9 Best Small-Cap Growth Stocks with High Growth Ratings - Value Sense 2025

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io.

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

The Explosive Potential of Small-Cap Growth Investing

Small-cap growth stocks represent the most dynamic segment of the equity market, offering investors exposure to emerging companies with exceptional growth trajectories and market disruption potential. These companies, with market capitalizations between $300 million and $2 billion, possess the agility to capitalize on new opportunities while maintaining the scale necessary for sustainable competitive advantages.

Our analysis focuses on small-cap companies with growth ratings exceeding 7.0 on our proprietary scale, indicating exceptional revenue growth, expanding market opportunities, and operational execution capabilities. These high-growth companies demonstrate the fundamental characteristics necessary for potential multibagger returns through sustained competitive advantages and market expansion.

Small-Cap Growth Selection Criteria:

- Market capitalization between $300 million and $2 billion

- Growth rating above 7.0 indicating exceptional growth potential

- Strong revenue growth across multiple time horizons

- Operational execution and market positioning for continued expansion

Top 9 Small-Cap Growth Stocks - Complete Analysis

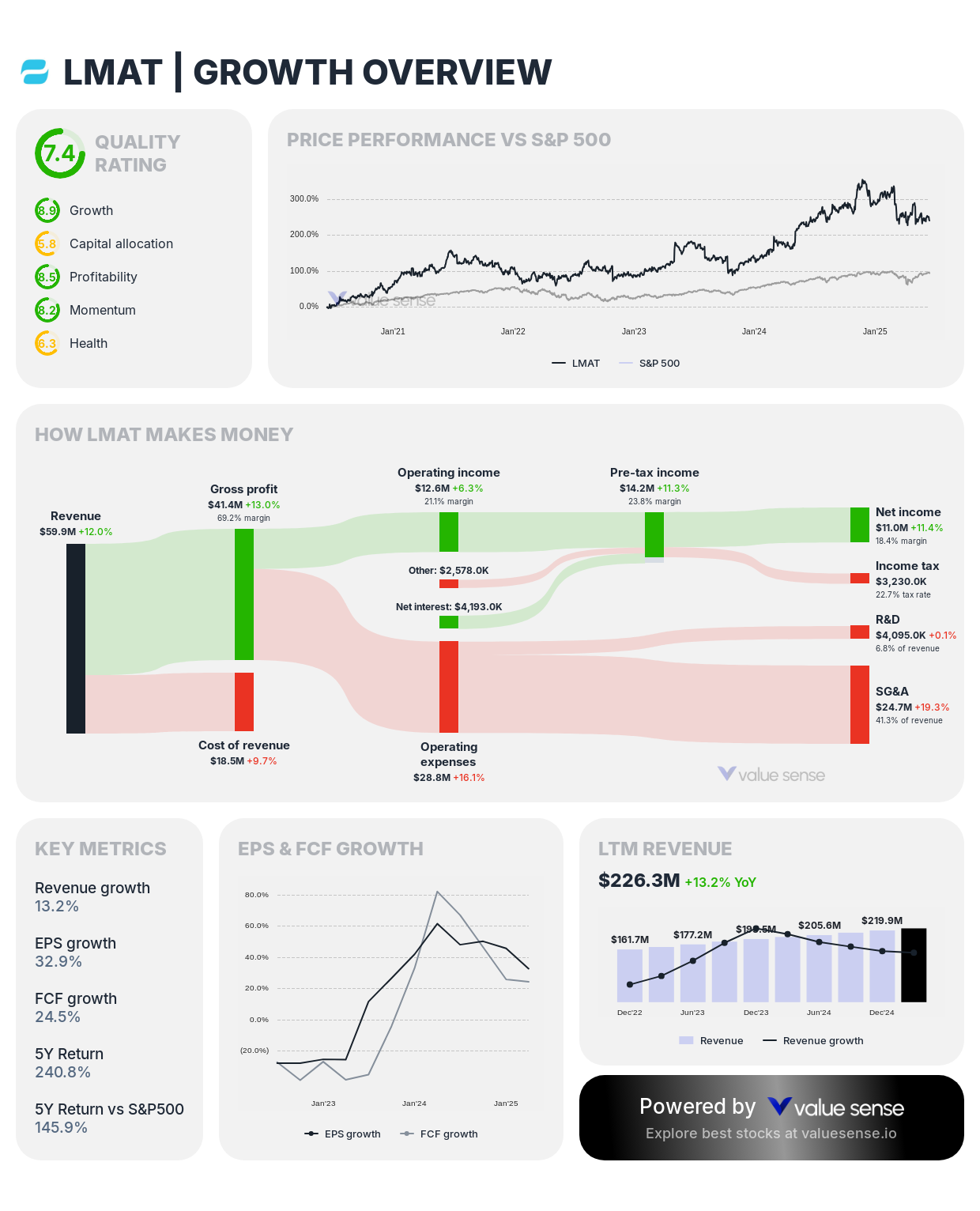

1. LeMaitre Vascular, Inc. (LMAT) - 8.9 Growth Rating ⭐

Sector: Medical Devices | Market Cap: $1,865.3M | Growth Rating: 8.9

- Revenue Growth (5Y CAGR): 13.7%

- Revenue Growth (YoY): 13.2%

- Revenue Growth (FWD): 8.8%

Investment Thesis: LeMaitre Vascular achieves the highest growth rating in our analysis at 8.9, specializing in medical devices for vascular surgery. The company demonstrates exceptional consistency with steady growth across all time horizons, benefiting from demographic trends and increasing medical innovation in vascular treatments.

Growth Catalysts:

- Aging population demographics driving increased vascular surgery demand

- Product portfolio expansion through internal development and strategic acquisitions

- International market expansion with direct sales and distribution partnerships

- Technology advancement in minimally invasive vascular procedures

Growth Sustainability: LeMaitre's consistent growth trajectory across all metrics (13.7% 5Y CAGR, 13.2% YoY, 8.8% forward) demonstrates the company's ability to execute its focused growth strategy. The specialized market position and demographic tailwinds support continued sustainable growth in the expanding vascular device market.

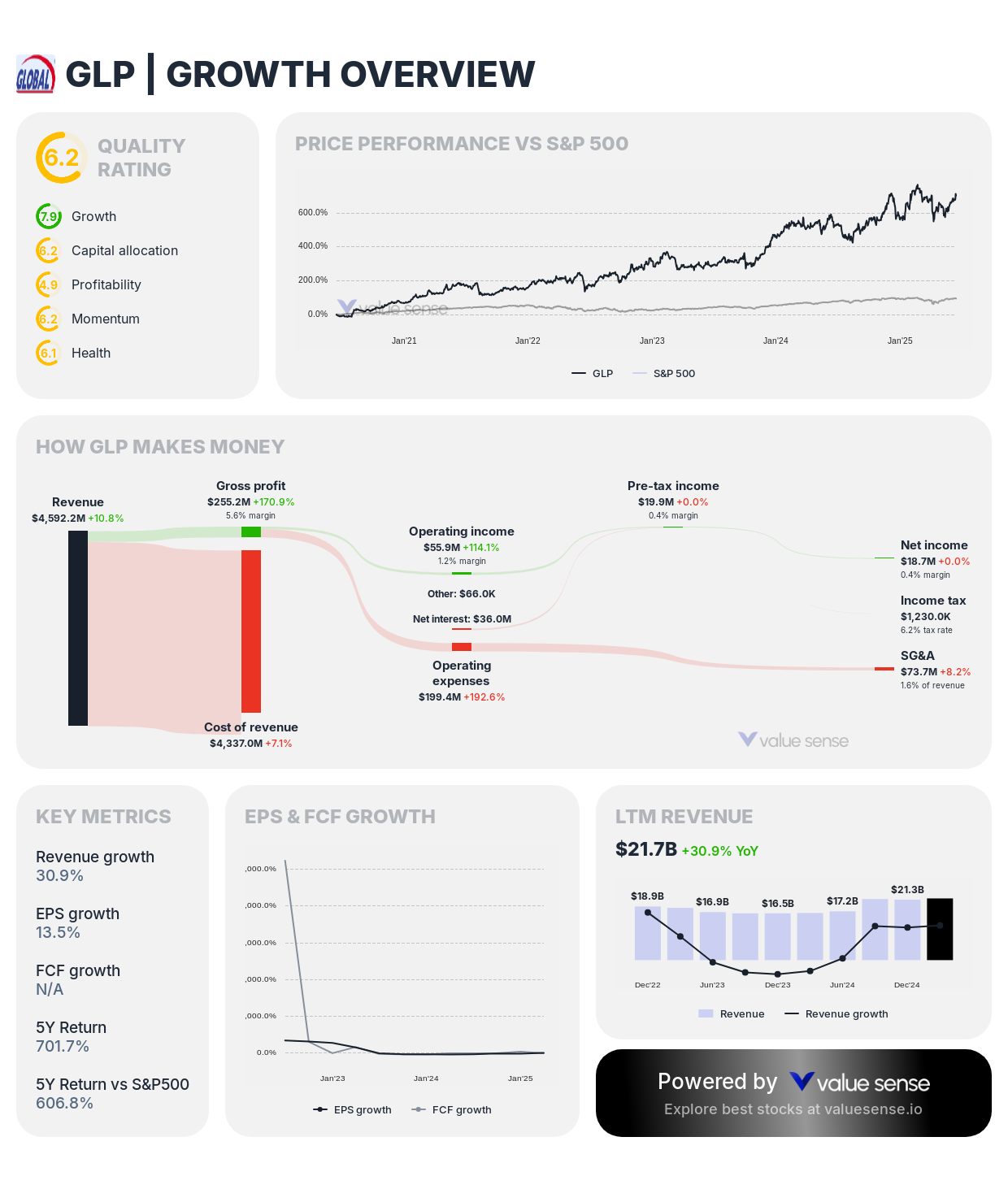

2. Global Partners LP (GLP) - 7.9 Growth Rating

Sector: Energy Distribution | Market Cap: $1,849.9M | Growth Rating: 7.9

- Revenue Growth (5Y CAGR): 11.4%

- Revenue Growth (YoY): 30.9%

- Revenue Growth (FWD): 43.5%

Investment Thesis: Global Partners demonstrates accelerating growth momentum with a 7.9 growth rating, reflecting strong execution in energy distribution and retail operations. The company's integrated business model spanning wholesale distribution, retail gasoline, and commercial services creates multiple revenue streams and substantial growth opportunities.

Growth Catalysts:

- Strategic acquisitions expanding geographic footprint and market share

- Convenience store and retail operations providing higher-margin revenue streams

- Commercial fuel distribution growth in Northeast markets

- Infrastructure investments supporting capacity expansion and operational efficiency

Growth Sustainability: Global Partners' exceptional forward revenue growth projection of 43.5% indicates strong management confidence in continued expansion. The company's asset-light distribution model and strategic market positioning support sustainable growth through both organic expansion and strategic acquisitions.

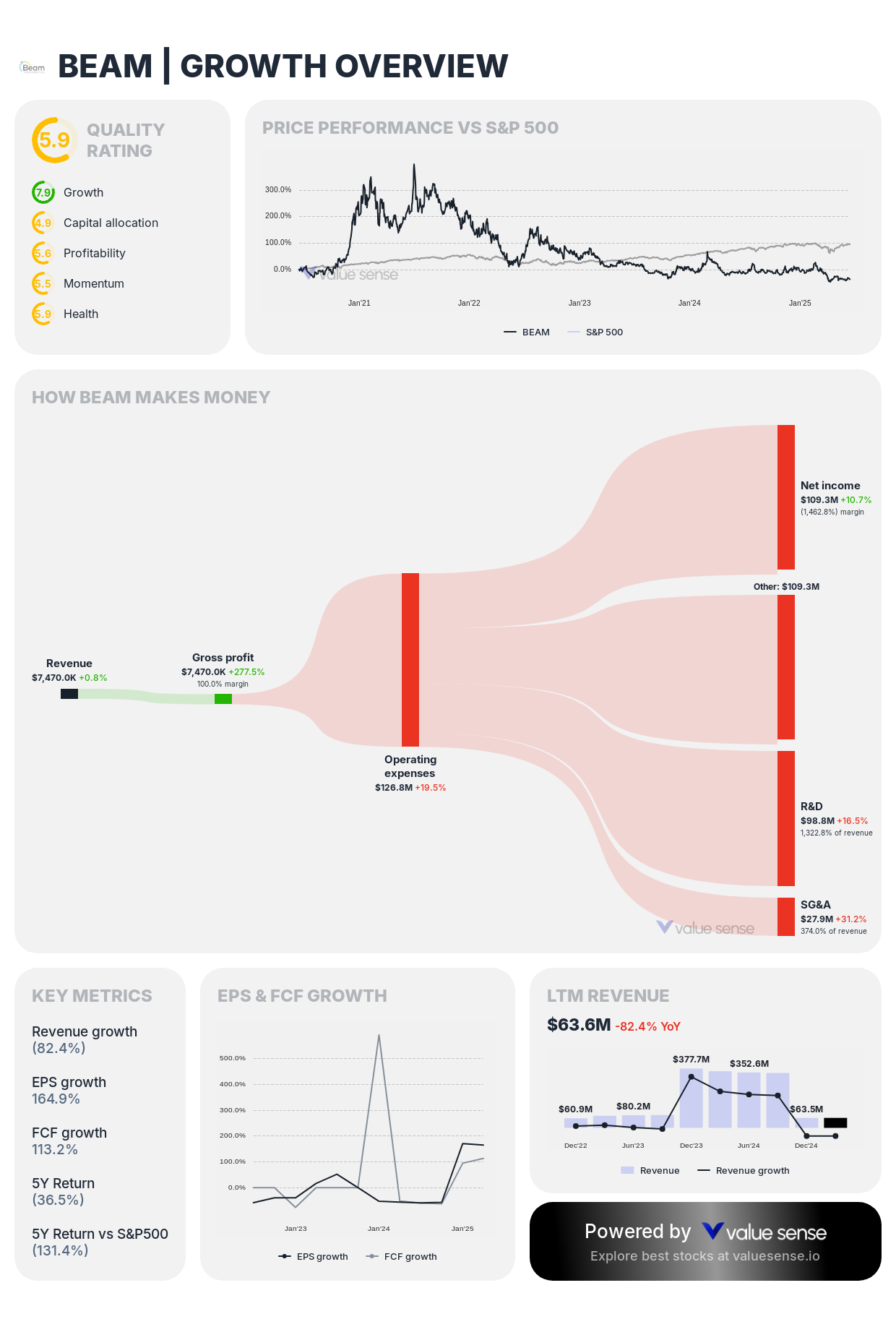

3. Beam Therapeutics Inc. (BEAM) - 7.9 Growth Rating

Sector: Biotechnology | Market Cap: $1,522.4M | Growth Rating: 7.9

- Revenue Growth (5Y CAGR): 383.7%

- Revenue Growth (YoY): (82.4%)

- Revenue Growth (FWD): 0.3%

Investment Thesis: Beam Therapeutics represents cutting-edge innovation in precision gene editing with an extraordinary 383.7% five-year compound annual growth rate. The company's base editing technology platform offers potential advantages over traditional CRISPR approaches, targeting genetic diseases with greater precision and reduced off-target effects.

Growth Catalysts:

- Base editing platform advancement with multiple therapeutic applications

- Strategic partnerships with pharmaceutical companies for drug development funding

- Clinical trial progression across multiple disease targets

- Intellectual property portfolio expansion in precision medicine

Growth Sustainability: While recent revenue declined 82.4% year-over-year due to typical volatility in early-stage biotech partnerships, Beam's fundamental technology platform and expanding clinical pipeline support long-term growth potential. The modest forward growth guidance reflects the partnership-dependent nature of early-stage biotech revenue streams.

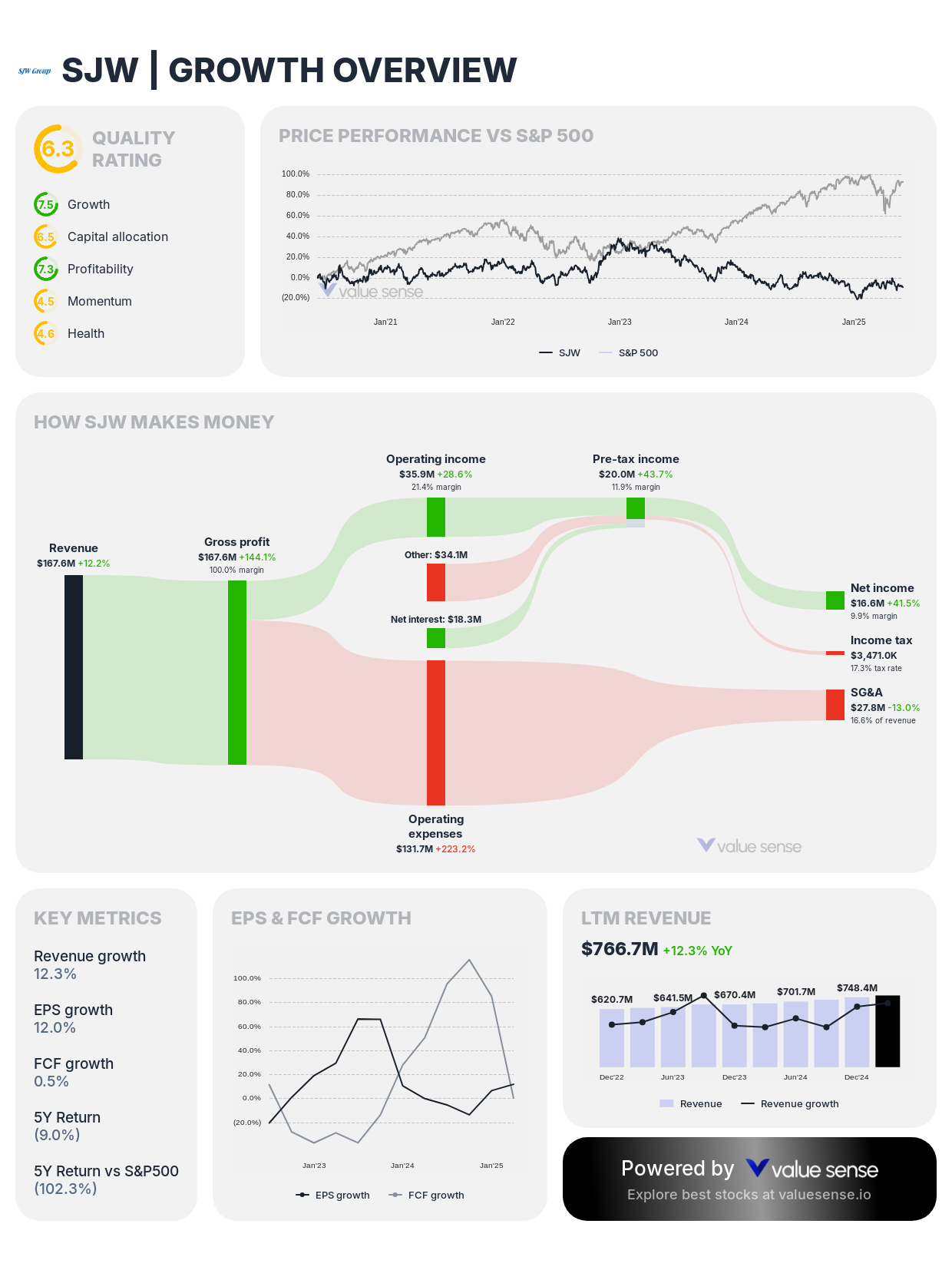

4. SJW Group (SJW) - 7.5 Growth Rating

Sector: Utilities | Market Cap: $1,751.1M | Growth Rating: 7.5

- Revenue Growth (5Y CAGR): 10.8%

- Revenue Growth (YoY): 12.3%

- Revenue Growth (FWD): 1.1%

Investment Thesis: SJW Group provides essential water utility services with consistent growth driven by population expansion and infrastructure investment in its service territories. The company's regulated utility model provides predictable revenue streams with growth potential from rate increases and system expansion.

Growth Catalysts:

- Population growth in California and Texas service territories

- Infrastructure investment programs supporting rate base expansion

- Water system acquisitions expanding customer base and service areas

- Regulatory environment supporting utility investment recovery

Growth Sustainability: SJW's regulated utility model provides stable, predictable growth with limited volatility. The modest forward growth guidance (1.1%) reflects the mature nature of utility operations, though infrastructure investment and population growth support continued expansion opportunities.

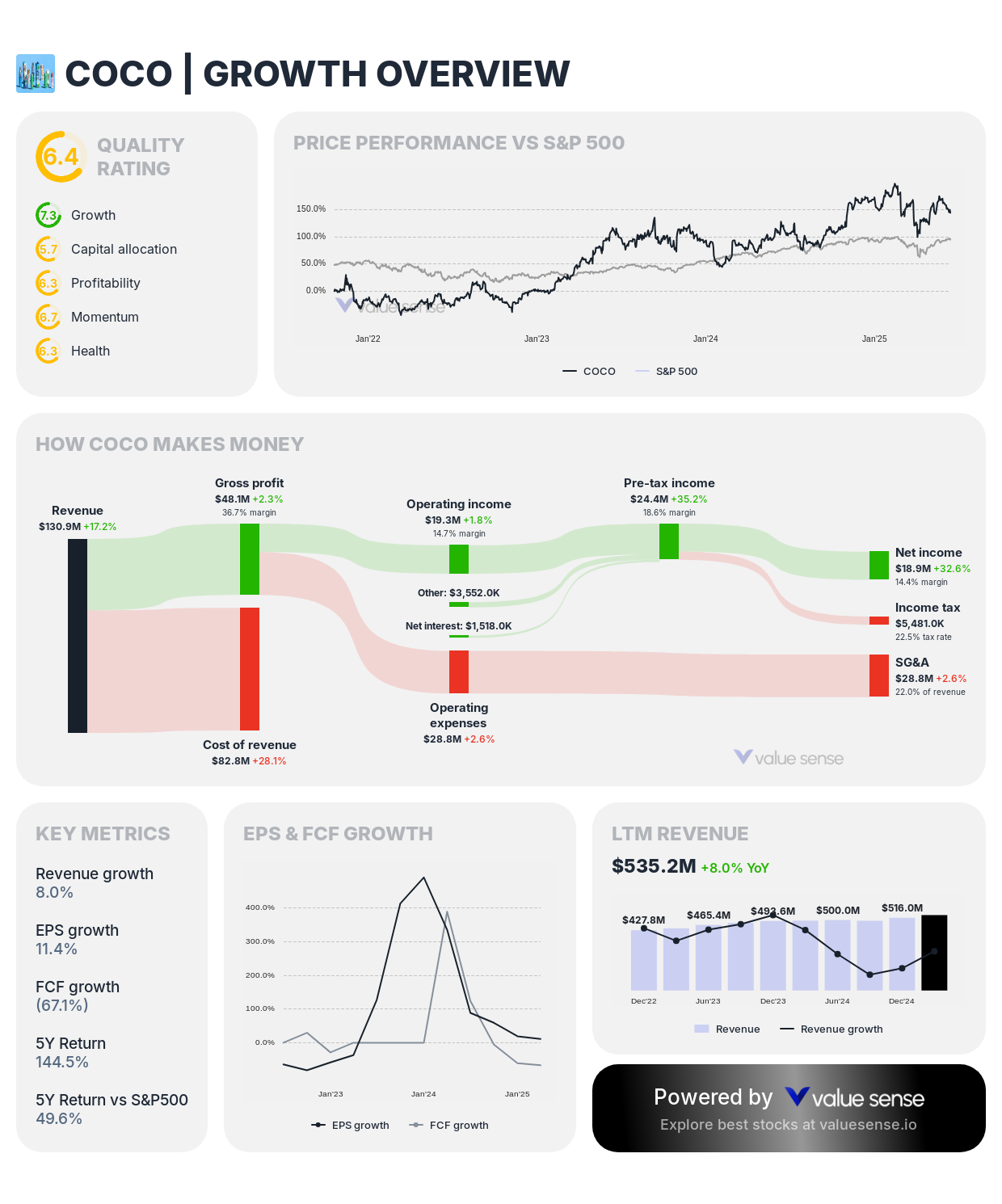

5. The Vita Coco Company, Inc. (COCO) - 7.3 Growth Rating

Sector: Consumer Beverages | Market Cap: $1,905.3M | Growth Rating: 7.3

- Revenue Growth (5Y CAGR): 47.4%

- Revenue Growth (YoY): 8.0%

- Revenue Growth (FWD): 10.2%

Investment Thesis: Vita Coco demonstrates consistent growth in the expanding coconut water and plant-based beverage market with an impressive 47.4% five-year compound annual growth rate. The company's brand leadership and distribution advantages position it to capitalize on growing consumer demand for healthy, natural beverage alternatives.

Growth Catalysts:

- Expanding distribution network across retail channels and geographic markets

- Product innovation and line extensions beyond traditional coconut water

- International market expansion with localized marketing strategies

- Premium positioning in the growing functional beverage category

Growth Sustainability: Vita Coco's moderate but consistent growth trajectory (8.0% YoY, 10.2% forward) reflects market maturation and competitive dynamics. The company's strong brand recognition and operational scale provide sustainable competitive advantages in the natural beverage market.

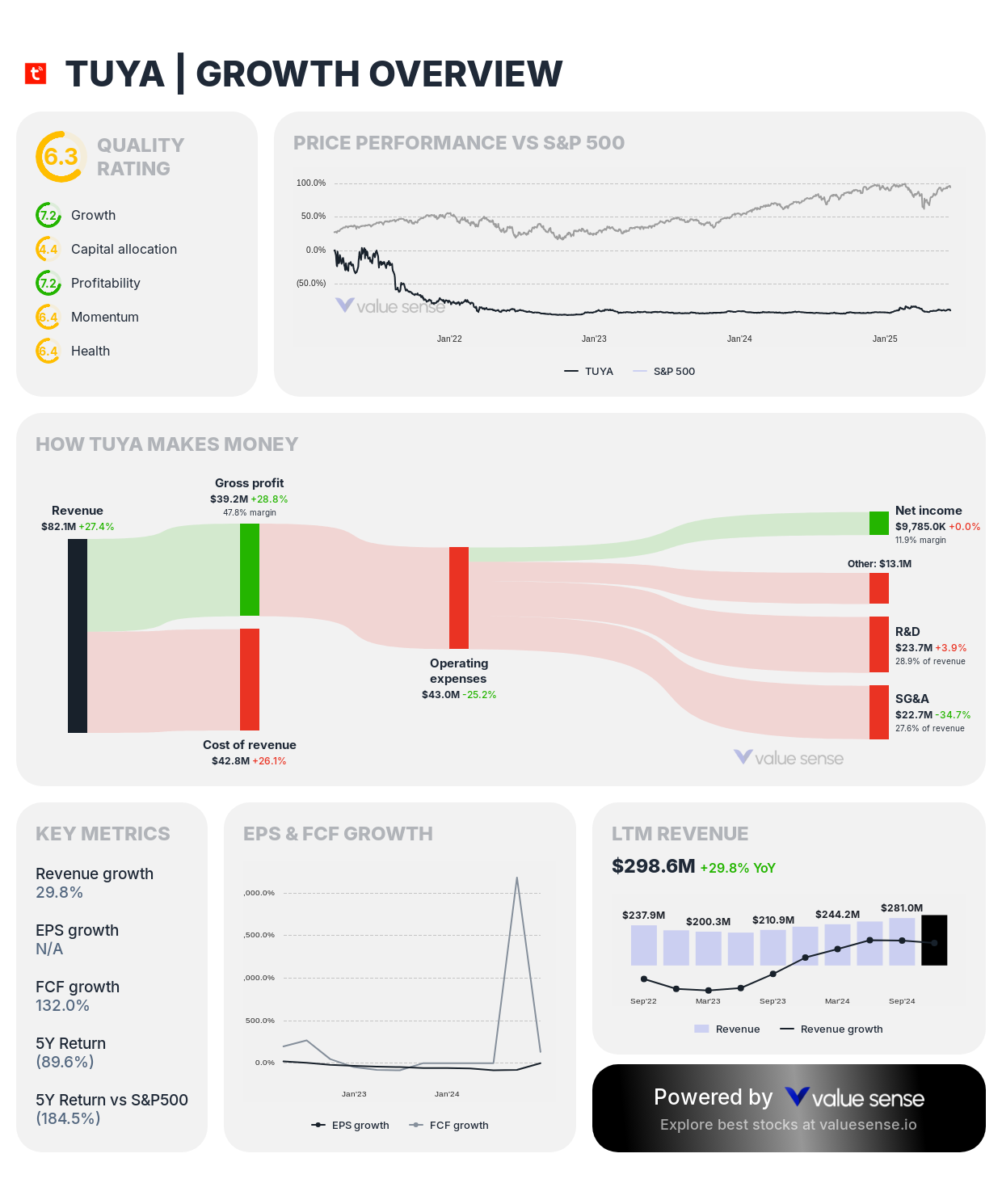

6. Tuya Inc. (TUYA) - 7.2 Growth Rating

Sector: IoT Technology | Market Cap: $1,457.0M | Growth Rating: 7.2

- Revenue Growth (5Y CAGR): 54.2%

- Revenue Growth (YoY): 29.8%

- Revenue Growth (FWD): 19.3%

Investment Thesis: Tuya operates a leading Internet of Things (IoT) platform enabling smart device connectivity and automation. The company's 54.2% five-year compound annual growth rate reflects the rapid adoption of smart home and IoT technologies globally, with Tuya's platform serving as critical infrastructure for device manufacturers and consumers.

Growth Catalysts:

- Global IoT market expansion with increasing smart device adoption

- Platform ecosystem growth connecting more devices and manufacturers

- International market expansion beyond core Chinese operations

- Enterprise and industrial IoT applications development

Growth Sustainability: Tuya's strong growth trajectory (29.8% YoY, 19.3% forward) demonstrates the company's ability to capitalize on IoT market expansion. The platform's network effects and developer ecosystem create competitive advantages supporting continued growth as IoT adoption accelerates globally.

7. Edgewise Therapeutics, Inc. (EWTX) - 7.2 Growth Rating

Sector: Biotechnology | Market Cap: $1,472.6M | Growth Rating: 7.2

- Revenue Growth (5Y CAGR): N/A

- Revenue Growth (YoY): (100.0%)

- Revenue Growth (FWD): N/A

Investment Thesis: Edgewise Therapeutics develops precision medicines for rare muscle disorders, addressing significant unmet medical needs in neuromuscular diseases. The company's focused approach on muscle biology and drug development creates potential for substantial value creation in specialized therapeutic markets with limited competition.

Growth Catalysts:

- Clinical trial advancement for rare muscle disorder treatments

- Precision medicine approach targeting specific patient populations

- Potential regulatory approvals and market exclusivity in orphan diseases

- Strategic partnerships for development and commercialization support

Growth Sustainability: As an early-stage biotech company, Edgewise's revenue growth metrics reflect the pre-commercial nature of its operations. The company's specialized focus on rare diseases and innovative therapeutic approaches support long-term growth potential despite current revenue limitations.

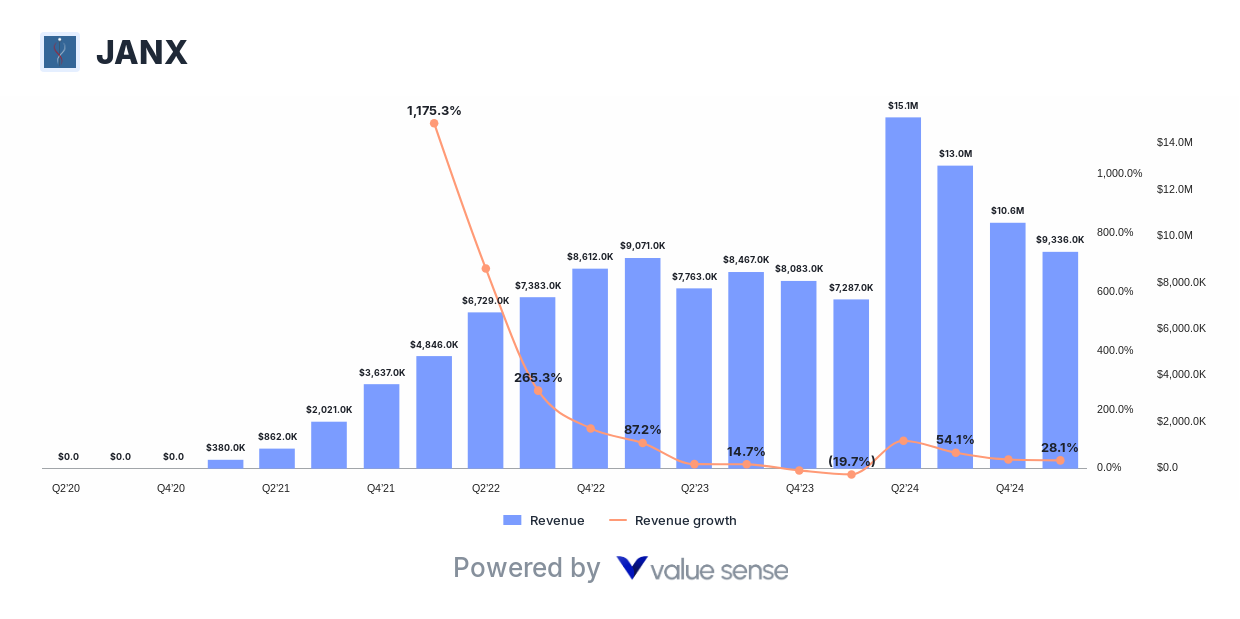

8. Janux Therapeutics, Inc. (JANX) - 7.1 Growth Rating

Sector: Biotechnology | Market Cap: $1,546.3M | Growth Rating: 7.1

- Revenue Growth (5Y CAGR): N/A

- Revenue Growth (YoY): 28.1%

- Revenue Growth (FWD): (76.6%)

Investment Thesis: Janux Therapeutics focuses on developing novel T cell engager therapies for cancer treatment. As an early-stage biotechnology company, Janux's growth potential stems from its innovative approach to cancer immunotherapy and expanding clinical pipeline addressing significant unmet medical needs.

Growth Catalysts:

- T cell engager platform advancement with multiple therapeutic targets

- Clinical trial progression and potential regulatory approvals

- Strategic partnerships with pharmaceutical companies for development funding

- Intellectual property expansion in cancer immunotherapy

Growth Sustainability: Janux's negative forward revenue growth (-76.6%) reflects typical volatility in early-stage biotech companies dependent on partnership agreements and milestone payments. The company's innovative platform and clinical pipeline support long-term growth potential despite near-term revenue fluctuations.

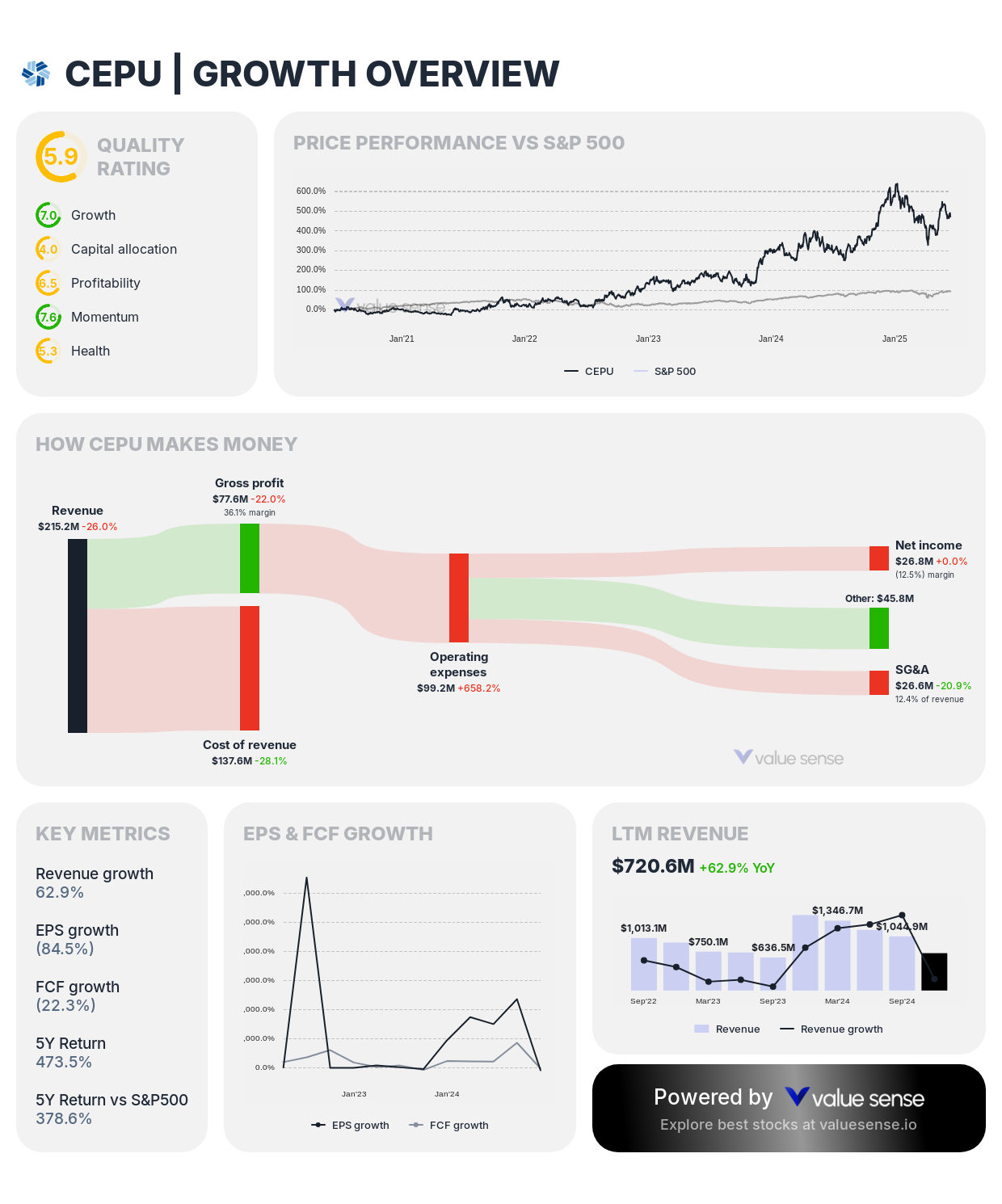

9. Central Puerto S.A. (CEPU) - 7.0 Growth Rating

Sector: Energy Infrastructure | Market Cap: $1,874.8M | Growth Rating: 7.0

- Revenue Growth (5Y CAGR): 85.0%

- Revenue Growth (YoY): 62.9%

- Revenue Growth (FWD): 25.6%

Investment Thesis: Central Puerto demonstrates exceptional historical growth with an impressive 85% five-year compound annual growth rate alongside 62.9% year-over-year revenue expansion. As Argentina's leading private power generation company, Central Puerto benefits from the country's growing energy demand and infrastructure modernization initiatives.

Growth Catalysts:

- Argentina's energy sector privatization and infrastructure investment

- Renewable energy portfolio expansion with government support

- Natural gas-fired power generation capacity additions

- Regional energy market integration opportunities

Growth Sustainability: The company's diversified power generation portfolio and strategic positioning in Argentina's energy transformation provide multiple growth avenues. Central Puerto's operational efficiency improvements and capacity expansion support continued revenue growth, though forward guidance suggests moderation to 25.6% as the business matures.

Small-Cap Growth Investment Strategy

Focus on Growth Rating Excellence: Companies with growth ratings above 7.5 (LeMaitre at 8.9, Global Partners and Beam at 7.9) demonstrate exceptional growth potential with strong operational execution. These businesses typically offer the highest potential for substantial returns through sustained competitive advantages and market expansion.

Diversification Across Sectors: Small-cap growth opportunities span multiple sectors from biotechnology and technology to energy and consumer goods. Diversification reduces concentration risk while providing exposure to different growth themes including healthcare innovation, energy transition, IoT expansion, and consumer health trends.

Assess Growth Sustainability: Evaluate the sustainability of historical growth rates and forward guidance. Companies like LeMaitre and SJW Group demonstrate more predictable growth trajectories, while biotech companies like Beam and Janux offer higher potential returns with greater volatility and execution risk.

Monitor Execution Risk: Small-cap companies face greater execution risks than large-cap peers. Focus on management teams with proven track records, strong financial positions, and clear strategic vision for continued growth and market expansion.

Understanding Our Growth Score Methodology

Our proprietary Growth Score evaluates companies across multiple dimensions to identify those with the highest potential for sustained expansion:

Historical Performance Analysis (40% Weight):

- Five-year compound annual growth rate demonstrating long-term expansion capability

- Year-over-year revenue growth indicating recent momentum and execution

- Consistency of growth across different market cycles and economic conditions

Future Growth Prospects (35% Weight):

- Forward revenue growth estimates incorporating analyst consensus and management guidance

- Market opportunity size and company's addressable market penetration potential

- Innovation pipeline and R&D investment supporting future competitive advantages

Business Quality Assessment (25% Weight):

- Competitive positioning and sustainable competitive moats

- Operational efficiency and margin expansion potential

- Management execution capability and strategic vision for market expansion

A Growth Score above 7.0 indicates companies demonstrating exceptional characteristics across these dimensions, suggesting higher probability of continued growth and value creation for shareholders.

Key Takeaways for Small-Cap Growth Investors

✅ Top Growth Opportunity: LeMaitre Vascular (8.9 rating) offers the highest growth score with consistent execution

✅ Accelerating Momentum: Global Partners and Beam Therapeutics (7.9 ratings) show exceptional growth potential

✅ Sector Diversification: Opportunities span medical devices, energy, biotechnology, utilities, and technology

✅ Growth Consistency: Companies like LeMaitre and Vita Coco demonstrate more predictable growth patterns

✅ Innovation Focus: Biotech companies offer breakthrough potential with higher risk-reward profiles

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 11 Best High Free Cash Flow Stocks

📖 10 Best Undervalued Dividend Stocks

📖 11 Best Multibagger Stocks with Heavy Moats

FAQ About Small-Cap Growth Stocks

What makes small-cap growth stocks attractive compared to large-cap alternatives?

Small-cap growth stocks offer several unique advantages including higher growth potential due to smaller revenue bases, greater operational flexibility and agility in responding to market opportunities, and less institutional coverage creating potential inefficiencies for individual investors to exploit. Companies like Central Puerto (85% 5Y CAGR) and Beam Therapeutics (383.7% 5Y CAGR) demonstrate growth rates rarely achievable by large-cap companies. However, these opportunities come with increased volatility and execution risk requiring careful analysis and portfolio management.

How important are growth ratings versus traditional financial metrics for small-cap evaluation?

Growth ratings provide crucial insights into small-cap companies' future potential, often more relevant than traditional metrics like P/E ratios for early-stage or rapidly growing businesses. Our growth ratings above 7.0 indicate companies with exceptional expansion potential, sustainable competitive advantages, and strong execution capabilities. However, investors should balance growth ratings with financial health metrics, market positioning, and management quality. Companies like LeMaitre (8.9 rating) combine strong growth potential with operational stability, while biotech companies offer higher ratings with greater uncertainty.

What are the primary risks associated with small-cap growth investing?

Small-cap growth investing involves several key risks including higher volatility due to limited liquidity and market coverage, execution risk from less experienced management teams, funding risk for companies requiring additional capital, and competitive threats from larger companies with more resources. Biotech companies like Janux (-76.6% forward growth) demonstrate typical revenue volatility in early-stage businesses. Investors can mitigate risks through diversification across sectors, careful due diligence on management teams, and position sizing appropriate for risk tolerance.

How should investors evaluate the sustainability of high growth rates in small-cap companies?

Growth sustainability analysis should focus on market opportunity size, competitive positioning, and operational scalability. Companies with large addressable markets like Tuya (IoT platform) and sustainable competitive advantages tend to maintain growth longer than those in mature or highly competitive markets. Examine whether growth comes from market expansion, market share gains, or price increases, and assess management's ability to reinvest capital at high returns. Forward guidance provides insights into management confidence, though biotech and early-stage companies often show more volatility.

What role should small-cap growth stocks play in a diversified investment portfolio?

Small-cap growth stocks should typically represent 5-15% of a diversified portfolio, depending on risk tolerance and investment objectives. These positions offer potential for outsized returns and portfolio diversification benefits due to lower correlation with large-cap stocks. Consider spreading investments across multiple small-cap growth companies and sectors to reduce concentration risk. Younger investors with longer time horizons can typically allocate higher percentages to small-cap growth, while conservative investors should limit exposure while still capturing some upside potential from this dynamic market segment.