The Little Book of Behavioral Investing by James Montier

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Book Overview

James Montier’s “The Little Book of Behavioral Investing” is a cornerstone text for anyone interested in the intersection of psychology and investment decision-making. Montier, a former Global Strategist at Société Générale and a respected authority on behavioral finance, brings decades of experience to this accessible yet deeply insightful book. With a background in both economics and psychology, Montier has published extensively on the practical implications of cognitive biases in financial markets, making him a trusted voice for both institutional and retail investors.

The main theme of the book is the pervasive influence of human psychology on investment outcomes. Montier systematically unpacks the cognitive errors and emotional pitfalls that sabotage even the most sophisticated investors. Drawing on evolutionary psychology, neuroscience, and real-world market examples, he demonstrates how our brains are wired for survival, not for the complexities of modern finance. The book’s purpose is not only to identify these biases but also to arm investors with practical tools to recognize and mitigate them, thereby improving long-term investment performance.

This book is essential reading for investors at all levels—from beginners eager to avoid common mistakes to seasoned professionals seeking an edge in behavioral discipline. Portfolio managers, financial advisors, and individual investors alike will benefit from Montier’s clear explanations and actionable advice. The book is especially valuable for those who have experienced the emotional rollercoaster of market volatility and want to develop a more resilient, process-driven approach to investing.

What sets “The Little Book of Behavioral Investing” apart is its blend of rigorous research, engaging storytelling, and practical application. Montier’s use of vivid analogies—such as Star Trek characters to illustrate thinking systems—makes complex concepts memorable and relatable. The book stands out for its actionable strategies, including pre-commitment devices, process orientation, and methods for overcoming procrastination and information overload. Its unique value lies in its ability to translate cutting-edge behavioral finance research into concrete steps that investors can implement immediately, regardless of portfolio size or experience.

Ultimately, Montier’s book is a masterclass in self-awareness, discipline, and humility. By exposing the psychological traps that ensnare even the best investors, he empowers readers to build habits and processes that lead to more rational, consistent, and successful investment outcomes. For anyone seeking to bridge the gap between theory and practice in behavioral investing, this book is an indispensable guide.

Key Concepts and Ideas

At the heart of “The Little Book of Behavioral Investing” lies the conviction that human psychology is both the greatest asset and the Achilles’ heel of every investor. Montier’s philosophy is rooted in the recognition that our brains, shaped by millennia of evolution, are ill-equipped for the demands of modern financial markets. He argues that understanding and managing our own cognitive biases is far more important than mastering complex financial models or chasing market forecasts.

The book’s investment philosophy emphasizes process over prediction, discipline over emotion, and self-awareness over blind confidence. Montier repeatedly demonstrates that successful investing is less about outsmarting the market and more about outsmarting ourselves. By identifying and counteracting biases such as overconfidence, confirmation bias, and herd mentality, investors can avoid the most common pitfalls that erode returns and amplify risk. The book’s practical framework is designed to help investors build robust, repeatable processes that withstand the temptations and terrors of volatile markets.

- Bias Blind Spot: Montier introduces the “bias blind spot,” the tendency to recognize cognitive biases in others but remain oblivious to them in ourselves. This concept is foundational, as self-awareness is the first step toward behavioral improvement. For example, investors often see overconfidence in peers but fail to notice their own risky bets.

- Two Systems of Thinking: Drawing on neuroscience, Montier distinguishes between the emotional, impulsive “X-system” (akin to Dr. McCoy from Star Trek) and the logical, deliberate “C-system” (Mr. Spock). He explains how stress amplifies the X-system, leading to rash decisions, and underscores the need to consciously engage the C-system when making investment choices.

- Empathy Gaps and Emotional Decision-Making: The book explores “empathy gaps,” where investors underestimate how they’ll react in emotionally charged situations. This often results in panic selling during downturns or exuberant buying in bubbles. Montier advocates for pre-commitment strategies to guard against emotional swings.

- Procrastination and Timely Action: Montier details how fear of making mistakes leads to procrastination, causing investors to delay critical decisions like rebalancing or selling losers. He recommends setting deadlines and automating decisions to ensure prompt action and avoid missed opportunities.

- Pre-Commitment and Process Discipline: A recurring theme is the power of pre-commitment—setting rules and guidelines in advance to reduce impulsive, emotion-driven choices. Montier suggests tools like stop-loss orders and automated investing to enforce discipline and ensure alignment with long-term goals.

- Managing Fear and Market Downturns: The book highlights how fear leads to panic selling and abandonment of strategies. Montier recommends focusing on long-term objectives, diversifying holdings, and viewing downturns as buying opportunities, not threats.

- Information Overload and Analysis Paralysis: Montier warns that too much information can paralyze decision-making or lead to poor choices. He advocates simplifying the investment process, focusing on key metrics, and setting clear priorities to manage cognitive load.

- Confirmation Bias and Independent Thinking: The author explains how investors seek data that confirms existing beliefs, ignoring contradictory evidence. He encourages seeking contrary opinions, challenging assumptions, and maintaining objectivity for balanced decision-making.

- Herd Behavior and Social Influence: Montier dissects the dangers of herd mentality, where fear of missing out leads to trend-chasing and bubble participation. He stresses the importance of independent research and resisting the crowd, especially during speculative frenzies.

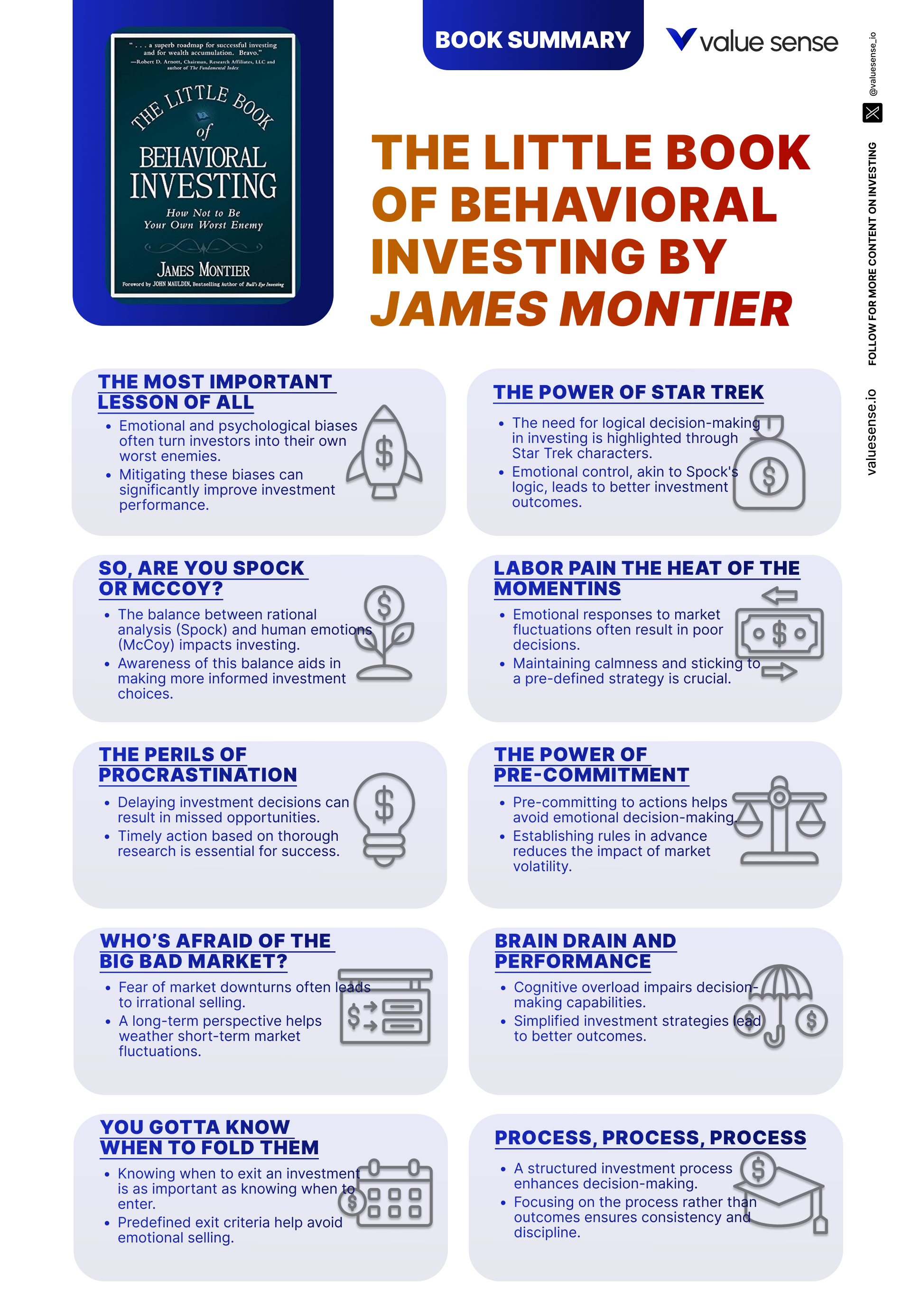

- Process over Outcome: Finally, Montier emphasizes that a good investment process is more important than short-term results. He urges investors to focus on refining their decision-making frameworks, learning from both successes and failures, and maintaining commitment to their strategy regardless of market noise.

Practical Strategies for Investors

Translating behavioral insights into actionable investment strategies is a central promise of Montier’s book. He recognizes that knowledge alone is insufficient; investors must build habits and systems that automatically counteract their psychological weaknesses. The strategies outlined in the book are designed to be both practical and robust, enabling investors to navigate the emotional turbulence of real-world markets.

Montier’s approach is grounded in simplicity and repeatability. He advocates for clear rules, automation, and regular self-assessment to keep emotions in check and maintain discipline. By embedding these strategies into their investment practice, investors can systematically reduce the influence of bias and emotion, leading to more consistent and rational outcomes.

- Self-Assessment and Bias Recognition: Begin by honestly evaluating your own susceptibility to common biases. Use checklists or written reflections to identify patterns of overconfidence, procrastination, or herd behavior in your past decisions. Make this a regular part of your investment review process.

- Engage the C-System through Deliberate Decision-Making: Slow down your investment decisions, especially during periods of stress or excitement. Before making any trade, write down your rationale, expected outcomes, and alternative scenarios. This activates the logical C-system and reduces impulsive, emotion-driven actions.

- Set Pre-Commitment Rules: Establish clear, written rules for buying, selling, and rebalancing your portfolio. For example, decide in advance to sell a stock if it falls 20% below your purchase price or if its fundamentals deteriorate. Automate these rules using stop-loss orders or scheduled reviews to enforce discipline.

- Automate Investment Actions: Use tools like automatic monthly contributions, dividend reinvestment plans (DRIPs), and robo-advisors to remove the need for constant decision-making. Automation helps you stick to your plan regardless of market noise or personal mood swings.

- Limit Information Intake: Set boundaries on news and data consumption. Choose a few key metrics and sources to monitor regularly, and avoid checking your portfolio or financial news more than once a week. This reduces anxiety and prevents information overload.

- Regular Performance Reviews with a Process Focus: Schedule quarterly or semi-annual reviews of your portfolio, focusing on adherence to your process rather than short-term results. Analyze mistakes to determine whether they were due to poor process or bad luck, and refine your strategy accordingly.

- Seek Contrary Opinions and Diverse Perspectives: Make it a habit to consult sources or individuals who challenge your assumptions. Before making major investment decisions, actively seek out arguments against your position to test the robustness of your analysis.

- Develop an Exit Strategy and Stick to It: Define clear exit criteria for each investment, such as price targets, fundamental changes, or time-based reviews. Commit to executing these exits even when it feels emotionally difficult, thereby avoiding the sunk cost fallacy and minimizing losses.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Chapter-by-Chapter Insights

Montier’s “The Little Book of Behavioral Investing” is meticulously structured, with each chapter tackling a specific psychological bias or behavioral challenge that investors face. The book’s progression mirrors the journey of self-discovery and discipline-building that every investor must undertake to achieve lasting success. Each chapter combines scientific research, real-world examples, and practical advice, making the book both comprehensive and actionable.

The chapters are designed to be read sequentially, as each builds on the lessons of the previous ones. Early chapters introduce foundational concepts such as bias awareness and the dual systems of thinking, while later chapters delve into advanced topics like process orientation, the dangers of forecasting, and managing information overload. Montier’s use of vivid analogies, historical market events, and behavioral experiments brings the material to life and ensures its relevance across different market environments.

Below, we provide a detailed, chapter-by-chapter analysis of the book’s key insights, practical applications, and historical context. Each section is crafted to help investors internalize the lessons and apply them directly to their own investment processes.

Chapter 1: The Most Important Lesson of All

The opening chapter sets the stage by emphasizing the universality of cognitive bias in investing. Montier introduces the “bias blind spot,” explaining that while it’s easy to spot irrationality in others, we are often oblivious to our own mental mistakes. He illustrates this with anecdotes from both professional and retail investors who, despite their expertise, fall prey to overconfidence, anchoring, and confirmation bias. Montier draws on evolutionary psychology, noting that our brains evolved for survival in small tribes, not for the abstract, probabilistic thinking required in financial markets. This mismatch leaves us vulnerable to a host of cognitive errors, especially when money is at stake.

Montier cites specific behavioral experiments where participants consistently underestimated their own biases, even when presented with clear evidence. For instance, he references studies showing that over 80% of fund managers believe they are above-average performers—a statistical impossibility. The author also discusses the prevalence of “hindsight bias” in investment circles, where investors rationalize past mistakes as inevitable or obvious in retrospect, further blinding themselves to learning opportunities. He quotes Daniel Kahneman and Amos Tversky, pioneers in behavioral economics, to reinforce the idea that “the human mind is a delusion-generating machine.”

To address these challenges, Montier urges investors to cultivate a mindset of humility and continuous learning. He recommends regular self-reflection, journaling of investment decisions, and seeking feedback from others to uncover hidden biases. By acknowledging that no one is immune to cognitive errors, investors can take the first step toward building more robust decision-making processes. Montier suggests setting aside time each quarter to review past trades, identifying not just what went wrong, but why it went wrong from a psychological perspective.

Historically, the consequences of unrecognized bias are evident in major market bubbles and crashes. The dot-com bubble of the late 1990s and the housing crisis of 2008 both featured widespread overconfidence and groupthink among investors and professionals. Montier’s lesson is clear: only by admitting our fallibility and striving for greater self-awareness can we hope to avoid the costly mistakes that have plagued investors throughout history.

Chapter 2: The Power of Star Trek

Montier uses the iconic characters of Star Trek—Dr. McCoy and Mr. Spock—to personify the two systems of human thinking: the impulsive, emotional “X-system” and the logical, deliberate “C-system.” He explains that the X-system, governed by the limbic brain, is fast, automatic, and driven by emotion, while the C-system, associated with the prefrontal cortex, is slow, effortful, and analytical. In high-stress situations, such as market sell-offs or rallies, the X-system often overrides the C-system, leading to irrational decisions. Montier’s analogy makes these abstract concepts accessible and memorable for readers.

The chapter includes examples of investor behavior during periods of market turbulence. Montier references the 2008 financial crisis, noting how fear and panic (X-system responses) led many investors to sell at market bottoms, only to miss subsequent rebounds. He also discusses the phenomenon of “loss aversion,” where the pain of losing money triggers emotional reactions that cloud judgment. Montier cites neuroscientific studies showing that financial losses activate the same brain regions as physical pain, underscoring the challenge of maintaining rationality under pressure.

To counteract emotional dominance, Montier advocates for techniques that engage the C-system. He recommends deliberate, written decision-making, where investors document their reasoning before executing trades. Mindfulness practices, such as pausing and taking deep breaths during stressful moments, can also help re-engage logical thinking. Montier suggests building routines—like pre-trade checklists and regular portfolio reviews—that force the C-system to the forefront and minimize knee-jerk reactions.

This dual-system framework is supported by decades of psychological research, including Daniel Kahneman’s “Thinking, Fast and Slow.” In the context of investing, the ability to shift from the X-system to the C-system is a hallmark of successful investors like Warren Buffett, who famously remains calm and analytical during market panics. Montier’s practical advice equips readers to emulate this discipline, regardless of their experience level.

Chapter 3: So, Are You Spock or McCoy?

This chapter challenges readers to assess their own decision-making tendencies by asking: are you more like Spock (logical) or McCoy (emotional)? Montier presents a simple self-assessment test that helps investors identify whether they lean toward impulsive, emotion-driven choices or methodical, analytical ones. He argues that while both systems have their place, over-reliance on the X-system leads to suboptimal investment outcomes, such as chasing trends or panic selling during downturns.

Montier shares case studies of investors who consistently made emotional decisions, resulting in poor performance. He references research showing that investors who trade frequently—often driven by emotional impulses—tend to underperform the market by 3-5% annually. Conversely, those who adopt a more Spock-like approach, characterized by patience and analysis, achieve better long-term results. The chapter includes practical exercises, such as writing down the rationale for each trade and seeking third-party feedback, to help investors strengthen their logical reasoning.

To build habits that favor the C-system, Montier recommends implementing structured decision-making processes. This includes setting aside dedicated time for investment analysis, using checklists to evaluate opportunities, and scheduling regular portfolio reviews. He also suggests creating a “decision diary” to track the thought process behind each investment, enabling investors to spot patterns and correct biases over time.

The importance of balancing emotion and logic is evident in the careers of legendary investors. For example, Charlie Munger, vice chairman of Berkshire Hathaway, is renowned for his disciplined, rational approach, which complements Buffett’s own analytical style. Montier’s advice is particularly relevant in today’s fast-paced markets, where social media and news headlines can easily trigger emotional reactions. By consciously cultivating Spock-like habits, investors can enhance their consistency and resilience.

Chapter 4: In the Heat of the Moment

In this chapter, Montier delves into the dangers of making investment decisions during emotionally charged situations, a phenomenon he terms “empathy gaps.” He explains that investors routinely underestimate how they will behave when faced with stress, fear, or euphoria, leading to actions that contradict their long-term interests. Common examples include panic selling during market crashes or impulsive buying during speculative bubbles.

Montier cites psychological studies demonstrating that people in a calm state cannot accurately predict their behavior under emotional duress. He references the 2008 financial crisis, where many investors, despite having a long-term plan, capitulated to fear and sold their holdings at the worst possible time. The author also discusses the role of “recency bias,” where recent market movements disproportionately influence decision-making, exacerbating emotional swings.

To guard against these pitfalls, Montier advocates for pre-commitment strategies. This involves setting predefined rules for buying, selling, and rebalancing before emotional situations arise. For example, an investor might decide in advance to rebalance their portfolio annually, regardless of market conditions, or to sell a stock if it drops below a certain threshold. By automating these decisions, investors reduce the likelihood of making impulsive, emotionally driven choices.

Historical market cycles, from the dot-com bust to the COVID-19 crash in 2020, provide ample evidence of the costs of emotional decision-making. Investors who stuck to disciplined, pre-committed strategies during these periods often emerged with stronger portfolios, while those who acted “in the heat of the moment” suffered lasting losses. Montier’s lesson is clear: emotional resilience and process discipline are essential for long-term investment success.

Chapter 5: The Perils of Procrastination

Montier addresses the widespread problem of procrastination in investment decision-making. He explains that fear of making the wrong choice often leads investors to delay important actions, such as rebalancing portfolios, selling underperforming assets, or deploying cash. This hesitation can result in missed opportunities and suboptimal performance, as markets rarely wait for investors to overcome their indecision.

The chapter includes real-world examples of investors who failed to act promptly, only to watch potential gains slip away. Montier references studies showing that investors who procrastinate on rebalancing tend to experience lower risk-adjusted returns, as their portfolios drift away from optimal allocations. He also discusses the psychological roots of procrastination, including loss aversion and status quo bias, which make it difficult to initiate change even when it’s clearly beneficial.

To combat procrastination, Montier suggests practical strategies such as setting deadlines for key investment actions and automating decisions wherever possible. For instance, investors can schedule automatic monthly contributions to their portfolios or use robo-advisors to handle rebalancing. He also recommends creating accountability systems, such as sharing goals with a trusted friend or advisor, to increase follow-through.

Historical data supports the importance of timely action. During the 2009 market rebound, investors who waited too long to reinvest missed out on significant gains, while those who acted decisively benefited from the recovery. Montier’s advice is particularly relevant in volatile markets, where hesitation can be costly. By building habits that prioritize action over perfection, investors can capture more opportunities and achieve better long-term outcomes.

---

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

---

Chapter 6: The Power of Pre-Commitment

Montier expands on the concept of pre-commitment, arguing that it is one of the most effective tools for improving investment outcomes. Pre-commitment involves setting rules and guidelines for decisions in advance, thereby reducing the influence of emotion and market noise. Montier draws parallels to Ulysses tying himself to the mast to resist the Sirens’ song, illustrating the power of pre-commitment to safeguard investors from their own worst impulses.

The chapter provides detailed examples of pre-commitment strategies, such as using stop-loss orders, scheduled rebalancing, and automated investing plans. Montier references research showing that investors who automate parts of their process are less likely to make impulsive trades or abandon their strategies during periods of volatility. He also discusses the benefits of “if-then” rules—for example, “If a stock exceeds a certain valuation, then I will reduce my position”—to enforce discipline.

Implementing pre-commitment starts with establishing clear, written rules for all major investment decisions. Montier recommends reviewing and updating these rules regularly to ensure they remain effective in changing market conditions. He also suggests using technology, such as portfolio management software or robo-advisors, to automate execution and minimize the need for manual intervention.

Historical examples underscore the value of pre-commitment. During the 2020 market crash, investors who had automated rebalancing or stop-loss mechanisms in place were able to maintain discipline and capitalize on subsequent recoveries. Montier’s message is that pre-commitment is not just a theoretical concept but a practical necessity for navigating the emotional ups and downs of investing.

Chapter 7: Who’s Afraid of the Big Bad Market?

This chapter explores the role of fear in investment decision-making, particularly during market downturns. Montier explains that fear is a powerful emotion that often leads investors to panic sell, abandon long-term strategies, and crystallize losses. He discusses the psychological roots of fear, including loss aversion and the tendency to overreact to negative news, which can derail even the most well-constructed investment plans.

Montier provides examples from the 2008 financial crisis, where widespread fear led to massive outflows from equities and into cash or bonds, only for markets to rebound shortly thereafter. He references studies showing that investors who sell during downturns typically miss the strongest recovery periods, resulting in lower long-term returns. The chapter also highlights the role of financial media in amplifying fear, with sensational headlines and dire predictions fueling investor anxiety.

To manage fear, Montier recommends focusing on long-term goals, diversifying portfolios, and limiting exposure to market news. He suggests viewing market downturns as opportunities to buy quality assets at discounted prices, rather than as threats to be avoided. Montier also advocates for regular portfolio reviews to ensure that asset allocations remain aligned with risk tolerance, reducing the temptation to make fear-driven changes during volatile periods.

Historical data supports Montier’s advice. During the COVID-19 crash in March 2020, investors who maintained discipline and continued to invest saw significant gains as markets rebounded. By contrast, those who succumbed to fear and sold at the bottom locked in losses and missed the recovery. Montier’s lesson is that rationality, resilience, and a focus on process are the antidotes to fear in investing.

Chapter 8: Brain Drain and Performance

Montier introduces the concept of “brain drain,” where cognitive fatigue leads to poorer decision-making in investing. He explains that making too many decisions in a short period depletes mental resources, resulting in suboptimal choices and increased susceptibility to bias. The chapter draws on research from behavioral economics and neuroscience, demonstrating that even expert investors are not immune to the effects of cognitive overload.

Examples include portfolio managers who, after a long day of trading and analysis, make hasty or ill-considered decisions late in the day. Montier references studies showing that decision quality declines as mental fatigue increases, leading to higher error rates and reduced performance. He also discusses the dangers of multitasking and constant portfolio monitoring, which fragment attention and exacerbate cognitive drain.

To manage cognitive load, Montier recommends simplifying investment processes, reducing the number of decisions required, and automating routine tasks. He suggests setting aside dedicated time for high-stakes decisions and taking regular breaks to restore mental energy. Montier also advocates for batching similar tasks—such as reviewing all portfolio holdings in one session—to minimize context switching and maintain focus.

The relevance of this advice is evident in the performance of top investors, who often attribute their success to disciplined routines and limited decision-making. Warren Buffett, for example, is known for his selective approach, making only a handful of major investment decisions each year. Montier’s chapter underscores that quality, not quantity, of decisions is the key to long-term investment success.

Chapter 9: The Cure for Temporary Paralysis

This chapter tackles “analysis paralysis,” the phenomenon where investors become overwhelmed by too much information and fail to act. Montier explains that the abundance of data, coupled with fear of making the wrong decision, can lead to inaction and missed opportunities. He cites research showing that investors who hesitate or overanalyze tend to underperform those who make timely, confident decisions based on clear criteria.

Montier provides practical strategies for overcoming analysis paralysis, such as setting predefined decision criteria and focusing on the most relevant information. He recommends limiting the time spent on each decision and using checklists to ensure that key factors are considered without getting bogged down in minutiae. The chapter includes examples of investors who streamlined their processes and achieved better results by acting decisively rather than waiting for perfect information.

To implement these strategies, Montier suggests creating a “decision matrix” that ranks investment opportunities based on a few critical metrics, such as valuation, growth prospects, and risk factors. By narrowing the focus to what truly matters, investors can reduce cognitive overload and make more confident choices. Montier also advocates for embracing imperfection, recognizing that even well-informed decisions can sometimes lead to suboptimal outcomes due to market randomness.

Historical market events, such as the rapid rebound after the 2020 COVID-19 selloff, highlight the costs of hesitation. Investors who waited for more clarity missed the swift recovery, while those who acted on sound process captured gains. Montier’s message is that action, guided by clear criteria and process, is preferable to perpetual analysis and inaction.

Chapter 10: Always Look on the Bright Side of Life

Montier explores the double-edged sword of optimism in investing. While a positive outlook can motivate investors to pursue opportunities and stay the course during downturns, excessive optimism often leads to overconfidence, underestimation of risks, and poor decision-making. Montier discusses “optimism bias,” where investors believe they are less likely to experience negative outcomes than others, resulting in overly aggressive strategies and inadequate risk management.

The chapter includes examples of investors who, buoyed by recent successes, extrapolated positive trends indefinitely and took on excessive risk. Montier references the tech boom of the late 1990s and the housing bubble of the mid-2000s, where widespread optimism led to speculative excesses and subsequent crashes. He also cites psychological studies showing that optimistic individuals are more likely to ignore warning signs and dismiss contrary evidence.

To balance optimism with realism, Montier recommends conducting thorough risk assessments and setting realistic expectations based on historical data and analysis. He suggests maintaining a positive outlook but tempering it with caution and critical evaluation of potential downsides. Montier also encourages seeking out contrary opinions and regularly reviewing assumptions to avoid falling into the trap of over-optimism.

Historical context reinforces the dangers of unchecked optimism. Each major market bubble has been fueled by the belief that “this time is different,” only for reality to intervene. Montier’s advice is to harness the motivational power of optimism while remaining vigilant against its potential to cloud judgment and inflate risk.

Advanced Strategies from the Book

As the book progresses, Montier introduces advanced strategies for investors who wish to further refine their behavioral discipline and process orientation. These techniques go beyond basic self-awareness and process discipline, offering sophisticated tools for mitigating bias, managing risk, and enhancing decision quality. Each strategy is grounded in behavioral finance research and illustrated with real-world examples, making them both practical and effective for investors at every level.

Below, we explore several advanced techniques from the book, providing detailed explanations and examples to help investors implement them in their own portfolios.

Strategy 1: Decision Journaling and Post-Mortem Analysis

Montier recommends maintaining a decision journal, where every investment choice is documented with the rationale, expected outcomes, and alternative scenarios. After a sufficient period, investors revisit these entries to conduct a post-mortem analysis, evaluating whether the decision was sound based on process rather than outcome. For example, if an investor bought shares of a company like Netflix in 2012 expecting streaming growth, the journal would record the reasoning and risk factors. If the investment underperformed, the post-mortem would assess whether the original thesis was flawed or if external events (like unexpected competition) were to blame. This process helps identify recurring biases, such as overconfidence or confirmation bias, and refines future decision-making.

Strategy 2: Pre-Mortem Risk Assessment

Borrowing from project management, Montier advocates for the “pre-mortem” technique, where investors imagine that a new investment has failed and then brainstorm all possible reasons for that failure. For instance, before buying a high-growth tech stock, an investor would list scenarios such as regulatory changes, competitive threats, or management missteps that could derail the thesis. By proactively identifying risks, investors can build more resilient portfolios and set realistic expectations. The pre-mortem also encourages diversification and the use of stop-loss orders to limit downside exposure.

Strategy 3: Contrarian Checklists and Red Team Reviews

Montier suggests formalizing the habit of seeking contrary opinions by using contrarian checklists and organizing “red team” reviews. Before making a major investment, the investor assembles a list of arguments against the position and, if possible, invites colleagues or friends to challenge the thesis. For example, if considering a large position in a popular sector like AI, the checklist might include questions about valuation, competitive dynamics, and potential regulatory risks. The red team approach, borrowed from military strategy, ensures that decisions are stress-tested and not unduly influenced by groupthink or narrative bias.

Strategy 4: Process Automation and Rule-Based Investing

Montier emphasizes the power of automating as many investment decisions as possible to reduce cognitive load and emotional influence. This includes setting up automatic contributions, scheduled rebalancing, and rule-based trading systems. For example, an investor might use a rules-based ETF strategy that rebalances quarterly based on valuation and momentum signals, removing the temptation to time the market or chase trends. Automation enforces discipline, ensures consistency, and allows investors to focus on higher-level analysis rather than day-to-day noise.

Strategy 5: Portfolio Stress Testing and Scenario Analysis

Advanced investors are encouraged to regularly stress test their portfolios against a range of adverse scenarios. Montier recommends simulating events such as sharp market downturns, sector-specific shocks, or interest rate spikes to assess potential vulnerabilities. For example, an investor with heavy exposure to technology stocks might model the impact of a 30% sector correction, identifying whether diversification or hedging is needed. Scenario analysis helps investors prepare for uncertainty, avoid concentration risk, and maintain confidence in their process during turbulent times.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Implementation Guide

Applying the lessons from “The Little Book of Behavioral Investing” requires a deliberate, step-by-step approach. Montier’s strategies are designed to be both accessible and scalable, allowing investors to start small and build more sophisticated processes over time. The key is to move from passive awareness of bias to active management through systems, routines, and ongoing self-assessment.

Investors should begin by integrating one or two behavioral strategies into their existing routines, gradually layering in more advanced techniques as comfort and discipline grow. Regular reviews and adjustments are essential to ensure that processes remain effective in changing market conditions. The ultimate goal is to build a resilient, process-driven investment practice that systematically counters the influence of emotion and bias.

- First step investors should take: Perform a self-assessment of current decision-making habits, identify common biases, and start a decision journal to document all trades and rationale.

- Second step for building the strategy: Establish clear, written pre-commitment rules for buying, selling, and rebalancing. Automate these rules using available technology (e.g., stop-loss orders, scheduled reviews, robo-advisors).

- Third step for long-term success: Regularly review and refine your investment process, conduct post-mortem analyses of both successes and failures, and seek diverse perspectives to challenge your assumptions. Focus on continuous learning and process improvement.

Critical Analysis

Montier’s “The Little Book of Behavioral Investing” excels at translating complex behavioral finance research into practical, actionable advice. Its greatest strength lies in its accessibility—readers of all backgrounds can grasp the core concepts and immediately apply them to their investment practice. The book’s use of vivid analogies, real-world examples, and step-by-step strategies makes it an indispensable resource for anyone seeking to improve their decision-making and investment outcomes.

However, the book’s focus on individual psychology may underplay the structural and systemic factors that also influence markets, such as regulatory changes, technological disruptions, and macroeconomic trends. Some readers may find the emphasis on process and discipline repetitive, though this repetition is intentional, reinforcing the importance of habit formation. Additionally, while the book provides a wealth of strategies, it leaves the implementation details largely to the reader, requiring self-motivation and discipline to fully realize its benefits.

In today’s fast-paced, information-saturated market environment, Montier’s lessons are more relevant than ever. The proliferation of financial news, social media, and algorithmic trading has amplified the impact of behavioral biases, making process-driven investing an essential safeguard. The book’s emphasis on humility, skepticism, and continuous improvement aligns perfectly with the needs of modern investors seeking to navigate uncertainty and volatility.

Conclusion

“The Little Book of Behavioral Investing” is a masterful guide to understanding and overcoming the psychological traps that undermine investment success. Montier’s blend of scientific rigor, practical wisdom, and engaging storytelling makes the book both enlightening and actionable. By focusing on self-awareness, process discipline, and continuous learning, investors can systematically reduce the influence of bias and emotion, leading to more consistent and rational outcomes.

The book’s key takeaway is that successful investing is less about predicting markets and more about managing ourselves. By implementing Montier’s strategies—such as pre-commitment, automation, regular reviews, and seeking contrary opinions—investors can build resilient portfolios that withstand the temptations and terrors of volatile markets. Whether you are a novice or a seasoned professional, this book offers invaluable insights for achieving long-term investment success.

For those committed to mastering the art of behavioral investing, “The Little Book of Behavioral Investing” is an essential addition to your library. Its lessons will serve you well through every market cycle, helping you navigate uncertainty with confidence, discipline, and clarity.

--- ---

10+ Free intrinsic value tools

For investors looking to find a stock's fair value, our analytics team has you covered with intrinsic value tools:

📍 Free Intrinsic Value Calculator

📍 Reverse DCF & DCF value tools

📍 Peter Lynch Fair Value Calculator

📍 Ben Graham Fair Value Calculator

📍 Relative Value tool

...and plenty more.

🔍 Explore all these tools for free on the Value Sense platform and start discovering what your favorite stocks are really worth.

FAQ: Common Questions About The Little Book of Behavioral Investing

1. Who is James Montier, and why is he credible in behavioral finance?

James Montier is a renowned behavioral finance expert with extensive experience as a Global Strategist at Société Générale and other major financial institutions. He has published numerous papers and books on investor psychology and is widely respected for his ability to translate academic research into practical investment strategies. Montier’s insights are trusted by both institutional and retail investors worldwide.

2. What are the main psychological biases covered in the book?

The book covers a wide range of cognitive biases, including overconfidence, confirmation bias, herding behavior, optimism bias, procrastination, and the bias blind spot. Each chapter explores how these biases impact investment decisions and provides actionable strategies to mitigate their effects, ensuring investors can make more rational and consistent choices.

3. How can I apply the book’s lessons to my own portfolio?

You can start by conducting a self-assessment of your investment habits and documenting your decision-making process in a journal. Implement pre-commitment rules for buying, selling, and rebalancing, automate routine actions, and regularly review your performance with a focus on process rather than outcomes. Seek feedback and contrary opinions to challenge your assumptions and continuously refine your strategy.

4. Is the book suitable for beginners or only for experienced investors?

The book is highly accessible and suitable for investors at all levels. Beginners will benefit from its clear explanations and practical advice, while experienced investors will find value in its advanced strategies and nuanced analysis of behavioral pitfalls. The actionable nature of the book makes it a valuable resource for anyone seeking to improve their investment outcomes.

5. What makes this book different from other behavioral finance books?

Unlike many academic texts, Montier’s book is grounded in real-world examples and offers concrete, step-by-step strategies for overcoming bias. Its engaging analogies, such as the Star Trek framework for thinking systems, make complex concepts memorable and practical. The book’s unique value lies in its focus on building robust investment processes that are both simple and effective.

6. Can the strategies in the book help during market crises?

Yes, the strategies are specifically designed to help investors maintain discipline and avoid emotional decision-making during periods of market stress. Techniques like pre-commitment, automation, and regular process reviews have proven effective in past crises, enabling investors to stay the course and capitalize on recovery opportunities rather than succumbing to panic selling.

7. How does the book address the influence of financial media and pundits?

Montier critically examines the role of financial media and market commentators, warning against overreliance on pundit predictions and entertainment-driven advice. He encourages investors to prioritize independent research, skepticism, and process-driven decision-making, rather than reacting to headlines or popular opinion.

8. What are the most important habits to develop according to Montier?

Montier recommends developing habits such as journaling investment decisions, setting clear pre-commitment rules, automating routine actions, conducting regular process reviews, and seeking diverse perspectives. These habits help investors systematically counteract bias, maintain discipline, and achieve more consistent long-term results.

9. Does the book address the challenges of information overload?

Yes, Montier dedicates several chapters to managing information overload and analysis paralysis. He advises focusing on a few key metrics, setting clear priorities, and limiting data consumption to avoid decision fatigue and confusion. Simplifying the investment process is a recurring theme throughout the book.

10. Where can I find more resources on behavioral investing and process-driven strategies?

For further learning, explore Value Sense’s research products, stock ideas, and educational content at valuesense.io. The platform offers tools and insights inspired by Montier’s principles, helping investors apply behavioral finance strategies to identify undervalued opportunities and build robust portfolios.