The Intelligent Investor by Benjamin Graham

Welcome to the Value Sense Blog, your resource for insights on the stock market! You're reading a book review written by the valuesense.io team.

On our platform, you'll find stock research and insights across all sectors. Dive into our research products and learn more about our unique approach at valuesense.io

We offer over 360+ automated stock ideas, a free AI-powered stock screener, interactive stock charting tools, and more than 10 intrinsic value models — all designed to help investors find undervalued growth opportunities.

Book Overview

Benjamin Graham’s The Intelligent Investor is widely regarded as the single most important investment book ever written. First published in 1949, the book has stood the test of time, influencing generations of investors, including Warren Buffett, who famously called it “by far the best book on investing ever written.” Graham, often hailed as the “father of value investing,” was a professor at Columbia Business School and a successful investor in his own right. His teachings form the bedrock of modern value investing, focusing on rational analysis, risk management, and the separation of investing from speculation.

Graham wrote The Intelligent Investor in the aftermath of the Great Depression and World War II—a period marked by economic uncertainty and volatile markets. The historical context is crucial: investors had seen fortunes made and lost in wild market swings, and Graham’s sober, methodical approach was a direct response to the speculative excesses that had led to financial disaster for many. Over the decades, the book has been updated with commentary by later financial writers, most notably Jason Zweig, who provides modern context and examples, ensuring its continued relevance for contemporary readers.

The central theme of the book is the distinction between investment and speculation. Graham defines investment as an operation that, upon thorough analysis, promises safety of principal and an adequate return. Anything else, he argues, is speculation. This core distinction underpins every concept and strategy in the book, from portfolio construction to security analysis and market behavior. Graham’s purpose is to arm readers with the intellectual tools and emotional discipline required to achieve long-term success in the stock market, regardless of prevailing trends or market sentiment.

The Intelligent Investor is considered a classic because it offers a timeless framework for thinking about investing—one that is rooted in rationality, discipline, and skepticism of market fads. Graham’s ideas about the “margin of safety,” the dangers of speculation, and the importance of understanding one’s own risk tolerance have become foundational principles for both individual and institutional investors. The book’s influence can be seen in the strategies of legendary investors such as Warren Buffett, Seth Klarman, and Joel Greenblatt, all of whom cite Graham as a key inspiration.

This book is essential reading for anyone serious about building wealth through the stock market. It is especially valuable for those who wish to avoid the pitfalls of emotional investing and market hype. Novices will find a comprehensive introduction to the principles of sound investing, while seasoned investors will appreciate Graham’s nuanced analysis and practical guidance. What sets The Intelligent Investor apart is its focus on the investor’s mindset—Graham insists that success comes not from predicting the market, but from cultivating the right habits, discipline, and temperament. In a world where financial advice is often short-term and speculative, Graham’s long-term, value-focused approach remains as relevant today as it was over seventy years ago.

Key Themes and Concepts

At its core, The Intelligent Investor is a book about discipline, rationality, and the enduring principles that separate successful investors from speculators. Graham’s writing is structured around several key themes that recur throughout the book, each building on the last to create a comprehensive philosophy of investing. These themes are not just theoretical concepts, but practical tools that readers can use to make better investment decisions, avoid common pitfalls, and achieve superior long-term results.

The book’s enduring value lies in its ability to tie together behavioral finance, risk management, and fundamental analysis into a coherent and actionable framework. Graham’s insights on market psychology, the dangers of speculation, and the necessity of a “margin of safety” are especially relevant in today’s fast-moving, information-saturated markets. The following are the most important themes that run through the book, each illustrated with examples from Graham’s text and real-world applications for investors.

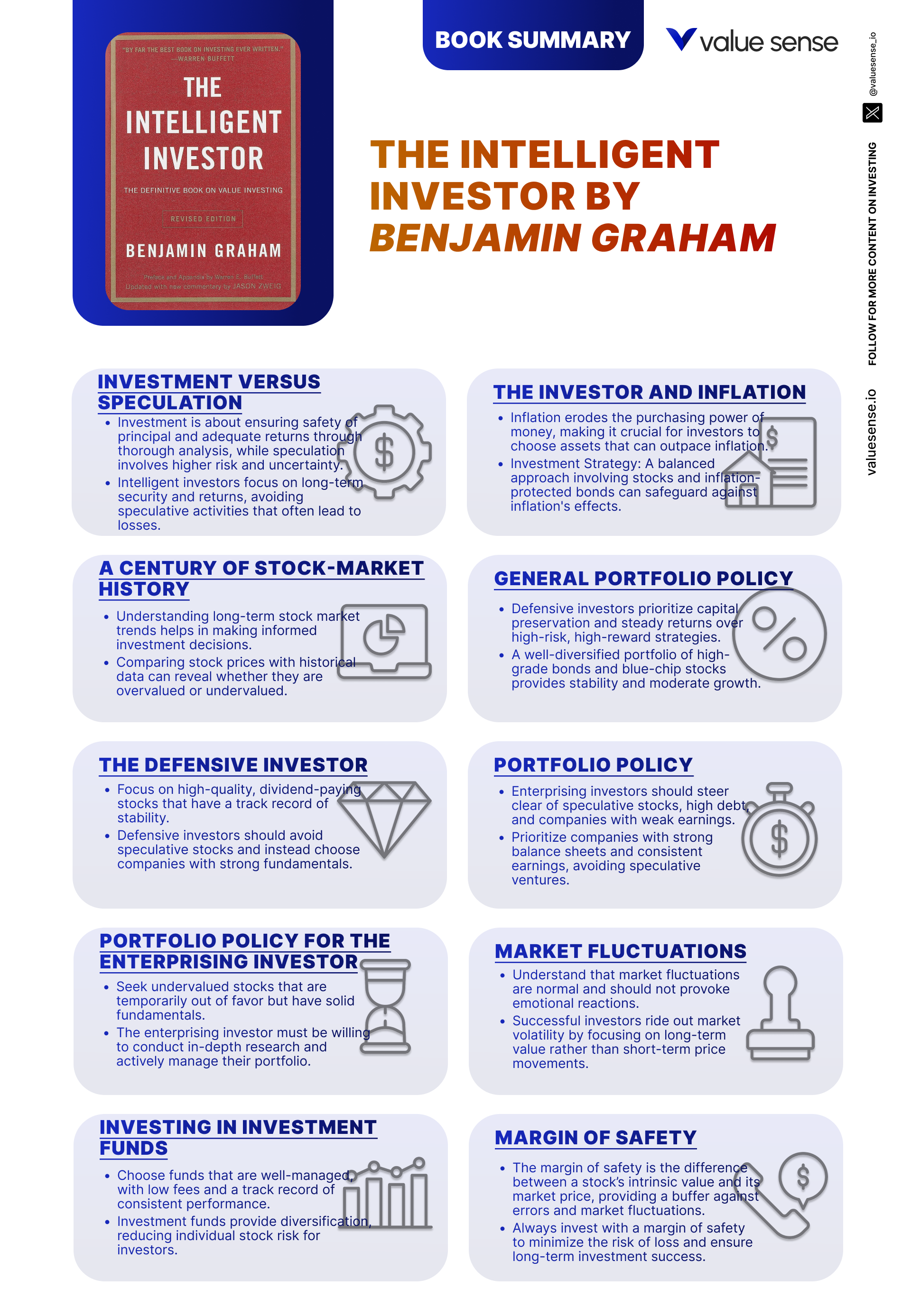

- Investment vs. Speculation: Graham’s most foundational theme is the clear distinction between investing and speculating. Investment, according to Graham, is an operation that, after thorough analysis, promises safety of principal and a satisfactory return. Speculation, on the other hand, is akin to gambling—relying on price movements and market sentiment rather than underlying value. This distinction is crucial throughout the book, as Graham warns investors to avoid the seductive allure of quick profits and instead focus on long-term wealth building. For example, he discusses how buying stocks based on rumors or short-term trends is speculative, while purchasing shares of fundamentally sound companies at a discount to intrinsic value is investing. Investors are urged to constantly ask themselves whether their actions are based on analysis or on hope and hype. This theme is especially relevant in bull markets, where speculation often masquerades as investment.

- Inflation and Investment Strategy: Another key theme is the impact of inflation on investment returns. Graham dedicates significant attention to how inflation erodes purchasing power, even when nominal returns appear satisfactory. He provides historical data showing periods of high inflation and how various asset classes—stocks, bonds, and cash—performed under such conditions. Graham’s analysis leads to practical advice: investors should not rely solely on fixed-income securities, as their real returns may be negative in inflationary environments. Instead, he advocates for a balanced approach that includes equities, which have historically offered better protection against inflation. This theme is especially pertinent today, as investors face renewed concerns about inflation and its impact on real returns.

- Defensive vs. Enterprising Investment: Graham recognizes that not all investors are the same. He divides them into two broad categories: defensive (or passive) investors and enterprising (or active) investors. Defensive investors prioritize safety and minimal effort, favoring diversified, low-maintenance portfolios of high-quality stocks and bonds. Enterprising investors, by contrast, are willing to devote time and effort to researching undervalued securities and are prepared to accept higher risk for potentially greater returns. Graham provides detailed strategies for both types, including specific stock selection criteria and portfolio allocation models. This bifurcation allows readers to tailor their approach based on their temperament, knowledge, and available time, making Graham’s advice accessible to a wide audience.

- Market Behavior and Investor Psychology: One of Graham’s most enduring contributions is his analysis of market behavior and the psychological traps that ensnare investors. Through the metaphor of “Mr. Market,” Graham illustrates how emotional swings in market sentiment can lead to irrational pricing. Investors are urged to view market fluctuations as opportunities rather than threats, and to avoid reacting impulsively to short-term volatility. Graham’s insights on behavioral finance were decades ahead of their time, anticipating later academic research on cognitive biases and herd behavior. By maintaining emotional discipline and a long-term perspective, investors can capitalize on the market’s irrationality rather than falling victim to it.

- Security Analysis: Graham provides a comprehensive framework for analyzing securities, emphasizing the importance of understanding a company’s financial health, earnings power, and intrinsic value. He teaches readers how to dissect financial statements, assess management quality, and compare companies within an industry. Security analysis is not just about crunching numbers—it’s about developing a skeptical, inquisitive mindset that seeks to uncover both risks and opportunities. Graham’s approach is methodical and conservative, focusing on tangible assets and demonstrated earning power rather than speculative projections. This theme is central to the book’s practical value, as it empowers investors to make informed decisions based on evidence rather than hype.

- Margin of Safety: Perhaps the most important theme in The Intelligent Investor is the concept of the “margin of safety.” Graham argues that the single most effective way to minimize investment risk is to purchase securities at a significant discount to their intrinsic value. This buffer protects investors from errors in analysis, unforeseen events, and market volatility. The margin of safety is not just a mathematical calculation—it’s a mindset that prioritizes caution and humility. Graham’s insistence on a margin of safety has become a cornerstone of value investing, adopted by countless successful investors as a guiding principle for risk management.

- Long-Term Perspective and Discipline: Throughout the book, Graham emphasizes the importance of patience, discipline, and a long-term outlook. He cautions against chasing short-term gains or reacting to market noise, advocating instead for a steady, systematic approach to investing. This theme is reinforced through historical examples and case studies, demonstrating that the most successful investors are those who stick to their principles even in the face of market euphoria or panic. Graham’s advice is timeless: true intelligence in investing is measured not by IQ or technical skill, but by temperament and self-control.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Book Structure: Major Sections

Part 1: Foundations of Investment

This opening section, encompassing chapters 1 through 3, establishes the bedrock principles that underpin Graham’s entire philosophy. Here, Graham draws a sharp line between investment and speculation, explores the corrosive effects of inflation, and provides a historical overview of stock-market trends. These chapters are unified by their focus on helping investors build a rational, evidence-based foundation for all future decisions.

Graham begins by defining investment as a process that requires thorough analysis, safety of principal, and an adequate return. He warns that speculation, while sometimes profitable in the short term, is inherently risky and often leads to losses. The discussion of inflation is particularly prescient—Graham warns that even “safe” investments like bonds can lose value in real terms when inflation is high. He supports his arguments with historical data, showing how different asset classes have performed through various economic cycles. The section closes by examining long-term stock-market trends, cautioning against extrapolating past returns into the future without considering changing economic realities.

For investors, the practical takeaway is the necessity of clear definitions and realistic expectations. Graham’s insistence on separating speculation from investment is a powerful tool for avoiding common mistakes, such as chasing hot stocks or underestimating inflation risk. By grounding investment decisions in historical data and rational analysis, readers can develop strategies that are robust to a wide range of future scenarios.

Even today, the lessons from this section are highly relevant. In a world of meme stocks, cryptocurrencies, and rapid-fire trading, the temptation to speculate is ever-present. Graham’s advice to focus on fundamentals, account for inflation, and maintain a long-term perspective is just as valuable now as it was in the post-war era. This section provides the intellectual toolkit that modern investors need to navigate uncertain markets with confidence.

Part 2: Investment Strategies for Different Investors

Chapters 4 through 7 are devoted to tailoring investment strategies to the needs and abilities of different types of investors. Graham distinguishes between the defensive (or passive) investor, who seeks safety and minimal effort, and the enterprising (or active) investor, who is willing to devote time and energy to uncovering undervalued opportunities. This section is unified by its practical focus on portfolio construction, stock selection, and risk management.

Graham provides detailed portfolio policies for both investor types. Defensive investors are advised to maintain a balanced allocation between high-grade bonds and stocks, emphasizing diversification and low turnover. Enterprising investors, on the other hand, are encouraged to seek out neglected or undervalued securities, but only if they are willing to do the requisite research. Graham offers specific screening criteria, such as minimum earnings histories, dividend records, and financial strength. He also discusses the psychological challenges of each approach, warning that even enterprising investors must avoid the siren song of speculation.

The key practical insight is the importance of aligning one’s investment strategy with one’s temperament, skills, and available time. Graham’s frameworks allow investors to choose a path that suits their individual circumstances, reducing the risk of emotional mistakes. By following clear, rules-based strategies, both defensive and enterprising investors can achieve satisfactory results without succumbing to market hype or fear.

In the modern era, this section remains highly applicable. The proliferation of index funds and robo-advisors has made passive investing more accessible than ever, while advances in data and technology have empowered enterprising investors to conduct sophisticated analyses. Graham’s emphasis on self-knowledge and discipline is a crucial antidote to the “one-size-fits-all” advice often found in financial media. Investors who tailor their strategies to their unique situation are far more likely to achieve their goals.

Part 3: Market Behavior and Investor Psychology

This section, covering chapters 8 through 10, delves into the behavioral side of investing. Graham explores how market fluctuations, mutual fund performance, and the influence of investment advisers shape investor outcomes. The unifying theme is the need for emotional discipline and rational decision-making in the face of unpredictable markets.

The famous “Mr. Market” metaphor is introduced here, personifying the stock market as a manic-depressive partner who offers to buy or sell shares at wildly fluctuating prices. Graham urges investors to treat market prices as opportunities rather than guides to value. He also analyzes the track record of investment funds, showing that most fail to outperform the market over time. The section concludes by discussing the role of advisers, emphasizing the importance of independent thinking and skepticism.

For investors, the practical application is clear: emotional reactions to market swings are the enemy of long-term success. By viewing volatility as a source of opportunity rather than risk, investors can buy when prices are low and sell when they are high. Graham’s advice to focus on intrinsic value, rather than market sentiment, provides a roadmap for navigating turbulent markets with confidence.

These lessons are more relevant than ever in today’s environment of 24/7 news cycles, social media-driven panic, and algorithmic trading. The psychological traps identified by Graham—herding, overconfidence, loss aversion—are amplified by modern technology. Investors who internalize Graham’s teachings on market behavior are better equipped to resist these pressures and make rational, profitable decisions.

Part 4: Security Analysis and Stock Selection

Chapters 11 through 15 form the analytical heart of the book, providing a detailed guide to evaluating securities and selecting stocks. This section is unified by its focus on evidence-based analysis, financial statement scrutiny, and systematic comparison of companies. Graham moves from general principles to specific criteria, offering a toolkit for both defensive and enterprising investors.

Graham teaches readers how to analyze income statements, balance sheets, and cash flow statements to assess a company’s financial health. He emphasizes the importance of stable earnings, conservative accounting, and prudent management. For stock selection, Graham provides clear benchmarks: minimum size, consistent dividends, moderate price-to-earnings ratios, and strong financial positions. He also discusses the pitfalls of relying on projections or chasing “growth stocks” without adequate margin of safety.

Practically, this section empowers investors to make informed decisions based on hard data rather than narratives or trends. By following Graham’s criteria and performing rigorous analysis, investors can avoid common traps such as overpaying for glamour stocks or ignoring hidden risks. The focus on fundamentals helps ensure that portfolios are built on solid ground.

In today’s data-rich environment, Graham’s approach remains indispensable. While modern tools have made financial analysis more accessible, they have also increased the temptation to rely on shortcuts or “black box” models. Graham’s insistence on transparency, skepticism, and independent analysis is a timeless antidote to these risks. Investors who master these techniques are well-positioned to uncover value where others see only noise.

Part 5: Advanced Investment Concepts

The final section, spanning chapters 16 through 20, delves into more sophisticated topics such as convertible securities, instructive case studies, dividend policy, and the central concept of margin of safety. These chapters are unified by their focus on risk management, critical thinking, and the application of Graham’s principles to real-world situations.

Graham explains the complexities of convertible issues and warrants, highlighting both their potential and their dangers. He presents detailed case studies of actual investments, illustrating the application of his analytical framework. The discussion of dividend policy and shareholder management provides a nuanced view of how companies allocate capital and reward investors. The section culminates with a deep exploration of the margin of safety—a buffer between price and value that protects against errors and unforeseen events.

For investors, the practical takeaway is the necessity of building portfolios that are resilient to uncertainty. Graham’s advanced concepts encourage readers to look beyond surface-level metrics and consider the full range of risks and opportunities. The margin of safety, in particular, is a powerful tool for ensuring that investments remain sound even when conditions change.

These advanced lessons are highly relevant in today’s complex financial landscape. Convertible bonds, options, and other hybrid securities are more prevalent than ever, and the need for rigorous analysis has only increased. Graham’s emphasis on case studies and real-world examples provides a blueprint for navigating new challenges while staying true to timeless principles. The margin of safety remains the ultimate safeguard for investors seeking to build durable, long-term wealth.

Deep Dive: Essential Chapters

Chapter 1: Investment versus Speculation: Results to Be Expected by the Intelligent Investor

This opening chapter is critically important because it frames the entire book around the fundamental distinction between investment and speculation. Graham argues that most market participants fail not because of a lack of intelligence, but because they do not understand this distinction. He defines an investment operation as one which, upon thorough analysis, promises safety of principal and an adequate return. Anything else is speculation. Graham’s clarity on this point is striking, and it sets the tone for the disciplined approach that follows in the rest of the book.

Graham provides examples of how speculation can masquerade as investment, especially during market booms. He cites the 1929 stock market crash as a cautionary tale, where many “investors” were in fact speculators who ignored fundamental analysis. He reinforces his point with the famous quote: “The essence of investment management is the management of risks, not the management of returns.” The chapter includes data showing that, over the long term, disciplined investors who focus on safety and adequate return outperform those who chase quick profits. Graham also discusses the psychological pitfalls that lead even knowledgeable investors to speculate, such as overconfidence and herd behavior.

For investors, the actionable lesson is to rigorously evaluate every investment decision using Graham’s three criteria: thorough analysis, safety of principal, and adequate return. This means resisting the temptation to chase hot stocks or market trends without a solid analytical basis. Investors should develop checklists or investment policies that force them to articulate their rationale for each purchase, ensuring that speculation is kept in check. This approach not only reduces risk but also improves long-term performance by avoiding costly mistakes.

Historically, the distinction between investment and speculation has never been more relevant. The dot-com bubble, the housing crisis, and the recent surge in meme stocks all illustrate the dangers of blurring these lines. Modern investors face new forms of speculation, from cryptocurrencies to leveraged ETFs, but Graham’s core message endures: true investing is grounded in analysis, discipline, and a commitment to safety. By internalizing this lesson, investors can avoid the fate of those who confuse luck with skill and speculation with sound judgment.

Chapter 2: The Investor and Inflation

This chapter is essential because it addresses one of the most persistent threats to investment returns: inflation. Graham explains that inflation erodes the real value of money, meaning that even investments with seemingly attractive nominal returns can result in a loss of purchasing power. He supports this argument with historical data, showing how periods of high inflation have decimated the real returns of bonds and cash equivalents.

Graham provides detailed examples of how different asset classes perform under inflationary pressure. He notes that while stocks are not immune to inflation risk, they have historically offered better protection than fixed-income securities. The chapter includes data from the 1940s and 1950s, demonstrating that investors who relied solely on bonds saw their real wealth decline, while those who held a mix of stocks and bonds fared better. Graham also discusses the limitations of “hedges” such as gold and real estate, cautioning that no asset is a perfect shield against inflation.

For investors, the practical takeaway is the importance of building portfolios that are robust to inflation. This means including a mix of asset classes, with a significant allocation to equities. Investors should also regularly review their portfolios to ensure that their real returns (after inflation) are positive. Graham recommends monitoring inflation trends and adjusting allocations accordingly, rather than relying on static models or historical averages.

The lessons from this chapter are especially relevant today, as inflation concerns have resurfaced in global markets. The recent surge in consumer prices has reminded investors that inflation is not a relic of the past. Graham’s advice to focus on real returns, diversify across asset classes, and remain vigilant against inflation risk is as timely now as it was in the mid-twentieth century. Investors who ignore inflation do so at their peril; those who heed Graham’s warnings are better positioned to preserve and grow their wealth over time.

Chapter 4: General Portfolio Policy: The Defensive Investor

This chapter is critically important because it provides a blueprint for investors who prioritize safety and simplicity. Graham recognizes that not everyone has the time, skill, or temperament to actively manage their investments. For these defensive investors, he outlines a set of rules designed to minimize risk and effort while still achieving satisfactory returns.

Graham recommends a balanced portfolio consisting of high-grade bonds and quality stocks, with the allocation between the two adjusted based on market conditions and personal risk tolerance. He emphasizes the importance of diversification, suggesting that investors hold at least 10 to 30 stocks to reduce the impact of any single failure. The chapter includes specific criteria for selecting both bonds and stocks, such as minimum credit ratings, earnings histories, and dividend records. Graham also warns against frequent trading, advocating a low-turnover, buy-and-hold approach.

For investors, the actionable steps are clear: construct a diversified portfolio of high-quality assets, avoid speculative securities, and rebalance periodically to maintain the desired allocation. Defensive investors should focus on minimizing costs and taxes by limiting trading activity. Graham’s advice is to “keep it simple”—by following a rules-based approach, investors can avoid the emotional pitfalls that often lead to poor decisions.

The defensive strategy outlined in this chapter has stood the test of time. Index funds and ETFs have made it easier than ever to implement Graham’s recommendations, allowing investors to achieve broad diversification at low cost. The recent popularity of passive investing is a testament to the enduring wisdom of Graham’s approach. By prioritizing safety, simplicity, and discipline, defensive investors can achieve their financial goals without unnecessary stress or risk.

Chapter 8: The Investor and Market Fluctuations

Chapter 8 is one of the most famous in the entire book, introducing the “Mr. Market” allegory—a powerful metaphor for understanding market psychology and volatility. Graham’s insights in this chapter are foundational for anyone seeking to navigate the emotional rollercoaster of investing.

Graham describes Mr. Market as a business partner who offers to buy or sell shares at different prices every day, often driven by mood swings rather than rational analysis. He illustrates how investors can use Mr. Market’s irrationality to their advantage, buying when prices are low and selling when they are high. The chapter includes vivid examples of market bubbles and crashes, showing how fear and greed can drive prices far from intrinsic value. Graham also discusses the dangers of trying to “time the market,” emphasizing the futility of predicting short-term price movements.

For investors, the key lesson is to treat market prices as opportunities, not as guides to value. Graham advises maintaining a shopping list of companies with known intrinsic values and acting only when Mr. Market offers prices that are significantly below those values. Investors should cultivate emotional detachment, viewing volatility as a source of opportunity rather than a cause for panic. This disciplined approach allows investors to buy low and sell high, rather than the reverse.

The Mr. Market metaphor has become a cornerstone of value investing, cited by Warren Buffett and countless others. Its relevance has only increased in the age of algorithmic trading, social media-driven panics, and high-frequency volatility. By internalizing Graham’s advice, investors can avoid the herd mentality that leads to buying at the top and selling at the bottom. The ability to remain calm and rational in the face of market swings is perhaps the single greatest advantage an investor can possess.

Chapter 11: Security Analysis for the Lay Investor: General Approach

This chapter is essential because it demystifies the process of security analysis for non-professional investors. Graham provides a framework that allows ordinary investors to evaluate the financial health and prospects of companies without relying on Wall Street experts or complex models.

Graham outlines a step-by-step approach to analyzing financial statements, focusing on key metrics such as earnings stability, dividend history, and balance sheet strength. He provides examples of how to read income statements and balance sheets, highlighting red flags such as inconsistent earnings or excessive debt. The chapter includes sample calculations and checklists, making the process accessible to readers with limited financial backgrounds. Graham also stresses the importance of independent thinking, warning against blindly following analyst recommendations or market consensus.

For investors, the practical application is to develop a systematic process for evaluating potential investments. This means gathering financial statements, calculating key ratios, and comparing companies within the same industry. Graham recommends looking for companies with a long history of profitability, conservative accounting practices, and strong balance sheets. By following this approach, investors can identify undervalued opportunities and avoid companies with hidden risks.

The democratization of financial information has made Graham’s advice more relevant than ever. Today, investors have access to a wealth of data and tools that make security analysis easier and more effective. However, the temptation to rely on shortcuts or “hot tips” remains strong. By mastering the basics of security analysis, investors can make informed decisions that are grounded in evidence rather than hype. Graham’s framework remains a powerful tool for building a resilient, high-quality portfolio.

---

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

---

Chapter 14: Stock Selection for the Defensive Investor

This chapter is crucial because it translates Graham’s principles into concrete criteria for stock selection. Recognizing that defensive investors seek safety and stability above all, Graham provides a detailed checklist of attributes that suitable stocks should possess.

Graham’s criteria include minimum size (measured by revenues or assets), a long record of uninterrupted dividends (at least 20 years), stable earnings growth, a moderate price-to-earnings ratio (no more than 15), and a price-to-assets ratio (no more than 1.5 times book value). He supports these guidelines with historical examples, showing that companies meeting these standards have consistently delivered satisfactory returns with lower risk. The chapter includes tables comparing the performance of stocks that meet these criteria versus the broader market, reinforcing the value of a disciplined, rules-based approach.

For investors, the actionable steps are to use Graham’s checklist as a screening tool when building a portfolio. This means focusing on large, established companies with a proven track record of profitability and dividend payments. Investors should avoid companies with erratic earnings, high valuations, or speculative business models. By sticking to these criteria, defensive investors can reduce the risk of permanent capital loss and achieve steady, long-term growth.

Graham’s stock selection framework has influenced generations of investors and is the foundation of many modern index funds and value-oriented ETFs. The focus on quality, stability, and reasonable valuation remains a powerful antidote to the speculative excesses that often dominate financial markets. In an era of rapid innovation and disruption, Graham’s emphasis on fundamentals provides a much-needed anchor for investors seeking to build durable wealth.

Chapter 15: Stock Selection for the Enterprising Investor

This chapter is significant because it addresses the needs of investors who are willing to put in extra effort to achieve above-average returns. Graham recognizes that not everyone is content with a purely defensive approach, and he provides a roadmap for enterprising investors seeking to uncover undervalued opportunities.

Graham outlines several strategies for identifying attractive stocks, including searching for companies with low price-to-earnings or price-to-book ratios, temporary setbacks, or neglected industries. He provides examples of “special situations,” such as mergers, liquidations, or spin-offs, where careful analysis can yield significant profits. The chapter includes case studies of successful enterprising investments, demonstrating the importance of thorough research and patience. Graham also warns that enterprising investing is not for everyone—it requires discipline, skepticism, and a willingness to go against the crowd.

For investors, the practical steps involve developing a screening process to identify potential bargains, conducting deep-dive analysis to assess intrinsic value, and being prepared to act when opportunities arise. Enterprising investors should maintain a watchlist of candidates, monitor news and filings for catalysts, and be patient in waiting for prices to reach attractive levels. Graham stresses the importance of diversification and risk management, even for aggressive investors.

The enterprising approach has inspired many of the world’s top investors, from Warren Buffett to Joel Greenblatt. In today’s market, where information is abundant but true insight is rare, Graham’s emphasis on independent analysis and contrarian thinking is more valuable than ever. Enterprising investors who follow Graham’s principles can achieve superior returns while avoiding the pitfalls of speculation and herd behavior.

Chapter 20: “Margin of Safety” as the Central Concept of Investment

The final chapter is perhaps the most important in the entire book, introducing the concept of the “margin of safety”—the bedrock principle of value investing. Graham argues that the single most effective way to minimize risk is to buy securities at prices significantly below their intrinsic value, creating a buffer against errors, bad luck, or unforeseen events.

Graham illustrates the margin of safety with examples from both stocks and bonds, showing how a discount to intrinsic value protects investors from downside risk. He discusses the limitations of forecasts and the inevitability of mistakes, emphasizing that no analysis is perfect. The chapter includes historical case studies where a margin of safety prevented significant losses, as well as examples where its absence led to disaster. Graham’s writing is both practical and philosophical, urging readers to adopt a mindset of humility and caution.

For investors, the actionable takeaway is to always demand a margin of safety when making investment decisions. This means being conservative in estimating intrinsic value, insisting on a significant discount to that value before buying, and avoiding situations where the downside risk is high. Graham recommends using checklists, valuation models, and scenario analysis to quantify the margin of safety and ensure that it is adequate.

The margin of safety has become the defining principle of value investing, cited by Warren Buffett as the “three most important words in investing.” Its relevance has only increased in today’s uncertain and rapidly changing markets. By insisting on a margin of safety, investors can protect themselves from the inevitable errors and surprises that come with investing. This principle is the ultimate safeguard for building long-term wealth and avoiding catastrophic losses.

Practical Investment Strategies

- 1. Establish a Clear Investment Policy Statement: Begin by writing a personal investment policy statement that outlines your objectives, risk tolerance, time horizon, and preferred investment approach (defensive or enterprising). This document should serve as your north star, helping you avoid impulsive decisions. Specify your target allocation between stocks and bonds, your criteria for stock selection, and your rebalancing schedule. Review and update this statement annually or whenever your circumstances change. By formalizing your strategy, you reduce the risk of emotional or speculative actions that can derail your long-term goals.

- 2. Implement Strategic Asset Allocation: Use Graham’s recommended allocation as a starting point—typically 50% stocks and 50% bonds for defensive investors, with flexibility to adjust within a 25%-75% range based on market conditions. For enterprising investors, consider a higher equity allocation with a portion in undervalued or special situation stocks. Use tools such as the Value Sense stock screener to identify suitable securities. Rebalance your portfolio at least once a year to maintain your target allocation, selling assets that have appreciated and buying those that have lagged. This disciplined approach enforces buy-low, sell-high behavior and manages risk.

- 3. Apply Graham’s Stock Selection Criteria: Screen for companies that meet Graham’s defensive criteria: large size (e.g., revenues above $500 million), at least 20 years of uninterrupted dividends, stable earnings growth, a price-to-earnings ratio below 15, and a price-to-book ratio below 1.5. For enterprising investors, look for stocks with low price-to-earnings and price-to-book ratios, temporary setbacks, or those in neglected industries. Use financial data platforms to filter and compare candidates. Document your analysis for each company, focusing on fundamentals rather than hype or projections.

- 4. Maintain Diversification and Limit Position Sizes: Hold a minimum of 10-30 stocks across different industries to reduce company-specific risk. Limit any single position to no more than 10% of your total portfolio. For bonds, diversify across issuers and maturities. Diversification is your first line of defense against unexpected events and ensures that no single mistake can destroy your portfolio. Use sector and style diversification as well, balancing growth and value exposures as appropriate.

- 5. Insist on a Margin of Safety: Before making any investment, estimate the intrinsic value of the security using conservative assumptions. Only buy when the market price is at least 25-30% below your estimate of value, providing a cushion against analytical errors or adverse developments. For bonds, ensure that the issuer’s financial strength is sufficient to weather downturns. The margin of safety is not optional—it is essential to long-term success and risk management.

- 6. Avoid Market Timing and Emotional Decisions: Commit to a regular investment schedule, such as monthly or quarterly contributions, regardless of market conditions. Use dollar-cost averaging to reduce the impact of volatility. Avoid trying to predict short-term market movements or reacting to news headlines. Instead, focus on your process and the underlying value of your holdings. Keep a journal of your investment decisions to identify emotional triggers and improve your discipline over time.

- 7. Review and Rebalance Regularly: Set a schedule to review your portfolio at least annually, checking for changes in fundamentals, valuation, and alignment with your investment policy. Rebalance back to your target allocation, trimming positions that have become overweight and adding to those that are underweight. This disciplined process enforces buy-low, sell-high behavior and keeps your risk profile in check. Use portfolio tracking software to automate alerts and facilitate rebalancing.

- 8. Continually Educate Yourself and Adapt: Stay informed about market trends, economic developments, and changes in accounting standards. Read annual reports, listen to earnings calls, and follow reputable investment publications. Periodically revisit Graham’s principles and compare your performance to relevant benchmarks. Seek feedback from mentors or investment groups. The market is always evolving, and continuous learning is essential for long-term success.

Modern Applications and Relevance

Despite being published over seventy years ago, The Intelligent Investor remains profoundly relevant in today’s rapidly evolving financial markets. Many of Graham’s core principles—such as the distinction between investment and speculation, the necessity of a margin of safety, and the importance of emotional discipline—have only grown more important as markets have become more complex and information flows have accelerated.

One of the key ways the book’s principles apply today is in the context of index investing and the proliferation of passive funds. Graham’s advice to defensive investors to diversify broadly and avoid excessive trading is echoed in the rise of low-cost index funds and ETFs, which provide instant diversification and low turnover. The widespread adoption of these vehicles is a testament to the enduring wisdom of Graham’s approach to risk management and simplicity.

However, the financial landscape has also changed in significant ways since Graham’s time. The rise of high-frequency trading, algorithmic strategies, and globalized markets has increased volatility and created new forms of risk. Behavioral finance research has confirmed many of Graham’s insights into investor psychology, but it has also revealed new cognitive biases and emotional traps. Social media and real-time news have amplified herd behavior, making emotional discipline more challenging than ever.

What remains timeless is Graham’s insistence on process over prediction. His framework for security analysis, focus on intrinsic value, and demand for a margin of safety are as applicable to today’s tech giants as they were to the industrial companies of the 1950s. Modern value investors like Warren Buffett, Seth Klarman, and Howard Marks have adapted Graham’s principles to new industries and asset classes, but the underlying philosophy has not changed. The best investors are still those who combine analytical rigor with emotional resilience and a long-term perspective.

To adapt Graham’s classic advice to current conditions, investors should leverage modern tools—such as advanced screeners, data analytics, and automated rebalancing—while remaining anchored in the timeless principles of value, discipline, and risk management. The temptation to speculate is greater than ever, but so too are the resources available for thoughtful, evidence-based investing. By marrying Graham’s wisdom with modern technology, investors can navigate today’s markets with confidence and achieve lasting success.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Implementation Guide

- Define Your Investor Profile: Start by assessing your risk tolerance, time commitment, and investment objectives. Decide whether you are a defensive (passive) or enterprising (active) investor. This foundational step determines your strategy, asset allocation, and the level of involvement required. Use questionnaires or online tools to clarify your profile, and write down your answers to revisit them annually.

- Develop a Written Investment Policy: Draft a personal investment policy statement that outlines your target asset allocation (e.g., 50% stocks, 50% bonds), selection criteria (such as Graham’s defensive or enterprising filters), and rebalancing schedule (e.g., annually or when allocations drift by more than 5%). Set clear rules for when to buy, hold, or sell, and specify your process for reviewing investment decisions. This document serves as your strategic anchor, especially during periods of market stress.

- Construct Your Portfolio: Using your policy statement, select a diversified mix of stocks and bonds. For defensive investors, choose broad-based index funds or ETFs that meet Graham’s criteria for quality and stability. For enterprising investors, use screeners to identify undervalued stocks, and conduct detailed fundamental analysis before investing. Allocate no more than 10% of your portfolio to any single security, and diversify across sectors and industries to mitigate risk.

- Implement a Regular Review and Rebalancing Process: Schedule portfolio reviews at least once per year (or quarterly for enterprising investors). Assess each holding against your original criteria, and rebalance your allocations to maintain your desired risk profile. Trim positions that have grown too large or no longer meet your standards, and add to those that are undervalued or underweight. Document your decisions and the rationale behind them to improve your process over time.

- Commit to Ongoing Education and Process Improvement: Stay current on market trends, read financial news, and revisit classic texts like The Intelligent Investor. Attend seminars, participate in investment forums, and consider joining a local or online investment club. Periodically update your investment policy to reflect new insights or changes in your financial situation. Use performance tracking tools to evaluate your results against benchmarks and identify areas for improvement.

--- ---

10+ Free intrinsic value tools

For investors looking to find a stock's fair value, our analytics team has you covered with intrinsic value tools:

📍 Free Intrinsic Value Calculator

📍 Reverse DCF & DCF value tools

📍 Peter Lynch Fair Value Calculator

📍 Ben Graham Fair Value Calculator

📍 Relative Value tool

...and plenty more.

🔍 Explore all these tools for free on the Value Sense platform and start discovering what your favorite stocks are really worth.

FAQ: Common Questions About The Intelligent Investor

1. What is the main difference between investment and speculation according to Graham?

Graham defines investment as an operation that, after thorough analysis, promises safety of principal and an adequate return. Speculation, by contrast, involves betting on price movements without sufficient analysis or regard for risk. The main difference lies in the investor’s process and mindset—investors focus on value and safety, while speculators focus on price and hope for quick gains. Graham insists that recognizing and respecting this distinction is the foundation of long-term success in the market.

2. How does Graham recommend dealing with inflation risk?

Graham emphasizes that inflation can erode real returns, even when nominal returns seem attractive. He recommends diversifying across asset classes, with a significant allocation to equities, which historically have offered better protection against inflation than bonds or cash. Graham also advises investors to regularly review their portfolios and adjust allocations based on inflation trends, rather than relying on static models. Monitoring real (inflation-adjusted) returns is key to preserving purchasing power over time.

3. What is the “margin of safety” and why is it important?

The margin of safety is the principle of buying securities at a significant discount to their intrinsic value. This buffer protects investors from errors in analysis, unforeseen events, or adverse market conditions. Graham considers it the single most important concept in investing, as it reduces the risk of permanent capital loss and increases the likelihood of satisfactory long-term returns. A margin of safety is essential for managing uncertainty and building a resilient portfolio.

4. Can Graham’s principles be applied to modern markets and new asset classes?

Yes, Graham’s core principles—thorough analysis, focus on intrinsic value, diversification, and margin of safety—are timeless and can be adapted to modern markets, including new asset classes like ETFs, REITs, and even cryptocurrencies. The tools and data available to investors have evolved, but the need for discipline, skepticism, and a long-term perspective remains unchanged. Successful investors continue to use Graham’s framework as a foundation, regardless of market innovations.

5. How should a beginner start implementing Graham’s advice?

Beginners should start by reading The Intelligent Investor in full, then define their investor profile (defensive or enterprising) and write an investment policy statement. They should focus on diversified, low-cost index funds or ETFs for safety and simplicity, and gradually learn the basics of security analysis. Regular reviews, disciplined rebalancing, and a commitment to ongoing education will help new investors build confidence and avoid common mistakes. Graham’s advice is to start slowly, stay patient, and always prioritize safety over speculation.