Stanley Druckenmiller - Duquesne Family Office Llc Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Stanley Druckenmiller, the legendary macro trader behind Duquesne Family Office, showcases his signature agility in the latest 13F filing. His $4.06B Q3 2025 portfolio features explosive moves like massive additions to biotech names amid a staggering 92.3% turnover, signaling a bold pivot toward high-conviction growth plays in healthcare and tech.

Portfolio Snapshot: High Turnover, Biotech-Heavy Concentration

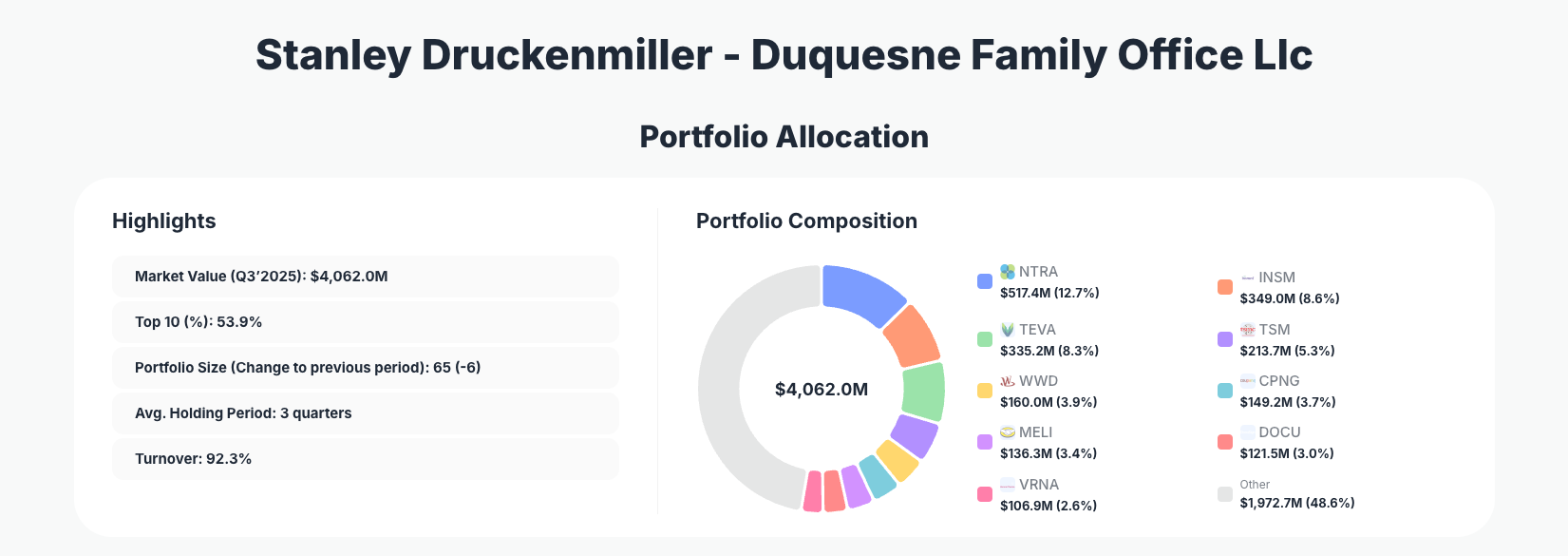

Portfolio Highlights (Q3 2025): - Market Value: $4,062.0M - Top 10 Holdings: 53.9% - Portfolio Size: 65 -6 - Average Holding Period: 3 quarters - Turnover: 92.3%

Druckenmiller's Duquesne Family Office portfolio exemplifies his opportunistic style, with the top 10 holdings commanding 53.9% of the $4.06 billion total despite a broad 65-position roster. The portfolio shrank by 6 names, reflecting aggressive pruning amid sky-high 92.3% turnover—far above typical long-term strategies. This short average holding period of 3 quarters underscores Druckenmiller's macro-driven approach, where he rotates capital based on evolving market dynamics rather than buy-and-hold conviction.

The concentration in the top tier, while moderate compared to ultra-focused peers, highlights bets on asymmetric opportunities. Healthcare dominates new additions, suggesting Druckenmiller sees undervalued growth in biotech amid broader market rotations. Tracking these shifts via his full portfolio page reveals a nimble strategy attuned to global trends, from semiconductors to e-commerce.

This setup balances diversification with conviction, as the remaining 46.1% spreads risk across 55 positions. Yet the turnover signals readiness for disruption—Druckenmiller isn't afraid to exit winners early or double down on emerging themes.

Top Positions Breakdown: Biotech Explosions and Tactical Trims

Druckenmiller's biggest swing is Natera, Inc. (NTRA) at 12.7% $517.4M, a staggering Add 2,707.45% that catapults it to the top ranks. Close behind, Insmed Incorporated (INSM) claims 8.6% $349.0M via an explosive Add 2,323.44%, doubling down on biotech innovation. Teva Pharmaceutical Industries Limited (TEVA) rounds out the pharma push at 8.3% $335.2M with a modest Add 3.91%.

Tactical adjustments continue with Woodward, Inc. (WWD) trimmed to 3.9% $160.0M by Reduce 25.43%, while Coupang, Inc. (CPNG) rises to 3.7% $149.2M on Add 12.85%. MercadoLibre, Inc. (MELI) gets a boost to 3.4% $136.3M via Add 8.60%, and DocuSign, Inc. (DOCU) climbs to 3.0% $121.5M with Add 30.65%.

Beyond the top 10, changes reveal further dynamism: Ishares Tr (_) drops to 2.5% $101.5M on Reduce 53.26%, Amazon.com, Inc. (AMZN) surges to 2.4% $96.0M via Add 219.58%, and Roku, Inc. (ROKU) holds 2.0% $82.4M after Reduce 25.27%. Steady anchors include Taiwan Semiconductor Manufacturing Company Limited (TSM) at 5.3% (No change) and Verona Pharma plc (VRNA) at 2.6% (No change), providing stability amid the churn.

What Druckenmiller's Moves Reveal About His Macro Playbook

Druckenmiller's Q3 actions spotlight a biotech and healthcare tilt, with mega-adds to NTRA and INSM betting on therapeutic breakthroughs amid aging demographics and innovation cycles. This sector focus—over 30% implied in top holdings—signals optimism for undervalued growth outside Big Tech.

Global diversification shines through TSM, TEVA, CPNG, and MELI, hedging U.S.-centric risks with exposure to semiconductors, Israel, Korea, and Latin America. High turnover 92.3% reflects risk management via agility, trimming laggards like WWD and ROKU to fund winners.

No overt dividend chase here—focus is on growth at reasonable prices, blending speculative biotech with proven scalers like AMZN. This reveals a macro lens: rotating into sectors poised for re-rating.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Natera, Inc. (NTRA) | $517.4M | 12.7% | Add 2,707.45% |

| Insmed Incorporated (INSM) | $349.0M | 8.6% | Add 2,323.44% |

| Teva Pharmaceutical Industries Limited (TEVA) | $335.2M | 8.3% | Add 3.91% |

| Taiwan Semiconductor Manufacturing Company Limited (TSM) | $213.7M | 5.3% | No change |

| Woodward, Inc. (WWD) | $160.0M | 3.9% | Reduce 25.43% |

| Coupang, Inc. (CPNG) | $149.2M | 3.7% | Add 12.85% |

| MercadoLibre, Inc. (MELI) | $136.3M | 3.4% | Add 8.60% |

| DocuSign, Inc. (DOCU) | $121.5M | 3.0% | Add 30.65% |

| Verona Pharma plc (VRNA) | $106.9M | 2.6% | No change |

The table underscores Druckenmiller's calculated concentration: the top three holdings alone exceed 29.6%, driven by biotech juggernauts NTRA, INSM, and TEVA. Massive percentage adds signal fresh conviction, while trims in WWD free capital for higher-upside bets.

Despite 53.9% top-10 weight, the 65-position breadth mitigates single-name risk. Stable holds like TSM anchor amid volatility, aligning with Druckenmiller's history of sizing positions by perceived edge.

Investment Lessons from Stanley Druckenmiller's Approach

- Embrace high turnover for macro shifts: 92.3% turnover teaches that staying nimble trumps permanence—exit early if the thesis evolves.

- Size aggressively on asymmetric bets: Explosive adds like NTRA's 2,707% show conviction demands outsized positions.

- Hunt undervalued growth in overlooked sectors: Biotech dominance highlights spotting re-rating opportunities before the crowd.

- Diversify globally but concentrate thematically: Blending TSM semis with LatAm e-tail like MELI balances risks.

- Monitor short holding periods: 3 quarters average reinforces constant thesis validation over blind loyalty.

Looking Ahead: What Comes Next?

With 92.3% turnover and a net reduction to 65 positions, Druckenmiller likely holds dry powder for Q4 opportunities, especially if biotech momentum sustains. Healthcare's prominence positions the portfolio for tailwinds from drug approvals and AI-driven diagnostics, while semis via TSM hedge AI chip demand.

Emerging markets exposure (CPNG, MELI) sets up for currency rebounds or consumer recovery. In volatile 2025 markets, expect further rotations—perhaps into energy or defensives if macros sour. Current setup favors growth repricing, but agility remains key.

FAQ about Stanley Druckenmiller's Duquesne Portfolio

Q: What drove Druckenmiller's massive biotech adds like NTRA and INSM in Q3 2025?

A: The Add 2,707.45% to NTRA 12.7% and Add 2,323.44% to INSM 8.6% reflect bets on genetic testing and rare-disease therapies amid undervalued healthcare growth post-market rotations.

Q: Why such high turnover 92.3% and short average holding periods?

A: Druckenmiller's macro style demands constant adaptation—3-quarter holds and 92.3% turnover enable pivots from underperformers like WWD to high-conviction themes like biotech.

Q: How concentrated is Druckenmiller's portfolio compared to peers?

A: Top 10 at 53.9% is focused yet balanced across 65 positions, less extreme than Buffett-style but aggressive in sizing winners like NTRA.

Q: What sectors dominate and why?

A: Biotech/healthcare leads (NTRA, INSM, TEVA, VRNA ~30%+), with tech globals (TSM, MELI, CPNG). This targets innovation cycles and EM recovery over U.S. megacaps.

Q: How can I track and follow Druckenmiller's portfolio?

A: Monitor quarterly 13F filings on the SEC (45-day lag post-quarter-end) via ValueSense's superinvestor tracker at https://valuesense.io/superinvestors/duquesnefamily for real-time changes, visualizations, and historical analysis.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!