Inside Smart Money Analysis

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io.

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

A deep dive into ValueSense's new Smart Money Analysis suite, demonstrated through Microsoft's real-time data

When we set out to build Smart Money Analysis, we had one goal: make institutional-grade intelligence as accessible as checking your email. Today, we're pulling back the curtain on exactly what this means by walking through a live analysis of Microsoft Corporation (MSFT) – showing you the same data that drives billion-dollar investment decisions.

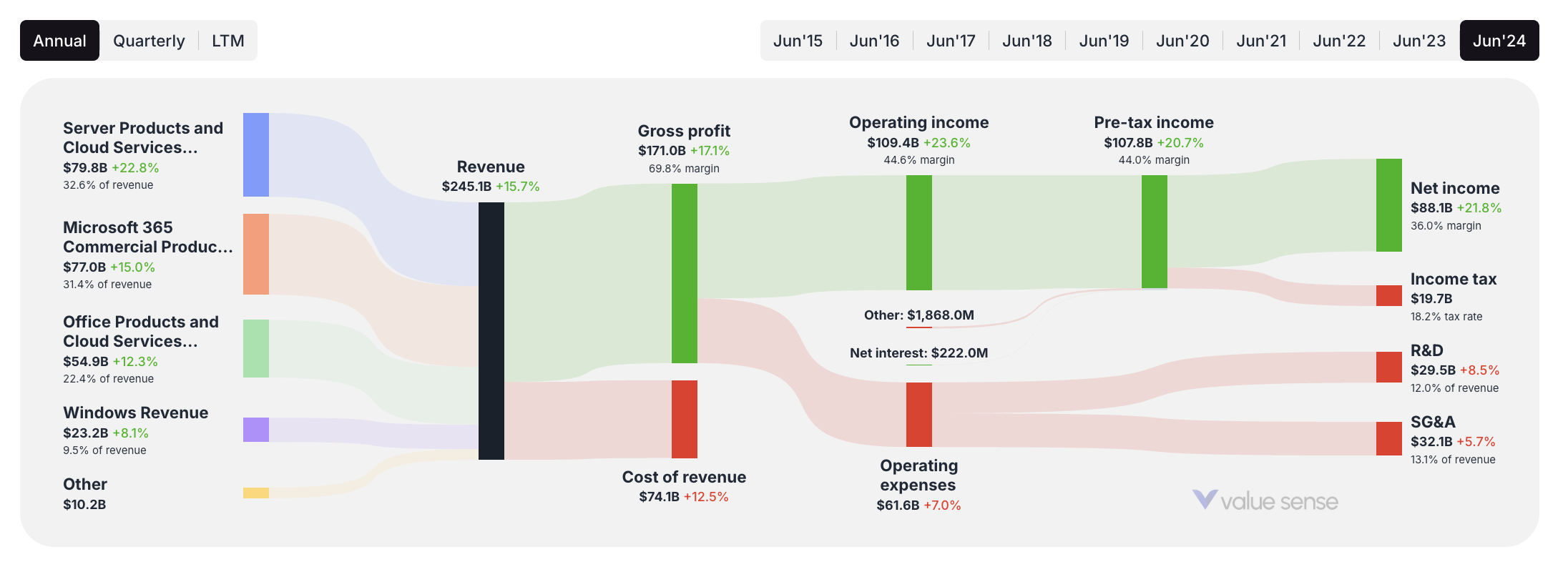

The Complete Financial Picture: More Than Just Numbers

Our Smart Money Analysis begins where traditional platforms end. Take Microsoft's latest financials: $245.1B in revenue flowing through a sophisticated business model that most platforms reduce to simple line items.

Our Sankey diagram visualization reveals the complete story:

- Server Products and Cloud Services: $79.8B (the growth engine)

- Microsoft 365 Commercial: $77.0B (the cash cow)

- Office Products and Cloud Services: $54.9B (legacy strength)

- Windows Revenue: $23.2B (the foundation)

But here's where it gets interesting – this $245.1B becomes $88.1B in net income (36% margin), and Smart Money Analysis shows you exactly how institutional investors are positioning around these fundamentals.

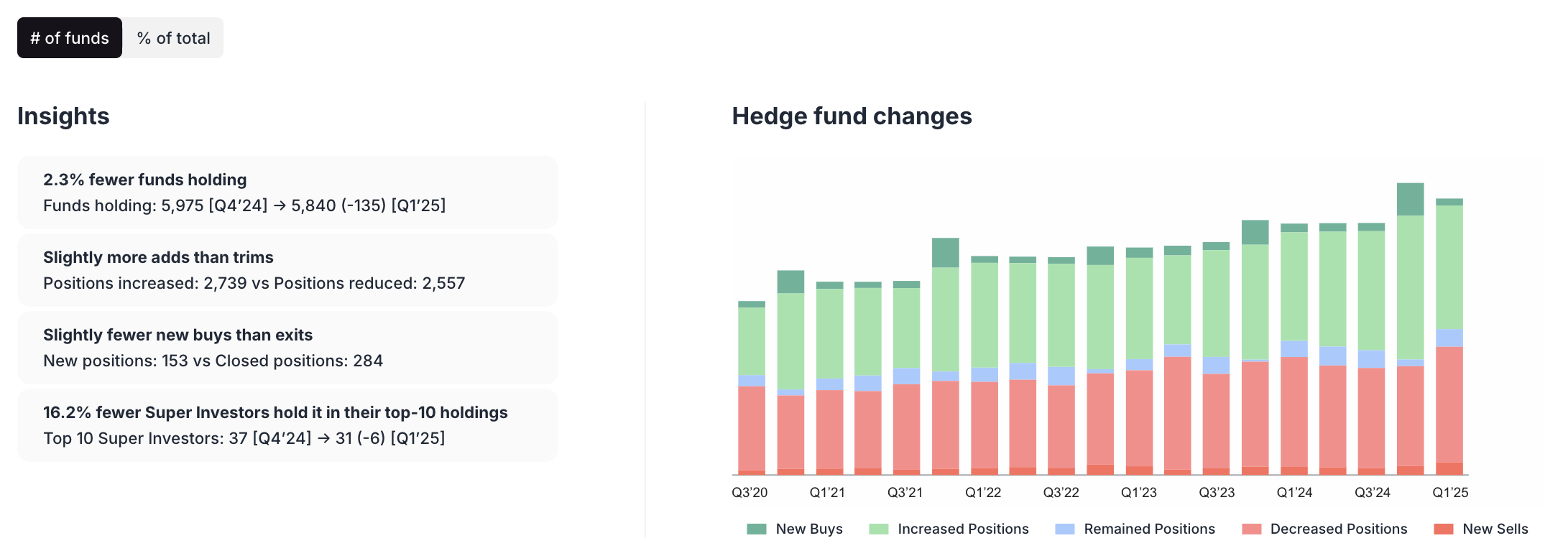

Hedge Fund Intelligence: Reading Between the Lines

While Microsoft's stock climbed from ~$400 to $513.7 over the past year, our hedge fund activity analysis reveals the nuanced institutional sentiment that price alone can't capture.

The Current Hedge Fund Landscape:

- Total funds holding MSFT decreased by 2.3% (institutional consolidation)

- 2,739 funds increased positions vs. 2,557 that reduced (net positive sentiment)

- Options activity shows $75.3M in puts vs. $72.6M in calls (slight bearish hedge)

This data tells a sophisticated story: while some funds are exiting, those remaining are generally increasing conviction – a pattern that often precedes sustained outperformance.

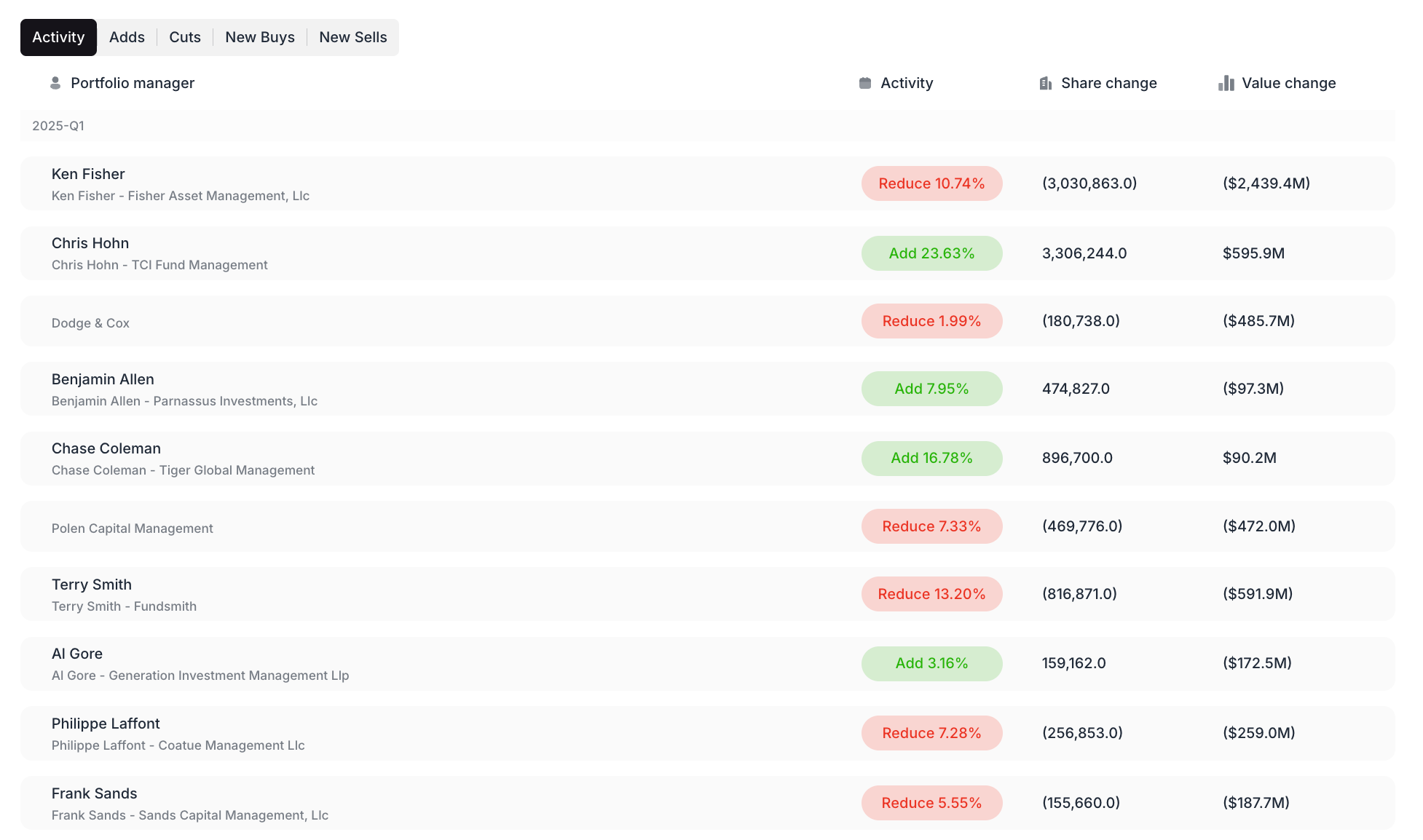

Institutional Investor Activity: Following the Smart Money

Our institutional analysis reveals fascinating positioning changes in Q1 2025:

Major Moves:

- Wallace Weitz: Increased position by 193.29% (value investor doubling down)

- David Rolfe: Added 18.31% (growth-focused increase)

- Ken Fisher: Reduced by 10.74% (profit-taking or rebalancing)

Meanwhile, the largest holders continue accumulating:

- Vanguard Group: Owns 9.3%, added 1.07%

- BlackRock: Owns 7.8%, added 1.22%

When passive giants like Vanguard and BlackRock are adding alongside concentrated value players like Weitz, it signals broad institutional confidence.

Insider Intelligence: The Ultimate Information Asymmetry

Here's where Smart Money Analysis gets uniquely powerful – insider transaction data that reveals what executives really think about their company's prospects.

The Microsoft Insider Reality:

- Last 3 months: $60.2M in sales, $0 in purchases

- Last 12 months: $152.5M in sales, $0 in purchases

Recent significant transactions include:

- Bradford L. Smith (Vice Chair and President): Sold $24.8M at $436.3 on May 2nd

- Takeshi Numoto (EVP, Chief Marketing Officer): Sold $1.4M at $463.0 on June 3rd

Our visualization overlays these transactions directly on the price chart, showing that executives have been selling consistently as the stock approached new highs – a classic pattern worth monitoring.

The Power of Integrated Analysis

What makes Smart Money Analysis revolutionary isn't any single data point – it's how these insights work together:

- Fundamentals show strong business performance ($245.1B revenue, 36% net margins)

- Institutional data reveals selective conviction (fewer funds, but stronger positions)

- Insider activity suggests caution (consistent selling, no buying)

- Price action confirms institutional support (steady climb to $513.7)

This creates a nuanced investment thesis: Microsoft remains institutionally favored with strong fundamentals, but insider selling suggests the current valuation may be full.

Beyond Traditional Analysis: Interactive Intelligence

Our Smart Money Analysis interface transforms static data into actionable intelligence:

- Interactive price charts with insider transaction overlays

- Filterable institutional activity (toggle between buyers and sellers)

- Real-time options sentiment tracking

- Historical pattern recognition across multiple timeframes

When you click "Buys" in our institutional filter, you immediately see which legendary investors are accumulating. When you hover over our price chart, you see exactly when insiders were selling and at what prices.

The Democratization Moment

For the first time, retail investors can analyze Microsoft the same way a $10 billion hedge fund would:

- Access the same institutional ownership data

- See the same insider transaction flows

- Analyze the same options sentiment indicators

- Use the same integrated visualization tools

This isn't just feature parity – it's intelligence equality.

Real-World Application: The Microsoft Decision Framework

Using Smart Money Analysis for Microsoft today, an investor might conclude:

Bullish signals:

- Strong fundamentals with cloud growth driving margins

- Net institutional accumulation despite fund count decrease

- Largest passive managers continuing to add

Cautious signals:

- Zero insider buying over 12 months with $152.5M in sales

- Recent executive sales near price highs

- Options sentiment slightly favoring puts

The Smart Money Verdict: Institutional confidence remains high, but insider behavior suggests valuation discipline – perfect for covered call strategies or waiting for pullbacks.

Looking Forward: Intelligence as Infrastructure

Smart Money Analysis represents more than a product launch – it's financial intelligence becoming infrastructure. When every investor has access to institutional-grade data, markets become more efficient, information asymmetries shrink, and investment decisions improve across the board.

Microsoft's data tells one story. But across thousands of stocks, Smart Money Analysis is revealing patterns, opportunities, and risks that were previously invisible to individual investors.

The playing field isn't just leveling – it's been leveled.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 11 Best High Free Cash Flow Stocks

📖 10 Best Undervalued Dividend Stocks

📖 11 Best Multibagger Stocks with Heavy Moats