S&P 500 Fair Value Heatmap: Top Overvalued and Undervalued Stocks to Watch in 2025

Welcome to Value Sense Blog

At Value Sense, we provide insights on the stock market, intrinsic value tools, and stock ideas with undervalued companies. You can explore our research products at valuesense.io and learn more about our approach on our site.

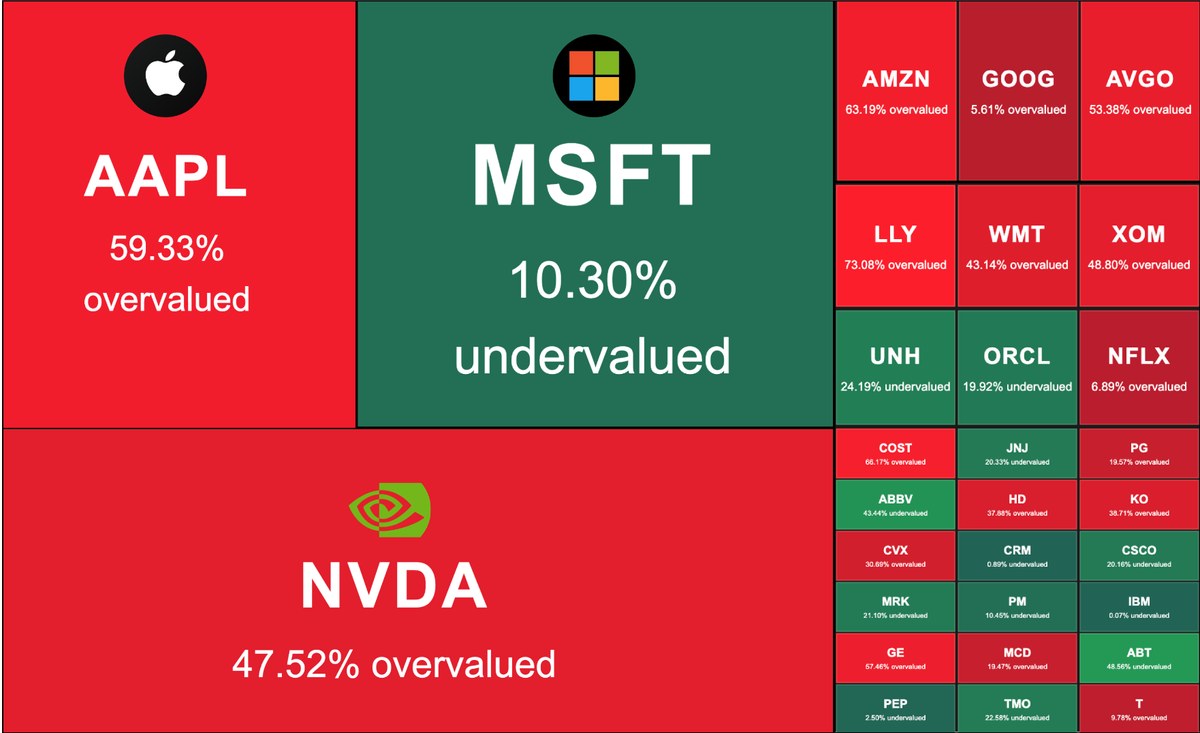

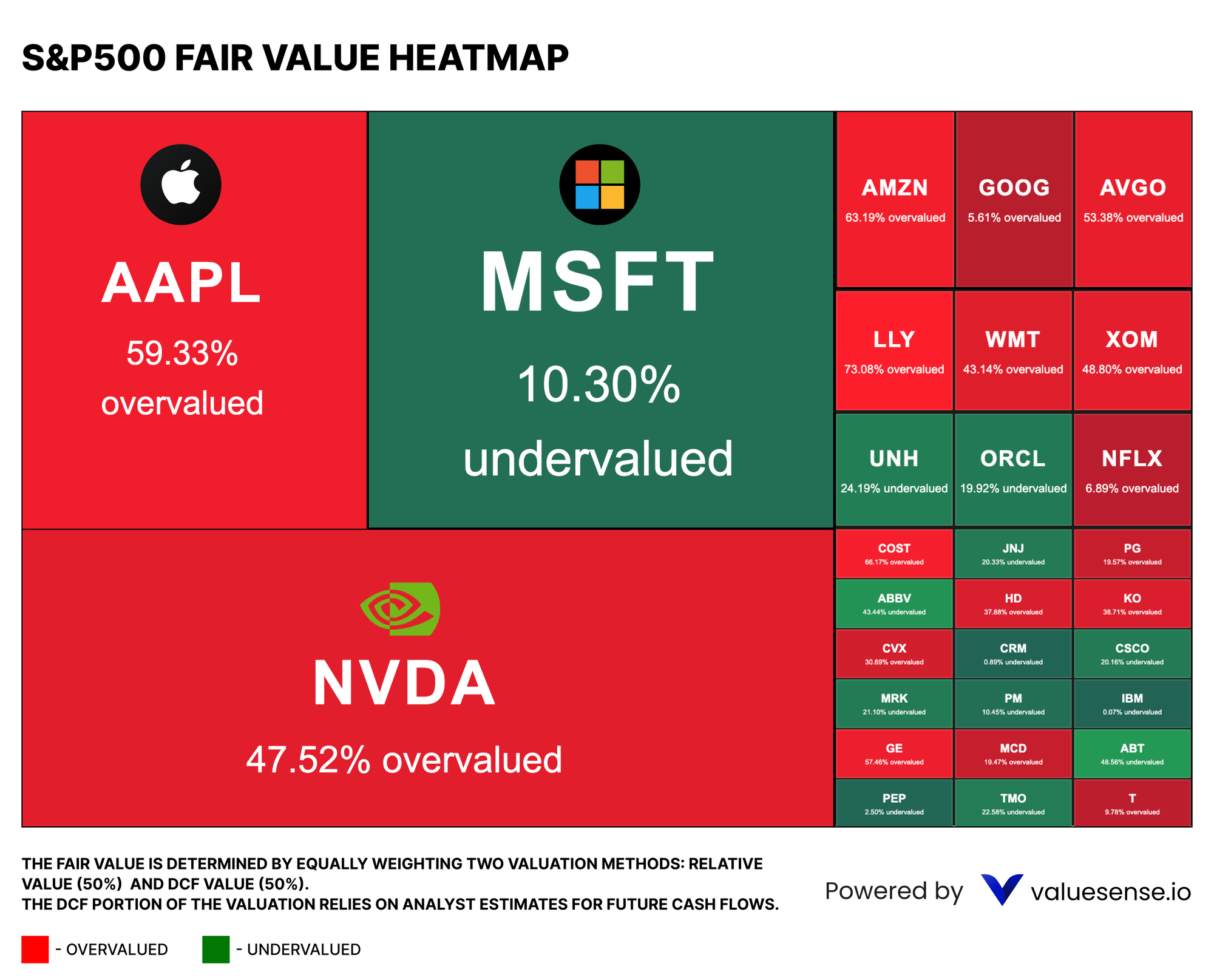

The S&P 500 is a cornerstone of the U.S. stock market, representing the performance of 500 of the largest publicly traded companies. But are these stocks trading at their fair value? A recent S&P 500 Fair Value Heatmap from Valuesense.io provides a clear picture of which stocks are overvalued and undervalued, offering investors critical insights for 2025. In this article, we’ll break down the heatmap, highlight key stocks, and explore what this means for your investment strategy.

What Is the S&P 500 Fair Value Heatmap?

The S&P 500 Fair Value Heatmap is a visual tool that evaluates the valuation of major S&P 500 companies by equally weighting two methods: relative valuation (50%) and discounted cash flow (DCF) valuation (50%). The DCF portion relies on analyst estimates for future cash flows, providing a data-driven perspective on whether a stock is overvalued (red) or undervalued (green).This heatmap is a powerful resource for investors looking to identify opportunities and risks in the market. Let’s dive into the key findings.

Top Overvalued Stocks in the S&P 500

The heatmap highlights several S&P 500 stocks that are significantly overvalued, meaning their current market price exceeds their fair value by a notable margin. Here are the standout overvalued stocks:

- Amazon (AMZN): 63.19% overvalued

Amazon’s dominance in e-commerce and cloud computing (AWS) has driven its stock price to lofty heights, but the heatmap suggests it may be overpriced relative to its fundamentals. - Apple (AAPL): 59.33% overvalued

Apple, a tech giant known for its iPhones and ecosystem, appears to be trading at a premium. Investors may want to reassess whether its growth justifies this valuation. - AvidXchange Holdings (AVGO): 53.38% overvalued

AvidXchange, a leader in accounts payable automation, has seen strong growth, but its current price may be too high for value-focused investors. - Lilly (LLY): 73.08% overvalued

Eli Lilly, a pharmaceutical giant, tops the list of overvalued stocks. Its recent success with weight-loss drugs like Mounjaro may have driven its stock price beyond its fair value. - Walmart (WMT): 43.78% overvalued

Walmart’s steady performance as a retail giant hasn’t gone unnoticed, but the heatmap indicates its stock may be priced too high. - ExxonMobil (XOM): 48.80% overvalued

Rising oil prices may have boosted ExxonMobil’s stock, but the heatmap suggests caution for investors. - NVIDIA (NVDA): 47.52% overvalued

NVIDIA, a leader in AI and graphics chips, has been a market darling, but its high valuation raises questions about sustainability. - Netflix (NFLX): 68.68% overvalued

Netflix’s growth in streaming and content production has come at a cost, with its stock price significantly above its fair value.

Other overvalued stocks include Alphabet (GOOG) at 5.61% overvalued, Costco (COST) at 61.17% overvalued, Procter & Gamble (PG) at 15.75% overvalued, and Coca-Cola (KO) at 30.75% overvalued.

What Does Overvaluation Mean for Investors?

Overvalued stocks can still rise in price, especially in a bullish market, but they carry higher risk. If market sentiment shifts or if these companies fail to meet growth expectations, their stock prices could face significant corrections. Investors might consider waiting for a better entry point or exploring undervalued opportunities instead.

Top Undervalued Stocks in the S&P 500

On the flip side, the heatmap identifies several S&P 500 stocks that are undervalued, meaning their market price is below their fair value. These stocks could present buying opportunities for value investors. Here are the top undervalued stocks:

- Microsoft (MSFT): 10.30% undervalued

Microsoft, a leader in software, cloud computing (Azure), and AI, appears to be trading at a discount. This could be a strong opportunity for long-term investors. - UnitedHealth Group (UNH): 24.19% undervalued

As a major player in healthcare, UnitedHealth’s undervaluation may appeal to investors seeking stability and growth. - Oracle (ORCL): 19.92% undervalued

Oracle’s focus on cloud infrastructure and enterprise software makes it an attractive undervalued pick. - Johnson & Johnson (JNJ): 20.37% undervalued

A healthcare stalwart, Johnson & Johnson offers a compelling value proposition with its diversified portfolio and consistent dividends. - AbbVie (ABBV): 43.46% undervalued

AbbVie, known for its blockbuster drug Humira, is one of the most undervalued stocks on the heatmap, making it a potential gem for value investors. - Home Depot (HD): 37.46% undervalued

Home Depot’s undervaluation could signal a buying opportunity, especially if the housing market rebounds. - CVS Health (CVS): 30.69% undervalued

CVS Health’s role in healthcare and retail pharmacy makes it an undervalued stock worth watching. - Merck (MRK): 21.10% undervalued

Merck’s strong pipeline of drugs positions it as an undervalued opportunity in the pharmaceutical sector. - PepsiCo (PEP): 2.50% undervalued

PepsiCo’s steady performance in snacks and beverages makes it a modestly undervalued stock.

Other undervalued stocks include Pfizer (PFE) at 2.50% undervalued, Thermo Fisher Scientific (TMO) at 22.50% undervalued, IBM at 0.07% undervalued, and AT&T (T) at 9.87% overvalued (notably, AT&T is slightly overvalued, but its inclusion in the green section suggests it’s close to fair value).

Why Invest in Undervalued Stocks?

Undervalued stocks often have a margin of safety, meaning there’s less downside risk if the market corrects. They also have the potential for significant upside as the market recognizes their true value over time. For long-term investors, these stocks can provide both growth and stability.

Key Takeaways from the S&P 500 Fair Value Heatmap

- Tech Giants Are Often Overvalued: Companies like Amazon, Apple, and NVIDIA are trading at significant premiums, reflecting high market expectations for their growth in AI, cloud computing, and consumer tech.

- Healthcare Offers Value: Stocks like AbbVie, UnitedHealth, and Johnson & Johnson are undervalued, making the healthcare sector a potential area for value investing.

- Retail and Consumer Goods Are Mixed: While Walmart and Costco are overvalued, Home Depot and PepsiCo present undervalued opportunities.

- Energy Stocks Are Overvalued: ExxonMobil’s high valuation may reflect optimism about oil prices, but it could be a risky bet.

How to Use This Heatmap in Your Investment Strategy

The S&P 500 Fair Value Heatmap is a starting point for deeper research. Here’s how to incorporate it into your investment decisions:

- For Overvalued Stocks: Consider taking profits if you’re already invested, or wait for a price correction before buying. Keep an eye on earnings reports and market trends that could impact these stocks.

- For Undervalued Stocks: Conduct fundamental analysis to confirm the heatmap’s findings. Look at factors like earnings growth, debt levels, and competitive positioning to ensure these stocks are truly undervalued.

- Diversify Your Portfolio: Balance your investments across sectors. For example, pairing an undervalued healthcare stock like AbbVie with a stable tech stock like Microsoft can reduce risk.

- Monitor Market Trends: The heatmap reflects a snapshot in time. Market conditions, interest rates, and economic data can shift valuations quickly, so stay informed.

Conclusion: Finding Value in the S&P 500 in 2025

The S&P 500 Fair Value Heatmap from Valuesense.io offers a clear view of where opportunities and risks lie in the market. While overvalued stocks like Amazon, Apple, and Lilly may face headwinds if growth slows, undervalued stocks like Microsoft, AbbVie, and UnitedHealth present compelling opportunities for value investors.

As you plan your investment strategy for 2025, use this heatmap as a guide to identify stocks that align with your risk tolerance and financial goals. Whether you’re seeking growth, value, or stability, the S&P 500 has something to offer—if you know where to look.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 9 low P/E & high ROIC stocks for 2025

📖 9 Undervalued Low Debt Stocks to Buy - 2025

📖 9 High-Momentum Stocks With Exceptional Quality