Tesla Stock Forecast: Is TSLA Undervalued or Overvalued? - 2025 Analysis

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

The eternal question surrounding Tesla (TSLA) continues to captivate investors and analysts alike: Is this electric vehicle pioneer trading at a justified premium, or has the market gotten carried away? At ValueSense, we've conducted a comprehensive analysis of Tesla's latest financial data, competitive positioning, and market dynamics to provide clarity on one of the most polarizing stocks in the market.

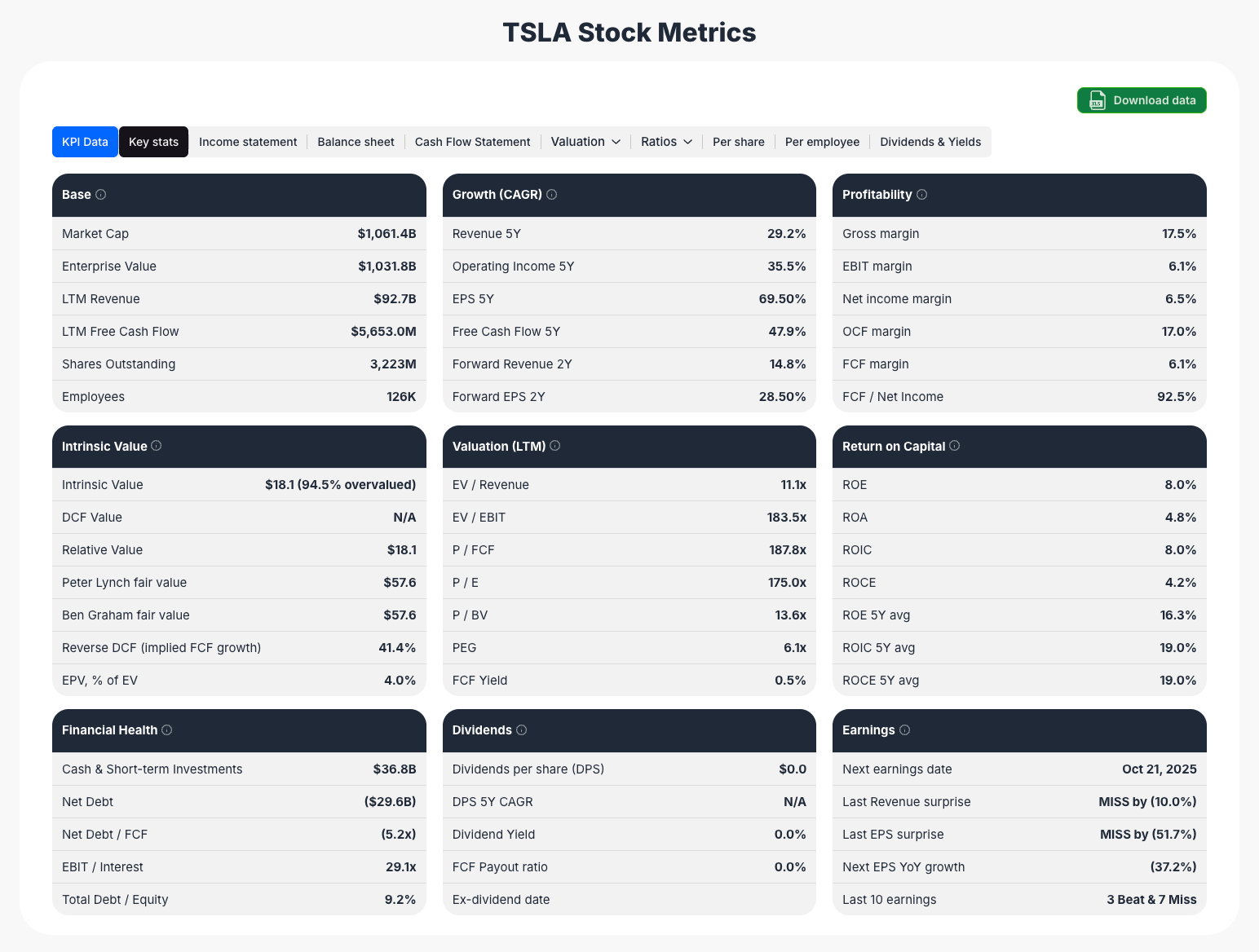

The numbers tell a complex story. With a $1.061 trillion market capitalization and multiple valuation models screaming "overvalued," Tesla presents both compelling growth prospects and significant valuation concerns that demand careful examination.

The Valuation Reality Check: What the Numbers Say

Our comprehensive analysis reveals a stark disconnect between Tesla's current market price and traditional valuation methodologies. The data is unequivocal: Tesla appears to be trading at a 94.5% premium to its intrinsic value of $18.1 per share, based on discounted cash flow analysis.

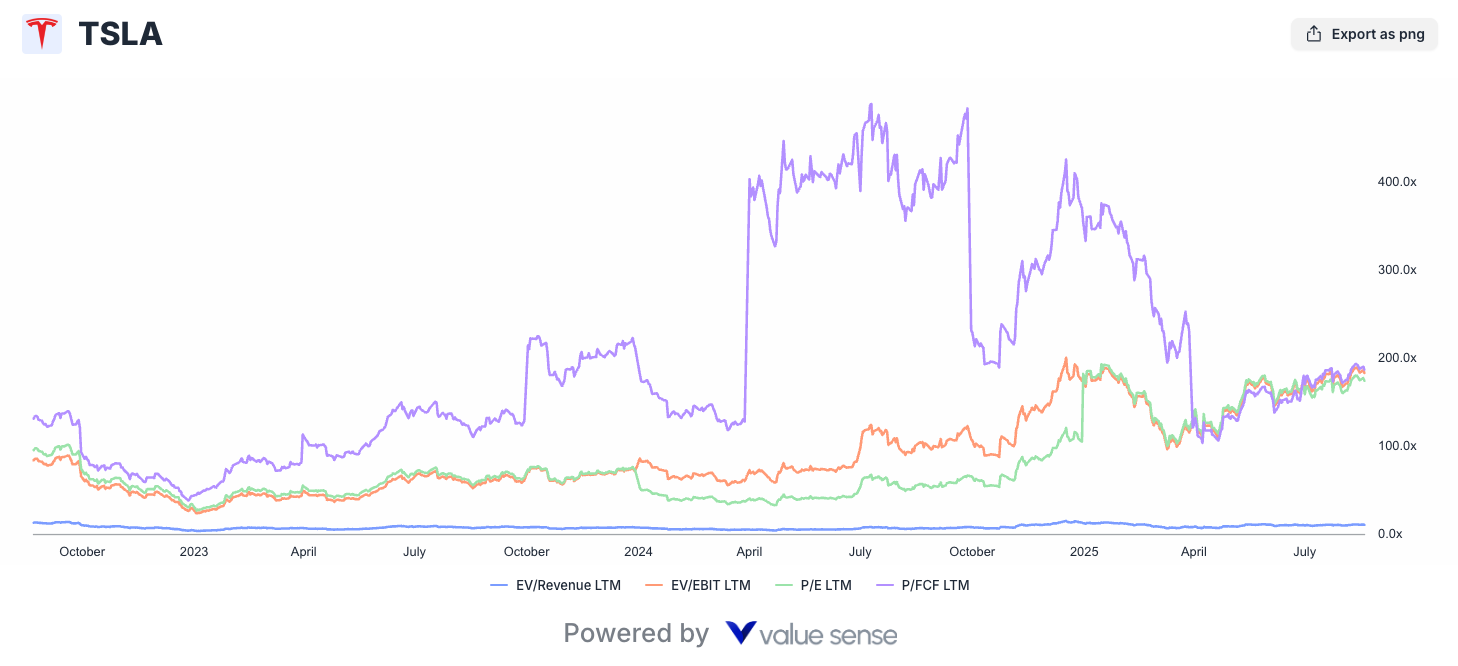

Valuation Metrics That Demand Attention

Enterprise Value Multiples Paint an Expensive Picture:

(https://valuesense.io/ticker/tsla#key-stats)

- EV/Revenue: 11.1x (significantly above traditional automotive multiples)

- EV/EBIT: 183.5x (extremely elevated compared to industry standards)

- P/E Ratio: 175.0x (reflecting high growth expectations)

- P/FCF: 187.8x (indicating substantial premium for cash generation)

These multiples place Tesla in rarefied air, typically reserved for high-growth technology companies rather than automotive manufacturers. The question becomes: can Tesla's business fundamentals justify these premium valuations?

Financial Health: A Mixed Bag

Positive Indicators:

- Debt-to-Equity: 9.2% (exceptionally strong balance sheet)

- Cash Position: $36.8B in cash and short-term investments

- Net Debt: Negative $29.6B (net cash position)

Concerning Metrics:

- FCF Yield: 0.5% (minimal free cash flow relative to market cap)

- EBIT/Interest: 29.1x (while strong, reflects limited current profitability)

Tesla's Growth Trajectory: The Bull Case Foundation

The growth metrics that have driven Tesla's stratospheric valuation remain impressive, though showing signs of maturation:

Revenue Growth Analysis

Historical Performance:

- 5-Year Revenue CAGR: 29.2% (remarkable sustained growth)

- 2024 Revenue Actual: $97.69B (up from $96.77B in 2023)

- Forward Revenue Growth: Projected 14.8% over next two years

Profitability Evolution

Tesla's journey from cash-burning startup to profitable enterprise represents one of the most remarkable corporate transformations in recent memory:

2024 Actual Performance:

- Gross Profit: $17.45B (17.9% margin)

- Operating Income: $7.08B (7.2% margin)

- Net Income: $7.09B (7.3% margin)

- EBITDA: $14.71B (solid cash generation)

The 6.5% net income margin demonstrates Tesla's evolution into a sustainably profitable enterprise, though margins remain lower than traditional premium automotive brands.

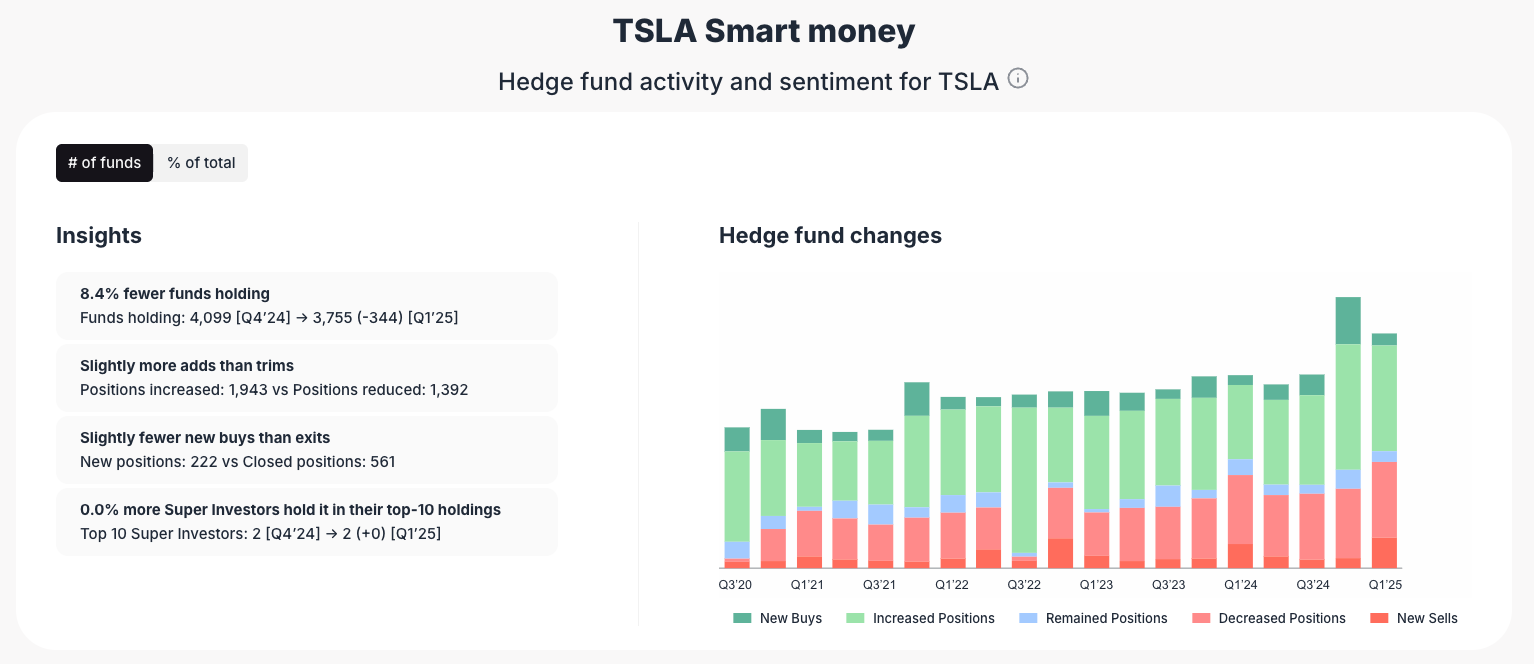

Smart Money Analysis: What Institutional Investors Are Doing

Institutional investor behavior provides crucial insights into professional sentiment surrounding Tesla:

Hedge Fund Positioning Trends

Recent Activity (Q4 2024 to Q1 2025):

- Fund Participation: 8.4% decrease in funds holding Tesla

- Current Holders: 3,755 funds (down from 4,099)

- Net Activity: Slightly more additions than exits

- Position Changes: More funds increasing positions than decreasing

The data suggests cautious optimism among professional investors, with many maintaining or increasing positions despite some funds exiting entirely.

Insider Trading Patterns: Management's Real View

Insider trading activity often provides the most honest assessment of a company's prospects:

Recent Insider Activity Analysis

3-Month Period (Through July 2025):

- Insider Sales: $213.1M (no insider purchases)

- Stock Performance: -3.7% during this period

12-Month Perspective:

- Insider Purchases: $1.025B

- Insider Sales: $618.7M

- Net Insider Buying: $406.5M

- Stock Performance: +47.9% over this period

The substantial net insider buying over the past year, despite recent selling, suggests management confidence in Tesla's long-term prospects while taking some profits after significant appreciation.

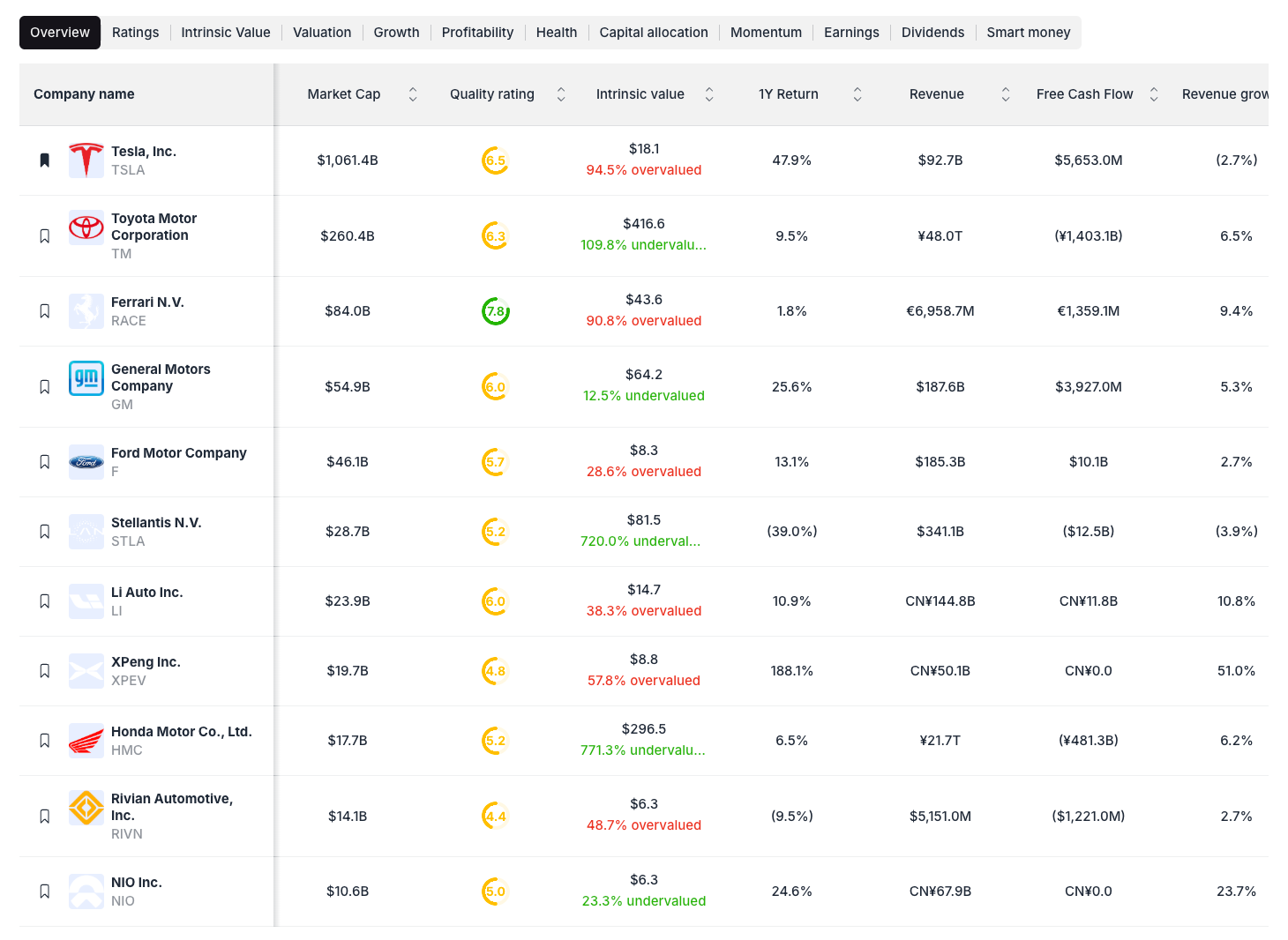

Competitive Landscape: Tesla vs. The Field

Tesla's competitive positioning reveals both strengths and vulnerabilities:

Valuation Comparison with Peers

Tesla's Premium Positioning:

- Market Cap: $1.061T (dwarfing all automotive competitors)

- Intrinsic Value: $18.1 (94.5% overvalued)

- Revenue: $92.7B

- 1Y Return: 47.9%

Key Competitor Analysis:

- Toyota (TM): $260.4B market cap, 109.8% undervalued

- General Motors (GM): $54.9B market cap, 12.5% undervalued

- Ford (F): $46.1B market cap, 28.6% overvalued

- Ferrari (RACE): $84.0B market cap, 90.6% overvalued

Tesla's valuation premium becomes stark when compared to established automotive giants with comparable or higher revenue bases.

The Bear Case: Why Tesla Might Be Overvalued

Valuation Concerns

Multiple Compression Risk: At 175x P/E and 187.8x P/FCF, Tesla trades at multiples that assume perfection. Any disappointment in growth, margins, or execution could trigger significant multiple compression.

Market Maturation: The revenue growth deceleration from previous years suggests Tesla may be entering a more mature phase where explosive growth becomes increasingly difficult.

Competition Intensification: Traditional automakers and new EV entrants have rapidly expanded electric offerings throughout 2024 and early 2025, potentially eroding Tesla's first-mover advantages.

Margin Pressure Indicators

Current Profitability Metrics:

- Gross Margin: 17.5% (under pressure from price competition)

- EBIT Margin: 6.1% (modest for premium valuation)

- Net Income Margin: 6.5% (below traditional luxury automotive brands)

The Bull Case: Why Tesla Could Still Deliver

Beyond Automotive: The Ecosystem Play

Tesla's valuation premium may be justified by businesses beyond vehicle manufacturing:

Energy Storage Segment: $10.9B in 2024 revenue (growing rapidly as grid storage demand explodes) Services Revenue: $10.5B (recurring, high-margin business) Autopilot/FSD Potential: Significant optionality with Full Self-Driving showing real progress in 2025

Technology Leadership

Production Innovation: Tesla's manufacturing efficiency and vertical integration provide competitive advantages that traditional metrics may not capture.

Software Monetization: Over-the-air updates and autonomous driving capabilities represent potential revenue streams with minimal marginal costs.

Market Expansion Opportunities

Geographic Growth: Continued expansion in emerging markets provides substantial runway Model Diversification: Cybertruck deliveries began in 2024, Semi production scaling, and future models expanding addressable markets

Our Investment Thesis: Navigating the Complexity

At ValueSense, we believe Tesla represents a unique investment proposition that defies traditional valuation frameworks:

Fair Value Assessment

Conservative Estimate: $50-75 per share (based on mature automotive company metrics) Growth-Adjusted Estimate: $100-150 per share (incorporating energy and software optionality) Bull Case Scenario: $200-300 per share (assuming successful FSD deployment and energy dominance)

Note: These estimates assume the current stock trades significantly above our calculated intrinsic value

Risk-Reward Framework

High Probability Scenarios:

- Continued EV market leadership despite increased competition

- Steady margin improvement through manufacturing scale

- Successful Cybertruck and Semi ramp-up

Moderate Probability, High Impact Scenarios:

- Breakthrough in autonomous driving technology deployment

- Significant energy storage market capture as grid modernization accelerates

- Successful entry into robotics and AI applications

Trading Strategy and Position Sizing

Given Tesla's unique risk-reward profile and extreme valuation, we recommend a nuanced approach:

For Growth Investors

Recommended Allocation: 1-3% of growth-oriented portfolios (reduced from historical recommendations due to valuation) Entry Strategy: Wait for significant corrections below $200 per share Risk Management: Strict position sizing limits due to extreme volatility

For Value Investors

Current Assessment: Significantly overvalued at current levels Watch Levels: Consider initial positions below $100 per share Catalyst Monitoring: Autonomous driving breakthroughs, energy business scaling

For Income Investors

Dividend Status: Tesla pays no dividends (0.0% yield) Total Return Focus: Capital appreciation remains sole return driver Alternative Consideration: Traditional auto stocks with dividends may offer better risk-adjusted returns

Key Catalysts to Monitor in Late 2025

Near-Term Catalysts (Next 6 months)

Q3 2025 Deliveries: Critical test of demand amid increased competition

FSD Progress: Beta expansion and potential regulatory approvals

Cybertruck Production: Scaling manufacturing and meeting delivery targets

Medium-Term Catalysts (6-18 months)

Energy Business Scaling: Grid storage contracts and deployment acceleration

Next-Gen Vehicle Platform: Lower-cost model development and timeline

International Expansion: European Gigafactory output and new market entry

Risk Factors That Could Derail the Bull Case

Company-Specific Risks

Valuation Compression: Extreme multiples vulnerable to any growth disappointment

Execution Risk: Ambitious timelines for Cybertruck, Semi, and FSD deployment

Key Person Risk: Continued dependence on Elon Musk's leadership

Market-Level Risks

EV Market Saturation: Slower adoption rates in key markets

Economic Sensitivity: Luxury vehicle demand vulnerable to economic downturns

Regulatory Changes: Potential reduction in EV incentives under changing political landscape

Technical Risks

Autonomous Driving Delays: Technical or regulatory setbacks in FSD rollout

Competition Acceleration: Traditional automakers rapidly closing technology gaps

Supply Chain Disruptions: Continued semiconductor and battery material constraints

August 2025 Market Context

The current market environment presents unique challenges for Tesla:

Rising Interest Rates: Higher rates pressure growth stock valuations and auto financing

EV Competition: Traditional automakers now offer compelling alternatives across price segments

China Market Dynamics: Local competitors gaining market share in Tesla's key growth market

Economic Uncertainty: Consumer discretionary spending under pressure from inflation

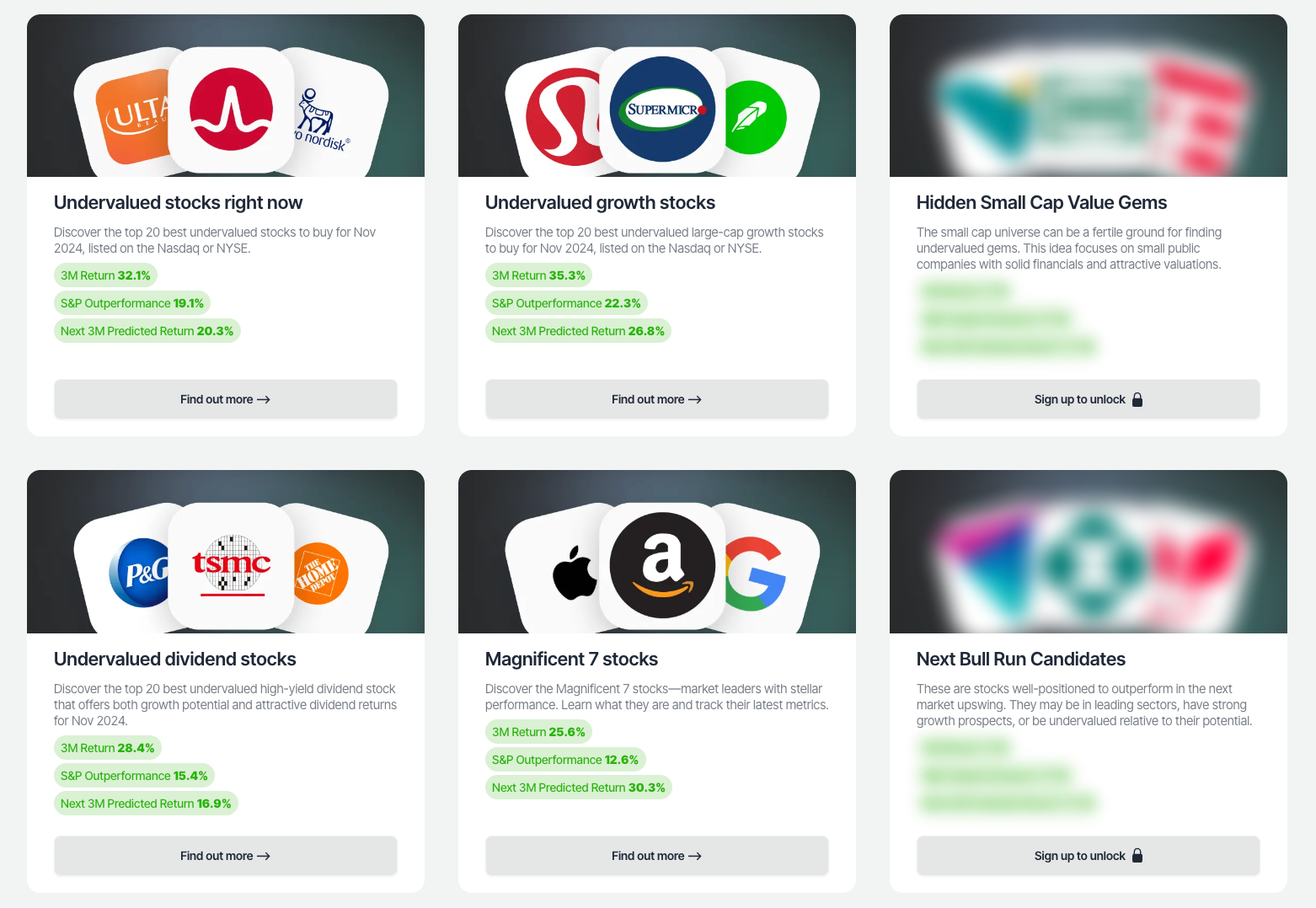

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 Best Undervalued S&P 500 Stocks

📖 11 Best Undervalued Multibagger Stocks

📖 The Magnificent 7 Stocks: Fundamental Quality Rankings & Insights

FAQ about Tesla Stock Analysis 2025

Q: Is Tesla stock overvalued based on current financial metrics in 2025?

A: Absolutely. Our analysis shows Tesla trading at a 94.5% premium to intrinsic value, with P/E ratios exceeding 175x. These metrics suggest extreme overvaluation by traditional measures. However, Tesla's unique position spanning automotive, energy, and technology sectors complicates standard valuation approaches. The premium requires near-perfect execution across multiple growth initiatives.

Q: How has Tesla's competitive position changed in 2025?

A: Tesla's competitive moat has narrowed significantly. Traditional automakers like GM, Ford, and international players have launched compelling EV alternatives. Chinese competitors like BYD are gaining global market share. While Tesla maintains technology leadership in some areas, the "only game in town" advantage has largely disappeared.

Q: What makes Tesla different from other overvalued growth stocks?

A: Tesla actually generates substantial profits ($7.09B net income in 2024) and cash flow, unlike many unprofitable growth stocks. The company has a strong balance sheet with net cash position. However, the valuation multiples remain extreme even for a profitable, growing company.

Q: Should I sell my Tesla position given the overvaluation?

A: This depends on your risk tolerance and position size. If Tesla represents more than 5% of your portfolio, consider trimming. However, Tesla has historically traded at extreme valuations and continued delivering growth. Dollar-cost averaging out of positions might be prudent rather than selling everything at once.

Q: What would cause Tesla's stock to justify current valuations?

A: Tesla would need to successfully deploy Full Self-Driving at scale (creating a robotaxi network), dominate the energy storage market, and maintain automotive market leadership while expanding margins significantly. These are ambitious but not impossible scenarios.

Q: How do recent insider sales affect the investment thesis?

A: Recent insider selling ($213.1M in Q2 2025) appears to be profit-taking after strong gains rather than lack of confidence. The 12-month net buying of $406.5M suggests management still believes in long-term prospects. However, the recent selling pattern warrants monitoring.

Q: Is Tesla a good hedge against inflation?

A: Tesla's pricing power and ability to pass through cost increases provide some inflation protection. However, higher interest rates that often accompany inflation pressure both Tesla's valuation multiples and customer financing costs, creating mixed effects.

Q: How important is the Cybertruck to Tesla's future?

A: The Cybertruck represents Tesla's entry into the profitable truck market and tests the company's ability to scale new platforms efficiently. Success could drive significant revenue growth; failure might signal broader execution challenges. Early 2025 deliveries will be crucial indicators.

Q: Should I wait for a crash to buy Tesla?

A: Given extreme valuation metrics, waiting for significant corrections (40-50%+) would provide better risk-adjusted entry points. Tesla has historically been volatile, and multiple compression could create attractive opportunities for patient investors.

Q: How does Tesla compare to other "magnificent seven" tech stocks?

A: Tesla trades at higher multiples than most big tech companies while generating lower margins and facing more direct competition. Unlike software companies with network effects, Tesla competes in capital-intensive manufacturing markets with lower barriers to entry.