Seth Klarman - Baupost Group Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

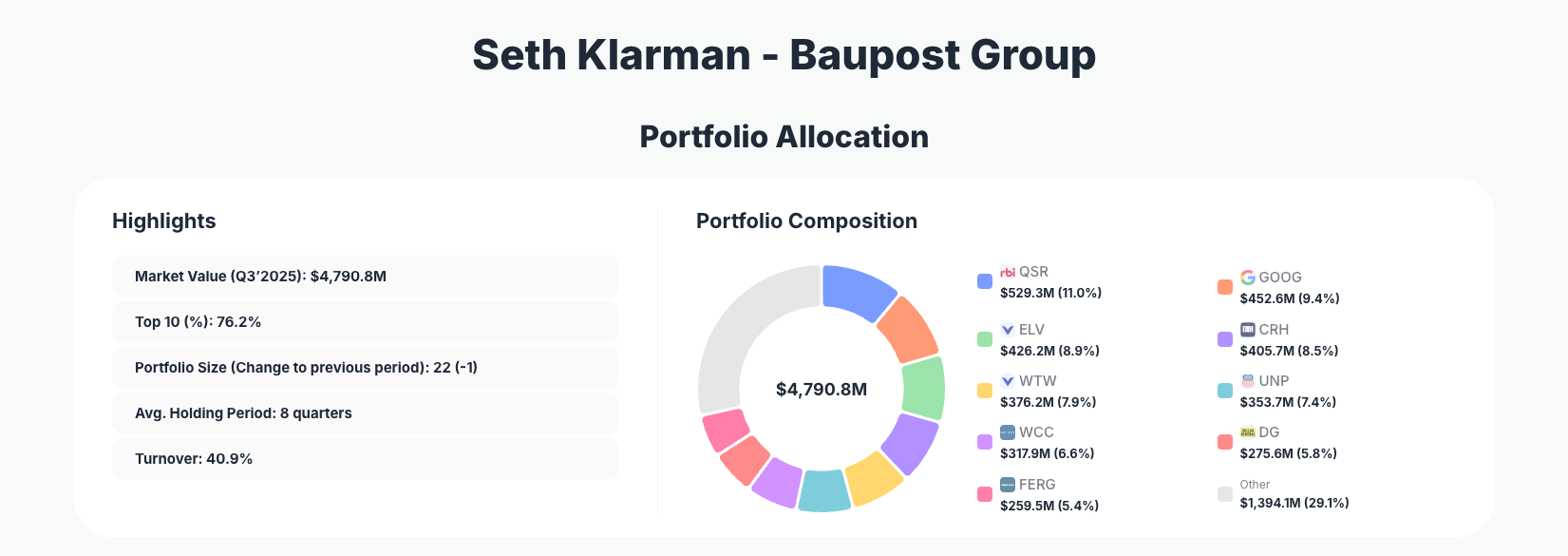

Seth Klarman, the legendary value investor behind Baupost Group, showcases his signature opportunistic style in the latest 13F filing. His $4.8B Q3 2025 portfolio features aggressive additions like a massive ramp-up in QSR and a new stake in ELV, alongside trims in tech and industrial names, signaling disciplined risk management amid market volatility.

Portfolio Overview: Classic Klarman Concentration with Active Rotation

Portfolio Highlights (Q3’2025): - Market Value: $4,790.8M - Top 10 Holdings: 76.2% - Portfolio Size: 22 -1 - Average Holding Period: 8 quarters - Turnover: 40.9%

Baupost Group's portfolio maintains its hallmark concentration, with the top 10 holdings commanding 76.2% of the $4.8 billion total. This reflects Seth Klarman's long-standing philosophy of focusing on a limited number of high-conviction ideas where deep research uncovers significant margins of safety. The slight reduction to 22 positions from the prior quarter underscores a willingness to exit underperformers, as evidenced by the one position trimmed entirely.

Turnover at 40.9% indicates active management, far from passive indexing, yet the 8-quarter average holding period shows patience with core bets. Klarman doubled down on select consumer and infrastructure plays while paring exposure to tech giants and cyclical industrials, suggesting a rotation toward resilient businesses with pricing power. This Q3 portfolio balances opportunistic buys with prudent sells, classic Baupost value hunting in a high-valuation environment.

The concentration level—over three-quarters in just 10 names—amplifies returns when right but demands rigorous analysis, aligning with Klarman's "margin of safety" mantra from his book Margin of Safety. Investors tracking Baupost via ValueSense can see how these metrics evolve quarter-to-quarter.

Top Holdings Breakdown: Massive Adds in Consumer and Rail, New Health Bet

The portfolio's changes paint a picture of opportunistic value plays. Leading the pack is Restaurant Brands International Inc. (QSR) at 11.0% after an explosive Add 103.80% to $529.3M, signaling strong conviction in the Burger King parent's franchise model. Tech exposure dipped with Alphabet Inc. (GOOG) trimmed Reduce 29.46% to 9.4% $452.6M, while a fresh Buy in Elevance Health Inc. (ELV) debuted at 8.9% $426.2M, betting on managed care stability.

Construction materials firm CRH plc (CRH) saw a Reduce 11.55% to 8.5% $405.7M, and WILLIS TOWERS WATSON PLC LTD was cut Reduce 17.13% to 7.9% $376.2M. A standout move was Union Pacific Corporation (UNP), boosted Add 754.97% to 7.4% $353.7M, highlighting infrastructure conviction. WESCO International, Inc. (WCC) faced a sharp Reduce 31.91% to 6.6% $317.9M.

Stable names like Dollar General Corporation (DG) held No change at 5.8% $275.6M, with a modest Add 2.08% in Ferguson plc (FERG) to 5.4% $259.5M. Beyond the top 10, Liberty Global plc (LBTYK) was trimmed Reduce 12.17% to 5.3% $254.5M, and Eagle Materials Inc. (EXP) added 38.95% to 4.6% $219.0M, rounding out a mix of defensive retail, telecom, and materials exposure.

These 13 holdings capture Baupost's dynamic Q3, prioritizing scalable franchises amid economic uncertainty.

What the Portfolio Reveals About Klarman's Strategy

Seth Klarman's moves reveal a value-oriented strategy emphasizing resilient cash flows and opportunistic sizing: - Quality Moats Over Hype: Additions in QSR and UNP favor consumer staples and essential infrastructure with durable pricing power. - Sector Diversification with Bias: Healthcare (ELV), tech (GOOG), and industrials dominate, but trims in cyclicals like WCC show caution on volatility. - Geographic Opportunism: International picks like CRH (Ireland-based) and FERG (UK) add global value exposure. - Risk Management via Trims: High turnover reflects selling into strength, as seen in GOOG and LBTYK, preserving dry powder. - Margin of Safety Focus: New buys and adds target undervalued names with strong balance sheets, avoiding growth traps.

This approach prioritizes downside protection while hunting asymmetric upside.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Restaurant Brands International Inc. | $529.3M | 11.0% | Add 103.80% |

| Alphabet Inc. | $452.6M | 9.4% | Reduce 29.46% |

| Elevance Health Inc. | $426.2M | 8.9% | Buy |

| CRH plc | $405.7M | 8.5% | Reduce 11.55% |

| WILLIS TOWERS WATSON PLC LTD | $376.2M | 7.9% | Reduce 17.13% |

| Union Pacific Corporation | $353.7M | 7.4% | Add 754.97% |

| WESCO International, Inc. | $317.9M | 6.6% | Reduce 31.91% |

| Dollar General Corporation | $275.6M | 5.8% | No change |

| Ferguson plc | $259.5M | 5.4% | Add 2.08% |

(Note: Top 10 starts from rank 2 in filing; #1 position not detailed in data.)

This table underscores Baupost's extreme concentration, with no single holding below 5.4% yet top positions driving nearly 80% of value. Explosive adds like UNP 755% show Klarman's willingness to aggressively size winners, while deep cuts in WCC 32% and others demonstrate profit-taking discipline. The mix—no pure growth plays, heavy on oligopolies—highlights risk-adjusted value hunting, where 76.2% concentration amplifies alpha from superior picks.

Investment Lessons from Seth Klarman's Baupost Approach

- Embrace Margin of Safety: Klarman's adds in EXP and QSR target businesses trading below intrinsic value, echoing his book’s core tenet.

- Active Position Sizing: Massive ramps like UNP 755% prove conviction demands bold allocation, not timid averaging.

- Trim Winners Ruthlessly: Reductions in GOOG and WCC show selling strength preserves capital for better ideas.

- Patience Pays: 8-quarter hold average favors quality over churn, letting compounders like DG work.

- Diversify Thoughtfully: 22 positions across sectors/geos balance concentration risks without diluting focus.

Looking Ahead: What Comes Next?

With turnover at 40.9% and a position trimmed (portfolio now 22), Baupost likely holds substantial cash for deployment into fresh value dislocations. Expect further infrastructure bets akin to UNP and EXP, plus healthcare stability via ELV. In a potentially slowing economy, Klarman's trims signal wariness of cyclicals, positioning for bargains in consumer/defensives. Current setup—76% top 10—primes for outsized gains if recession fears create mispricings.

FAQ about Seth Klarman Baupost Group Portfolio

Q: What are the biggest changes in Baupost's Q3 2025 13F filing?

A: Key moves include Add 103.80% to QSR 11.0%, Add 754.97% to UNP 7.4%, a new Buy in ELV 8.9%, and trims like Reduce 29.46% in GOOG.

Q: Why is Baupost's portfolio so concentrated?

A: At 76.2% in top 10, it follows Klarman's high-conviction value strategy, focusing on deeply researched ideas with margin of safety for superior risk-adjusted returns.

Q: What sectors does Klarman favor now?

A: Consumer (QSR, DG), healthcare (ELV), infrastructure (UNP, CRH), with reduced tech and industrials.

Q: How can I track Baupost Group's portfolio?

A: Follow quarterly 13F filings on the SEC (45-day lag post-quarter-end) or use ValueSense's superinvestor tracker at https://valuesense.io/superinvestors/baupost-group for real-time analysis, changes, and visuals.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!