Seeking Wisdom: From Darwin to Munger by Peter Bevelin

Welcome to the Value Sense Blog, your resource for insights on the stock market! You're reading a book review written by the valuesense.io team.

On our platform, you'll find stock research and insights across all sectors. Dive into our research products and learn more about our unique approach at valuesense.io

We offer over 360+ automated stock ideas, a free AI-powered stock screener, interactive stock charting tools, and more than 10 intrinsic value models — all designed to help investors find undervalued growth opportunities.

Book Overview

Peter Bevelin’s “Seeking Wisdom: From Darwin to Munger” is a modern classic in the world of decision-making, behavioral finance, and value investing. Bevelin, a Swedish investor and author, is renowned for his deep study of multidisciplinary thinking and the mental models that drive rational decision-making. Drawing inspiration from the likes of Charles Darwin, Charlie Munger, and Warren Buffett, Bevelin’s work bridges the gap between evolutionary biology, psychology, and sound investment practice. His unique approach has made “Seeking Wisdom” a favorite among professional investors, business leaders, and lifelong learners seeking a competitive edge in complex environments.

First published in 2003, “Seeking Wisdom” emerged during a period of renewed interest in behavioral finance and cognitive psychology, following the dot-com bubble’s burst. At a time when investors were rethinking traditional models and searching for more robust frameworks, Bevelin’s book offered an accessible yet profound synthesis of scientific research, historical anecdotes, and practical investment wisdom. The book’s multidisciplinary scope reflects the intellectual curiosity of its primary muse, Charlie Munger, vice chairman of Berkshire Hathaway, whose advocacy for “worldly wisdom” and mental models permeates every chapter.

The central theme of “Seeking Wisdom” is the relentless pursuit of better thinking. Bevelin argues that understanding the biological, psychological, and environmental factors that shape our decisions is essential for avoiding costly mistakes — in investing and in life. The book systematically explores how our evolutionary heritage, cognitive biases, and flawed heuristics often lead us astray, and how we can counteract these tendencies through deliberate practice, scientific reasoning, and the use of practical checklists and mental models.

What sets “Seeking Wisdom” apart from other investment books is its breadth and depth. Rather than focusing solely on financial markets, Bevelin draws lessons from biology, psychology, mathematics, and history, showing how the same patterns of error and insight apply across disciplines. The book is peppered with memorable quotes, real-world case studies, and actionable frameworks, making it both intellectually stimulating and highly practical. This multidimensional approach makes the book invaluable not only for investors but for anyone seeking to improve their decision-making — from executives to students to policymakers.

“Seeking Wisdom” is considered essential reading for value investors, behavioral economists, and anyone interested in rational thought. It stands out for its clarity, its integration of diverse fields, and its emphasis on learning from the successes and failures of others. If you’re looking for a book that will challenge your assumptions, expand your mental toolkit, and provide actionable strategies for navigating uncertainty, “Seeking Wisdom” is a must-read. Its enduring relevance and practical insights ensure it will remain a cornerstone of intelligent investing for years to come.

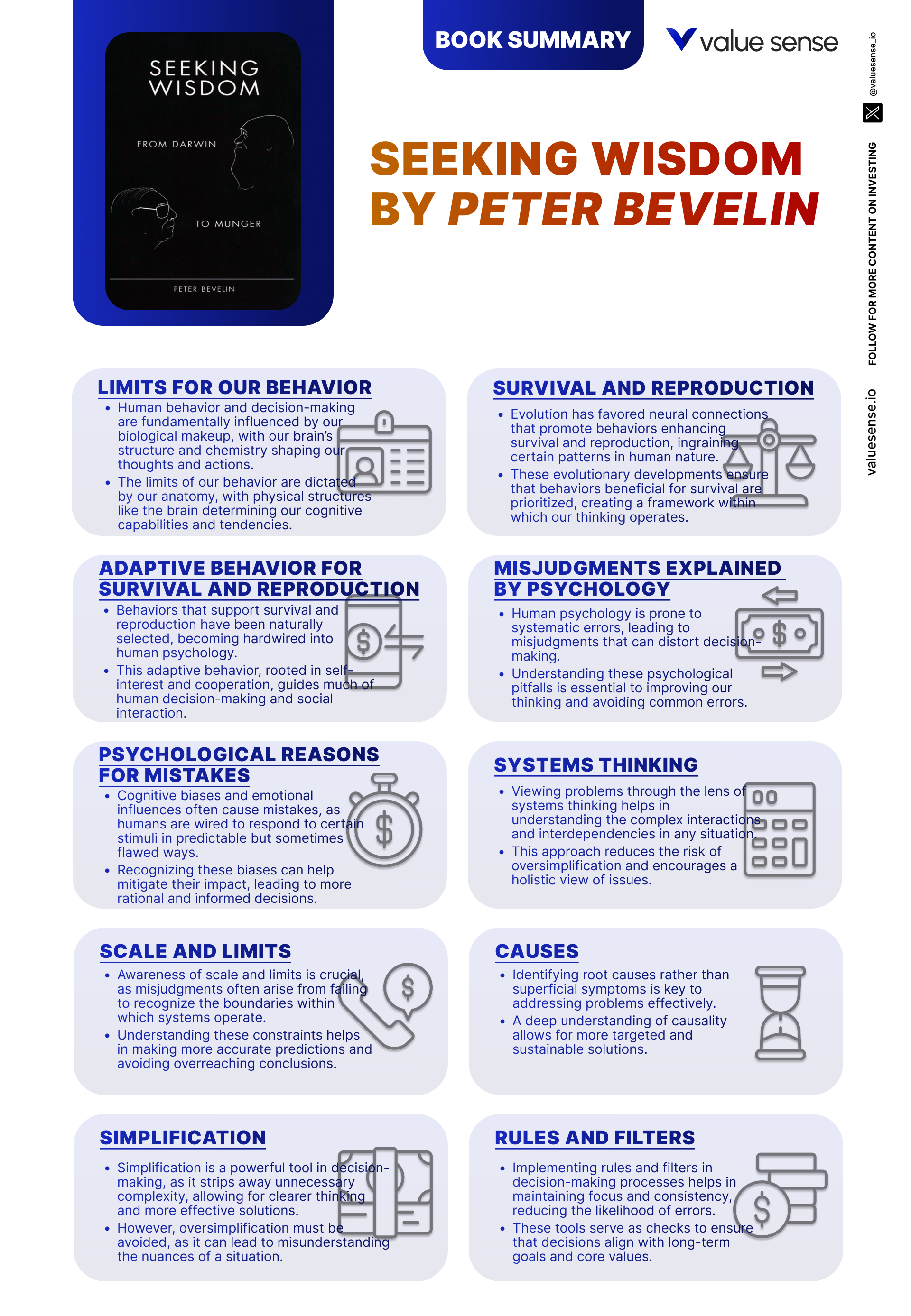

Key Themes and Concepts

“Seeking Wisdom” is built on the conviction that superior decision-making arises from understanding the fundamental drivers of human behavior and learning to counteract our innate biases. Bevelin weaves together concepts from evolutionary biology, psychology, mathematics, and the investment philosophies of Munger and Buffett to create a toolkit for rational thought. Throughout the book, several key themes emerge repeatedly, each providing a lens through which readers can analyze problems, avoid common pitfalls, and make more informed choices.

From the evolutionary roots of our instincts to the practical application of mental models, the book systematically uncovers the hidden forces that shape our judgments. By dissecting the causes of human misjudgment and offering practical remedies, Bevelin empowers readers to build more robust frameworks for thinking — frameworks that are as useful in the stock market as they are in everyday life. The following key themes are central to the book’s enduring value:

- Evolutionary Psychology: Bevelin starts with the premise that much of human behavior is rooted in evolutionary adaptation. Our brains evolved to solve problems of survival and reproduction, leading to instincts and heuristics that were advantageous in a prehistoric environment but often misfire in modern contexts. For example, our tendency toward loss aversion and risk avoidance may have helped our ancestors survive, but can cause us to make poor investment decisions today. By understanding these evolutionary origins, investors can recognize when their instincts are leading them astray and develop strategies to counteract them — such as deliberately seeking out contrary evidence or using checklists to override impulsive reactions.

- Cognitive Biases: The book provides a comprehensive taxonomy of cognitive biases — systematic errors in thinking that lead to misjudgments. Bevelin draws on the work of psychologists like Daniel Kahneman and Amos Tversky to explain biases such as confirmation bias, anchoring, availability heuristic, and overconfidence. These biases distort our perception of reality and can lead to poor investment decisions, such as chasing hot stocks or ignoring negative information. Bevelin emphasizes the importance of self-awareness and structured thinking to mitigate the impact of these biases, recommending tools like pre-mortems, devil’s advocacy, and group feedback to challenge assumptions.

- Systems and Complexity: A recurring theme is the importance of systems thinking — the ability to see the interconnectedness of variables within complex environments. Bevelin argues that most real-world problems, especially in investing, are not linear but involve feedback loops, unintended consequences, and emergent behaviors. By adopting a systems perspective, investors can better anticipate second- and third-order effects, avoid simplistic solutions, and build more resilient portfolios. Real-world examples include the cascading failures of financial markets during crises, where interconnected risks amplify small errors into systemic meltdowns.

- Mental Models: Inspired by Charlie Munger’s philosophy, Bevelin advocates for building a “latticework” of mental models — core concepts from multiple disciplines that help simplify and frame complex problems. These models include probabilistic thinking, opportunity cost, inversion, and margin of safety. By drawing on models from biology, physics, mathematics, and economics, investors can avoid narrow thinking and approach problems from multiple angles. The practical application is clear: investors who use diverse models are less likely to fall victim to blind spots or overconfidence.

- Practical Wisdom: The book is infused with the practical insights of legendary investors like Munger and Buffett, who stress the importance of humility, patience, and continuous learning. Bevelin distills their philosophies into actionable guidelines, such as sticking to one’s circle of competence, demanding a margin of safety, and being wary of leverage. He also emphasizes the value of learning from mistakes — both one’s own and those of others — and the importance of cultivating habits that promote rationality, such as journaling, reflection, and regular review of decisions.

- Scientific and Mathematical Reasoning: Bevelin highlights the necessity of scientific rigor and quantitative analysis in decision-making. He underscores the value of evidence-based reasoning, statistical thinking, and probabilistic forecasting. This theme is especially relevant for investors, who must grapple with uncertainty and incomplete information. By applying scientific principles — such as hypothesis testing, falsification, and sensitivity analysis — investors can avoid being misled by anecdote or intuition and make more reliable predictions.

- Checklists and Decision Frameworks: Recognizing the limits of human memory and attention, Bevelin champions the use of checklists to ensure thoroughness and reduce the risk of oversight. Drawing parallels to aviation and medicine, where checklists have dramatically improved safety, he argues that investors can benefit from similar discipline. Practical examples include investment checklists for evaluating management, business quality, and risk factors — tools that can help prevent costly errors and improve long-term outcomes.

Book Structure: Major Sections

Part 1: Foundations of Human Behavior

This section, encompassing Chapters 1 through 3, lays the groundwork for understanding the biological and evolutionary roots of human behavior. Bevelin begins by exploring how our anatomy, physiology, and biochemistry set the parameters for our actions, and how evolution has shaped the neural connections that drive our instincts and habits. The unifying theme is that much of what we consider rational or irrational behavior is deeply rooted in our physical and evolutionary makeup.

Key concepts include the influence of brain structure on behavior, the role of neurotransmitters in shaping mood and motivation, and the evolutionary mechanisms — such as natural selection and mutation — that have favored certain behavioral tendencies over others. Bevelin draws on examples from animal behavior, neuroscience, and evolutionary psychology to illustrate how traits like risk aversion, social cooperation, and pattern recognition have developed over millennia. These insights provide a foundation for understanding why humans are prone to certain errors and how these tendencies can be both adaptive and maladaptive in modern contexts.

For investors, the practical application lies in recognizing that many of our gut instincts — such as the fear of loss or the attraction to herd behavior — are not always rational in today’s markets. By understanding the origins of these instincts, investors can develop strategies to counteract them, such as using objective data, seeking disconfirming evidence, or employing structured decision-making frameworks. This awareness is the first step toward building a more rational investment process.

In the modern world, where financial markets are far removed from the environments in which our instincts evolved, this section’s lessons are more relevant than ever. Behavioral finance has shown that evolutionary biases can lead to systematic errors, such as panic selling during downturns or overconfidence during booms. By grounding investment practice in an understanding of human nature, investors can better navigate the emotional ups and downs of the market and make decisions that are aligned with long-term success.

Part 2: Psychological Misjudgments

Chapters 4 through 6 delve into the psychological factors that lead to misjudgments and errors in decision-making. Bevelin systematically catalogs the most common cognitive biases — from confirmation bias to overconfidence — and explains how these distort our perception of reality. The unifying theme is that our brains are wired for efficiency, not accuracy, leading to predictable patterns of error.

Key concepts include the mechanisms behind cognitive shortcuts (heuristics), the dangers of groupthink and social proof, and the impact of emotional states on rational analysis. Bevelin provides vivid examples of how these biases manifest in real-world decisions, such as investors chasing momentum stocks or ignoring negative news about their holdings. He also discusses strategies for recognizing and mitigating these biases, including the use of checklists, pre-mortem analysis, and deliberate contrarianism.

Investors can apply these insights by building processes that make bias less likely to creep in. For example, establishing rules for when to sell a stock, requiring written investment theses, or seeking out dissenting opinions can all help counteract the influence of cognitive errors. The key is to create an environment where rational analysis trumps emotion and where mistakes are seen as learning opportunities rather than failures.

In today’s fast-paced, information-saturated markets, the prevalence of psychological misjudgments is arguably higher than ever. Social media and 24/7 news cycles amplify biases like herd behavior and recency effect, making it crucial for investors to cultivate self-awareness and discipline. The lessons from this section are timeless, offering a roadmap for avoiding the pitfalls that have ensnared even the most experienced professionals.

Part 3: Scientific and Mathematical Thinking

This section, covering Chapters 7 through 9, emphasizes the importance of scientific rigor and quantitative analysis in improving judgment. Bevelin argues that adopting a scientific mindset — characterized by skepticism, hypothesis testing, and a willingness to change one’s mind — is essential for navigating uncertainty and complexity. The unifying theme is that good decision-making requires both critical thinking and a grounding in mathematical principles.

Key concepts include systems thinking, probabilistic reasoning, and the use of statistics to evaluate outcomes. Bevelin illustrates how understanding feedback loops, non-linear dynamics, and the law of large numbers can help investors avoid common errors, such as mistaking luck for skill or underestimating the likelihood of rare events. He also discusses the dangers of overfitting, confirmation bias in data analysis, and the importance of falsifiability in hypothesis testing.

For investors, the practical application is clear: rely on evidence, not intuition, and use quantitative tools to assess risk and reward. This might include scenario analysis, Monte Carlo simulations, or the use of base rates to inform forecasts. By grounding decisions in data and being open to updating beliefs in the face of new evidence, investors can avoid costly mistakes and improve long-term performance.

In a world awash with data but short on wisdom, the principles outlined in this section are more important than ever. The rise of algorithmic trading, big data analytics, and quantitative investing underscores the need for a solid foundation in scientific and mathematical reasoning. Bevelin’s emphasis on humility, skepticism, and continuous learning provides a valuable antidote to the overconfidence and data mining that often plague modern markets.

Part 4: Guidelines for Better Thinking

Chapters 10 through 12 provide practical tools and frameworks for improving decision-making. Building on the insights from earlier sections, Bevelin introduces the concept of mental models — simplified representations of reality that help us understand and navigate complexity. The unifying theme is that structured thinking, aided by checklists and backward reasoning, can dramatically improve outcomes.

Key concepts include the construction and application of mental models, the use of inversion (thinking backward from the desired outcome), and the power of checklists in ensuring thoroughness. Bevelin draws on the wisdom of Munger and Buffett, showing how these legendary investors use mental models to avoid errors and identify opportunities. He also provides examples of decision-making frameworks from other fields, such as aviation and medicine, where structured processes have led to dramatic improvements in safety and performance.

Investors can apply these lessons by developing their own latticework of mental models, using checklists to evaluate investments, and employing backward reasoning to clarify goals and identify potential pitfalls. The key is to move from intuition-driven decisions to process-driven analysis, reducing the likelihood of oversight and bias.

In a rapidly changing world, where complexity and uncertainty are the norm, the ability to think clearly and systematically is a major competitive advantage. The frameworks outlined in this section are as relevant to portfolio management as they are to business strategy, personal finance, or any domain where high-stakes decisions are made. By internalizing these guidelines, investors can build a foundation for lifelong learning and continuous improvement.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Deep Dive: Essential Chapters

Chapter 1: Our Anatomy Sets the Limits for Our Behavior

This opening chapter is foundational because it establishes the biological basis for human behavior, a perspective often neglected in traditional investment literature. Bevelin argues that our decisions, emotions, and habits are not solely products of rational thought but are deeply influenced by our anatomy, physiology, and biochemistry. By starting here, the book sets the stage for understanding why even the most rational investors are sometimes swayed by emotion or instinct — and why self-knowledge is the cornerstone of better decision-making.

Bevelin explores the structure and function of the human brain, highlighting how different regions govern emotion, reason, and memory. He discusses the role of neurotransmitters like dopamine and serotonin in shaping mood, motivation, and risk tolerance, and explains how physical changes — such as sleep deprivation or hormonal fluctuations — can dramatically alter behavior. The chapter includes vivid examples from neuroscience and case studies of individuals with brain injuries, illustrating how even minor changes in anatomy can lead to profound shifts in personality and judgment.

Investors can apply these lessons by recognizing the limits of their own rationality and building safeguards into their decision-making processes. For example, understanding how fatigue or stress can impair judgment might lead an investor to avoid making major decisions late at night or during periods of emotional upheaval. Regular self-assessment, mindfulness practices, and the use of checklists can help counteract the influence of temporary physiological states.

Historically, the failure to account for biological constraints has led to costly errors — from traders making rash decisions during periods of market stress to executives ignoring warning signs due to overconfidence fueled by adrenaline. In today’s high-stakes, high-pressure investment environment, the insights from this chapter are more relevant than ever, reminding us that the mind is not a computer and that self-awareness is a critical component of success.

Chapter 2: Evolution Selected the Connections That Produce Useful Behavior

This chapter is crucial because it explains how natural selection has shaped the neural connections and behavioral tendencies that influence decision-making. Bevelin draws on evolutionary psychology to show that many of our instincts — including our responses to risk, reward, and uncertainty — are the result of adaptations that improved our ancestors’ chances of survival. By understanding these evolutionary roots, readers can better anticipate and manage the biases that affect their own thinking.

The chapter delves into the mechanisms of natural selection, mutation, and adaptation, using examples from both human and animal behavior. Bevelin explains how traits that were once advantageous — such as the tendency to overreact to threats or to follow the crowd — can become liabilities in modern environments like financial markets. He also discusses the concept of evolutionary mismatch, where instincts that served us well in the past can lead to systematic errors today. Illustrative anecdotes include the panic-driven selling during market crashes and the herd mentality that fuels bubbles.

For investors, the key takeaway is to recognize when their instincts are likely to be maladaptive and to develop strategies for counteracting them. This might involve slowing down decision-making, seeking out disconfirming evidence, or using quantitative models to check gut instincts. The goal is not to suppress emotion entirely but to understand its origins and manage its influence.

Real-world examples abound, from the fear-driven selloffs during the 2008 financial crisis to the exuberant buying during the dot-com bubble. By grounding investment practice in an understanding of evolutionary psychology, investors can avoid being swept up in collective panic or euphoria and maintain the discipline needed for long-term success.

Chapter 4: Misjudgments Explained by Psychology

This chapter is a cornerstone of the book because it catalogs the psychological biases that lead to systematic errors in judgment. Bevelin builds on the work of Kahneman and Tversky to explain how heuristics — mental shortcuts designed for efficiency — can often lead us astray. By identifying and understanding these biases, readers can begin to build defenses against them.

Bevelin provides detailed descriptions of biases such as confirmation bias (the tendency to seek information that supports our preconceptions), anchoring (the influence of initial information on subsequent judgments), and the availability heuristic (overweighting recent or vivid events). He includes real-world examples from investing, such as analysts clinging to optimistic forecasts despite contrary evidence or investors overreacting to recent news. The chapter is rich with quotes and case studies, making the abstract concepts concrete and relatable.

Investors can apply these lessons by building processes that make bias less likely to influence decisions. This might include requiring written investment theses, conducting pre-mortem analyses to anticipate potential failures, or seeking out dissenting opinions. The use of checklists and structured decision-making frameworks can also help ensure that all relevant factors are considered.

History is replete with examples of investors who fell victim to psychological misjudgments, from the “irrational exuberance” of the late 1990s to the panic selling of 2020. By internalizing the lessons from this chapter, investors can develop the self-awareness and discipline needed to avoid repeating these mistakes and to make more rational, evidence-based decisions.

Chapter 7: Systems Thinking

This chapter is pivotal because it introduces the concept of systems thinking — the ability to see problems as part of larger, interconnected systems rather than as isolated events. Bevelin argues that many of the most costly errors in judgment arise from a failure to consider the broader context and the feedback loops that drive complex systems.

Bevelin uses examples from ecology, engineering, and economics to illustrate how small changes can have large, unintended consequences. He discusses the dangers of linear thinking in environments characterized by nonlinearity, emergence, and delayed feedback. The chapter includes case studies of financial crises, environmental disasters, and business failures, all of which were exacerbated by a failure to anticipate second- and third-order effects.

For investors, the practical application is to adopt a systems perspective when analyzing companies, industries, or markets. This might involve mapping out the key drivers of value, considering the impact of regulatory changes, or anticipating how competitors will respond to strategic moves. Scenario analysis and sensitivity testing are valuable tools for understanding how different variables interact.

The importance of systems thinking has only grown in the era of globalization and complex supply chains. The COVID-19 pandemic, for example, revealed how interconnected our world has become and how shocks in one part of the system can quickly propagate elsewhere. By cultivating a systems mindset, investors can better anticipate risks and identify opportunities that others overlook.

Chapter 10: Models of Reality

This chapter is essential because it introduces the idea of mental models — simplified representations of complex systems that help us understand and navigate the world. Bevelin, drawing heavily on Munger’s philosophy, argues that building a “latticework” of models from multiple disciplines is the key to robust decision-making.

The chapter explains how mental models, such as opportunity cost, inversion, and margin of safety, can be used to frame problems, generate hypotheses, and evaluate alternatives. Bevelin provides examples from investing, physics, and biology to show how the same models can be applied across domains. He includes memorable quotes from Munger and Buffett, emphasizing the importance of lifelong learning and intellectual humility.

Investors can apply these lessons by systematically studying key models from fields like mathematics, economics, psychology, and engineering. The goal is to develop a toolkit that can be drawn upon when faced with new or unfamiliar problems. Regular review and practice are essential for internalizing these models and making them second nature.

In an era of increasing complexity and specialization, the ability to think broadly and draw connections across disciplines is a major competitive advantage. The most successful investors, from Buffett to Ray Dalio, are those who have built rich mental toolkits and are able to synthesize insights from diverse sources. This chapter provides a roadmap for building that capability.

---

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

---

Chapter 11: Backward Thinking

This chapter is important because it introduces the strategy of backward thinking, or inversion — starting with the desired outcome and working backward to identify the steps needed to achieve it. Bevelin argues that this approach can clarify goals, reveal hidden obstacles, and prevent costly errors.

Bevelin uses examples from mathematics, engineering, and investing to illustrate how inversion can simplify complex problems. He discusses the practice of “pre-mortems,” where teams imagine a future failure and work backward to identify what could cause it. The chapter includes anecdotes from Munger and Buffett, who often use inversion to avoid mistakes rather than to seek brilliance.

Investors can apply backward thinking by asking questions like, “What would cause this investment to fail?” or “What risks am I overlooking?” This approach can help identify vulnerabilities in an investment thesis and prompt the development of contingency plans. It also encourages humility and a focus on risk management.

Historically, backward thinking has helped investors avoid disasters by highlighting hidden risks and challenging complacency. The collapse of Long-Term Capital Management in 1998, for example, might have been avoided if more attention had been paid to what could go wrong. In today’s uncertain world, the ability to think backward is a critical skill for managing risk and ensuring long-term success.

Chapter 12: Checklists

This chapter is a standout because it demonstrates the power of checklists in reducing errors and ensuring thoroughness in decision-making. Bevelin draws parallels to aviation and medicine, where checklists have dramatically improved safety and outcomes, and argues that investors can benefit from similar discipline.

The chapter provides practical guidance on how to construct and use checklists, including examples of investment checklists for evaluating management quality, business durability, and risk factors. Bevelin discusses the psychological benefits of checklists — they free up mental bandwidth, reduce the likelihood of oversight, and provide a record for post-mortem analysis. The chapter is rich with anecdotes from pilots, surgeons, and investors who have avoided disaster by relying on structured processes.

Investors can implement checklists by developing standardized criteria for stock selection, portfolio review, and risk assessment. Regular use of checklists can help ensure that all relevant factors are considered and that decisions are consistent over time. The key is to tailor checklists to one’s own process and to update them based on experience and new insights.

The use of checklists has become a best practice in many fields, and their adoption in investing is growing. The success of firms like Bridgewater Associates, which relies heavily on process and documentation, is a testament to the power of structured thinking. In a world of increasing complexity and information overload, checklists are an essential tool for maintaining discipline and avoiding costly mistakes.

Chapter 13: Wisdom from Charles T. Munger and Warren E. Buffett

This chapter is a highlight of the book because it distills the philosophies and practical wisdom of two of the most successful investors in history. Bevelin shares key lessons from Munger and Buffett on topics ranging from decision-making and risk management to ethics and lifelong learning.

The chapter includes memorable quotes, anecdotes, and case studies illustrating how Munger and Buffett apply mental models, maintain intellectual humility, and learn from mistakes. Bevelin emphasizes their commitment to sticking within their circle of competence, demanding a margin of safety, and valuing patience over action. He also discusses their approaches to reading, reflection, and continuous improvement.

Investors can apply these lessons by adopting a similar mindset — focusing on process over outcome, being willing to admit mistakes, and constantly seeking to expand their knowledge. The importance of ethical behavior, transparency, and long-term thinking is also underscored, providing a blueprint for sustainable success.

Munger and Buffett’s track record speaks for itself, and their principles have stood the test of time. In an industry often driven by short-term thinking and fads, their emphasis on rationality, discipline, and humility is a refreshing counterpoint. This chapter serves as both inspiration and a practical guide for investors seeking to emulate their success.

Practical Investment Strategies

- Build a Latticework of Mental Models: Develop a broad base of mental models from diverse disciplines such as economics, psychology, biology, and mathematics. Start by identifying key models (e.g., opportunity cost, margin of safety, probabilistic thinking) and study their application in various contexts. Create a personal “mental model map” and regularly review it when analyzing investments. Practice applying these models to real-world scenarios, and refine your understanding through reading, discussion, and reflection. This approach reduces blind spots and improves your ability to solve complex problems.

- Use Checklists to Ensure Thoroughness: Design comprehensive checklists for each stage of your investment process — from screening stocks to conducting due diligence and monitoring portfolio holdings. Include criteria for business quality, management integrity, valuation, competitive advantages, and risk factors. Before making any investment decision, review your checklist to ensure all relevant aspects have been considered. Regularly update your checklists based on past mistakes and new insights, turning them into living documents that evolve with your experience.

- Practice Inversion and Backward Thinking: When analyzing an investment, start by asking, “What could cause this to fail?” or “How could I lose money on this?” List all potential risks and obstacles, then work backward to identify how they might be mitigated or avoided. Conduct pre-mortem analyses for major decisions and use inversion to stress-test your assumptions. This approach helps uncover hidden flaws and encourages a focus on risk management rather than just upside potential.

- Quantify Probabilities and Outcomes: Move beyond qualitative analysis by estimating the probabilities of different scenarios and their potential outcomes. Use base rates, historical data, and statistical tools to inform your forecasts. Incorporate scenario analysis and Monte Carlo simulations to account for uncertainty and variability. Document your assumptions and review them regularly to ensure they remain valid as new information emerges. This quantitative rigor leads to more disciplined and objective decision-making.

- Recognize and Counteract Cognitive Biases: Educate yourself on common cognitive biases such as confirmation bias, anchoring, and overconfidence. Implement processes to mitigate their impact, such as requiring written investment theses, seeking out devil’s advocates, and conducting regular post-mortems. Use group feedback and diversity of thought to challenge assumptions and surface blind spots. The goal is to create a culture of self-awareness and continuous improvement.

- Stick to Your Circle of Competence: Define your areas of expertise and focus your investments within those boundaries. Avoid the temptation to chase hot trends or venture into unfamiliar sectors without sufficient knowledge. Regularly assess your circle of competence and expand it deliberately through study and experience. This discipline reduces the risk of costly mistakes and increases the likelihood of consistent returns.

- Demand a Margin of Safety: Always invest with a margin of safety — the difference between your estimate of intrinsic value and the price you pay. Use conservative assumptions in your analysis, and be willing to walk away if the margin is insufficient. This principle, championed by Graham, Buffett, and Munger, protects against unforeseen risks and ensures that you only invest when the odds are clearly in your favor.

- Learn from Mistakes — Yours and Others’: Keep a decision journal to document your investment rationale, outcomes, and lessons learned. Regularly review past decisions to identify patterns of error and areas for improvement. Study the failures and successes of other investors, seeking to understand the underlying causes. This habit of reflection and learning is essential for long-term growth and resilience in investing.

Modern Applications and Relevance

The principles and frameworks outlined in “Seeking Wisdom” are more relevant today than ever, given the increasing complexity, speed, and uncertainty of modern financial markets. The behavioral biases Bevelin describes have only been amplified by the rise of algorithmic trading, social media, and real-time information flows. Investors now face not only their own psychological pitfalls but also the collective biases of millions of participants, all interacting in unpredictable ways.

Since the book’s publication, advances in behavioral finance have confirmed and expanded upon many of Bevelin’s insights. Research by Kahneman, Thaler, and others has shown that cognitive biases are persistent and often resistant to education alone. As a result, the book’s emphasis on process — including the use of checklists, structured decision frameworks, and regular post-mortems — has become standard practice among top investment firms and hedge funds. The importance of systems thinking and probabilistic analysis has also grown, with leading investors using scenario planning and quantitative models to manage risk in a volatile world.

What remains timeless is the need for humility, discipline, and continuous learning. The wisdom of Munger and Buffett, as distilled by Bevelin, is as applicable to cryptocurrencies and AI-driven markets as it was to the blue-chip stocks of the 20th century. The core message — that success depends on understanding human nature, building robust mental models, and learning from mistakes — transcends changes in technology or market structure.

Modern examples abound: the meme stock frenzy of 2021 illustrated the dangers of herd behavior and the power of narrative over fundamentals. The collapse of major crypto exchanges revealed the risks of ignoring basic principles like margin of safety and due diligence. At the same time, investors who applied the lessons of “Seeking Wisdom” — using checklists, focusing on process, and maintaining a long-term perspective — were better positioned to navigate these upheavals.

To adapt Bevelin’s advice to current conditions, investors should embrace technology as a tool for improving process and discipline, not as a substitute for judgment. Leveraging data analytics, automated checklists, and collaborative decision-making platforms can help reduce bias and enhance rigor. But the ultimate edge remains the same: the ability to think clearly, act rationally, and learn continuously in the face of uncertainty.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Implementation Guide

- Conduct a Self-Assessment of Your Decision-Making: Begin by evaluating your own decision-making process. Keep a journal of past investment decisions, noting the rationale, emotions, and outcomes associated with each. Identify recurring patterns of error — such as overconfidence, impulsivity, or herd behavior — and reflect on their root causes. This self-awareness is the foundation for improvement.

- Build Your Latticework of Mental Models (1-3 Months): Set aside time each week to study key mental models from disciplines like economics, psychology, biology, and mathematics. Summarize each model in your own words and practice applying it to recent investment decisions. Over a period of 1-3 months, aim to internalize 10-20 core models and create a reference guide for future use.

- Design and Implement Investment Checklists (Month 2-4): Develop customized checklists for stock selection, portfolio review, and risk assessment. Start with templates from “Seeking Wisdom” and adapt them to your own strategy and goals. Test your checklists on historical investments and refine them based on feedback and results. Incorporate these checklists into your regular investment process for consistency and thoroughness.

- Construct a Diversified Portfolio Within Your Circle of Competence (Month 3-6): Define your areas of expertise and focus your investments within those boundaries. Use your checklists and mental models to evaluate potential holdings, demanding a margin of safety for each. Build a diversified portfolio that balances risk and reward, allocating more capital to areas where your knowledge and conviction are highest. Maintain written records of your rationale for each position.

- Establish a Regular Review and Post-Mortem Schedule (Quarterly): At the end of each quarter, review your portfolio and decision journal. Analyze both successes and failures, looking for patterns of bias, error, and insight. Update your mental models and checklists based on these reviews, and set goals for continuous improvement. Share your findings with trusted peers or mentors for additional perspective and accountability.

- Stay Informed and Continuously Learn (Ongoing): Commit to lifelong learning by reading widely across disciplines, attending seminars, and engaging with other investors. Subscribe to reputable investment publications, follow thought leaders, and participate in discussions that challenge your assumptions. Regularly revisit “Seeking Wisdom” and similar works to reinforce key lessons and stay grounded in timeless principles.

- Leverage Technology for Process Discipline (Ongoing): Use digital tools to automate checklists, track portfolio performance, and facilitate collaborative decision-making. Experiment with AI-powered screeners, scenario analysis tools, and data visualization platforms to enhance your analysis. But remember: technology is a supplement, not a substitute, for critical thinking and sound judgment.

- Prioritize Ethical Behavior and Long-Term Thinking: Make ethics and integrity central to your investment process. Avoid shortcuts, conflicts of interest, and the temptation to chase short-term gains at the expense of long-term value. Align your actions with your values and the principles outlined in “Seeking Wisdom,” building trust with clients, partners, and yourself.

--- ---

10+ Free intrinsic value tools

For investors looking to find a stock's fair value, our analytics team has you covered with intrinsic value tools:

📍 Free Intrinsic Value Calculator

📍 Reverse DCF & DCF value tools

📍 Peter Lynch Fair Value Calculator

📍 Ben Graham Fair Value Calculator

📍 Relative Value tool

...and plenty more.

🔍 Explore all these tools for free on the Value Sense platform and start discovering what your favorite stocks are really worth.

FAQ: Common Questions About Seeking Wisdom: From Darwin to Munger

1. Who should read “Seeking Wisdom: From Darwin to Munger”?

This book is ideal for investors, business leaders, students, and anyone interested in improving their decision-making skills. Its multidisciplinary approach makes it valuable for those seeking to understand the psychological, biological, and mathematical foundations of judgment. Both beginners and experienced professionals will find actionable insights, practical frameworks, and timeless wisdom relevant to investing and everyday life.

2. How is “Seeking Wisdom” different from other investment books?

Unlike most investment books that focus solely on financial theory or market analysis, “Seeking Wisdom” integrates lessons from biology, psychology, mathematics, and history. Peter Bevelin draws on the philosophies of Charlie Munger and Warren Buffett, offering a holistic approach to rational thinking. The book emphasizes mental models, cognitive biases, and practical decision-making tools, making it a comprehensive guide for lifelong learning and sound judgment.

3. What are the main takeaways for investors from the book?

Key takeaways include the importance of understanding and mitigating cognitive biases, building a latticework of mental models, and adopting a disciplined, process-driven approach to investing. The book stresses the value of checklists, backward thinking, and learning from mistakes. Investors are encouraged to focus on their circle of competence, demand a margin of safety, and continuously seek self-improvement.

4. Can the principles in “Seeking Wisdom” be applied outside of investing?

Absolutely. The frameworks and models discussed in “Seeking Wisdom” are applicable to a wide range of fields, including business, personal finance, management, and everyday decision-making. The book’s emphasis on rationality, self-awareness, and continuous learning makes it a valuable resource for anyone seeking to improve their judgment and avoid common errors in any domain.

5. How should readers implement the lessons from “Seeking Wisdom” in practice?

Readers should start by conducting a self-assessment of their decision-making patterns, then build a personal toolkit of mental models and checklists. Regular review, reflection, and adaptation are crucial for internalizing the book’s lessons. Engaging with a community of like-minded individuals, leveraging technology for discipline, and committing to lifelong learning will help ensure lasting improvement and success.