The Little Book of Big Dividends by Charles B. Carlson

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Book Overview

Charles B. Carlson, CFA, is a highly respected investment expert known for his deep expertise in dividend investing and his ability to make complex financial strategies accessible to everyday investors. As the CEO of Horizon Investment Services and editor of the DRIP Investor newsletter, Carlson has spent decades helping individuals build wealth through disciplined, long-term investment in dividend-paying stocks. His previous works, including "Eight Steps to Seven Figures," have established him as a practical voice for investors seeking stable, growing income streams. "The Little Book of Big Dividends" distills his years of research and real-world experience into a concise, actionable guide for those aiming to harness the power of dividends for financial security.

The central theme of the book is straightforward yet powerful: dividend investing, when executed with discipline and prudence, can deliver robust returns and provide a steady, inflation-resistant income. Carlson’s approach is grounded in the belief that dividends are more than just periodic cash payments—they are a signal of financial health, management confidence, and shareholder alignment. The book walks readers through the process of identifying quality dividend stocks, constructing diversified portfolios, and using reinvestment strategies to compound wealth over decades. Carlson’s focus on safety, sustainability, and growth sets his method apart from mere yield-chasing, making his advice especially relevant in uncertain or low-interest-rate environments.

This book is ideal for a broad range of readers, from novice investors looking to build their first income-generating portfolio to experienced market participants seeking to refine their dividend strategies. Retirees and those planning for financial independence will find actionable frameworks for creating reliable monthly income, while younger investors can learn how to maximize long-term compounding through reinvestment. The book’s clear explanations, practical tools (like the Big, Safe Dividend formula), and real-world examples make it accessible without sacrificing depth or rigor. Readers interested in global diversification, direct stock purchase plans, and advanced yield-enhancement techniques will also find valuable insights tailored to their needs.

What sets "The Little Book of Big Dividends" apart is its blend of time-tested wisdom and modern, data-driven analysis. Carlson doesn’t simply advocate buying high-yield stocks; he provides a comprehensive system for evaluating dividend safety, growth prospects, and portfolio construction. The inclusion of international opportunities, direct investment plans, and advanced vehicles like REITs and MLPs ensures the book remains relevant in today’s interconnected, rapidly evolving markets. Carlson’s style is approachable and encouraging, empowering readers to take control of their financial futures with confidence and clarity. Above all, the book stands out for its focus on actionable steps—every chapter ends with concrete guidance that readers can immediately implement.

Whether you are seeking to supplement your income, protect your wealth from inflation, or simply build a more resilient portfolio, "The Little Book of Big Dividends" offers a roadmap grounded in decades of market-tested strategies. Carlson’s emphasis on patience, discipline, and risk management resonates throughout, making this book a must-read for anyone serious about achieving financial independence through dividend investing.

Key Concepts and Ideas

At the heart of "The Little Book of Big Dividends" is a disciplined, systematic approach to dividend investing that balances the pursuit of income with risk management and long-term growth. Carlson’s philosophy is rooted in the belief that dividends are not just a byproduct of investing, but a central driver of total returns and a key indicator of company health. The book systematically debunks the myth that only glamorous or high-flying stocks can deliver strong performance, showing instead that overlooked companies and consistent payers often lead to outsized results. By focusing on safety, sustainability, and compounding, Carlson arms readers with the tools to build wealth across market cycles.

The author introduces several foundational principles, including the importance of the payout ratio, the dangers of chasing yield, and the necessity of diversification across sectors and geographies. He also emphasizes the role of patience, urging investors to give undervalued or underappreciated stocks time to realize their potential. Carlson’s approach is inherently practical—each concept is illustrated with real-world examples, historical data, and actionable screening criteria. Investors are encouraged to think beyond short-term fluctuations and to view dividends as both a source of income and a signal of underlying business strength.

- Undervalued, Low-Priced Stocks: Carlson highlights the potential of stocks trading under $10, particularly those in unglamorous industries that are often ignored by Wall Street. These companies, like Darling International, can offer substantial upside for investors willing to research their business models and market positions. The key is to identify leaders in niche markets with stable supply chains and customer bases.

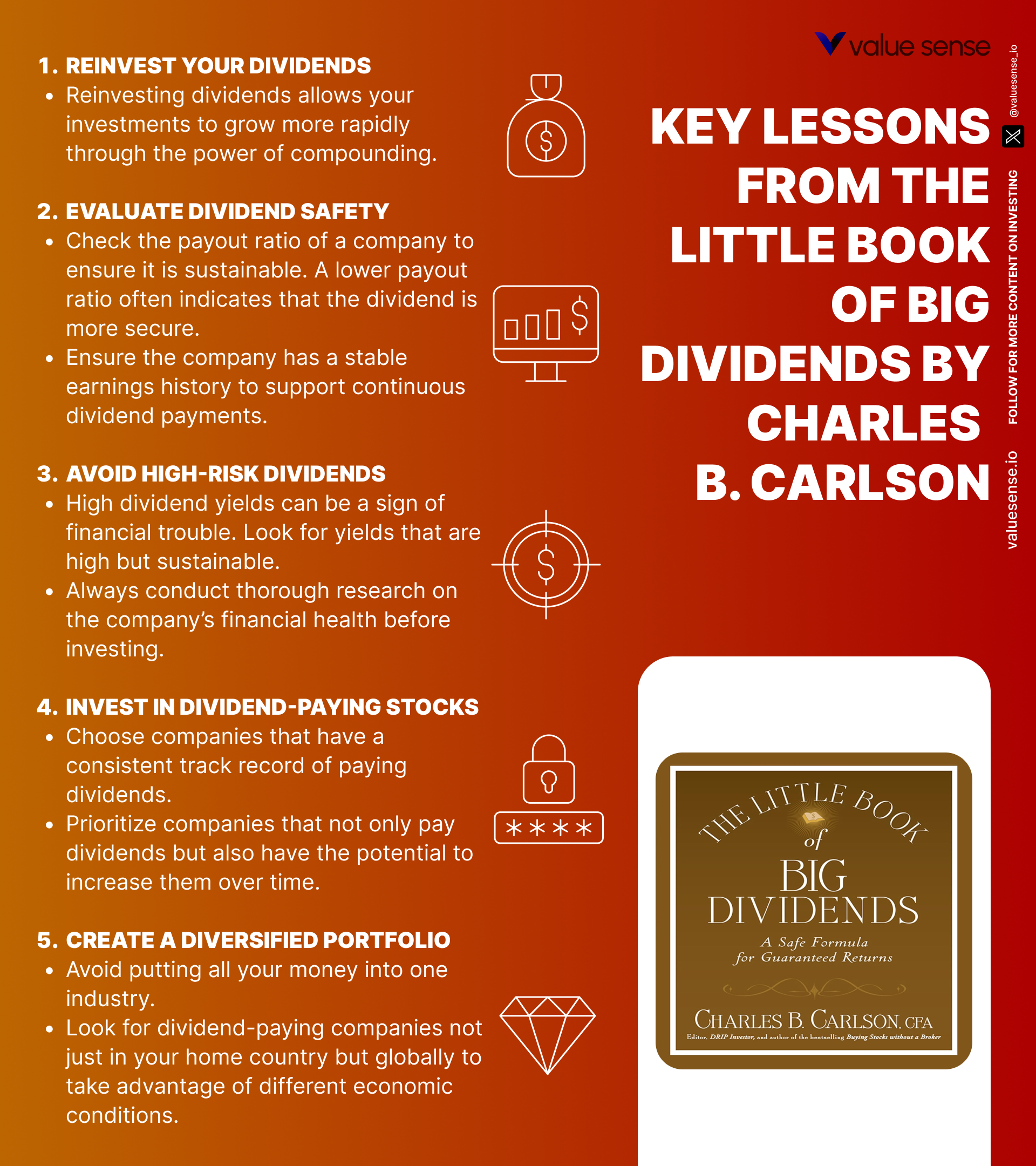

- Dividend Yield vs. Dividend Safety: The book warns against the temptation to chase high yields without understanding the risks. Extremely high yields can signal financial distress or an impending dividend cut. Carlson stresses the importance of analyzing a company’s financial health, cash flow, and payout ratio—ideally below 60%—to ensure dividends are sustainable.

- The Big, Safe Dividend (BSD) Formula: Carlson introduces a proprietary formula for filtering stocks that offer both attractive yields and strong safety profiles. The BSD formula combines payout ratio analysis with overall financial strength metrics, helping investors avoid risky dividend traps and focus on companies likely to maintain or grow their payouts.

- Global Diversification: Recognizing the limits of domestic investing, Carlson advocates for including international dividend stocks in portfolios. He discusses how American Depository Receipts (ADRs) and global mutual funds can provide exposure to foreign markets, while also explaining the added risks of currency fluctuation and foreign taxation.

- Direct Stock Purchase Plans (DSPPs): The book explores DSPPs as a low-cost, broker-free way to accumulate shares in dividend-paying companies. Many plans offer automatic reinvestment and access to international stocks, making them ideal for long-term investors and those starting with modest amounts.

- Dividend Growth and Inflation Protection: Carlson underscores the importance of selecting companies with a history of regular dividend increases. Dividend growth not only enhances total returns through compounding, but also helps protect purchasing power against inflation—an essential consideration for retirees and long-term savers.

- Monthly Income Planning: By selecting stocks with staggered dividend payment dates, investors can construct portfolios that deliver reliable monthly income. This strategy helps synchronize investment cash flow with personal expenses, providing greater financial stability and peace of mind.

- High-Yield Alternatives: REITs, Preferreds, and MLPs: For those seeking higher income, Carlson examines vehicles like real estate investment trusts (REITs), preferred stocks, and master limited partnerships (MLPs). He details the risks, rewards, and tax implications of these instruments, cautioning that they should complement—not replace—core dividend holdings.

- Dividend Reinvestment Plans (DRIPs): DRIPs are presented as a powerful tool for compounding wealth. By automatically reinvesting dividends into additional shares, investors benefit from dollar-cost averaging and maximize the long-term impact of compounding, even with small, regular contributions.

- Portfolio Construction and Diversification: The book concludes with a blueprint for building a balanced, resilient dividend portfolio. Carlson stresses diversification across sectors, industries, and geographies, and provides guidance on aligning dividend payments with personal financial goals and cash flow needs.

Practical Strategies for Investors

Applying the insights from "The Little Book of Big Dividends" requires more than theoretical understanding—it demands a structured, step-by-step approach to portfolio building, stock selection, and ongoing management. Carlson provides readers with a toolkit of actionable strategies designed to maximize income, manage risk, and take advantage of the compounding power of dividends. These strategies are tailored for investors at every stage, from beginners with limited capital to experienced savers seeking to optimize cash flow in retirement.

The book emphasizes starting with a clear investment objective, such as generating reliable monthly income or building long-term wealth through reinvestment. Investors are encouraged to use screening tools and checklists to identify candidates that meet Carlson’s strict safety and growth criteria. The practical steps outlined in each chapter empower readers to move from theory to action, whether by setting up automatic investment plans, diversifying globally, or incorporating higher-yielding alternatives in a balanced way.

- Screen for Safe Dividend Payers: Begin by filtering stocks with a payout ratio below 60%, strong free cash flow, and a history of consistent or growing dividends. Use tools like the BSD formula or stock-rating systems (e.g., Quadrix) to assess overall financial strength. Action Step: Run monthly screens using free financial websites or brokerage tools to identify new candidates.

- Build a Diversified Portfolio: Construct a portfolio with at least 15-20 dividend-paying stocks across multiple sectors (e.g., healthcare, technology, consumer staples) and geographies. Action Step: Allocate no more than 5-7% to any single holding and include international ADRs or global ETFs for added diversification.

- Leverage Direct Stock Purchase Plans (DSPPs): Enroll in DSPPs to buy shares directly from companies, often with zero or minimal fees. Many plans allow automatic monthly investments and dividend reinvestment. Action Step: Research DSPPs for your target companies and set up recurring contributions, even if starting with $50-$100 per month.

- Utilize Dividend Reinvestment Plans (DRIPs): Automatically reinvest dividends into additional shares to harness compounding and dollar-cost averaging. Action Step: Activate DRIP options through your broker or directly with companies, and track share accumulation over time.

- Synchronize Dividend Payments with Cash Flow Needs: Select stocks with staggered payment schedules (e.g., January, April, July, October) to ensure monthly income. Action Step: Create a spreadsheet to map out payment dates and adjust holdings to fill any income gaps throughout the year.

- Balance High Yield with Growth: Include a mix of high-yield stocks and those with strong dividend growth records. Avoid over-concentration in high-yield, high-risk sectors. Action Step: Review portfolio yield and growth rates annually, rebalancing as needed to maintain your target mix.

- Explore REITs, Preferreds, and MLPs for Yield Enhancement: Add these vehicles selectively to boost income, but limit exposure to avoid excessive risk. Action Step: Research tax implications and liquidity before investing, and cap allocations to 10-15% of your portfolio.

- Monitor and Adjust Regularly: Review portfolio performance, dividend safety, and company fundamentals quarterly. Be prepared to replace stocks that cut dividends or show signs of financial distress. Action Step: Set calendar reminders for quarterly reviews and use checklists to guide decision-making.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Chapter-by-Chapter Insights

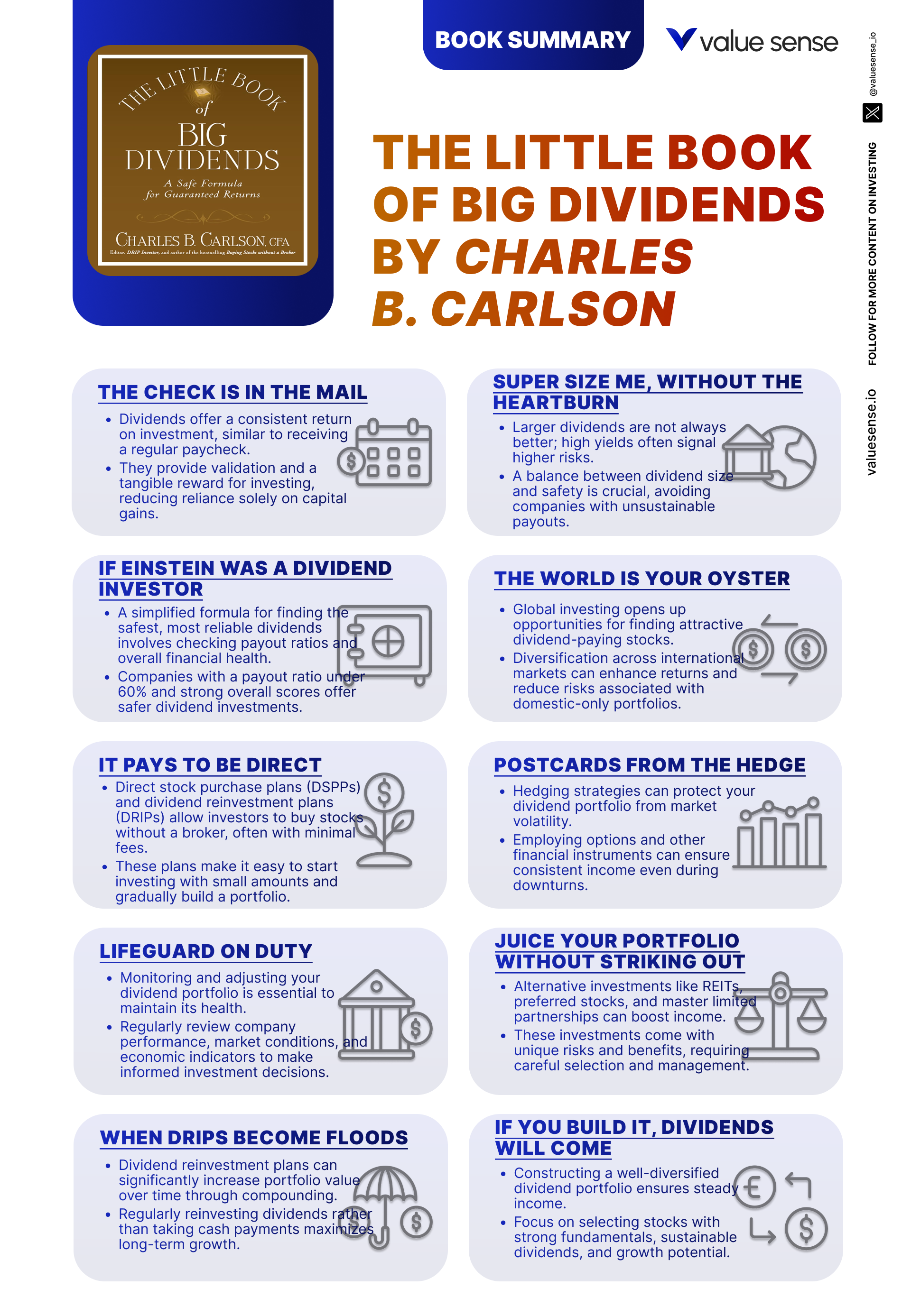

"The Little Book of Big Dividends" is structured as a practical guide, with each chapter building on the last to create a comprehensive dividend investing framework. The book begins by challenging conventional wisdom about low-priced stocks and the dangers of chasing yield, then introduces Carlson’s proprietary BSD formula for identifying safe, high-yield opportunities. Subsequent chapters expand the toolkit to include global diversification, direct investment plans, and advanced yield strategies, culminating in a blueprint for constructing a resilient, income-generating portfolio. Each chapter is packed with detailed examples, actionable checklists, and real-world case studies, making the book both educational and immediately useful.

The following section provides an in-depth analysis of each major chapter, highlighting not only the key concepts and lessons, but also the practical steps investors can take to implement these ideas in their own portfolios. Every chapter is explored in detail, with specific references to companies, data, and historical context, ensuring readers gain a thorough understanding of Carlson’s approach and how to apply it in today’s markets.

Chapter 1: The Classic Under $10 Stock

Chapter one sets the tone by challenging the notion that only large, well-known companies are worthy of investment. Carlson uses the story of Darling International—a company operating in the unglamorous business of rendering and recycling animal by-products—as a prime example of how overlooked and undervalued stocks, particularly those trading under $10, can deliver substantial returns. The author explains that such companies are often ignored by Wall Street analysts and institutional investors, creating fertile ground for diligent individual investors willing to conduct thorough research. The key, he argues, is to look beyond the stock price and focus on the underlying business fundamentals, competitive advantages, and market position.

Specific examples abound in this chapter. Carlson details how Darling International, despite operating in a sector most investors would shun, managed to dominate its niche and build a stable supply chain and customer base. He notes that these companies often have scalable business models and the potential for significant growth, especially when the broader market eventually recognizes their value. The chapter includes data on historical returns for low-priced stocks and highlights the importance of patience—these investments may take years to pay off, but the rewards can be significant. Carlson also warns that not all low-priced stocks are bargains; some are cheap for good reason, such as deteriorating fundamentals or unsustainable business models.

For investors, the practical takeaway is to develop a screening process that identifies companies with strong market positions, stable cash flows, and clear paths to profitability, regardless of their share price. Carlson recommends focusing on firms that dominate a niche, have established customer relationships, and demonstrate operational efficiency. He also emphasizes the importance of patience and conviction—holding onto undervalued stocks through market downturns can lead to outsized gains when sentiment shifts. Investors should avoid the temptation to chase quick wins and instead adopt a long-term perspective, allowing time for the market to recognize the true value of these hidden gems.

Historically, many of the market’s best-performing stocks started as overlooked, low-priced companies in unglamorous industries. For example, Waste Management and Republic Services—both leaders in the waste disposal sector—were once considered unattractive investments but have since delivered impressive returns to patient shareholders. Carlson’s approach echoes the strategies of legendary investors like Peter Lynch, who famously advocated for investing in what you know and seeking out underappreciated opportunities. In today’s market, where information is abundant but true insight is rare, the willingness to dig deeper and take calculated risks remains a powerful edge for individual investors.

Chapter 2: Super Size Me, without the Heartburn

In this chapter, Carlson tackles one of the most common mistakes made by income-seeking investors: chasing the highest possible dividend yields without regard for safety or sustainability. He draws a vivid analogy to fast food—tempting in the short term, but potentially harmful in the long run. The author explains that extremely high yields can be a red flag, often signaling underlying financial problems such as declining earnings, excessive debt, or an unsustainable payout ratio. Carlson provides a framework for distinguishing between healthy, sustainable yields and those that are likely to be cut, emphasizing the importance of thorough financial analysis.

To illustrate his point, Carlson presents case studies of companies that offered eye-popping yields but ultimately slashed their dividends, leading to sharp declines in share prices. He references historical data showing that the majority of dividend cuts occur in companies with yields significantly above the market average, often in sectors facing structural headwinds. The chapter includes detailed explanations of key metrics, such as the payout ratio (dividends as a percentage of earnings) and free cash flow coverage, which can help investors assess the likelihood of a dividend being maintained. Carlson also discusses the importance of comparing a company’s yield to its sector peers and the broader market to determine whether it is reasonable or a sign of distress.

Investors are advised to balance the desire for income with a rigorous assessment of dividend safety. Carlson recommends prioritizing companies with stable earnings, conservative payout ratios (generally below 60%), and a track record of consistent or growing dividends. He encourages readers to look beyond the headline yield and evaluate the underlying business fundamentals, including cash flow generation, debt levels, and competitive position. By focusing on both current yield and the potential for future dividend growth, investors can build portfolios that deliver reliable income without exposing themselves to undue risk.

The lessons of this chapter are especially relevant in today’s low-interest-rate environment, where the temptation to reach for yield is stronger than ever. During the 2008-2009 financial crisis, many high-yielding financial and energy stocks suffered devastating losses as their dividends were cut or eliminated. In contrast, companies with moderate yields and strong fundamentals—such as Procter & Gamble, Johnson & Johnson, and PepsiCo—continued to deliver steady income and outperformed the broader market. Carlson’s advice to “super size” your income without the “heartburn” of excessive risk remains a cornerstone of successful dividend investing.

Chapter 3: If Einstein Was a Dividend Investor

This chapter introduces one of the book’s most valuable tools: the Big, Safe Dividend (BSD) formula. Drawing an analogy to Einstein’s famous equation, Carlson presents a simple yet powerful method for identifying stocks that offer both attractive yields and strong safety profiles. The BSD formula combines two key components: the payout ratio and the company’s overall financial strength. Carlson explains that a payout ratio below 60% is generally a sign of sustainability, as it leaves room for the company to maintain or even grow its dividend during periods of temporary earnings weakness.

The chapter provides step-by-step instructions for applying the BSD formula, including how to calculate the payout ratio and evaluate financial health using metrics such as cash flow, debt-to-equity, and profitability. Carlson recommends using stock-rating systems like Quadrix to obtain a comprehensive view of a company’s financial position, noting that a high rating across multiple dimensions (e.g., value, quality, momentum) is a strong indicator of dividend safety. He also includes real-world examples of companies that pass the BSD screen, such as Kimberly-Clark and Colgate-Palmolive, both of which have long histories of stable or growing dividends and robust financials.

For investors, the BSD formula serves as a discipline-enforcing filter, helping to eliminate risky dividend payers from consideration. By focusing on companies that meet strict payout and financial strength criteria, investors can build portfolios that are less vulnerable to dividend cuts and share price declines. Carlson encourages readers to use the BSD formula as the first step in their screening process, followed by deeper analysis of business fundamentals and growth prospects. This approach not only improves income reliability but also enhances total returns by avoiding the pitfalls of yield chasing.

The BSD formula is particularly relevant in volatile or uncertain markets, where the risk of dividend cuts increases. During the COVID-19 pandemic, many companies with high payout ratios and weak balance sheets were forced to reduce or suspend dividends, while those with conservative policies weathered the storm. By adopting the BSD framework, investors can position themselves for long-term success, capturing the dual benefits of income and capital appreciation while minimizing downside risk. Carlson’s method echoes the practices of institutional investors and pension funds, which prioritize safety and sustainability above all else in their income portfolios.

Chapter 4: The World Is Your Oyster

In this chapter, Carlson expands the scope of dividend investing to the global stage, arguing that international stocks offer valuable opportunities for diversification, income, and growth. He explains that by looking beyond domestic markets, investors can access companies operating in different economic environments, industries, and regulatory regimes, thereby reducing portfolio risk and enhancing return potential. The chapter provides an overview of the benefits and risks associated with foreign dividend payers, including currency risk, foreign taxation, and political stability.

Carlson introduces practical avenues for gaining international exposure, such as American Depository Receipts (ADRs), global mutual funds, and exchange-traded funds (ETFs). He highlights companies like Nestlé, Unilever, and Royal Dutch Shell as examples of global dividend leaders with long histories of shareholder payouts. The author also discusses the importance of understanding the economic and political context of the countries in which these companies operate, noting that factors such as inflation, currency volatility, and regulatory changes can impact dividend sustainability and total returns.

For U.S. investors, the most accessible route to international dividend stocks is often through ADRs, which trade on U.S. exchanges and pay dividends in dollars. Carlson recommends focusing on companies with strong financials, stable business models, and a track record of consistent or growing dividends. He also advises considering global mutual funds or ETFs for instant diversification across countries and sectors, especially for those new to international investing. The same principles of dividend safety and growth apply—investors should screen for low payout ratios, robust cash flows, and resilient business models regardless of geography.

The benefits of global diversification have been demonstrated in multiple market cycles. During periods of U.S. market underperformance, international stocks—particularly those from emerging markets—have provided valuable ballast and growth potential. For example, in the early 2000s, international dividend payers outpaced their U.S. counterparts as the dollar weakened and global growth accelerated. Carlson’s advice to “make the world your oyster” is especially pertinent in today’s interconnected economy, where opportunities and risks are increasingly global in nature.

Chapter 5: It Pays to Be Direct

This chapter explores the advantages of direct stock purchase plans (DSPPs), which allow investors to buy shares directly from companies, often bypassing brokers and minimizing transaction costs. Carlson explains that DSPPs are particularly well-suited for small investors or those looking to build positions gradually, as many plans permit investments as low as $25 or $50 per month. The author details how DSPPs typically offer automatic dividend reinvestment, enabling participants to compound their returns over time without incurring additional fees.

Carlson provides a step-by-step guide to enrolling in DSPPs, including how to find eligible companies, complete the necessary paperwork, and set up recurring contributions. He highlights the cost-effectiveness of these plans, noting that many companies cover administrative fees or offer shares at a discount to market price. The chapter also discusses the availability of DSPPs for international stocks, allowing investors to diversify globally without the complexities of foreign exchanges or currencies. Real-world examples include blue-chip companies like Coca-Cola, Procter & Gamble, and ExxonMobil, all of which offer robust DSPP options for individual investors.

For investors, DSPPs represent a practical, low-cost way to accumulate shares in high-quality, dividend-paying companies. Carlson recommends using DSPPs to implement dollar-cost averaging strategies, smoothing out the impact of market volatility and reducing the temptation to time the market. He also emphasizes the benefits of automatic reinvestment, which accelerates wealth accumulation by harnessing the power of compounding. Investors can start small and increase their contributions over time, making DSPPs accessible to those at all stages of their financial journey.

Historically, investors who have consistently contributed to DSPPs and reinvested dividends have enjoyed impressive long-term results. For example, a $100 monthly investment in Johnson & Johnson’s DSPP since the early 1990s would have grown to over $100,000 by 2020, thanks in large part to dividend reinvestment and compounding. In an era of rising brokerage fees and market volatility, the simplicity and cost-effectiveness of DSPPs make them an attractive option for patient, disciplined investors seeking to build lasting wealth.

---

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

---

Chapter 6: Postcards from the Hedge

Chapter six addresses the critical issue of inflation and its impact on income-focused investors. Carlson argues that dividend growth is the most effective hedge against the erosion of purchasing power, as companies that regularly increase their payouts enable shareholders to maintain or even improve their standard of living over time. The chapter provides a framework for identifying “dividend growers”—companies with long histories of annual increases—and explains why these firms are often financially robust, with stable earnings and strong cash flows.

Carlson presents data showing that dividend growth stocks have outperformed both non-dividend payers and high-yield, low-growth stocks over the long term. He cites examples like Johnson & Johnson, Procter & Gamble, and 3M, all of which have raised their dividends for decades, delivering superior total returns to shareholders. The author also explains how reinvesting dividends from these companies creates a compounding effect, accelerating wealth accumulation and enhancing portfolio resilience during periods of market turbulence or rising prices.

For investors, the practical lesson is to prioritize companies with a demonstrated commitment to dividend growth, supported by conservative payout ratios and strong balance sheets. Carlson recommends screening for firms with at least 10-20 years of consecutive increases and analyzing their financial statements for signs of continued stability. He also advises balancing high-yield holdings with growth-oriented stocks, ensuring that the portfolio is positioned to deliver both current income and long-term capital appreciation.

The historical record supports Carlson’s thesis: during the inflationary 1970s and the low-rate environment of the 2010s, dividend growth stocks consistently outperformed their peers. In particular, the “Dividend Aristocrats” index—comprising S&P 500 companies with 25+ years of increases—has delivered higher returns with lower volatility than the broader market. In today’s uncertain economic climate, where inflation risk is once again on the rise, the focus on dividend growth remains as relevant as ever for investors seeking to preserve and grow their wealth.

Chapter 7: Lifeguard on Duty

In this chapter, Carlson introduces a practical strategy for synchronizing dividend payments with personal cash flow needs. He explains that by selecting stocks with staggered payment schedules—such as those paying in January, April, July, and October—investors can structure portfolios to deliver monthly income, providing greater predictability and financial stability. This approach is particularly valuable for retirees or anyone relying on investment income to cover regular expenses.

Carlson provides detailed examples of how to build a “monthly dividend portfolio,” including lists of companies with complementary payment dates. He emphasizes the importance of diversification, recommending that investors include stocks from different sectors and regions to reduce reliance on any single company or industry. The chapter also discusses the benefits of aligning dividend payments with major expenses, such as mortgage payments or utility bills, making it easier to manage household finances and avoid cash shortfalls.

For investors, the key takeaway is to map out dividend payment dates for each holding and adjust the portfolio as needed to ensure a consistent income stream throughout the year. Carlson suggests using spreadsheets or online tools to track payment schedules and identify gaps or overlaps. He also advises reviewing the portfolio periodically to account for changes in payment dates, dividend cuts, or new investment opportunities. By proactively managing cash flow, investors can reduce financial stress and improve their overall quality of life.

The monthly dividend strategy has gained popularity in recent years, with many mutual funds and ETFs now offering products designed to deliver regular income. Historically, investors who have implemented this approach have enjoyed greater peace of mind and flexibility, especially during periods of market volatility or economic uncertainty. Carlson’s guidance is especially relevant for those transitioning into retirement, as it provides a framework for matching investment income to living expenses and maintaining financial independence.

Chapter 8: Juice Your Portfolio without Striking Out

This chapter explores higher-yielding but riskier investment vehicles, including preferred stocks, real estate investment trusts (REITs), and master limited partnerships (MLPs). Carlson explains that while these instruments can provide significant income boosts, they come with unique risks—such as interest rate sensitivity, economic dependency, and complex tax treatment—that must be carefully managed. The author provides an overview of each vehicle, including their structure, typical yields, and role within a diversified portfolio.

Carlson presents case studies of investors who have successfully incorporated these vehicles to enhance income, as well as cautionary tales of those who suffered losses due to over-concentration or lack of due diligence. He discusses the pros and cons of each option: preferred stocks offer fixed payments but limited upside; REITs provide exposure to real estate but are sensitive to rate changes; and MLPs deliver high yields but can be complex from a tax perspective. The chapter includes data on historical returns, volatility, and correlations with other asset classes, helping investors understand how these vehicles can fit into a broader income strategy.

For practical implementation, Carlson advises limiting exposure to high-yield alternatives to 10-15% of the portfolio, ensuring that core holdings remain in stable, dividend-growing companies. He recommends conducting thorough due diligence on each vehicle, including analysis of financial health, payout sustainability, and tax implications. Investors should also diversify within these asset classes, spreading risk across multiple holdings and sectors. By balancing high-yield opportunities with safer core positions, investors can boost income without significantly increasing portfolio risk.

Historically, REITs and MLPs have delivered attractive total returns, especially during periods of low interest rates or strong economic growth. However, they have also experienced sharp drawdowns during market downturns or regulatory changes. For example, REITs suffered during the 2008 financial crisis but rebounded strongly in the years that followed. Carlson’s advice to “juice your portfolio without striking out” is a reminder that higher yields should be pursued with caution and integrated thoughtfully into a well-diversified income strategy.

Chapter 9: When DRIPs Become Floods

Chapter nine delves into the mechanics and benefits of dividend reinvestment plans (DRIPs). Carlson explains that DRIPs allow investors to automatically reinvest dividends into additional shares of the issuing company, often at little or no cost. This automated approach removes emotion from the investment process and ensures consistent buying, regardless of market conditions. The chapter provides a detailed overview of how DRIPs work, including enrollment procedures, fee structures, and the ability to purchase fractional shares.

Carlson highlights the power of compounding through regular reinvestment, showing that even small, periodic contributions can grow into substantial sums over time. He uses historical examples and hypothetical scenarios to illustrate how DRIP participants have outperformed non-reinvestors, thanks to the combined effects of dollar-cost averaging and compounding. The chapter also discusses the advantages of DRIPs for long-term investors, including lower average cost per share, increased share accumulation, and the ability to remain fully invested without manual intervention.

For investors, the practical steps are straightforward: enroll in DRIP programs through your broker or directly with companies, ensure that all eligible holdings are set to reinvest dividends, and periodically review account statements to track progress. Carlson recommends DRIPs as a cornerstone strategy for anyone with a long-term investment horizon, particularly those looking to maximize growth without frequent trading or market timing. He also notes that DRIPs are especially beneficial for younger investors, who have the advantage of time to let compounding work its magic.

The historical success of DRIP investors is well documented. For example, a $10,000 investment in PepsiCo with dividends reinvested since 1985 would be worth over $250,000 by 2020, compared to less than $150,000 without reinvestment. In today’s market, where transaction costs are low and automation is widely available, DRIPs remain one of the most effective tools for building wealth and achieving long-term financial goals.

Chapter 10: If You Build It, Dividends Will Come

The final chapter brings together all the concepts discussed throughout the book, providing a comprehensive blueprint for constructing a resilient, income-generating dividend portfolio. Carlson emphasizes the importance of diversification across sectors, industries, and geographies, noting that a well-balanced portfolio is better equipped to weather market downturns and deliver consistent income. He provides step-by-step guidance on selecting companies with strong financials, stable or growing dividends, and robust business models capable of withstanding economic fluctuations.

Carlson recommends including both U.S. and international stocks to capture global growth opportunities and hedge against domestic risks. He advises prioritizing companies with a history of dividend increases, conservative payout ratios, and solid balance sheets. The chapter includes practical tips for aligning dividend payments with personal financial goals, such as mapping out payment dates, monitoring cash flow, and adjusting holdings as needed to maintain income stability. Carlson also discusses the importance of regular portfolio reviews, rebalancing, and staying disciplined in the face of market volatility.

For implementation, Carlson suggests starting with a core group of 15-20 dividend-paying stocks, supplemented by high-yield alternatives and global holdings as appropriate. He encourages investors to use screening tools, checklists, and financial analysis to ensure each holding meets strict safety and growth criteria. The chapter also covers the role of dividend reinvestment, dollar-cost averaging, and automatic investment plans in maximizing long-term returns and minimizing emotional decision-making.

The blueprint provided in this chapter reflects the practices of successful institutional investors and endowments, which prioritize income stability, risk management, and long-term growth. In today’s uncertain market environment, Carlson’s approach offers a roadmap for achieving financial independence through disciplined dividend investing. By building a portfolio that delivers consistent, reliable income, investors can support their financial objectives and enjoy greater peace of mind, regardless of market conditions.

Advanced Strategies from the Book

Beyond the foundational principles of dividend safety, diversification, and reinvestment, Carlson equips readers with advanced techniques for optimizing income and managing risk. These strategies are designed for investors seeking to enhance returns, navigate complex market environments, and tailor their portfolios to specific financial goals. The book provides detailed guidance on implementing these techniques, complete with real-world examples and step-by-step instructions.

Advanced strategies include leveraging tax-advantaged accounts, using covered calls to boost income, strategically timing investments to capture dividends, and incorporating alternative income vehicles like REITs and MLPs. Carlson also addresses the nuances of international investing, such as managing currency risk and understanding foreign tax implications. By mastering these techniques, investors can further enhance the resilience and performance of their dividend portfolios.

Strategy 1: Tax-Efficient Dividend Investing

Carlson emphasizes the importance of maximizing after-tax returns by holding dividend-paying stocks in tax-advantaged accounts like IRAs and Roth IRAs. Qualified dividends are taxed at lower rates in taxable accounts, but tax-deferred vehicles can shield investors from immediate tax liabilities, allowing dividends to compound unimpeded. The author provides examples of how to allocate high-yield, tax-inefficient assets (such as REITs and MLPs) to retirement accounts, while holding qualified dividend payers in taxable portfolios. He also discusses the impact of foreign withholding taxes on international dividends and recommends strategies for reclaiming or minimizing these costs. By optimizing asset location, investors can increase net income and accelerate wealth accumulation over time.

Strategy 2: Boosting Income with Covered Calls

For investors comfortable with options, Carlson introduces the covered call strategy as a way to generate additional income from dividend stocks. By selling call options against existing holdings, investors can collect premiums in addition to regular dividends. The author explains the mechanics of covered calls, including strike price selection, expiration dates, and risk management. He provides examples of how this strategy can increase portfolio yield by 2-4% annually, while also highlighting the trade-offs—namely, the potential for having shares called away if the stock price rises above the strike price. Carlson advises using covered calls on stable, blue-chip dividend payers and limiting exposure to avoid excessive turnover or missed appreciation. This strategy is best suited for investors seeking to enhance cash flow in flat or moderately rising markets.

Strategy 3: Strategic Dividend Capture

Dividend capture involves timing purchases and sales to collect dividends from multiple companies in a short period. Carlson explains that while this strategy can boost short-term income, it requires careful planning to account for ex-dividend dates, record dates, and settlement periods. The author cautions that frequent trading can erode returns through transaction costs and taxes, but notes that strategic dividend capture may be appropriate for sophisticated investors seeking to maximize cash flow during specific periods (e.g., retirement withdrawals). He recommends focusing on high-quality companies with stable payouts and using tax-advantaged accounts to minimize the impact of short-term gains. While not a core strategy for most investors, dividend capture can be a useful tool when implemented judiciously.

Strategy 4: Hedging Portfolio Risk with Dividend Stocks

To protect against market downturns, Carlson suggests overweighting defensive sectors—such as utilities, consumer staples, and healthcare—that tend to maintain or grow dividends during recessions. He provides data showing that these sectors have historically outperformed during bear markets, thanks to their stable cash flows and inelastic demand. The author also discusses the use of inverse ETFs or put options as portfolio hedges, but notes that simply maintaining a diversified, dividend-focused portfolio is often the most effective risk management tool. By prioritizing companies with strong balance sheets, low payout ratios, and consistent earnings, investors can reduce volatility and preserve income even in challenging environments.

Strategy 5: International Dividend Arbitrage

Carlson introduces the concept of international dividend arbitrage, where investors take advantage of differences in yield, valuation, and currency trends across global markets. He explains how to identify undervalued foreign dividend payers, assess currency risk, and use ADRs or global ETFs to gain exposure. The author provides examples of periods when international dividend stocks outperformed U.S. counterparts, such as during the early 2000s and in certain emerging markets. He also discusses the importance of monitoring macroeconomic indicators, political stability, and tax treaties to maximize returns and minimize risk. For advanced investors, international arbitrage offers a way to enhance diversification and capitalize on global opportunities.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Implementation Guide

Putting Carlson’s strategies into action requires a systematic, step-by-step approach. The book encourages readers to start with clear objectives—whether it’s generating monthly income, building long-term wealth, or protecting against inflation—and then methodically construct a portfolio aligned with those goals. Regular monitoring, disciplined reinvestment, and periodic rebalancing are essential to maintaining progress and adapting to changing market conditions.

Investors should leverage available tools—such as screeners, spreadsheets, and brokerage platforms—to track dividend payments, monitor financial health, and identify new opportunities. By automating as much of the process as possible (through DRIPs, DSPPs, and scheduled reviews), investors can minimize emotional decision-making and maximize the benefits of compounding. The following concrete steps will help guide the implementation of Carlson’s dividend investing blueprint:

- Define your investment objectives (income, growth, inflation protection) and risk tolerance.

- Screen for dividend-paying stocks with payout ratios below 60%, strong financials, and a history of stable or growing dividends.

- Build a diversified portfolio across sectors, industries, and geographies, including U.S. and international holdings.

- Set up DRIPs and DSPPs to automate reinvestment and regular contributions, taking advantage of dollar-cost averaging.

- Map out dividend payment dates to synchronize income with personal cash flow needs, adjusting holdings as necessary.

- Incorporate high-yield alternatives (REITs, preferreds, MLPs) selectively, capping exposure to 10-15% of the portfolio.

- Review and rebalance the portfolio quarterly, replacing any stocks that cut dividends or show signs of financial distress.

- Optimize asset location for tax efficiency, holding tax-inefficient assets in retirement accounts where possible.

Critical Analysis

"The Little Book of Big Dividends" excels at demystifying dividend investing and making it accessible to a broad audience. Carlson’s writing is clear, concise, and packed with actionable advice, making the book an invaluable resource for both beginners and experienced investors. The inclusion of proprietary tools like the BSD formula, as well as detailed explanations of DRIPs, DSPPs, and global diversification, sets the book apart from more generic investment guides. Carlson’s emphasis on risk management, patience, and discipline resonates throughout, reinforcing the importance of building wealth steadily rather than chasing quick wins.

However, the book is not without its limitations. Some readers may find that the focus on traditional dividend stocks and established companies overlooks opportunities in emerging sectors, such as technology or renewable energy, where dividends are less common but growth potential is significant. Additionally, while Carlson provides a solid foundation for international investing, the book could delve deeper into the nuances of currency risk, geopolitical factors, and tax treaties that impact foreign dividend payers. Advanced investors may also desire more sophisticated quantitative tools or portfolio optimization techniques.

In the context of the current market environment—characterized by low interest rates, increased volatility, and shifting sector dynamics—Carlson’s approach remains highly relevant. The emphasis on safety, sustainability, and compounding is especially valuable for investors seeking to navigate uncertainty and build resilient portfolios. As dividend investing continues to evolve, the principles outlined in "The Little Book of Big Dividends" provide a timeless framework for achieving financial independence and peace of mind.

Conclusion

"The Little Book of Big Dividends" by Charles B. Carlson stands as a comprehensive, practical guide to dividend investing, blending time-tested wisdom with actionable strategies for today’s markets. The book’s core message—that disciplined, patient investment in quality dividend payers can deliver robust returns and financial security—resonates through every chapter. Carlson’s proprietary BSD formula, emphasis on diversification, and focus on reinvestment provide readers with a clear roadmap for building and managing income-generating portfolios.

Whether you are a novice investor seeking to build your first portfolio, a retiree aiming to maximize monthly income, or an experienced market participant looking to refine your strategy, this book offers valuable insights and concrete steps for success. The inclusion of advanced techniques—such as tax optimization, covered calls, and international arbitrage—ensures that readers at every level can benefit from Carlson’s expertise. By following the principles outlined in this book, investors can achieve their financial goals with confidence and clarity.

In a world where market noise and short-term speculation often dominate headlines, "The Little Book of Big Dividends" serves as a beacon of rational, long-term investing. Its lessons are as relevant today as they were when first published, offering a blueprint for financial independence that stands the test of time. For anyone serious about building wealth through dividends, this book is an essential addition to your investment library.

--- ---

10+ Free intrinsic value tools

For investors looking to find a stock's fair value, our analytics team has you covered with intrinsic value tools:

📍 Free Intrinsic Value Calculator

📍 Reverse DCF & DCF value tools

📍 Peter Lynch Fair Value Calculator

📍 Ben Graham Fair Value Calculator

📍 Relative Value tool

...and plenty more.

🔍 Explore all these tools for free on the Value Sense platform and start discovering what your favorite stocks are really worth.

FAQ: Common Questions About The Little Book of Big Dividends

1. Who is Charles B. Carlson, and why should I trust his advice on dividend investing?

Charles B. Carlson is a Chartered Financial Analyst (CFA), CEO of Horizon Investment Services, and editor of the DRIP Investor newsletter. With decades of experience helping individuals build wealth through dividend investing, Carlson is recognized for his practical, research-driven approach. His insights are grounded in real-world results and a deep understanding of both market history and current trends.

2. What is the Big, Safe Dividend (BSD) formula, and how does it help investors?

The BSD formula is Carlson’s proprietary method for identifying stocks that offer both attractive yields and strong safety profiles. It combines the payout ratio (ideally below 60%) with overall financial strength metrics to filter out companies at risk of cutting dividends. By applying this formula, investors can focus on stocks likely to maintain or grow their payouts, reducing the risk of income disruption.

3. How can I use this book if I’m just starting out with a small amount of money?

The book provides step-by-step guidance for beginners, including how to use direct stock purchase plans (DSPPs) and dividend reinvestment plans (DRIPs) to build positions gradually with minimal fees. Carlson’s strategies are accessible to investors at all levels, enabling you to start with as little as $25 or $50 per month and scale up over time as your confidence and resources grow.

4. Does the book cover international dividend investing, and what are the key considerations?

Yes, Carlson dedicates a chapter to global diversification, explaining how to access international dividend stocks through ADRs, mutual funds, and ETFs. He discusses the benefits and risks, including currency fluctuations and foreign taxation, and provides guidance on selecting companies with strong payment histories and stable business models worldwide.

5. How do DRIPs and DSPPs help compound my investment returns?

DRIPs and DSPPs enable you to automatically reinvest dividends and make regular contributions, harnessing the power of compounding and dollar-cost averaging. Over time, this approach accelerates share accumulation and maximizes long-term growth, even with small, consistent investments. The book provides detailed instructions on enrolling in and managing these plans.

6. What are the risks of chasing high dividend yields, according to Carlson?

Carlson warns that extremely high yields often signal financial distress or the risk of a dividend cut. He advises investors to prioritize safety by analyzing payout ratios, cash flow, and company financials. The BSD formula helps screen out unsustainable payers, focusing your portfolio on reliable income sources and reducing the risk of sharp losses.

7. Can I use these strategies to generate reliable monthly income for retirement?

Absolutely. The book outlines how to build a “monthly dividend portfolio” by selecting stocks with staggered payment dates, ensuring a steady income stream throughout the year. Carlson also covers how to align dividend payments with personal expenses, making these strategies particularly valuable for retirees and those seeking financial independence.

8. How should I balance high-yield alternatives like REITs and MLPs in my portfolio?

Carlson recommends limiting exposure to higher-yield, higher-risk vehicles such as REITs, preferred stocks, and MLPs to 10-15% of your portfolio. These instruments can enhance income but should complement—not replace—core holdings in stable, dividend-growing companies. Careful due diligence and diversification within these asset classes are essential for risk management.

9. What tools or resources does the book suggest for tracking and managing dividend portfolios?

The book encourages using online screeners, spreadsheets, and brokerage tools to monitor dividend payments, payment dates, and company fundamentals. Carlson also recommends setting up calendar reminders for quarterly reviews and leveraging automation (through DRIPs and DSPPs) to streamline portfolio management and reduce emotional decision-making.

10. How often should I review and rebalance my dividend portfolio?

Carlson suggests conducting quarterly reviews to assess dividend safety, company financial health, and overall portfolio diversification. Rebalancing should be done as needed—especially if a company cuts its dividend or experiences financial distress—to ensure your portfolio remains aligned with your income and growth objectives.