Stephen Mandel - Lone Pine Capital Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

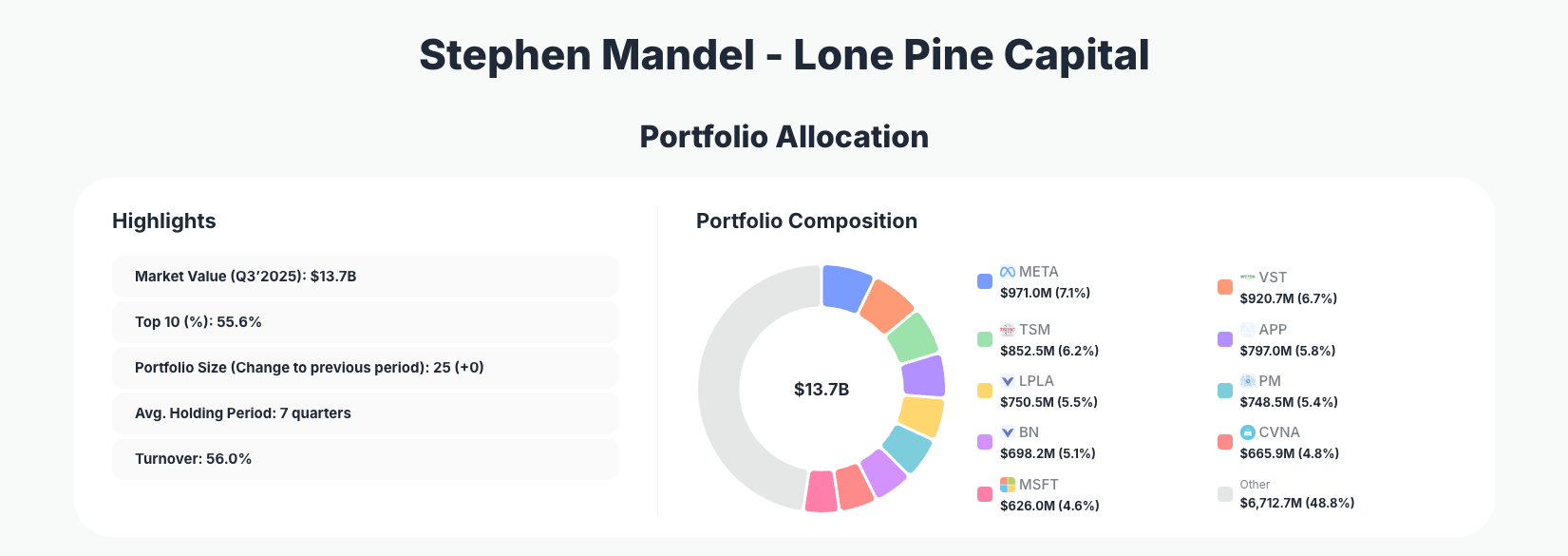

Stephen Mandel, the founder of Lone Pine Capital, showcases his signature growth-oriented strategy with aggressive portfolio rotations in the latest 13F filing. His $13.7B Q3 2025 portfolio reflects high conviction through significant adds in disruptive names like AppLovin and Carvana, balanced by trims in mega-cap tech leaders, signaling a pivot toward emerging opportunities in a volatile market.

Portfolio Overview: High Turnover Signals Dynamic Growth Hunting

Portfolio Highlights (Q3 2025): - Market Value: $13.7B - Top 10 Holdings: 55.6% - Portfolio Size: 25 +0 - Average Holding Period: 7 quarters - Turnover: 56.0%

Lone Pine Capital's portfolio maintains a moderately concentrated structure, with the top 10 holdings commanding over half of the $13.7B total, underscoring Mandel's focus on high-conviction growth bets. The 56.0% turnover rate is notably elevated, indicating active management amid market shifts, while the average holding period of 7 quarters suggests patience with core positions despite rotations. Portfolio size holding steady at 25 positions reflects disciplined pruning rather than expansion.

This balance of concentration and activity aligns with Mandel's long-standing tiger cub heritage, emphasizing scalable growth businesses. The $13.7B portfolio's evolution points to tactical adjustments, trimming overvalued leaders to fund explosive adds in under-the-radar winners. Investors tracking via 13F filings can see how this approach adapts to tech dominance and energy transitions.

Top Holdings Breakdown: Mega-Cap Trims Fuel Explosive New Positions

The Lone Pine portfolio reveals dramatic shifts, starting with Meta Platforms (META) at 7.1% after a Reduce 20.59% trim, followed by Vistra (VST) at 6.7% with a Reduce 27.37% cut, and Taiwan Semiconductor (TSM) at 6.2% down Reduce 11.16%. These reductions in established growth names freed capital for bold initiatives.

New firepower shines in AppLovin (APP) at 5.8% via an eye-popping Add 251.44%, LPL Financial (LPLA) at 5.5% with Add 20.48%, and Philip Morris (PM) at 5.4% boosted by Add 67.33%. Momentum continued with Brookfield (BN) at 5.1% on Add 81.12%, Carvana (CVNA) exploding to 4.8% via Add 360.31%, and Microsoft (MSFT) at 4.6% after Reduce 34.84%. Beyond the top ranks, Amazon (AMZN) at 4.5% saw a sharp Reduce 44.14%, highlighting a pattern of profit-taking in Big Tech to chase higher-upside plays.

This mix of 11 key changes paints a picture of Mandel reallocating toward ad tech innovators, financial services disruptors, consumer staples with tailwinds, and alternative asset managers, while dialing back on semiconductors and cloud giants.

What the Portfolio Reveals: Growth Rotation with Calculated Risks

Lone Pine's Q3 moves signal a strategic pivot from mature tech dominance toward high-beta growth stories, blending AI-adjacent plays with turnaround narratives: - Sector focus on tech and disruption: Heavy exposure to ad tech (APP), semiconductors (TSM), and energy transition (VST), reflecting bets on AI monetization and power demand. - Aggressive position sizing in winners: Massive adds like CVNA 360% show conviction in post-pandemic recoveries and e-commerce logistics. - Defensive diversification: Entries into PM and BN add stability via dividends and real assets amid tech volatility. - Risk management via turnover: 56% churn demonstrates nimble capital rotation, trimming laggards like META and MSFT to fund 5-7% stakes in outperformers. - Global tilt: International flavor via TSM underscores supply chain resilience.

Overall, the portfolio reveals Mandel's adaptability, favoring quality growth at inflection points over passive indexing.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Meta Platforms, Inc. (META) | $971.0M | 7.1% | Reduce 20.59% |

| Vistra Corp. (VST) | $920.7M | 6.7% | Reduce 27.37% |

| Taiwan Semiconductor Manufacturing Company Limited (TSM) | $852.5M | 6.2% | Reduce 11.16% |

| AppLovin Corporation (APP) | $797.0M | 5.8% | Add 251.44% |

| LPL Financial Holdings Inc. (LPLA) | $750.5M | 5.5% | Add 20.48% |

| Philip Morris International Inc. (PM) | $748.5M | 5.4% | Add 67.33% |

| Brookfield Corporation (BN) | $698.2M | 5.1% | Add 81.12% |

| Carvana Co. (CVNA) | $665.9M | 4.8% | Add 360.31% |

| Microsoft Corporation (MSFT) | $626.0M | 4.6% | Reduce 34.84% |

This table highlights Lone Pine's hallmark concentration, with the top 10 averaging ~5.8% per position and totaling 55.6% of the portfolio—a level that amplifies returns from winners like APP and CVNA but demands precise timing. The split of five reduces and four adds within the top tier illustrates disciplined rebalancing, reducing exposure to crowded trades (VST, META) while super-sizing bets on momentum shifts. At 25 total positions, this setup balances firepower with diversification, true to Mandel's growth-at-a-reasonable-price ethos.

Investment Lessons from Stephen Mandel's Lone Pine Approach

- Embrace high turnover for alpha: 56% churn shows the value of active monitoring, cutting underperformers to fuel multi-baggers like CVNA's 360% add.

- Size positions for conviction: 4-7% stakes in top ideas like APP demonstrate betting big when growth inflections align.

- Trim winners proactively: Reduces in MSFT 34.84% and META 20.59% lock in gains before complacency sets in.

- Hunt across sectors and geographies: From U.S. ad tech to Taiwan semis and Canadian asset managers, diversification within growth tempers risk.

- Favor 7-quarter holds for compounding: Average tenure balances patience with adaptability, avoiding short-term noise.

Looking Ahead: What Comes Next?

With 56% turnover and steady 25-position count, Lone Pine likely holds dry powder for Q4 deployments amid AI hype and rate cut tailwinds. Trims in TSM and VST suggest caution on semis and utilities overload, opening doors to more financial disruptors like LPLA expansions or fresh consumer plays. In a 2026 market favoring growth rotation, positions in APP and CVNA position Mandel for upside from digital ads and e-commerce rebounds, while PM and BN provide ballast against volatility.

FAQ about Stephen Mandel Lone Pine Capital Portfolio

Q: What drove Lone Pine's most aggressive Q3 2025 changes?

A: Mandel supercharged growth bets with massive adds like CVNA (Add 360.31%) and APP (Add 251.44%), while trimming Big Tech like MSFT (Reduce 34.84%) and AMZN (Reduce 44.14%) to reallocate toward higher-conviction inflections.

Q: Why does Lone Pine maintain 55.6% in just 10 holdings?

A: Concentration amplifies returns on deep-researched ideas, aligning with Mandel's tiger cub roots—top positions like META 7.1% and VST 6.7% drive performance, balanced by 15 smaller names for risk control.

Q: What sectors dominate Lone Pine's strategy?

A: Tech and disruption lead with ad platforms (APP), semis (TSM), and energy (VST), plus defensive tilts in financials (LPLA) and staples (PM).

Q: How can I track Lone Pine Capital's portfolio like a pro?

A: Follow quarterly 13F filings on the SEC site, but use ValueSense at https://valuesense.io/superinvestors/lone-pine for real-time analysis, change tracking, and visualizations—note the 45-day lag means positions evolve post-filing.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!