The Little Book of Big Profits from Small Stocks by Hilary Kramer, Louis Navellier

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

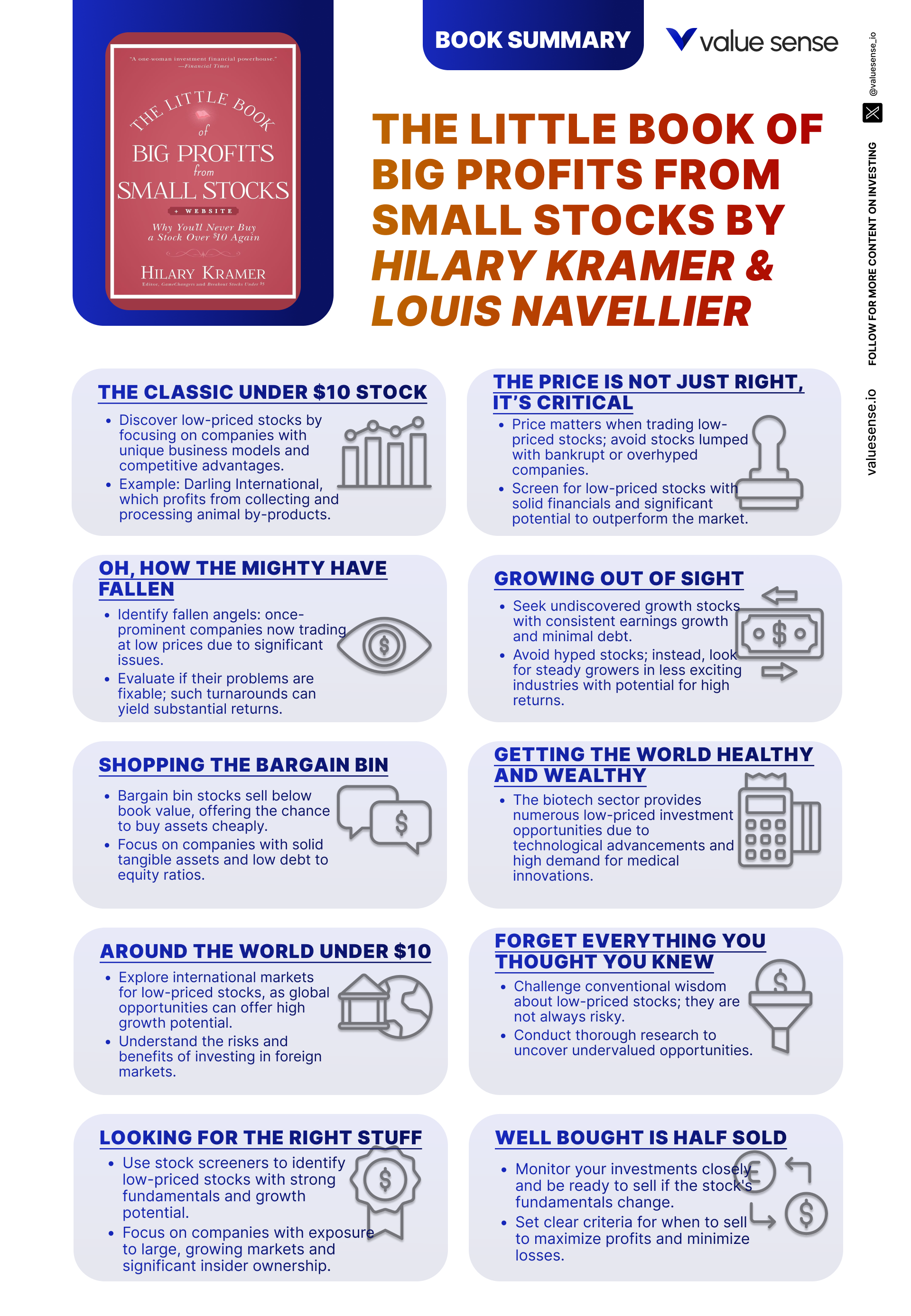

Book Overview

In “The Little Book of Big Profits from Small Stocks,” Hilary Kramer and Louis Navellier present a compelling guide to uncovering and profiting from undervalued, low-priced stocks—often overlooked by Wall Street but brimming with potential. Both authors are seasoned investment professionals: Hilary Kramer is a well-known Wall Street analyst, media commentator, and founder of Kramer Capital Research, while Louis Navellier is a respected quantitative investor and publisher of multiple investment newsletters. Their combined expertise brings a unique blend of practical, data-driven, and psychological perspectives to the world of small-cap and low-priced stock investing.

The book’s central theme is simple yet profound: the greatest investment opportunities are often found in the market’s overlooked corners—specifically, in stocks trading under $10. Kramer and Navellier argue that these “small stocks” are frequently mispriced due to institutional neglect, psychological biases, and market inefficiencies. By applying disciplined research, value investing principles, and a healthy dose of contrarian thinking, investors can discover hidden gems with the potential for outsized returns.

This book is tailored for both new and experienced investors looking to diversify beyond blue chips and well-known large-cap names. It is particularly valuable for those who are willing to do the extra work required to analyze financial statements, management quality, and industry trends. The authors make a strong case that with the right approach—one that combines patience, research, and risk management—retail investors can level the playing field and even outperform institutional players who are often restricted from trading low-priced stocks.

What sets “The Little Book of Big Profits from Small Stocks” apart is its practical, actionable focus. Rather than just presenting theoretical frameworks, Kramer and Navellier provide readers with step-by-step strategies, detailed screening criteria, and real-world examples. The book is structured to lead readers through the entire process: from understanding the psychological barriers to low-priced stocks, to conducting thorough due diligence, and finally to executing trades and managing risk. Each chapter is rich with anecdotes, historical case studies, and lessons learned from decades in the markets.

Investors who want to maximize returns in today’s volatile and rapidly changing market environment will find this book a valuable addition to their library. The authors’ emphasis on adaptability, continuous learning, and skepticism toward Wall Street “hype” provides a timeless blueprint for success. Whether you’re seeking your first ten-bagger or aiming to refine your approach to small-cap investing, this book offers the tools and mindset required to thrive.

Key Concepts and Ideas

At the heart of “The Little Book of Big Profits from Small Stocks” is the belief that the market’s inefficiencies—especially among low-priced and small-cap stocks—offer fertile ground for disciplined investors. Kramer and Navellier challenge conventional wisdom by arguing that institutional neglect, psychological biases, and the sheer complexity of the small-cap universe create persistent mispricings. The authors stress that while these stocks carry higher volatility and risk, the rewards for those who do their homework can be significant.

The book’s investment philosophy is rooted in value investing but adapted for the unique characteristics of small stocks. Instead of chasing hot trends or following the herd, readers are encouraged to develop a systematic approach: screen for undervalued opportunities, conduct rigorous fundamental analysis, and remain patient as the market eventually discovers these hidden gems. The authors are clear that success in this arena requires a blend of quantitative analysis, qualitative judgment, and emotional discipline.

Below are the book’s most important concepts—each one a cornerstone of the small-stock investing strategy:

- Dividends as a Core Component of Returns: The book opens by emphasizing the power of dividends, especially for long-term investors. Dividends provide a steady income stream, offer downside protection during market volatility, and, when reinvested, can dramatically boost total returns. For example, the authors highlight Procter & Gamble and Johnson & Johnson as companies whose long-term dividend growth has compounded investor wealth, even during bear markets.

- The Volatility—and Opportunity—of Low-Priced Stocks: Low-priced stocks (often under $10) are more sensitive to changes in demand, leading to outsized price swings. While this volatility can be intimidating, it also creates opportunities for significant gains. The authors explain that small increases in buying interest can lead to rapid price appreciation, especially when institutional investors are absent due to trading restrictions.

- Fallen Angels: Turnaround Stories: The concept of “fallen angels”—companies that have suffered sharp declines but retain core strengths—is central to the book. By carefully analyzing the causes of decline and assessing management’s ability to adapt, investors can identify stocks poised for recovery. Examples include tech firms that rebounded after restructuring or consumer brands that regained market share after product recalls.

- Undiscovered Growth Stocks: Many high-growth companies operate under Wall Street’s radar, often because they serve niche markets or lack analyst coverage. The authors stress the importance of seeking out innovative businesses with scalable models, such as early-stage biotech firms or tech disruptors, before the crowd catches on.

- Value Investing and Intrinsic Value: The authors are staunch advocates of buying stocks below their intrinsic value. This involves assessing a company’s assets, earnings power, and market potential. By focusing on fundamentals rather than market sentiment, investors can patiently wait for the market to recognize and correct mispricings.

- Healthcare as a Growth Engine: The book dedicates a chapter to the healthcare sector, noting its long-term growth drivers—aging populations, technological innovation, and rising global demand. Companies at the forefront of medical devices, biotechnology, and healthcare services are highlighted as prime candidates for small-stock investors.

- International Diversification: Kramer and Navellier encourage readers to look beyond domestic markets, especially in emerging economies where industrialization and urbanization fuel rapid growth. They discuss the use of ADRs, ETFs, and global mutual funds to access international small-cap opportunities, while also warning about geopolitical risks.

- Challenging Conventional Wisdom: The authors urge investors to question established norms and remain flexible. Traditional large-cap strategies often don’t translate to small stocks, so adaptability and continuous learning are essential. This mindset helps investors spot opportunities that others miss.

- Management Quality and Qualitative Factors: Beyond numbers, the book stresses the importance of strong management, company culture, and leadership vision. Companies with experienced, adaptable leaders are better positioned to navigate challenges and seize growth opportunities.

- Risk Management and Patience: Perhaps the most important theme is disciplined risk management—through diversification, setting stop-losses, and maintaining a long-term perspective. The authors caution against overconcentration, impulsive trades, and chasing hype, emphasizing that patience is often the key to unlocking big profits from small stocks.

Practical Strategies for Investors

While the book is rich in theory, its greatest strength lies in the detailed, actionable strategies it provides. Kramer and Navellier want readers to move beyond passive investing and take a hands-on approach to finding, analyzing, and profiting from small stocks. They stress that success comes not from luck or speculation, but from a repeatable process built on research, discipline, and patience.

The authors encourage investors to create their own “playbook” by combining screening tools, fundamental analysis, and qualitative judgment. They provide clear step-by-step instructions for each stage of the investment process, from idea generation to portfolio management. Importantly, they address the psychological challenges of investing in volatile, low-priced stocks, offering tips to maintain discipline and avoid common pitfalls like panic selling or chasing hype.

Below are the most actionable strategies from the book, each with concrete steps for implementation:

- Screen for Dividend-Paying Small Stocks: Start by filtering for companies with a history of regular and growing dividends, even among low-priced stocks. Look for payout ratios below 70%, consistent free cash flow, and a track record of dividend increases. This narrows your universe to financially healthy, shareholder-friendly companies.

- Identify Fallen Angels with Turnaround Potential: Use screeners to find stocks that have declined 50% or more from their highs but still maintain strong balance sheets and positive cash flow. Research management changes, restructuring plans, and recent earnings reports for signs of recovery. Avoid companies facing existential threats or permanent business model shifts.

- Spot Undiscovered Growth Stories: Seek out companies in emerging industries (e.g., biotech, renewable energy, fintech) with double-digit revenue growth, expanding margins, and scalable business models. Focus on firms with low analyst coverage and increasing insider ownership, signaling management’s confidence in future prospects.

- Perform Intrinsic Value Analysis: Calculate a company’s fair value using discounted cash flow (DCF), price-to-earnings (P/E), and price-to-book (P/B) ratios. Compare these metrics to industry peers and historical averages. Only buy when a significant margin of safety exists—ideally, when the stock trades 30% or more below your estimated intrinsic value.

- Diversify Across Sectors and Geographies: Build a portfolio of at least 15–20 small stocks across different industries (healthcare, technology, consumer goods) and regions (U.S., emerging markets, developed international markets). This reduces company-specific and country-specific risks.

- Monitor Management Quality: Before investing, research the track record of the CEO and executive team. Look for evidence of successful turnarounds, innovation, and shareholder alignment (e.g., insider stock ownership). Read earnings call transcripts and industry interviews to gauge leadership vision.

- Set Price Targets and Stop-Losses: For each position, establish a target price based on your valuation work as well as a stop-loss level (typically 15–25% below purchase price) to limit downside. Review these levels quarterly and adjust as new information emerges.

- Stay Patient and Avoid Herd Mentality: Resist the urge to chase momentum or follow the crowd into overhyped names. Stick to your research and conviction, even if a stock remains undervalued for months or years. Remember: many of the biggest winners were ignored by Wall Street before their breakout.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Chapter-by-Chapter Insights

“The Little Book of Big Profits from Small Stocks” is structured to guide readers step-by-step through the process of finding, analyzing, and profiting from low-priced stocks. Each chapter tackles a different aspect of the strategy, building from foundational concepts like dividends and pricing dynamics to advanced topics such as international investing and risk management. The authors use a mix of historical context, case studies, and practical checklists to ensure that readers not only understand the theory but can also apply it in real-world investing.

Below is a comprehensive, chapter-by-chapter analysis. Each section includes a detailed summary of the chapter’s core ideas, specific examples and data, practical application tips, and historical or modern context. This deep dive will help you extract maximum value from the book and integrate its lessons into your own investing approach.

Chapter 1: The Check Is in the Mail

The opening chapter establishes the foundational role of dividends in building long-term wealth, particularly within the context of small and low-priced stocks. Kramer and Navellier stress that dividends are more than just a bonus—they are a central source of total return, especially when the market is volatile or stagnant. The authors draw on examples like Procter & Gamble and Johnson & Johnson, companies that have increased dividends for decades, to illustrate how steady income can cushion against market downturns. They explain that while capital gains are dependent on price appreciation, dividends are paid regardless of market sentiment, providing a “paycheck” to investors even in tough times.

The chapter is packed with data showing the power of reinvested dividends. For instance, the authors cite studies indicating that over the past 50 years, dividends have accounted for more than 40% of the S&P 500’s total return. They also highlight how dividend-paying stocks tend to outperform non-payers during bear markets, as seen during the 2008 financial crisis when dividend aristocrats declined far less than the broader market. The authors warn against chasing high yields, instead recommending companies with a history of sustainable, growing dividends and payout ratios below 70%.

Investors are encouraged to screen for small-cap and low-priced stocks with consistent dividend records. The authors suggest starting with a watchlist of companies that have maintained or raised dividends for at least five years, then analyzing their financial health using metrics like free cash flow, payout ratios, and debt levels. They recommend using dividend reinvestment plans (DRIPs) to harness the power of compounding, and stress the importance of tracking dividend growth rates over time.

Historically, this approach has provided resilience through market cycles. During the 2000 dot-com crash and the 2008–2009 recession, portfolios anchored by dividend growers outperformed by a significant margin. Today, with interest rates still relatively low and many technology companies joining the ranks of dividend payers, the authors argue that this strategy remains relevant for investors seeking both income and growth—even among small stocks.

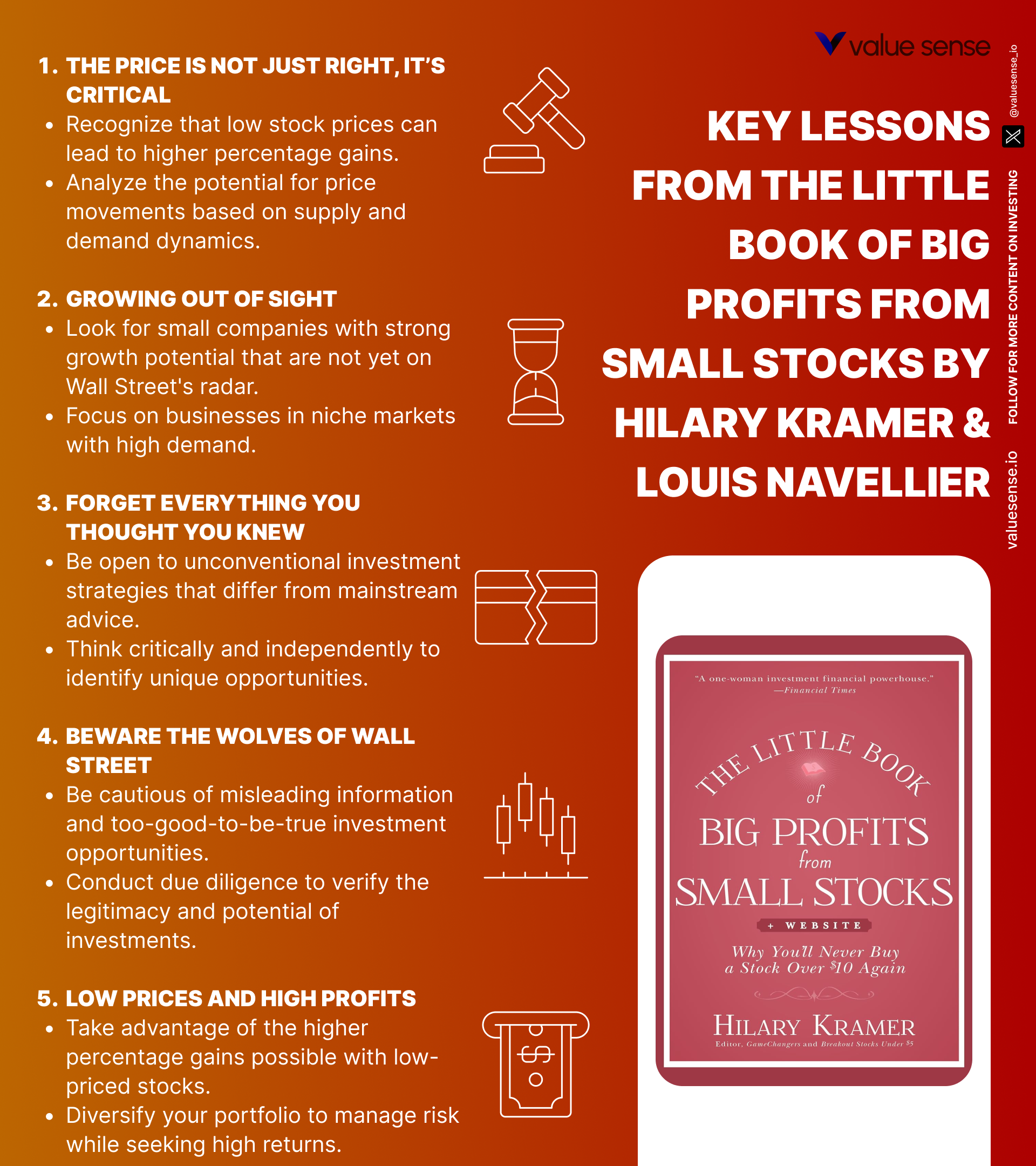

Chapter 2: The Price Is Not Just Right, It’s Critical

This chapter delves into the unique dynamics of low-priced stocks, emphasizing how their volatility can be both a risk and an opportunity. Kramer and Navellier explain that stocks trading under $10 are more sensitive to changes in demand, which means that even modest buying interest can trigger significant price movements. The authors use real-world examples to show how a small-cap stock with a market cap of $300 million can double in price with just a few million dollars of new investment—something that rarely happens with large-cap stocks.

The chapter explores the psychological barriers that keep many investors away from low-priced stocks. Wall Street institutions often avoid these names due to trading restrictions, liquidity concerns, and reputational risk, leaving a gap for retail investors to exploit. The authors argue that this institutional neglect creates persistent inefficiencies, allowing disciplined investors to find bargains. They also caution against the “penny stock” stigma, noting that not all low-priced stocks are speculative or low quality—many are simply overlooked or temporarily out of favor.

To capitalize on this dynamic, investors are encouraged to look beyond price alone and focus on underlying value and growth potential. Kramer and Navellier recommend using screeners to filter for low-priced stocks with positive earnings, strong balance sheets, and rising revenue. They also advise monitoring trading volumes and bid-ask spreads to ensure sufficient liquidity for entry and exit. By understanding the supply and demand mechanics of these stocks, investors can better time their buys and avoid getting caught in illiquid positions.

Historically, many of the market’s biggest winners started as low-priced stocks that were ignored by the mainstream. The authors cite examples from the 1990s and early 2000s, such as Apple and Netflix, which traded under $10 before their business models gained traction. In today’s market, similar opportunities exist in sectors like biotechnology, renewable energy, and fintech—areas where institutional investors are still hesitant to tread.

Chapter 3: Oh, How the Mighty Have Fallen

Here, the authors introduce the concept of “fallen angels”—companies that were once market leaders but have experienced significant price declines due to temporary setbacks. Kramer and Navellier argue that these stocks can offer some of the best risk-reward profiles if investors can accurately assess the causes of decline and the likelihood of recovery. The chapter provides a framework for evaluating fallen angels, focusing on factors such as management changes, restructuring initiatives, and core business strengths.

The authors provide vivid examples, such as tech companies that rebounded after product failures or consumer brands that recovered from scandals. They stress the importance of distinguishing between temporary issues (e.g., a bad earnings quarter, a product recall) and permanent structural problems (e.g., obsolescence, loss of competitive advantage). The book recommends looking for signs of operational improvement, such as debt reduction, cost-cutting measures, and new product launches.

Investors are advised to conduct thorough due diligence before investing in fallen angels. This includes reading annual reports, listening to earnings calls, and tracking insider buying activity—which often signals management’s confidence in a turnaround. The authors also suggest monitoring news for evidence of strategic realignment, such as asset sales or new leadership appointments. Patience is key, as turnarounds can take several quarters or even years to materialize.

Historically, some of the market’s most dramatic comebacks have come from fallen angels. The authors point to examples like Ford Motor Company, which rebounded after the 2008 crisis, or tech firms like AMD, which staged multi-year recoveries after near-collapse. In the current environment, sectors such as retail, energy, and travel may be fertile ground for finding new fallen angels with the potential for outsized gains.

Chapter 4: Growing Out of Sight

This chapter explores the world of “undiscovered growth stocks”—companies with strong growth potential that have not yet attracted Wall Street’s attention. Kramer and Navellier argue that many of the market’s future leaders are currently small, operate in niche markets, or are overshadowed by larger peers. By identifying these companies early, investors can position themselves for substantial gains as the broader market eventually catches on.

The authors provide a checklist for spotting undiscovered growth stories: look for double-digit revenue growth, expanding margins, innovative products or services, and a scalable business model. They stress the importance of low analyst coverage as a positive sign, since it often means the stock is under the radar. Examples include early-stage biotech firms developing breakthrough treatments or technology companies disrupting traditional industries.

To find these opportunities, investors are encouraged to monitor industry trade publications, attend investor conferences, and track venture capital activity for clues about emerging trends. The authors also recommend looking for increasing insider ownership, which signals management’s belief in the company’s prospects. Screening for companies with accelerating earnings growth and positive free cash flow can further narrow the field.

Historically, many of today’s blue-chip companies were once undiscovered growth stocks. The authors cite Amazon, which traded below $10 in its early days before revolutionizing e-commerce. In today’s market, sectors like cloud computing, artificial intelligence, and renewable energy offer similar prospects for finding the next generation of market leaders before they become household names.

Chapter 5: Shopping the Bargain Bin

Value investing takes center stage in this chapter, as the authors explain how to find stocks trading below their intrinsic value. Kramer and Navellier emphasize that the market often misprices small and low-priced stocks due to neglect, temporary setbacks, or negative sentiment. By focusing on fundamentals—assets, earnings, and market potential—investors can identify bargains that offer significant upside once the market corrects its mispricing.

The authors walk readers through various methods for assessing intrinsic value, including discounted cash flow (DCF) analysis, price-to-earnings (P/E) ratios, and price-to-book (P/B) ratios. They stress the importance of comparing these metrics to industry peers and historical averages to determine whether a stock truly represents a bargain. The chapter includes examples of companies that traded at deep discounts before being re-rated by the market, resulting in multi-bagger returns for patient investors.

Investors are advised to be disciplined and patient when pursuing value stocks. The authors caution against being swayed by short-term market movements or negative headlines, urging readers to stick to their valuation work and wait for the market to recognize the company’s true worth. Diversification is also emphasized as a risk management tool, since not all value stocks will appreciate at the same pace—or at all.

Historically, value investing has produced some of the market’s most enduring winners. The authors reference Warren Buffett’s early investments in undervalued companies and the 2009–2013 bull market, when many financial and industrial stocks rebounded sharply from depressed valuations. Today, with growth stocks dominating headlines, the authors argue that the “bargain bin” is once again full of overlooked opportunities for diligent investors.

---

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

---

Chapter 6: Getting the World Healthy and Wealthy

The healthcare sector is the focus here, with Kramer and Navellier highlighting its long-term growth drivers—demographic shifts, technological innovation, and rising global demand. The authors argue that healthcare offers one of the best risk-reward profiles for small-stock investors, especially as aging populations and emerging markets fuel sustained increases in medical spending.

The chapter provides a framework for identifying promising healthcare stocks, from biotech startups developing breakthrough treatments to established medical device manufacturers. The authors recommend focusing on companies with strong pipelines, proven management teams, and a track record of successful product launches. They also stress the importance of understanding the regulatory environment, as FDA approvals and reimbursement policies can dramatically affect a company’s prospects.

Investors are encouraged to diversify within the healthcare sector, spreading bets across sub-industries such as pharmaceuticals, diagnostics, and healthcare IT. The authors suggest monitoring industry news for clues about upcoming clinical trial results, mergers and acquisitions, and regulatory developments. They also recommend tracking demographic trends, such as the growth of the elderly population in developed countries and the expansion of healthcare access in emerging markets.

Historically, healthcare has produced some of the market’s biggest winners, from Amgen and Gilead Sciences in biotech to Intuitive Surgical in medical devices. In today’s environment, the authors see similar opportunities in areas like gene therapy, telemedicine, and personalized medicine—fields where small, innovative companies can quickly gain market share and deliver outsized returns to early investors.

Chapter 7: Around the World Under $10

This chapter expands the book’s focus to international markets, where Kramer and Navellier see abundant opportunities in low-priced stocks. The authors argue that emerging economies—driven by industrialization, urbanization, and the rise of the middle class—are fertile ground for investors willing to navigate additional risks. They highlight sectors such as infrastructure, manufacturing, and consumer goods as particularly attractive for small-cap investing.

The chapter discusses the unique risks of international investing, including currency fluctuations, regulatory changes, and political instability. The authors recommend diversifying across regions and using vehicles like American Depositary Receipts (ADRs), global mutual funds, and exchange-traded funds (ETFs) to access foreign markets. They also stress the importance of understanding local market dynamics, such as consumer preferences and competitive landscapes.

Investors are encouraged to identify long-term economic trends—such as the growth of e-commerce in Southeast Asia or infrastructure development in Africa—and target companies poised to benefit. The authors suggest screening for international stocks with strong revenue growth, improving margins, and increasing market share. They also advise monitoring geopolitical developments and using hedging strategies to manage currency risk.

Historically, some of the market’s most explosive growth stories have come from international small stocks. The authors cite examples like Alibaba and MercadoLibre, which delivered multi-bagger returns as their home markets expanded. In today’s interconnected world, the authors argue that global diversification is essential for maximizing returns and managing risk in a small-stock portfolio.

Chapter 8: Forget Everything You Thought You Knew

In this thought-provoking chapter, Kramer and Navellier challenge readers to question conventional investment wisdom. They argue that traditional strategies—often designed for large-cap stocks—may not apply to the world of low-priced and small-cap investing. Instead, they advocate for a flexible, adaptive approach that evolves with changing market conditions and emerging opportunities.

The authors stress the importance of continuous learning and staying informed about new developments in the market. They encourage investors to read widely, attend industry conferences, and network with other investors to gain fresh perspectives. The chapter includes anecdotes about investors who succeeded by thinking differently—such as those who bought into cloud computing or electric vehicles before they became mainstream trends.

Investors are urged to embrace a dynamic approach, adjusting strategies as new information emerges. This might mean shifting from value to growth stocks as market conditions change, or reallocating capital to new sectors or regions based on evolving trends. The authors also highlight the importance of re-examining risk, arguing that unconventional opportunities often carry hidden rewards for those willing to look beyond the obvious.

Historically, many of the market’s biggest winners were initially dismissed by conventional analysts. The authors point to companies like Tesla and Netflix, which defied traditional valuation metrics and industry norms. In today’s rapidly changing environment, the authors argue that adaptability and open-mindedness are more important than ever for small-stock investors.

Chapter 9: Looking for the Right Stuff

This chapter provides a detailed checklist for identifying high-potential small stocks, with a focus on management quality, financial health, and growth strategy. Kramer and Navellier argue that the best investments combine strong leadership, solid fundamentals, and a clear plan for expansion. They stress that qualitative factors—such as company culture and competitive positioning—are just as important as quantitative metrics.

The authors recommend starting with an analysis of the management team, looking for experienced leaders with a track record of navigating challenges and driving growth. They suggest reading biographies, reviewing past performance, and tracking insider stock ownership as indicators of alignment with shareholders. Financial health is assessed through balance sheet analysis, cash flow statements, and profitability metrics.

Growth strategy is another key criterion, with the authors advising investors to look for companies with well-defined plans for expanding market share, launching new products, or entering new markets. They also recommend considering the company’s competitive position within its industry, as well as its ability to adapt to changing conditions. Qualitative factors such as company culture, innovation, and customer loyalty are highlighted as predictors of long-term success.

Historically, companies that combined these attributes have delivered some of the market’s best returns. The authors cite examples from the technology and healthcare sectors, where visionary leaders and strong cultures enabled rapid growth and resilience during downturns. In today’s market, the authors argue that these criteria are more important than ever for separating winners from losers among small-cap and low-priced stocks.

Chapter 10: Well Bought is Half Sold

The focus here is on the art and science of buying stocks at the right price. Kramer and Navellier argue that purchase price is one of the most important determinants of investment success, especially in the volatile world of small stocks. They stress that buying at a discount to intrinsic value maximizes upside potential and provides a cushion against unforeseen setbacks.

The chapter provides a detailed overview of valuation metrics, including price-to-earnings (P/E) ratios, price-to-book (P/B) ratios, and discounted cash flow (DCF) analysis. The authors recommend comparing a stock’s current valuation to its historical averages and industry peers to gauge whether it is truly undervalued. They also discuss the importance of patience and discipline, advising investors to wait for the right entry point rather than chasing momentum or overpaying for growth.

Investors are encouraged to set price targets and stop-loss levels for each position, reviewing them regularly as new information emerges. The authors suggest using limit orders to ensure favorable entry prices and avoiding emotional decisions during periods of volatility. Diversification across sectors and industries is also recommended to manage risk and reduce the impact of individual stock fluctuations.

Historically, disciplined buying has been a hallmark of successful investors, from Warren Buffett’s early purchases of undervalued companies to Peter Lynch’s strategy of waiting for the right price before initiating a position. In today’s market, with valuations stretched in many sectors, the authors argue that careful buying is more important than ever for generating outsized returns from small and low-priced stocks.

Chapter 11: Beware the Wolves of Wall Street

This chapter serves as a cautionary guide, warning investors about the many pitfalls and dangers lurking in the stock market. Kramer and Navellier discuss common traps such as following the crowd, falling for hype, and neglecting due diligence. They argue that the market is full of noise and that investors must maintain a skeptical, independent mindset to avoid costly mistakes.

The authors provide numerous examples of overhyped stocks that crashed after attracting speculative fervor, as well as cases where herd mentality led to bubbles and subsequent collapses. They stress the importance of conducting independent research, focusing on fundamentals, and avoiding investments that seem “too good to be true.” The chapter includes practical tips for analyzing financial statements, management quality, and industry trends to separate substance from hype.

Investors are advised to take their time and verify information before committing capital. The authors recommend reading multiple sources, cross-checking data, and seeking out dissenting opinions to avoid confirmation bias. They also suggest setting strict criteria for investments and sticking to them, regardless of market sentiment or peer pressure.

Historically, skepticism and caution have saved investors from some of the market’s biggest disasters, from the dot-com bubble to the subprime mortgage crisis. In today’s era of meme stocks and social media-driven speculation, the authors argue that these principles are more relevant than ever for protecting capital and achieving long-term success in small-stock investing.

Chapter 12: Low Prices and High Profits

The final chapter brings together all the book’s key concepts, reinforcing the idea that low-priced stocks—when approached strategically—offer the potential for high profits. Kramer and Navellier reflect on the importance of thorough research, disciplined execution, and a long-term perspective. They argue that the best opportunities are often found in overlooked and unconventional areas of the market, where patience and independent thinking are rewarded.

The authors provide a checklist for successful small-stock investing: build a diversified portfolio, focus on intrinsic value, monitor management quality, and set clear price targets and stop-loss levels. They stress that patience is essential, as it can take months or even years for the market to recognize the value of an overlooked stock. The chapter includes anecdotes about investors who held through volatility and were ultimately rewarded with multi-bagger returns.

Risk management is emphasized as a crucial component of the strategy. The authors recommend diversifying across sectors and regions, setting strict position sizes, and regularly reviewing portfolios for signs of deteriorating fundamentals. They also advise maintaining a healthy skepticism toward market hype and being willing to sell when the investment thesis no longer holds.

Historically, the approach outlined in the book has produced some of the market’s most impressive success stories. The authors cite examples from their own careers, as well as well-known investors who built fortunes by focusing on small and low-priced stocks. In today’s market, with volatility and uncertainty at record highs, the authors argue that their strategy is more relevant than ever for investors seeking outsized returns and financial independence.

Advanced Strategies from the Book

While the main chapters provide a solid foundation, Kramer and Navellier also equip readers with advanced strategies to further enhance returns and manage risk. These techniques are designed for investors who want to go beyond the basics and develop a professional-level approach to small-stock investing. The authors draw on their decades of experience to share insights into screening, portfolio construction, and tactical trading that can give retail investors a significant edge.

Below are some of the most powerful advanced strategies from the book, each explained in detail with actionable examples:

Strategy 1: Quantitative Screening for Hidden Value

The authors advocate the use of quantitative screening tools to filter thousands of small and low-priced stocks down to a manageable shortlist. By setting strict criteria—such as positive free cash flow, debt-to-equity ratios below 1.0, and earnings growth above 10%—investors can eliminate low-quality names and focus on the most promising candidates. Kramer and Navellier recommend using platforms like Value Sense, Finviz, or Yahoo Finance to run these screens. For example, a screen targeting healthcare stocks with a forward P/E below 15, a price-to-sales ratio under 2, and insider ownership above 5% can quickly surface overlooked gems. The key is to regularly update screening parameters based on changing market conditions and sector trends.

Strategy 2: Event-Driven Investing in Small Stocks

Event-driven investing involves targeting stocks poised for significant moves due to catalysts such as earnings releases, FDA approvals, or M&A activity. The authors suggest monitoring news feeds, SEC filings, and industry reports for upcoming events that could trigger re-ratings. For instance, a biotech stock awaiting Phase III trial results or a small tech firm rumored to be an acquisition target can deliver rapid gains if the event is positive. Kramer and Navellier caution that this strategy requires tight risk controls—such as stop-losses and position sizing—since negative surprises can lead to sharp declines. Investors should also be wary of buying after a catalyst has already been widely publicized.

Strategy 3: Tactical Sector Rotation

Another advanced technique is tactical sector rotation—shifting portfolio allocations based on macroeconomic trends and sector momentum. The authors recommend periodically reviewing sector performance and reallocating capital to areas showing improving fundamentals and relative strength. For example, during periods of rising interest rates, financials and industrials may outperform, while healthcare and consumer staples tend to lead during recessions. By combining sector rotation with small-stock screening, investors can capture both market and stock-specific upside. Kramer and Navellier suggest reviewing sector weightings quarterly and using ETFs to gain exposure to underrepresented areas.

Strategy 4: Leveraging Insider Activity and Institutional Buying

The book highlights the importance of tracking insider buying and institutional ownership as signals of future outperformance. The authors recommend using tools like SEC Form 4 filings and 13F reports to monitor when executives or large funds are accumulating shares. A surge in insider buying often precedes positive news or operational improvements, while increasing institutional ownership can drive liquidity and price appreciation. For example, when a small-cap CEO doubles their stake ahead of a new product launch, it’s a strong vote of confidence. Investors should cross-reference insider activity with fundamentals to avoid “window dressing” or one-off purchases.

Strategy 5: Building a “Core and Explore” Portfolio

Kramer and Navellier suggest structuring portfolios with a “core” of stable, dividend-paying small stocks and an “explore” segment dedicated to higher-risk, high-reward opportunities like turnarounds and undiscovered growth names. This approach balances income and capital preservation with the potential for explosive gains. The authors recommend allocating 60–70% of capital to core holdings and 30–40% to explore positions, rebalancing semiannually. This strategy allows investors to benefit from both steady compounding and the asymmetric upside of small-stock winners.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Implementation Guide

Applying the lessons from “The Little Book of Big Profits from Small Stocks” requires a structured, disciplined approach. Kramer and Navellier emphasize that success comes from consistent execution, continuous learning, and emotional resilience. Investors should start by building a solid foundation—developing a watchlist, conducting due diligence, and setting clear investment criteria—before gradually expanding into more advanced techniques.

The implementation process is iterative: investors should regularly review their portfolios, update screening parameters, and stay abreast of market developments. The authors advise starting small, learning from early trades, and gradually increasing exposure as confidence and skill grow. Patience is critical, as the best opportunities may take time to play out.

- First step investors should take: Develop a screening process to identify small and low-priced stocks with strong fundamentals—positive earnings, manageable debt, and consistent cash flow. Use online tools to build a watchlist of 20–30 candidates.

- Second step for building the strategy: Conduct deep-dive research on each candidate, assessing management quality, growth strategy, and competitive position. Set clear entry prices, target returns, and stop-loss levels for each stock.

- Third step for long-term success: Build a diversified portfolio of 15–20 small stocks across sectors and regions. Monitor positions quarterly, rebalance as needed, and remain patient—allowing time for the market to recognize undervalued opportunities. Continuously refine your process based on results and new insights.

Critical Analysis

“The Little Book of Big Profits from Small Stocks” excels at demystifying the world of low-priced stocks and providing a practical, actionable roadmap for investors. Kramer and Navellier’s blend of value investing principles, psychological insights, and real-world examples makes the book accessible and relevant to a wide audience. The focus on dividends, management quality, and intrinsic value is timeless, while the detailed screening and portfolio management strategies are especially useful for today’s volatile markets.

One limitation is that the book occasionally glosses over the unique risks associated with small and micro-cap stocks—such as illiquidity, lack of transparency, and the potential for fraud. While the authors stress the importance of due diligence and risk management, some readers may underestimate the challenges of trading in less-followed names. Additionally, the book’s emphasis on U.S. markets, though balanced by a chapter on international investing, may not fully capture the nuances of global small-cap investing.

In the current market environment—characterized by high volatility, rapid technological change, and increasing retail participation—the book’s core message is more relevant than ever. Investors who are willing to do the work, think independently, and remain patient can find big profits in small stocks. However, success requires discipline, skepticism, and a willingness to learn from mistakes. The book provides an excellent foundation, but readers should supplement it with ongoing research and a healthy awareness of the risks involved.

Conclusion

“The Little Book of Big Profits from Small Stocks” offers a comprehensive, actionable guide for investors seeking to uncover hidden gems in the stock market. Kramer and Navellier combine decades of experience with a clear, systematic approach to small-stock investing—covering everything from dividends and value analysis to international diversification and risk management. The book’s strength lies in its practical strategies, detailed checklists, and emphasis on patience and discipline.

For retail investors eager to move beyond blue chips and index funds, this book provides the tools and mindset needed to succeed in the world of low-priced stocks. The authors’ focus on intrinsic value, management quality, and independent thinking is timeless, while their advanced techniques offer a path to professional-level performance. While the risks are real, the potential rewards are substantial for those willing to do the work.

In sum, this book is a must-read for anyone serious about building wealth through small-cap and low-priced stocks. It is both a blueprint and an inspiration—reminding readers that the market’s best opportunities are often hiding in plain sight, waiting for the diligent and patient to discover them.

--- ---

10+ Free intrinsic value tools

For investors looking to find a stock's fair value, our analytics team has you covered with intrinsic value tools:

📍 Free Intrinsic Value Calculator

📍 Reverse DCF & DCF value tools

📍 Peter Lynch Fair Value Calculator

📍 Ben Graham Fair Value Calculator

📍 Relative Value tool

...and plenty more.

🔍 Explore all these tools for free on the Value Sense platform and start discovering what your favorite stocks are really worth.

FAQ: Common Questions About The Little Book of Big Profits from Small Stocks

1. What is the main investment philosophy of the book?

The book’s core philosophy is that small and low-priced stocks are often overlooked and undervalued due to institutional neglect and psychological biases. By applying disciplined research, value investing principles, and patience, investors can uncover hidden gems with the potential for outsized returns. The authors advocate for a systematic, research-driven approach rather than speculation or chasing hype.

2. Are low-priced stocks riskier than large-cap stocks?

Yes, low-priced and small-cap stocks typically exhibit higher volatility, lower liquidity, and greater business risk compared to large-cap stocks. However, the book argues that with proper screening, diversification, and risk management, these risks can be mitigated, allowing investors to capitalize on the inefficiencies present in this segment of the market.

3. How important are dividends in small-stock investing?

Dividends play a central role in the book’s strategy. The authors highlight that even among small stocks, companies with a track record of regular and growing dividends offer stability, income, and a cushion during market downturns. Reinvesting dividends can significantly enhance long-term compounding and total returns.

4. What criteria should I use to screen for high-potential small stocks?

Key criteria include positive earnings, manageable debt, consistent cash flow, strong management, and a clear growth strategy. The authors also recommend looking for insider ownership, low analyst coverage (indicating under-the-radar status), and valuation metrics such as low P/E and P/B ratios relative to peers. Qualitative factors like company culture and leadership vision are equally important.

5. How do I manage risk when investing in low-priced stocks?

Risk management is critical. The book advises diversifying across sectors and regions, setting strict position sizes, using stop-loss orders, and regularly reviewing portfolio holdings. Investors should avoid overconcentration in any single stock and be willing to sell if the investment thesis deteriorates or fundamentals worsen.

6. Can international small stocks provide better returns?

International small stocks, especially in emerging markets, can offer significant growth opportunities due to rapid economic development and expanding middle classes. However, they also come with added risks such as currency fluctuations, regulatory changes, and political instability. The book recommends using ADRs, ETFs, and thorough research to access and manage these opportunities.

7. What are “fallen angels” and how can I profit from them?

“Fallen angels” are stocks of companies that were once market leaders but have suffered significant declines due to temporary setbacks. By analyzing the root causes of decline and assessing the potential for turnaround, investors can identify stocks poised for recovery. The key is to distinguish between temporary problems and permanent business model issues.

8. How much of my portfolio should be allocated to small stocks?

The optimal allocation depends on your risk tolerance, investment goals, and time horizon. The authors suggest that conservative investors allocate 20–30% to small stocks, while more aggressive investors may go up to 50%. The “core and explore” approach—combining stable dividend payers with high-growth or turnaround names—is recommended for balance.

9. How do I avoid hype and speculation in the small-stock universe?

Focus on independent research, fundamental analysis, and skepticism toward market fads. Avoid chasing momentum or following the crowd into overhyped names. Stick to your screening criteria and investment thesis, and be willing to pass on “hot” stocks that don’t meet your standards. Conducting due diligence and verifying information from multiple sources is essential.

10. Is this book suitable for beginners or only experienced investors?

The book is accessible to both beginners and experienced investors. It provides clear explanations of key concepts, practical screening and research steps, and real-world examples. While some advanced strategies may require additional learning, the core principles and checklists are designed to help investors at any level build a strong foundation for small-stock investing.