Security Analysis by Benjamin Graham and David Dodd

Welcome to the Value Sense Blog, your resource for insights on the stock market! You're reading a book review written by the valuesense.io team.

On our platform, you'll find stock research and insights across all sectors. Dive into our research products and learn more about our unique approach at valuesense.io

We offer over 360+ automated stock ideas, a free AI-powered stock screener, interactive stock charting tools, and more than 10 intrinsic value models — all designed to help investors find undervalued growth opportunities.

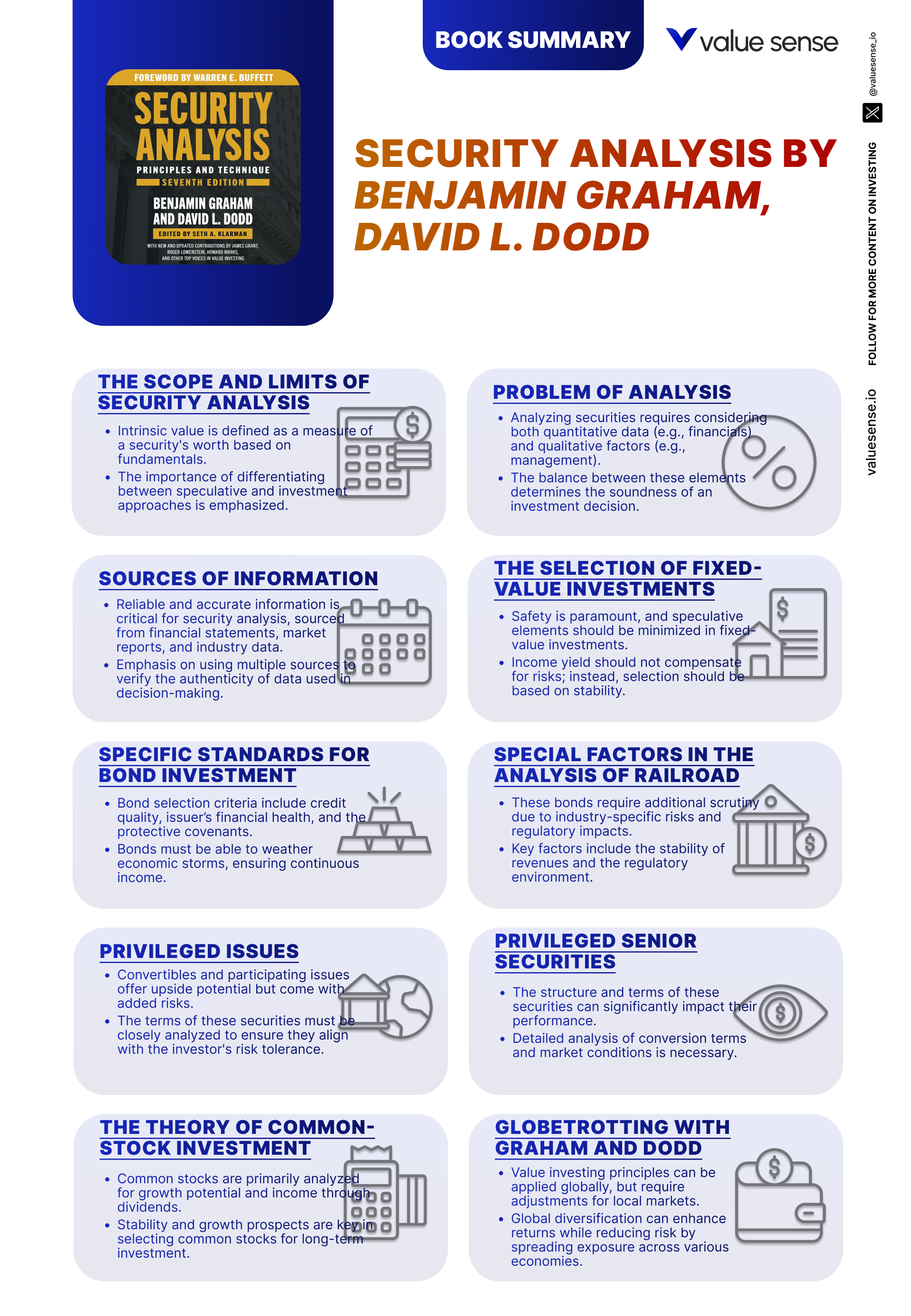

Book Overview

“Security Analysis,” authored by Benjamin Graham and David Dodd, stands as one of the most influential and enduring works in the field of investment literature. First published in 1934 during the depths of the Great Depression, this book established the foundational principles of value investing and professional security analysis. Graham, often referred to as the “father of value investing,” was a professor at Columbia Business School and an accomplished investor, while David Dodd was his trusted colleague and academic collaborator. Their combined expertise and rigorous approach to financial analysis have shaped generations of investors, including Warren Buffett, who famously described “Security Analysis” as his investing bible.

The historical context of the book’s publication is crucial. In the aftermath of the 1929 stock market crash, investors faced enormous uncertainty, widespread financial fraud, and a lack of standardized accounting practices. Graham and Dodd’s work emerged as a beacon of rationality, advocating for a disciplined, analytical approach grounded in the careful study of financial statements, intrinsic value, and the margin of safety. Their ideas were revolutionary at a time when speculation and hype dominated Wall Street, offering a systematic framework for separating sound investment from reckless gambling.

The main theme of “Security Analysis” is the rigorous evaluation of securities—both stocks and bonds—based on intrinsic value rather than market sentiment or speculation. Graham and Dodd meticulously dissect the process of analyzing financial statements, assessing management quality, and understanding the underlying value drivers of businesses. The book’s purpose is to empower investors to make informed, rational decisions, emphasizing that true investment is rooted in thorough analysis and a clear distinction between speculation and prudent capital allocation.

“Security Analysis” is considered a classic not only for its historical significance but also for its depth, detail, and practical applicability. It laid the groundwork for the entire field of value investing and continues to be referenced by professional investors, academics, and students alike. The book’s influence extends far beyond its era, with its core principles remaining relevant even in today’s complex and rapidly evolving markets. Its systematic approach to risk management, valuation, and financial statement analysis is unmatched in its scope and rigor.

This book is essential reading for anyone serious about investing—whether you are a professional analyst, portfolio manager, business student, or a self-directed investor seeking to build lasting wealth. What sets “Security Analysis” apart from other investment books is its comprehensive treatment of both fixed-income and equity securities, its insistence on a margin of safety, and its unwavering commitment to analytical discipline. While the language and examples may reflect its time, the underlying wisdom is timeless. For those willing to engage deeply with its concepts, “Security Analysis” offers a masterclass in rational investing and remains an indispensable guide for navigating the uncertainties of financial markets.

Key Themes and Concepts

At the heart of “Security Analysis” are several enduring themes that have shaped modern investment practice. Graham and Dodd’s work is not merely a technical manual but a philosophical treatise on the discipline of investing. The book’s core concepts—intrinsic value, the margin of safety, and the critical distinction between investment and speculation—reverberate through every chapter, offering a blueprint for rational decision-making in the face of market uncertainty.

These themes are interwoven throughout the book, each reinforcing the others. The authors argue that successful investing requires more than just quantitative analysis; it demands a mindset oriented toward skepticism, patience, and a willingness to question prevailing market narratives. By grouping the book’s 52 chapters into thematic areas, we can better appreciate the depth and breadth of Graham and Dodd’s insights. Below, we explore the most important themes that define “Security Analysis,” illustrating how they appear throughout the book and how they remain relevant for today’s investors.

- Intrinsic Value: The concept of intrinsic value is the cornerstone of security analysis. Graham and Dodd define intrinsic value as the underlying worth of a security, determined by careful analysis of its assets, earnings, dividends, and future prospects. This theme appears throughout the book, notably in chapters 1, 27, and 50. The authors stress that intrinsic value is not a precise figure but a range, reflecting the uncertainty inherent in forecasting future business performance. For investors, this means focusing on the fundamentals—book value, earnings power, and cash flows—rather than market price fluctuations. Practical application involves estimating a conservative range of value and investing only when the market price offers a significant discount, providing a margin of safety.

- Investment vs. Speculation: One of the most critical distinctions in “Security Analysis” is between investment and speculation. Graham and Dodd argue that true investment is characterized by thorough analysis, safety of principal, and an adequate return, while speculation is driven by market trends, rumors, or hope for quick profits. This theme is explored in chapters 4, 27, and 50, where the authors provide criteria for distinguishing between the two. The book warns against the dangers of speculation, emphasizing the importance of discipline and a long-term perspective. For modern investors, this means resisting the temptation to chase fads or hot stocks and instead focusing on sound, evidence-based decision-making.

- Margin of Safety: The margin of safety principle is perhaps Graham’s most famous contribution to investment thought. It refers to the practice of buying securities at a significant discount to their intrinsic value, thus providing a buffer against errors in analysis, unforeseen events, or market volatility. This theme is prominent in chapters 1, 8, and 50. The authors illustrate how a margin of safety can be achieved through conservative valuation, diversification, and a focus on high-quality assets. In practice, this means never stretching for yield or growth at the expense of safety, and always demanding a substantial discount before committing capital.

- Financial Statement Analysis: A rigorous approach to analyzing financial statements is central to “Security Analysis.” Graham and Dodd devote multiple chapters (31, 42, 43) to dissecting balance sheets, income statements, and cash flow statements. They emphasize the importance of understanding book value, earnings power, and the quality of reported profits. The book provides detailed checklists and examples for evaluating asset values, liabilities, and the sustainability of earnings. For investors, mastering financial statement analysis is essential for uncovering hidden risks and identifying undervalued opportunities. In today’s market, this means going beyond headline numbers and scrutinizing footnotes, off-balance-sheet items, and management assumptions.

- Market Inefficiencies: Graham and Dodd were among the first to recognize that markets are not always efficient. Chapters 50, 51, and 52 explore how discrepancies between market price and intrinsic value arise due to investor psychology, herd behavior, and information asymmetry. The authors argue that these inefficiencies create opportunities for disciplined investors willing to do the hard work of analysis. In the modern era, where information is abundant but attention is scarce, the ability to identify and exploit market mispricings remains a key source of alpha for value investors.

- Value Investing: The philosophy of value investing permeates the entire book. Graham and Dodd advocate for buying securities that are undervalued relative to their intrinsic worth, holding them patiently, and selling only when the price approaches or exceeds fair value. This approach is detailed in chapters 27, 50, and 52. The authors provide case studies and statistical evidence to support their thesis, demonstrating that value investing outperforms speculation over the long run. For today’s investor, value investing means maintaining discipline in the face of market exuberance, focusing on fundamentals, and avoiding the pitfalls of short-termism.

- Risk Management: Effective risk management is a recurring theme in “Security Analysis.” Chapters 4, 8, and 15 explore various dimensions of risk, from credit risk in bonds to the dangers of overpaying for growth in equities. Graham and Dodd emphasize diversification, conservative assumptions, and the avoidance of leverage as key tools for managing risk. They also stress the importance of understanding one’s own limitations and the limits of analysis. In practice, this means constructing a well-diversified portfolio, avoiding concentrated bets, and always being mindful of downside risk.

Book Structure: Major Sections

Part 1: Foundations of Security Analysis

This opening section, covering chapters 1 through 5, lays the intellectual groundwork for the entire book. Graham and Dodd introduce the fundamental principles of security analysis, beginning with the scope and limits of analysis, the definition and estimation of intrinsic value, and the crucial distinction between investment and speculation. These chapters also establish the importance of both qualitative and quantitative factors in evaluating securities, setting the stage for the detailed analytical techniques that follow.

Key concepts in this section include the recognition that intrinsic value is not a fixed number but a range based on careful analysis of a company’s assets, earnings, and prospects. The authors delve into the limitations of financial analysis, cautioning that even the best models are subject to error and uncertainty. They stress the need for discipline, skepticism, and a long-term orientation. Specific examples illustrate how investors can be misled by market hype or superficial analysis, reinforcing the necessity of rigorous, independent thinking. The section also introduces the concept of the margin of safety, which becomes a recurring motif throughout the book.

For investors, the practical application is clear: always begin with a thorough, methodical analysis of a security’s intrinsic value and avoid being swayed by market sentiment or short-term price movements. This means developing a repeatable process for evaluating companies, relying on both quantitative data and qualitative judgment. The lessons from this section are foundational for building an investment philosophy rooted in rationality and caution.

In today’s fast-moving markets, the principles established in these chapters are more relevant than ever. The temptation to chase speculative gains or follow the crowd remains strong, but Graham and Dodd’s insistence on analytical rigor and the separation of investment from speculation continues to provide a powerful antidote to irrational exuberance. Modern investors can benefit from revisiting these core ideas, especially as new asset classes and technologies introduce fresh sources of risk and uncertainty.

Part 2: Fixed-Value Investments

This thematic section encompasses chapters 6, 7, 8, 10, and 15, focusing on the analysis and selection of fixed-value investments such as bonds and preferred stocks. Graham and Dodd provide detailed criteria for evaluating the safety and yield of these instruments, emphasizing the importance of protective covenants, credit analysis, and the assessment of underlying collateral. The section also covers the unique challenges associated with preferred stocks, including dividend stability and the risk of default.

Key concepts include the establishment of minimum safety standards for bond investments, such as coverage ratios, asset backing, and the quality of issuer management. The authors provide statistical evidence and historical examples to show how neglecting these standards can lead to significant losses. They also discuss the role of protective provisions—such as sinking funds and restrictive covenants—in safeguarding investor interests. For preferred stocks, Graham and Dodd outline a methodology for assessing dividend sustainability and the adequacy of protective features.

Investors can apply these lessons by developing a checklist for evaluating fixed-income securities, focusing on creditworthiness, covenant strength, and the likelihood of timely interest and principal payments. This disciplined approach helps mitigate the risk of permanent capital loss and enhances the reliability of income streams. The section’s emphasis on conservative analysis is especially pertinent for those managing retirement portfolios or seeking stable returns in uncertain markets.

With today’s low-interest-rate environment and the proliferation of complex fixed-income products, the principles outlined in this section remain highly relevant. Modern investors must navigate a landscape filled with high-yield bonds, leveraged loans, and contingent convertible securities, making Graham and Dodd’s insistence on safety, due diligence, and protective covenants more important than ever. The enduring value of their approach is evident in the continued prevalence of credit crises and defaults, underscoring the need for rigorous fixed-income analysis.

Part 3: Common Stock Investment

Part 3 brings together chapters 27, 28, 29, 31, and 39, shifting focus to the theory and practice of common stock investment. Here, Graham and Dodd explore the factors that drive equity value, including the role of dividends, the analysis of earnings, and the interpretation of price-earnings ratios. The section also addresses the psychological and behavioral aspects of stock investing, highlighting the dangers of speculative mania and the importance of a disciplined, value-oriented approach.

The authors argue that dividends are a critical component of stock valuation, providing both a tangible return and a check on management’s capital allocation decisions. They dissect the relationship between earnings and market prices, cautioning against overreliance on short-term trends or accounting gimmicks. The section provides detailed guidance on assessing growth potential, evaluating management quality, and interpreting financial ratios. Graham and Dodd also stress the importance of diversification and the avoidance of overconcentration in any single security or sector.

For investors, the practical takeaway is to focus on companies with stable, growing dividends, strong earnings power, and reasonable valuations. This means conducting in-depth analysis of financial statements, assessing the sustainability of profits, and avoiding the temptation to chase high-flying stocks with little regard for fundamentals. The authors’ emphasis on patience and long-term thinking is particularly valuable for those seeking to build wealth through compounding rather than speculation.

In the current era of meme stocks, algorithmic trading, and market volatility, the lessons of this section are especially pertinent. The enduring relevance of Graham and Dodd’s approach is evident in the continued outperformance of value-oriented strategies over speculative ones in the long run. Investors who adhere to these principles are better equipped to navigate the noise of modern markets and avoid the pitfalls of herd behavior.

Part 4: Balance Sheet and Income Analysis

This section, covering chapters 42 through 45, delves deeply into the analysis of financial statements, with a particular focus on the balance sheet and income account. Graham and Dodd provide a comprehensive framework for assessing asset values, liabilities, and earnings power, emphasizing the importance of book value, liquidating value, and the quality of reported profits. The section also addresses the challenges of interpreting complex financial statements and the need for skepticism in the face of creative accounting.

The authors illustrate how balance-sheet analysis can reveal hidden strengths or weaknesses in a company’s financial position, such as excessive leverage, overvalued assets, or contingent liabilities. They provide detailed examples and case studies to show how careful scrutiny of financial statements can uncover undervalued opportunities or warn of impending trouble. The section also covers the limitations of book value as a measure of intrinsic worth, highlighting the need to adjust for intangible assets, off-balance-sheet items, and changes in accounting standards.

For investors, the practical application is to develop a systematic process for analyzing financial statements, including the use of checklists, ratio analysis, and scenario testing. This approach helps identify red flags, assess the sustainability of earnings, and estimate a company’s true economic value. The lessons from this section are particularly valuable for those investing in cyclical industries, turnaround situations, or companies with complex capital structures.

With the increasing complexity of modern financial reporting and the prevalence of non-GAAP metrics, the principles outlined in this section are more relevant than ever. Investors must remain vigilant against accounting manipulation, aggressive revenue recognition, and hidden liabilities. Graham and Dodd’s insistence on thorough, skeptical analysis provides a powerful defense against the risks of financial statement fraud and misrepresentation.

Part 5: Market Discrepancies and Value Investing

The final thematic section, encompassing chapters 50, 51, and 52, explores the discrepancies that often exist between market price and intrinsic value. Graham and Dodd analyze the psychological, structural, and informational factors that give rise to market inefficiencies, and they offer strategies for value investing in both domestic and global markets. This section synthesizes the book’s core themes, providing a roadmap for exploiting mispricings and achieving superior long-term returns.

The authors discuss the role of investor psychology, herd behavior, and market sentiment in driving prices away from fundamental value. They provide case studies and statistical evidence demonstrating that disciplined value investors can consistently outperform by purchasing securities when they are out of favor and selling when they become overvalued. The section also addresses the challenges and opportunities of investing in international markets, including currency risk, regulatory differences, and the need for local knowledge.

For investors, the practical lesson is to develop a process for identifying and capitalizing on market inefficiencies, such as screening for low price-to-book or price-to-earnings stocks, conducting deep fundamental research, and maintaining the discipline to act when opportunities arise. The authors emphasize the importance of patience, contrarian thinking, and the willingness to go against the crowd when warranted by the evidence.

In today’s globalized and information-rich markets, the principles of value investing and the exploitation of market discrepancies remain as relevant as ever. The proliferation of passive investing, algorithmic trading, and short-termism has, if anything, increased the opportunities for disciplined, long-term investors to find mispriced securities. Graham and Dodd’s insights provide a timeless guide for navigating the complexities of modern markets and achieving sustainable investment success.

Deep Dive: Essential Chapters

Chapter 1: The Scope and Limits of Security Analysis

Chapter 1 is critically important because it frames the entire discipline of security analysis, introducing the foundational concept of intrinsic value. The authors begin by defining the scope of security analysis, emphasizing that its primary goal is to estimate the intrinsic value of a security based on objective data rather than market sentiment. Graham and Dodd stress that while analysis can provide valuable insights, it is inherently limited by the quality of available information and the unpredictability of the future. They caution investors against overconfidence in their analytical abilities and highlight the need for humility and discipline.

Specific examples in this chapter illustrate how intrinsic value is derived from a careful assessment of a company’s assets, earnings, and prospects. Graham and Dodd provide early case studies showing the dangers of relying solely on market prices or superficial analysis. They quote: “The function of security analysis is primarily to appraise the safety and quality of the principal and interest or dividend, rather than to forecast future prices.” The authors use data from past market cycles to demonstrate how intrinsic value can diverge significantly from prevailing market prices, especially during periods of exuberance or panic.

For investors, the lessons are clear: always ground your decisions in a thorough analysis of intrinsic value, and recognize the limits of your knowledge. Concrete steps include developing a repeatable process for evaluating companies, focusing on fundamental data, and maintaining a skeptical attitude toward market narratives. Investors should avoid making decisions based solely on price trends or speculative forecasts and instead prioritize evidence-based analysis.

Historically, the principles outlined in this chapter have proven their worth during periods of market turmoil, such as the dot-com bubble and the 2008 financial crisis. In both cases, investors who focused on intrinsic value were better able to avoid catastrophic losses and capitalize on opportunities created by market dislocations. Today, with the rise of algorithmic trading and information overload, the need for disciplined, fundamental analysis is greater than ever. Graham and Dodd’s insights remain a vital guide for navigating uncertainty and building lasting wealth.

Chapter 4: Distinctions Between Investment and Speculation

This chapter is essential because it establishes the critical boundary between investment and speculation—a distinction that underpins the entire philosophy of Graham and Dodd. The authors provide clear criteria for what constitutes an investment: “An investment operation is one which, upon thorough analysis, promises safety of principal and an adequate return. Operations not meeting these requirements are speculative.” This definition has become a touchstone for value investors, serving as a safeguard against the temptations of market speculation.

Graham and Dodd use numerous examples to illustrate the dangers of speculation, including historical episodes of market mania and subsequent crashes. They analyze the behavior of investors during periods of exuberance, showing how the abandonment of analytical discipline leads to inflated asset prices and inevitable losses. The chapter includes data on the performance of speculative versus investment-grade securities, demonstrating that speculation rarely leads to sustainable wealth creation. Quotes such as “The distinction between investment and speculation is as important today as it was in the past” underscore the enduring relevance of this lesson.

Investors can apply these insights by developing clear criteria for investment decisions, such as requiring a margin of safety, conducting thorough due diligence, and focusing on long-term value rather than short-term price movements. Practical steps include creating an investment policy statement, avoiding leverage, and resisting the urge to chase hot stocks or market trends. By adhering to the principles outlined in this chapter, investors can protect themselves from the psychological and financial risks of speculation.

The historical context of this chapter is especially relevant given the recurring cycles of boom and bust in financial markets. From the South Sea Bubble to the recent cryptocurrency mania, the dangers of speculation remain ever-present. Graham and Dodd’s framework provides a timeless defense against these risks, helping investors maintain discipline and achieve consistent, long-term success.

Chapter 8: Specific Standards for Bond Investment

Chapter 8 holds critical importance as it outlines the specific criteria for selecting bonds, a cornerstone of fixed-income investing. Graham and Dodd argue that the primary objective in bond investment is the preservation of capital, and they provide detailed standards for evaluating the safety and yield of bond issues. These standards include minimum coverage ratios, asset backing, and the quality of issuer management. The chapter also addresses the importance of credit analysis and the role of protective covenants in safeguarding investor interests.

Examples in this chapter include statistical data on bond defaults, historical case studies of failed bond issues, and analysis of the protective features that distinguish high-quality bonds from speculative ones. The authors provide checklists for evaluating bond safety, such as requiring interest coverage ratios above a certain threshold and insisting on adequate collateral. Quotes like “The essence of bond selection is the avoidance of loss” encapsulate the conservative approach advocated by Graham and Dodd.

Investors can apply these lessons by adopting a disciplined, rules-based approach to bond selection. This includes conducting thorough credit analysis, evaluating the strength of protective covenants, and avoiding issues with inadequate coverage or weak collateral. Practical steps involve using financial ratios, reviewing bond indentures, and monitoring issuer financial health on an ongoing basis. By adhering to these standards, investors can reduce the risk of default and enhance the reliability of their fixed-income portfolios.

Historically, the principles in this chapter have been validated during periods of credit crisis, such as the Great Depression and the 2008 financial meltdown. Investors who ignored Graham and Dodd’s standards often suffered significant losses, while those who prioritized safety and due diligence fared much better. In today’s environment of low yields and complex fixed-income products, the need for rigorous bond analysis is as great as ever.

Chapter 15: Technique of Selecting Preferred Stocks for Investment

This chapter is crucial because it addresses the methodology for selecting preferred stocks, a key component in many income-oriented portfolios. Graham and Dodd provide a systematic approach to evaluating preferred stocks, focusing on dividend stability, protective provisions, and the issuer’s financial strength. The chapter highlights the unique risks associated with preferred stocks, such as the potential for dividend suspension and the lack of voting rights, and offers strategies for mitigating these risks.

The authors use real-world examples to illustrate the importance of analyzing dividend coverage, reviewing the issuer’s balance sheet, and assessing the presence of protective features such as cumulative dividends and sinking funds. Data on historical default rates and dividend suspensions reinforce the need for careful analysis. Quotes like “The safety of a preferred stock rests primarily on the ability of the company to maintain earnings at a level sufficient to cover dividends” capture the essence of the chapter’s message.

For investors, the practical steps include conducting detailed financial analysis of the issuer, reviewing the terms of preferred stock issues, and prioritizing securities with strong protective provisions. This means favoring issues with cumulative dividends, adequate coverage ratios, and robust covenants. Investors should also diversify across issuers and sectors to reduce the impact of individual defaults or dividend cuts.

Preferred stocks have played a significant role in both institutional and retail portfolios, especially during periods of low interest rates. The lessons from this chapter remain highly relevant for modern investors seeking stable income with an acceptable risk profile. Graham and Dodd’s analytical framework provides a valuable toolkit for navigating the complexities of the preferred stock market and avoiding common pitfalls.

Chapter 27: The Theory of Common-Stock Investment

Chapter 27 is foundational because it lays out the theoretical underpinnings of common stock investment, a major focus of the book. Graham and Dodd argue that the value of a common stock is derived from its earning power and dividend-paying capacity, rather than speculative hopes for price appreciation. They emphasize the importance of analyzing a company’s fundamentals, including its profitability, growth prospects, and financial stability, as the basis for investment decisions.

The authors provide detailed examples of companies with strong dividend records and consistent earnings growth, contrasting them with speculative stocks that rely on unproven business models or fleeting trends. They analyze historical data on stock performance, showing that companies with stable dividends and solid fundamentals tend to outperform over the long run. Quotes such as “The value of a common stock depends in the last analysis upon what it will earn and pay out in the future” encapsulate the chapter’s core message.

For investors, the practical application involves focusing on companies with a track record of profitability, conservative financial management, and a commitment to returning capital to shareholders. This means analyzing dividend histories, reviewing earnings reports, and assessing the sustainability of growth. Investors should avoid the temptation to chase speculative growth stories and instead prioritize businesses with proven value-creation capabilities.

The principles outlined in this chapter have stood the test of time, as evidenced by the long-term outperformance of dividend-paying stocks and value-oriented strategies. In an era of low interest rates and market volatility, the emphasis on fundamentals and income remains as relevant as ever. Graham and Dodd’s framework provides a robust foundation for building resilient equity portfolios that can weather the ups and downs of the market cycle.

---

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

---

Chapter 31: Analysis of the Income Account

This chapter is essential because it provides a detailed approach to analyzing income statements, which is critical for evaluating a company’s profitability and earning power. Graham and Dodd break down the components of the income account, including revenues, expenses, and net income, and offer guidance on identifying sustainable profits versus temporary or artificially inflated earnings. The chapter emphasizes the importance of understanding the quality and sources of reported income.

The authors use specific company examples and historical data to illustrate how revenue recognition, expense management, and nonrecurring items can distort the true picture of profitability. They highlight the risks of relying on headline earnings and stress the need to adjust for one-time gains, write-offs, and changes in accounting policies. Quotes such as “The analyst must be on guard against the inclusion of nonrecurring profits in the calculation of normal earning power” underscore the importance of skepticism and diligence.

For investors, the practical steps include conducting a line-by-line review of income statements, adjusting for nonrecurring items, and focusing on the sustainability of core operating profits. This means looking beyond reported net income to assess the underlying drivers of profitability and identifying potential red flags. Investors should also compare reported earnings to cash flows and peer benchmarks to ensure consistency and reliability.

In the modern era, with the proliferation of non-GAAP metrics and aggressive accounting practices, the lessons from this chapter are more important than ever. Investors who master the art of income statement analysis are better equipped to identify high-quality businesses, avoid value traps, and make informed investment decisions. Graham and Dodd’s analytical framework remains a cornerstone of sound fundamental analysis.

Chapter 42: Balance-Sheet Analysis: Significance of Book Value

Chapter 42 is critically important because it highlights the role of balance-sheet analysis in determining a company’s financial stability and intrinsic value. Graham and Dodd argue that book value—the net asset value of a company as reported on the balance sheet—is a key indicator of financial strength, especially for asset-intensive businesses. They provide a detailed methodology for assessing asset quality, liability structure, and the adequacy of shareholder equity.

The authors use real-world examples to show how balance-sheet analysis can uncover hidden strengths or weaknesses, such as undervalued assets, excessive leverage, or off-balance-sheet liabilities. They discuss the limitations of book value, including the impact of accounting policies and the need to adjust for intangible assets or obsolete inventory. Quotes like “Book value is an important starting point in the analysis of intrinsic worth, but it must be interpreted with care” capture the nuanced approach advocated by Graham and Dodd.

For investors, the practical application involves conducting a thorough review of balance sheets, adjusting reported figures as necessary, and comparing asset and liability structures across peers. This means looking for companies with strong equity cushions, low debt levels, and high-quality assets. Investors should also be alert to signs of financial engineering or aggressive accounting that may inflate reported book value.

With the increasing complexity of corporate balance sheets and the rise of intangible asset-driven business models, the principles in this chapter are more relevant than ever. Investors who understand the nuances of balance-sheet analysis are better positioned to assess financial risk, identify undervalued opportunities, and avoid companies with hidden liabilities or weak capital structures.

Chapter 50: Discrepancies Between Price and Value

This chapter is pivotal because it explores the critical concept of market inefficiencies, which is central to the practice of value investing. Graham and Dodd analyze the factors that cause market prices to diverge from intrinsic value, including investor psychology, herd behavior, and information asymmetry. They provide a framework for identifying and exploiting these discrepancies, arguing that disciplined investors can achieve superior returns by buying undervalued securities and selling overvalued ones.

The authors use statistical evidence and historical case studies to demonstrate the persistence of mispricings in financial markets. They analyze episodes of market panic and euphoria, showing how fear and greed can drive prices far from fundamental value. Quotes such as “The market is often wrong in its appraisal of securities, and these errors create opportunities for the alert analyst” encapsulate the chapter’s central message.

For investors, the practical steps include developing screening tools to identify undervalued stocks, conducting deep fundamental research, and maintaining the discipline to act when opportunities arise. This means having the patience to wait for mispricings and the courage to go against the crowd when warranted by the evidence. Investors should also be prepared to hold positions for extended periods, as market corrections can take time to play out.

The relevance of this chapter is underscored by the continued prevalence of market bubbles, crashes, and irrational price movements. From the tech bubble of the late 1990s to the meme stock mania of 2021, the lessons of Graham and Dodd remain as pertinent as ever. Investors who embrace the discipline of value investing and focus on intrinsic value are better equipped to navigate the noise and volatility of modern markets.

Chapter 52: Market Analysis and Security Analysis

Chapter 52 is significant because it integrates market analysis with security analysis, offering a comprehensive approach to investment decision-making. Graham and Dodd argue that while security analysis focuses on the intrinsic value of individual securities, market analysis considers broader trends, cycles, and sentiment. The chapter emphasizes the importance of combining both perspectives to develop a holistic investment strategy.

The authors provide examples of how market trends can impact security prices, even when fundamentals remain unchanged. They discuss the limitations of technical analysis and caution against overreliance on market forecasts. Quotes such as “The intelligent investor must recognize that market trends can influence prices in the short run, but intrinsic value will ultimately assert itself” highlight the need for balance and perspective.

For investors, the practical application involves using market analysis as a tool for timing entry and exit points, managing risk, and understanding the broader context in which individual securities operate. This means monitoring economic indicators, sentiment measures, and market cycles, while remaining anchored in fundamental analysis. Investors should avoid making decisions based solely on market trends and instead use them to complement a rigorous security analysis process.

In the modern era, with the proliferation of quantitative and algorithmic trading strategies, the integration of market and security analysis is more important than ever. Investors who can synthesize both approaches are better positioned to capitalize on opportunities, manage risk, and achieve consistent long-term returns. Graham and Dodd’s comprehensive framework remains a touchstone for thoughtful, evidence-based investing in a complex and dynamic market environment.

Practical Investment Strategies

- Strategy 1: Intrinsic Value Estimation: Begin by collecting and analyzing a company’s financial statements—balance sheet, income statement, and cash flow statement. Estimate intrinsic value by calculating normalized earnings, adjusting for one-time items, and applying a conservative earnings multiple or discounted cash flow model. Cross-check the result with book value and asset-based valuations. Only consider investing if the market price is significantly below your estimated intrinsic value, providing a clear margin of safety. Regularly update your valuation as new information becomes available.

- Strategy 2: Margin of Safety Application: Always require a substantial margin of safety before making any investment. For stocks, this means buying only when the price is at least 20-40% below your conservative estimate of intrinsic value. For bonds, insist on strong coverage ratios and protective covenants. Use screening tools to identify candidates that meet these thresholds, and avoid stretching for yield or growth at the expense of safety. This approach helps protect against analytical errors, unforeseen events, and market volatility.

- Strategy 3: Fixed-Income Security Selection: Develop a checklist for evaluating bonds and preferred stocks. Assess creditworthiness by reviewing coverage ratios, asset backing, and issuer management quality. Prioritize securities with strong protective provisions, such as sinking funds, cumulative dividends, and restrictive covenants. Diversify across issuers, sectors, and maturities to reduce risk. Monitor credit ratings and issuer financial health regularly, and be prepared to exit positions if safety deteriorates.

- Strategy 4: Dividend and Earnings Analysis: Focus on companies with a consistent track record of dividend payments and earnings growth. Analyze dividend coverage ratios, payout trends, and the sustainability of profits. Avoid companies with erratic or unsustainable dividends, as well as those that rely heavily on nonrecurring income. Use peer comparisons and historical data to benchmark performance. This strategy helps identify high-quality businesses that can compound capital over time.

- Strategy 5: Financial Statement Forensics: Go beyond surface-level analysis by conducting a forensic review of financial statements. Scrutinize footnotes, off-balance-sheet items, and management assumptions. Adjust reported figures for nonrecurring items, aggressive accounting, and changes in accounting policies. Compare reported earnings to cash flows and peer benchmarks. This approach helps uncover hidden risks and avoid value traps.

- Strategy 6: Exploiting Market Inefficiencies: Develop a systematic process for identifying and capitalizing on market mispricings. Use value screens—such as low price-to-book, price-to-earnings, or enterprise value-to-EBITDA ratios—to generate candidate lists. Conduct deep fundamental research to validate opportunities, and act decisively when evidence supports a clear discrepancy between price and value. Maintain patience and discipline, as market corrections may take time to materialize.

- Strategy 7: Risk Management and Diversification: Construct portfolios with broad diversification across sectors, asset classes, and geographies. Limit position sizes to avoid overconcentration, and use stop-losses or hedges where appropriate. Regularly review and rebalance the portfolio to maintain desired risk exposures. Avoid leverage and speculative instruments that can amplify losses. This approach helps protect capital and smooth returns over time.

- Strategy 8: Integrating Market and Security Analysis: Combine fundamental security analysis with an awareness of market trends, cycles, and sentiment. Use economic indicators, technical analysis, and macro data to inform timing and risk management decisions, but always anchor investment choices in intrinsic value. This integrated approach allows for more effective portfolio management and helps avoid common behavioral pitfalls.

Modern Applications and Relevance

The principles laid out in “Security Analysis” are as relevant today as they were at the time of its publication, despite the dramatic changes in financial markets over the past nine decades. The core ideas—intrinsic value, margin of safety, and rigorous analysis—provide a timeless framework for navigating uncertainty and complexity. In an era characterized by rapid technological innovation, the proliferation of new asset classes, and unprecedented market volatility, Graham and Dodd’s insistence on discipline and skepticism is more important than ever.

Since the book’s publication, the investment landscape has evolved significantly. Advances in information technology have democratized access to data, while the rise of passive investing and algorithmic trading has transformed market dynamics. Accounting standards have become more standardized, and regulatory oversight has improved. However, the fundamental challenge of distinguishing investment from speculation remains unchanged. The temptation to chase short-term gains, follow the crowd, or rely on superficial analysis continues to lead investors astray.

What remains timeless is the need for a disciplined, evidence-based approach to investing. The proliferation of non-GAAP metrics, creative accounting, and financial engineering has only increased the importance of mastering financial statement analysis and maintaining a healthy skepticism toward management claims. Modern examples of Graham and Dodd’s principles in action include the resurgence of value investing after the bursting of the dot-com bubble, the success of investors like Warren Buffett and Seth Klarman, and the ongoing opportunities created by market overreactions and mispricings.

To adapt classic advice to current conditions, investors should leverage modern tools—such as advanced screening software, data analytics, and global research platforms—while remaining anchored in fundamental analysis. The ability to synthesize quantitative data with qualitative judgment is more valuable than ever, as is the discipline to act independently of market sentiment. By combining the timeless wisdom of “Security Analysis” with contemporary techniques, investors can build resilient portfolios capable of withstanding the shocks and surprises of the modern financial world.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Implementation Guide

- Conduct a Thorough Self-Assessment: Begin by evaluating your investment goals, risk tolerance, time horizon, and areas of expertise. Determine whether you are best suited for fixed-income, equity, or a blended approach. Create a written investment policy statement that outlines your objectives and constraints, serving as a guide for future decisions.

- Develop a Research and Analysis Process (1-2 weeks): Establish a repeatable process for analyzing securities, including gathering financial statements, conducting ratio analysis, and estimating intrinsic value. Use checklists to ensure consistency and reduce the risk of oversight. Allocate time each week for research, and maintain a database of analyzed companies for future reference.

- Construct a Diversified Portfolio (2-4 weeks): Build a portfolio that reflects your risk tolerance and investment philosophy. Diversify across sectors, asset classes, and geographies to mitigate risk. Use allocation guidelines—such as limiting any single position to no more than 5% of total capital—and adjust exposures based on your assessment of value and risk.

- Implement Ongoing Portfolio Management (Monthly/Quarterly): Regularly review portfolio holdings, monitor financial performance, and reassess intrinsic value estimates. Rebalance positions as necessary to maintain desired risk exposures and capitalize on new opportunities. Establish a review schedule—monthly for high-conviction positions, quarterly for the broader portfolio—to ensure discipline and consistency.

- Pursue Continuous Improvement (Ongoing): Stay informed about developments in accounting standards, industry trends, and investment theory. Read widely—books, academic papers, investor letters—and participate in professional networks or online forums. Use tools such as the Value Sense screener, financial modeling software, and data analytics platforms to enhance your research capabilities. Regularly revisit and refine your investment process based on new insights and experiences.

--- ---

10+ Free intrinsic value tools

For investors looking to find a stock's fair value, our analytics team has you covered with intrinsic value tools:

📍 Free Intrinsic Value Calculator

📍 Reverse DCF & DCF value tools

📍 Peter Lynch Fair Value Calculator

📍 Ben Graham Fair Value Calculator

📍 Relative Value tool

...and plenty more.

🔍 Explore all these tools for free on the Value Sense platform and start discovering what your favorite stocks are really worth.

FAQ: Common Questions About Security Analysis

1. Why is “Security Analysis” considered the definitive book on value investing?

“Security Analysis” is regarded as the definitive book on value investing because it established the foundational principles of intrinsic value, margin of safety, and rigorous financial analysis. Graham and Dodd’s systematic approach has influenced generations of investors, including Warren Buffett. The book’s depth, detail, and emphasis on discipline set it apart from other investment texts, making it a timeless guide for both professionals and self-directed investors.

2. How can modern investors apply the lessons from “Security Analysis” in today’s markets?

Modern investors can apply the lessons by focusing on fundamental analysis, estimating intrinsic value, and demanding a margin of safety before committing capital. The principles of diversification, risk management, and skepticism toward market hype remain as relevant as ever. By combining classic analysis with modern tools—such as advanced screeners and data analytics—investors can identify and capitalize on market inefficiencies.

3. What is the difference between investment and speculation according to Graham and Dodd?

According to Graham and Dodd, an investment is an operation that, after thorough analysis, promises safety of principal and an adequate return. Speculation, on the other hand, involves decisions driven by market trends, rumors, or the hope of quick profits without sufficient analysis. The authors warn that speculation exposes investors to significant risk and rarely leads to sustainable wealth creation.

4. Why is the margin of safety principle so important?

The margin of safety principle is crucial because it provides a buffer against analytical errors, unforeseen events, and market volatility. By insisting on a significant discount to intrinsic value, investors reduce the risk of permanent capital loss. This disciplined approach allows for more consistent, long-term success, even in unpredictable or turbulent markets.

5. Is “Security Analysis” still relevant given the rise of passive investing and modern financial technology?

Yes, “Security Analysis” is more relevant than ever. While passive investing and technology have changed market dynamics, the need for fundamental analysis, risk management, and independent thinking remains unchanged. The book’s core principles help investors navigate complexity, avoid speculative excesses, and identify undervalued opportunities in any market environment.