Salesforce Rule of 40 Analysis: CRM Leader's Growth Efficiency Challenge

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

The Salesforce rule of 40 analysis reveals one of the most compelling transformation stories in enterprise software, chronicling Salesforce's evolution from pure growth-focused startup to mature SaaS efficiency leader. As the world's #1 CRM platform navigating market maturation and profitability pressures, Salesforce's Rule of 40 performance provides crucial insights for investors evaluating SaaS efficiency metrics and long-term value creation in cloud software.

The Rule of 40, combining revenue growth rate and profit margin to measure balanced efficiency, has become the gold standard for evaluating SaaS company health. Salesforce's 20+ year journey through various Rule of 40 phases demonstrates how enterprise software companies must adapt their growth-profitability balance as they scale from disruptive startups to industry-leading platforms serving millions of customers globally.

Current analysis shows Salesforce achieving a CRM rule of 40 score of 41.5% in 2024, representing a remarkable transformation from growth-at-all-costs mentality to disciplined profitability focus. This evolution offers valuable lessons for SaaS companies, investors, and executives seeking to understand optimal efficiency strategies in today's competitive cloud software landscape.

Understanding the Rule of 40: SaaS Efficiency Foundation

The Rule of 40 Framework

The Rule of 40 represents a fundamental principle in SaaS evaluation: Revenue Growth Rate + Profit Margin ≥ 40%. This metric provides a balanced assessment of company health by recognizing that sustainable software businesses must optimize both expansion and profitability rather than pursuing growth at the expense of long-term financial stability.

Why 40% Matters:

- Investment Benchmark: Venture capitalists and public market investors use 40% as minimum threshold for quality SaaS investments

- Capital Efficiency: Companies above 40% typically generate sufficient returns to fund growth without excessive dilution

- Market Validation: Rule of 40 leaders command premium valuations and strategic flexibility

- Sustainable Growth: Balanced growth-profitability ensures long-term competitive positioning

SaaS Evolution and Efficiency Metrics

The software industry's maturation has elevated Rule of 40 importance as easy growth becomes scarce and investors demand proof of sustainable unit economics. Leading SaaS companies now optimize for efficiency rather than pure growth, recognizing that profitable expansion creates more durable value than revenue growth alone.

Market Context:

- Valuation Discipline: Public markets reward balanced growth-profitability over pure revenue expansion

- Capital Accessibility: Higher interest rates make profitable growth more attractive than debt-funded expansion

- Competitive Dynamics: Mature markets require operational excellence rather than pure land-grab strategies

- Customer Expectations: Enterprises demand proven ROI rather than experimental solutions

Salesforce Rule of 40 Evolution: Two-Decade Journey

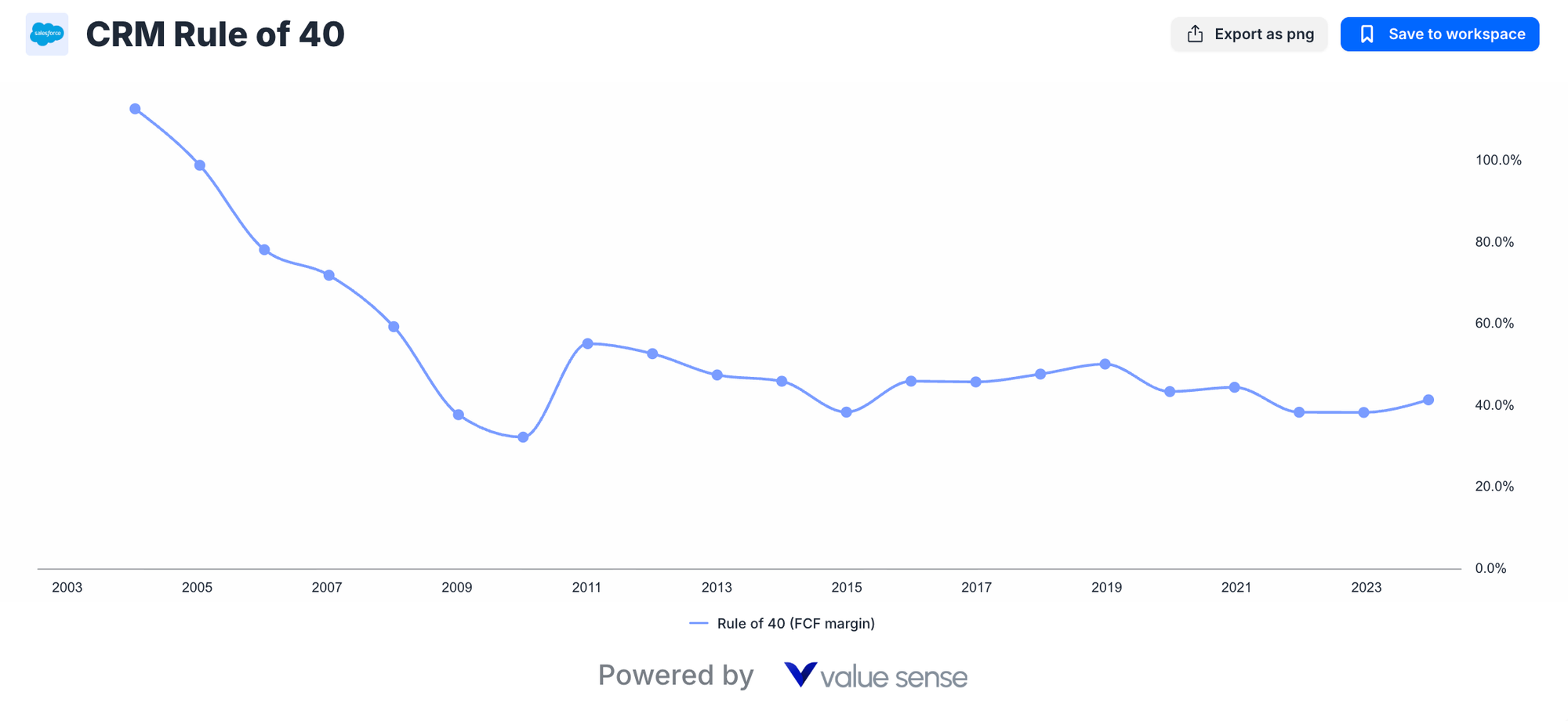

Salesforce Rule of 40 evolution from 2003-2023 shows dramatic transformation from >100% growth-driven efficiency to balanced 40%+ performance

Historical Performance Analysis

Salesforce's Rule of 40 journey reflects broader SaaS industry evolution, demonstrating how successful cloud companies navigate the transition from high-growth startups to mature, profitable enterprises. The 20-year performance data reveals distinct phases of strategic focus and market adaptation.

Rule of 40 Historical Data:

| Period | Rule of 40 Range | Strategic Focus | Market Context |

|---|---|---|---|

| 2003-2006 | 112.9% → 72.1% | Pure growth phase | CRM market disruption |

| 2007-2010 | 59.5% → 32.4% | Market expansion | Economic crisis adaptation |

| 2011-2014 | 55.3% → 46.1% | Platform building | Cloud computing mainstream |

| 2015-2018 | 38.5% → 50.3% | Efficiency focus | Public market maturation |

| 2019-2022 | 43.5% → 38.5% | Scale challenges | Pandemic acceleration |

| 2023-2024 | 38.4% → 41.5% | Profitability optimization | Market maturation |

Phase 1: Growth Supremacy (2003-2010)

Early Salesforce exemplified growth-at-all-costs SaaS strategy, achieving Rule of 40 scores exceeding 100% through explosive revenue expansion. This period established CRM market leadership but required substantial capital investment and limited profitability focus.

Growth Phase Characteristics:

- Revenue Growth: 60-80% annual expansion rates

- Market Creation: Pioneering cloud CRM disrupted traditional software

- Investment Priority: Customer acquisition over immediate profitability

- Competitive Advantage: First-mover benefits in emerging SaaS category

The dramatic Rule of 40 decline from 112.9% to 32.4% reflected natural growth rate normalization as Salesforce scaled, demonstrating typical SaaS maturation patterns where exceptional early growth becomes unsustainable at larger revenue bases.

Phase 2: Balance Discovery (2011-2018)

The middle period showed Salesforce learning to balance growth and profitability, with Rule of 40 performance fluctuating between 38-55% as management optimized operations while maintaining market leadership. This phase established sustainable growth frameworks still evident today.

Balance Phase Evolution:

- Operational Discipline: Improved sales efficiency and cost management

- Platform Expansion: Multi-cloud strategy diversified revenue streams

- Profitability Focus: Margin improvement without sacrificing growth

- Market Leadership: Established dominant CRM market position

Phase 3: Efficiency Mastery (2019-2024)

Recent years demonstrate Salesforce's evolution into efficiency-focused enterprise software leader, maintaining Rule of 40 performance near optimal 40% threshold while generating substantial cash flows and shareholder returns. This transformation reflects mature SaaS company best practices.

Efficiency Phase Achievements:

- Margin Expansion: Operating margins exceeding 30%

- Cash Generation: Free cash flow margins reaching 32.8%

- Capital Returns: Substantial buyback and dividend programs

- Market Defense: Maintaining growth despite increased competition

Revenue Growth and Profitability Balance

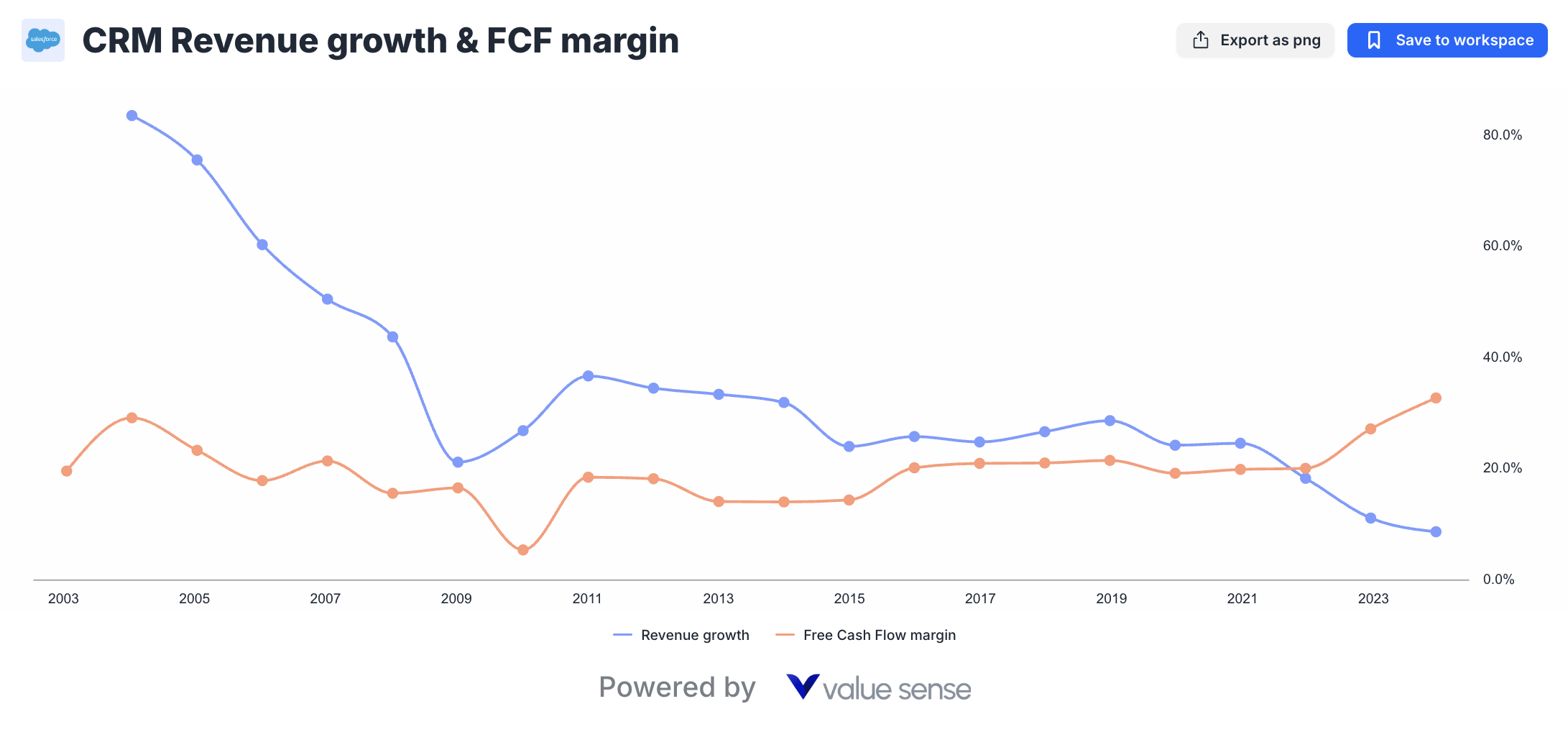

Revenue growth evolution from 80%+ to single digits while Free Cash Flow margin expanded from 5% to 32.8%, demonstrating classic SaaS maturation pattern

Growth Rate Evolution

Salesforce's revenue growth trajectory illustrates natural SaaS lifecycle progression from hypergrowth startup to mature enterprise software leader. The systematic decline from 80%+ growth rates to current 8-11% levels reflects both company scale and market maturation dynamics.

Revenue Growth Phases:

2009-2012: Peak Growth Era

- Growth Rates: 26.9% - 36.8%

- Market Drivers: Cloud adoption acceleration

- Strategic Focus: Market expansion and customer acquisition

- Competitive Position: Establishing CRM category leadership

2013-2019: Normalization Period

- Growth Rates: 24-32% range

- Market Evolution: Increased competition and market saturation

- Platform Strategy: Multi-cloud expansion beyond core CRM

- Customer Base: Enterprise client acquisition focus

2020-2024: Mature Growth

- Growth Rates: 8-25% range

- Market Context: COVID acceleration followed by normalization

- Strategic Priorities: Efficiency optimization and AI integration

- Competitive Landscape: Defending market leadership against emerging threats

Profitability Transformation

The most remarkable aspect of Salesforce's evolution lies in dramatic profitability improvement, with Free Cash Flow margins expanding from 5.4% in 2010 to 32.8% in 2024. This transformation demonstrates successful transition from growth-focused to efficiency-optimized SaaS operations.

Profitability Milestones:

Early Stage (2010-2015): Foundation Building

- FCF Margins: 5.4% - 20.2%

- Investment Priority: Platform development and market expansion

- Operational Focus: Scaling infrastructure and sales organization

- Profitability Approach: Gradual margin improvement

Growth Stage (2016-2020): Balance Optimization

- FCF Margins: 19.2% - 21.6%

- Strategic Shift: Balancing growth investments with profit generation

- Market Position: Leveraging scale for operational efficiency

- Capital Allocation: Disciplined investment in high-ROI initiatives

Mature Stage (2021-2024): Efficiency Leadership

- FCF Margins: 19.9% - 32.8%

- Operating Excellence: Industry-leading profitability metrics

- Shareholder Focus: Substantial capital returns and dividend initiation

- Competitive Advantage: Scale-driven cost advantages

Current Financial Performance and Metrics

Q3 2024 Performance Highlights

Salesforce's recent financial results demonstrate successful execution of efficiency-focused strategy, delivering balanced growth and profitability that exemplifies optimal Rule of 40 performance for mature SaaS companies.

Key Q3 2024 Metrics:

- Revenue: $8.7 billion (+11% YoY)

- Operating Margin: 31.2% (non-GAAP, +850 bps YoY)

- Free Cash Flow: $1.4 billion (+1,088% YoY)

- Operating Cash Flow: $1.5 billion (+389% YoY)

Rule of 40 Calculation (2024):

- Revenue Growth: 8.7%

- FCF Margin: 32.8%

- Rule of 40 Score: 41.5%

This performance places Salesforce solidly above the 40% threshold while demonstrating sustainable growth characteristics and industry-leading profitability metrics that justify premium valuations among enterprise software peers.

Cash Flow Generation Excellence

Salesforce's cash flow transformation represents one of the most impressive efficiency improvements in enterprise software history. The dramatic acceleration in free cash flow generation provides strategic flexibility for investments, acquisitions, and shareholder returns.

Cash Flow Evolution:

- Q3 2024: $1.4B FCF (+1,088% YoY)

- Margin Expansion: 32.8% FCF margin vs. historical 15-20%

- Collections Efficiency: Improved billing and payment processes

- Cost Discipline: Operating leverage from scale advantages

Strategic Implications:

- Investment Capacity: Self-funding capability for AI and platform investments

- Acquisition Power: Strong balance sheet enables strategic M&A

- Shareholder Returns: $1.9B quarterly buybacks demonstrate capital return commitment

- Competitive Moats: Cash generation advantages over smaller competitors

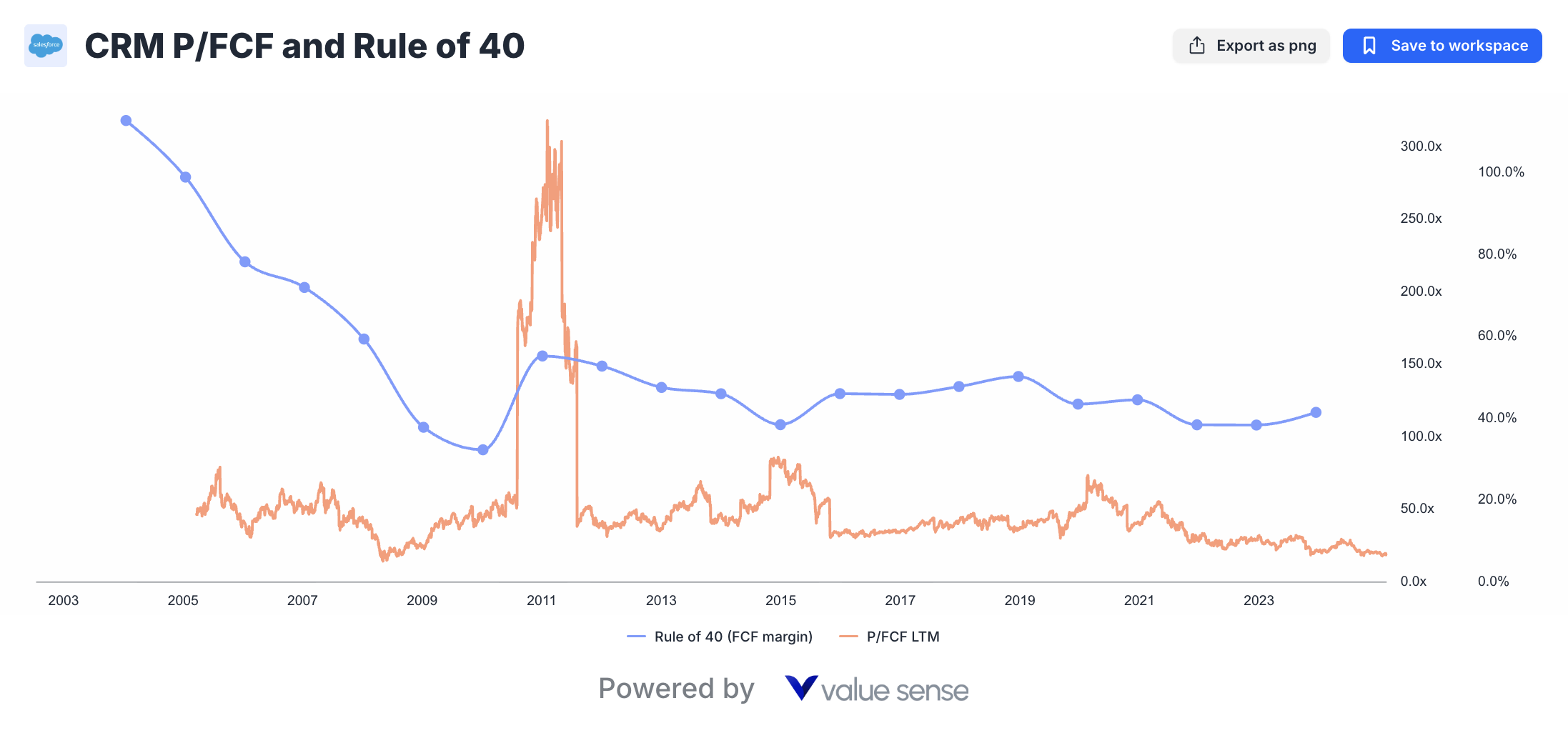

P/FCF Valuation Analysis

Valuation Multiple Evolution

Salesforce's Price-to-Free Cash Flow multiple evolution provides insights into market perception of SaaS efficiency and growth balance. The P/FCF progression reflects both company performance improvements and broader SaaS market valuation dynamics.

P/FCF Historical Analysis:

| Period | P/FCF Range | Market Context | Valuation Driver |

|---|---|---|---|

| 2004-2008 | 31.1x - 49.5x | Early SaaS premium | Growth expectations |

| 2009-2012 | 18.1x - 162.4x | Crisis + recovery volatility | Market uncertainty |

| 2013-2017 | 36.1x - 59.3x | SaaS mainstream adoption | Platform value recognition |

| 2018-2021 | 39.8x - 58.0x | Cloud acceleration | COVID digital transformation |

| 2022-2024 | 27.7x - 31.7x | Efficiency focus | Profitability premium |

- 2024 P/FCF: 27.7x

- Historical Average: 45-50x

- Peer Comparison: Premium to SaaS average

- Efficiency Premium: Market rewards balanced growth-profitability

Investment Implications

Current P/FCF multiples reflect market recognition of Salesforce's successful transformation into efficiency-focused SaaS leader while maintaining growth optionality. The valuation provides reasonable entry point for investors seeking exposure to mature, profitable cloud software.

Valuation Considerations:

- Multiple Compression: Lower multiples reflect maturity vs. growth premium

- Quality Premium: Market values predictable cash flows and market leadership

- Efficiency Dividend: Superior Rule of 40 performance justifies premium pricing

- Growth Optionality: AI initiatives provide potential growth reacceleration

Competitive Benchmarking and Industry Context

SaaS Rule of 40 Landscape

Salesforce's Rule of 40 performance positions the company favorably among enterprise software leaders, demonstrating that mature SaaS platforms can maintain efficiency advantages through operational excellence and market leadership.

Industry Rule of 40 Comparison:

- Salesforce (CRM): 41.5%

- Microsoft (MSFT): ~45% (Cloud segment)

- ServiceNow (NOW): ~40%

- Workday (WDAY): ~35%

- Adobe (ADBE): ~38%

Competitive Advantages:

- Scale Benefits: Market leadership enables operational leverage

- Platform Economics: Multi-cloud strategy diversifies revenue streams

- Customer Stickiness: High switching costs support pricing power

- Innovation Investment: R&D scale advantages in AI and automation

Market Leadership Sustainability

Salesforce's ability to maintain Rule of 40 performance above threshold while defending market leadership demonstrates sustainable competitive advantages that justify investor confidence in long-term value creation.

Sustainable Advantages:

- Ecosystem Lock-in: Extensive third-party developer platform

- Data Network Effects: Customer data improves platform value

- Brand Recognition: Salesforce synonymous with CRM category

- Innovation Pipeline: AI integration provides differentiation opportunities

Strategic Initiatives and Growth Catalysts

AI Integration and Innovation

Salesforce's Einstein AI platform and recent generative AI initiatives represent significant growth catalysts that could reaccelerate revenue expansion while maintaining operational efficiency improvements achieved through Rule of 40 optimization.

AI Growth Drivers:

- Einstein Platform: Embedded AI across all Salesforce products

- Generative AI: ChatGPT integration and custom AI development tools

- Automation Efficiency: AI-driven productivity improvements for customers

- Premium Pricing: Advanced AI features command higher prices

Investment in Innovation:

- R&D Spending: Substantial investment in AI capabilities

- Talent Acquisition: Hiring top AI researchers and engineers

- Partnership Strategy: Collaborations with OpenAI and other AI leaders

- Platform Integration: Seamless AI embedding across multi-cloud portfolio

Market Expansion Opportunities

Despite mature core CRM market, Salesforce continues identifying expansion opportunities that could support sustained growth while leveraging existing operational efficiency infrastructure.

Expansion Vectors:

- Industry Verticalization: Specialized solutions for healthcare, financial services, retail

- International Growth: Emerging market expansion with local partnerships

- SMB Market: Simplified offerings for small and medium businesses

- Adjacent Categories: Marketing automation, e-commerce, analytics platform expansion

Strategic Acquisitions:

- Capability Building: Strategic M&A to fill platform gaps

- Market Access: Acquisitions for geographic or vertical market entry

- Technology Integration: Acquiring innovative technologies for platform enhancement

- Talent Acquisition: Acqui-hiring for specialized capabilities

Investment Analysis and Valuation Framework

Rule of 40 Investment Thesis

Salesforce's Rule of 40 evolution supports compelling investment thesis for investors seeking exposure to mature, efficient SaaS platforms with sustainable competitive advantages and balanced growth-profitability profiles.

Investment Merits:

- Efficiency Leadership: Superior Rule of 40 performance demonstrates operational excellence

- Market Position: Dominant CRM leadership provides pricing power and customer retention

- Cash Generation: Strong free cash flows enable shareholder returns and strategic investments

- Growth Optionality: AI initiatives provide reacceleration potential without sacrificing efficiency

Valuation Framework:

- DCF Analysis: Strong cash flows support intrinsic value calculations

- Multiple Analysis: P/FCF multiples reasonable relative to growth and profitability

- Peer Comparison: Premium justified by market leadership and efficiency metrics

- Sum-of-Parts: Multi-cloud platform value exceeds sum of individual components

Risk Assessment and Mitigation

While Salesforce's Rule of 40 performance indicates operational strength, investors should consider risks that could impact sustained efficiency and growth balance.

Key Risks:

- Market Saturation: Core CRM market maturation limiting organic growth

- Competitive Pressure: Microsoft, Oracle, and other platforms increasing competition

- Economic Sensitivity: Enterprise software spending vulnerable to economic downturns

- Execution Risk: AI initiatives require successful implementation and customer adoption

Risk Mitigation Factors:

- Diversification: Multi-cloud platform reduces dependence on single product category

- Switching Costs: High customer switching costs provide retention advantages

- Financial Strength: Strong balance sheet and cash flows provide recession resilience

- Innovation Capability: Proven track record of successful platform evolution

SaaS Efficiency Best Practices and Lessons

Operational Excellence Framework

Salesforce's Rule of 40 transformation provides valuable lessons for SaaS companies seeking to optimize growth-profitability balance while maintaining market competitiveness and customer satisfaction.

Key Success Factors:

1. Gradual Efficiency Improvement

- Phased Approach: Systematic margin improvement without sacrificing growth

- Customer Focus: Maintaining service quality during efficiency optimization

- Investment Discipline: Selective spending on high-ROI initiatives

- Market Timing: Efficiency focus aligned with market maturation cycles

2. Scale Advantage Utilization

- Fixed Cost Leverage: Spreading infrastructure costs across growing revenue base

- Sales Efficiency: Improving sales productivity through technology and process

- Customer Success: Reducing churn through proactive customer management

- Platform Economics: Multi-product cross-selling and upselling optimization

3. Technology-Driven Automation

- Process Automation: Reducing manual processes through workflow technology

- AI Integration: Leveraging artificial intelligence for operational efficiency

- Self-Service: Enabling customer self-service to reduce support costs

- Data Analytics: Using data insights to optimize resource allocation

Strategic Transformation Lessons

Salesforce's evolution from growth-focused startup to efficiency-optimized enterprise platform offers strategic insights for SaaS executives and investors evaluating similar transformations.

Transformation Principles:

- Market Leadership First: Establish category leadership before optimizing efficiency

- Customer Retention Priority: Focus on churn reduction during margin improvement

- Platform Strategy: Build multi-product platforms to improve customer lifetime value

- Innovation Investment: Continue R&D spending even during efficiency optimization

Execution Framework:

- Metrics-Driven Management: Use Rule of 40 and similar metrics to guide decisions

- Balanced Scorecards: Optimize multiple KPIs simultaneously rather than single metrics

- Long-Term Perspective: Accept short-term trade-offs for sustainable competitive advantages

- Stakeholder Alignment: Communicate efficiency strategy to investors, employees, and customers

Future Outlook and Investment Implications

Long-Term Rule of 40 Trajectory

Salesforce's future Rule of 40 performance will likely depend on successful AI integration, market expansion execution, and ability to maintain operational efficiency while investing in growth initiatives.

Scenarios Analysis:

Base Case: Sustained Efficiency (Rule of 40: 40-45%)

- Growth: 8-12% revenue expansion

- Margins: 30-35% operating margins

- Drivers: Market share defense, AI monetization, operational leverage

Bull Case: AI-Driven Acceleration (Rule of 40: 45-50%)

- Growth: 12-18% revenue expansion

- Margins: 32-38% operating margins

- Catalysts: Successful AI product launches, market expansion, premium pricing

Bear Case: Competitive Pressure (Rule of 40: 35-40%)

- Growth: 5-8% revenue expansion

- Margins: 25-30% operating margins

- Headwinds: Increased competition, economic slowdown, execution challenges

Investment Positioning Strategy

Salesforce's Rule of 40 profile makes it suitable for investors seeking balanced exposure to SaaS efficiency leaders with defensive growth characteristics and sustainable competitive advantages.

Investor Alignment:

- Growth Investors: AI initiatives provide growth reacceleration potential

- Value Investors: Reasonable valuation with strong cash flow generation

- Income Investors: Growing dividend and buyback programs

- Quality Investors: Market leadership and operational excellence

Portfolio Positioning:

- Core Holdings: Suitable for core technology portfolio positions

- SaaS Exposure: Representative of mature, efficient cloud software

- Defensive Growth: Resilient business model during economic uncertainty

- Innovation Proxy: AI integration provides technology transformation exposure

The Rule of 40 Verdict

Salesforce's rule of 40 analysis demonstrates successful transformation from hypergrowth startup to mature, efficient SaaS leader while maintaining market dominance and innovation capabilities. The company's current 41.5% Rule of 40 score reflects optimal balance between sustainable growth and industry-leading profitability that creates long-term shareholder value.

Key Investment Conclusions

Efficiency Leadership Confirmed: Salesforce's Rule of 40 performance above 40% threshold validates the company's operational excellence and strategic execution in balancing growth investments with profitability optimization.

Market Position Sustainability: The ability to maintain Rule of 40 performance while defending CRM market leadership demonstrates sustainable competitive advantages that justify premium valuations relative to less efficient SaaS competitors.

Growth Optionality Preserved: AI integration initiatives and market expansion opportunities provide potential for growth reacceleration without sacrificing the operational efficiency gains achieved through Rule of 40 focus.

Shareholder Value Creation: Strong free cash flow generation and capital return programs demonstrate management's commitment to balanced stakeholder value creation through both growth investments and immediate returns.

Strategic Recommendation

Buy Recommendation for investors seeking:

- SaaS Efficiency Leaders with proven Rule of 40 execution

- Defensive Growth exposure through market-leading platforms

- AI Innovation participation with operational discipline

- Balanced Returns from both growth and cash flow generation

- Quality Technology investments with sustainable competitive moats

Salesforce's Rule of 40 evolution exemplifies optimal SaaS efficiency metrics execution, making it an essential holding for investors seeking exposure to mature, profitable cloud software platforms positioned for sustained value creation in an increasingly competitive technology landscape.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 Mastercard Undervalued: Payment Processing Profit Machine

📖 UnitedHealth Group Undervalued: Healthcare Insurance

📖 Undervalued Infrastructure Stocks: 5 Value Plays

FAQ

Q: What does Salesforce's Rule of 40 score of 41.5% indicate about the company's performance?

A: Salesforce's Rule of 40 score of 41.5% (8.7% revenue growth + 32.8% FCF margin) indicates excellent SaaS efficiency, exceeding the 40% threshold that defines healthy software companies. This score demonstrates Salesforce has successfully balanced growth investments with profitability optimization, achieving industry-leading cash flow margins while maintaining steady revenue expansion. The score places Salesforce among top-performing SaaS companies and validates its transformation from growth-focused startup to mature, efficient enterprise platform.

Q: How has Salesforce's Rule of 40 performance evolved since its early days?

A: Salesforce's Rule of 40 journey shows dramatic evolution: starting at 112.9% in 2004 (driven by explosive 80%+ growth rates), declining to 32.4% in 2010 during market maturation, then stabilizing around 40-50% from 2011-2024. The early period prioritized pure growth, while recent years demonstrate balanced efficiency with 8-11% growth and 30%+ margins. This evolution reflects natural SaaS lifecycle progression from hypergrowth startup to mature, profitable enterprise software leader.

Q: Why is the Rule of 40 metric important for evaluating SaaS companies like Salesforce?

A: The Rule of 40 is crucial for SaaS evaluation because it measures balanced efficiency between growth and profitability. Pure growth without profitability is unsustainable, while high margins without growth indicate stagnation. Companies above 40% demonstrate they can expand while generating sufficient returns to fund operations and investments. Investors use Rule of 40 to identify quality SaaS businesses that create long-term value through balanced capital allocation rather than unsustainable growth-at-all-costs strategies.

Q: How does Salesforce's current Rule of 40 performance compare to other enterprise software companies?

A: Salesforce's 41.5% Rule of 40 score positions it favorably among enterprise software leaders. Microsoft's cloud segments achieve ~45%, ServiceNow reaches ~40%, while Workday and Adobe score 35-38%. Salesforce's performance demonstrates competitive efficiency while maintaining market leadership in CRM. The score reflects successful operational optimization and validates the company's ability to generate superior returns through scale advantages, platform economics, and customer retention that smaller competitors cannot easily replicate.

Q: What factors could drive Salesforce's Rule of 40 performance higher in the future?

A: Several factors could improve Salesforce's Rule of 40: 1) AI integration driving both growth reacceleration (through premium pricing and new use cases) and margin expansion (through automation and efficiency), 2) International expansion and vertical market penetration increasing revenue growth, 3) Platform cross-selling and upselling improving customer lifetime value, 4) Operational leverage from scale advantages reducing relative costs, and 5) Strategic acquisitions adding high-margin capabilities. Success in AI monetization particularly could drive Rule of 40 scores toward 45-50% range while maintaining sustainable growth characteristics.