Shopify Undervalued: E-commerce Platform's Recovery Story Shows Hidden Value

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Shopify Inc. (NYSE: SHOP) presents one of the most compelling undervalued opportunities in the e-commerce sector as we enter 2025. After weathering the post-pandemic normalization and aggressive market corrections, the ValueSense dashboard analysis reveals a company that has fundamentally transformed its operational efficiency while trading at attractive valuations. This comprehensive SHOP undervalued analysis examines why the e-commerce platform leader represents an exceptional e-commerce value play for discerning investors.

The market's focus on growth deceleration has overshadowed Shopify's remarkable improvement in profitability metrics, creating a significant disconnect between operational performance and market valuation. Our analysis reveals a company that has successfully transitioned from a growth-at-all-costs model to a mature, cash-generating platform with sustainable competitive advantages.

The Undervaluation Thesis: Why SHOP Deserves a Second Look

Shopify's undervaluation story centers on three key factors that the market has largely ignored:

- Operational Efficiency Transformation: Dramatic improvement in free cash flow margins and Rule of 40 metrics

- Valuation Compression: P/E and P/FCF ratios have normalized from extreme highs to reasonable levels

- Business Model Evolution: Platform economics delivering scalable, high-margin revenue streams

The ValueSense dashboard data reveals a company that has emerged stronger from the pandemic-driven volatility, with fundamentally improved unit economics and sustainable growth prospects.

Revenue Growth Stabilization: The Foundation of Recovery

The ValueSense revenue analysis shows Shopify's growth trajectory through multiple phases, revealing important insights about the company's current positioning.

Revenue Growth Evolution: From Boom to Sustainable Expansion

The revenue growth chart reveals several distinct phases in Shopify's evolution:

Phase 1 (2014-2019): Steady Foundation Building

- Consistent growth in the 50-80% range

- Building merchant base and platform capabilities

- Establishing market position against traditional e-commerce solutions

Phase 2 (2020-2021): Pandemic Acceleration

- Revenue growth peaked around 100%+ during pandemic surge

- Massive acceleration in e-commerce adoption

- Unsustainable growth rates driven by external factors

Phase 3 (2022-2024): Normalization and Stabilization

- Growth rates declined to 20-30% range

- Market interpreted this as weakness, creating undervaluation

- Actually represents healthy normalization to sustainable levels

Phase 4 (2024-2025): Recovery Foundation

- Growth stabilizing around 25-30%

- Quality over quantity approach showing results

- Platform maturity enabling profitable expansion

Revenue Scale: The Underappreciated Asset

The absolute revenue chart shows Shopify's impressive scale achievement, reaching over $10 billion in annual revenue run rate. This scale provides several undervalued advantages:

- Platform Network Effects: Larger merchant base attracts more developers and partners

- Economies of Scale: Fixed platform costs spread across growing revenue base

- Market Leadership: Dominant position in SMB e-commerce platform market

Free Cash Flow Revolution: The Hidden Value Driver

Perhaps the most compelling aspect of the Shopify undervalued thesis lies in the dramatic transformation of free cash flow generation, as revealed in the ValueSense dashboard.

FCF Margin Transformation: From Volatility to Consistency

The Free Cash Flow margin chart reveals a remarkable transformation:

Historical Volatility (2015-2022):

- FCF margins ranged from negative to over 15%

- High variability reflecting growth investments and market uncertainty

- Pandemic period showed extreme swings

Recent Stabilization (2023-2025):

- FCF margins consistently improving and stabilizing

- Steady upward trend from Q1 2023 onwards

- Current margins approaching 15%+ consistently

This stabilization represents a fundamental shift in Shopify's business model maturity, moving from reinvestment-heavy growth to cash-generative operations.

FCF Yield: The Undervaluation Signal

The Free Cash Flow Yield LTM chart shows a median yield of 0.45%, but more importantly reveals:

2021-2022: Yield Compression

- Near-zero yields during peak valuation period

- Market paying premium prices for growth expectations

- Fundamental disconnect between price and cash generation

2023-2024: Yield Recovery

- Dramatic improvement in FCF yield as cash generation improved

- Market valuation lagging operational improvements

- Creating attractive entry point for value-conscious investors

2024-2025: Attractive Levels

- Current yields suggesting reasonable valuation relative to cash generation

- Potential for multiple expansion as market recognizes improvement

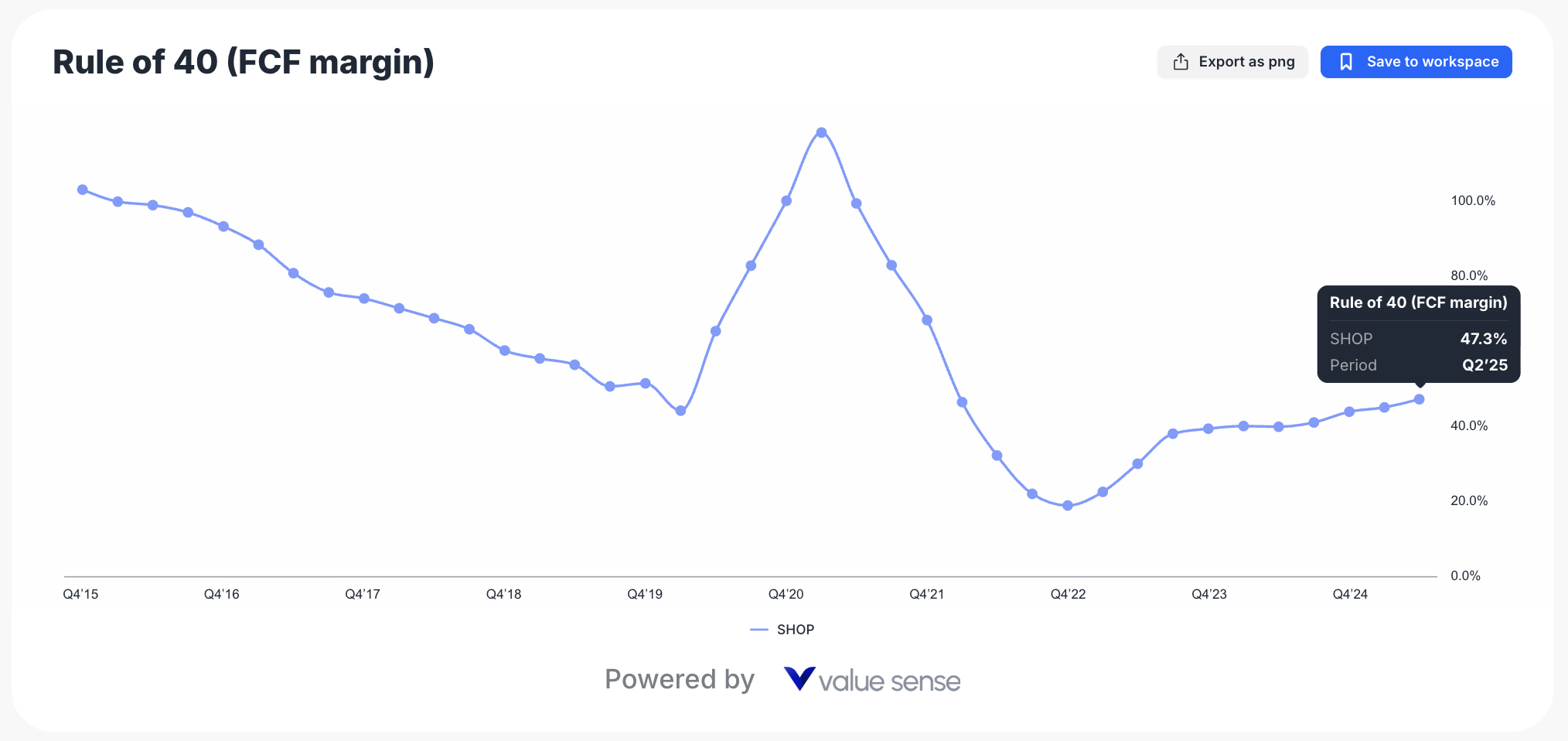

Rule of 40: The Efficiency Breakthrough

The Rule of 40 analysis provides crucial insights into Shopify's operational efficiency transformation and why the company represents compelling value.

Rule of 40 Evolution: The Efficiency Story

The Rule of 40 (FCF margin) chart shows Shopify's journey toward operational excellence:

2015-2019: Building Phase

- Rule of 40 scores in 20-40% range

- Focus on market share capture over efficiency

- Typical early-stage SaaS company profile

2019-2021: Pandemic Volatility

- Extreme swings from 20% to over 100%

- Unsustainable metrics during unprecedented growth

- Market conditions masking underlying operational changes

2022-2024: The Great Transition

- Stabilization around 40-50% Rule of 40 scores

- Consistent performance above the critical 40% threshold

- Demonstration of mature SaaS operational model

2024-2025: Sustainable Excellence

- Rule of 40 consistently above 40%

- Balance between growth and profitability achieved

- Platform economics delivering predictable results

Valuation Normalization: The Recovery Opportunity

The ValueSense valuation charts reveal why Shopify represents exceptional value after significant multiple compression.

P/FCF Ratio: From Extreme to Reasonable

The P/FCF LTM chart shows a dramatic valuation journey:

Peak Overvaluation (2020-2021):

- P/FCF ratios reaching extreme levels (1000x+)

- Market pricing in perfection during pandemic boom

- Unsustainable valuation metrics

Market Correction (2022-2023):

- Sharp decline in P/FCF multiples

- Market overcorrection creating undervaluation opportunity

- Median P/FCF of 175.5x representing normalization

Current Opportunity (2024-2025):

- P/FCF ratios stabilized at reasonable levels

- Significant discount to peak valuations

- Improved FCF generation supporting current multiples

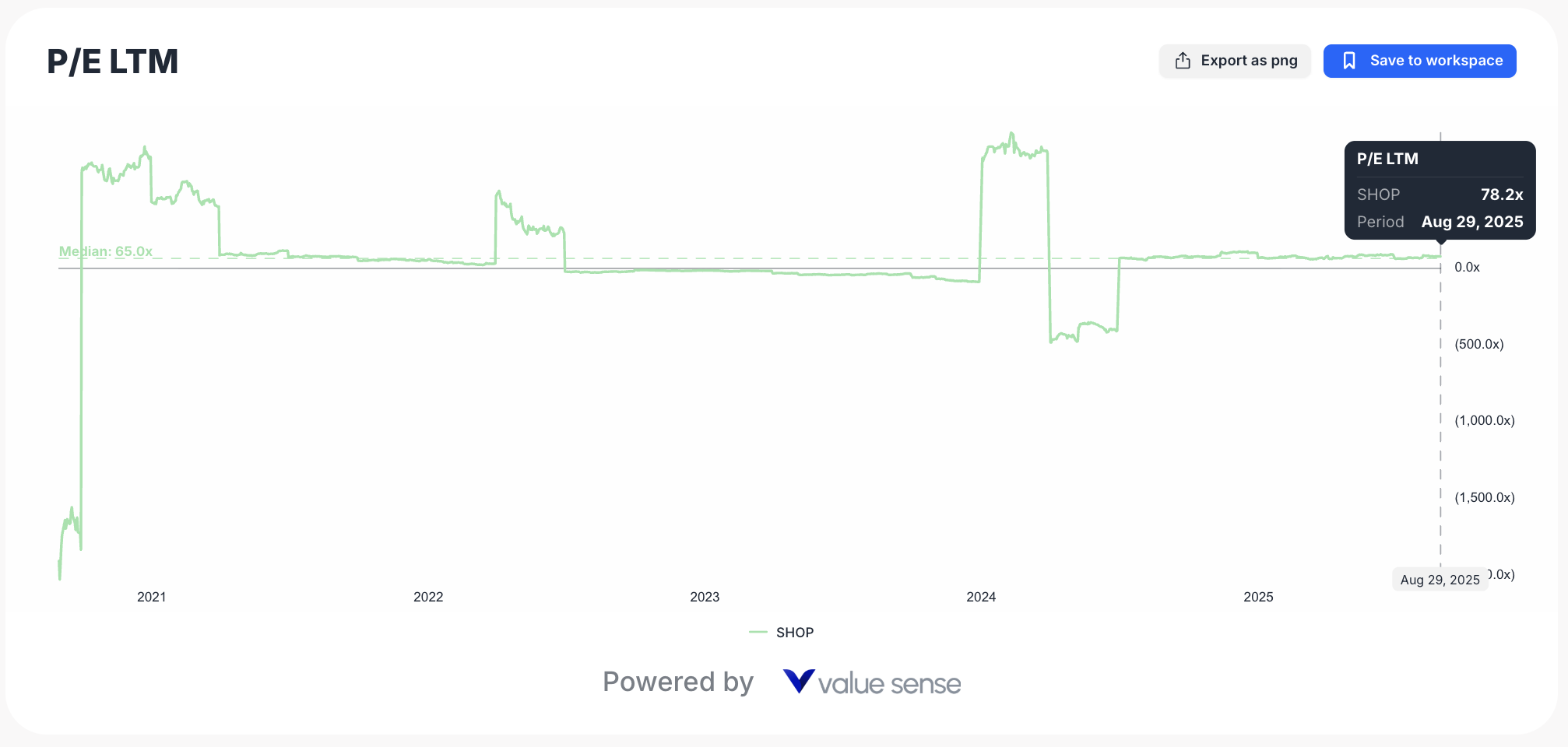

P/E Ratio: Earnings Power Recognition

The P/E LTM chart reveals similar patterns:

- Historical Extremes: P/E ratios reaching unsustainable levels

- Correction Phase: Sharp decline in 2023 creating opportunity

- Stabilization: Current levels reflecting improved earnings power

The E-commerce Value Play: Why SHOP is Undervalued

1. Platform Economics Misunderstood

The market continues to treat Shopify as a traditional software company rather than recognizing its unique platform economics:

Network Effects: Growing merchant base attracts more developers, apps, and services

Recurring Revenue: Subscription fees provide predictable base revenue

Transaction Leverage: Payment processing and fulfillment services scale with merchant success

International Expansion: Proven model ready for global replication

2. Competitive Moat Strengthening

Shopify's competitive position has actually strengthened during the normalization period:

Market Share: Continued gains in SMB e-commerce platform market

Enterprise Growth: Success in enterprise segment reducing customer concentration risk

Innovation Pace: Continued platform enhancements maintaining technological leadership

Ecosystem Depth: App store and partner network creating switching costs

3. Financial Model Maturation

The transformation from growth-at-all-costs to profitable growth represents sustainable value creation:

Cash Generation: Consistent free cash flow production

Capital Efficiency: Reduced need for external financing

Shareholder Returns: Potential for buybacks and dividends as cash builds

Investment Flexibility: Strong balance sheet enabling strategic opportunities

Key Financial Metrics Supporting Undervaluation

| Metric | Historical Peak | Current Level | Implication |

|---|---|---|---|

| Revenue Growth | 100%+ | ~25-30% | Sustainable, quality growth |

| FCF Margin | Volatile (0-15%) | ~15% consistent | Operational maturity |

| Rule of 40 | Volatile (20-100%) | ~45% stable | Balanced efficiency |

| P/FCF Ratio | 1000x+ | ~175x | Normalized valuation |

| FCF Yield | Near 0% | ~0.45% | Attractive cash return |

Source: ValueSense Dashboard Analysis

Investment Risks and Considerations

While the undervaluation thesis is compelling, investors should consider several risk factors:

E-commerce Market Maturation

- Growth Deceleration: Overall e-commerce growth rates may continue moderating

- Competition Intensification: Increased competition from Amazon, WooCommerce, and others

- Market Saturation: Potential limits to SMB market expansion

Macroeconomic Sensitivity

- Consumer Spending: Economic downturns could impact merchant success and platform usage

- Small Business Vulnerability: SMB customers more sensitive to economic cycles

- International Exposure: Currency and geopolitical risks from global expansion

Execution Challenges

- Enterprise Competition: Competing against established enterprise solutions

- Technology Evolution: Need to maintain innovation pace in rapidly evolving market

- Regulatory Changes: Potential impacts from e-commerce and payment regulations

The Path Forward: Catalysts for Value Recognition

Several factors could drive market recognition of Shopify's undervaluation:

Near-term Catalysts (3-6 months)

- Quarterly Results: Continued demonstration of stable growth and margin improvement

- Enterprise Wins: Large customer announcements validating upmarket strategy

- International Expansion: Success metrics from global market penetration

Medium-term Catalysts (6-18 months)

- AI Integration: Successful deployment of AI features driving merchant value

- New Product Lines: Launch of adjacent services expanding revenue streams

- Market Share Gains: Continued growth relative to e-commerce platform competitors

Long-term Catalysts (1-3 years)

- Capital Returns: Initiation of dividend or significant buyback programs

- Strategic Partnerships: Major integrations or partnerships expanding reach

- Market Leadership: Clear dominance in SMB e-commerce platform space

Investment Strategy: How to Play the Recovery

For investors convinced by the SHOP undervalued analysis, several approaches merit consideration:

Value Approach

- Dollar-Cost Averaging: Regular purchases taking advantage of volatility

- Catalyst-Driven: Buying ahead of expected positive developments

- Contrarian Positioning: Taking advantage of continued market skepticism

Growth-Value Hybrid

- Quality Focus: Emphasizing sustainable growth metrics over pure growth rates

- Multiple Expansion: Benefiting from potential P/E and P/FCF re-rating

- Long-term Holding: Allowing platform economics to compound over time

Conclusion: The Compelling Case for Shopify Undervalued

The comprehensive ValueSense dashboard analysis reveals a company that has successfully navigated one of the most challenging transitions in technology: from hyper-growth startup to mature, profitable platform. Shopify's transformation from pandemic darling to undervalued recovery play represents a classic value investing opportunity disguised as a technology stock.

The data tells a clear story: while the market focused on growth deceleration, Shopify quietly built a sustainable, cash-generating business model with improving unit economics and strengthening competitive moats. The current valuation fails to reflect this operational transformation, creating an attractive entry point for investors with conviction in the e-commerce platform leader.

For those seeking an e-commerce value play, Shopify offers the rare combination of market leadership, operational improvement, and valuation attractiveness. The company's platform economics, proven execution capability, and enormous addressable market position it well for the next phase of growth.

The SHOP undervalued thesis isn't about betting on a return to pandemic-era growth rates – it's about recognizing a fundamentally stronger business trading at a significant discount to its intrinsic value. As the market eventually recognizes this operational transformation, patient investors stand to benefit from both multiple expansion and continued business improvement.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 Palantir Rule of 40 Analysis

📖 Undervalued Utility Stocks: Best Defensive Value Plays

📖 Disney vs Netflix Stock Analysis 2025

FAQ: Shopify Undervalued

Q1: What makes Shopify undervalued in 2025 according to the ValueSense analysis?

A: The ValueSense dashboard shows Shopify has achieved operational maturity with stable 15% FCF margins, Rule of 40 scores above 40%, and normalized P/FCF ratios around 175x (down from 1000x+ peaks). The market hasn't recognized this transformation from volatile growth to sustainable profitability.

Q2: How has Shopify's Rule of 40 performance evolved and what does it indicate?

A: ValueSense data shows Shopify's Rule of 40 evolved from volatile 20-100% swings to consistent 40-45% scores since 2024. This indicates the company has achieved the critical balance between growth and profitability that defines mature, efficient SaaS businesses.

Q3: What role does free cash flow play in the SHOP undervalued analysis?

A: Free cash flow margins have stabilized around 15% after years of volatility, while FCF yield improved dramatically from near-zero in 2021-2022 to current levels around 0.45%. This transformation represents the core of Shopify's undervaluation as the market pays for current cash generation rather than speculative growth.

Q4: How do current valuation metrics support the undervalued thesis?

A: ValueSense charts show P/FCF ratios have normalized to ~175x from extreme peaks above 1000x, while P/E ratios have similarly compressed. Combined with improving fundamentals (stable growth, higher margins), current valuations offer attractive risk-adjusted returns compared to historical peaks.

Q5: What are the key risks to the Shopify undervalued investment thesis?

A: Primary risks include e-commerce market maturation limiting growth, increased competition from Amazon and others, macroeconomic sensitivity affecting SMB customers, and execution challenges in enterprise markets. However, the platform's network effects and operational improvements provide downside protection at current valuations.