Sarah Ketterer - Causeway Capital Management Llc Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

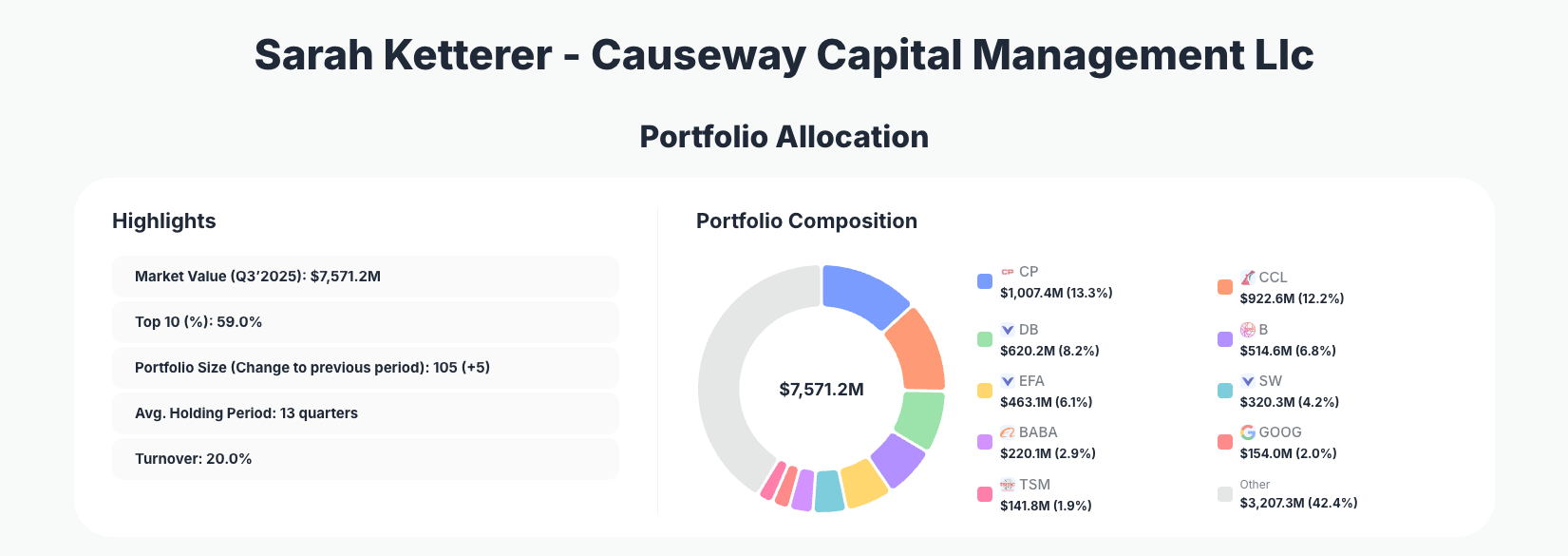

Sarah Ketterer - Causeway Capital Management Llc continues to execute a disciplined global value strategy, tilting toward cyclicals, financials, and international equities. Their Q3’2025 portfolio shows a $7.57B collection of 105 positions, with notable trims in long-held financials and tech-related names and aggressive additions to travel, industrials, and broad international exposure via an MSCI EAFE ETF.

Explore Sarah Ketterer – Causeway Capital full Q3’2025 portfolio on ValueSense

The Big Picture: Global Value with Selective Concentration

Portfolio Highlights (Q3 2025): - Market Value: $7,571.2M

- Top 10 Holdings: 59.0%

- Portfolio Size: 105 +5 positions

- Average Holding Period: 13 quarters

- Turnover: 20.0%

Causeway’s Q3’2025 portfolio is meaningfully concentrated at the top, with 59.0% of capital in the 10 largest positions despite holding 105 names overall. This reflects a barbell approach: high-conviction core stakes like Canadian rail, cruise lines, European banking, and industrials, complemented by a long tail of smaller positions for diversification and idea incubation.

An average holding period of 13 quarters underscores a long-term orientation—roughly three years per position—while 20.0% turnover shows that Ketterer is willing to rebalance and rotate as valuations and fundamentals shift. Within this framework, the large increase in international exposure via an MSCI EAFE ETF and targeted moves in companies like Carnival, Deutsche Bank, and Smurfit Westrock highlight an active yet valuation-driven process across the Causeway Capital portfolio.

The addition of five new positions this quarter (portfolio size 105, up from 100) suggests Ketterer is seeing broader opportunity in global value stocks, particularly outside the U.S., while still anchoring the Causeway Capital Management portfolio in a relatively small group of high-weighted names that drive overall performance.

Top Holdings Overview: Cyclicals, Financials, and Global Tech Leaders

The portfolio is led by Canadian transportation, global travel, and European financials. At the top, Canadian rail operator Canadian Pacific Railway Limited (CP) represents 13.3% of the portfolio and remains a cornerstone position despite a Reduce 7.89% action in Q3’2025, indicating some profit-taking or risk management rather than a loss of conviction. Close behind, cruise operator Carnival Corporation & plc (CCL) stands at 12.2% after an Add 9.56% move, signaling growing confidence in a continued recovery in leisure travel and cyclical demand.

European banking remains a major theme: Deutsche Bank AG (DB) accounts for 8.2% of the portfolio even after a Reduce 8.78% adjustment, suggesting risk is being trimmed while maintaining significant exposure. U.S. industrial and aerospace supplier Barnes Group Inc. (B) sits at 6.8%, with a notable Reduce 11.10% that may reflect valuation discipline or a re-assessment of cyclical risk.

One of the most striking moves is the massive allocation to international developed markets via the ISHARES MSCI EAFE ETF (ticker “_” in the filing), now 6.1% of the portfolio after an extraordinary Add 70,110.46%. This indicates a decisive top-down bet on non-U.S. equities and a desire to quickly scale exposure through a broad ETF rather than individual security selection for that slice of capital.

Packaging and paper giant Smurfit Westrock Plc (SW) at 4.2% benefited from an Add 7.23%, pointing to increased confidence in global packaging demand and synergy realization in the combined business. In China tech, Alibaba Group Holding Limited (BABA) remains a meaningful 2.9% holding despite a Reduce 0.89% trim—effectively a minor position right-sizing rather than a strategic exit.

In U.S. large-cap tech, Alphabet Inc. (GOOG) is a 2.0% position that saw a sharper Reduce 12.39%, showing willingness to lock in gains or redeploy capital from mega-cap growth into more traditional value and cyclical names. Semiconductor leader Taiwan Semiconductor Manufacturing Company Limited (TSM) at 1.9% was modestly cut (Reduce 1.94%), again a small adjustment rather than a thesis change.

Rounding out the key changes, U.S. banking giant Citigroup Inc. (C) represents 1.3% of the portfolio after a sizeable Reduce 20.79%, signaling a meaningful risk reduction in U.S. money-center banks while retaining exposure to European financials like Deutsche Bank.

Across these 10–11 highlighted names, Ketterer is clearly rotating within cyclicals and financials, scaling international exposure via ETF, and trimming some mega-cap tech while still keeping a diversified global footprint.

What the Portfolio Reveals About Causeway’s Current Strategy

Several strategic themes emerge from the Q3’2025 positioning:

- Global value tilt with cyclical exposure

Heavy allocations to Canadian Pacific Railway (CP), Carnival (CCL), Barnes Group (B), and Smurfit Westrock (SW) show a clear bias toward economically sensitive businesses that can benefit from continued global growth and reopening dynamics. - International and non-U.S. focus

The outsized Add 70,110.46% to the ISHARES MSCI EAFE ETF (6.1% of the portfolio) and major stakes in Deutsche Bank (DB), TSMC (TSM), and Alibaba (BABA) highlight Causeway’s long-standing specialization in international and emerging markets value. - Measured de-risking in financials and mega-cap tech

Reductions in DB, C, GOOG, and TSM suggest profit-taking and risk management rather than wholesale sector exits, consistent with a value manager that emphasizes valuation discipline. - Long-term orientation with active rebalancing

A 13-quarter average holding period paired with 20.0% turnover indicates that while Causeway typically holds positions for years, the team actively “nudges” position sizes up or down as fundamentals, prices, and relative value change.

Overall, the Q3’2025 landscape for the Causeway Capital portfolio is one of selective risk-on in global cyclicals and non-U.S. equities, funded in part by trims to big-cap tech and certain financials.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Canadian Pacific Railway Limited (CP) | $1,007.4M | 13.3% | Reduce 7.89% |

| Carnival Corporation & plc (CCL) | $922.6M | 12.2% | Add 9.56% |

| Deutsche Bank AG (DB) | $620.2M | 8.2% | Reduce 8.78% |

| Barnes Group Inc. (B) | $514.6M | 6.8% | Reduce 11.10% |

| ISHARES MSCI EAFE ETF | $463.1M | 6.1% | Add 70,110.46% |

| Smurfit Westrock Plc (SW) | $320.3M | 4.2% | Add 7.23% |

| Alibaba Group Holding Limited (BABA) | $220.1M | 2.9% | Reduce 0.89% |

| Alphabet Inc. (GOOG) | $154.0M | 2.0% | Reduce 12.39% |

| Taiwan Semiconductor Manufacturing Company Limited (TSM) | $141.8M | 1.9% | Reduce 1.94% |

The table underscores how dominant the top three positions are: CP, CCL, and DB together account for over one-third of the entire portfolio by value. This level of concentration reflects high conviction in specific companies and themes—North American rail, global cruise recovery, and European banking reform—while still maintaining sector and geographic diversification through names like Barnes Group, Smurfit Westrock, and the EAFE ETF.

At the same time, the inclusion of broad international exposure via ISHARES MSCI EAFE at 6.1% offers a counterbalance to single-stock risk, essentially diversifying a meaningful slice of capital across developed markets outside the U.S. Lower-weight positions in BABA, GOOG, and TSM provide exposure to secular growth in tech and semiconductors, but with position sizes that limit drawdown risk if sentiment reverses.

Investment Lessons from Sarah Ketterer and Causeway’s Global Value Approach

Investors studying the Q3’2025 Causeway positioning can draw several practical lessons:

- Concentrate where conviction is highest

Allocating over 10% each to CP and CCL shows that when Causeway deeply understands a business and its risk/reward, it is willing to size that position meaningfully. - Use ETFs tactically to express top-down views

The huge increase in ISHARES MSCI EAFE exposure illustrates how a fundamentally driven manager can quickly implement a macro or regional view—here, a bullish stance on developed ex-U.S. markets—without having to build dozens of new single-stock positions. - Trim, don’t toggle, when managing risk

Many actions this quarter are partial reductions—Reduce 7.89% in CP, Reduce 8.78% in DB, Reduce 12.39% in GOOG, and Reduce 1.94% in TSM—showing a preference for gradual size adjustments over binary in-or-out decisions. - Stay patient, but not static

A 13-quarter average holding period paired with 20.0% turnover teaches that long-term investing does not mean ignoring new information. Ketterer holds for years but still actively rebalances as risk/reward changes. - Blend value and selective growth

While Causeway is known for value and cyclicals, maintaining positions in GOOG and TSM demonstrates an understanding that high-quality growth franchises can also be attractive when valuations are reasonable.

Looking Ahead: What Comes Next for Causeway’s Portfolio?

From the current positioning, several forward-looking implications emerge:

- Room for more international deployment

With a substantial stake already in ISHARES MSCI EAFE, Causeway could further increase non-U.S. exposure via individual names if specific opportunities in Europe or Japan become compelling relative to the ETF basket. - Cyclical sensitivity to global growth

Heavy weights in rail, cruise lines, industrials, and packaging mean portfolio returns will likely be sensitive to economic data, travel trends, and industrial production. Continued global recovery would be a tailwind; a slowdown would test these convictions. - Potential for further trims in mega-cap tech

Having already reduced GOOG, Causeway might continue to reallocate from large U.S. growth into attractively valued cyclicals or international banks if valuation gaps widen. - Ongoing optimization within financials

The sharp Reduce 20.79% cut to Citigroup (C) but more moderate trim in DB suggests Causeway may continue to differentiate between banking franchises, adjusting country and balance sheet risk as regulatory and rate environments evolve.

Investors following the Causeway Capital Q3’2025 holdings should watch future 13F filings for whether the large EAFE ETF position is a long-term core stake or a bridge to more idiosyncratic international ideas.

FAQ about Sarah Ketterer – Causeway Capital Portfolio

Q: What were the biggest portfolio changes for Causeway in Q3’2025?

The most dramatic move was the Add 70,110.46% to the ISHARES MSCI EAFE ETF, now 6.1% of the portfolio. Other notable changes include adding 9.56% to Carnival (CCL) and reductions in Canadian Pacific (CP), Deutsche Bank (DB), Barnes Group (B), Alphabet (GOOG), TSMC (TSM), and Citigroup (C).

Q: How concentrated is the Causeway Capital portfolio?

Despite holding 105 positions, 59.0% of assets are in the top 10 holdings. The largest two positions—CP and CCL—alone represent over 25% of the portfolio, reflecting high conviction in a few core ideas.

Q: What is Sarah Ketterer’s typical holding period and trading style?

The average holding period is 13 quarters, indicating a long-term approach. At the same time, 20.0% turnover shows that Causeway actively rebalances—trimming winners, adding to laggards, and shifting between regions and sectors as valuations and fundamentals change.

Q: Which sectors or themes stand out in the Q3’2025 Causeway portfolio?

Key themes include global cyclicals (rail, cruise, industrials, packaging), international financials (Deutsche Bank), Chinese and U.S. tech (Alibaba, Alphabet, TSMC), and a major allocation to developed ex-U.S. markets via the ISHARES MSCI EAFE ETF.

Q: How can I track and follow Sarah Ketterer’s Causeway Capital portfolio?

You can follow Causeway’s holdings and quarterly 13F filing updates using ValueSense’s superinvestor tracker at Causeway Capital’s portfolio. Remember that 13F filings are reported with up to a 45-day lag after quarter-end, so positions may have changed since the reported date.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!