How SBUX (Starbucks) Makes Money in 2026: A Deep-Dive With Income Statement

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

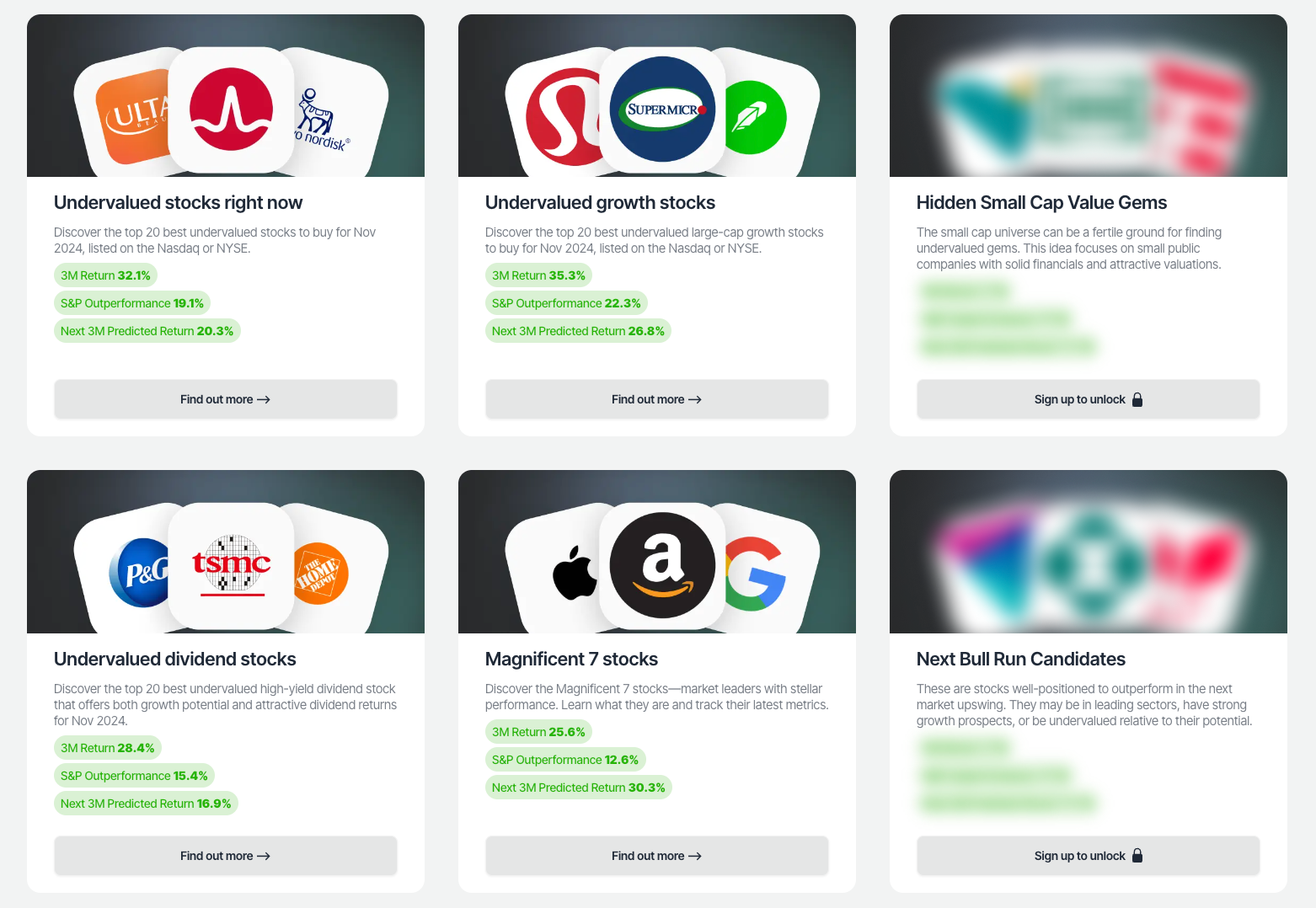

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Understanding how a coffeehouse chain like Starbucks makes money is essential for investors and anyone interested in the business of quick-service restaurants. In this post, we break down Starbucks's quarterly income statement (Q4 2025) using a Sankey chart to visualize the financial flows — what comes in, where it goes, and what's left as profit.

Quick Starbucks Overview

Income Statement Overview](https://blog.valuesense.io/content/images/2026/02/SBUX_income_1771329282.png)

Starbucks operates as a leading global coffeehouse chain, serving beverages, food, and packaged goods through company-operated stores, licensed stores, and consumer packaged goods channels. Revenue comes primarily from Beverage Revenue, Food Revenue, and Other Revenue by Product 1 such as packaged coffee and merchandise. The company focuses on premium coffee experiences, store expansion, and digital loyalty programs to drive customer traffic and sales.

Revenue Breakdown

- Total Revenue (Q4 2025): $9.91B (+5.4% YoY)

- Beverage Revenue: $5.94B (60.0% of total)

- Other Revenue by Product 1: $2.08B (21.0% of total)

- Food Revenue: $1.88B (19.0% of total)

- Growth is powered by modest increases across all segments, with Other Revenue by Product 1 leading at +8.0% YoY, reflecting strength in packaged goods and merchandise.

Starbucks' revenue model relies heavily on high-margin beverages, which form the core of its menu and drive the majority of store traffic. The beverage segment benefits from brand loyalty through the Starbucks Rewards program, seasonal offerings like Pumpkin Spice Latte, and customization options that encourage premium pricing. Food items complement drinks, boosting average ticket sizes, while other products extend the brand into retail shelves worldwide. This diversified yet beverage-dominant structure supports steady growth even amid economic pressures.

Gross Profit and Margins

- Gross Profit: $1.55B (15.6% gross margin)

- Cost of Revenue: $8.36B (+17.8% YoY)

- Starbucks maintains moderate margins due to commodity price volatility in coffee beans and dairy, offset by pricing power and supply chain efficiencies.

- Most costs come from cost of revenue (primarily ingredients, packaging, and store labor), which surged due to inflation and higher volumes.

The elevated cost of revenue growth outpaced revenue, compressing gross margins compared to prior periods. Key pressures include rising green coffee prices and labor costs in company-operated stores. However, Starbucks mitigates this through long-term supplier contracts, automated roasting facilities, and menu innovations that shift toward higher-margin items.

Operating Income and Expenses

- Operating Income: $0.91B (-18.9% YoY, 9.2% margin)

- Operating Expenses: $0.64B (-51.2% YoY)

- R&D: N/A

- SG&A: $0.64B (-4.1% YoY, 6.4% of revenue) — Covers general corporate overhead, marketing, and administrative functions, with reductions likely from cost controls and restructuring.

- Starbucks continues to prioritize cost control while expanding operations, as evidenced by sharp declines in overall operating expenses.

The significant drop in operating expenses contributed to some margin stability despite revenue cost pressures. SG&A reductions reflect efficiencies from store optimizations, digital investments reducing physical marketing needs, and workforce adjustments. This discipline helped offset gross profit compression, though operating income still declined due to the imbalance.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Net Income

- Pre-Tax Income: $0.76B (-25.2% YoY, 7.7% margin)

- Income Tax: $0.47B (61.7% effective tax rate)

- Net Income: $0.29B (-62.4% YoY, 3.0% net margin)

- Starbucks converts a moderate portion of sales into profit due to pricing power and operational scale, though Q4 was pressured by high taxes and other items.

Other items impacted pre-tax income, including Net interest expense of $152M and Other income of $7.00B (noted as unusually large, potentially including one-time gains). The elevated effective tax rate significantly eroded net income, reflecting discrete tax charges or valuation allowances.

What Drives Starbucks's Money Machine?

- Beverage Revenue: 60.0%+ of revenue, fueled by core coffee drinks, iced beverages, and ready-to-drink products sold in stores and retail.

- Comparable Store Sales Growth: Key metric with implied stability from overall +5.4% revenue growth, supported by +4.7% in beverages.

- Digital and Loyalty Investments: Ongoing spend in app-based ordering and Rewards program, embedded in SG&A, driving repeat visits.

- International Expansion: Growth areas like China and licensed stores, though not yet fully offsetting U.S. softness.

Starbucks' machine thrives on its asset-light licensing model abroad and premium positioning, allowing price increases without major volume loss. Challenges include labor shortages and competition from lower-cost rivals.

Visualizing Starbucks's Financial Flows

The Sankey chart below visualizes how each dollar flows from gross revenue, through costs and expenses, down to net income. This helps investors spot where value is created, what areas weigh on profits, and how efficiently the company operates.

- Most revenue flows into gross profit, with operating expenses (especially SG&A) taking the largest chunk.

- Even after significant costs, 3.0% of revenue drops to the bottom line.

The visualization reveals cost of revenue as the widest outflow (84.4% of revenue), dwarfing operating expenses 6.4%. Profit streams narrow sharply post-tax, highlighting tax and interest as key bottlenecks.

Key Takeaways

- Starbucks's money comes overwhelmingly from Beverage Revenue

- Moderate gross and net margins illustrate the power of Starbucks's premium brand and scale

- Heavy investment in operations, balanced by efficiency in operating costs

- Ongoing growth is driven by product diversification and digital engagement

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2026)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

FAQ About Starbucks's Income Statement

1. What is the main source of Starbucks's revenue in 2025?

Starbucks generates over 60% of its revenue from Beverage Revenue. Additional revenue sources include Other Revenue by Product 1 21% and Food Revenue 19%.

2. How profitable is Starbucks in Q4 2025?

Starbucks reported net income of $0.29B in Q4 2025, with a net margin of approximately 3.0%, reflecting moderate profitability driven by pricing power offset by high cost of revenue and taxes.

3. What are the largest expense categories for Starbucks?

The biggest expenses on Starbucks's income statement are operating expenses, particularly Sales, General & Administrative (SG&A) costs. SG&A investment reached $0.64B in Q4 2025, as Starbucks prioritizes marketing and administrative efficiencies.

4. Why does Other Revenue by Product 1 operate strongly?

Other Revenue by Product 1, generating $2.08B in revenue, showed robust +8.0% YoY growth in Q4 2025. This is because Starbucks leverages packaged goods and merchandise for high-margin expansion—even as core store sales face pressures.

5. How does Starbucks's effective tax rate compare to previous years?

Starbucks's effective tax rate in Q4 2025 was 61.7%, higher than previous years. This high rate is primarily due to discrete tax charges and international structuring impacts.