The Algebra of Wealth: A Simple Formula for Financial Security by Scott Galloway

Welcome to the Value Sense Blog, your resource for insights on the stock market! You're reading a book review written by the valuesense.io team.

On our platform, you'll find stock research and insights across all sectors. Dive into our research products and learn more about our unique approach at valuesense.io

We offer over 360+ automated stock ideas, a free AI-powered stock screener, interactive stock charting tools, and more than 10 intrinsic value models — all designed to help investors find undervalued growth opportunities.

Book Overview

Scott Galloway’s “The Algebra of Wealth: A Simple Formula for Financial Security” stands out as a modern classic in the personal finance and investing genre. Galloway, a professor at NYU Stern School of Business, serial entrepreneur, and renowned public intellectual, brings a unique blend of academic rigor and real-world experience to the subject of wealth creation. His previous works, including “The Four” and “The Algebra of Happiness,” have established him as a trusted voice in analyzing markets, technology, and personal development. With “The Algebra of Wealth,” Galloway distills decades of research, business experience, and personal lessons into a concise, actionable guide for building lasting financial security.

First published in 2024, “The Algebra of Wealth” arrives at a time when economic uncertainty, technological disruption, and shifting social norms are reshaping the landscape of personal finance. Galloway’s book addresses these challenges head-on, offering a blend of timeless principles and contemporary insights. He emphasizes that financial success is not merely a product of intelligence or luck but is grounded in character, discipline, and the cultivation of strong relationships. By weaving together philosophical frameworks like Stoicism with practical strategies for career management, investing, and community building, Galloway creates a holistic blueprint for wealth that resonates with readers across generations.

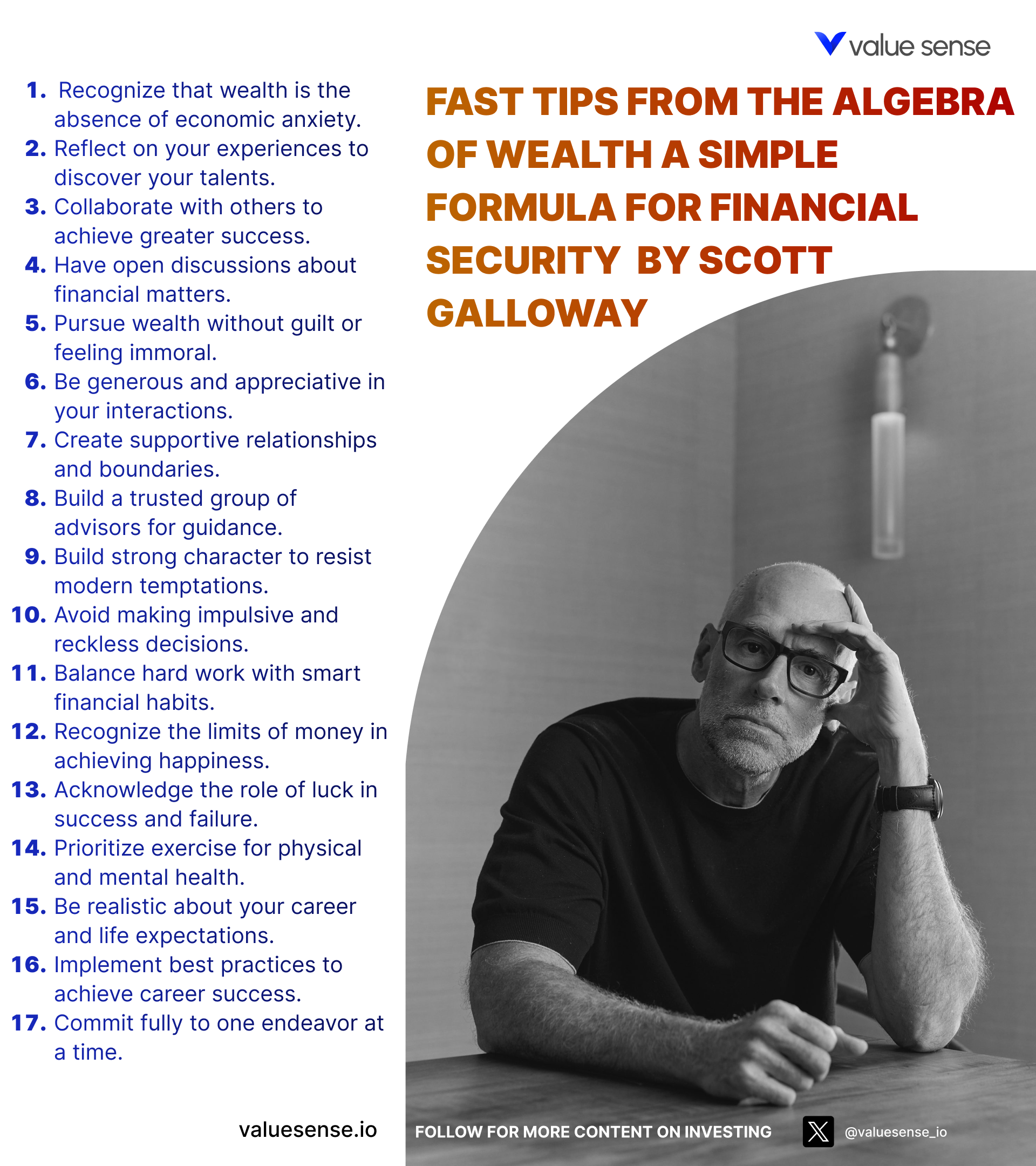

The main theme of the book is that financial security is an achievable goal for most people, provided they understand and apply a simple yet powerful formula: wealth equals character, focus, time, and diversification. Galloway argues that while market timing and stock picking may grab headlines, true wealth is built through consistent behavior, strategic career decisions, and the compounding effects of time and disciplined investing. The book’s purpose is to demystify the process of wealth creation, stripping away jargon and complexity to reveal the core drivers of financial independence.

“The Algebra of Wealth” is considered essential reading for anyone seeking to take control of their financial future. Its appeal spans from young professionals just starting out to seasoned investors looking to reinforce their foundations. Unlike many investment books that focus narrowly on technical analysis or market trends, Galloway’s approach is refreshingly broad, integrating psychological, social, and philosophical dimensions. He addresses not just how to invest, but why character, community, and a sense of purpose are critical to sustaining wealth over the long term. This makes the book especially valuable for readers who want more than just financial tips—they want a framework for a well-lived, prosperous life.

What sets “The Algebra of Wealth” apart is its synthesis of wisdom from multiple disciplines, its actionable advice, and its candid, sometimes provocative, tone. Galloway’s willingness to challenge conventional wisdom—while grounding his arguments in data and lived experience—makes this book a standout in a crowded field. Readers will find not only practical strategies for saving, investing, and career advancement but also a call to cultivate virtues like resilience, generosity, and focus. For anyone serious about achieving financial security in the modern world, this book offers both a roadmap and the inspiration to stay the course.

Key Themes and Concepts

Throughout “The Algebra of Wealth,” Scott Galloway weaves together a series of interconnected themes that form the backbone of his financial philosophy. Rather than offering a one-size-fits-all formula, Galloway presents a nuanced framework that emphasizes character, discipline, and community as much as technical investing skills. The book’s structure reflects this holistic approach, with each section building upon the last to create a comprehensive guide to wealth creation.

Galloway’s key themes are both timeless and uniquely suited to the challenges of today’s world. He draws on lessons from philosophy, behavioral economics, and his own career to show that financial security is not just about numbers—it’s about mindset, relationships, and the intelligent use of time. These themes recur throughout the book, providing readers with a set of guiding principles that can be adapted to any stage of life or market environment.

- Character and Behavior: One of the book’s central arguments is that lasting wealth is built on a foundation of strong character and disciplined behavior. Galloway draws heavily on Stoic philosophy, advocating for virtues such as resilience, self-control, and integrity. He argues that while intelligence and luck play roles in financial success, it is consistent, principled behavior—like living below your means, honoring commitments, and resisting impulsive decisions—that ultimately determines outcomes. For example, Galloway shares stories of individuals who achieved financial security not through windfalls, but through decades of steady saving and prudent choices. For investors, this theme underscores the importance of developing habits and systems that encourage good financial behavior, such as automatic saving and regular portfolio reviews.

- Focus and Career: Galloway emphasizes that focus is a critical driver of both career and financial success. He encourages readers to identify their strengths, avoid distractions, and commit deeply to their chosen paths. The book provides strategies for maximizing productivity, such as batching tasks, setting clear boundaries, and saying “no” to low-value opportunities. Galloway also discusses the importance of choosing the right career—one that offers both personal fulfillment and strong earning potential. He cites research showing that career decisions have a far greater impact on lifetime wealth than investment returns alone. For modern investors, this theme highlights the value of investing in one’s own skills and career trajectory as a form of “human capital.”

- Time and Compounding: The power of time and compounding is a recurring motif throughout the book. Galloway demonstrates, with data and anecdotes, how starting early and allowing investments to grow can create exponential wealth over decades. He explains the mathematical realities of compounding, illustrating how even modest, consistent contributions can lead to significant outcomes. The book encourages readers to set clear financial goals, automate savings, and resist the temptation to chase short-term gains. Galloway’s message is clear: time is the most valuable asset, and those who harness it intelligently will reap the greatest rewards. This theme is especially relevant for young investors, but its lessons apply universally.

- Investment and Diversification: Galloway provides a clear, accessible overview of core investment principles, with a strong emphasis on diversification and risk management. He explains why spreading investments across asset classes—such as stocks, bonds, real estate, and alternatives—reduces risk and increases the likelihood of steady returns. The book also covers the importance of understanding fees, taxes, and the behavioral traps that often lead investors astray. Galloway cautions against overconfidence and market timing, advocating instead for a disciplined, long-term approach. For readers navigating today’s volatile markets, this theme offers practical guidance on constructing resilient portfolios that can weather uncertainty.

- Community and Relationships: Unlike many finance books that focus solely on individual achievement, “The Algebra of Wealth” highlights the essential role of community and relationships in building and sustaining wealth. Galloway argues that strong personal and professional networks provide emotional support, access to opportunities, and a sense of purpose. He shares examples of how mentorship, collaboration, and generosity can accelerate both career and financial growth. The book encourages readers to cultivate relationships intentionally, invest in their communities, and recognize that wealth is most meaningful when it is shared. For investors, this theme suggests that social capital is as important as financial capital.

- Philosophical Frameworks for Wealth: Galloway integrates Stoic and other philosophical traditions to provide a deeper context for financial decision-making. He discusses how adopting a stoic mindset—focusing on what can be controlled, accepting uncertainty, and prioritizing virtue—can help investors navigate market volatility and life’s inevitable setbacks. By grounding financial advice in broader philosophical principles, the book offers readers tools for maintaining perspective and emotional balance, especially during turbulent times.

- Practical Financial Literacy: Finally, the book is a masterclass in practical financial literacy. Galloway demystifies concepts like asset allocation, tax efficiency, and risk-adjusted returns, breaking them down into actionable steps. He provides checklists, rules of thumb, and real-world examples that make complex topics accessible to readers of all backgrounds. This theme ensures that readers are not only inspired but also equipped with the knowledge needed to implement the book’s advice in their own lives.

Book Structure: Major Sections

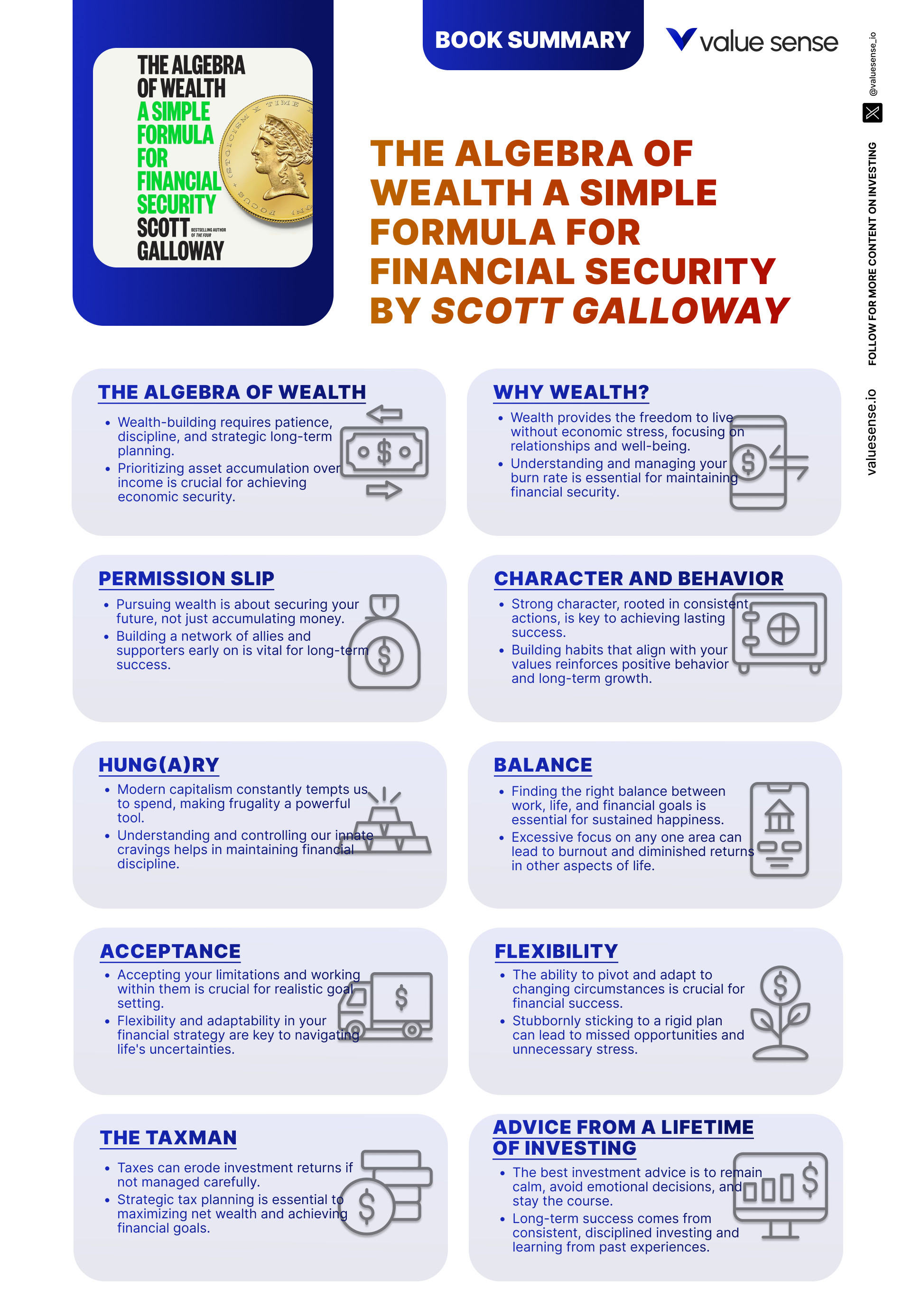

Part 1: Foundations of Wealth

This opening section, covering Chapter 1, sets the philosophical and behavioral groundwork for the entire book. Galloway introduces the core principles that underpin wealth creation, emphasizing that financial success is as much about who you are as it is about what you do. The unifying theme here is the interplay between character, behavior, and the support structures provided by community and relationships.

The chapters in this section delve into the importance of cultivating virtues such as discipline, resilience, and integrity. Galloway draws on Stoic philosophy, highlighting how ancient wisdom can inform modern financial decisions. He argues that wealth is not just the result of market savvy but is built through consistent actions—saving regularly, living below your means, and honoring commitments. The section also explores the role of community, showing how strong relationships provide both emotional and practical support on the journey to financial security.

For investors, the lessons here are foundational: before focusing on advanced investment strategies, one must first develop the habits and mindset that enable long-term success. This means setting clear goals, creating systems for accountability, and surrounding oneself with supportive people. Galloway offers concrete exercises for assessing personal values and building a network of mentors and peers.

In today’s world, where financial advice is often reduced to hot stock tips or market forecasts, this section’s emphasis on character and community is both refreshing and essential. It reminds readers that the roots of wealth are deeply personal and social, not merely technical. The enduring relevance of these principles is seen in the lives of successful investors who attribute their achievements to discipline and strong networks rather than luck or genius.

Part 2: Career and Focus

The second section, corresponding to Chapter 2, explores the critical role of focus and career management in wealth accumulation. Galloway argues that one’s career is the primary engine of wealth for most people and that strategic choices in this domain have outsized effects on financial outcomes. The unifying theme here is the power of intentionality—choosing where to direct your energy and attention for maximum impact.

Key concepts from this section include the importance of identifying and leveraging personal strengths, setting boundaries to avoid burnout, and making deliberate career moves that align with both financial and personal goals. Galloway provides frameworks for evaluating job opportunities, negotiating compensation, and developing skills that command a premium in the marketplace. He also discusses the dangers of distraction and the value of saying “no” to low-return activities.

For investors, the actionable takeaway is that investing in oneself—through education, skill development, and strategic career moves—often yields higher returns than any stock or bond. Galloway encourages readers to view their career as a portfolio, regularly reviewing and rebalancing it to ensure alignment with long-term objectives. He also offers advice on building professional networks and seeking out mentors who can accelerate growth.

In the modern economy, where job security is less certain and the pace of change is accelerating, this section’s insights are especially relevant. Galloway’s emphasis on adaptability, continuous learning, and focus provides a roadmap for thriving in a competitive landscape. His advice resonates with both early-career professionals and those contemplating mid-career pivots.

Part 3: Time and Compounding

The third section, mapped to Chapter 3, centers on the transformative power of time and compounding in wealth creation. Galloway illustrates how starting early, maintaining discipline, and allowing investments to grow can lead to exponential financial outcomes. The unifying theme is the harnessing of time as an ally rather than an adversary.

This section breaks down the mathematics of compounding, showing how even modest, regular contributions can snowball into substantial wealth over decades. Galloway provides vivid examples and simple models to demonstrate the difference between starting to invest at age 25 versus 35. He also discusses the psychological barriers that prevent people from taking action, such as fear of loss or the illusion of having “plenty of time.” The importance of setting clear, measurable financial goals is emphasized throughout.

Investors are encouraged to automate savings, invest in low-cost index funds, and avoid the pitfalls of market timing. Galloway provides checklists and tools for tracking progress, reinforcing the idea that small, consistent actions compound into significant results. He also highlights the dangers of procrastination and the value of starting “imperfectly” rather than waiting for the perfect moment.

In an era of instant gratification and short-term thinking, this section’s focus on patience and consistency is a powerful counterpoint. The enduring relevance of compounding is evident in the stories of investors who have achieved financial independence through decades of steady investing. Galloway’s message is clear: time is the most valuable asset, and those who respect it will be rewarded.

Part 4: Investment and Diversification

The final section, corresponding to Chapter 4, delves into the nuts and bolts of investing, with a strong emphasis on diversification and risk management. Galloway synthesizes decades of investment research to provide a clear, actionable framework for building resilient portfolios. The unifying theme is the intelligent management of risk through diversification and informed decision-making.

Key concepts include the importance of spreading investments across asset classes—stocks, bonds, real estate, and alternatives—to reduce volatility and increase the likelihood of steady returns. Galloway explains the basics of asset allocation, the impact of fees and taxes, and the behavioral biases that often derail investors. He uses real-world data to illustrate how diversified portfolios perform across different market environments and offers guidance on rebalancing and tax efficiency.

For investors, this section provides a practical roadmap for portfolio construction. Galloway emphasizes the value of simplicity—favoring low-cost, diversified funds over complex or speculative products. He also discusses the importance of regular portfolio reviews and the discipline to stick with a plan in the face of market turbulence. Actionable checklists and allocation models help readers tailor strategies to their own risk tolerance and goals.

In today’s volatile markets, where headlines often drive emotional decision-making, this section’s focus on diversification and discipline is more relevant than ever. Galloway’s advice aligns with the best practices of leading investment professionals and provides a timeless foundation for both novice and experienced investors.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Deep Dive: Essential Chapters

Chapter 1: Stoicism

This opening chapter is critically important because it establishes the philosophical and behavioral foundation for the entire book. Galloway argues that building wealth is not just a technical exercise but a deeply personal journey shaped by character, discipline, and community. He introduces Stoicism as a guiding philosophy, suggesting that virtues like resilience, self-control, and integrity are essential prerequisites for financial success. This chapter challenges readers to examine their own behaviors and beliefs, setting the stage for the practical advice that follows.

Galloway draws on both historical and contemporary examples to illustrate the power of Stoic principles. He recounts stories of individuals who weathered financial storms by adhering to disciplined routines and maintaining perspective during market downturns. The chapter is rich with quotes from Stoic philosophers such as Marcus Aurelius and Seneca, as well as modern parallels from accomplished investors. Galloway also shares personal anecdotes about how his own adherence to Stoic practices—like journaling, reflection, and gratitude—has contributed to his financial and emotional resilience.

Investors can apply the lessons from this chapter by developing routines that reinforce disciplined behavior. This might include setting clear financial goals, automating savings, and conducting regular self-assessments to ensure alignment with one’s values. Galloway recommends creating a “decision journal” to track emotional responses to market events, helping investors recognize and counteract impulsive tendencies. He also encourages readers to seek out communities—whether in person or online—that support healthy financial habits.

Historically, the principles outlined in this chapter have guided some of the world’s most successful investors. Figures like Warren Buffett and Charlie Munger have cited Stoic virtues as foundational to their approach. In the modern context, where market volatility and social pressures can lead to emotional decision-making, the chapter’s emphasis on self-mastery and community support is more relevant than ever. Galloway’s integration of Stoicism into financial planning offers a timeless blueprint for navigating uncertainty with confidence and grace.

Chapter 2: Focus

Focus is presented in this chapter as a non-negotiable ingredient for both career advancement and financial achievement. Galloway contends that in a world filled with distractions and competing demands, the ability to concentrate deeply on high-impact activities is what separates the successful from the mediocre. This chapter is essential because it bridges the philosophical foundation of the previous chapter with the practical realities of career and wealth-building.

Galloway offers a wealth of strategies for cultivating focus, including time-blocking, setting clear boundaries, and prioritizing tasks that align with long-term objectives. He shares data on productivity, noting that the average worker is interrupted every three minutes and that multitasking can reduce efficiency by up to 40%. The chapter includes case studies of high achievers who credit their success to ruthless prioritization and the willingness to say “no” to distractions. Galloway also discusses the psychological toll of constant connectivity and provides tips for digital detoxing and mindfulness.

To apply these lessons, investors and professionals should audit their daily routines, identify sources of distraction, and implement systems for deep work. Galloway recommends scheduling time for uninterrupted focus, setting aside devices during critical tasks, and regularly reviewing one’s calendar to ensure alignment with strategic goals. He also encourages readers to seek feedback from mentors and peers to identify blind spots and areas for improvement.

In today’s fast-paced, always-on environment, the ability to focus is a superpower. The chapter’s lessons are supported by research from productivity experts and real-world examples from leaders in business and investing. Galloway’s practical advice is particularly relevant for those navigating remote work, gig economy jobs, or entrepreneurial ventures, where self-discipline and focus are paramount. By mastering focus, readers can unlock greater career satisfaction and accelerate their path to financial security.

Chapter 3: Time

This chapter is crucial because it demystifies the concept of compounding and underscores the irreplaceable value of time in the wealth-building process. Galloway explains that while many investors obsess over returns, the most significant driver of wealth is the duration of time that money is allowed to grow. The chapter provides a mathematical and psychological exploration of why starting early is the single most important financial decision one can make.

Galloway uses compelling charts and examples to illustrate the exponential effects of compounding. He compares scenarios where two investors contribute the same amount but start at different ages, demonstrating how the early starter ends up with dramatically more wealth. The chapter includes quotes from Albert Einstein, who famously called compound interest the “eighth wonder of the world.” Galloway also addresses common barriers to early investing, such as student debt and fear of market volatility, offering practical solutions for overcoming them.

Investors are encouraged to automate their savings and investments, take advantage of employer-sponsored retirement plans, and avoid the temptation to time the market. Galloway provides action steps for setting up automatic transfers, choosing low-fee index funds, and tracking progress against specific goals. He also emphasizes the importance of patience, urging readers to resist the urge to tinker with their portfolios in response to short-term market movements.

The historical context for this chapter is clear: the most successful investors, from John Bogle to Jack Welch, have built fortunes by harnessing the power of compounding over decades. In today’s environment, where instant gratification is the norm, Galloway’s message about the value of time is both countercultural and essential. The chapter’s lessons are supported by decades of financial research and are as relevant for Gen Z as they are for retirees.

Chapter 4: Diversification

This chapter is a linchpin of the book because it provides the technical foundation for risk management and portfolio construction. Galloway articulates the importance of diversification—not just as a buzzword, but as a mathematically proven strategy for reducing risk and increasing the likelihood of steady returns. He explains that even the most skilled investors cannot predict individual asset performance, making diversification the “only free lunch” in investing.

The chapter is rich with data and real-world examples. Galloway presents historical returns for various asset classes, showing how diversified portfolios have outperformed concentrated bets over time. He explains the mechanics of asset allocation, the role of rebalancing, and the impact of fees and taxes on long-term returns. The chapter includes quotes from Nobel laureates like Harry Markowitz and practical case studies of investors who weathered market downturns thanks to diversified holdings.

Investors are advised to construct portfolios that include a mix of stocks, bonds, real estate, and alternative assets, tailored to their risk tolerance and time horizon. Galloway provides model portfolios for different stages of life and explains how to adjust allocations as circumstances change. He also offers tips for minimizing taxes and avoiding common behavioral pitfalls, such as chasing hot sectors or panic selling during downturns.

In the context of recent market volatility and the proliferation of new investment products, this chapter’s emphasis on diversification is more relevant than ever. Galloway’s advice is consistent with the best practices of leading financial planners and institutional investors. The chapter provides a timeless roadmap for building resilient portfolios that can withstand both bull and bear markets.

Practical Investment Strategies

- Automate Savings and Investments: Set up automatic transfers from your paycheck or checking account into investment accounts each month. Automating contributions removes the temptation to spend before saving and ensures consistent progress toward financial goals. Use direct deposit to fund retirement accounts, such as 401(k)s or IRAs, and schedule regular purchases of low-cost index funds. Review your automation settings annually to adjust for salary increases or changes in expenses. This “pay yourself first” approach is one of the most reliable ways to harness the power of compounding and build wealth over time.

- Focus on Low-Cost Index Funds: Prioritize investing in broad-market, low-fee index funds or ETFs rather than attempting to pick individual stocks or time the market. Research consistently shows that the majority of active managers fail to outperform passive benchmarks over long periods. By keeping fees low—ideally under 0.20%—and maintaining broad diversification, you increase your odds of matching market returns. Use tools like the Value Sense screener to compare fund options, track expense ratios, and monitor performance against relevant benchmarks.

- Strategic Asset Allocation and Rebalancing: Develop a target allocation across asset classes (e.g., 60% stocks, 30% bonds, 10% alternatives) based on your risk tolerance, financial goals, and investment horizon. Rebalance your portfolio at least annually to maintain your desired allocation, selling outperforming assets and buying underperformers. This systematic approach helps control risk and capitalizes on market fluctuations without emotional decision-making. Use software or spreadsheets to automate rebalancing alerts and track historical allocation shifts.

- Maximize Tax Efficiency: Structure your investments to minimize taxes and maximize after-tax returns. Prioritize tax-advantaged accounts (401(k), IRA, Roth IRA, HSA) for long-term holdings, and use taxable accounts for investments that generate qualified dividends or capital gains. Harvest tax losses in down years to offset gains, and consider asset location strategies—placing income-generating assets in tax-sheltered accounts. Consult with a tax advisor annually to optimize your strategy and stay current with evolving tax laws.

- Invest in Human Capital: Allocate time and resources to building skills, earning credentials, and expanding your professional network. Career advancement and salary growth often have a greater impact on lifetime wealth than incremental investment returns. Attend industry conferences, pursue relevant certifications, and seek out mentors who can provide guidance and open doors. Track your career progress alongside your financial portfolio to ensure both are aligned with your long-term objectives.

- Build and Leverage Community: Cultivate relationships with peers, mentors, and professional networks that support your financial and personal growth. Join investment clubs, participate in online forums, and attend local meetups to exchange ideas and stay accountable. Strong communities provide emotional support during market downturns, help identify new opportunities, and foster a sense of shared purpose. Make generosity and collaboration core values in your approach to wealth-building.

- Set Clear, Measurable Goals: Define specific financial targets—such as saving for a home, funding education, or reaching a retirement number—and break them into actionable milestones. Use SMART (Specific, Measurable, Achievable, Relevant, Time-bound) criteria to track progress and adjust as needed. Regularly review your goals and celebrate achievements to maintain motivation and discipline. Integrate goal tracking into your monthly or quarterly financial reviews for greater accountability.

- Practice Emotional Discipline and Mindfulness: Recognize the psychological traps that can derail investment success, such as fear, greed, and herd mentality. Develop routines for self-reflection, such as journaling or meditation, to maintain perspective during periods of volatility. Use decision journals to record your thought process during major financial decisions, and review them periodically to identify patterns and biases. Seek feedback from trusted advisors to stay grounded and avoid costly mistakes.

Modern Applications and Relevance

Scott Galloway’s “The Algebra of Wealth” is uniquely positioned to address the challenges and opportunities facing today’s investors. In an era marked by technological disruption, economic volatility, and shifting social norms, the book’s principles provide a steady compass. Galloway’s emphasis on character, focus, and community is particularly relevant in a world where traditional career paths are evolving and financial markets are more accessible—but also more complex—than ever before.

Since the book’s publication, several trends have reinforced its core messages. The rise of remote work and the gig economy has made career management and adaptability more important than ever. Galloway’s advice to invest in human capital and cultivate professional networks is echoed by data showing that those who continuously learn and pivot are best positioned for long-term success. Similarly, the proliferation of low-cost investment platforms and robo-advisors has democratized access to markets, making the book’s guidance on diversification and low-fee investing both timely and actionable.

What remains timeless in Galloway’s framework is the focus on behavior and discipline. Despite advances in technology and financial products, the most significant determinants of wealth are still personal habits and the intelligent use of time. The book’s advocacy for starting early, automating savings, and resisting emotional decision-making is supported by decades of academic research and the lived experiences of successful investors. These principles have proven resilient across bull and bear markets, inflationary and deflationary periods, and technological revolutions.

Modern examples abound of the book’s principles in action. The FIRE (Financial Independence, Retire Early) movement, for instance, is built on the pillars of disciplined saving, aggressive investing, and intentional living—all themes championed by Galloway. The recent surge in retail investing, fueled by platforms like Robinhood, underscores the importance of financial literacy and risk management. Those who follow Galloway’s advice on diversification and emotional discipline are better equipped to navigate market swings and avoid costly mistakes.

To adapt the book’s classic advice to current conditions, investors should leverage technology to automate and monitor their finances, seek out diverse communities for support and accountability, and remain vigilant against new forms of distraction and misinformation. By combining the timeless wisdom of “The Algebra of Wealth” with modern tools and resources, today’s readers can build resilient, purpose-driven financial lives in an unpredictable world.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Implementation Guide

- Assess Your Current Financial and Behavioral Baseline: Begin by conducting a thorough audit of your finances, habits, and support networks. List all assets, liabilities, income, and expenses. Reflect on your daily routines, decision-making processes, and the communities you engage with. Use this assessment to identify strengths and areas for improvement, setting the stage for targeted action. This foundational step provides clarity and motivation for the journey ahead.

- Set Clear, Actionable Goals and Build Systems: Define your financial objectives—such as saving for retirement, buying a home, or funding education—using the SMART framework. Break each goal into measurable milestones with specific timelines (e.g., “Save $10,000 for a down payment in 24 months”). Establish automated systems for saving and investing, and create recurring calendar reminders for progress reviews. This approach ensures consistent action and reduces reliance on willpower.

- Construct a Diversified Portfolio Aligned with Your Risk Profile: Based on your age, time horizon, and risk tolerance, develop a target asset allocation (e.g., 70% stocks, 20% bonds, 10% alternatives). Use low-cost index funds or ETFs to implement your strategy, and allocate assets across tax-advantaged and taxable accounts as appropriate. Document your investment policy statement to guide future decisions and minimize emotional reactions to market volatility.

- Implement Regular Review and Rebalancing Processes: Schedule quarterly or annual portfolio reviews to assess performance, rebalance to your target allocation, and adjust for changes in life circumstances. Use automated tools or spreadsheets to track allocation drift and trigger rebalancing when thresholds are exceeded (e.g., 5% deviation from target). During reviews, revisit your goals, update your financial plan, and reflect on recent decisions to reinforce discipline and learning.

- Invest in Continuous Improvement and Lifelong Learning: Commit to ongoing education in both personal finance and professional development. Subscribe to reputable investment publications, attend webinars, and participate in relevant courses. Seek feedback from mentors, join accountability groups, and stay engaged with evolving best practices. Regularly audit your habits and systems, making incremental adjustments to improve efficiency and outcomes. Leverage the resources at valuesense.io for tools, screeners, and up-to-date research to support your journey.

--- ---

10+ Free intrinsic value tools

For investors looking to find a stock's fair value, our analytics team has you covered with intrinsic value tools:

📍 Free Intrinsic Value Calculator

📍 Reverse DCF & DCF value tools

📍 Peter Lynch Fair Value Calculator

📍 Ben Graham Fair Value Calculator

📍 Relative Value tool

...and plenty more.

🔍 Explore all these tools for free on the Value Sense platform and start discovering what your favorite stocks are really worth.

FAQ: Common Questions About The Algebra of Wealth: A Simple Formula for Financial Security

1. What is the core message of “The Algebra of Wealth”?

The core message is that financial security is achievable for most people by focusing on character, disciplined behavior, strategic career choices, and the intelligent use of time and diversification. Scott Galloway argues that wealth is not just about technical investing skills but is built on a foundation of personal virtues, community support, and consistent action. The book provides a holistic framework that integrates philosophical, behavioral, and practical financial advice.

2. How does Scott Galloway’s approach differ from other investment books?

Galloway’s approach is unique because it combines timeless philosophical wisdom—especially Stoicism—with actionable financial strategies and a strong emphasis on character and community. Unlike books that focus solely on stock picking or technical analysis, “The Algebra of Wealth” addresses the psychological and social dimensions of wealth. Galloway’s candid, data-driven writing style and integration of personal stories make the book both accessible and deeply insightful.

3. What practical steps does the book recommend for new investors?

The book recommends starting early, automating savings and investments, focusing on low-cost index funds, and constructing diversified portfolios tailored to individual risk profiles. Galloway also advises investing in one’s own education and career, building strong support networks, and practicing emotional discipline. The emphasis is on creating systems and habits that drive consistent, positive financial behavior over time.

4. Is “The Algebra of Wealth” relevant for experienced investors?

Yes, the book is highly relevant for experienced investors as well. Its focus on behavioral finance, risk management, and long-term strategy provides valuable reminders and new perspectives, even for those with substantial market experience. Galloway’s integration of philosophical principles and modern investing best practices offers fresh insights for refining existing strategies and navigating changing market conditions.

5. Can the book’s principles be applied in today’s volatile markets?

Absolutely. Galloway’s principles are designed to be resilient across different market environments. The emphasis on diversification, emotional discipline, and long-term planning is particularly effective in volatile markets. By focusing on what can be controlled—such as saving rates, asset allocation, and personal development—investors can build financial security regardless of short-term market fluctuations.