Samantha McLemore - Patient Capital Management Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

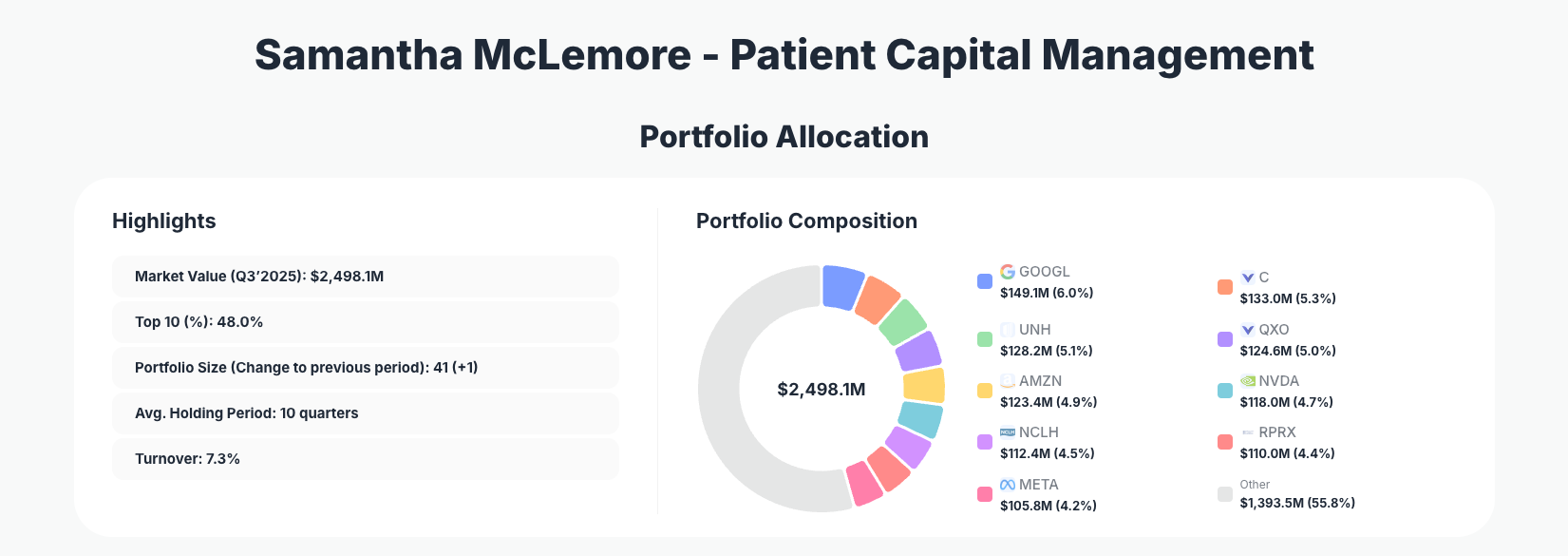

Samantha McLemore of Patient Capital Management showcases her disciplined approach to long-term value investing through precise portfolio adjustments. Her $2.5B portfolio in Q3 2025 reflects a balanced strategy across tech giants and healthcare plays, with notable increases in UNH and RPRX signaling conviction in resilient sectors amid market volatility.

Portfolio Snapshot: Balanced Concentration with Patient Precision

Portfolio Highlights (Q3 2025): - Market Value: $2,498.1M - Top 10 Holdings: 48.0% - Portfolio Size: 41 +1 - Average Holding Period: 10 quarters - Turnover: 7.3%

Patient Capital Management's portfolio maintains a moderate concentration level, with the top 10 holdings comprising 48.0% of the total $2.5 billion value. This structure balances high-conviction bets on established leaders like tech and healthcare with broader diversification across 41 positions, demonstrating Samantha McLemore's patient approach to building wealth over time. The low turnover of 7.3% underscores a buy-and-hold philosophy, where positions are adjusted surgically rather than overhauled.

The average holding period of 10 quarters—over two years—highlights a strategy rooted in intrinsic value assessment, allowing compound growth to work while avoiding short-term noise. Recent additions to the portfolio size (+1 position) suggest ongoing opportunity hunting without disrupting core allocations. McLemore's Q3 2025 portfolio tilts toward quality growth names, blending mega-cap stability with selective value plays in financials and cruises.

This disciplined evolution positions Patient Capital to navigate uncertain markets, with tech exposure providing growth upside and healthcare adding defensive qualities. Track these metrics live on the Patient Capital superinvestor page for real-time updates post-13F filings.

Top Holdings Breakdown: Tech Core with Bold Healthcare Bets

Samantha McLemore's portfolio leads with strategic tweaks across key names, prioritizing all recent changes before layering in top positions. Alphabet Inc. (GOOGL) holds at 6.0% after an "Add 0.05%", maintaining its role as a foundational tech bet with $149.1M invested. Citigroup Inc. (C) sits at 5.3% following a "Reduce 2.62%" to $133.0M, trimming financial exposure amid sector rotations.

The standout move is UnitedHealth Group Incorporated (UNH), surging with an "Add 93.49%" to 5.1% $128.2M, signaling strong conviction in healthcare resilience. QXO Inc (QXO) remains steady at 5.0% after a minor "Reduce 0.08%" to $124.6M. Amazon.com, Inc. (AMZN) holds 4.9% post "Reduce 0.27%" $123.4M, while NVIDIA Corporation (NVDA) is at 4.7% after "Reduce 0.23%" $118.0M, fine-tuning AI exposure.

Further adjustments include Norwegian Cruise Line Holdings Ltd. (NCLH) at 4.5% via "Reduce 3.05%" $112.4M, and gains in Royalty Pharma plc (RPRX) to 4.4% with "Add 4.35%" $110.0M. Meta Platforms, Inc. (META) weighs in at 4.2% after "Reduce 0.20%" $105.8M, and CVS Health Corporation (CVS) at 3.7% post "Reduce 0.16%" $93.5M. These moves blend top holdings like GOOGL and UNH with tactical trims in cyclicals like NCLH, reflecting adaptive conviction.

What the Portfolio Reveals About McLemore's Strategy

Samantha McLemore's Q3 adjustments reveal a strategy favoring quality compounders with durable moats, particularly in technology and healthcare where innovation drives long-term value.

- Tech-Heavy Core with Selective Trims: Heavy weighting in GOOGL, AMZN, NVDA, and META (over 19% combined) shows faith in digital ecosystems, but reductions signal profit-taking after rallies, balancing growth with valuation discipline.

- Healthcare Conviction Amid Volatility: Massive 93.49% add to UNH and 4.35% to RPRX highlight defensive bets on essential services—UNH's managed care dominance and RPRX's royalty streams offer stability and cash flow.

- Financial and Cyclical Pruning: Reductions in C 2.62% and NCLH 3.05% suggest risk management in rate-sensitive and travel-exposed names, prioritizing resilience over momentum.

- Low Turnover Discipline: At 7.3%, changes are incremental, emphasizing patience—average 10-quarter holds allow winners like QXO to mature.

- Diversified Yet Focused: 41 positions with 48% in top 10 avoid over-reliance, blending U.S.-centric giants with niche plays like QXO for asymmetric upside.

This mix positions Patient Capital for steady compounding, with healthcare adds providing ballast against tech volatility.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Alphabet Inc. (GOOGL) | $149.1M | 6.0% | Add 0.05% |

| Citigroup Inc. (C) | $133.0M | 5.3% | Reduce 2.62% |

| UnitedHealth Group Incorporated (UNH) | $128.2M | 5.1% | Add 93.49% |

| QXO Inc (QXO) | $124.6M | 5.0% | Reduce 0.08% |

| Amazon.com, Inc. (AMZN) | $123.4M | 4.9% | Reduce 0.27% |

| NVIDIA Corporation (NVDA) | $118.0M | 4.7% | Reduce 0.23% |

| Norwegian Cruise Line Holdings Ltd. (NCLH) | $112.4M | 4.5% | Reduce 3.05% |

| Royalty Pharma plc (RPRX) | $110.0M | 4.4% | Add 4.35% |

| Meta Platforms, Inc. (META) | $105.8M | 4.2% | Reduce 0.20% |

The top 10 holdings command 48.0% of the portfolio, showcasing Samantha McLemore's comfort with meaningful but not extreme concentration—each position under 6.0% allows flexibility while driving returns from conviction names. Bold moves like the 93.49% UNH increase contrast with trims in C and NCLH, indicating active risk calibration without abandoning core themes.

This table underscores a tech-healthcare axis (GOOGL, UNH, AMZN, NVDA, RPRX totaling ~25%), diversified enough for downside protection yet focused for upside capture. Low changes in most positions reinforce the 10-quarter average hold, prioritizing long-term ownership over trading.

Investment Lessons from Samantha McLemore's Patient Capital Approach

Samantha McLemore's Q3 portfolio exemplifies timeless principles tailored to patient value investing:

- Incremental Adjustments Over Revolutions: Minor adds like 0.05% to GOOGL and trims like 0.20% to META show position sizing evolves gradually, avoiding emotional overhauls.

- Bet Big on Moats When Conviction Aligns: The 93.49% UNH surge and 4.35% RPRX add highlight doubling down on healthcare cash cows with proven durability.

- Trim Winners to Fund Opportunities: Reductions in NVDA, AMZN, and META post-rallies demonstrate discipline in harvesting gains for resilient bets like UNH.

- Long Holding Periods Unlock Compounding: 10-quarter average tenure across 41 positions stresses patience, letting quality like QXO mature amid noise.

- Balance Concentration with Diversification: 48% top-10 weighting pairs high-conviction (UNH, GOOGL) with breadth, mitigating single-stock risks.

These lessons from Patient Capital emphasize understanding businesses deeply before sizing bets large.

Looking Ahead: What Comes Next?

Patient Capital's low 7.3% turnover and +1 position suggest ample dry powder for opportunistic deploys, especially with trims from cyclicals like NCLH freeing capital. Healthcare momentum (UNH, RPRX, CVS) positions the portfolio defensively for economic slowdowns, while tech staples (GOOGL, AMZN, NVDA, META) capture AI and cloud tailwinds.

Watch for further healthcare consolidation or value unlocks in financials like C, as McLemore's patient style favors undervalued compounders. In a high-valuation market, expect continued trims in frothy names to fund asymmetric bets like QXO. Current positioning sets up for 2026 resilience, blending growth and stability—track updates on ValueSense.

FAQ about Samantha McLemore's Patient Capital Portfolio

Q: What are the most significant changes in Samantha McLemore's Q3 2025 portfolio?

A: Key moves include a massive "Add 93.49%" to UNH (now 5.1%), "Add 4.35%" to RPRX 4.4%, and reductions like "Reduce 3.05%" in NCLH and "Reduce 2.62%" in C, reflecting healthcare conviction and cyclical caution.

Q: Why does Patient Capital maintain 48% concentration in its top 10 holdings?

A: This level balances high-conviction bets on moats like GOOGL and UNH with 41-position diversification, enabling outsized returns from quality while managing risk—low 7.3% turnover supports long-term focus.

Q: What sectors dominate Samantha McLemore's strategy?

A: Technology (GOOGL, AMZN, NVDA, META) and healthcare (UNH, RPRX, CVS) lead, comprising the portfolio core for growth and resilience, with selective financials (C) and consumer plays (NCLH, QXO) adding targeted exposure.

Q: How can I track and follow Patient Capital Management's portfolio?

A: Monitor quarterly 13F filings on the SEC site or use ValueSense's superinvestor tracker at https://valuesense.io/superinvestors/patient-capital for real-time analysis, historical changes, and visualizations—note the 45-day reporting lag means positions may evolve post-filing.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!