How to find a stock value & intrinsic value

Value investing is simply buying businesses for less than what they are worth. By far, it is one of the most proven ways of generating strong returns in the stock market.

Some of the most successful investors and now billionaires have adopted this approach - Warren Buffett, Peter Lynch, Joel Greenblatt, Seth Klarman, and the list goes on.

In order to do this, you must be able to come up with a value for said businesses. While there are complex valuation techniques such as the Discounted Cash Flow Model, and Price-to-Earnings, let’s look at a simple way to find a fair value.

LET'S LOOK AT A SIMPLE SMALL BUSINESS

We have an owner, Kevin. Kevin opens a soda business. He hires one person to run the business. Kevin isn’t going to do anything to help run the business.

Kevin’s soda business generates:

- $100,000 = Revenue

Costs are, $20,000 on wages, $40,000 on soda, and $10,000 on rent:

- $70,000 = Total Costs

Income is:

- $30,000 = Income ($100,000 revenue – $70,000 costs)

Tax paid on the income:

- $10,000 = Taxation

Earnings are:

- $20,000 = Earnings ($30,000 income – $10,000 taxes)

SO, HOW MUCH WOULD YOU PAY FOR THIS BUSINESS?

Would you pay $400,000 for this business? How about $200,000? Maybe $100,000?

Let’s assume the business makes $20,000 per year, for the remainder of its lifetime. Let’s also assume the business has very little risk of failure.

If you paid $400,000 for this business, it would take 20 years for you to get your money back. (400,000 / 20,000 = 20 years)

That would be a return of 5% per year. (20,000 / 400,000 = 5%)

If you paid $200,000 for this business, it would take 10 years for you to get your money back. (200,000 / 20,000 = 10 years)

That would be a return of 10% per year. (20,000 / 200,000 = 10%)

If you paid $100,000 for this business, it would take 5 years for you to get your money back. (100,000 / 20,000 = 5 years)

That would be a return of 20% per year. (20,000 / 100,000 = 20%)

So the real question is, for the level of risk you are taking, what (reasonable) rate of return do you want to earn on your capital?

Working backward from here is a good place to start.

Let’s assume you want a 10% return per year. That means you would not be willing to pay more than $200,000 for Kevin’s soda business.

HOW TO APPLY THIS TO STOCKS?

A stock simply represents a large company.

The owners include anyone who owns a share in the company (shareholders). There can be thousands of shareholders of a stock. The shareholders are represented by a group of people called the board of directors. The CEO and all the employees work for the owners (shareholders).

When looking at a stock profits are often described as earnings and commonly written as Earnings per Share (EPS)

EPS is simply the net income divided by the total number of shares outstanding.

That is the earnings you would be entitled to if you owned a single share. A quick way to judge the price of a company is using the Price to Earnings Ratio (P/E Ratio). To calculate the P/E Ratio we simply divide the price of the stock by its EPS.

For example, if a stock had a price of $400 per share and an EPS of $20 per share, its P/E Ratio would be 20. (400 / 20 = 20).

We can then calculate the expected return we would get from this stock using Earnings Yield. To calculate earnings yield we simply divide 1 by the P/E Ratio. In the above example, the Earnings Yield would be 5%. (1 / 20 = 0.5 = 5%).

If you only wanted to invest in companies that would generate a 10% return, you would be looking at companies with a P/E Ratio of 10 or lower. (10 /10 = 0.1 = 10%).

ARE THERE ANY OTHER VALUATION METHODS?

In addition to using the Price-to-Earnings (P/E) Ratio, there are other popular methods for evaluating a company's intrinsic value:

- Discounted Cash Flow (DCF): The DCF method involves projecting a company's future cash flows and discounting them back to their present value using a required rate of return (usually the company's weighted average cost of capital). This method aims to capture the time value of money. By summing the present values of these future cash flows, you can estimate the intrinsic value of the company. If the intrinsic value exceeds the current stock price, the stock may be considered undervalued.

- Relative Valuation: This method involves comparing the valuation ratios (like the P/E ratio, Price-to-Sales ratio, or EV/EBITDA) of a company to its peers or the industry average. If a company's valuation ratios are lower than those of similar companies but its fundamentals (e.g., growth, profitability) are similar or better, the stock might be undervalued.

- Reverse DCF: The reverse DCF approach works by assuming the current stock price is correct and then determining what level of future cash flows or growth the market is pricing in. By reverse-engineering the current stock price using the DCF model, you can see if the market's assumptions about future performance are realistic or overly optimistic/pessimistic.

WHAT'S THE EASIEST WAY TO VALUE STOCKS AND FIND INTRINSIC VALUE?

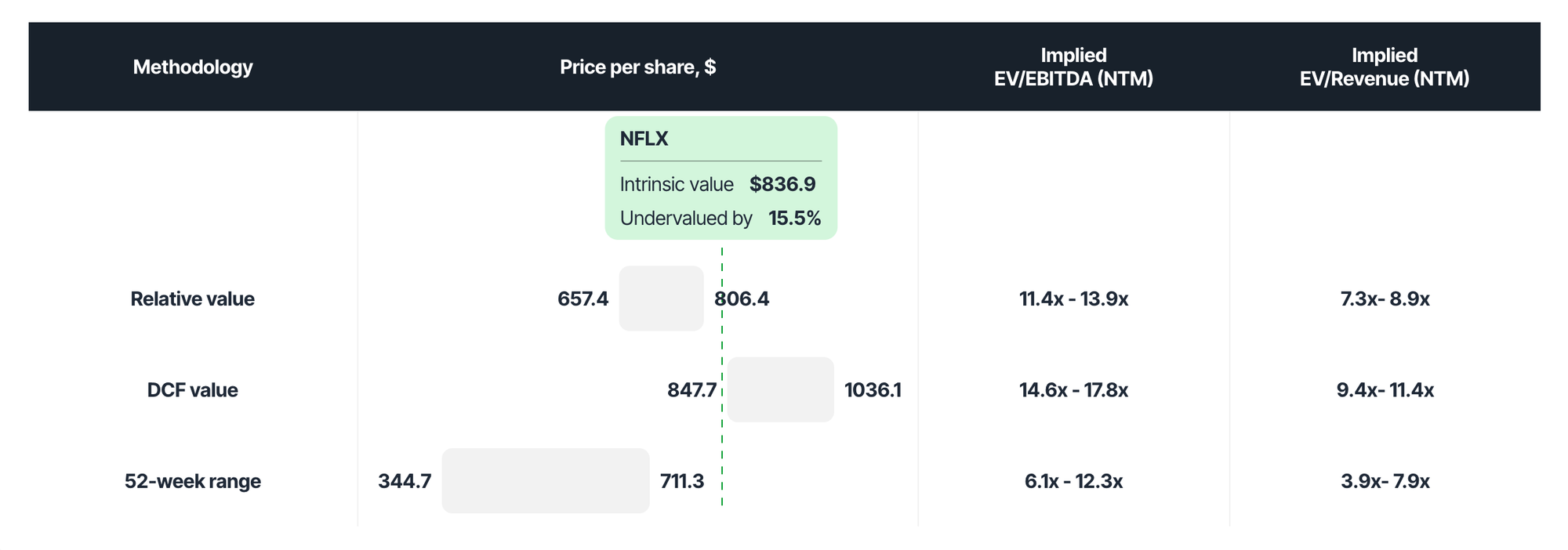

At Value Sense, we've integrated the most trusted methods for valuing stocks to automatically calculate intrinsic value. This includes a combination of the Discounted Cash Flow (DCF) model, Relative Valuation, and the 52-week low analysis for a comprehensive approach.

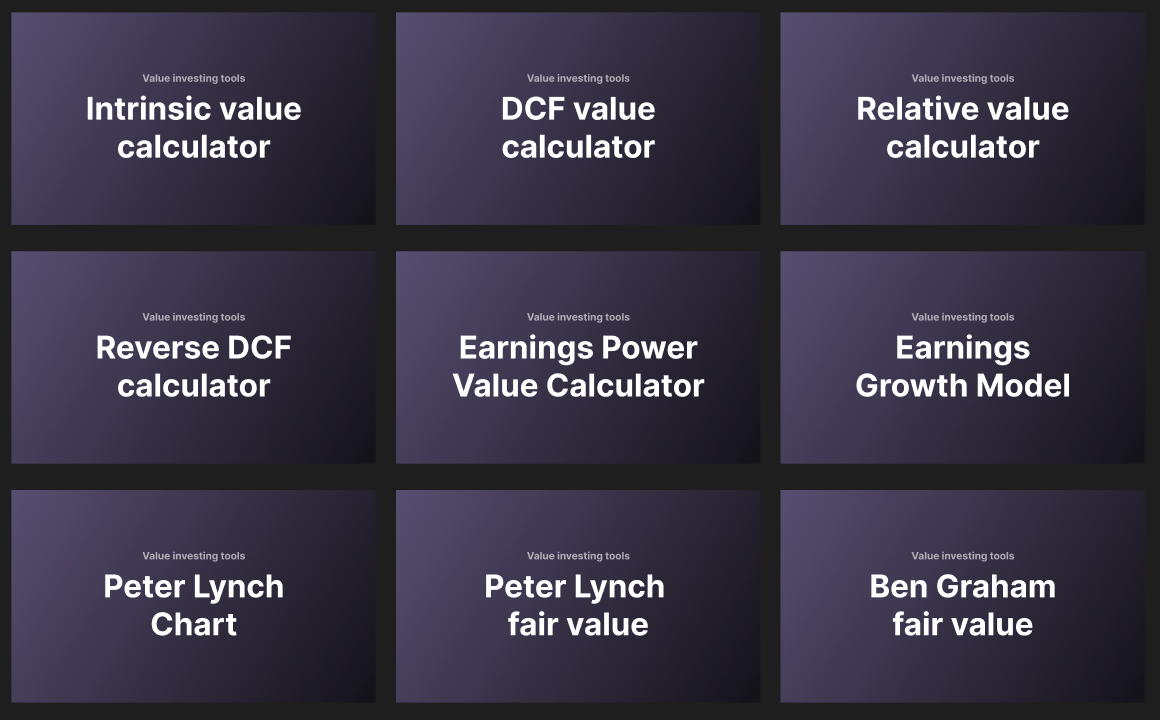

We also have 10 easy-to-use value investing calculators that help you understand stock valuation better:

- Earnings Growth Model: Projects future earnings growth to estimate a stock's value.

- Discount Rate: Calculates the rate used to discount future cash flows back to present value.

- Peter Lynch Fair Value: Uses a formula based on earnings growth to determine a fair price for a stock.

- Ben Graham Fair Value: Applies classic valuation principles to find the intrinsic value of a stock.

- Peter Lynch Charts: Visual tools that display historical performance and growth metrics to aid decision-making.

- Intrinsic Value Calculator: Provides a quick estimate of a stock’s intrinsic value based on key financial metrics.

- Earnings Power Value (EPV): Assesses the sustainable earning power of a business to establish its value.

- Reverse DCF: Works backward from the current stock price to find out what growth rate the market expects.

- Relative Value: Compares valuation metrics of similar companies to identify undervalued stocks.

- DCF Value: Uses the DCF method to determine the present value of expected future cash flows.

With these tools, you can easily evaluate stocks, make informed investment decisions, and enhance your value investing strategy.

Value Sense helps you understand all companies' financial data, and provides essential tools.

- Historical Financial Analysis - historical financial statements prove useful across the investment chain. Like a company report card, investment decisions hinge on critical pieces of information showcased in historical statements.

- Financial ratios - get access to the most important financial ratios

- Dividends analysis - understand how often is a dividend paid, get dividend yields, and find stocks with growing dividends.

- Comparison analysis - stock competitors, stock price compare, stocks comparison charts, all in one tool for stock comparison.

Value Sense stock screener features 4000+ financial metrics users can filter to find stocks based on custom criteria and build custom analysis formulas. Our screener returns a group of stocks that match one or more selected criteria (called filters).

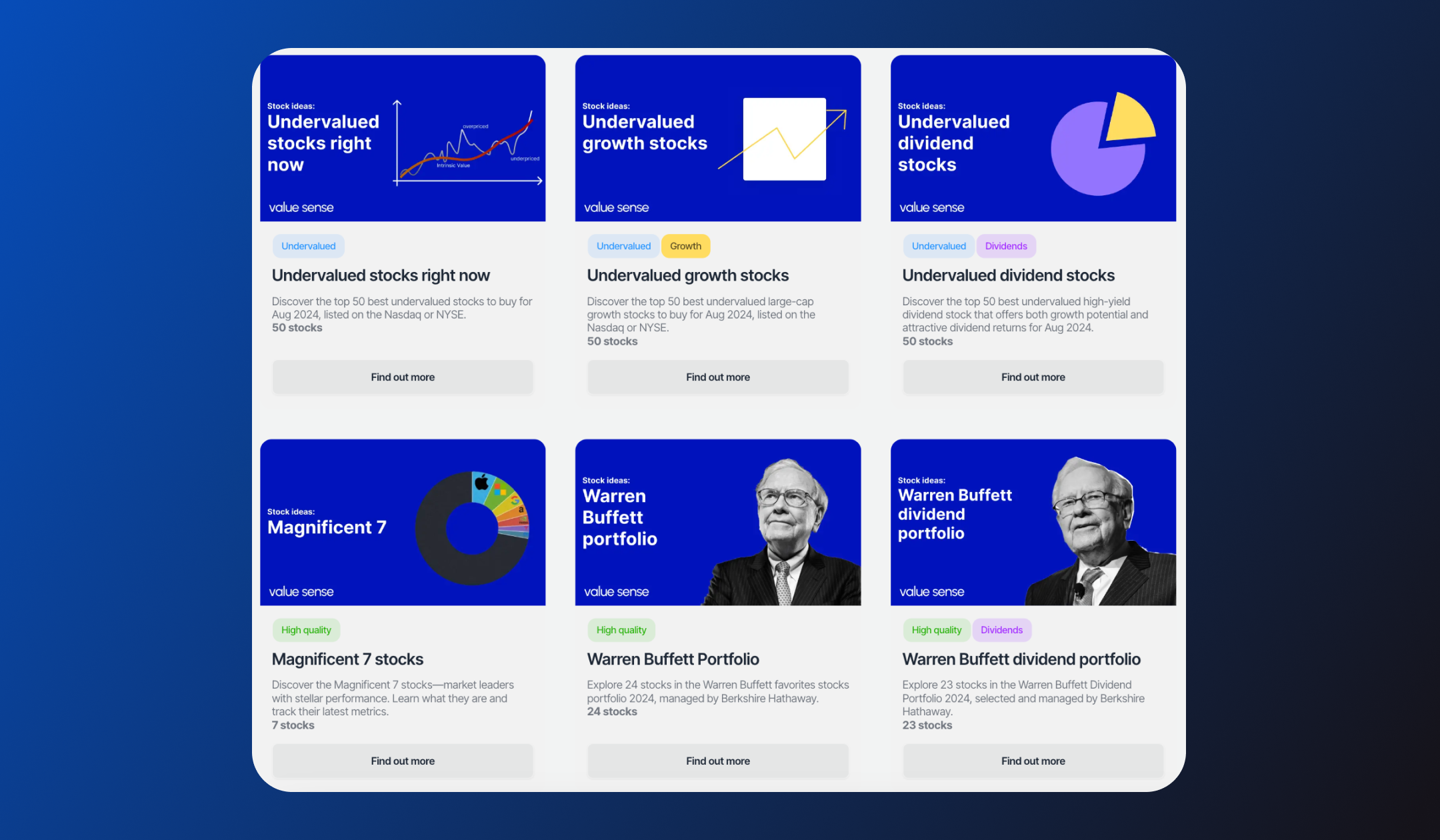

For those seeking market opportunities, our analytics team has compiled over 10 exclusive lists of undervalued and high-quality stocks:

Ready to start?

Join 3,500+ value investors worldwide