Steven Cohen - Point72 Asset Management, L.p. Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

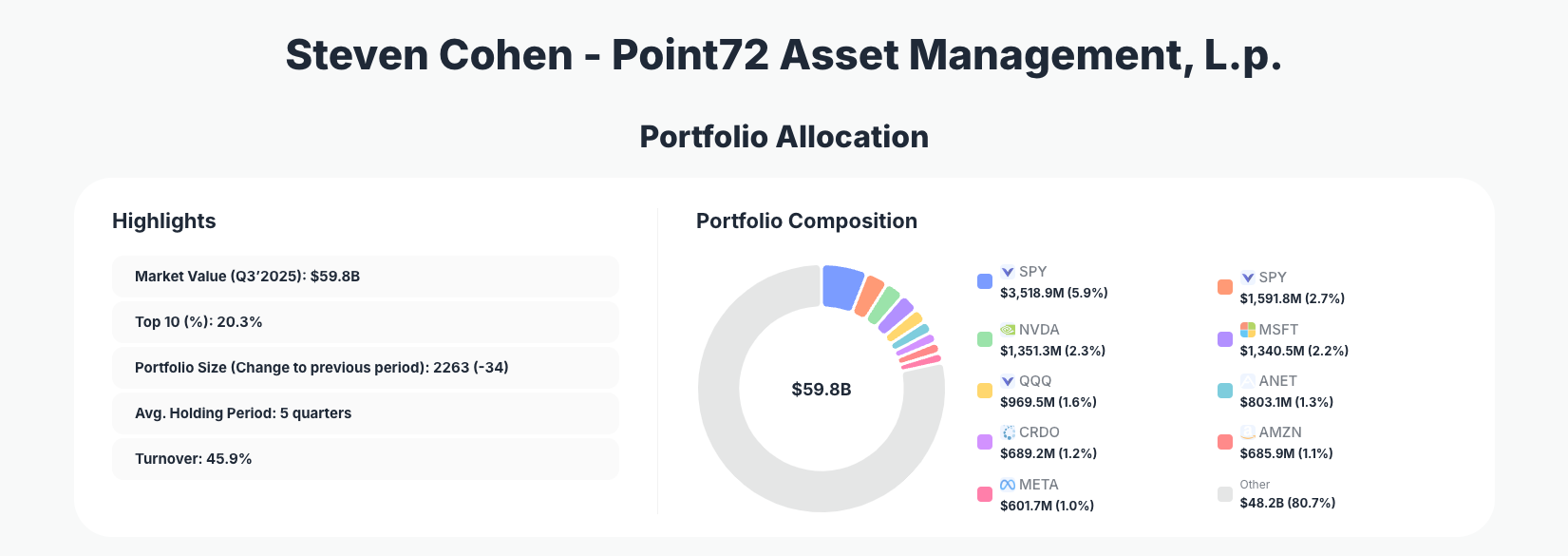

Steven Cohen, the legendary hedge fund manager behind Point72 Asset Management, showcases his signature high-velocity trading style in the latest 13F filing. His $59.8B portfolio for Q3 2025 bursts with aggressive additions in AI leaders and broad market ETFs, signaling bold conviction in tech-driven growth amid market volatility.

Portfolio Snapshot: Massive Scale with High Turnover Precision

Portfolio Highlights (Q3 2025): - Market Value: $59.8B - Top 10 Holdings: 20.3% - Portfolio Size: 2263 -34 - Average Holding Period: 5 quarters - Turnover: 45.9%

Point72's portfolio stands out for its enormous scale and diversification across 2,263 positions, a slight trim of 34 from the prior quarter, reflecting disciplined position management in a multi-strategy hedge fund environment. The top 10 holdings represent just 20.3% of the total, underscoring a broad-based approach rather than ultra-concentration, which aligns with Cohen's quantitative and discretionary trading prowess. High turnover at 45.9% indicates active rebalancing, with an average holding period of 5 quarters suggesting tactical swings rather than long-term buy-and-hold.

This structure enables Point72 to capitalize on short-term opportunities while maintaining exposure to megatrends like AI and semiconductors. The $59.8B portfolio demonstrates Cohen's ability to deploy massive capital efficiently across equities and ETFs, blending passive S&P 500 tracking with high-conviction tech names. Investors tracking these moves via 13F filings gain insights into institutional flows, though the high turnover warns of rapid shifts post-filing.

Top Positions Unleashed: AI Explosions and ETF Power Plays

Point72's latest moves prioritize massive buildups in market proxies and tech giants, starting with SPDR S&P 500 ETF TR as the standout at 5.9% after an Add 121.07%, followed by another tranche at 2.7% with Add 26.40%. NVIDIA (NVDA, 2.3%) exploded with Add 5,288.57%, underscoring Cohen's aggressive AI infrastructure bet, while Microsoft (MSFT, 2.2%) saw Add 4,393.15% in a clear cloud and AI software push.

Broad market conviction continues via INVESCO QQQ TR at 1.6% (Add 2,863.12%), complemented by networking play Arista Networks (ANET, 1.3%, Add 74.14%) and high-speed connectivity leader Credo Technology (CRDO, 1.2%, Add 15.33%). E-commerce and social heavyweights shine with Amazon (AMZN, 1.1%, Add 18,604.31%) and Meta Platforms (META, 1.0%, Add 294.09%), rounding out the top tier.

The changes extend to Teradyne (TER, 0.9%, Add 1,370.82%), a semiconductor test equipment provider signaling deeper AI hardware ecosystem exposure. These 11 positions from holdings with changes dominate the narrative, blending ETF stability with explosive growth stock additions that highlight Point72's tech momentum focus.

What the Portfolio Reveals: Tech Momentum and Quantitative Edge

Cohen's Q3 moves paint a picture of opportunistic tech bullishness within a diversified framework: - Heavy tech and AI tilt: Massive adds in NVDA, MSFT, ANET, CRDO, AMZN, META, and TER reveal conviction in semiconductors, cloud, networking, and digital platforms driving the next growth wave. - ETF core for market beta: Dual SPDR S&P 500 and QQQ positions provide broad exposure with amplified sizing, balancing individual stock risks. - High-velocity risk management: 45.9% turnover and short average holds reflect quant-driven trading, pruning 34 positions for efficiency. - Scale advantages: $59.8B AUM enables billion-dollar swings without market impact, targeting alpha in volatile sectors.

This strategy leverages Point72's data-driven models to front-run trends, favoring U.S.-centric growth over value or dividends.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| SPDR S&P 500 ETF TR | $3,518.9M | 5.9% | Add 121.07% |

| SPDR S&P 500 ETF TR | $1,591.8M | 2.7% | Add 26.40% |

| NVIDIA Corporation | $1,351.3M | 2.3% | Add 5,288.57% |

| Microsoft Corporation | $1,340.5M | 2.2% | Add 4,393.15% |

| INVESCO QQQ TR | $969.5M | 1.6% | Add 2,863.12% |

| Arista Networks, Inc. | $803.1M | 1.3% | Add 74.14% |

| Credo Technology Group Holding Ltd | $689.2M | 1.2% | Add 15.33% |

| Amazon.com, Inc. | $685.9M | 1.1% | Add 18,604.31% |

| Meta Platforms, Inc. | $601.7M | 1.0% | Add 294.09% |

The table reveals Point72's intentionally diffuse top 10 concentration at 20.3%, with no single position exceeding 6%, a hallmark of hedge fund diversification across 2,263 holdings. Dual SPDR S&P 500 ETF TR entries dominate value at over $5B combined, providing efficient market beta while tech adds like NVDA and MSFT inject high-growth alpha.

This low concentration mitigates idiosyncratic risk, enabling Cohen's team to layer thousands of smaller positions atop these anchors. The uniform "Add" actions across the board signal portfolio rebuilding for AI tailwinds, with ETF boosts hedging against single-stock volatility in a high-turnover environment.

Investment Lessons from Steven Cohen's Point72 Approach

- Embrace high turnover for alpha: 45.9% turnover shows constant position sizing adjustments capture momentum without emotional attachment.

- Layer ETFs with conviction stocks: Broad SPY and QQQ exposure provides stability, amplified by outsized AI/tech bets like NVDA and MSFT.

- Scale unlocks opportunities: $59.8B firepower allows massive adds (e.g., 5,288% NVDA) that retail can't replicate, emphasizing institutional edges.

- Tech ecosystem focus wins: Prioritizing interconnected AI plays (NVDA, MSFT, ANET, CRDO, TER) bets on secular trends over short-term noise.

- Diversify aggressively: 2,263 positions with shallow top-10 weighting spreads risk, balancing quant signals across market regimes.

Looking Ahead: What Comes Next?

Point72's Q3 positioning sets up for continued AI and tech dominance, with ETF cores buffering potential 2026 volatility from rate cuts or election cycles. High turnover suggests readiness to rotate into undervalued sectors if megacap froth emerges, while the -34 position trim hints at cash reserves for opportunistic buys. Watch for deeper semiconductor and cloud expansions, as Cohen's models likely eye emerging AI applications amid robust economic growth. Current bets align with S&P 500 upside, positioning the portfolio for 10-15% annual returns if tech momentum persists.

FAQ about Steven Cohen's Point72 Portfolio

Q: What drove Point72's massive position increases in Q3 2025?

A: Every top holding saw dramatic "Add" actions, from 121% in SPDR S&P 500 ETF TR to over 18,000% in AMZN, reflecting aggressive deployment into AI leaders like NVDA and MSFT amid tech rally conviction.

Q: Why is Point72's portfolio so large yet unconcentrated?

A: With 2,263 positions and top 10 at just 20.3%, the strategy diversifies across quant signals, using scale for broad exposure while top adds target high-conviction themes like AI.

Q: What sectors dominate Steven Cohen's latest 13F?

A: Technology rules with NVDA, MSFT, ANET, CRDO, AMZN, META, and TER, blended with broad-market ETFs for balanced growth exposure.

Q: How can I track and follow Point72's portfolio changes?

A: Monitor quarterly 13F filings on the SEC site or use ValueSense's superinvestor tracker at https://valuesense.io/superinvestors/point72 for real-time analysis, historical changes, and visualizations—note the 45-day reporting lag means positions may evolve post-filing.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!