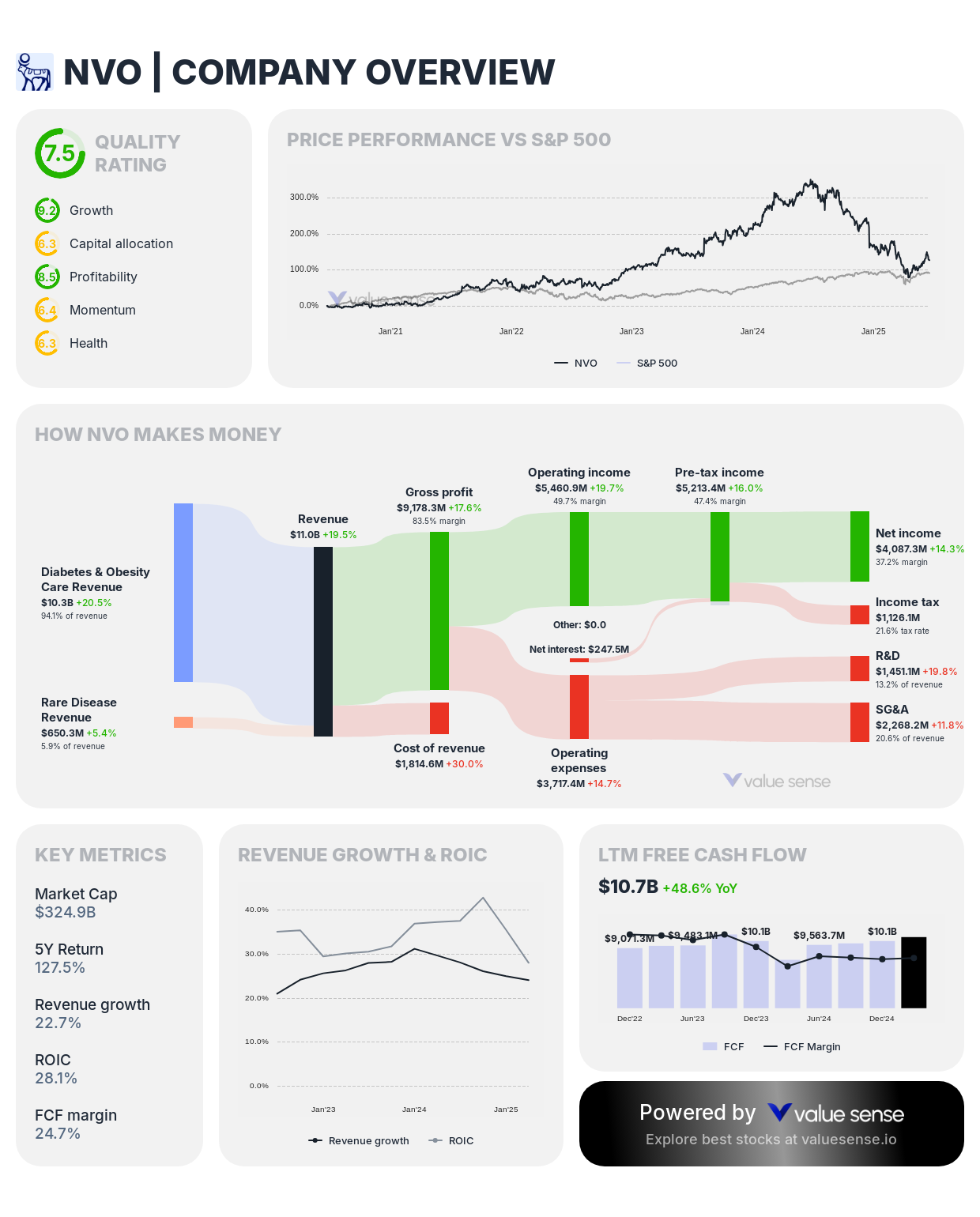

8. Novo Nordisk A/S (NVO) - 28.1% ROIC

- Quality Rating: 7.5 (Strong)

- ROIC: 28.1%

- FCF Margin: 24.7%

- Intrinsic Value: 7.3% overvalued

- 1-Year Return: (47.5%)

- Revenue: DKK 303.1B

- Free Cash Flow: DKK 74.7B

- Revenue Growth: 24.1%

Investment Thesis: Novo Nordisk demonstrates solid 28.1% ROIC with strong quality rating of 7.5, reflecting the pharmaceutical company's specialized leadership in diabetes and obesity care. Trading near fair value with modest 7.3% overvaluation, Novo Nordisk offers beginning investors exposure to healthcare innovation with predictable demand and premium pricing power.

Why It's Safe for Beginners: The company's safety characteristics include global leadership in diabetes care with expanding patient populations, revolutionary obesity treatments addressing massive markets, specialized therapeutic focus creating competitive advantages, and predictable healthcare demand providing defensive characteristics. Novo Nordisk's continuous innovation maintains its market leadership position.

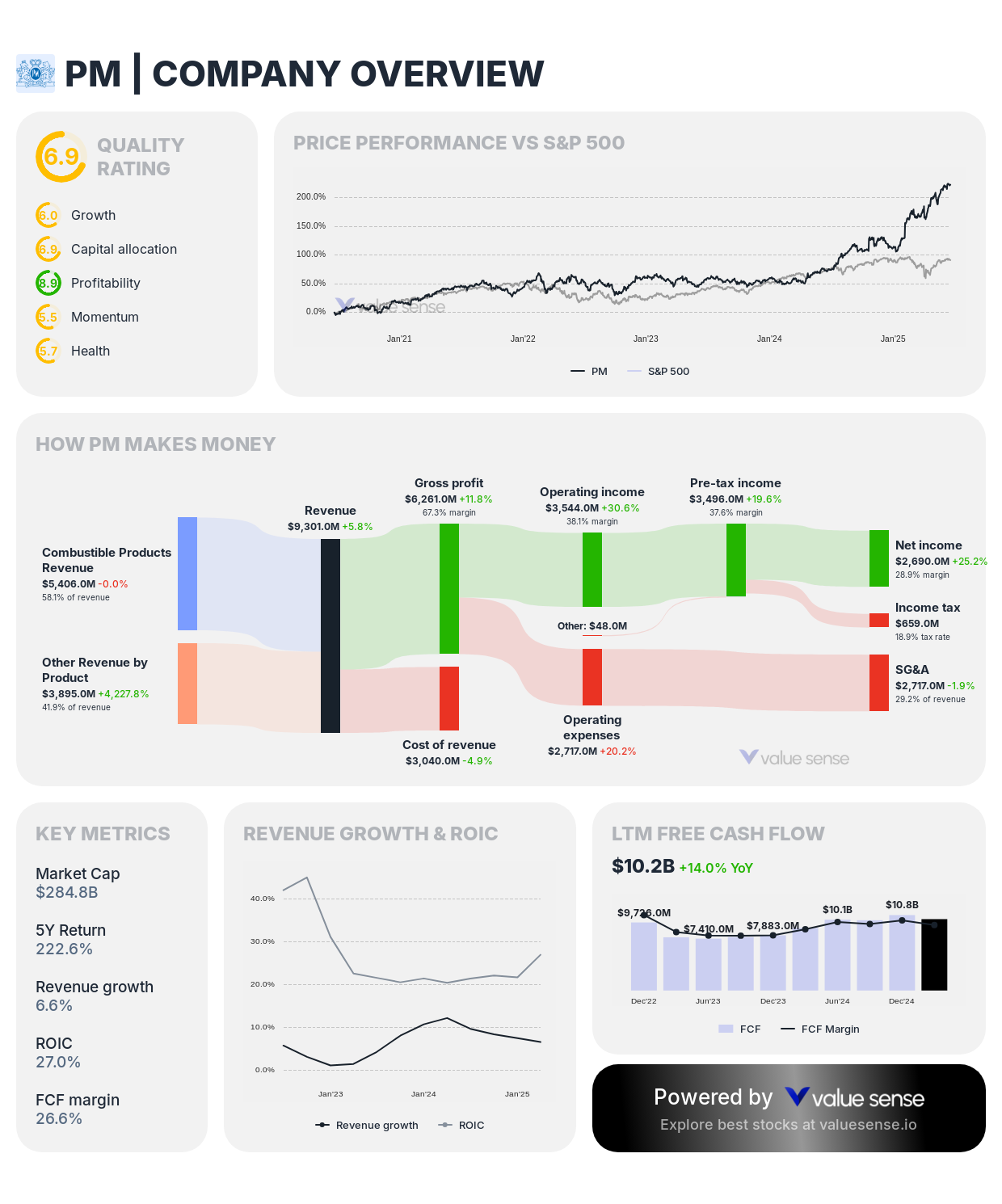

9. Philip Morris International Inc. (PM) - 27.0% ROIC

- Quality Rating: 6.5 (Strong)

- ROIC: 27.0%

- FCF Margin: 26.6%

- Intrinsic Value: 60.4% overvalued

- 1-Year Return: 87.6%

- Revenue: $38.3B

- Free Cash Flow: $10.2B

- Revenue Growth: 6.6%

Investment Thesis: Philip Morris achieves solid 27.0% ROIC with quality rating of 6.5, demonstrating the international tobacco company's capital efficiency despite regulatory challenges. The company's transformation toward reduced-risk products and strong international brand portfolio create predictable cash flows suitable for beginning investors seeking income-oriented investments.

Why It's Safe for Beginners: Philip Morris offers safety through strong international brand portfolio with pricing power, transformation toward reduced-risk products addressing regulatory concerns, predictable cash generation supporting consistent dividends, and geographic diversification reducing single-market dependence. The company's reduced-risk product strategy positions it for long-term sustainability.

10. Microsoft Corporation (MSFT) - 27.2% ROIC

- Quality Rating: 7.5 (Strong)

- ROIC: 27.2%

- FCF Margin: 25.7%

- Intrinsic Value: 5.4% undervalued

- 1-Year Return: 7.9%

- Revenue: $270.0B

- Free Cash Flow: $69.4B

- Revenue Growth: 14.1%

Investment Thesis: Microsoft demonstrates excellent 27.2% ROIC with strong quality rating of 7.5 and attractive 5.4% undervaluation, making it an ideal cornerstone holding for beginning investors. The software giant's transformation to cloud computing and subscription services creates predictable revenue streams and exceptional cash generation with defensive characteristics.

Why It's Safe for Beginners: Microsoft's safety profile includes enterprise software dominance with high switching costs, Azure cloud platform providing scalable growth opportunities, diversified business model across multiple segments, and conservative management with consistent dividend growth. The company's mission-critical software creates predictable, recurring revenue streams.

Safe Investing Strategy for Beginners

Start with Quality Leaders: Focus on companies with quality ratings above 7.5, including NVIDIA (8.3), TSMC (8.2), Palantir (7.7), Meta (7.6), and Alphabet (7.5). These companies demonstrate exceptional competitive positioning and business model quality ideal for long-term wealth building.

Prioritize Capital Efficiency: Companies with ROIC above 30% like Apple (196.9%), NVIDIA (180.7%), and Palantir (42.9%) demonstrate superior capital allocation and profitability that creates sustainable competitive advantages and shareholder value over time.

Seek Undervaluation Opportunities: TSMC (141.6% undervalued), Alphabet (22.3% undervalued), and Microsoft (5.4% undervalued) offer attractive entry points for beginning investors seeking quality companies at reasonable valuations with substantial upside potential.

Diversify Across Sectors: Spread investments across technology (NVIDIA, Apple, Microsoft), healthcare (Novo Nordisk), semiconductors (TSMC, ASML), and consumer platforms (Meta, Alphabet) to reduce concentration risk while maintaining exposure to different growth themes.

Understanding Our Safety Methodology

Quality Rating Assessment: Our proprietary quality rating evaluates competitive moats, financial strength, management quality, and business model sustainability. Ratings above 7.0 indicate exceptional business quality with sustainable competitive advantages that protect against competitive threats and market volatility.

Capital Efficiency Analysis: ROIC measures how effectively companies generate profits from invested capital, with rates above 20% indicating exceptional capital efficiency and competitive positioning. High ROIC typically correlates with strong competitive moats, pricing power, and operational excellence.

Cash Generation Evaluation: FCF margin reveals operational efficiency and cash generation capability, with margins above 20% demonstrating superior business models that convert revenue into available cash for strategic deployment, debt reduction, or shareholder returns.

Key Takeaways for Beginning Investors

✅ Capital Efficiency Leaders: Apple (196.9% ROIC) and NVIDIA (180.7% ROIC) demonstrate exceptional capital allocation

✅ Quality Excellence: TSMC (8.2) and NVIDIA (8.3) offer the highest quality ratings with strong competitive positioning

✅ Value Opportunities: TSMC (141.6% undervalued) and Alphabet (22.3% undervalued) provide attractive entry points

✅ Diversified Safety: Opportunities span technology, healthcare, semiconductors, and consumer platforms

✅ Cash Generation: All companies demonstrate FCF margins above 20% ensuring financial flexibility

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 10 Best High Margin Businesses

📖 11 Best Earnings Growth Stocks

📖 9 Best DCF Undervalued Stocks

FAQ About Safe Stock Investing

What makes these stocks particularly safe for beginning investors?

These stocks combine three critical safety factors: quality ratings above 6.5 indicating strong competitive moats, ROIC above 20% demonstrating exceptional capital efficiency, and FCF margins above 20% showing superior cash generation. Companies like TSMC (8.2 quality rating, 30.9% ROIC, 29.4% FCF margin) and Microsoft (7.5 quality rating, 27.2% ROIC, 25.7% FCF margin) provide the financial strength and competitive advantages that help beginning investors avoid common pitfalls while building long-term wealth through proven business models.

How important is ROIC compared to other financial metrics for safe investing?

ROIC is crucial for safe investing because it measures how effectively companies generate profits from invested capital, indicating sustainable competitive advantages and management quality. Companies with ROIC above 30% like Apple (196.9%) and NVIDIA (180.7%) demonstrate exceptional capital allocation that creates long-term shareholder value. High ROIC typically indicates strong competitive moats, pricing power, and operational efficiency that help companies maintain profitability through various economic cycles, making them ideal for conservative investors.

Should beginning investors be concerned about overvalued stocks in this list?

While some companies like Apple (77.4% overvalued) and Palantir (86.5% overvalued) trade above intrinsic value, their exceptional quality ratings and capital efficiency provide defensive characteristics that can justify premium valuations. Beginning investors should focus on companies with the strongest competitive advantages and consider dollar-cost averaging to reduce timing risk. Companies like TSMC (141.6% undervalued) and Alphabet (22.3% undervalued) offer more attractive entry points while maintaining similar quality characteristics.

How should beginners diversify across these safe stock opportunities?

Successful diversification for beginners should spread investments across different sectors and business models while maintaining focus on quality companies. Consider allocating across technology platforms (Apple, Microsoft), semiconductor leaders (NVIDIA, TSMC), healthcare innovation (Novo Nordisk), and internet services (Alphabet, Meta). This approach provides exposure to different growth themes while reducing concentration risk, with each company offering strong competitive advantages and financial stability suitable for long-term wealth building.

What role should these safe stocks play in a beginner's overall portfolio?

Safe stocks with strong quality ratings and capital efficiency should form the core foundation of a beginner's portfolio, typically representing 60-80% of equity allocations. These companies provide stability and growth potential while teaching beginning investors about business fundamentals and market dynamics. The remaining portfolio allocation can include broader market exposure through index funds or more speculative growth opportunities as investors gain experience and confidence in their investment decision-making capabilities.

Important Note for Beginning Investors: While these companies demonstrate strong safety characteristics through quality ratings, capital efficiency, and cash generation, all stock investments carry risk and past performance does not guarantee future results. Beginning investors should start with small positions, focus on long-term holding periods, and consider dollar-cost averaging to reduce timing risk. Diversification across multiple companies and asset classes remains essential for risk management.

Disclaimer: This analysis is for informational purposes only and should not be considered personalized investment advice. Financial metrics are based on the most recent available data and may vary with quarterly reporting. Beginning investors should conduct thorough research, understand their risk tolerance, and consult with qualified financial advisors before making investment decisions.