The Dhandho Investor by Mohnish Pabrai

Welcome to the Value Sense Blog, your resource for insights on the stock market! You're reading a book review written by the valuesense.io team.

On our platform, you'll find stock research and insights across all sectors. Dive into our research products and learn more about our unique approach at valuesense.io

We offer over 360+ automated stock ideas, a free AI-powered stock screener, interactive stock charting tools, and more than 10 intrinsic value models — all designed to help investors find undervalued growth opportunities.

Book Overview

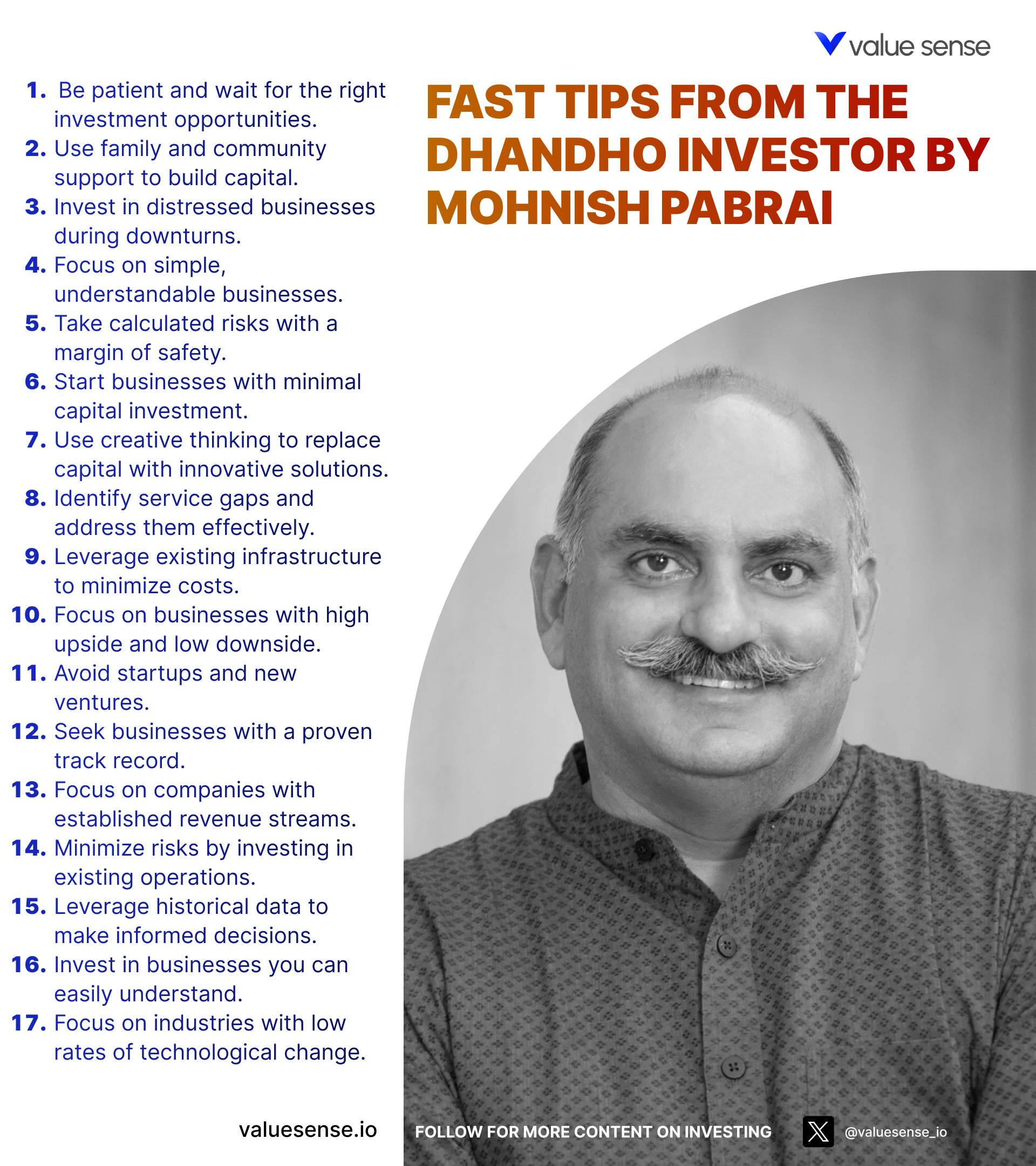

Published in 2007, The Dhandho Investor is the definitive guide to value investing through the lens of the Dhandho philosophy, authored by Mohnish Pabrai. Pabrai, a well-known value investor, is the founder of Pabrai Investment Funds and a disciple of Warren Buffett and Charlie Munger. His investing track record, which has consistently outperformed the S&P 500 over long periods, gives him significant credibility in the investment world. Pabrai’s unique background as an Indian immigrant who built his fortune from scratch adds an invaluable perspective, blending Eastern business wisdom with Western capital markets expertise.

The book was written during a period of intense market optimism, just before the 2008 global financial crisis. This timing is significant because Pabrai’s emphasis on low-risk, high-return investments and his advocacy for a margin of safety became even more relevant as markets crashed and many investors suffered devastating losses. The Dhandho Investor stands out because it distills complex value investing concepts into accessible, actionable principles, using vivid stories of real-life entrepreneurs—especially the Patels, who came to dominate the U.S. motel industry through shrewd, risk-averse strategies.

The main theme of the book is the pursuit of high returns with minimal risk, a principle encapsulated in the phrase “Heads, I win; tails, I don’t lose much.” Pabrai demonstrates how this philosophy is not only achievable but has been practiced successfully by ordinary people with limited resources. He provides a structured framework—the Dhandho Framework—comprising nine core principles that guide investors toward identifying exceptional opportunities while avoiding catastrophic losses.

This book is considered a classic because it bridges the gap between academic investing theory and practical, real-world application. It’s a must-read for investors at all levels, from beginners seeking foundational principles to seasoned professionals looking for a fresh perspective on risk and opportunity. The Dhandho philosophy is particularly valuable for those interested in value investing, special situations, and contrarian strategies, as it emphasizes simplicity, discipline, and a relentless focus on downside protection.

What sets The Dhandho Investor apart from other investment books is its use of storytelling to illustrate timeless principles. Pabrai draws on examples ranging from Indian shopkeepers to Richard Branson and Warren Buffett, making the concepts memorable and relatable. He also provides concrete, repeatable strategies for identifying and exploiting market inefficiencies, all while maintaining a humble, approachable tone. The book’s enduring relevance is evident in its widespread adoption by investors and its frequent citation in discussions of value investing best practices.

Key Themes and Concepts

At its core, The Dhandho Investor revolves around a handful of powerful themes that shape every chapter and example. These themes are not only the foundation of the Dhandho philosophy but also serve as practical guides for investors seeking to outperform the market with less risk. Pabrai’s writing is purposefully repetitive, reinforcing these core ideas through stories, data, and actionable frameworks.

Understanding these themes is crucial to applying the Dhandho approach. They are interwoven throughout the book, with each chapter offering a new angle or real-world case study. Below, we outline the most important themes that define the Dhandho method, explain how they recur throughout the book, and show how investors can use them to improve their decision-making and results.

- Low-Risk, High-Return Investing: The defining principle of Dhandho is to pursue opportunities where the downside is minimal but the upside is substantial. Pabrai repeatedly demonstrates how the Patels, Richard Branson, and others achieved outsized returns by investing in situations where losses were unlikely or limited. For example, the Patels bought struggling motels at deep discounts, ensuring that even in the worst-case scenario, their capital was mostly protected. This theme is actionable for investors who seek asymmetric risk-reward situations, such as distressed assets or special situations, and who resist the temptation to chase high-risk, high-reward gambles.

- Margin of Safety: Borrowing from Benjamin Graham and Warren Buffett, Pabrai emphasizes the importance of buying assets at prices far below their intrinsic value. This “margin of safety” acts as a buffer against errors in judgment, unforeseen events, or market volatility. In practice, this means being highly selective, patient, and disciplined—waiting for opportunities where the odds are overwhelmingly in your favor. The book illustrates this with examples of businesses bought at fire-sale prices, protecting the investor from permanent capital loss while providing substantial upside.

- Investing in Distressed Opportunities: Pabrai devotes significant attention to the advantages of investing in distressed businesses and industries. He explains how market participants often overreact to negative news, leading to temporary mispricings. By focusing on the underlying economics and being willing to act when others are fearful, investors can acquire valuable assets at steep discounts. The book provides examples of the Patels buying motels during downturns and of public companies trading at distressed valuations, showing that these situations often revert to the mean, rewarding patient investors.

- Simplicity in Business Models: One of the most actionable themes is the preference for simple, easy-to-understand businesses. Pabrai argues that complexity increases risk, making it harder to forecast cash flows and identify threats. The Dhandho approach is to invest in businesses with transparent economics, stable demand, and straightforward operations—such as motels, insurance, and consumer staples. This theme encourages investors to avoid “black box” companies and stick to their circle of competence.

- Arbitrage and Competitive Advantage: The book explores how investors can exploit arbitrage opportunities—situations where market inefficiencies allow for risk-free or low-risk profits. Pabrai also stresses the importance of investing in companies with durable competitive advantages, or “moats,” that protect profitability over time. He uses examples from Buffett’s investments in See’s Candies and Coca-Cola, as well as his own investments, to show how moats create resilience and pricing power, leading to superior long-term returns.

- The Art of Selling: While most investment books focus on buying, Pabrai dedicates significant attention to the art of selling. He likens the process to the dilemma faced by Abhimanyu in the Mahabharata—getting in is easy, but getting out is hard. The book provides frameworks for deciding when to sell, emphasizing the importance of discipline, emotional detachment, and maximizing long-term value. This theme is especially relevant in today’s fast-moving markets, where holding on too long or selling too early can erode returns.

- Contrarian and Value-Oriented Mindset: Throughout the book, Pabrai advocates for a contrarian approach—going against the crowd when the odds are in your favor. He encourages investors to seek out unpopular, overlooked, or misunderstood situations, where fear and uncertainty create opportunity. This mindset, combined with rigorous analysis and a focus on intrinsic value, is the hallmark of successful value investors.

Book Structure: Major Sections

Part 1: Introduction to Dhandho

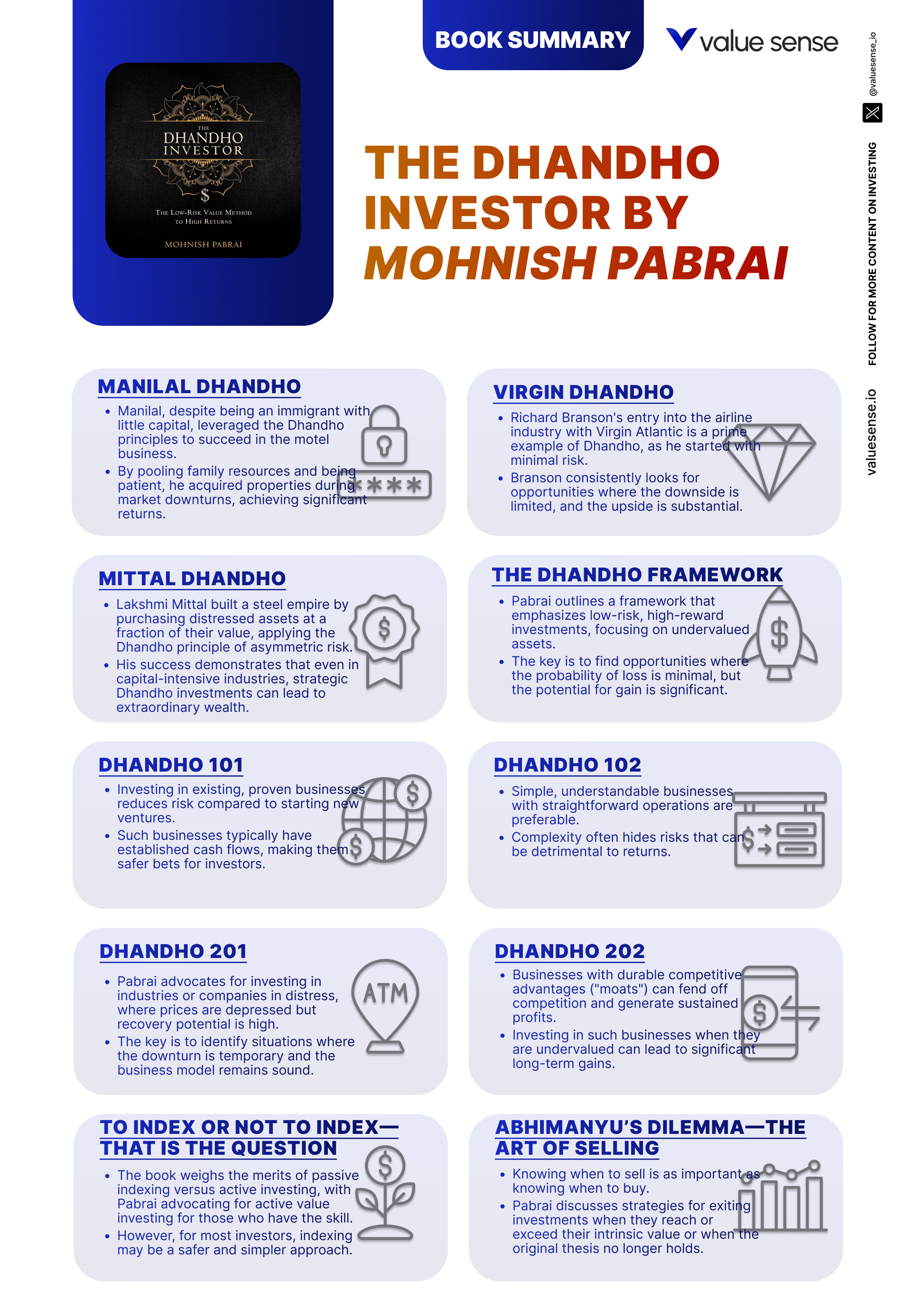

This opening section, encompassing Chapters 1 through 4, introduces the Dhandho philosophy through compelling stories and real-life examples. Pabrai begins with the remarkable rise of the Patels in the U.S. motel industry, then explores the entrepreneurial journeys of Manilal and Richard Branson. The unifying theme here is the demonstration of low-risk, high-return investing in the context of entrepreneurship and business ownership.

Key concepts from these chapters include the importance of buying assets at bargain prices, leveraging community support, and focusing on businesses with limited downside. Pabrai highlights how the Patels acquired motels during periods of industry distress, using minimal capital and sweat equity to transform struggling properties into profitable ventures. The stories are rich with data, such as the statistic that Patels owned over 40% of U.S. motels by the early 2000s, illustrating the power of disciplined, risk-averse investing.

For investors, the practical takeaway is the value of seeking asymmetric opportunities—where the potential loss is small but the upside is significant. This can be applied by looking for distressed assets, negotiating favorable terms, and leveraging networks or partnerships to reduce risk. The section also encourages investors to develop a mindset that welcomes uncertainty, provided that the downside is limited and the odds are favorable.

In today’s market, the lessons from this section are more relevant than ever. The rise of private equity, special situations investing, and “turnaround” plays all echo the Dhandho approach. Investors who can identify overlooked assets and apply operational improvements stand to benefit, especially during economic downturns or sector-specific crises.

Part 2: The Dhandho Framework

This section (Chapters 5-7) lays out the nine core principles of the Dhandho investment philosophy. Pabrai distills decades of investing wisdom into a concise, repeatable framework that emphasizes buying existing businesses, focusing on simplicity, and targeting distressed opportunities. The section’s unifying theme is the translation of abstract investing principles into a practical playbook.

Key concepts include the advantages of acquiring existing businesses rather than starting new ones, the importance of simplicity in business models, and the benefits of buying when others are fearful. Pabrai uses examples from both public and private markets to illustrate how these principles lead to superior risk-adjusted returns. The framework also includes guidance on understanding competitive advantages, managing risk, and maintaining discipline.

Investors can apply these insights by creating their own investment checklists based on the Dhandho principles. For example, before making an investment, one might ask: Is this an existing business with a proven track record? Is the business model simple and understandable? Is the purchase price well below intrinsic value? By systematically applying these filters, investors can avoid many common pitfalls.

The Dhandho Framework’s relevance has only increased in the age of information overload and complex financial products. By focusing on simplicity, durability, and margin of safety, investors can navigate volatile markets with greater confidence and resilience.

Part 3: Advanced Dhandho Strategies

Chapters 8 through 11 delve into more sophisticated aspects of the Dhandho philosophy, such as investing in businesses with durable moats, making few but significant bets, and exploiting arbitrage opportunities. The unifying theme is the pursuit of exceptional returns through focused, disciplined, and creative investing.

Key concepts include the identification of businesses with sustainable competitive advantages, the benefits of portfolio concentration, and the ability to exploit market inefficiencies through arbitrage. Pabrai provides examples of successful investments in companies with strong brands, cost advantages, or regulatory barriers. He also discusses the importance of patience and conviction, arguing that a handful of high-quality investments can drive the majority of portfolio returns.

Investors can apply these strategies by concentrating capital in their best ideas, rather than diversifying excessively. This requires deep research, conviction, and emotional discipline. The section also encourages investors to look for arbitrage opportunities, such as mergers, spin-offs, or mispriced securities, where the probability of a positive outcome is high.

In the current era of heightened competition and information efficiency, the ability to identify and act on advanced Dhandho strategies is a key differentiator. Investors who can find durable moats and exploit temporary dislocations will continue to outperform over the long term.

Part 4: Risk Management and Exit Strategies

This section (Chapters 12-15) focuses on the critical aspects of risk management, margin of safety, and the art of selling. The unifying theme is the preservation of capital and the disciplined management of investments throughout their lifecycle.

Key concepts include the necessity of maintaining a margin of safety, the advantages of investing in low-risk, high-uncertainty businesses, and the development of effective exit strategies. Pabrai draws on both historical and personal examples to show how disciplined risk management leads to superior long-term results. He also addresses the psychological challenges of selling, emphasizing the need for clear criteria and emotional detachment.

Investors can apply these lessons by setting strict entry and exit criteria, regularly reviewing portfolio holdings, and being willing to sell when the original thesis no longer holds. The section also highlights the importance of patience and the avoidance of unnecessary trading, which can erode returns through costs and taxes.

In today’s volatile markets, robust risk management and disciplined selling are more important than ever. The proliferation of algorithmic trading and behavioral biases makes it easy to fall into traps; the Dhandho approach provides a timeless antidote to these pitfalls.

Part 5: Lessons from Dhandho

The final section (Chapters 16-17) synthesizes the book’s lessons, contrasting indexing with active investing and drawing wisdom from historical and mythical figures. The unifying theme is the reinforcement of Dhandho principles through broader context and reflection.

Key concepts include the benefits and limitations of index investing, the circumstances under which active management can add value, and the timeless nature of value-oriented strategies. Pabrai uses stories from history and mythology to illustrate the enduring power of patience, discipline, and rational analysis.

For investors, the practical application is to choose an investment approach that matches their skills, temperament, and resources. Those unable or unwilling to devote significant time to research may be better served by indexing, while disciplined, value-oriented investors can pursue active strategies. The section also encourages lifelong learning and adaptation.

The modern relevance of these lessons is clear: as markets evolve and new strategies emerge, the core principles of Dhandho remain as effective as ever. Whether through indexing or active management, investors who prioritize risk management, simplicity, and intrinsic value will continue to thrive.

Deep Dive: Essential Chapters

Chapter 1: Patel Motel Dhandho

This chapter is foundational because it introduces the Dhandho philosophy through the extraordinary story of the Patels, a small Indian community that came to dominate the U.S. motel industry. Pabrai uses their journey to exemplify how ordinary people can achieve extraordinary wealth by following a disciplined, low-risk, high-return approach. The main concept is that by buying distressed motels at bargain prices, leveraging family and community labor, and focusing on cost control, the Patels created a business empire with minimal downside and immense upside.

Pabrai provides compelling data, such as the fact that by the early 2000s, Patels owned over 40% of all motels in the United States, despite representing a tiny fraction of the population. He describes how the Patels would buy run-down motels at steep discounts, often with seller financing, and turn them around through hard work and operational improvements. The use of family labor reduced costs, while the focus on cash flow and conservative financing minimized risk. Notably, the Patels avoided speculative expansion, preferring to reinvest profits in additional properties only when the risk was low and the reward high.

Investors can apply these lessons by seeking out distressed assets where the downside is limited—such as companies trading below net asset value or with strong balance sheets—and by focusing on operational improvements. The Patel approach also highlights the importance of leveraging networks, whether through partnerships, industry contacts, or community ties, to reduce costs and share knowledge. Practically, this means being patient, disciplined, and willing to do the hard work that others avoid.

The story of the Patels is especially relevant in today’s market, where distressed assets and turnaround opportunities abound. The rise of private equity “roll-up” strategies and real estate syndications echoes the Patel model. Investors who emulate their discipline, frugality, and focus on downside protection are likely to achieve superior long-term results, regardless of market cycles.

Chapter 3: Virgin Dhandho

This chapter is critically important because it demonstrates the universality of the Dhandho philosophy through the entrepreneurial journey of Richard Branson. Pabrai shows that the principles of low-risk, high-return investing are not limited to small businesses or specific industries—they can be applied to create global empires. The main concept is that Branson consistently sought opportunities where the potential loss was minimal but the upside was enormous, using creativity, negotiation, and brand leverage to mitigate risk.

Pabrai details how Branson launched Virgin Atlantic by negotiating a deal with Boeing to lease a 747 with minimal upfront capital and the option to return the plane if the venture failed. Branson’s willingness to walk away from deals, his focus on brand strength, and his ability to structure investments to minimize downside are all highlighted as key factors in his success. The chapter is rich with anecdotes, such as Branson’s use of publicity stunts to gain free media coverage, further reducing risk and amplifying returns.

Investors can apply these lessons by looking for ways to structure investments with favorable risk-reward profiles, such as negotiating downside protection, using options, or seeking out “free lottery ticket” situations. The chapter also encourages creative problem-solving and the use of intangible assets—like brand or reputation—to enhance value without significant capital investment.

Branson’s approach is highly relevant in the age of startups and technology disruption, where capital efficiency and risk mitigation are critical. Entrepreneurs and investors alike can benefit from thinking like Branson—seeking asymmetric bets, leveraging strengths, and always protecting the downside.

Chapter 5: The Dhandho Framework

This chapter is a cornerstone of the book, as it articulates the nine core principles of the Dhandho investment framework. Pabrai synthesizes decades of value investing wisdom into a practical, actionable checklist that guides decision-making. The main concept is that by adhering to these principles—such as investing in existing businesses, focusing on simplicity, and seeking distressed opportunities—investors can systematically reduce risk and increase returns.

Pabrai uses specific examples, such as Buffett’s purchase of See’s Candies and his own investments in undervalued companies, to illustrate each principle. He provides data on historical returns from distressed investments and highlights the importance of understanding competitive advantages. Notably, the chapter includes memorable quotes, such as “Heads, I win; tails, I don’t lose much,” encapsulating the Dhandho mindset.

Investors can use the Dhandho Framework as a checklist before making any investment. For example, they might ask: Is this an existing business with a proven track record? Is the business model simple and understandable? Is the purchase price well below intrinsic value? Are there durable competitive advantages? By systematically applying these filters, investors can avoid common pitfalls and focus on the most promising opportunities.

The framework’s relevance is timeless—it provides a structured approach that can be adapted to changing markets, asset classes, and economic conditions. Investors who internalize these principles are better equipped to navigate uncertainty and achieve consistent, superior results.

Chapter 6: Dhandho 101: Invest in Existing Businesses

This chapter is vital because it challenges the conventional wisdom that entrepreneurship is about starting new businesses. Pabrai argues persuasively that buying existing businesses—either privately or through the stock market—is far less risky and often more rewarding. The main concept is that existing businesses have proven economics, established customer bases, and operational infrastructure, reducing the uncertainty and capital requirements associated with startups.

Pabrai provides examples of successful acquisitions, both by individual investors (such as the Patels buying motels) and by corporate acquirers. He compares the failure rates of startups (which are extremely high) with the much higher survival rates of established businesses. The chapter includes data on historical returns from acquiring existing businesses at favorable prices, reinforcing the argument for this approach.

For investors, the practical application is to focus on buying existing businesses with strong cash flows, stable demand, and competent management. This can be done through direct ownership, private equity, or public equities. The chapter also encourages investors to use the stock market as a tool for acquiring fractional ownership in high-quality businesses at attractive prices.

The lesson is especially relevant in today’s environment, where the proliferation of SPACs, direct listings, and startup hype often distracts investors from the steady returns available from established businesses. By focusing on proven models and avoiding unnecessary risk, investors can build wealth more reliably and with less stress.

Chapter 8: Dhandho 201: Invest in Distressed Businesses in Distressed Industries

This chapter is crucial because it explores one of the highest-return strategies in value investing: buying distressed businesses in distressed industries. Pabrai explains that markets often overreact to negative news, leading to temporary mispricings and exceptional opportunities for patient investors. The main concept is that by focusing on the underlying economics and being willing to act when others are fearful, investors can achieve outsized returns with limited risk.

Pabrai provides case studies of investments in industries facing temporary headwinds—such as airlines after 9/11 or financials during the 2008 crisis. He discusses the importance of thorough due diligence, risk management, and the identification of catalysts for recovery. The chapter includes data on historical returns from distressed investing and highlights the psychological barriers that prevent most investors from acting in these situations.

Investors can apply these lessons by developing a watchlist of industries and companies facing temporary distress, conducting deep research to separate permanent impairment from temporary setbacks, and being prepared to act when valuations are compelling. The chapter also encourages the use of checklists and scenario analysis to manage risk.

Distressed investing remains highly relevant in today’s market, where economic cycles, technological disruption, and regulatory changes create periodic dislocations. Investors who can remain objective and disciplined during periods of fear are well positioned to capitalize on these opportunities.

---

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

---

Chapter 12: Dhandho 401: Margin of Safety—Always!

This chapter is a linchpin of the Dhandho philosophy, emphasizing the critical importance of maintaining a margin of safety in every investment. Pabrai draws on the teachings of Benjamin Graham and Warren Buffett to explain how buying assets well below intrinsic value protects against downside risk while allowing for substantial upside. The main concept is that a wide margin of safety acts as both a buffer and a springboard for superior returns.

Pabrai provides data on the performance of investments made with a significant margin of safety, citing examples from his own portfolio and from value investing legends. He explains that even if the investor’s analysis is partially wrong, the margin of safety provides a cushion against permanent capital loss. The chapter includes memorable quotes, such as “The margin of safety is the essence of value investing,” and provides checklists for assessing intrinsic value and downside risk.

For investors, the practical application is to be highly selective, only buying when the price is far below conservative estimates of intrinsic value. This requires patience, discipline, and a willingness to wait for the right opportunities. The chapter also encourages investors to use multiple valuation methods and to err on the side of caution when estimating future cash flows.

The importance of margin of safety is timeless, but it is especially relevant in today’s volatile and uncertain markets. Investors who adhere to this principle are less likely to suffer catastrophic losses and more likely to achieve consistent, compounding returns over time.

Chapter 13: Dhandho 402: Invest in Low-Risk, High-Uncertainty Businesses

This chapter is important because it challenges the conventional wisdom that uncertainty equals risk. Pabrai explains that many businesses are temporarily undervalued because the market confuses uncertainty with risk, leading to opportunities for investors who can distinguish between the two. The main concept is that low-risk, high-uncertainty situations often offer the best risk-reward profiles, as the downside is limited but the upside is significant if uncertainty resolves favorably.

Pabrai provides examples of companies facing temporary uncertainty—such as regulatory investigations, management changes, or industry disruptions—that are fundamentally sound but trade at distressed valuations. He discusses the psychological biases that cause most investors to avoid uncertainty and provides frameworks for assessing whether the risk is truly elevated or merely perceived.

Investors can apply these lessons by seeking out companies with solid balance sheets, strong competitive positions, and temporary uncertainty. By conducting thorough due diligence and scenario analysis, investors can identify situations where the odds are in their favor and the downside is minimal. The chapter also encourages emotional discipline and the avoidance of herd mentality.

In the modern market, where news cycles and social media amplify uncertainty, the ability to distinguish between risk and uncertainty is a key edge. Investors who can remain objective and focused on fundamentals are well positioned to capitalize on these opportunities.

Chapter 15: Abhimanyu’s Dilemma—The Art of Selling

This chapter is essential because it addresses the often-overlooked aspect of knowing when to sell an investment. Pabrai uses the story of Abhimanyu from the Mahabharata to illustrate the challenges of exiting investments, emphasizing that getting in is easy but getting out is hard. The main concept is that disciplined selling is critical to maximizing returns and managing risk, yet it is fraught with psychological and practical challenges.

Pabrai provides frameworks for deciding when to sell, such as when the original investment thesis no longer holds, when the price exceeds intrinsic value by a significant margin, or when better opportunities arise. He discusses the emotional biases—such as anchoring, loss aversion, and overconfidence—that can lead investors to hold on too long or sell too early. The chapter includes specific examples of both successful and unsuccessful exits from Pabrai’s own portfolio.

Investors can apply these lessons by setting clear exit criteria before making an investment, regularly reviewing their holdings, and being willing to act decisively when circumstances change. The chapter also encourages the use of checklists and accountability partners to overcome emotional biases and maintain discipline.

The art of selling is more relevant than ever in today’s fast-moving markets, where volatility and rapid information flow can lead to hasty or emotional decisions. Investors who develop a disciplined approach to selling are better positioned to preserve capital and capture gains over the long term.

Chapter 16: To Index or Not to Index—That Is the Question

This chapter is important because it addresses the perennial debate between indexing and active investing. Pabrai evaluates the pros and cons of each approach, providing nuanced insights into when indexing is appropriate and when active management can add value. The main concept is that most investors are better off indexing, but disciplined, value-oriented investors can outperform if they adhere to the Dhandho principles.

Pabrai provides data on the long-term performance of index funds versus actively managed funds, highlighting the impact of fees, taxes, and behavioral biases. He discusses the circumstances under which active investing can succeed—such as when markets are inefficient, when the investor has a clear edge, or when special situations arise. The chapter includes memorable anecdotes and practical guidelines for choosing the right approach.

For investors, the practical application is to honestly assess their skills, temperament, and resources before choosing an investment strategy. Those unable or unwilling to devote significant time to research are likely to achieve better results through low-cost index funds. Those with the requisite discipline and knowledge can pursue active strategies, but must be vigilant about risk management and costs.

The indexing debate remains highly relevant in today’s market, where passive investing has grown dramatically and active managers face increasing scrutiny. Pabrai’s balanced perspective helps investors make informed choices that align with their goals and capabilities.

Practical Investment Strategies

- Seek Asymmetric Risk-Reward Opportunities: Focus on investments where the potential loss is small but the upside is significant. Start by screening for companies trading below tangible book value or with net cash positions. Analyze the downside scenario—what happens if things go wrong? If the loss is limited but the upside is at least 2-3x your investment, consider proceeding. Use scenario analysis and stress testing to confirm the asymmetry before committing capital.

- Maintain a Wide Margin of Safety: Always insist on a significant discount to intrinsic value before buying. Use conservative assumptions in your valuation models—discount future cash flows heavily, use lower growth rates, and factor in potential negative events. Only invest when the price is at least 30-50% below your most pessimistic estimate of value. This buffer protects you from errors and market volatility, allowing you to invest with confidence.

- Focus on Simple, Understandable Businesses: Avoid complex or opaque companies. Instead, target businesses with straightforward operations, stable demand, and transparent financials. Use tools like ValueSense’s screener to filter for companies with consistent cash flow, high returns on capital, and low leverage. If you can’t explain the business model to a non-expert in two minutes, move on.

- Invest in Distressed Businesses and Industries: Monitor industries and companies experiencing temporary distress, such as regulatory setbacks, cyclical downturns, or management changes. Create a watchlist of potential turnaround candidates. Conduct deep research to separate temporary issues from permanent impairment. When you find a fundamentally sound company trading at distressed prices, act decisively but size your position to manage risk.

- Concentrate Capital in Best Ideas: Rather than diversifying excessively, allocate more capital to your highest conviction ideas. Limit your portfolio to 8-12 positions, each representing at least 5-10% of assets. This concentration amplifies the impact of your best insights, but requires rigorous research and emotional discipline. Regularly review each holding to ensure it still meets your criteria.

- Exploit Arbitrage and Special Situations: Look for mergers, spin-offs, tender offers, and other corporate actions that create temporary mispricings. Use event-driven strategies to capture low-risk profits. For example, analyze announced mergers with a high probability of completion, or invest in spin-offs where the parent company’s shareholders indiscriminately sell the new entity. Monitor regulatory filings and use tools like ValueSense’s event calendar to identify opportunities.

- Develop and Follow a Selling Discipline: Set clear exit criteria before you buy—such as a target price, a change in the investment thesis, or the emergence of better opportunities. Use trailing stops or periodic reviews to trigger sales when warranted. Avoid emotional decision-making by maintaining a written investment journal and reviewing it regularly. Celebrate successful exits, but also analyze mistakes to improve your process.

- Balance Indexing and Active Investing: If you lack the time or inclination for deep research, allocate the majority of your assets to low-cost index funds. Use active strategies only for a portion of your portfolio where you have a clear edge. Monitor performance and costs closely, and be willing to shift your allocation based on results and changing circumstances.

Modern Applications and Relevance

Despite being published in 2007, The Dhandho Investor remains highly relevant in today’s investment landscape. The core principles of low-risk, high-return investing, margin of safety, and simplicity are timeless, providing a sturdy foundation in an era of rapid technological change, market volatility, and information overload. As markets have become more global and interconnected, the importance of risk management and disciplined decision-making has only grown.

One major change since the book’s publication is the rise of passive investing and algorithmic trading, which have made markets more efficient but also more prone to occasional, severe dislocations. The Dhandho approach is well suited to these conditions, as it emphasizes patience, discipline, and the willingness to act when others are fearful. For example, during the COVID-19 market crash of 2020, investors who followed Dhandho principles—buying high-quality businesses at distressed prices—were handsomely rewarded when markets rebounded.

What remains timeless is the focus on downside protection and the avoidance of permanent capital loss. In an age where speculative bubbles and meme stocks can capture headlines, the Dhandho philosophy serves as a reminder that true wealth is built through careful, disciplined investing—not by chasing fads or taking unnecessary risks. The principles of buying existing businesses, insisting on a margin of safety, and concentrating on best ideas are as effective today as they were a century ago.

Modern examples of the Dhandho approach in action include Warren Buffett’s investments in Bank of America during the financial crisis, private equity firms acquiring distressed assets during downturns, and value investors profiting from temporary dislocations in sectors like energy or retail. The proliferation of data and analytical tools—such as those offered by ValueSense—has made it easier than ever for individual investors to identify and evaluate these opportunities.

To adapt classic Dhandho advice to current conditions, investors should leverage technology for screening and analysis, stay informed about macroeconomic trends, and be prepared to act quickly when opportunities arise. At the same time, they should resist the temptation to overtrade or chase short-term gains, focusing instead on long-term compounding and capital preservation. The Dhandho philosophy, with its emphasis on simplicity, patience, and risk management, is the perfect antidote to the noise and complexity of modern markets.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Implementation Guide

- Define Your Investment Universe: Start by identifying the types of businesses and industries you understand best. Use tools like ValueSense’s screener to filter for companies with simple business models, stable cash flows, and high returns on capital. Set up watchlists for distressed industries or companies trading at discounts to tangible book value. Timeline: 1-2 weeks for initial setup, ongoing refinement as your circle of competence expands.

- Develop a Dhandho Checklist: Create a personalized checklist based on the nine Dhandho principles. Include questions such as: Is this an existing business with proven economics? Is the business model simple and understandable? Is the purchase price well below intrinsic value? Does the company have a durable competitive advantage? Use this checklist before every investment decision. Timeline: 1 week to draft, ongoing updates as you learn.

- Construct a Concentrated Portfolio: Allocate capital to your highest conviction ideas, aiming for 8-12 positions with meaningful weights (5-10% each). Avoid over-diversification, which can dilute returns and increase complexity. Use position sizing rules to manage risk—never put more than 20% in a single holding, and scale up only as your conviction grows. Timeline: 1-3 months to build initial portfolio, ongoing adjustments as new opportunities arise.

- Implement Rigorous Risk Management: Insist on a wide margin of safety for every purchase. Set strict entry and exit criteria, using trailing stops or target prices to trigger sales. Regularly review each holding to ensure it still meets your criteria. Use scenario analysis and stress testing to evaluate downside risk. Timeline: Ongoing, with quarterly portfolio reviews and annual deep dives.

- Adopt a Disciplined Selling Process: Before buying, define clear exit criteria—such as a target price, a change in the investment thesis, or the emergence of better opportunities. Maintain a written investment journal to track your reasoning and decisions. Schedule periodic reviews (monthly or quarterly) to reassess each holding and act decisively when your criteria are met. Timeline: Ongoing, with structured review sessions every 1-3 months.

- Balance Active and Passive Strategies: If you lack the time or expertise for deep research, allocate a portion of your portfolio (e.g., 50-80%) to low-cost index funds. Use active Dhandho strategies for the remainder, focusing on your best ideas. Monitor performance and costs closely, and adjust your allocation based on results and changing circumstances. Timeline: Initial allocation in 1-2 weeks, ongoing rebalancing as needed.

- Commit to Continuous Learning and Improvement: Stay informed by reading investment classics, following reputable newsletters and blogs, and participating in investment communities. Regularly review your investment decisions, analyze mistakes, and refine your checklist and process. Use resources like ValueSense’s research tools, webinars, and forums to stay ahead of market trends. Timeline: Ongoing, with dedicated learning sessions each month.

--- ---

10+ Free intrinsic value tools

For investors looking to find a stock's fair value, our analytics team has you covered with intrinsic value tools:

📍 Free Intrinsic Value Calculator

📍 Reverse DCF & DCF value tools

📍 Peter Lynch Fair Value Calculator

📍 Ben Graham Fair Value Calculator

📍 Relative Value tool

...and plenty more.

🔍 Explore all these tools for free on the Value Sense platform and start discovering what your favorite stocks are really worth.

FAQ: Common Questions About The Dhandho Investor

1. What is the core philosophy of The Dhandho Investor?

The core philosophy is to pursue high returns with minimal risk, focusing on investments where the downside is limited but the upside is substantial. Mohnish Pabrai advocates for the “Heads, I win; tails, I don’t lose much” approach, emphasizing a wide margin of safety, simplicity, and discipline. The book draws on real-world examples to demonstrate how this philosophy can be applied by ordinary investors to achieve exceptional results.

2. How does The Dhandho Investor differ from other value investing books?

The Dhandho Investor stands out for its storytelling approach, using vivid case studies—such as the Patels’ rise in the motel industry and Richard Branson’s entrepreneurial exploits—to illustrate timeless investing principles. Pabrai distills complex concepts into an accessible framework and provides actionable checklists, making it practical for both beginners and experienced investors. The focus on low-risk, high-return opportunities and the art of selling also sets it apart from more theoretical texts.

3. Can the Dhandho approach be applied to today’s markets?

Absolutely. The principles of low-risk, high-return investing, margin of safety, and simplicity are timeless and have proven effective across market cycles. In today’s volatile and information-rich environment, the Dhandho approach helps investors avoid speculative bubbles, manage risk, and capitalize on temporary mispricings. Modern tools and data make it easier than ever to identify Dhandho-style opportunities in public and private markets.

4. What are some practical steps for implementing Dhandho principles?

Start by defining your circle of competence and screening for simple, understandable businesses trading at significant discounts to intrinsic value. Use a checklist based on the nine Dhandho principles to evaluate each opportunity. Construct a concentrated portfolio, insist on a wide margin of safety, and set clear entry and exit criteria. Regularly review your holdings and commit to continuous learning and process improvement.

5. Who should read The Dhandho Investor?

The book is ideal for investors at all levels, from beginners seeking foundational principles to experienced professionals looking for a fresh perspective on risk and opportunity. It is especially valuable for those interested in value investing, special situations, or contrarian strategies. The accessible writing style and practical frameworks make it a must-read for anyone seeking to build wealth through disciplined, low-risk investing.