The Little Book of Alternative Investments by Ben Stein, Phil DeMuth

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Book Overview

Ben Stein and Phil DeMuth’s “The Little Book of Alternative Investments” is a comprehensive guide that demystifies the often misunderstood world of alternative investments. Ben Stein, renowned for his multifaceted career as an economist, lawyer, and commentator, brings a unique blend of wit and financial acumen to the subject. Phil DeMuth, a respected investment advisor and author, complements Stein’s approach with deep practical experience in portfolio management and financial planning. Together, they provide readers with a balanced and accessible exploration of alternatives beyond the traditional stock and bond mix, drawing from decades of real-world experience and research.

The book’s main theme revolves around the limitations of conventional 60/40 portfolios and the necessity of diversifying with assets that behave differently from stocks and bonds. Stein and DeMuth meticulously dissect a variety of alternative investments—ranging from collectibles and commodities to hedge funds and private equity—explaining their benefits, risks, and appropriate role within a portfolio. Their purpose is clear: empower investors to achieve better risk-adjusted returns and greater portfolio resilience, especially during turbulent market conditions. The authors challenge the dogma of efficient markets and encourage readers to think critically about diversification, risk, and the true drivers of long-term wealth.

“The Little Book of Alternative Investments” is particularly valuable for individual investors, financial advisors, and anyone seeking to future-proof their portfolio against unforeseen shocks. The book is suitable for both novices and experienced investors, as it avoids jargon, provides practical examples, and offers actionable guidance. It’s especially relevant for those who have felt the sting of market downturns and are eager to explore options that can mitigate volatility and smooth out returns over time. The authors’ pragmatic approach helps readers avoid common pitfalls and focus on strategies that genuinely add value rather than chasing fads or opaque products.

What sets this book apart is its candid assessment of both the promise and perils of alternative investments. Stein and DeMuth do not blindly advocate for every non-traditional asset; instead, they critically evaluate each category, highlighting where investors are likely to benefit and where caution is warranted. Their blend of humor, clear explanations, and real-world anecdotes makes complex topics approachable. The book’s structure—moving from foundational concepts to specific asset classes and implementation strategies—ensures that readers come away with a holistic understanding of how to intelligently incorporate alternatives into their investment approach.

Key Concepts and Ideas

At the heart of “The Little Book of Alternative Investments” is a philosophy that challenges the status quo of investing. Stein and DeMuth believe that true diversification goes well beyond the traditional allocation of stocks and bonds. They argue that the financial landscape has evolved, and so too must our investment strategies. By integrating assets with low correlation to the broader market, investors can reduce risk, improve returns, and build portfolios that are more resilient in the face of economic shocks and market downturns.

The authors systematically break down the universe of alternative investments, explaining their characteristics, roles, and the conditions under which they can enhance portfolio performance. They stress the importance of critical thinking, due diligence, and a disciplined approach—reminding readers that not all alternatives are created equal, and that some may introduce more risk than reward. The book’s practical tone is reinforced with examples, data, and clear frameworks for evaluating each type of alternative asset.

- Beyond the 60/40 Portfolio: Stein and DeMuth highlight the limitations of the classic 60% stocks/40% bonds mix, especially in environments of low yields or market crises. They advocate for a broader toolkit that incorporates alternatives to reduce reliance on any single asset class.

- Correlation and Diversification: The book emphasizes that true diversification is achieved by adding assets with low or negative correlation to stocks and bonds. Examples include real estate, commodities, and certain hedge fund strategies, which can move independently of equity and fixed-income markets.

- Efficient Market Theory (EMT) Skepticism: While acknowledging the merits of EMT, the authors point out its real-world limitations. They explain how market inefficiencies—such as the small-cap effect and value premium—can be systematically exploited through alternative strategies.

- Risk Management: Alternatives are presented not just as return enhancers but as risk mitigators. The authors show how commodities can hedge inflation, real estate can provide steady income, and market-neutral hedge funds can reduce portfolio volatility.

- Liquidity and Transparency: Stein and DeMuth caution that many alternatives (like private equity and collectibles) are illiquid and opaque. Investors must weigh the trade-off between potential return and the ability to access or value their investments.

- Fees and Complexity: The book is critical of high-fee, complex products that often fail to deliver on their promises. The authors urge investors to favor simplicity, transparency, and low costs—pointing out how fees can erode returns over time.

- Collectibles and Personal Enjoyment: Collectibles (art, coins, rare items) are discussed as speculative and illiquid, best pursued for personal satisfaction rather than as core investments. Expertise is essential, and only a small allocation is advised.

- Commodities and Real Estate as “Conventional” Alternatives: These asset classes are explored in depth for their inflation-hedging and diversification benefits, but also for their volatility and unique risks. The book provides actionable frameworks for including them in a portfolio.

- Hedge Funds and “Ultimate” Alternatives: The authors demystify hedge fund strategies, explaining long/short equity, global macro, and event-driven approaches. They highlight the importance of manager skill, due diligence, and the risks of high fees and lack of transparency.

- Practical Implementation: The final chapters focus on how to size allocations, monitor and rebalance portfolios, and avoid overexposure to high-risk alternatives. The importance of ongoing education, discipline, and alignment with personal goals is underscored throughout.

Practical Strategies for Investors

Applying the teachings from “The Little Book of Alternative Investments” requires a thoughtful, step-by-step approach. Stein and DeMuth provide practical frameworks and guidelines to help investors avoid common mistakes and maximize the benefits of alternatives. The goal is not to chase exotic assets for the sake of novelty, but to construct a portfolio that is robust, resilient, and aligned with one’s risk tolerance and financial objectives.

The authors repeatedly stress that alternatives are not a panacea; they must be integrated judiciously, with a clear understanding of their risks, costs, and role within the broader portfolio. Investors are encouraged to focus on transparency, simplicity, and ongoing education, rather than being lured by marketing hype or promises of outsized returns. The following strategies distill the book’s most actionable recommendations.

- Assess Your Current Portfolio’s Diversification: Begin by analyzing your existing asset allocation. Use correlation matrices to determine how much your portfolio relies on equities and bonds. Identify gaps where alternatives could improve diversification.

- Start Small with Alternatives: Allocate a modest portion (5-15%) of your portfolio to alternatives like REITs, commodities, or market-neutral funds. This allows you to gain exposure and experience without taking excessive risk.

- Focus on Low-Correlation Assets: Prioritize adding assets that have historically shown low or negative correlation to your core holdings. For example, consider gold ETFs, real estate funds, or managed futures products.

- Beware of High Fees and Complexity: Avoid alternative investments with opaque structures, high fees, or limited transparency. Use expense ratios, performance histories, and manager track records to vet your options.

- Use REITs and Commodity Funds for Accessibility: Instead of direct property or physical commodities, use liquid vehicles like REITs and commodity ETFs to gain exposure while maintaining liquidity and diversification.

- Monitor and Rebalance Regularly: Set a schedule (quarterly or annually) to review your portfolio’s allocation to alternatives. Rebalance as needed to maintain your target risk profile and adapt to changing market conditions.

- Educate Yourself Continuously: Stay informed about new products, regulatory changes, and evolving best practices in alternative investing. Leverage resources like Value Sense for ongoing research and analysis.

- Align Alternatives with Your Financial Goals: Ensure that each alternative investment serves a specific purpose—whether it’s hedging inflation, generating income, or reducing volatility. Avoid adding alternatives simply for the sake of diversification if they don’t fit your objectives.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Chapter-by-Chapter Insights

“The Little Book of Alternative Investments” is meticulously structured, guiding readers from foundational concepts through increasingly complex and nuanced topics. Each chapter builds upon the last, introducing new asset classes, strategies, and practical considerations for portfolio construction. The authors blend theoretical discussion with real-world examples, ensuring that readers understand both the “why” and the “how” of alternative investing.

The book is organized into fourteen chapters, each focusing on a distinct aspect of alternatives—from the pitfalls of conventional wisdom to the mechanics of hedge funds and the practicalities of portfolio implementation. Stein and DeMuth use case studies, historical data, and clear frameworks to illustrate their points, making each chapter a self-contained lesson that contributes to the overall narrative. Below, we provide a detailed, chapter-by-chapter analysis, highlighting the key ideas, practical applications, and actionable insights for investors.

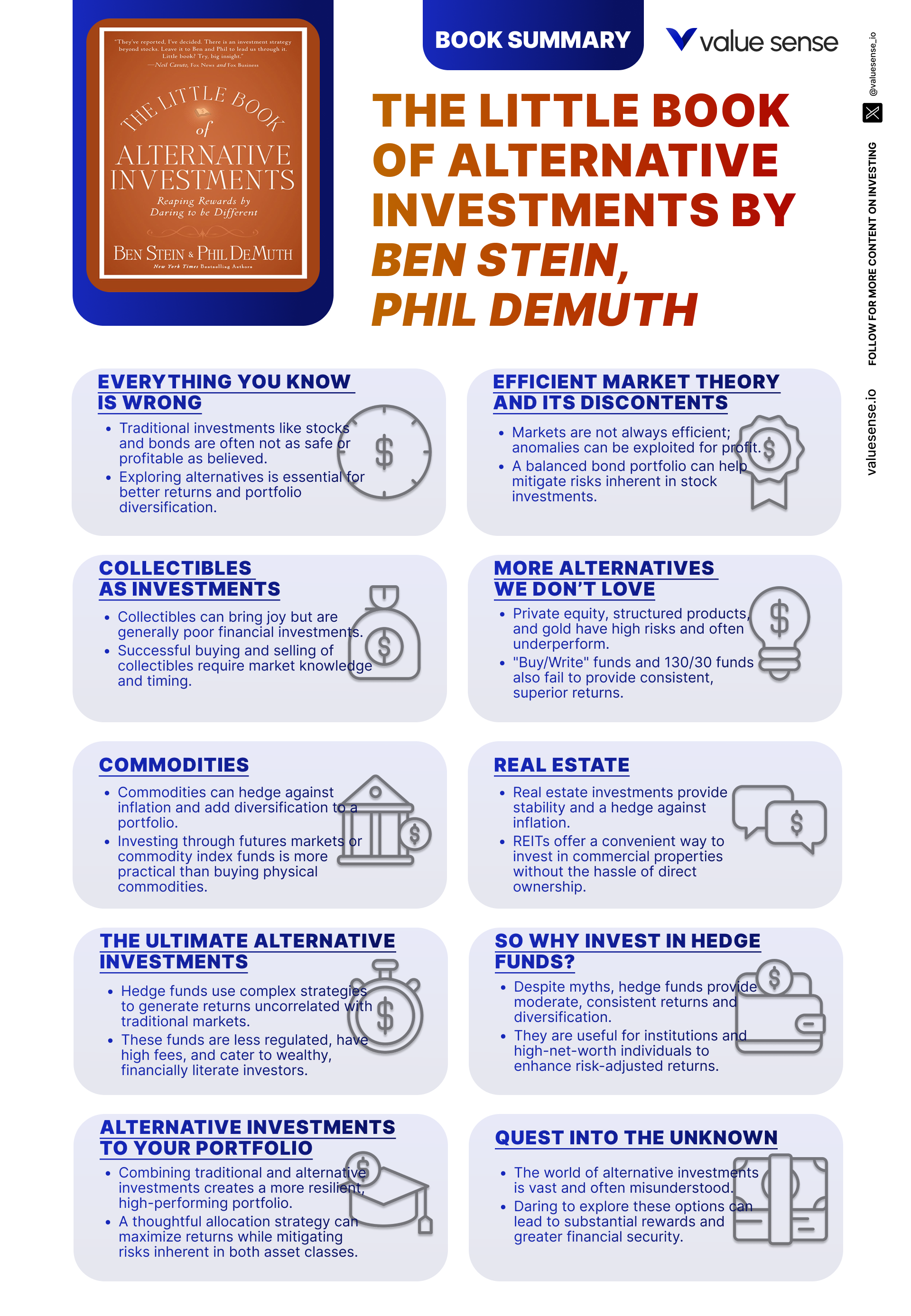

Chapter 1: Everything You Know Is Wrong

The opening chapter sets the stage by challenging the conventional wisdom that dominates most investment portfolios: the 60/40 split between stocks and bonds. Stein and DeMuth argue that this approach, while popular, is fundamentally flawed in today’s market environment. They point out that relying heavily on stocks for growth and bonds for stability leaves investors vulnerable to systemic risks, such as market crashes or prolonged periods of low returns. The authors cite historical periods—like the 2000 dot-com bust and the 2008 financial crisis—where traditional portfolios suffered significant drawdowns, exposing the limitations of standard diversification.

To address these shortcomings, the authors introduce the concept of true diversification, which requires moving beyond stocks and bonds to include alternative assets with low correlation to traditional markets. They use correlation coefficients to illustrate how adding alternatives can smooth out portfolio returns and reduce overall risk. For example, they discuss how commodities and real estate often behave differently from equities during economic downturns, providing a buffer against losses. Stein and DeMuth emphasize that diversification is not just about owning more assets, but about owning the right mix of assets that respond differently to market forces.

Investors are encouraged to critically evaluate their current portfolios and consider where they may be overexposed to equity risk. The authors recommend starting by analyzing historical performance during market stress periods, then identifying alternative asset classes that could have mitigated losses. They suggest using tools like correlation matrices and stress tests to assess potential benefits. The chapter provides a framework for gradually introducing alternatives, such as allocating 5-10% to commodities or real estate, and monitoring results over time.

Historically, portfolios with diversified alternatives have demonstrated greater resilience. For example, during the 2008 crisis, portfolios with allocations to gold, REITs, and managed futures experienced smaller drawdowns compared to those invested solely in stocks and bonds. The authors point to the Yale Endowment’s approach—famous for its large allocations to alternatives—as evidence that a broader toolkit can lead to superior risk-adjusted returns. In today’s volatile markets, this lesson is more relevant than ever, prompting investors to rethink their approach to diversification and risk management.

Chapter 2: Efficient Market Theory and Its Discontents

This chapter delves into the foundations of Efficient Market Theory (EMT), which posits that all available information is reflected in asset prices, making it impossible to consistently outperform the market. Stein and DeMuth acknowledge the academic rigor behind EMT but highlight its real-world limitations. They point out that markets are not always rational, and inefficiencies—such as bubbles, panics, and mispricings—are common. The authors reference anomalies like the small-cap effect, value premium, and momentum, which have persisted over decades and can be systematically exploited.

Stein and DeMuth provide concrete examples of how value investing and other alternative strategies have outperformed the market by capitalizing on these inefficiencies. They cite research showing that portfolios tilted toward undervalued stocks or small-cap equities have generated higher long-term returns than the market average. The chapter discusses legendary investors like Warren Buffett, who built fortunes by recognizing and exploiting market anomalies, often going against prevailing sentiment. The authors also reference academic studies that document persistent excess returns from strategies that deviate from EMT assumptions.

For practical application, the authors encourage investors to question the assumption that markets are always efficient. They recommend exploring strategies that target documented anomalies, such as value, size, and momentum factors. Investors can implement these approaches through factor-based ETFs, mutual funds, or by screening for undervalued stocks using tools like price-to-earnings and price-to-book ratios. The chapter also advises maintaining a critical mindset, regularly reviewing the evidence for persistent anomalies, and being willing to adapt as market conditions evolve.

Historically, periods of market dislocation—such as the 2000 tech bubble or the 2008 financial crisis—have provided fertile ground for alternative strategies. Investors who embraced value or contrarian approaches during these times often outperformed those who adhered strictly to EMT principles. The authors highlight that while markets are generally efficient, pockets of inefficiency exist and can be systematically exploited by disciplined, informed investors. This perspective lays the groundwork for the exploration of alternatives throughout the rest of the book.

Chapter 3: Collectibles as Investments

In this chapter, Stein and DeMuth venture into the world of collectibles—art, coins, rare stamps, vintage cars, and more—as potential alternative investments. They begin by acknowledging the allure of collectibles, which can generate substantial returns for those with expertise and a keen eye for value. However, the authors are quick to caution that collectibles are among the most speculative and illiquid investment categories. Prices are often driven by trends, fashions, and subjective valuations, making it difficult to predict future returns or to find buyers at fair prices.

The authors provide examples of collectibles that have soared in value, such as rare paintings or vintage baseball cards, but also highlight numerous cases where trends reversed or markets collapsed, leaving investors with significant losses. They emphasize that success in this arena requires deep market knowledge, connections, and often a willingness to hold assets for long periods. Stein and DeMuth share anecdotes of investors who mistook temporary fads for enduring value, only to see their investments become illiquid and unsellable. The chapter includes data on the volatility and transaction costs associated with collectibles, which can further erode returns.

For individual investors, the key takeaway is to approach collectibles primarily as a source of personal enjoyment rather than a core investment strategy. The authors recommend allocating only a small portion of one’s portfolio—if any—to collectibles, and only after gaining substantial expertise in the chosen category. They suggest that investors focus on items they genuinely appreciate and would be happy to own regardless of future price movements. This approach minimizes regret and aligns expectations with the realities of the market.

Historically, collectible markets have experienced dramatic booms and busts. For example, the art market saw a surge in the 1980s followed by a prolonged downturn, while the Beanie Babies craze of the 1990s left many speculators with worthless inventory. In contrast, some categories—such as rare coins or classic cars—have demonstrated more enduring value, but only for those with specialized knowledge. The authors’ nuanced perspective helps readers avoid the pitfalls of chasing speculative trends and encourages a disciplined, informed approach to alternative investing.

Chapter 4: More Alternatives We Don’t Love

This chapter serves as a cautionary guide, highlighting several alternative investments that Stein and DeMuth do not recommend for most investors. They focus on categories such as private equity, structured products, and certain hedge funds, which are often marketed as sophisticated solutions but come with significant risks and complexities. The authors explain that these investments frequently involve high fees, lack transparency, and may not deliver the promised returns. They use real-world examples of funds that underperformed or failed to provide adequate disclosure, leaving investors exposed to hidden risks.

Stein and DeMuth provide data on the average fee structures in private equity and hedge funds, noting that management fees of 2% and performance fees of 20% are common. They discuss how these costs can erode returns over time, especially when compounded over long holding periods. The chapter includes case studies of structured products that were marketed as “principal protected” but ultimately failed to deliver due to complex terms and counterparty risk. The authors also highlight the challenges of valuing illiquid assets and the dangers of investing in products that are not fully understood.

The practical advice for investors is to favor simplicity and transparency. The authors recommend avoiding products with opaque structures, high fees, or limited disclosure. They suggest that investors focus on alternatives that are easy to understand, liquid, and have a clear track record of performance. For those considering more complex alternatives, the authors stress the importance of thorough due diligence, including a careful review of offering documents, fee schedules, and manager backgrounds.

Historically, many investors have been lured into complex alternatives during periods of market exuberance, only to suffer losses when reality failed to match marketing hype. The 2008 financial crisis exposed the risks of structured products and leveraged hedge funds, leading to widespread losses among institutional and retail investors alike. Stein and DeMuth’s perspective is particularly relevant in today’s environment, where financial innovation has produced a proliferation of complex products that may not serve the best interests of most investors.

Chapter 5: Conventional Alternatives I: Commodities

In this chapter, Stein and DeMuth explore commodities—such as gold, oil, and agricultural products—as conventional alternative investments. They begin by explaining the historical role of commodities as a hedge against inflation and a source of diversification. Commodities often have low or negative correlation with stocks and bonds, making them valuable additions to a diversified portfolio. The authors reference periods of high inflation, such as the 1970s, when gold and oil outperformed traditional assets and preserved purchasing power for investors.

The authors provide data on the volatility of commodity markets, noting that prices are subject to fluctuations driven by supply and demand, geopolitical events, and weather patterns. They discuss the mechanics of investing in commodities through futures contracts, ETFs, and mutual funds, highlighting the advantages and disadvantages of each approach. The chapter includes examples of commodity “super cycles” and the risks associated with leveraged or narrowly focused products. Stein and DeMuth also address the challenges of storage, insurance, and physical delivery for investors considering direct ownership of commodities.

The practical takeaway is to include commodities as a modest allocation—typically 5-10%—within a broader portfolio. The authors recommend using liquid vehicles like commodity ETFs or mutual funds to gain exposure without the complexities of futures trading or physical ownership. They advise investors to be mindful of the unique risks of commodities, including high volatility and the potential for prolonged periods of underperformance. Regular monitoring and rebalancing are essential to ensure that commodity allocations remain aligned with overall portfolio objectives.

Historically, commodities have provided diversification benefits during periods of market stress or inflationary shocks. For example, during the 2008 crisis, gold prices surged even as equities plummeted, helping to offset losses in traditional portfolios. However, commodities can also experience extended bear markets, as seen in the oil price collapse of 2014-2016. Stein and DeMuth’s balanced approach helps investors understand when and how to use commodities effectively, avoiding the pitfalls of overexposure or excessive speculation.

---

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

---

Chapter 6: Conventional Alternatives II: Real Estate

This chapter focuses on real estate as a conventional alternative investment, examining both direct property ownership and indirect vehicles like Real Estate Investment Trusts (REITs). Stein and DeMuth highlight the dual benefits of real estate: steady income through rents and the potential for capital appreciation over time. They explain that real estate has historically exhibited low correlation with stocks and bonds, making it a valuable component of a diversified portfolio. The authors reference long-term data showing that real estate returns have often matched or exceeded those of equities, with lower volatility in certain periods.

The authors discuss the risks and challenges of real estate investing, including market downturns, liquidity constraints, and the complexities of property management. They provide examples of real estate bubbles—such as the U.S. housing crisis of 2007-2009—that resulted in significant losses for investors who failed to recognize the risks. The chapter also covers the impact of interest rates on property values and the importance of understanding local market dynamics. Stein and DeMuth explain how REITs offer a way to gain diversified exposure to real estate without the hassles of direct ownership, providing liquidity and professional management.

For practical implementation, the authors recommend that most investors use REITs or real estate funds as the primary vehicle for real estate exposure. They suggest allocating 10-20% of a portfolio to real estate, depending on risk tolerance and investment objectives. Investors are advised to diversify across property types (residential, commercial, industrial) and geographic regions to mitigate concentration risk. The chapter also emphasizes the importance of due diligence, including a review of REIT balance sheets, dividend histories, and management quality.

Historically, real estate has provided a reliable source of income and diversification, especially during periods of low interest rates or stock market volatility. The Yale Endowment’s significant allocation to real estate is cited as an example of institutional best practice. However, the authors caution that real estate is not immune to downturns, as seen during the global financial crisis. Their balanced perspective helps investors understand both the opportunities and risks of this important asset class.

Chapter 7: The Ultimate Alternative Investments

In this chapter, Stein and DeMuth explore what they term the “ultimate” alternative investments: venture capital, private equity, and certain types of hedge funds. These assets offer the potential for substantial returns but come with significant risks, including illiquidity, high fees, and the possibility of total loss. The authors explain that these investments are typically accessible only to experienced, high-net-worth investors who can afford to take on greater risk and withstand long lock-up periods.

The chapter provides examples of successful venture capital and private equity investments, such as early-stage funding of technology companies that later became industry leaders. However, the authors are quick to point out that for every success story, there are numerous failures. They discuss the high failure rate of startups and the challenges of identifying winners in a crowded field. Stein and DeMuth also detail the fee structures common in these investments, which can significantly reduce net returns even in successful cases.

For individual investors, the key recommendation is to approach these alternatives with caution. The authors suggest that only a small portion of one’s portfolio—if any—should be allocated to such high-risk, illiquid assets. Due diligence is paramount, including a thorough evaluation of fund managers, investment strategies, and underlying holdings. Investors should be prepared for long holding periods and the possibility of losing their entire investment.

Historically, institutional investors like university endowments and pension funds have allocated to venture capital and private equity as part of a diversified strategy. These allocations have contributed to strong long-term performance, but only when managed by highly skilled professionals with access to top-tier opportunities. The authors’ nuanced view helps readers understand the potential rewards and pitfalls of these “ultimate” alternatives, ensuring that only suitable investors pursue them.

Chapter 8: So Why Invest in Hedge Funds?

This chapter examines the role of hedge funds as alternative investments, focusing on their diverse strategies and potential benefits. Stein and DeMuth explain that hedge funds employ a variety of approaches—such as long/short equity, global macro, and arbitrage—to generate returns in both rising and falling markets. The authors discuss the appeal of hedge funds for sophisticated investors seeking diversification and absolute returns, but also highlight the high fees and lack of transparency that characterize much of the industry.

The authors provide examples of famous hedge fund strategies, such as George Soros’s currency trades and John Paulson’s bet against the U.S. housing market. They detail the typical fee structures—2% management fees plus 20% of profits—and explain how these costs can significantly impact net returns over time. The chapter includes data on the dispersion of hedge fund performance, noting that while some managers achieve spectacular results, many fail to outperform simpler, lower-cost alternatives.

For investors considering hedge funds, the authors recommend a careful evaluation of strategy, manager skill, and alignment with personal risk tolerance. They suggest that hedge funds may be appropriate for those with substantial assets and a desire for exposure to non-traditional strategies, but caution that most investors are better served by more transparent, liquid, and cost-effective alternatives. The chapter provides a checklist for due diligence, including a review of fund documents, performance history, and risk management practices.

Historically, hedge funds have delivered mixed results. While some managers have achieved legendary status, the average hedge fund has underperformed the S&P 500 in recent years, especially after accounting for fees. The authors’ balanced approach helps investors understand when hedge funds may add value and when they may simply add complexity and cost.

Chapter 9: A Field Guide to Hedge Funds, Part One

This chapter provides a detailed taxonomy of hedge fund strategies, demystifying a sector that is often shrouded in secrecy. Stein and DeMuth introduce readers to equity long/short, market neutral, and event-driven strategies, explaining the mechanics, risks, and ideal market environments for each. The authors use real-world examples to illustrate how these strategies work in practice, highlighting both their strengths and limitations.

The equity long/short strategy involves taking long positions in undervalued stocks and short positions in overvalued ones, aiming to profit from both rising and falling markets. The success of this approach depends on the manager’s ability to accurately identify mispriced securities. The authors provide data on historical performance, noting that skilled managers can generate alpha, but that the approach is not without risk—especially if market trends overwhelm individual stock selection.

Market neutral funds aim to minimize market risk by balancing long and short positions, focusing on generating returns through stock selection rather than overall market movements. These funds are designed to provide steady, low-volatility returns, but may underperform during strong bull markets. Event-driven funds seek to profit from corporate actions—such as mergers, acquisitions, or bankruptcies—that create pricing inefficiencies. The authors discuss the unique risks of each strategy, including the potential for losses if events do not unfold as expected.

For investors, the chapter emphasizes the importance of understanding the underlying strategy and its fit within a broader portfolio. The authors recommend diversifying across multiple hedge fund strategies to reduce risk and improve the odds of consistent returns. They also stress the need for ongoing due diligence, as manager skill and discipline are critical determinants of success in this complex sector. Historical case studies, such as the merger arbitrage boom of the early 2000s, provide context for evaluating current opportunities.

Chapter 10: A Field Guide to Hedge Funds, Part Deux

Continuing the exploration of hedge fund strategies, this chapter covers global macro, fixed-income arbitrage, and managed futures. Stein and DeMuth explain that global macro funds invest based on large-scale economic and political trends, often taking positions in currencies, commodities, and interest rates. These strategies require a deep understanding of global markets and can be highly profitable, but also carry significant risk and require exceptional manager skill.

Fixed-income arbitrage involves exploiting price discrepancies between related fixed-income securities, aiming for small, consistent profits. The authors discuss the use of leverage in this strategy, which can amplify both gains and losses. They reference the collapse of Long-Term Capital Management in 1998 as a cautionary tale, illustrating how even sophisticated strategies can fail catastrophically when market conditions change unexpectedly. Managed futures funds trade futures contracts on commodities, currencies, and financial instruments, often using trend-following techniques. These funds can provide diversification benefits, but are also highly volatile and dependent on the manager’s ability to identify and ride market trends.

For investors, the chapter underscores the importance of manager selection and risk management. The authors recommend conducting thorough due diligence on fund managers, including a review of their track record, investment process, and risk controls. They suggest that these strategies may be appropriate for sophisticated investors with a high risk tolerance and the ability to monitor investments closely. The chapter provides practical tips for evaluating fund disclosures, fee structures, and alignment with investor objectives.

Historically, global macro and managed futures funds have delivered strong performance during periods of market dislocation, such as the 2008 financial crisis. However, they have also experienced prolonged periods of underperformance, highlighting the cyclical nature of alternative strategies. Stein and DeMuth’s analysis helps investors understand when and how to incorporate these complex alternatives into their portfolios.

Chapter 11: One-Fund Solutions

This chapter explores the concept of one-fund solutions, such as target-date funds and balanced funds, which offer a simplified approach to investing by providing a diversified portfolio in a single investment. Stein and DeMuth explain that these products are particularly appealing to investors who prefer a hands-off approach or lack the time and expertise to manage their own portfolios. Target-date funds automatically adjust their asset allocation over time, becoming more conservative as the target date approaches, while balanced funds maintain a fixed ratio of stocks and bonds.

The authors discuss the benefits of one-fund solutions, including professional management, automatic rebalancing, and broad diversification. They provide data on the growth of target-date funds in retirement accounts and highlight their role in improving investment outcomes for individuals who might otherwise remain in cash or overly concentrated positions. However, the chapter also addresses the limitations of these products, noting that one-size-fits-all solutions may not be suitable for investors with complex financial situations or specific goals.

For practical implementation, the authors recommend that investors assess whether a one-fund solution aligns with their long-term objectives, risk tolerance, and need for customization. They suggest that one-fund solutions can serve as a core holding for many investors, supplemented by targeted allocations to alternatives or other asset classes as needed. The chapter provides a checklist for evaluating fund options, including fees, glide path design, and underlying asset quality.

Historically, one-fund solutions have improved investment outcomes for many individuals, particularly in employer-sponsored retirement plans. However, the authors caution that these products are not a panacea and may not address the unique needs of all investors. Their balanced perspective helps readers understand when and how to use one-fund solutions as part of a comprehensive investment strategy.

Chapter 12: Hedge Funds Pigs in Mutual Fund Blankets

This chapter examines the trend of hedge fund-like strategies being offered within mutual fund structures, providing retail investors with access to alternative strategies that were previously available only to institutional investors. Stein and DeMuth explain that these “hedge fund mutual funds” offer greater accessibility and liquidity, allowing investors to buy and sell shares daily. The authors discuss the benefits of these products, including diversification and risk management, but also highlight the higher fees and reduced transparency compared to traditional mutual funds.

The authors provide examples of hedge fund mutual funds that have gained popularity in recent years, noting that while some have delivered attractive returns, others have underperformed or failed to justify their higher costs. They discuss the importance of evaluating fund disclosures, fee structures, and underlying strategies to ensure alignment with investor objectives. The chapter includes data on the growth of alternative mutual funds and the regulatory changes that have enabled broader access to these products.

For investors, the key recommendation is to carefully evaluate whether hedge fund mutual funds truly add value to their portfolios. The authors suggest comparing these products to traditional mutual funds and ETFs in terms of performance, fees, and transparency. They recommend favoring funds with clear, understandable strategies and a track record of risk-adjusted returns. The chapter provides a framework for due diligence, including a review of fund holdings, manager backgrounds, and risk management practices.

Historically, the proliferation of alternative mutual funds has democratized access to sophisticated strategies, but also introduced new risks for retail investors. The authors’ balanced approach helps readers navigate this evolving landscape, ensuring that they make informed decisions about which products, if any, deserve a place in their portfolios.

Chapter 13: Adding Alternative Investments to Your Portfolio

This chapter provides a step-by-step guide for integrating alternative investments into a traditional portfolio. Stein and DeMuth emphasize the importance of determining the right allocation based on an investor’s risk tolerance, financial goals, and time horizon. They discuss frameworks for sizing allocations to alternatives, such as starting with a small percentage (5-15%) and adjusting over time based on experience and market conditions. The authors provide data on the impact of alternatives on portfolio volatility and risk-adjusted returns, illustrating how even modest allocations can enhance diversification.

The authors stress the need for ongoing monitoring and rebalancing to maintain the desired asset mix. They explain that market movements can cause alternative allocations to drift over time, potentially increasing risk or reducing diversification benefits. The chapter includes practical tips for setting up rebalancing schedules, using portfolio management software, and tracking performance metrics. Stein and DeMuth also address the importance of avoiding overexposure to high-risk alternatives, recommending a conservative approach that prioritizes capital preservation.

For practical application, the authors suggest starting with liquid, transparent alternatives—such as REITs, commodity ETFs, or market-neutral funds—before venturing into more complex or illiquid categories. They encourage investors to educate themselves about each asset class, use tools like correlation matrices to assess diversification benefits, and consult with advisors as needed. The chapter provides a checklist for evaluating new alternative investments, including due diligence on fees, liquidity, and manager quality.

Historically, portfolios that have incorporated alternatives in a disciplined manner have achieved superior risk-adjusted returns and greater resilience during market downturns. The Yale Endowment’s approach is cited as a model, but the authors caution that individual investors must tailor their strategies to their own circumstances. Their comprehensive framework ensures that readers can confidently add alternatives to their portfolios, avoiding common mistakes and maximizing the benefits of diversification.

Chapter 14: Conclusion: Quest into the Unknown

The final chapter reflects on the journey through the world of alternative investments, encouraging readers to continue their quest for better strategies. Stein and DeMuth emphasize that while alternatives offer opportunities for enhanced returns and diversification, they also come with risks that require careful management. The authors remind investors that the key to success lies not just in finding new opportunities, but in maintaining discipline, conducting thorough research, and staying true to one’s financial goals.

The authors highlight the importance of balancing opportunity and risk, noting that successful investing requires a willingness to explore new ideas while also protecting capital. They discuss the role of ongoing education, critical thinking, and adaptability in navigating the evolving landscape of alternative investments. The chapter includes anecdotes of investors who succeeded by remaining curious and disciplined, as well as cautionary tales of those who were undone by overconfidence or lack of preparation.

For practical application, the authors recommend that investors maintain a long-term perspective, regularly review their portfolios, and be open to adjusting their strategies as new information emerges. They stress the importance of thorough research and due diligence, especially when evaluating complex or illiquid alternatives. The chapter concludes with a call to action, urging readers to leverage the tools and insights provided throughout the book to build more resilient, diversified portfolios.

Historically, the most successful investors have been those who combined curiosity with caution, embracing innovation while respecting the lessons of the past. Stein and DeMuth’s final message is one of empowerment: by staying informed, disciplined, and true to one’s goals, investors can confidently navigate the unknown and achieve lasting financial success.

Advanced Strategies from the Book

While “The Little Book of Alternative Investments” is accessible to all investors, it also offers advanced strategies for those seeking to further optimize their portfolios. Stein and DeMuth delve into sophisticated techniques that leverage the unique characteristics of alternative assets, emphasizing the importance of manager selection, tactical allocation, and dynamic risk management. These strategies are particularly relevant for high-net-worth individuals, institutional investors, or anyone with the expertise and resources to navigate complex markets.

The following advanced strategies illustrate how experienced investors can harness the full potential of alternatives, while also managing the associated risks. Each technique is grounded in real-world examples and actionable insights drawn from the book’s comprehensive analysis.

Strategy 1: Tactical Allocation to Alternatives

Tactical allocation involves dynamically adjusting portfolio exposure to alternative assets based on market conditions, macroeconomic trends, or valuation signals. Stein and DeMuth explain that while a strategic allocation provides core diversification, tactical shifts can enhance returns or reduce risk during periods of market stress. For example, increasing exposure to gold or managed futures during inflationary periods or market crises can help offset losses in equities and bonds. The authors caution that tactical allocation requires discipline, clear rules, and ongoing monitoring to avoid emotional decision-making. They provide frameworks for using economic indicators, momentum signals, or valuation metrics to guide allocation decisions. This strategy is best suited for investors with the time and expertise to actively manage their portfolios and adapt to changing market environments.

Strategy 2: Manager Selection and Due Diligence

In alternative investing, manager skill is often the primary driver of returns. Stein and DeMuth emphasize the importance of rigorous due diligence when selecting hedge funds, private equity, or venture capital managers. They provide checklists for evaluating track records, investment processes, risk controls, and alignment of interests. The authors recommend interviewing managers, reviewing audited performance data, and assessing transparency before committing capital. They also discuss the value of investing alongside experienced institutions or using fund-of-funds structures to diversify manager risk. This strategy is critical for investors seeking to access the highest-performing alternatives while minimizing the risk of fraud, mismanagement, or underperformance.

Strategy 3: Risk Parity and Volatility Targeting

Risk parity is an advanced portfolio construction technique that allocates capital based on the risk contribution of each asset class, rather than fixed percentages. Stein and DeMuth explain how risk parity can be used to balance exposure across equities, bonds, commodities, and alternatives, resulting in a more stable return profile. The authors discuss the use of volatility targeting—adjusting allocations to maintain a consistent level of portfolio risk—as a way to adapt to changing market conditions. They provide examples of institutional investors who have implemented risk parity strategies, achieving superior risk-adjusted returns and lower drawdowns during crises. This approach requires sophisticated risk modeling and ongoing monitoring, making it best suited for advanced investors or those with access to professional management.

Strategy 4: Overlay Strategies and Portable Alpha

Overlay strategies involve adding alternative return streams—such as hedge fund replication or currency overlays—on top of a core portfolio. Stein and DeMuth discuss the concept of “portable alpha,” where investors seek to generate excess returns independent of market direction by combining passive market exposure with active alternative strategies. For example, an investor might hold a traditional equity index fund while allocating a portion of capital to a market-neutral hedge fund or managed futures program. The goal is to enhance returns without increasing market risk. The authors provide case studies of institutions that have successfully implemented overlay strategies, but caution that these approaches require careful risk management and a deep understanding of correlations and leverage.

Strategy 5: Tax Optimization with Alternatives

Tax considerations are often overlooked in alternative investing, but can have a significant impact on net returns. Stein and DeMuth explain how certain alternatives—such as municipal bond funds, master limited partnerships (MLPs), or real estate investments—offer unique tax advantages. They discuss strategies for tax-loss harvesting, deferring gains, and structuring investments to minimize taxable income. The authors recommend consulting with tax professionals and using tax-efficient vehicles, such as ETFs or tax-managed funds, to optimize after-tax returns. This strategy is particularly valuable for high-net-worth investors seeking to preserve wealth and maximize compounding over time.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Implementation Guide

Getting started with alternative investments can seem daunting, but Stein and DeMuth provide a clear roadmap for implementation. The key is to approach alternatives as a complement to, not a replacement for, traditional assets. Investors should begin by assessing their current portfolio, identifying gaps in diversification, and setting clear objectives for adding alternatives. The authors recommend starting with liquid, transparent vehicles—such as REITs or commodity ETFs—before exploring more complex or illiquid options.

Ongoing education, discipline, and regular portfolio reviews are essential for long-term success. Stein and DeMuth stress the importance of monitoring performance, rebalancing allocations, and staying informed about market developments. By following a systematic process, investors can confidently integrate alternatives into their portfolios and achieve better risk-adjusted returns.

- Assess your current portfolio for gaps in diversification and identify potential roles for alternatives.

- Start with liquid, transparent alternatives such as REITs, commodity ETFs, or market-neutral funds.

- Set clear allocation targets (e.g., 5-15% of portfolio) and adjust based on experience and market conditions.

- Conduct thorough due diligence on new investments, focusing on fees, transparency, and manager quality.

- Monitor performance and rebalance regularly to maintain desired asset mix and risk profile.

- Continue educating yourself about new products, strategies, and best practices in alternative investing.

- Consult with financial advisors or use platforms like Value Sense for ongoing research and portfolio analysis.

Critical Analysis

“The Little Book of Alternative Investments” excels at making a complex subject accessible to a broad audience. Stein and DeMuth’s clear explanations, humor, and real-world examples demystify alternatives and empower readers to make informed decisions. The book’s balanced approach—highlighting both the opportunities and risks of each asset class—sets it apart from more promotional or technical texts. The authors’ emphasis on discipline, due diligence, and alignment with personal goals provides a practical framework for investors at all levels.

However, the book does have limitations. Some readers may desire more in-depth analysis of specific alternative strategies, particularly in areas like private equity or advanced hedge fund techniques. The focus on simplicity and caution, while appropriate for most investors, may understate the potential rewards available to those with the resources and expertise to pursue more complex alternatives. Additionally, the rapidly evolving landscape of alternative investments means that some product-specific details may become outdated over time.

In the context of today’s market environment—characterized by low yields, high volatility, and increasing uncertainty—the book’s core messages are more relevant than ever. Investors seeking to build resilient portfolios must look beyond traditional assets and embrace a disciplined, informed approach to alternatives. Stein and DeMuth provide a valuable roadmap for navigating this landscape, helping readers avoid common pitfalls and focus on strategies that genuinely add value.

Conclusion

“The Little Book of Alternative Investments” is an essential resource for anyone looking to future-proof their portfolio and achieve better risk-adjusted returns. Stein and DeMuth’s accessible style, balanced analysis, and actionable recommendations make the book suitable for both novices and experienced investors. By challenging conventional wisdom and providing a comprehensive guide to alternatives, the authors empower readers to build more resilient, diversified portfolios.

The book’s emphasis on discipline, due diligence, and alignment with personal goals ensures that investors can confidently navigate the complex world of alternatives. Whether you’re seeking to hedge inflation, generate income, or reduce volatility, the frameworks and strategies outlined in this book will help you achieve your objectives. In a world of constant market change, “The Little Book of Alternative Investments” is a timeless guide to smarter, more resilient investing.

--- ---

10+ Free intrinsic value tools

For investors looking to find a stock's fair value, our analytics team has you covered with intrinsic value tools:

📍 Free Intrinsic Value Calculator

📍 Reverse DCF & DCF value tools

📍 Peter Lynch Fair Value Calculator

📍 Ben Graham Fair Value Calculator

📍 Relative Value tool

...and plenty more.

🔍 Explore all these tools for free on the Value Sense platform and start discovering what your favorite stocks are really worth.

FAQ: Common Questions About The Little Book of Alternative Investments

1. Who are Ben Stein and Phil DeMuth, and why are they credible authors on alternative investments?

Ben Stein is a renowned economist, lawyer, and commentator, known for his ability to explain complex financial topics with clarity and humor. Phil DeMuth is a respected investment advisor and author with extensive experience in portfolio management. Together, they bring a unique combination of academic knowledge and practical expertise to the subject of alternative investments, making their insights both accessible and trustworthy.

2. What makes “The Little Book of Alternative Investments” different from other investment books?

This book stands out for its balanced approach, clear explanations, and real-world examples. Stein and DeMuth critically evaluate each type of alternative investment, highlighting both potential benefits and risks. Unlike many texts that either promote or dismiss alternatives wholesale, this book helps readers make informed decisions based on their individual goals and risk tolerance.

3. Is this book suitable for beginners, or do I need prior investment experience?

The book is designed for a broad audience, including both beginners and experienced investors. It avoids jargon, provides practical examples, and offers clear frameworks for evaluating alternatives. Readers with little prior knowledge will find the concepts approachable, while seasoned investors will appreciate the depth and nuance of the analysis.

4. What are the main risks associated with alternative investments?

Alternative investments often come with unique risks, such as illiquidity, lack of transparency, high fees, and complex structures. Some categories, like collectibles or private equity, can be highly speculative and difficult to value. Stein and DeMuth emphasize the importance of due diligence, discipline, and only allocating a modest portion of your portfolio to high-risk alternatives.

5. How much of my portfolio should I allocate to alternative investments?

The appropriate allocation depends on your risk tolerance, financial goals, and investment horizon. The authors generally recommend starting with a small allocation (5-15%) and adjusting over time based on experience and market conditions. It’s important to avoid overexposure to any single alternative asset and to maintain a diversified, balanced portfolio.

6. Are there any alternatives that the authors recommend avoiding?

Yes, Stein and DeMuth caution against overly complex, opaque, or high-fee alternatives such as certain structured products, private equity funds, and some hedge funds. They recommend favoring transparent, liquid, and easy-to-understand alternatives like REITs, commodity ETFs, and market-neutral funds for most investors.

7. How can I get started with alternative investments if I have a small portfolio?

Begin by assessing your current portfolio and identifying areas where alternatives could improve diversification. Start with liquid, accessible options like REITs or commodity ETFs, and allocate a small percentage of your assets. Use platforms like Value Sense to research and monitor your investments, and continue educating yourself as you gain experience.

8. What role do alternative investments play during market downturns?

Alternatives can provide valuable diversification and risk mitigation during periods of market stress. Assets like gold, real estate, and managed futures often behave differently from stocks and bonds, helping to offset losses and stabilize returns. The book provides historical examples of how alternatives have enhanced portfolio resilience during crises.

9. How important is manager selection in alternative investing?

Manager skill is often the primary driver of returns in alternatives like hedge funds and private equity. Rigorous due diligence is essential—evaluate track records, investment processes, and risk controls before committing capital. The book offers checklists and frameworks to help investors select high-quality managers and avoid common pitfalls.

10. Where can I find more resources and tools to implement the book’s strategies?

Platforms like Value Sense offer research, analytics, and portfolio management tools tailored to alternative investing. The book also recommends ongoing education through financial publications, professional advisors, and investment courses. Staying informed and disciplined is key to successfully integrating alternatives into your investment strategy.