The Ascent of Money by Niall Ferguson

Welcome to the Value Sense Blog, your resource for insights on the stock market! You're reading a book review written by the valuesense.io team.

On our platform, you'll find stock research and insights across all sectors. Dive into our research products and learn more about our unique approach at valuesense.io

We offer over 360+ automated stock ideas, a free AI-powered stock screener, interactive stock charting tools, and more than 10 intrinsic value models — all designed to help investors find undervalued growth opportunities.

Book Overview

"The Ascent of Money: A Financial History of the World" by Niall Ferguson stands as one of the most comprehensive and accessible explorations of finance’s pivotal role in shaping civilization. Ferguson, a renowned British historian and professor at Harvard, is celebrated for his ability to weave economic, political, and social history into compelling narratives. His expertise spans several acclaimed works, but "The Ascent of Money" is particularly significant for its ambitious attempt to chronicle the evolution of money, credit, banking, and markets from ancient Mesopotamia to the twenty-first century.

First published in 2008—on the eve of the global financial crisis—the book arrived at a moment when the world was forced to reckon with the profound impact of finance on everyday life. Ferguson’s timing was impeccable; his analysis of historical booms, busts, and the mechanisms underlying financial innovation provided readers with a critical lens through which to view the unfolding crisis. The book’s historical sweep, paired with its contemporary relevance, cemented its place as a modern classic in both financial literature and popular history.

The central theme of "The Ascent of Money" is the inextricable link between financial innovation and human progress. Ferguson argues that the story of money is the story of civilization itself, with each leap in financial technology—coins, bonds, insurance, stock markets, and derivatives—enabling new forms of economic and social organization. The book’s purpose is not just to recount events but to demonstrate how finance underpins everything from nation-building to war, from real estate booms to the rise of global superpowers.

This book is essential reading for anyone seeking a deeper understanding of how financial systems function, why they periodically fail, and how they continue to evolve. Investors, policymakers, students of economics, and history buffs alike will find value in Ferguson’s engaging style and rigorous analysis. Unlike technical investment guides, "The Ascent of Money" offers a panoramic view, making complex concepts accessible without sacrificing nuance. Its blend of storytelling, data, and historical case studies makes it a unique bridge between academic finance and the general reader.

What sets "The Ascent of Money" apart is its thematic approach—connecting ancient innovations to modern crises, and showing the continuity and change in financial behavior across centuries. Ferguson’s use of vivid anecdotes, from the Medici bankers of Renaissance Florence to the mortgage meltdown of 2008, brings history to life and provides actionable lessons for today’s investors. The book’s enduring value lies in its demonstration that understanding financial history is not just an academic exercise, but a vital tool for navigating the risks and opportunities of the modern world.

Key Themes and Concepts

"The Ascent of Money" is structured around several interwoven themes that recur throughout the book, each illustrating how finance both shapes and is shaped by the broader currents of history. Ferguson’s narrative moves from the birth of money in ancient civilizations to the intricacies of modern global finance, consistently returning to the central idea that financial innovation is both a catalyst for progress and a source of instability. The book challenges readers to see financial history not as a series of isolated events, but as a dynamic process that continues to influence every aspect of our lives.

These themes are not only historical in nature but offer practical insights for today’s investors. Ferguson’s analysis of bubbles, risk, and globalization, for example, provides a framework for understanding current financial phenomena in light of centuries-old patterns. The book’s thematic approach encourages readers to draw connections between past and present, and to apply historical lessons to modern investment decisions.

- The Evolution of Money: Ferguson traces the journey of money from primitive barter systems to the complex financial instruments of today. This theme is developed through detailed accounts of ancient Sumerian clay tablets, the invention of coins in Lydia, and the rise of paper money in China. The narrative highlights how each innovation—whether coins, bills of exchange, or electronic money—transformed economies by making trade more efficient and enabling the accumulation and transfer of wealth. For investors, understanding this evolution is crucial for appreciating the foundations of modern financial systems and the ongoing shift toward digital currencies and fintech.

- Financial Crises and Bubbles: A recurring motif is the inevitability of financial bubbles and the devastating impact of crashes. Ferguson examines classic bubbles such as the Dutch Tulip Mania, the South Sea Bubble, and more recent events like the subprime mortgage crisis. He dissects the psychological drivers of speculative manias—herd behavior, overconfidence, and the illusion of safety—while emphasizing the cyclical nature of booms and busts. This theme serves as a cautionary tale for investors, underscoring the importance of skepticism, risk assessment, and historical perspective when evaluating market exuberance.

- The Role of Risk in Finance: The book delves into the concept of risk, exploring how societies have developed tools to measure, manage, and transfer it. Ferguson discusses the birth of insurance in Renaissance Italy, the emergence of actuarial science, and the proliferation of derivatives. He demonstrates that the management of risk is both an art and a science, central to the functioning of financial markets. Investors are reminded that risk cannot be eliminated—only understood and mitigated—and that the failure to respect risk has led to some of history’s greatest financial disasters.

- Real Estate as a Financial Asset: Ferguson explores the unique role of real estate in wealth accumulation and economic stability. From feudal landholdings to the modern mortgage market, he shows how property has been both a source of security and a driver of instability. The discussion of housing bubbles, particularly the US subprime crisis, illustrates the dangers of excessive leverage and the systemic risks embedded in real estate finance. This theme is especially relevant for investors considering property as part of a diversified portfolio, highlighting the need for careful valuation and risk management.

- Globalization and Financial Interdependence: The final sections of the book examine the rise of global financial markets and the increasing interdependence of national economies. Ferguson analyzes the symbiotic relationship between China and the United States—dubbed "Chimerica"—and the challenges posed by global capital flows. He argues that globalization has amplified both opportunities and risks, making financial crises more contagious. For investors, this theme underscores the importance of understanding geopolitical dynamics, currency risk, and the impact of global events on local markets.

- The Power of Financial Innovation: Throughout the book, Ferguson emphasizes how financial innovation—whether in the form of bonds, joint-stock companies, or derivatives—has driven economic growth and shaped the course of history. However, he also warns that innovation can outpace regulation and understanding, leading to unintended consequences. Investors are encouraged to balance enthusiasm for new financial products with caution and due diligence.

- Finance as a Driver of Social Change: Ferguson illustrates how access to credit, the democratization of investment, and the spread of financial literacy have transformed societies. He links financial development to the rise of the middle class, the empowerment of individuals, and the reduction of poverty. Yet, he also acknowledges the dark side—how financial exclusion and predatory lending can exacerbate inequality. This theme invites investors to consider the ethical dimensions of finance and the broader societal impact of their decisions.

Book Structure: Major Sections

Part 1: The Origins and Evolution of Money

This section, encompassing the first two chapters, delves into the historical roots of money and the emergence of financial systems. Ferguson begins by exploring how early civilizations transitioned from barter economies to the use of various forms of money, such as shells, coins, and paper currency. He traces the development of financial instruments from the ancient Sumerians, who recorded debts on clay tablets, to the rise of banking in Renaissance Italy. The unifying theme is the relentless human drive to create more efficient ways to store, exchange, and measure value.

Key concepts in these chapters include the dual role of money as both a medium of exchange and a store of value. Ferguson provides vivid examples, such as the Lydian invention of coinage and the Medici family’s pioneering banking practices. He discusses how the spread of money facilitated trade, enabled taxation, and laid the groundwork for complex economies. The transition from tangible forms of money to intangible credit systems is highlighted as a pivotal moment in financial history, with far-reaching implications for economic growth and social organization.

For investors, this section reinforces the importance of understanding the foundations of money and credit. Recognizing the historical evolution of financial instruments can inform better decision-making, whether evaluating the risks of new fintech innovations or appreciating the enduring value of established assets. The lessons here encourage a healthy skepticism toward both untested financial products and the assumption that current systems are immutable.

In today’s context, the rise of cryptocurrencies and digital payment systems echoes many of the historical transitions Ferguson describes. The ongoing debates about the future of money, central bank digital currencies, and the decline of cash all find precedent in the book’s discussion of past monetary revolutions. By grounding modern developments in historical perspective, investors gain a more nuanced view of both opportunities and risks in the evolving landscape of money.

Part 2: Financial Bubbles and Crises

This section covers chapters three and four, focusing on the recurring phenomenon of financial bubbles and the crises that inevitably follow. Ferguson examines the anatomy of bubbles, from the irrational exuberance of Dutch Tulip Mania to the catastrophic collapse of the South Sea Bubble and the more recent subprime mortgage crisis. He dissects the psychological and structural factors that fuel speculative manias, including herd behavior, easy credit, and regulatory failures.

The key concepts explored here are the cyclical nature of financial markets and the persistent role of risk. Ferguson uses historical case studies to illustrate how bubbles form, expand, and burst, often with devastating consequences for economies and individuals. He highlights the importance of risk management, the dangers of leverage, and the limitations of financial models that underestimate the potential for extreme events. The narrative is enriched with data, anecdotes, and quotes from contemporary observers of each crisis.

Practical application for investors lies in cultivating a disciplined approach to risk assessment and portfolio management. Recognizing the warning signs of bubbles—such as rapid price appreciation, widespread speculation, and the proliferation of complex financial products—can help investors avoid catastrophic losses. Ferguson’s analysis underscores the value of diversification, skepticism, and historical awareness in navigating volatile markets.

In the modern era, the lessons of past bubbles are more relevant than ever. The dot-com crash, the global financial crisis of 2008, and the recent surge in speculative assets all reflect patterns identified by Ferguson. The increasing speed and interconnectedness of financial markets amplify both the opportunities and dangers of speculation, making historical perspective an indispensable tool for today’s investors.

Part 3: Real Estate and Economic Power

Chapter five stands as a thematic section on its own, examining the centrality of real estate in economic history and financial power structures. Ferguson explores how land ownership has historically been a primary source of wealth, security, and influence. He traces the evolution of real estate from feudal estates to the rise of the mortgage market, highlighting the role of property as both a tangible asset and a vehicle for speculation.

The chapter delves into the dynamics of housing markets, the development of mortgages, and the systemic risks associated with real estate finance. Ferguson provides data on the growth of homeownership, the proliferation of mortgage-backed securities, and the consequences of housing bubbles. He discusses the impact of government policies, urbanization, and demographic shifts on property markets, illustrating how real estate cycles can drive broader economic booms and busts.

For investors, the practical takeaway is the need for rigorous analysis of property markets, careful consideration of leverage, and an appreciation for the illiquidity and cyclicality of real estate assets. Ferguson’s insights encourage diversification across asset classes and caution against overexposure to property, particularly in overheated markets. The historical perspective also highlights the importance of policy and regulatory environments in shaping real estate outcomes.

In today’s world, real estate remains a critical component of wealth and financial stability. The global housing boom, rising concerns about affordability, and the impact of low interest rates on property prices all echo themes explored in this section. Understanding the historical patterns of real estate cycles can help investors anticipate risks and identify opportunities in both local and global markets.

Part 4: Globalization and Financial Interdependence

The final thematic section, based on chapter six, explores the rise of global financial markets and the increasing interdependence of national economies. Ferguson examines the economic relationship between major powers, particularly the United States and China, and the emergence of what he calls "Chimerica." He discusses the flow of capital across borders, the integration of financial systems, and the challenges posed by global imbalances.

Key concepts include the benefits and risks of financial globalization, the role of international institutions, and the potential for contagion in a world of interconnected markets. Ferguson provides examples of how global capital flows have fueled growth and innovation, but also how they have contributed to volatility and crisis. He analyzes the impact of currency regimes, trade balances, and sovereign debt on global stability.

For investors, this section highlights the importance of understanding geopolitical dynamics, currency risk, and the implications of global events for portfolio construction. Ferguson’s analysis encourages a global perspective, diversification across regions, and vigilance regarding the potential for systemic shocks. The discussion of "Chimerica" serves as a case study in the complexities of economic interdependence and the potential for both cooperation and conflict.

In the modern era, the themes of globalization and interdependence are more salient than ever. The COVID-19 pandemic, trade wars, and the rise of digital finance have all underscored the interconnectedness of global markets. Ferguson’s insights provide a framework for navigating these challenges and seizing the opportunities presented by an increasingly global financial system.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Deep Dive: Essential Chapters

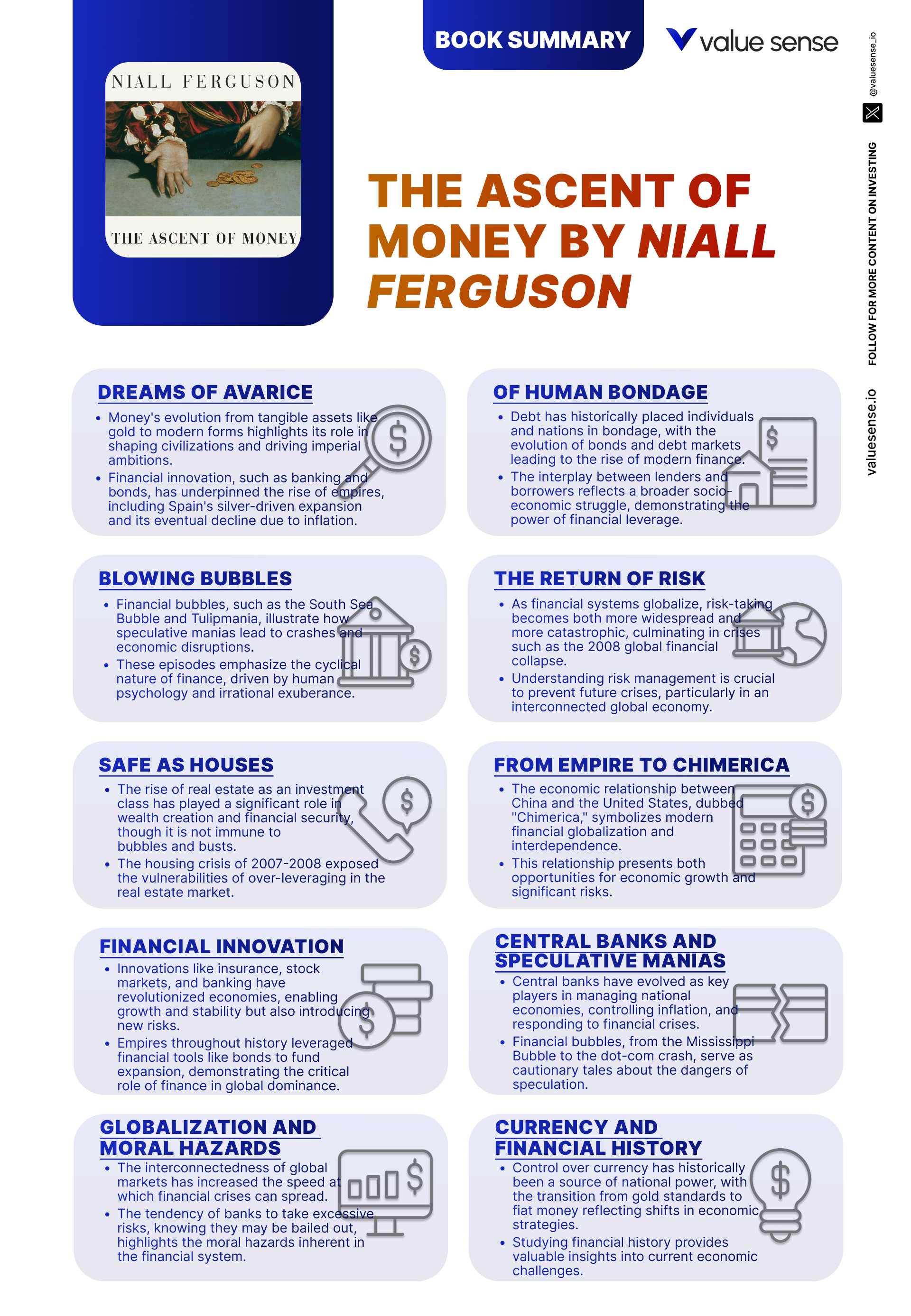

Chapter 1: Dreams of Avarice

This opening chapter is critically important because it lays the foundation for the entire book, introducing readers to the fundamental role of money in human civilization. Ferguson explores the concept of money as both a practical tool and a powerful cultural force, tracing its origins from early barter systems to the first coins and paper currencies. The chapter sets the stage for understanding how money evolved to become the backbone of trade, statecraft, and social organization. Ferguson’s narrative establishes the central thesis that financial innovation is inseparable from human progress, making this chapter essential for grasping the subsequent discussions in the book.

Ferguson uses vivid historical examples, such as the Sumerians’ use of clay tablets to record debts and the Lydians’ invention of coinage, to illustrate the transformative impact of money. He quotes Herodotus on the significance of coinage and provides data on the spread of monetary economies across ancient societies. The chapter also discusses the transition from tangible money—like gold and silver coins—to intangible forms such as bills of exchange and electronic money. Ferguson highlights the cultural implications of money, from religious prohibitions on usury to the rise of banking families like the Medicis.

Investors can apply the lessons of this chapter by recognizing the importance of trust, credibility, and innovation in financial systems. Understanding how money has evolved—and how it has been shaped by societal needs and technological advances—can inform investment decisions in emerging financial technologies such as cryptocurrencies and digital payment systems. Ferguson’s analysis encourages investors to consider the underlying structures and incentives that drive financial innovation, rather than focusing solely on surface-level trends.

Historically, the evolution of money has been marked by both progress and disruption. The shift from barter to coinage enabled the rise of empires and the expansion of trade networks, while the invention of paper money facilitated economic growth in medieval China and Renaissance Europe. In the modern era, the proliferation of digital currencies and the decline of cash echo many of the transitions described in this chapter. By grounding investment strategies in a deep understanding of monetary history, investors can better anticipate the risks and opportunities of financial innovation.

Chapter 2: Of Human Bondage

This chapter is pivotal because it delves into the development of credit and debt, which are the lifeblood of modern financial systems. Ferguson examines how societies have used credit to facilitate trade, fund governments, and spur economic growth, while also exploring the social and moral complexities of indebtedness. The chapter underscores the dual nature of debt—as both a tool for empowerment and a source of vulnerability—making it essential reading for anyone seeking to understand the mechanics of financial markets.

Ferguson provides detailed historical examples, such as the rise of banking in Renaissance Italy and the use of government bonds to finance wars. He discusses the role of financial institutions in managing debt and highlights the societal impact of widespread indebtedness, from the debt peonage of ancient Mesopotamia to the modern subprime mortgage crisis. The chapter includes quotes from contemporary observers and data on the growth of credit markets, illustrating how debt has shaped both individual lives and entire economies.

For investors, the key takeaway is the importance of credit analysis and risk management. Understanding the origins and dynamics of debt markets can help investors evaluate the creditworthiness of borrowers, assess the sustainability of leverage, and anticipate potential defaults. Ferguson’s discussion of historical debt crises serves as a reminder to scrutinize the terms and conditions of credit, as well as the broader economic context in which lending occurs.

In the modern era, the expansion of credit has enabled unprecedented economic growth but also contributed to financial instability. The global financial crisis of 2008, fueled by excessive lending and lax standards, echoes the patterns described in this chapter. By studying the history of credit and debt, investors can develop a more nuanced approach to risk assessment and avoid the pitfalls of overleveraging in both personal and institutional finance.

Chapter 3: Blowing Bubbles

This chapter is essential because it provides a deep analysis of financial bubbles—the recurring cycles of speculative mania and collapse that have shaped economic history. Ferguson dissects the anatomy of bubbles, exploring their psychological, structural, and regulatory drivers. By examining historical case studies, he demonstrates that bubbles are not anomalies but integral features of financial markets, making this chapter a critical resource for investors seeking to navigate periods of exuberance and volatility.

Ferguson presents detailed examples, including the Dutch Tulip Mania, the South Sea Bubble, and the dot-com boom. He quotes contemporary accounts of these events, such as Charles Mackay’s "Extraordinary Popular Delusions and the Madness of Crowds," and provides data on price movements, trading volumes, and the eventual crashes. The chapter analyzes the psychology of speculation, the role of leverage, and the impact of regulatory failures, illustrating how bubbles can build and burst with devastating speed.

Investors can apply the lessons of this chapter by developing a disciplined approach to risk assessment and portfolio construction. Recognizing the warning signs of bubbles—such as rapid price appreciation, widespread speculation, and the proliferation of complex financial products—can help investors avoid catastrophic losses. Ferguson’s analysis encourages skepticism, diversification, and a commitment to historical awareness when evaluating investment opportunities.

Historically, financial bubbles have been driven by a combination of innovation, optimism, and regulatory gaps. The South Sea Bubble and the dot-com crash, for example, were both fueled by new technologies and the promise of unlimited growth. In the modern era, the rise of cryptocurrencies, meme stocks, and speculative real estate markets all reflect patterns identified in this chapter. By studying the history of bubbles, investors can better anticipate market cycles and position themselves for long-term success.

Chapter 4: The Return of Risk

This chapter is crucial because it explores the concept of risk in financial markets and the strategies developed to manage it. Ferguson traces the historical development of risk management tools, from early insurance contracts to modern derivatives, and examines the impact of risk on both individual investors and entire economies. The chapter highlights the centrality of risk in financial decision-making and underscores the limitations of even the most sophisticated models.

Ferguson provides examples such as the creation of insurance markets in Renaissance Italy, the development of actuarial science, and the proliferation of derivatives in recent decades. He discusses the role of risk in financial crises, citing data on the volatility of asset prices and the failures of risk management systems during events like the 2008 financial meltdown. The chapter includes quotes from mathematicians, economists, and market participants, illustrating the evolving understanding of risk.

For investors, the key lesson is that risk cannot be eliminated—only understood, measured, and managed. Ferguson’s analysis encourages the use of diversification, hedging, and scenario analysis to mitigate risk, while also warning against overreliance on mathematical models. He emphasizes the importance of humility, adaptability, and continuous learning in the face of uncertainty.

Historically, the management of risk has enabled the growth of financial markets and the expansion of economic opportunity. However, the failure to respect risk has also led to some of the most catastrophic losses in history. The collapse of Long-Term Capital Management, the subprime crisis, and the COVID-19 pandemic all demonstrate the dangers of underestimating tail risks. By studying the history of risk, investors can develop more resilient strategies and avoid the complacency that often precedes disaster.

Chapter 5: Safe as Houses

This chapter is particularly important for its examination of real estate as a financial asset and its role in economic stability. Ferguson traces the historical significance of land ownership, from feudal estates to the rise of the modern mortgage market, and analyzes the dynamics of housing bubbles and crashes. The chapter provides a comprehensive overview of the ways in which property markets have shaped wealth accumulation, social mobility, and financial crises.

Ferguson presents data on the growth of homeownership, the development of mortgage-backed securities, and the systemic risks associated with real estate finance. He discusses the impact of government policies, such as tax incentives and housing subsidies, on property markets, and provides case studies of housing booms and busts in the United States, Japan, and Europe. The chapter includes quotes from economists, policymakers, and market participants, illustrating the complexities of real estate valuation and risk.

For investors, the key takeaway is the need for rigorous analysis of property markets, careful consideration of leverage, and an appreciation for the illiquidity and cyclicality of real estate assets. Ferguson’s insights encourage diversification across asset classes and caution against overexposure to property, particularly in overheated markets. The historical perspective also highlights the importance of policy and regulatory environments in shaping real estate outcomes.

In the modern era, real estate remains a critical component of wealth and financial stability. The global housing boom, rising concerns about affordability, and the impact of low interest rates on property prices all echo themes explored in this chapter. By studying the history of real estate cycles, investors can better anticipate risks and identify opportunities in both local and global markets.

---

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

---

Chapter 6: From Empire to Chimerica

This chapter is essential for its exploration of globalization and the interconnectedness of modern financial systems. Ferguson examines the economic relationship between major powers, particularly the United States and China, and analyzes the implications of global capital flows, trade imbalances, and financial integration. The chapter provides a framework for understanding the opportunities and risks of financial globalization, making it a critical resource for investors operating in a globalized world.

Ferguson presents data on global capital flows, trade balances, and currency regimes, and discusses the rise of "Chimerica"—the economic symbiosis between China and the United States. He analyzes the impact of global financial institutions, such as the International Monetary Fund and the World Bank, on economic stability and development. The chapter includes quotes from policymakers, economists, and market participants, illustrating the complexities of global finance.

For investors, the key lesson is the importance of understanding geopolitical dynamics, currency risk, and the implications of global events for portfolio construction. Ferguson’s analysis encourages a global perspective, diversification across regions, and vigilance regarding the potential for systemic shocks. The discussion of "Chimerica" serves as a case study in the complexities of economic interdependence and the potential for both cooperation and conflict.

In the modern era, the themes of globalization and interdependence are more salient than ever. The COVID-19 pandemic, trade wars, and the rise of digital finance have all underscored the interconnectedness of global markets. By studying the history of financial globalization, investors can better anticipate the risks and opportunities of operating in an increasingly complex and dynamic environment.

Chapter 7: The Power of Financial Innovation

Though not a standalone chapter in the book’s official structure, Ferguson’s discussion of financial innovation is threaded throughout the narrative and deserves focused attention. This theme is critical because it highlights how new financial instruments—bonds, joint-stock companies, derivatives—have driven economic growth, expanded access to capital, and transformed entire industries. At the same time, innovation has introduced new risks and vulnerabilities, making it a double-edged sword for investors and policymakers alike.

Ferguson provides examples such as the Medici family’s development of double-entry bookkeeping, the creation of government bonds to fund wars, and the rise of derivatives markets in the late twentieth century. He discusses the impact of financial innovation on market efficiency, liquidity, and risk distribution, and provides data on the growth of new financial products. The chapter includes quotes from innovators, regulators, and critics, illustrating the ongoing debate over the benefits and dangers of financial innovation.

For investors, the key takeaway is the importance of balancing enthusiasm for new financial products with caution and due diligence. Ferguson’s analysis encourages investors to assess the underlying risks, incentives, and regulatory environments associated with innovation, and to avoid the temptation to chase returns without understanding the potential downsides. The historical perspective also highlights the role of innovation in driving both progress and crisis.

In the modern era, financial innovation continues to reshape markets and investment strategies. The rise of fintech, cryptocurrencies, and algorithmic trading all reflect the ongoing evolution of financial instruments. By studying the history of innovation, investors can better anticipate the risks and opportunities associated with new products and technologies, and position themselves for long-term success.

Chapter 8: Finance as a Driver of Social Change

Another cross-cutting theme in Ferguson’s work is the role of finance in driving social change. This theme is critically important because it highlights how access to credit, the democratization of investment, and the spread of financial literacy have transformed societies, empowered individuals, and reduced poverty. At the same time, finance has also contributed to inequality and exclusion, making it a powerful force for both progress and conflict.

Ferguson provides examples such as the rise of the middle class in nineteenth-century Europe, the expansion of homeownership in the twentieth century, and the growth of microfinance in the developing world. He discusses the impact of financial development on social mobility, education, and health outcomes, and provides data on the distribution of wealth and access to credit. The chapter includes quotes from social reformers, economists, and policymakers, illustrating the complex relationship between finance and society.

For investors, the key lesson is the importance of considering the social and ethical dimensions of financial decisions. Ferguson’s analysis encourages investors to seek opportunities that promote financial inclusion, support sustainable development, and align with broader societal goals. The historical perspective also highlights the potential for finance to drive positive change, as well as the risks of exacerbating inequality and instability.

In the modern era, the themes of financial inclusion, impact investing, and corporate social responsibility are increasingly important. The rise of ESG (environmental, social, and governance) investing, the growth of microfinance, and the expansion of financial education all reflect the ongoing evolution of finance as a driver of social change. By studying the history of finance and society, investors can better understand the broader implications of their decisions and contribute to more equitable and sustainable outcomes.

Practical Investment Strategies

- Historical Pattern Recognition: Investors should study historical financial cycles to identify patterns that tend to repeat, such as the formation of bubbles, the triggers of crises, and the aftermath of panics. Action steps include maintaining a library of historical case studies, monitoring market sentiment indicators (like the VIX or margin debt levels), and regularly comparing current valuations to historical averages. This approach helps investors avoid euphoria-driven mistakes and spot opportunities when fear dominates the market.

- Risk Management through Diversification: Ferguson’s analysis highlights the inevitability of risk and the importance of diversification. Investors should allocate capital across different asset classes (equities, bonds, real estate, cash) and geographies to mitigate the impact of localized shocks. Tools such as Monte Carlo simulations, stress testing, and scenario analysis can be used to assess portfolio resilience. Regularly rebalancing the portfolio according to changing risk profiles ensures that no single asset dominates exposure.

- Credit Analysis and Debt Sustainability: Understanding the mechanics of credit and debt is essential for both bond investors and equity analysts. Investors should assess the creditworthiness of issuers by analyzing debt ratios, interest coverage, and cash flow stability. Using tools like credit ratings, bond yield spreads, and covenant analysis, investors can avoid high-risk borrowers and anticipate potential defaults. Monitoring macroeconomic indicators, such as central bank policy and credit growth, further enhances credit risk assessment.

- Real Estate Cycle Awareness: Ferguson’s discussion of real estate cycles encourages investors to analyze local and global property markets for signs of overheating or undervaluation. Investors should track metrics such as price-to-rent ratios, housing affordability indexes, and mortgage delinquency rates. Incorporating scenario analysis for interest rate changes and regulatory shifts helps anticipate turning points in the real estate cycle. Diversifying across regions and property types further reduces exposure to localized downturns.

- Global Macro Perspective: The book’s emphasis on globalization underscores the need for a global perspective in portfolio construction. Investors should monitor international economic indicators, currency movements, and geopolitical developments. Tools such as country risk ratings, global ETF allocations, and currency hedging strategies enable investors to capitalize on global opportunities while managing cross-border risks. Staying informed about global trade flows and capital movements is essential for anticipating market shifts.

- Embracing Financial Innovation with Caution: Ferguson’s narrative encourages investors to engage with new financial products and technologies, but with a healthy dose of skepticism. Before adopting innovations such as cryptocurrencies, structured products, or fintech platforms, investors should conduct thorough due diligence, understand the underlying risks, and assess regulatory environments. Allocating only a small portion of the portfolio to experimental assets helps balance the potential for outsized returns with the risk of total loss.

- Scenario Planning for Systemic Shocks: Given the recurring nature of financial crises, investors should regularly conduct scenario planning to prepare for systemic shocks. This involves identifying potential sources of contagion, such as highly leveraged financial institutions or global supply chain disruptions, and developing contingency plans. Maintaining liquidity buffers, establishing lines of credit, and predefining asset allocation shifts for crisis scenarios can enhance portfolio resilience.

- Ethical and Social Impact Investing: Ferguson’s discussion of finance as a driver of social change invites investors to consider the ethical dimensions of their portfolios. Investors should evaluate companies and funds based on ESG criteria, support initiatives that promote financial inclusion, and engage in shareholder advocacy for responsible corporate behavior. Using tools such as ESG ratings, impact measurement frameworks, and engagement platforms enables investors to align financial goals with broader societal values.

Modern Applications and Relevance

The principles outlined in "The Ascent of Money" remain profoundly relevant in today’s rapidly evolving financial landscape. The book’s historical narrative provides a valuable framework for interpreting modern developments, from the rise of cryptocurrencies and digital banking to the resurgence of inflation and the ongoing debate over central bank policy. Ferguson’s emphasis on the cyclical nature of financial markets encourages investors to maintain a long-term perspective and to avoid the pitfalls of short-term thinking.

Since the book’s publication in 2008, the world has witnessed a series of transformative events, including the global financial crisis, the European sovereign debt crisis, and the COVID-19 pandemic. These episodes have underscored the enduring importance of risk management, the dangers of excessive leverage, and the interconnectedness of global financial systems. At the same time, technological innovation has accelerated, with the proliferation of fintech platforms, blockchain technology, and algorithmic trading reshaping the way markets operate.

What remains timeless is Ferguson’s core insight that financial innovation is both a driver of progress and a source of instability. The rise of decentralized finance (DeFi), non-fungible tokens (NFTs), and other digital assets reflects the ongoing evolution of money and credit, echoing the historical transitions described in the book. However, the rapid pace of change also introduces new risks, from cybersecurity threats to regulatory uncertainty, making historical perspective more valuable than ever.

Modern examples of the book’s principles in action include the global response to the COVID-19 pandemic, which saw unprecedented monetary and fiscal stimulus, the surge in retail trading and speculative assets, and the renewed focus on financial inclusion and ESG investing. Investors who understand the lessons of financial history are better equipped to navigate these challenges, anticipate market shifts, and identify opportunities for long-term growth.

To adapt classic advice to current conditions, investors should combine historical awareness with technological savvy, embracing innovation while maintaining a disciplined approach to risk management. By integrating the insights of "The Ascent of Money" into their investment strategies, investors can build more resilient portfolios and contribute to a more stable and inclusive financial system.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Implementation Guide

- Establish a Foundation in Financial History: Begin by dedicating time to studying the major cycles, crises, and innovations described in "The Ascent of Money." Allocate several weeks to reading the book and supplementing with additional resources, such as historical market data, documentaries, and scholarly articles. This foundational knowledge will inform all subsequent investment decisions and provide context for interpreting market developments.

- Develop a Disciplined Investment Strategy: Over the next one to three months, use insights from the book to design a strategy that incorporates risk management, diversification, and historical pattern recognition. Set clear investment goals, define asset allocation targets, and establish criteria for evaluating new opportunities. Document your strategy in a written investment policy statement to guide decision-making during periods of market turbulence.

- Construct a Diversified Portfolio: Allocate capital across a mix of asset classes—including equities, bonds, real estate, and alternative investments—based on your risk tolerance, time horizon, and financial goals. Use tools such as portfolio optimization models and asset correlation matrices to ensure diversification. Consider global diversification to reduce exposure to country-specific risks and capitalize on international opportunities.

- Implement Ongoing Risk Management: Set a regular schedule—such as quarterly or semi-annual reviews—to assess portfolio performance, rebalance allocations, and monitor risk exposures. Use scenario analysis, stress testing, and liquidity assessments to identify potential vulnerabilities. Stay informed about macroeconomic trends, regulatory changes, and emerging risks by following reputable financial news sources and market research.

- Pursue Continuous Improvement and Education: Commit to lifelong learning by regularly reading financial history, attending investment seminars, and participating in professional networks. Subscribe to newsletters, podcasts, and online courses that focus on financial innovation, risk management, and global markets. Use platforms like Value Sense to access automated stock ideas, screening tools, and intrinsic value models that enhance decision-making.

--- ---

10+ Free intrinsic value tools

For investors looking to find a stock's fair value, our analytics team has you covered with intrinsic value tools:

📍 Free Intrinsic Value Calculator

📍 Reverse DCF & DCF value tools

📍 Peter Lynch Fair Value Calculator

📍 Ben Graham Fair Value Calculator

📍 Relative Value tool

...and plenty more.

🔍 Explore all these tools for free on the Value Sense platform and start discovering what your favorite stocks are really worth.

FAQ: Common Questions About The Ascent of Money

1. What is the main argument of "The Ascent of Money"?

The central argument of "The Ascent of Money" is that the evolution of financial systems—money, credit, banking, and markets—has been a driving force behind human progress and the development of civilization. Niall Ferguson contends that understanding financial history is essential for making sense of the modern world, as financial innovation has enabled economic growth, social change, and global integration, but has also introduced new risks and periodic crises.

2. How does the book explain the causes of financial bubbles and crises?

Ferguson explains that financial bubbles and crises are recurring features of market economies, driven by a combination of psychological factors (such as herd behavior and overconfidence), structural vulnerabilities (like excessive leverage), and regulatory failures. The book uses historical case studies—including Tulip Mania, the South Sea Bubble, and the subprime mortgage crisis—to illustrate how speculative manias build and collapse, often with devastating consequences for individuals and economies.

3. What practical lessons can investors learn from "The Ascent of Money"?

Investors can learn the importance of historical awareness, disciplined risk management, and diversification. The book encourages skepticism toward market exuberance, careful credit analysis, and a global perspective on portfolio construction. Ferguson’s analysis also underscores the need to balance enthusiasm for financial innovation with caution and due diligence, and to consider the ethical and social impact of investment decisions.

4. Is "The Ascent of Money" suitable for readers without a background in finance?

Yes, "The Ascent of Money" is written in an accessible style that makes complex financial concepts understandable to general readers. Ferguson uses engaging storytelling, historical anecdotes, and clear explanations to bridge the gap between academic finance and popular history. The book is suitable for students, professionals, and anyone interested in understanding the role of finance in shaping the modern world.

5. How does the book remain relevant in today’s financial environment?

The book remains highly relevant due to its focus on the timeless patterns of financial behavior—such as cycles of innovation, risk, and crisis—that continue to shape markets today. Ferguson’s insights into globalization, real estate, and financial innovation provide a framework for interpreting current developments, including the rise of digital currencies, the impact of geopolitical tensions, and the ongoing evolution of global capital markets.