10 Stocks With Great Health Rating and 15%+ Returns Over 5 Years

Welcome to Value Sense Blog

At Value Sense, we provide insights on the stock market, intrinsic value tools, and stock ideas with undervalued companies. You can explore our research products at valuesense.io and learn more about our approach on our site.

Investors looking for high-quality stocks often focus on two key metrics: financial health and long-term price performance. Companies with solid fundamentals and consistent stock growth tend to offer better risk-adjusted returns.

In this analysis, we highlight top-performing stocks that meet the following investment criteria:

✅ Health Rating above 7, indicating strong financial stability and business resilience.

✅ 5-Year CAGR (Compound Annual Growth Rate) above 1%, proving sustained stock price appreciation.

These companies span technology, cybersecurity, energy, and semiconductors, making them attractive options for long-term investors. Read on to discover which stocks stand out in today’s market.

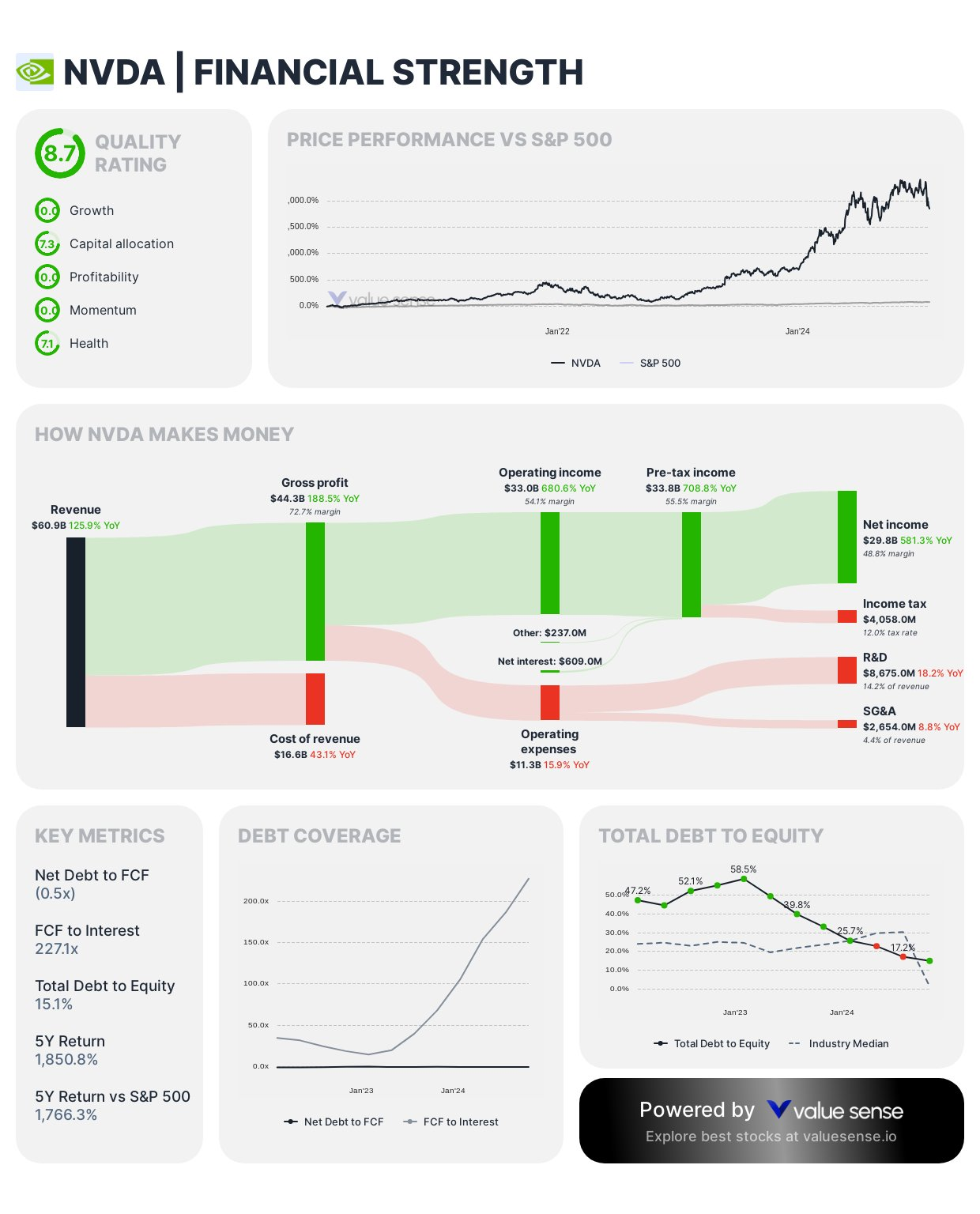

NVIDIA Corporation ($NVDA)

- Health Rating: 7.1

- Price performance CAGR 5y: 85.9%

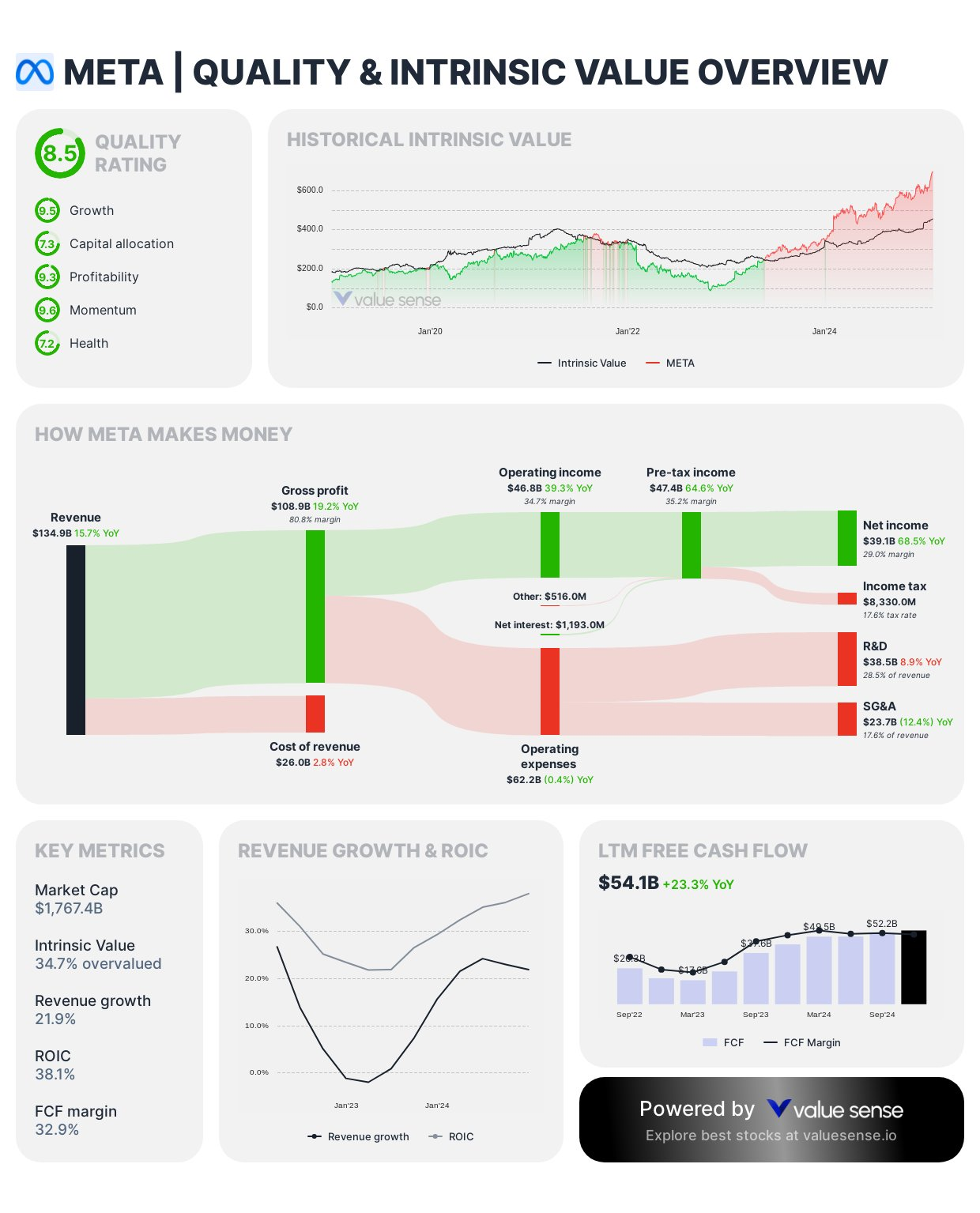

Meta Platforms, Inc. ($META)

- Health Rating: 7.2

- Price performance CAGR 5y: 22.6%

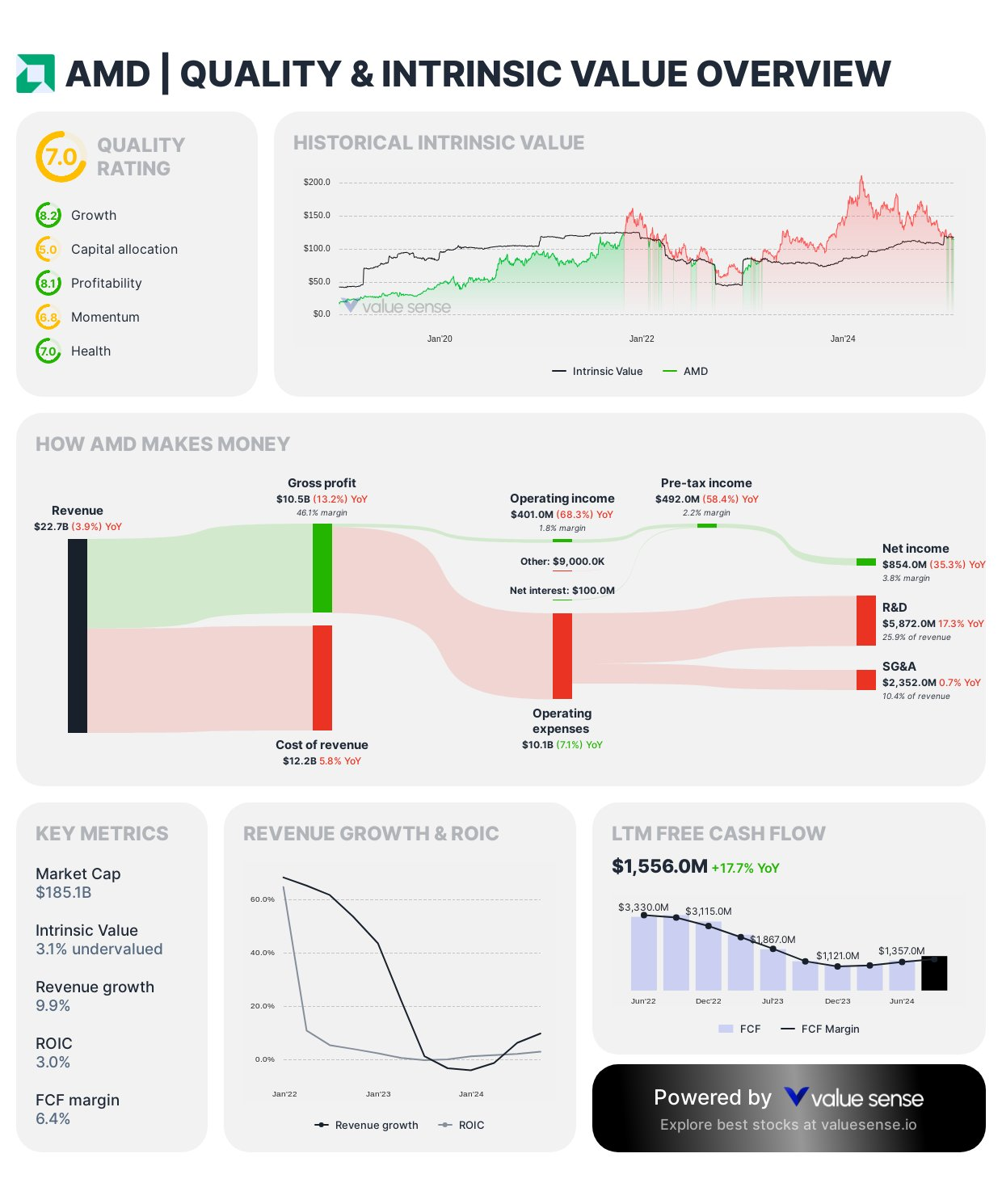

Advanced Micro Devices ($AMD)

- Health Rating: 7.0

- Price performance CAGR 5y: 19.0%

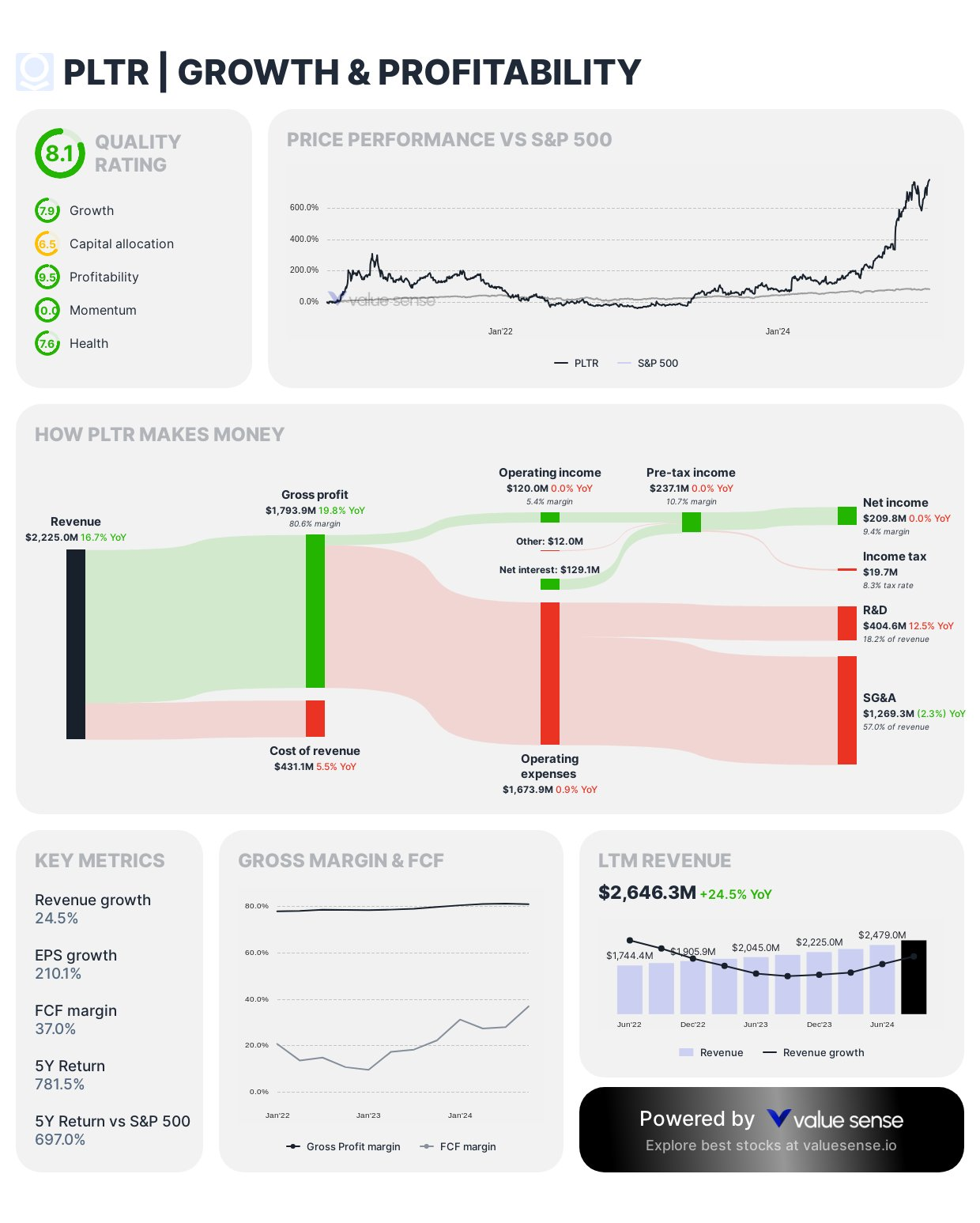

Palantir Technologies ($PLTR)

- Health Rating: 7.6

- Price performance CAGR 5y: 65.8%

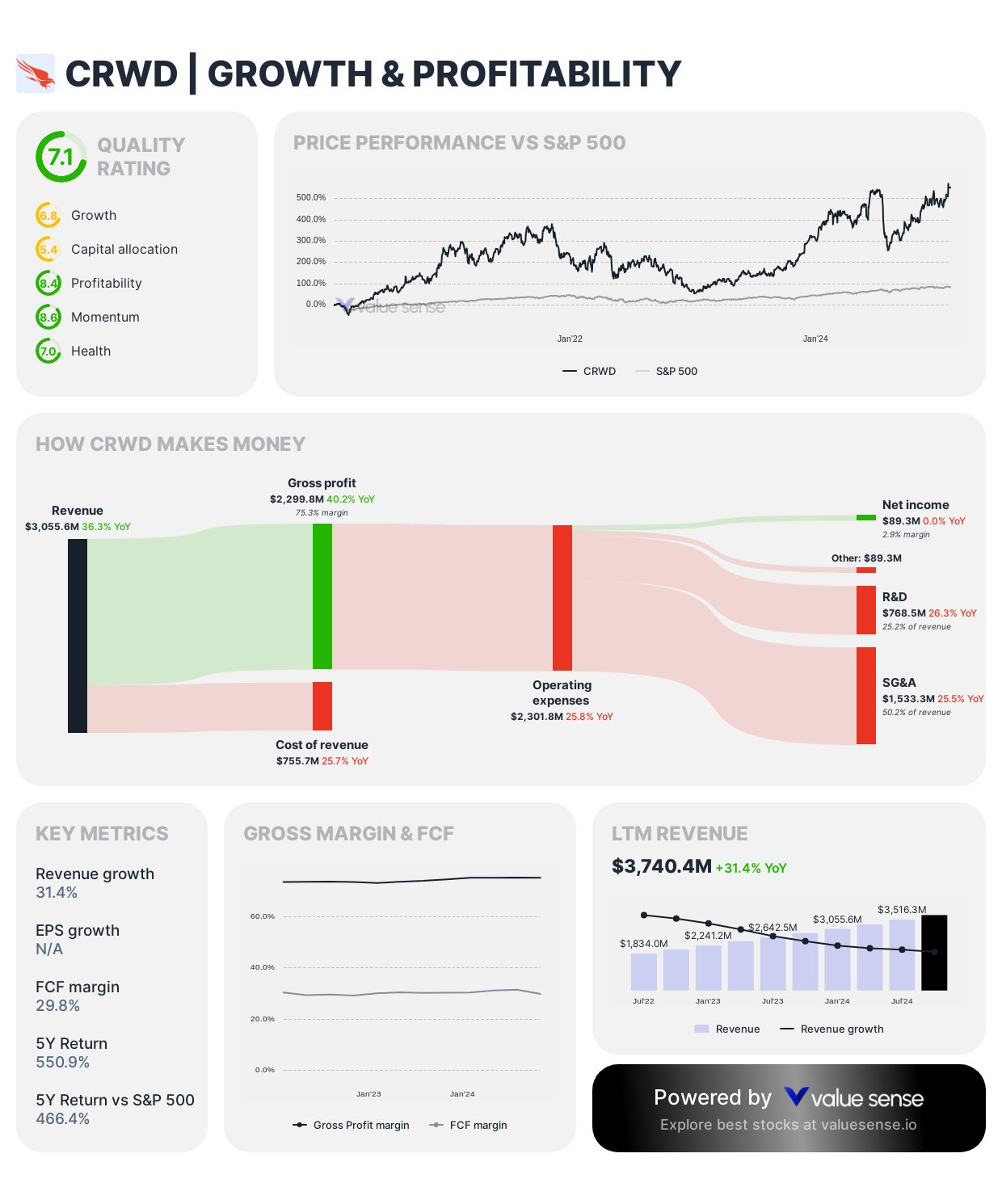

CrowdStrike Holdings ($CRWD)

- Health Rating: 7.0

- Price performance CAGR 5y: 41.3%

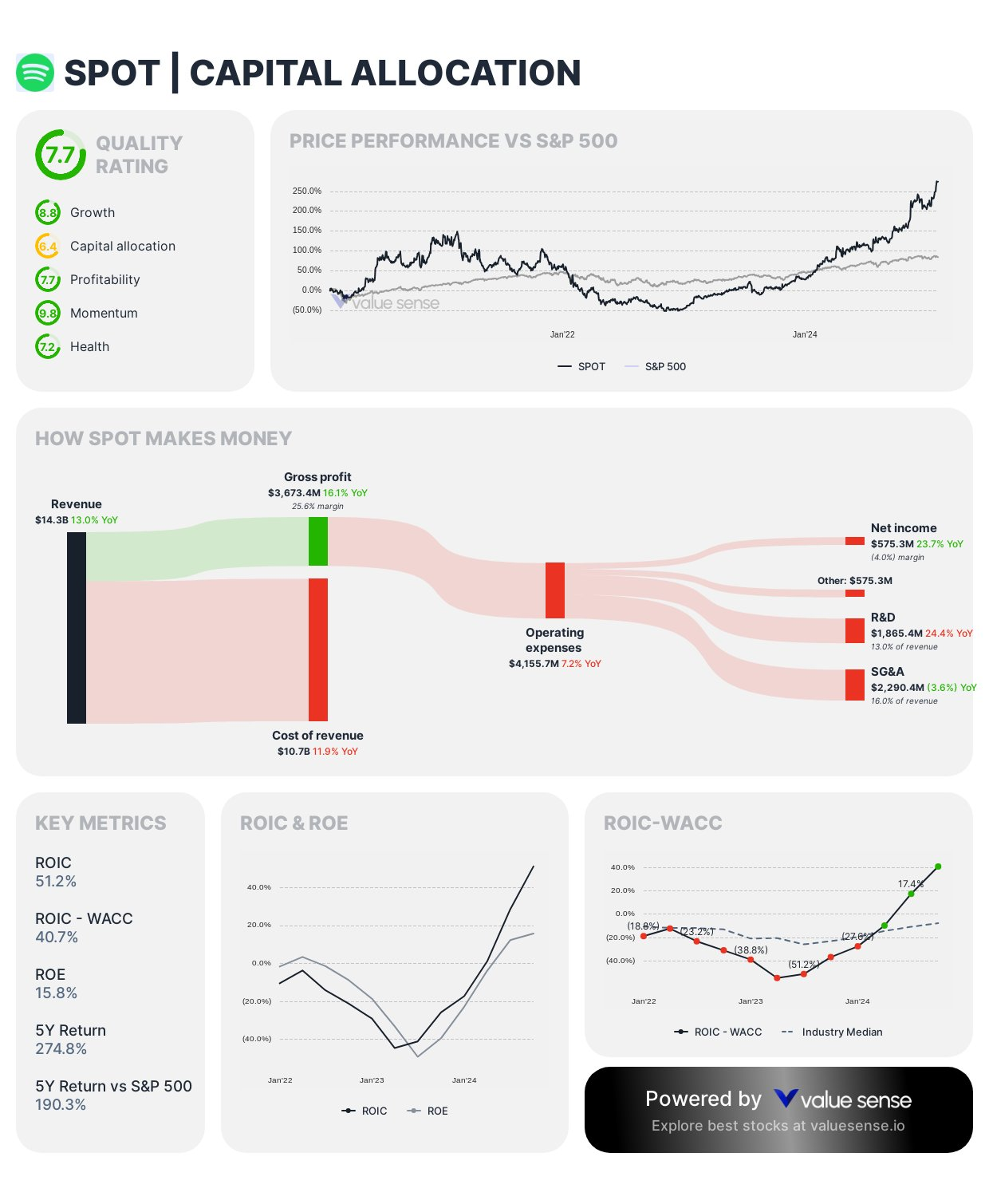

Spotify ($SPOT)

- Health Rating: 7.2

- Price performance CAGR 5y: 26.8%

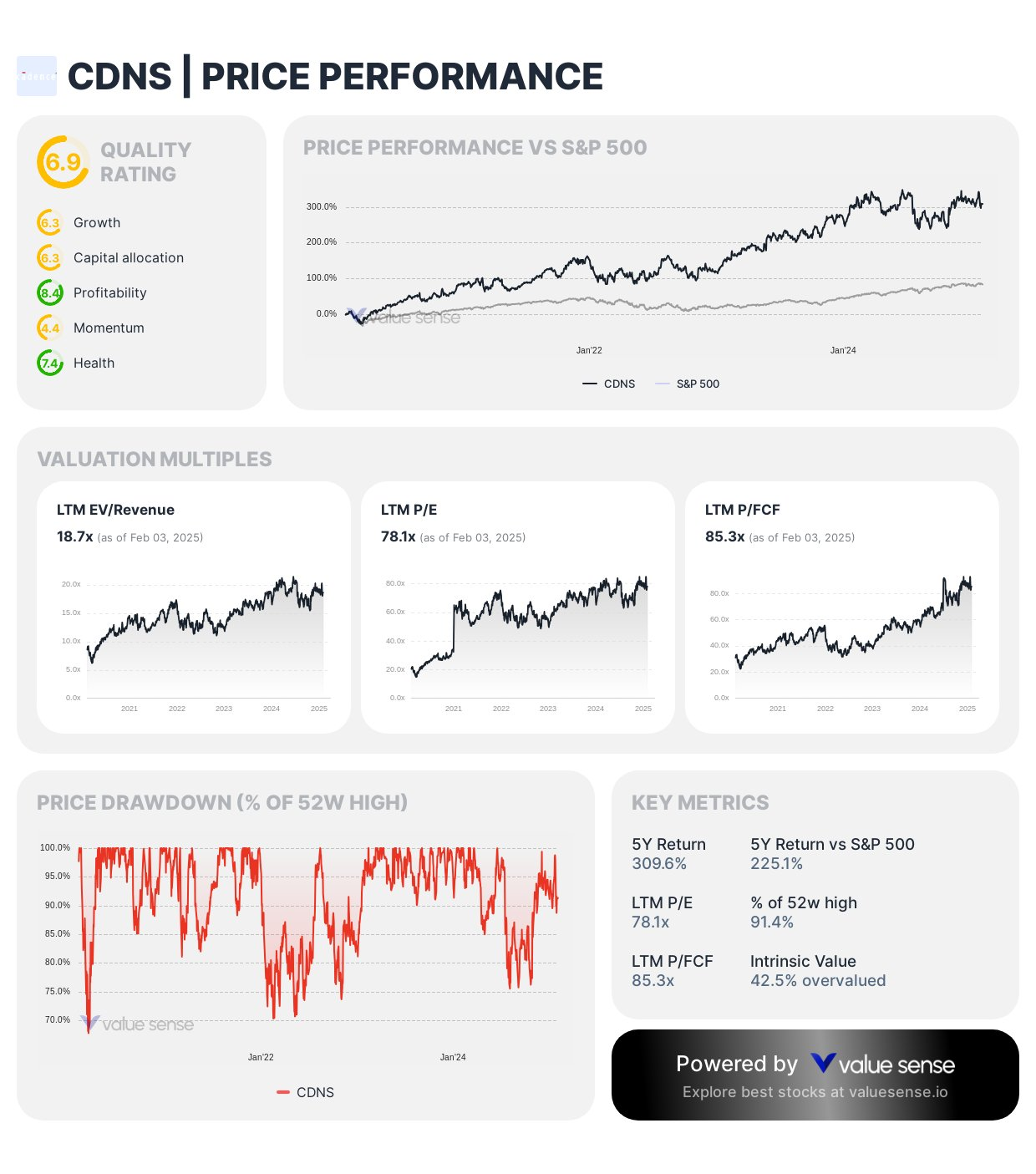

Cadence Design Systems ($CDNS)

- Health Rating: 7.4

- Price performance CAGR 5y: 32.9%

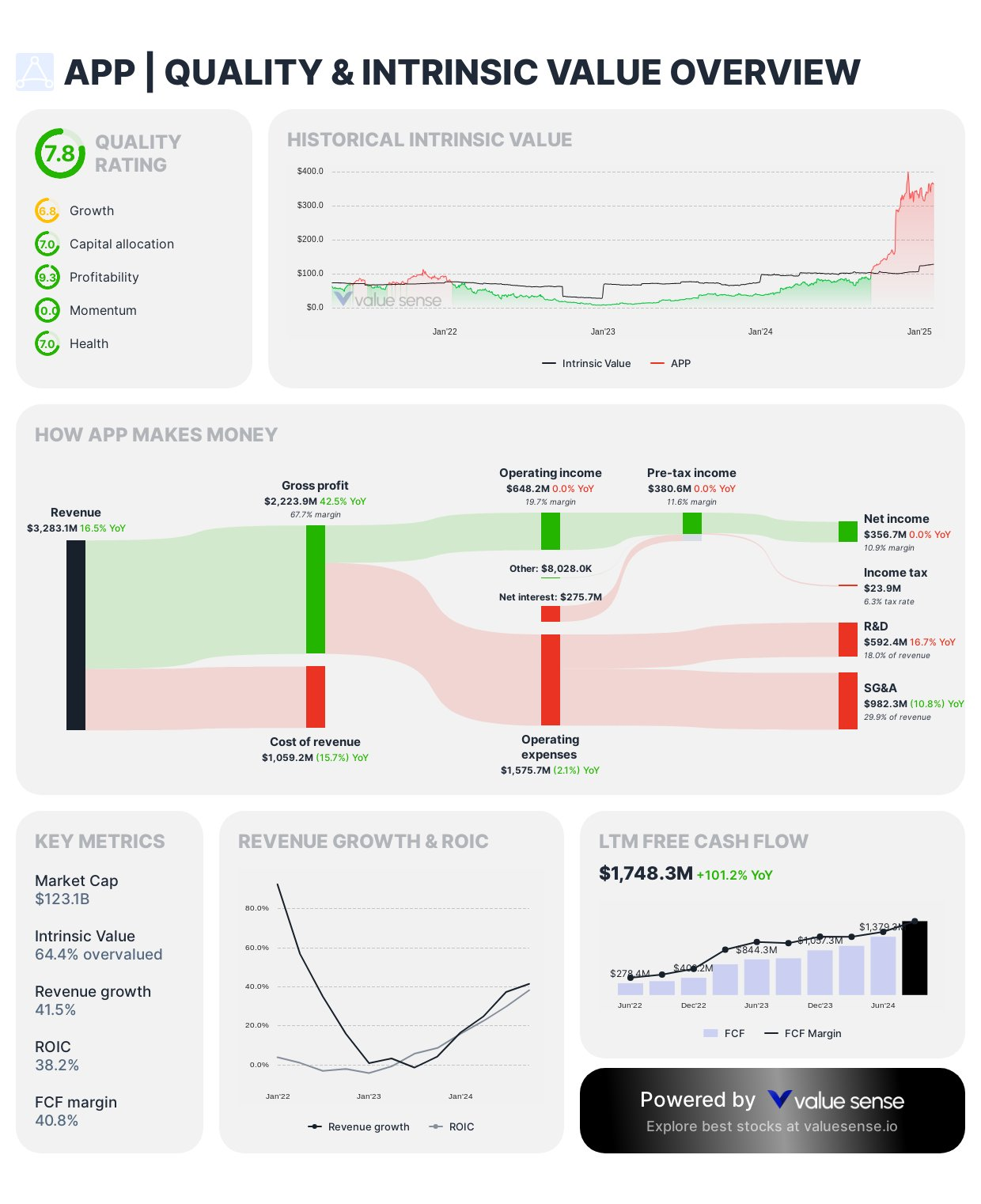

AppLovin ($APP)

- Health Rating: 7.0

- Price performance CAGR 5y: 73.8%

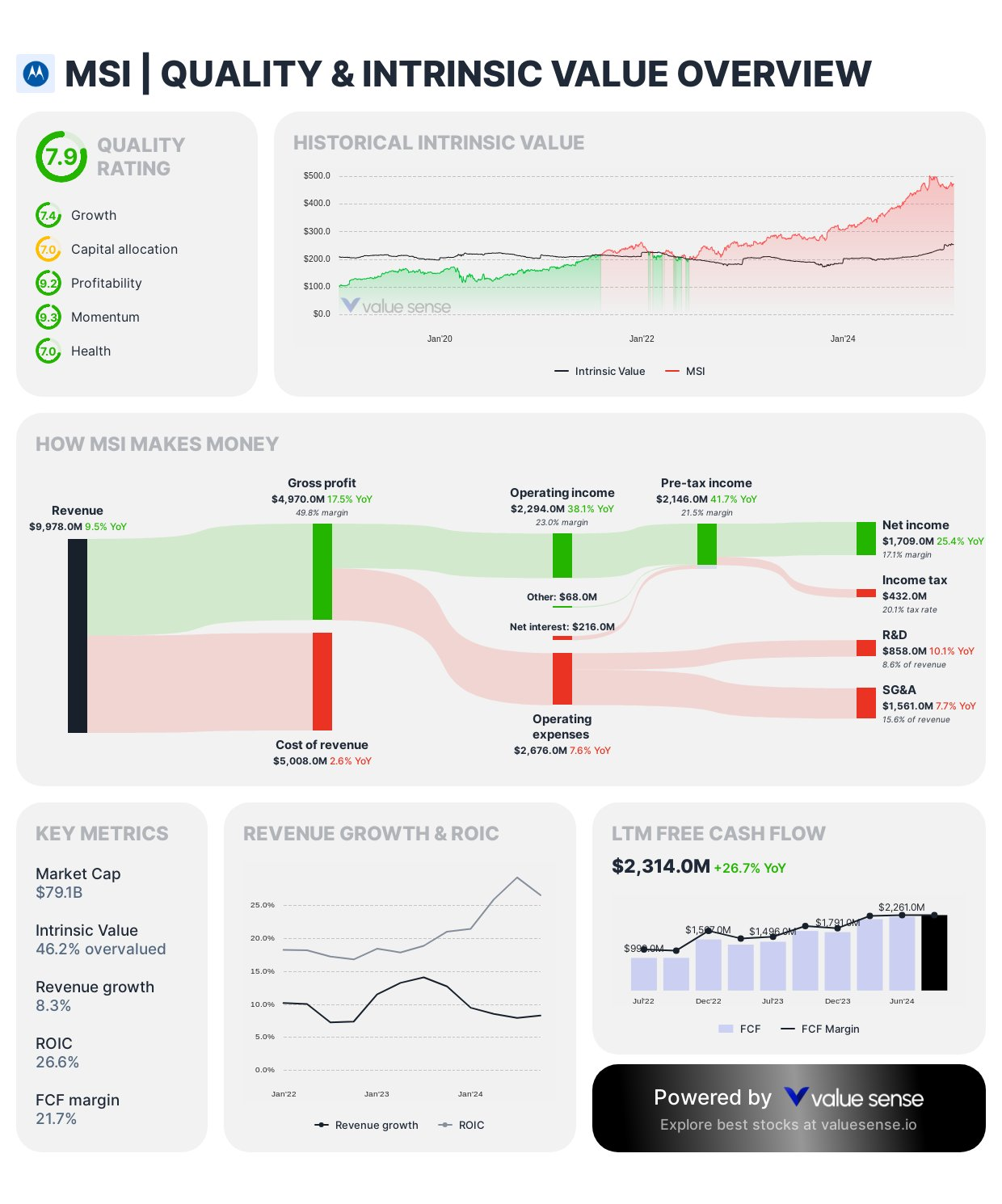

Motorola Solutions ($MSI)

- Health Rating: 7.0

- Price performance CAGR 5y: 23.1%

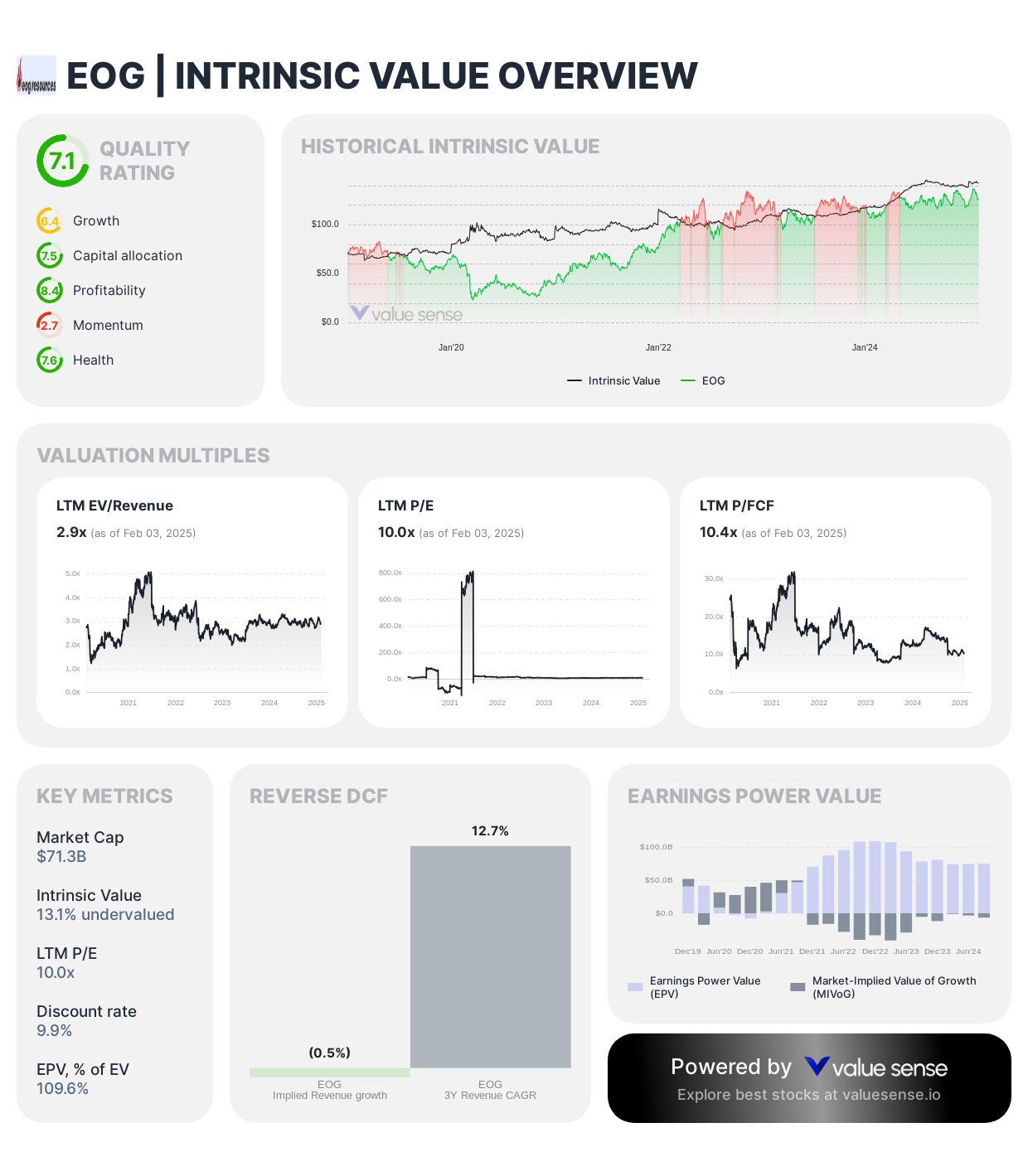

EOG Resources ($EOG)

- Health Rating: 7.6

- Price performance CAGR 5y: 15.1%

You can check out the companies from the thread on the Value Sense platform. It's absolutely free.

For investors seeking opportunities, our analytics team provides comprehensive lists of undervalued companies where the intrinsic value suggests potential undervaluation, combining fundamental analysis with quality metrics:

Ready to start?

Join 3,500+ value investors worldwide

FAQ

1. What is a Health Rating in stock analysis, and why does it matter?

A Health Rating measures a company's financial stability and business resilience based on key financial indicators such as debt levels, profitability, and cash flow. A higher rating (above 7) suggests a strong financial position, reducing investment risks.

2. Why is the 5-Year CAGR important for stock performance evaluation?

The 5-Year Compound Annual Growth Rate (CAGR) reflects a stock's consistent growth over time. A positive CAGR above 1% indicates that a company has sustained price appreciation, making it a potential candidate for long-term investment.

3. Which stock on the list has the highest 5-Year CAGR?

NVIDIA Corporation (NVDA) leads the list with a 5-Year CAGR of 85.9%, showcasing its exceptional stock price growth and market dominance in AI and semiconductors.

4. How can I find more undervalued stocks for investment?

You can explore Value Sense's research tools for curated lists of undervalued stocks, including 50 Undervalued Stocks, 50 Undervalued Dividend Stocks, and 50 Undervalued Growth Stocks on the Value Sense platform—available for free.

5. Is Value Sense free to use for stock research?

Yes! Value Sense offers free access to its platform, allowing investors to analyze undervalued stocks, assess intrinsic value, and discover high-quality investment opportunities with strong fundamentals.