The Little Book of Bull Moves in Bear Markets by Peter D. Schiff

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Book Overview

"The Little Book of Bull Moves in Bear Markets" by Peter D. Schiff is a compelling guide for investors navigating turbulent financial waters. Peter Schiff is a renowned economist, financial commentator, and CEO of Euro Pacific Capital. He gained significant attention for predicting the 2008 financial crisis and has since become a prominent voice warning about the risks of inflation, government intervention, and the vulnerabilities of the U.S. economy. Schiff's background as both a Wall Street professional and a contrarian thinker lends considerable credibility to his views, making his books essential reading for those seeking an alternative perspective on mainstream investment advice.

The central theme of this book revolves around thriving during economic downturns by employing "bull moves" even when most investors are fearful. Schiff argues that bear markets are not merely periods to survive but unique opportunities to reposition portfolios, protect wealth, and even profit. He systematically breaks down the root causes of economic malaise—such as inflation, currency debasement, and misguided government policies—and explains how investors can shield themselves from these forces. Schiff’s approach is unapologetically global, urging readers to look beyond U.S. borders and traditional assets to find growth and safety.

This book is particularly valuable for individual investors, financial advisors, and anyone concerned about the erosion of purchasing power or the sustainability of the current economic system. Whether you are a seasoned investor or a beginner, Schiff’s clear explanations, actionable strategies, and historical context equip you to make informed decisions. His writing style is direct, engaging, and often provocative, challenging many of the assumptions held by conventional financial media and advisors.

What sets "The Little Book of Bull Moves in Bear Markets" apart is its blend of macroeconomic insight and practical investment guidance. Schiff doesn’t just diagnose problems; he provides a roadmap for action, including specific asset classes, portfolio allocations, and risk management techniques. The book’s unique focus on global diversification, precious metals, and commodities, combined with a deep critique of monetary policy, makes it a lasting resource for those seeking to build resilience in their portfolios. Schiff’s prescient commentary, especially given the events of the past decade, makes this book even more relevant today as investors face renewed inflationary pressures and market volatility.

Key Concepts and Ideas

At its heart, "The Little Book of Bull Moves in Bear Markets" is built on the philosophy that economic cycles are inevitable, and that smart investors must adapt their strategies to the prevailing environment. Schiff’s investment approach begins with the recognition that the U.S. economy has shifted from a production-based powerhouse to a consumption-driven, service-oriented system. This transformation, he argues, has left the nation vulnerable to inflation, currency depreciation, and asset bubbles, all exacerbated by persistent government and central bank intervention.

Schiff’s core message is that traditional investment wisdom—such as holding cash, U.S. bonds, or blindly following Wall Street pundits—no longer offers the safety or returns it once did. Instead, he urges investors to embrace a contrarian mindset, focusing on real assets, global diversification, and the preservation of purchasing power. The book weaves together macroeconomic analysis, practical asset allocation, and behavioral finance to create a comprehensive playbook for surviving and thriving in bear markets.

- Inflation as a Hidden Tax: Schiff explains that inflation is not just about rising prices but is fundamentally the result of expanding the money supply. He likens inflation to a "hidden tax" that erodes the value of cash and fixed-income investments. For example, between 2000 and 2020, the U.S. dollar lost about 35% of its purchasing power, illustrating Schiff’s point that savers are penalized in inflationary regimes.

- Global Diversification: Unlike many U.S.-centric investment books, Schiff advocates for investing in foreign markets, especially those with strong currencies and robust economic growth. He cites examples of countries like Australia, Canada, and Switzerland, whose currencies and stock markets outperformed the U.S. during periods of dollar weakness.

- Commodity and Precious Metal Investing: Schiff is a strong proponent of commodities—particularly gold and silver—as hedges against inflation and currency debasement. He provides data showing that gold rose from $250/oz in 2001 to over $1,900/oz by 2011, outpacing inflation and offering real returns when stocks and bonds lagged.

- Government Intervention and Market Distortion: The book details how policies such as artificially low interest rates, quantitative easing, and fiscal stimulus create asset bubbles and distort market signals. Schiff points to the housing bubble of the mid-2000s and the tech bubble of the late 1990s as examples of policy-driven excess.

- Critical Thinking and Independent Analysis: Schiff warns against following the herd or relying on mainstream financial commentators, whom he dubs "false prophets." He encourages investors to question consensus views and base decisions on fundamental analysis and historical perspective.

- Long-Term Perspective and Patience: Rather than chasing short-term gains, the book emphasizes the importance of maintaining a long-term outlook. Schiff cites the resilience of value stocks and dividend payers during bear markets as evidence that patience pays off.

- Risk Management and Portfolio Resilience: Schiff offers concrete strategies for building portfolios that can withstand economic shocks, including diversification across asset classes and geographies, and limiting exposure to speculative or overvalued sectors.

- Debt Reduction and Personal Frugality: Recognizing the broader economic shift toward frugality, Schiff advises investors to reduce personal debt and focus on saving, echoing the conservative mindset needed for long-term financial security.

- Speculation vs. Investment: The book draws a clear distinction between speculative bets and sound investments, cautioning readers to limit the former to amounts they can afford to lose.

- Opportunity in Crisis: Finally, Schiff argues that bear markets, while painful, create rare opportunities to acquire high-quality assets at distressed prices. He encourages investors to remain vigilant and ready to act when the tide turns.

Practical Strategies for Investors

The actionable insights in "The Little Book of Bull Moves in Bear Markets" are designed to help investors not just survive, but thrive during economic downturns. Schiff’s strategies are rooted in real-world examples and supported by decades of market data. He guides readers to rethink conventional asset allocation and adopt a proactive, globally diversified approach that protects against inflation, currency risk, and government-induced distortions.

Applying these teachings requires a willingness to challenge mainstream beliefs, conduct independent research, and maintain discipline in the face of market volatility. Schiff’s recommendations are especially relevant in today’s environment of rising inflation, geopolitical uncertainty, and unprecedented monetary expansion. By following his blueprint, investors can build portfolios that are both resilient and positioned for growth, even when markets are in turmoil.

- Shift Away from Cash and U.S. Bonds: Reduce allocations to cash and long-term U.S. Treasuries, as these are most vulnerable to inflation and currency depreciation. Instead, consider short-duration bonds in strong foreign currencies or inflation-protected securities.

- Increase Exposure to Commodities and Precious Metals: Allocate a portion of your portfolio—Schiff suggests 10-20%—to gold, silver, and commodity ETFs. Use vehicles like GLD, SLV, or direct bullion ownership to hedge against inflation and systemic risk.

- Invest Internationally: Diversify equity holdings across developed and emerging markets with strong fundamentals and appreciating currencies. Look for international ETFs (such as EFA, VWO) and ADRs of companies in countries like Australia, Singapore, and Switzerland.

- Focus on Dividend-Growing Stocks: Seek out companies with a long track record of increasing dividends, especially in sectors like consumer staples, energy, and basic materials. These firms tend to outperform during bear markets and inflationary periods.

- Limit Speculative Bets: If you choose to speculate, cap your exposure to no more than 5% of your portfolio, and only use funds you can afford to lose. Set clear entry and exit rules and stick to them.

- Monitor Government Policy and Adapt: Stay informed about central bank actions, fiscal policy changes, and regulatory developments. Adjust your portfolio as needed to account for new risks or opportunities created by government intervention.

- Reduce Personal Debt and Increase Savings: Prioritize paying down high-interest debt and building an emergency fund. This creates flexibility and reduces vulnerability during economic shocks.

- Maintain a Watchlist and Act on Opportunities: Track high-quality assets that are temporarily out of favor. Be prepared to buy when valuations are attractive and sentiment is negative, following the classic contrarian playbook.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Chapter-by-Chapter Insights

Schiff structures "The Little Book of Bull Moves in Bear Markets" as a series of concise, thematic chapters, each addressing a specific challenge or opportunity facing investors in bear markets. The book’s progression is logical, starting with the root causes of economic decline and moving through asset allocation, risk management, and global diversification, before concluding with practical and psychological advice for weathering prolonged downturns.

Each chapter is packed with historical anecdotes, data-driven arguments, and actionable takeaways. Schiff uses real-world examples—ranging from the 1970s stagflation to the 2008 financial crisis—to illustrate his points and make the content accessible to both novice and experienced investors. The following section provides a detailed analysis of each major chapter, highlighting the key lessons, practical steps, and real-world relevance of Schiff’s advice.

By examining every chapter in depth, we’ll uncover not only the book’s central arguments but also the nuances that make Schiff’s approach uniquely valuable for today’s volatile markets. Whether you’re rebalancing your portfolio, researching new asset classes, or simply seeking to understand the forces shaping the global economy, these chapter summaries will equip you with the knowledge and tools needed for success.

Chapter 1: Let's Do the Time Warp Again

Schiff opens the book by dissecting the fundamental shifts that have led to the erosion of purchasing power in the U.S. economy. He argues that the dramatic rise in the cost of essentials such as gasoline and food is not a temporary phenomenon but rather a symptom of deep-seated, irreversible economic problems. Citing the transition from a manufacturing-based economy to a service-oriented one, Schiff traces how the U.S. lost its productive edge, leading to persistent trade deficits and a reliance on consumer debt to fuel growth. He points out that from 1970 to 2008, the U.S. went from being the world’s largest creditor to its largest debtor, a reversal that underpins many of the vulnerabilities facing American households today.

Schiff provides concrete examples of how Federal Reserve policies—particularly the maintenance of artificially low interest rates—have distorted market signals, encouraged excessive borrowing, and fueled asset bubbles. He references the housing boom of the early 2000s, noting how easy credit and speculative fervor led to unsustainable price increases. The chapter is peppered with data showing the decline in real wages and the increasing burden of basic expenses on average Americans. Schiff quotes, “The cost of living is rising, but it’s not because things are becoming more valuable—it’s because the dollar is becoming less valuable.”

For investors, the key lesson is to recognize that the forces driving inflation and declining purchasing power are structural, not cyclical. Schiff urges readers to understand the origins of these challenges so they can make informed investment decisions. He advises against complacency and warns that traditional safe havens like cash and bonds may no longer provide protection in a world where monetary policy is aggressively expansionary. Investors should begin by analyzing their exposure to dollar-denominated assets and consider reallocating to sectors and geographies less vulnerable to these trends.

Historically, similar periods of economic transition—such as the shift from the gold standard in the 1970s—have resulted in significant market volatility and lasting changes to the investment landscape. Schiff’s analysis is particularly relevant in the context of the post-2008 era, where central banks around the world have engaged in unprecedented monetary stimulus. The lessons of this chapter are a call to vigilance: understanding economic history is essential for navigating the present and preparing for the future.

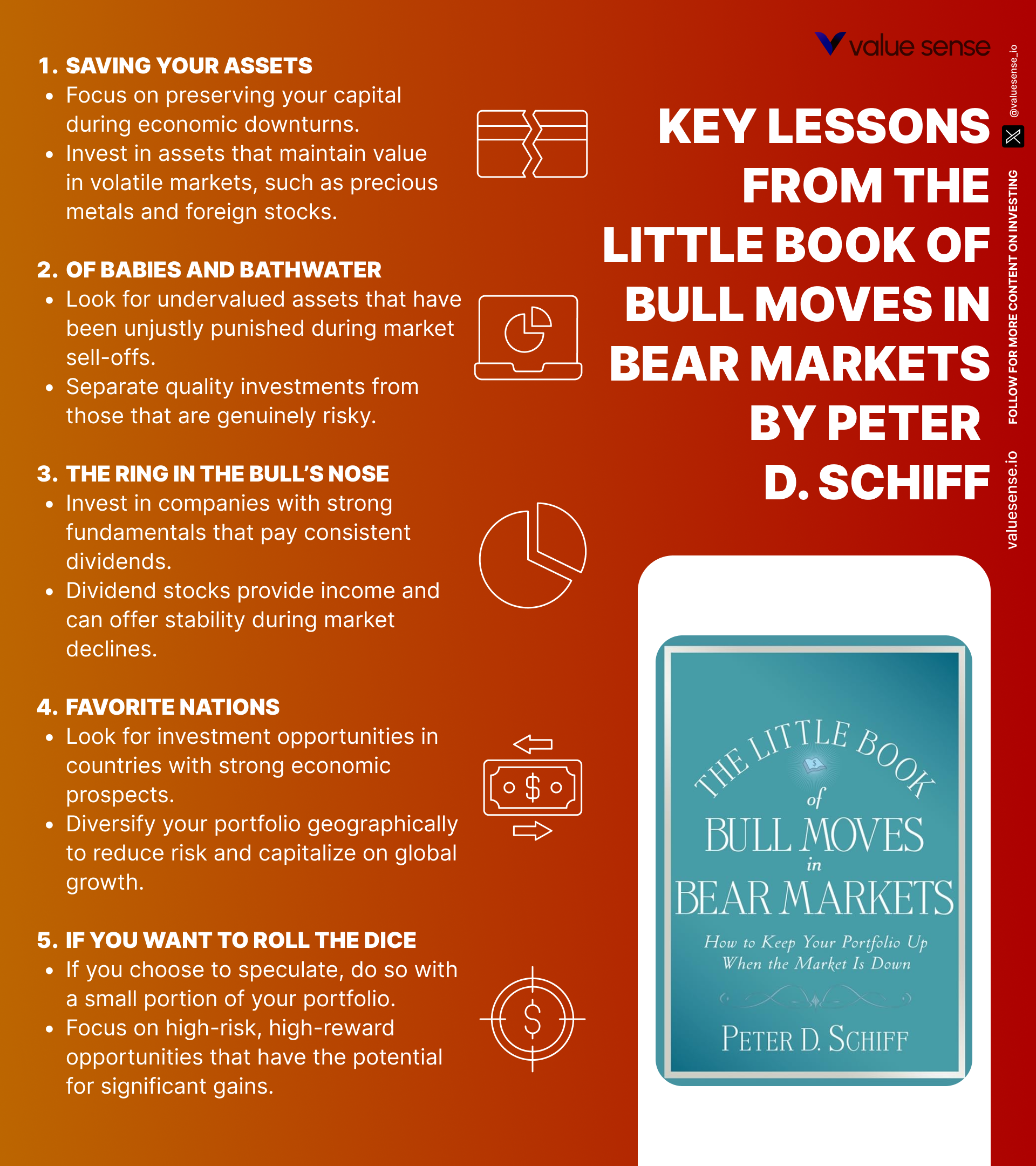

Chapter 2: Saving Your Assets

This chapter builds on the previous discussion by focusing on the dangers of holding cash and bonds during periods of rising inflation. Schiff explains that inflation is not merely an increase in prices but a direct consequence of expanding the money supply—a process largely driven by central banks. He uses the analogy of “watering down the soup” to describe how each new dollar printed reduces the value of those already in circulation. The chapter includes charts showing the steady decline in the purchasing power of the U.S. dollar since the Federal Reserve’s creation in 1913, with particularly sharp drops during periods of aggressive monetary expansion.

Schiff provides specific examples of how inflation erodes fixed-income investments. For instance, he notes that a 10-year Treasury bond yielding 2% becomes a losing proposition when inflation is running at 4% or higher, resulting in negative real returns. He also highlights the plight of retirees who depend on fixed incomes, showing how their standard of living is gradually diminished by rising costs. Schiff quotes, “Holding cash during inflation is like standing still on a moving walkway—you fall behind even if you don’t move.”

To protect against inflation, Schiff advocates reallocating assets into commodities, precious metals, and foreign equities. He suggests that investors consider gold and silver as core portfolio holdings, given their historical role as stores of value. Schiff also recommends looking at foreign stocks and bonds in countries with sound monetary policies and appreciating currencies. Practical steps include reviewing portfolio allocations, reducing exposure to long-duration U.S. bonds, and increasing positions in inflation-protected securities and real assets.

The historical context for this chapter is the stagflation of the 1970s, when traditional portfolios suffered as both stocks and bonds delivered poor returns. Gold, by contrast, rose from $35/oz in 1971 to $850/oz by 1980, illustrating the power of real assets during inflationary periods. Schiff’s advice is especially timely given the renewed focus on inflation in the wake of the COVID-19 pandemic and subsequent stimulus programs. The chapter serves as a warning that what worked in the past may not work in the future, and that adaptation is key to preserving wealth.

Chapter 3: Beware of False Prophets

In this chapter, Schiff turns his attention to the dangers of relying on financial experts and market commentators who often provide overly optimistic or misleading advice. He refers to these individuals as “false prophets,” arguing that their incentives are often misaligned with the interests of everyday investors. Schiff cites examples from the lead-up to the 2008 financial crisis, when mainstream analysts and television personalities assured the public that the housing market was sound and that stocks would continue to rise. He notes that many investors suffered significant losses by following such advice.

Schiff underscores the importance of independent thinking and critical analysis. He encourages readers to question consensus views and to conduct their own due diligence before making investment decisions. The chapter includes anecdotes of investors who avoided major losses by ignoring the herd and focusing on fundamentals. Schiff writes, “The crowd is usually wrong at turning points—if everyone agrees, it’s probably time to do the opposite.”

For practical application, Schiff suggests that investors develop a process for evaluating expert opinions. This includes examining the track record of commentators, understanding their potential conflicts of interest, and cross-referencing their advice with independent data. Investors should prioritize capital preservation during bear markets and avoid chasing speculative opportunities based on hype or emotion. Schiff recommends maintaining a checklist of criteria for investment decisions and sticking to it, regardless of prevailing sentiment.

The lessons of this chapter are reinforced by numerous historical examples, including the dot-com bubble of the late 1990s and the housing crash of 2007-2008. In both cases, mainstream voices failed to recognize the risks until it was too late. Schiff’s emphasis on skepticism and independent analysis is a timeless principle, especially in today’s era of 24/7 financial news and social media-driven market swings. Investors who cultivate critical thinking are better equipped to navigate uncertainty and avoid costly mistakes.

Chapter 4: Of Babies and Bathwater

Schiff uses the metaphor of “throwing the baby out with the bathwater” to describe the common investor mistake of indiscriminately selling both good and bad assets during market downturns. He observes that fear-driven selling often leads to the liquidation of high-quality holdings alongside weaker ones, resulting in missed opportunities for long-term gains. The chapter details how panic selling during crises—such as the 2008 financial meltdown—caused even fundamentally sound companies to trade at distressed valuations.

Schiff provides examples of blue-chip stocks and commodity producers whose prices were temporarily depressed during market panics, only to recover strongly as conditions stabilized. He points to companies like Johnson & Johnson and ExxonMobil, which maintained strong balance sheets and continued to generate cash flow even as their stock prices fell with the broader market. Schiff quotes, “Not every asset deserves to be abandoned in a storm—some are lifeboats, not anchors.”

For investors, the key is to conduct a thorough portfolio review during downturns, distinguishing between assets with enduring value and those likely to suffer permanent impairment. Schiff recommends focusing on companies with strong fundamentals, resilient business models, and the ability to weather economic shocks. Investors should resist the urge to liquidate indiscriminately and instead consider adding to positions in high-quality assets when prices are depressed.

Historically, investors who maintained a long-term perspective and avoided panic selling have been rewarded. For example, during the 2008-2009 bear market, many dividend aristocrats declined less than the broader market and rebounded more quickly. Schiff’s advice echoes the lessons of legendary investors like Warren Buffett, who famously bought shares of American Express and Coca-Cola during periods of widespread fear. The chapter is a reminder that volatility creates opportunity for those who remain disciplined and discerning.

Chapter 5: Hot Stuff

This chapter focuses on the importance of investing in “hot” sectors—particularly commodities and precious metals—during times of economic uncertainty. Schiff argues that these asset classes are uniquely positioned to benefit from inflationary environments and the declining value of fiat currencies. He provides historical data showing how gold, silver, and oil outperformed stocks and bonds during periods of currency debasement and rising prices.

Schiff highlights the structural factors driving demand for commodities, including population growth, industrialization in emerging markets, and supply constraints. He notes that from 2001 to 2011, gold prices increased by more than 600%, while oil rose from $20 to over $100 per barrel. The chapter includes practical guidance on how to gain exposure to these sectors, such as through commodity ETFs, mining stocks, and direct ownership of physical metals. Schiff writes, “When paper assets falter, real assets shine brightest.”

For investors, Schiff recommends allocating a meaningful portion of their portfolios—typically 10-20%—to commodities and precious metals. He suggests starting with gold and silver, given their liquidity and historical role as stores of value, and then diversifying into other resources like energy and agriculture. Schiff advises using dollar-cost averaging to build positions over time and cautions against excessive leverage, which can amplify volatility.

The historical context for this chapter includes the 1970s oil crisis and the 2000s commodity boom, both of which saw real assets outperform financial assets during periods of economic stress. Schiff’s emphasis on diversification into “hot” sectors is particularly relevant in today’s environment, where central banks continue to expand the money supply and geopolitical risks threaten supply chains. The chapter provides a roadmap for building inflation-resistant portfolios that can thrive in uncertain times.

---

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

---

Chapter 6: The Ring in the Bull’s Nose

In this chapter, Schiff examines the impact of government intervention on markets, arguing that policies such as bailouts, stimulus packages, and regulatory changes often distort market signals and create unintended consequences. He points to the housing bubble as a prime example of how government-sponsored entities and easy money policies fueled reckless lending and unsustainable price appreciation. Schiff warns that similar interventions can lead to asset bubbles, inflation, and increased systemic risk.

Schiff provides specific examples of market distortions, such as the artificially low interest rates maintained by the Federal Reserve following the 2008 crisis. He notes that these policies encouraged excessive risk-taking and created a “search for yield” that drove investors into increasingly speculative assets. The chapter includes data on the growth of government debt and the expansion of central bank balance sheets, illustrating the scale of intervention in recent decades. Schiff writes, “When the invisible hand is tied by the visible hand of government, markets lose their way.”

For investors, the lesson is to remain vigilant and critical of market signals that may be influenced by policy rather than fundamentals. Schiff recommends focusing on sectors and assets that are less vulnerable to government-induced distortions, such as commodities, foreign equities, and companies with global revenue streams. He also advises monitoring policy developments closely and being prepared to adjust portfolio allocations in response to major regulatory or monetary shifts.

Historically, government intervention has often led to boom-bust cycles, as seen in the aftermath of the dot-com and housing bubbles. Schiff’s critique is especially pertinent in today’s environment, where central banks continue to play an outsized role in global markets. The chapter serves as a cautionary tale, reminding investors that policy-driven markets require a flexible and adaptive approach to risk management and asset allocation.

Chapter 7: Weathering the Storm

Schiff offers a comprehensive set of strategies for surviving and thriving during economic downturns. He emphasizes the importance of preparation, adaptability, and maintaining a diversified portfolio that includes assets likely to perform well during recessions and bear markets. Schiff argues that investors who plan ahead and remain disciplined are best positioned to protect and grow their wealth when volatility strikes.

The chapter includes practical advice on portfolio construction, such as balancing equities, commodities, and foreign assets to reduce risk and enhance returns. Schiff advocates for regular portfolio reviews and rebalancing, ensuring that allocations remain aligned with changing market conditions. He also stresses the value of staying informed about economic trends, citing examples of investors who successfully navigated the 2008 crisis by anticipating shifts in policy and market sentiment. Schiff writes, “Survival is not about avoiding risk, but about managing it intelligently.”

To implement these strategies, Schiff recommends developing a written investment plan that outlines asset allocation targets, rebalancing schedules, and criteria for adding or trimming positions. He suggests maintaining a watchlist of high-quality assets to buy during market corrections and setting aside cash reserves for opportunistic purchases. Investors should also cultivate a network of information sources, including independent analysts and global news outlets, to stay ahead of emerging risks and opportunities.

Historically, well-diversified portfolios have outperformed concentrated bets during periods of market stress. For example, during the 2008-2009 downturn, portfolios with exposure to gold, foreign equities, and defensive sectors experienced smaller drawdowns and recovered more quickly. Schiff’s advice is particularly relevant for investors facing the uncertainties of the post-pandemic world, where new economic shocks and policy shifts are likely to create both challenges and opportunities.

Chapter 8: Favorite Nations

This chapter explores the benefits of investing in foreign markets, particularly in countries experiencing economic growth and currency appreciation. Schiff argues that the U.S. is no longer the only—or even the best—destination for investment capital, given its fiscal deficits, monetary expansion, and structural challenges. He highlights nations such as Australia, Canada, Singapore, and Switzerland as examples of markets with strong fundamentals, stable governments, and appreciating currencies.

Schiff provides data showing how foreign equities and currencies have outperformed their U.S. counterparts during periods of dollar weakness. For example, from 2002 to 2007, the Australian dollar appreciated by over 50% against the U.S. dollar, while the country’s stock market delivered double-digit annual returns. The chapter includes guidance on how to identify promising foreign markets, such as looking for countries with low debt-to-GDP ratios, robust export sectors, and prudent monetary policies. Schiff writes, “In a global economy, opportunity is not confined by borders.”

For investors, the key takeaway is to diversify internationally, reducing exposure to the declining dollar and tapping into global growth trends. Schiff suggests using international ETFs, ADRs, and direct investments in foreign companies to access these markets. He also recommends monitoring currency trends and considering hedged or unhedged strategies depending on risk tolerance and investment objectives.

Historically, global diversification has been a powerful tool for reducing portfolio volatility and enhancing returns. The rise of emerging markets in the 2000s and the resilience of certain developed economies during the 2008 crisis underscore the value of looking beyond the U.S. for investment opportunities. Schiff’s advice is particularly timely as investors grapple with the challenges of a multipolar world and shifting economic power dynamics.

Chapter 9: If You Want to Roll the Dice

Schiff tackles the subject of speculative investments, acknowledging that while they can offer high returns, they also come with significant risks—including the potential for total loss. He distinguishes between speculation and investing, emphasizing that the former should be approached with caution and only with capital that investors can afford to lose. Schiff details the psychological pitfalls of speculation, such as overconfidence, greed, and the tendency to chase recent winners.

The chapter includes examples of speculative manias, such as the dot-com bubble and the cryptocurrency boom, where fortunes were made and lost in short order. Schiff provides guidance on setting strict limits for speculative positions—typically no more than 5% of a total portfolio—and recommends using stop-loss orders to manage downside risk. He writes, “Speculation is not a strategy, it’s a gamble—treat it as entertainment, not a plan for wealth.”

For practical application, Schiff advises investors to balance speculative bets with a core portfolio of stable, income-generating assets. He suggests using a “barbell” approach, where the bulk of the portfolio is allocated to conservative investments, while a small portion is reserved for high-risk, high-reward opportunities. Schiff also stresses the importance of discipline, urging investors to set clear entry and exit rules and to avoid doubling down on losing trades.

Historically, speculation has been a recurring feature of financial markets, from tulip mania in the 17th century to meme stocks in the 21st. While some investors have achieved outsized gains, the majority have suffered losses when the music stopped. Schiff’s measured approach to speculation is a valuable reminder that risk management and capital preservation should always take precedence over chasing windfalls.

Chapter 10: To Infinity and Beyond

In this pivotal chapter, Schiff examines the long-term outlook for inflation and the potential for hyperinflation if current economic policies persist. He warns that unchecked monetary expansion and fiscal deficits could eventually lead to a collapse in the value of the U.S. dollar, with devastating consequences for savers and investors. Schiff draws parallels to historical episodes of hyperinflation, such as Weimar Germany and Zimbabwe, where currency debasement wiped out wealth and destabilized economies.

Schiff provides data on the growth of the U.S. money supply and the ballooning national debt, arguing that these trends are unsustainable. He notes that while hyperinflation is rare, the risk increases as governments resort to ever more aggressive stimulus measures. The chapter includes practical advice on how to protect wealth in such scenarios, including investing in commodities, precious metals, and foreign currencies. Schiff writes, “The ultimate hedge against hyperinflation is ownership of real assets that cannot be printed into existence.”

For investors, the lesson is to remain vigilant and prepared for extreme economic outcomes, even if they seem unlikely. Schiff recommends diversifying into assets that have historically retained value during inflationary crises, such as gold, silver, and real estate. He also suggests considering foreign currencies and global equities as a way to mitigate currency risk and gain exposure to more stable economic environments.

The historical context for this chapter includes the runaway inflation of the 1970s in the U.S., as well as more recent examples in emerging markets. Schiff’s warnings about the dangers of unchecked policy are especially relevant in the current era of unprecedented stimulus and quantitative easing. The chapter is a call to action for investors to build resilient portfolios capable of withstanding even the most challenging economic conditions.

Chapter 11: A Decade of Frugality

Schiff predicts that the coming decade will be characterized by a shift toward frugality and economic conservatism, as the realities of a weakened economy set in. He argues that both individuals and institutions will need to adjust their expectations and behaviors to thrive in a slower-growing, more uncertain environment. Schiff highlights the importance of saving, reducing debt, and focusing on long-term financial stability rather than short-term consumption or speculation.

The chapter includes examples of countries and households that successfully navigated periods of austerity by prioritizing savings and prudent investment. Schiff provides data showing that U.S. household savings rates, which dropped to historic lows during the housing boom, began to recover in the aftermath of the 2008 crisis. He writes, “Frugality is not just a virtue, it’s a necessity in a world where easy money is no longer a given.”

For investors, Schiff recommends reassessing spending habits, paying down high-interest debt, and building cash reserves to cushion against future shocks. He suggests focusing on sectors and assets that offer stability and long-term growth potential, such as utilities, consumer staples, and dividend-paying stocks. Schiff also advises maintaining a long-term perspective, recognizing that periods of slow growth can still offer opportunities for disciplined, patient investors.

The historical context for this chapter includes the post-World War II era, when many countries adopted conservative fiscal policies and rebuilt their economies through savings and investment. Schiff’s call for a return to frugality is particularly relevant in light of rising debt levels and demographic challenges facing many developed economies. The chapter is a reminder that resilience and discipline are key to navigating prolonged periods of economic adjustment.

Chapter 12: Pack Your Bags

Schiff explores the possibility of relocating investments—and even personal residences—to countries that offer better economic opportunities and stability. He argues that geographic diversification is an essential tool for protecting wealth and accessing new markets. Schiff highlights the benefits of investing in countries with sound fiscal policies, strong legal systems, and favorable tax regimes.

The chapter includes practical guidance on the logistics of moving assets or relocating abroad, such as understanding tax implications, legal requirements, and cultural differences. Schiff provides examples of investors who successfully diversified internationally, citing cases where foreign real estate, bank accounts, and business ventures provided both safety and growth. He writes, “In a globalized world, your financial home does not have to be your physical home.”

For investors, Schiff recommends conducting thorough research before making any relocation decisions. This includes evaluating the economic and political stability of potential destinations, assessing the ease of doing business, and consulting with legal and tax professionals. Schiff also advises ensuring that any move aligns with personal and financial goals, rather than being driven solely by fear or short-term considerations.

The historical context for this chapter includes waves of capital flight from countries experiencing economic or political turmoil, as well as the rise of “citizen investors” who leverage global mobility for financial advantage. Schiff’s advice is increasingly relevant as more investors seek to diversify beyond their home markets and take advantage of global opportunities. The chapter underscores the importance of flexibility and adaptability in an ever-changing world.

Chapter 13: The Light at the End of the Tunnel

In the final chapter, Schiff offers a note of optimism, arguing that while the road ahead may be challenging, there will be significant opportunities for those who are prepared. He emphasizes that economic crises, while painful, often lay the groundwork for future growth and innovation. Schiff encourages investors to remain patient, stay informed, and be ready to act when new opportunities arise.

The chapter includes examples of past recoveries, such as the post-1982 bull market and the rebound following the 2008 crisis, when disciplined investors who stayed the course were rewarded. Schiff writes, “Every storm eventually passes—the key is to survive with your capital intact, so you can seize the sun when it returns.” He highlights the importance of resilience, adaptability, and maintaining a long-term perspective in the face of uncertainty.

For practical application, Schiff suggests maintaining a watchlist of high-quality assets, continuing to educate oneself about economic trends, and being prepared to deploy capital when valuations are attractive. He advises against making impulsive decisions based on fear or euphoria, instead advocating for a steady, methodical approach to investing. Schiff also stresses the value of community and information-sharing, urging readers to connect with like-minded investors and stay engaged with the broader world.

The historical context for this chapter is the recurring cycle of boom and bust that has defined financial markets for centuries. Schiff’s closing message is one of hope and determination: those who prepare, stay disciplined, and maintain perspective will not only survive bear markets but emerge stronger and more prosperous on the other side. The chapter serves as a fitting conclusion to a book that is as much about mindset as it is about markets.

Advanced Strategies from the Book

Beyond the foundational principles, Schiff’s book offers advanced strategies for investors seeking to further insulate their portfolios from economic shocks and capitalize on global trends. These techniques involve a deeper understanding of macroeconomic forces, tactical asset allocation, and cross-border investment opportunities. By applying these advanced methods, investors can enhance returns while managing risk in an increasingly complex financial landscape.

Schiff’s advanced strategies are particularly relevant for those with larger portfolios or institutional mandates, but many can be adapted by individual investors willing to do the necessary research and due diligence. The following sections outline some of the most impactful techniques discussed in the book, complete with real-world examples and actionable guidance.

Strategy 1: Currency Hedging and Foreign Cash Holdings

Schiff recommends holding cash and short-term bonds denominated in strong foreign currencies—such as the Swiss franc, Singapore dollar, or Australian dollar—as a way to hedge against U.S. dollar depreciation. By diversifying cash holdings internationally, investors can protect purchasing power and benefit from currency appreciation. For example, during the 2002-2007 period, the euro and Australian dollar both gained significantly against the U.S. dollar, providing additional returns for those who held assets in these currencies. Schiff advises using global brokerage accounts or international money market funds to gain exposure, and cautions investors to consider transaction costs and local banking regulations.

Strategy 2: Tactical Commodity Rotation

Instead of simply buying and holding commodities, Schiff suggests a tactical approach that rotates capital among different resource sectors based on macroeconomic trends and supply-demand dynamics. For instance, during periods of rising inflation expectations, investors might overweight energy and industrial metals, while shifting to agricultural commodities during weather-driven supply shocks. Schiff references the 2008 oil spike, when energy outperformed other commodities, and the 2010-2012 agricultural rally, driven by droughts and rising global demand. He recommends using sector-specific ETFs and staying abreast of global economic indicators to inform allocation decisions.

Strategy 3: International Dividend Growth Investing

Schiff encourages investors to look for dividend-growing companies outside the U.S., particularly in markets with stable currencies and conservative fiscal policies. He highlights Canadian banks, Australian miners, and Swiss consumer goods firms as examples of international dividend aristocrats that have delivered reliable income and capital appreciation. By reinvesting dividends in local currencies, investors can compound returns and reduce reliance on a single economy. Schiff suggests screening for companies with 10+ years of consecutive dividend increases and strong balance sheets, using international stock screens and ADR listings.

Strategy 4: Real Asset Diversification (Farmland, Timber, Infrastructure)

Going beyond stocks and bonds, Schiff advocates for direct ownership or investment in real assets such as farmland, timberland, and infrastructure projects. These assets have historically provided inflation protection and low correlation with traditional markets. For example, U.S. farmland returned an average of 11% annually from 1992 to 2020, according to the National Council of Real Estate Investment Fiduciaries. Schiff notes that infrastructure investments—such as toll roads, ports, and utilities—offer stable cash flows and can benefit from government stimulus in emerging markets. Investors can access these opportunities through REITs, private funds, or direct ownership, depending on capital and risk tolerance.

Strategy 5: Tax Optimization and International Residency

Schiff addresses the importance of tax planning, especially for investors with significant international exposure. He discusses strategies such as establishing residency in countries with favorable tax regimes, utilizing tax treaties, and structuring investments through offshore entities. For example, some investors have reduced global tax burdens by relocating to countries with territorial taxation or by leveraging dual citizenship programs. Schiff cautions that tax optimization requires careful legal and regulatory compliance, and recommends consulting with cross-border tax specialists before making major moves.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Implementation Guide

Applying the lessons of "The Little Book of Bull Moves in Bear Markets" begins with a commitment to independent thinking, disciplined execution, and ongoing education. Schiff’s strategies are accessible to investors of all experience levels, but successful implementation requires a step-by-step approach and a willingness to adapt as conditions change. The following guide outlines the key steps for putting Schiff’s philosophy into practice.

Start by conducting a comprehensive review of your current portfolio, identifying exposures to inflation, currency risk, and government intervention. Next, research and select appropriate vehicles for commodities, foreign equities, and real assets, using ETFs, ADRs, and direct investments as needed. Finally, establish a regular schedule for monitoring economic trends, rebalancing allocations, and staying informed about policy developments worldwide.

- First step investors should take: Assess current portfolio allocations for vulnerabilities to inflation and U.S. dollar depreciation. Identify areas where diversification is lacking, especially in real assets and international markets.

- Second step for building the strategy: Begin reallocating capital to commodities, precious metals, and foreign equities. Use dollar-cost averaging to build positions over time, and consider using global brokerage accounts for currency diversification.

- Third step for long-term success: Regularly review and rebalance the portfolio in response to changing economic conditions and market signals. Stay informed through independent research, monitor government policy, and maintain a long-term, disciplined approach to risk management.

Critical Analysis

"The Little Book of Bull Moves in Bear Markets" excels at distilling complex macroeconomic concepts into actionable advice for everyday investors. Schiff’s clear writing style, historical perspective, and willingness to challenge conventional wisdom make the book both engaging and educational. The inclusion of real-world examples, data, and case studies helps ground the theory in practical reality, making the content accessible to readers at all levels of expertise.

One of the book’s main strengths is its emphasis on global diversification and real assets, which are often overlooked in mainstream investment literature. Schiff’s contrarian approach encourages readers to think critically and independently, a valuable skill in today’s fast-moving financial markets. However, some readers may find his tone overly pessimistic, especially regarding the long-term prospects of the U.S. economy and dollar. While Schiff’s warnings about inflation and government intervention have proven prescient at times, markets are inherently unpredictable, and no single strategy is foolproof.

The book’s focus on inflation and currency risk is particularly relevant in the current environment of rising prices and geopolitical uncertainty. However, investors should be mindful of the risks associated with international investing, including political instability, currency volatility, and regulatory differences. Schiff’s advice should be seen as a framework for risk management and opportunity, not as a one-size-fits-all solution. Ultimately, the book is a valuable addition to any investor’s library, providing both a wake-up call and a toolkit for building resilient, globally diversified portfolios.

Conclusion

"The Little Book of Bull Moves in Bear Markets" is a timely and practical guide for investors seeking to navigate the challenges of economic downturns, inflation, and market volatility. Peter Schiff’s blend of macroeconomic analysis, historical insight, and actionable strategies equips readers to rethink traditional portfolio construction and embrace a more global, resilient approach to investing. The book’s emphasis on real assets, independent thinking, and disciplined execution is as relevant today as when it was first published.

Investors who apply Schiff’s lessons—diversifying internationally, hedging against inflation, and maintaining a long-term perspective—will be better positioned to protect and grow their wealth in uncertain times. While no strategy is without risk, the principles outlined in this book provide a solid foundation for building portfolios that can withstand shocks and capitalize on new opportunities. Schiff’s contrarian voice is a valuable counterweight to the optimism of mainstream finance, reminding us that preparation and vigilance are the keys to long-term success.

--- ---

10+ Free intrinsic value tools

For investors looking to find a stock's fair value, our analytics team has you covered with intrinsic value tools:

📍 Free Intrinsic Value Calculator

📍 Reverse DCF & DCF value tools

📍 Peter Lynch Fair Value Calculator

📍 Ben Graham Fair Value Calculator

📍 Relative Value tool

...and plenty more.

🔍 Explore all these tools for free on the Value Sense platform and start discovering what your favorite stocks are really worth.

FAQ: Common Questions About The Little Book of Bull Moves in Bear Markets

1. Who is Peter D. Schiff and why should I trust his investment advice?

Peter D. Schiff is a well-known economist, financial commentator, and CEO of Euro Pacific Capital. He gained prominence for accurately predicting the 2008 financial crisis and is respected for his contrarian views on monetary policy, inflation, and global investing. His track record and deep understanding of macroeconomics make his insights particularly valuable for investors seeking alternative perspectives.

2. What is the main message of "The Little Book of Bull Moves in Bear Markets"?

The main message is that bear markets present unique opportunities for disciplined investors to protect and even grow their wealth. Schiff argues that traditional strategies—like holding cash or U.S. bonds—are increasingly risky in an era of inflation and currency debasement. He advocates for global diversification, real assets, and independent thinking as the keys to long-term success.

3. How does Schiff recommend protecting against inflation?

Schiff recommends reducing exposure to cash and long-term U.S. bonds, which are most vulnerable to inflation. Instead, he suggests investing in commodities, precious metals (such as gold and silver), and foreign equities in countries with strong currencies and sound fiscal policies. These assets have historically preserved purchasing power during inflationary periods.

4. What role do foreign investments play in Schiff’s strategy?

Foreign investments are central to Schiff’s approach. He encourages diversifying into international markets—especially those with robust economic growth and appreciating currencies—to reduce reliance on the U.S. dollar and tap into global opportunities. Schiff provides practical guidance on using ETFs, ADRs, and direct investments to access foreign assets.

5. Is this book suitable for beginner investors?

Yes, the book is accessible to both beginners and experienced investors. Schiff explains complex economic concepts in clear language and offers step-by-step strategies for building a resilient portfolio. Beginners will benefit from the book’s emphasis on critical thinking, risk management, and long-term planning.

6. Does Schiff address the risks of international investing?

Schiff acknowledges that international investing carries risks, including political instability, currency fluctuations, and regulatory differences. He advises conducting thorough research, diversifying across multiple countries, and consulting with professionals when necessary. The book provides a balanced view of both the opportunities and challenges of global diversification.

7. How much of my portfolio should I allocate to commodities and precious metals?

Schiff typically recommends allocating 10-20% of a portfolio to commodities and precious metals, depending on individual risk tolerance and investment goals. He emphasizes the importance of these assets as hedges against inflation and systemic risk, but also advises maintaining diversification across other asset classes.

8. What is Schiff’s view on speculative investments?

Schiff distinguishes between speculation and investing, urging readers to limit speculative bets to small portions of their portfolios—generally no more than 5%. He stresses that speculation should be approached with caution and only with money that can be lost without jeopardizing long-term financial security.

9. How often should I rebalance my portfolio according to Schiff’s strategies?

Schiff recommends regular portfolio reviews and rebalancing, at least annually or whenever significant economic or market changes occur. This ensures that allocations remain aligned with evolving risks and opportunities, and helps investors avoid being caught off guard by sudden shifts in policy or market sentiment.

10. Where can I learn more about implementing these strategies?

You can find additional resources—including stock ideas, intrinsic value tools, and in-depth market research—at valuesense.io. The Value Sense platform offers analytics, courses, and community support to help you put Schiff’s (and other value investing) strategies into practice.