Terry Smith - Fundsmith Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

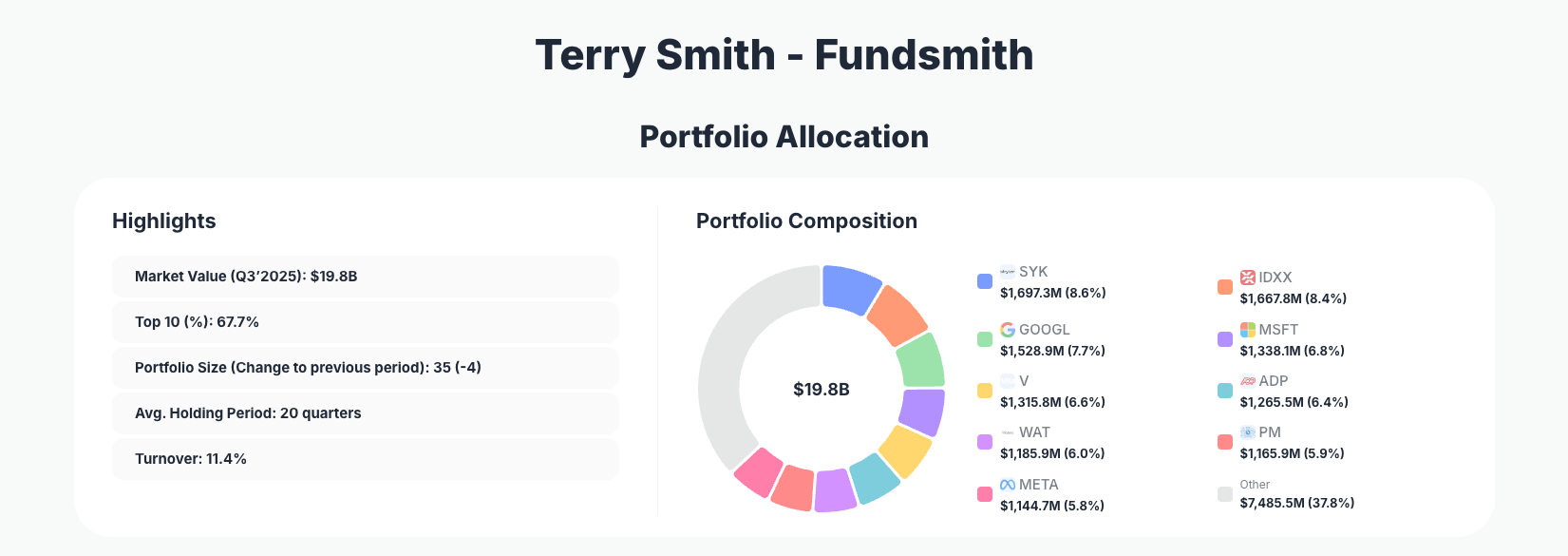

Terry Smith - Fundsmith stayed true to his “buy good companies, don’t overpay, do nothing” mantra in Q3’2025, but his latest 13F shows notable trims to big-tech winners and tobacco, alongside selective adds in high‑quality healthcare and analytical tools. His Q3’2025 Fundsmith portfolio now concentrates $19.8B across 35 positions, with the top holdings still dominated by durable growth franchises in medical devices, diagnostics, payments, and software.

View full Fundsmith 13F breakdown on ValueSense

Portfolio Overview: Quality at a Sensible Concentration

Portfolio Highlights (Q3’2025): - Market Value: $19.8B

- Top 10 Holdings: 67.7%

- Portfolio Size: 35 -4

- Average Holding Period: 20 quarters

- Turnover: 11.4%

The latest Fundsmith portfolio remains firmly in concentrated territory, with nearly two‑thirds of capital in the top 10 holdings 67.7% and just 35 positions, down by four from the prior quarter. This reflects Smith’s preference for owning a focused basket of resilient compounders rather than a broad, index‑like mix. An average holding period of 20 quarters underlines his long‑term orientation despite an 11.4% turnover, indicating that when changes happen, they’re deliberate and often valuation‑driven rather than tactical trading.

The reduction in total holdings (35, down 4) suggests ongoing pruning of lower‑conviction or less scalable ideas while keeping the core intact. Within this concentrated framework, the Fundsmith 13F shows Smith leaning into healthcare tools and life‑science exposure while trimming some high‑flying mega‑cap tech and a major tobacco stake. The combination of modest turnover and selective position sizing adjustments continues to embody a disciplined “quality at a reasonable price” strategy.

For investors following the Terry Smith portfolio Q3 2025, the message is clear: the fund is not rotating into cyclical or speculative names, but rather fine‑tuning allocations around a core of high‑margin, cash‑generative businesses in structurally growing niches.

Top Holdings Overview: Healthcare, Tech Platforms, and Cash‑Rich Franchises

The Q3’2025 Fundsmith holdings with changes highlight subtle but important shifts across several large positions. The portfolio is anchored by leading medical technology and diagnostics names like Stryker Corporation, which stands at 8.6% of the portfolio with $1,697.3M invested after a “Reduce 1.83%” action, suggesting mild profit‑taking while retaining a major conviction position. Another core healthcare holding, IDEXX Laboratories, Inc., represents 8.4% at $1,667.8M and was also “Reduce 1.09%”, a small trim that still leaves it as one of Fundsmith’s largest bets.

In communication services and technology, Alphabet Inc. holds 7.7% of the portfolio at $1,528.9M, with a “Reduce 7.56%” move—meaningful but far from an exit, likely reflecting valuation discipline after strong share price performance. Microsoft Corporation remains a key pillar at 6.8% and $1,338.1M, yet the “Reduce 47.72%” action stands out as one of the most aggressive trims this quarter, freeing up capital while still maintaining a sizable position in the software giant.

On the payments side, Visa Inc. constitutes 6.6% of the portfolio with $1,315.8M and saw a tiny “Add 0.01%”—effectively reaffirming conviction rather than materially altering risk. Payroll and business services exposure via Automatic Data Processing, Inc. stands at 6.4% and $1,265.5M, with a “Reduce 1.16%” indicating incremental trimming but sustained belief in its recurring‑revenue model.

One of the more notable additions is Waters Corporation, which now makes up 6.0% of the portfolio at $1,185.9M following an “Add 9.62%”. This sizable increase underscores Smith’s enthusiasm for specialized analytical instruments and life‑science tools—businesses with high switching costs and mission‑critical roles in research and quality control.

In contrast, Philip Morris International Inc. accounts for 5.9% at $1,165.9M but was “Reduce 20.78%”, signaling a clear downshift in exposure to global tobacco. Whether driven by valuation, regulation risk, or ESG pressures, this is one of the sharper cuts among Fundsmith’s legacy consumer staples holdings. Growth‑tech giant Meta Platforms, Inc. still weighs in at 5.8% and $1,144.7M, yet the fund executed a very large “Reduce 56.32%”, crystallizing gains while preserving a meaningful residual stake.

Lastly, travel and lodging leader Marriott International, Inc. comes in at 5.6% with $1,101.2M after a marginal “Reduce 0.20%”. This tiny trim suggests portfolio fine‑tuning rather than any change in long‑term thesis on asset‑light hospitality.

Collectively, these 10–11 key Terry Smith stocks show a pattern: modest trims across several long‑term winners, two large de‑risks in MSFT and META, a significant scale‑back in PM, and a strong add to WAT, aligning the portfolio even more tightly with defensible, recurring‑revenue franchises.

What the Portfolio Reveals About Fundsmith’s Current Strategy

The Q3’2025 Terry Smith – Fundsmith portfolio offers several strategic signals:

- Quality compounding over speculative growth

The heaviest‑weighted names—SYK, IDXX, GOOGL, MSFT, V, ADP—are all established, cash‑rich businesses with strong moats and pricing power rather than early‑stage disruptors. - Healthcare and life‑science tools as core growth engines

Allocations to Stryker, IDEXX, and especially the increased stake in Waters underscore a structural bet on aging populations, veterinary care, diagnostics, and lab testing—sectors less sensitive to short‑term macro swings. - Tech trimming, not abandoning

Deep cuts in Microsoft (Reduce 47.72%) and Meta (Reduce 56.32%) appear more like valuation and risk management decisions than a rejection of tech as a theme. Both still sit in the top echelon of holdings by weight. - Consumer and vice exposure carefully managed

The 20.78% reduction in Philip Morris suggests a recalibration of tobacco exposure, possibly reflecting slower volume growth, regulatory overhangs, or a desire to re‑weight toward higher‑quality growth elsewhere in the Fundsmith portfolio. - Geographic and currency diversification via global franchises

While the data here is position‑level rather than geographic, many of these companies—Visa, Microsoft, Alphabet, Stryker, Waters, Marriott—derive a significant portion of revenue globally, giving the fund natural currency and geography diversification through multinational champions. - Dividends as a bonus, not the goal

Names like V, ADP, and PM pay solid dividends, but position sizes and actions indicate the focus remains on total return through compounding, not yield‑maximization.

Overall, the Fundsmith Q3 2025 holdings continue to emphasize high returns on capital, recurring revenue, and durable competitive advantages, while the quarter’s trades show Smith sharpening risk‑reward by taking profits in richly valued winners and leaning into underappreciated quality.

Portfolio Concentration Analysis

Using the reported top 10 holdings:

Note: The JSON data provides ranks 2–10; rank 1 is not included in this snippet, so only ranks 2–10 are shown below.

| Position (Rank) | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Stryker Corporation (SYK) – Rank 2 | $1,697.3M | 8.6% | Reduce 1.83% |

| IDEXX Laboratories, Inc. (IDXX) – Rank 3 | $1,667.8M | 8.4% | Reduce 1.09% |

| Alphabet Inc. (GOOGL) – Rank 4 | $1,528.9M | 7.7% | Reduce 7.56% |

| Microsoft Corporation (MSFT) – Rank 5 | $1,338.1M | 6.8% | Reduce 47.72% |

| Visa Inc. (V) – Rank 6 | $1,315.8M | 6.6% | Add 0.01% |

| Automatic Data Processing, Inc. (ADP) – Rank 7 | $1,265.5M | 6.4% | Reduce 1.16% |

| Waters Corporation (WAT) – Rank 8 | $1,185.9M | 6.0% | Add 9.62% |

| Philip Morris International Inc. (PM) – Rank 9 | $1,165.9M | 5.9% | Reduce 20.78% |

| Meta Platforms, Inc. (META) – Rank 10 | $1,144.7M | 5.8% | Reduce 56.32% |

These nine disclosed top positions alone sum to 61.2% of the portfolio, very close to the reported 67.7% in the top 10, implying that the undisclosed #1 position is also a major holding and consistent with Fundsmith’s concentrated style. The spread between the largest and smallest of these positions is narrow (8.6% down to 5.8%), which illustrates balanced concentration: no single stock dominates, but each top holding is large enough to materially impact returns.

The pattern of actions in the table—light trims in several core compounders, one large add in Waters, and large reductions in Microsoft, Meta, and Philip Morris—shows Smith using position size as an active risk lever. Instead of binary buy/sell decisions, he prefers graduated scaling, allowing winners to compound while clipping risk when valuations stretch or business risk tilts.

Investment Lessons from Terry Smith’s Fundsmith Approach

For investors studying the Terry Smith – Fundsmith portfolio Q3 2025, several enduring principles stand out:

- Own a concentrated basket of businesses you deeply understand

With just 35 holdings and nearly 68% in the top 10, Fundsmith demonstrates that diversification beyond a point can dilute returns if it forces inclusion of lower‑quality names. - Let winners run—but trim when risk/reward skews

Positions like GOOGL, MSFT, and META show long‑term ownership combined with disciplined reductions when valuations or position size warrant. - Favor recurring, resilient revenue models

From ADP to V, IDXX, and WAT, the fund focuses on subscription‑like, repeat‑purchase, or usage‑based revenue streams with high switching costs. - Low turnover plus long holding periods compound advantages

An average holding period of 20 quarters with only 11.4% turnover highlights the power of staying invested in high‑quality names rather than chasing short‑term narratives. - Position sizing is an active risk‑management tool

The difference between a Reduce 1.09% in IDXX and a Reduce 56.32% in META illustrates how Smith adjusts exposure based on conviction, valuation, and business risk—without abandoning core themes. - Prune the tail to upgrade the core

The portfolio shrink from 39 to 35 positions (35 -4) suggests ongoing removal of lower‑conviction holdings, reallocating capital to best‑in‑class franchises already in the Fundsmith portfolio.

Looking Ahead: What Comes Next for Fundsmith?

Based on the Q3’2025 Fundsmith 13F:

- Dry powder via trims

Large reductions in MSFT, META, and PM likely free up capital for future opportunities or to reinforce existing high‑conviction names like WAT. - Potential future adds in healthcare and software

The Add 9.62% in Waters and modest trims rather than exits in Stryker and IDEXX suggest Smith could continue to lean into mission‑critical healthcare and analytics if valuations cooperate. - Watch for further re‑balancing in Big Tech

After such a large cut in Microsoft and Meta, future 13Fs will show whether Fundsmith stabilizes these weights, trims further, or reallocates back on any pullback. - Macro agnostic, business focused

The overall structure—global, high‑ROIC franchises in secular growth sectors—implies a strategy built to weather varied macro environments rather than making explicit macro calls. Expect future moves to remain business‑ and valuation‑driven rather than tied to short‑term economic forecasts.

Investors tracking Terry Smith stocks can use these patterns as a lens: when valuations compress on quality names in healthcare, software, or payments, Fundsmith may respond with incremental adds rather than style shifts.

FAQ about Terry Smith – Fundsmith Portfolio

Q: What were the most significant changes in Fundsmith’s Q3’2025 portfolio?

A: The most notable moves were large reductions in Microsoft Corporation (MSFT) (Reduce 47.72%), Meta Platforms, Inc. (META) (Reduce 56.32%), and Philip Morris International Inc. (PM) (Reduce 20.78%), alongside a substantial Add 9.62% in Waters Corporation (WAT). Smaller trims occurred in SYK, IDXX, GOOGL, ADP, and MAR, while V saw a tiny add (Add 0.01%).

Q: How concentrated is the Terry Smith – Fundsmith portfolio?

A: The top 10 holdings account for 67.7% of the portfolio’s $19.8B market value, and there are only 35 positions in total. The disclosed ranks 2–10 alone already represent about 61.2% of assets, showing a highly concentrated but balanced focus on a small set of high‑conviction names.

Q: Does Fundsmith actively trade or mostly buy and hold?

A: With an average holding period of 20 quarters and turnover of 11.4%, Fundsmith is clearly a long‑term, low‑turnover investor. Changes like “Reduce 1–8%” or “Add 0.01%” show incremental position management rather than frequent trading, while larger moves (e.g., in MSFT and META) are relatively rare but meaningful.

Q: Which sectors or themes dominate Terry Smith’s holdings?

A: The largest disclosed positions cluster around: - Healthcare & diagnostics: Stryker, IDEXX, Waters

- Technology & platforms: Alphabet, Microsoft, Meta

- Payments & business services: Visa, ADP

- Consumer & travel: Philip Morris, Marriott

The unifying theme is high‑quality, asset‑light, globally scalable franchises.

Q: How can I track Terry Smith’s portfolio changes over time?

A: Fundsmith discloses its U.S. equity holdings via quarterly 13F filings, which U.S. institutional managers must submit within 45 days after quarter‑end. Because of this 45‑day reporting lag, investors see positions with a delay and should treat them as a strategic snapshot rather than real‑time trades. You can track all updates, historical changes, and visual breakdowns on ValueSense’s superinvestor tracker here: Fundsmith’s portfolio.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!