The Little Book of Bull’s Eye Investing by John Mauldin

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Book Overview

The Little Book of Bull’s Eye Investing by John Mauldin is a concise yet powerful guide to navigating the complexities of modern financial markets. Mauldin, a renowned financial writer, economist, and publisher of the influential “Thoughts from the Frontline” newsletter, brings decades of market experience and a sharp analytical mind to the table. His background as an investment advisor and economic commentator lends credibility and practical insight to the book’s advice, making it a trusted resource for both new and seasoned investors.

The book’s central theme is the importance of “targeted investing”—what Mauldin calls “Bull’s Eye Investing.” This approach is about aligning your investment strategies with long-term trends and adapting to changing market conditions, rather than simply reacting to current headlines or chasing past performance. Mauldin argues that in the post-2000 era, the traditional playbook of buy-and-hold, index-focused investing is often insufficient. Instead, he advocates for a more nuanced, flexible approach that blends historical awareness with forward-looking strategies, emphasizing the need for discipline, skepticism, and adaptability.

Mauldin’s writing is accessible yet rigorous, distilling complex topics like behavioral finance, diversification, and market cycles into actionable lessons. He draws on historical data, real-world examples, and personal anecdotes to illustrate key points. For instance, his analysis of market bubbles, bear markets, and investor psychology is grounded in both academic research and practical experience. The book is particularly valuable for individual investors who want to take control of their portfolios, avoid common pitfalls, and develop a resilient, long-term investment strategy.

This book is a must-read for anyone seeking to improve their investment results in uncertain or volatile markets. It is especially relevant for those who have been frustrated by the limitations of traditional asset allocation or have fallen prey to emotional decision-making. Mauldin’s emphasis on education, critical thinking, and personal responsibility resonates with readers who want to move beyond passive investing and engage more actively with their financial futures. The book’s unique value lies in its blend of actionable advice and philosophical perspective, encouraging investors to be both pragmatic and optimistic, even when markets are challenging.

What sets The Little Book of Bull’s Eye Investing apart from other investment guides is its clear-eyed recognition of market realities. Mauldin does not promise quick riches or easy answers; instead, he offers a framework for thinking about risk, opportunity, and long-term wealth creation. His candid discussions of market cycles, behavioral traps, and the necessity of diversification are grounded in decades of market observation. The book’s structure—moving from big-picture strategy to practical tactics—ensures that readers come away with both a philosophy and a toolkit for investment success.

Key Concepts and Ideas

At the heart of The Little Book of Bull’s Eye Investing is a philosophy that blends realism, adaptability, and disciplined analysis. Mauldin believes that successful investing is less about predicting the future with certainty and more about positioning oneself to benefit from long-term trends while managing risk. He challenges the notion that historical returns can be reliably extrapolated into the future, urging investors to develop a toolkit that is both flexible and robust.

Mauldin emphasizes that investors must move beyond one-size-fits-all solutions. Instead, they should cultivate a deep understanding of market cycles, behavioral biases, and the limitations of traditional investment models. By focusing on what he calls “targeted investing,” readers are encouraged to seek out opportunities that align with enduring trends and to remain vigilant against complacency, emotional decision-making, and herd behavior. The book’s key concepts offer a roadmap for navigating turbulent markets and building a resilient portfolio.

- Anticipating Market Trends: Mauldin stresses that effective investing requires looking ahead, not just reacting to current conditions. For example, after the 2008 financial crisis, investors who recognized the long-term shift toward technology and healthcare outperformed those who clung to outdated sectors. He encourages readers to analyze macroeconomic trends, demographic shifts, and technological innovation to identify where the market is heading.

- Long-Term Perspective: The book repeatedly underscores the value of patience and a long-term outlook. Mauldin cites studies showing that investors who maintain discipline during bear markets—rather than panic selling—are more likely to achieve superior returns. He references Warren Buffett’s approach of buying quality companies and holding them through market cycles as a model for enduring success.

- Adaptive Strategies: Flexibility is a recurring theme. Mauldin critiques rigid adherence to Modern Portfolio Theory or static asset allocations, arguing that investors must be willing to adjust their strategies as market realities evolve. For instance, during the 2000–2010 “lost decade,” investors who diversified beyond U.S. equities into emerging markets, commodities, and alternative assets fared far better.

- Risk Management: Managing downside risk is central to Bull’s Eye Investing. Mauldin advocates for diversification across asset classes, sectors, and geographies. He points to the 2008 crisis as a lesson in the dangers of concentration and the value of spreading risk through global diversification and alternative investments like commodities or macro funds.

- Behavioral Biases: Mauldin explores how overconfidence, herd mentality, and loss aversion can undermine even the best investment plans. He references studies in behavioral finance and provides examples—such as the tech bubble of 2000 and the housing bubble of 2007—to show how emotional decision-making leads to poor outcomes.

- Value Investing: The book champions value investing—buying assets with strong fundamentals and attractive valuations. Mauldin highlights the success of investors like Benjamin Graham and Warren Buffett, who focus on intrinsic value rather than market hype. He encourages readers to seek out companies with solid balance sheets, consistent cash flow, and growth potential.

- Diversification: Mauldin is a strong proponent of diversification, not just among stocks and bonds but across asset classes and regions. He explains how including commodities, real estate, and global equities can buffer portfolios against market shocks and provide more stable returns.

- Disciplined Approach: Discipline is portrayed as the antidote to emotional investing. Mauldin recommends creating a written investment plan, setting clear goals, and reviewing strategies regularly to avoid impulsive decisions driven by fear or greed.

- Realistic Expectations: Avoiding performance chasing and setting achievable goals are key. Mauldin warns against the temptation to pursue hot sectors or high returns without understanding the risks involved, advocating instead for steady, sustainable growth.

- Forward-Looking Strategies: The concept of “leading the duck” encapsulates Mauldin’s advice to anticipate where the market is going. This means being proactive, continuously learning, and positioning portfolios to benefit from future opportunities rather than reacting to past trends.

Practical Strategies for Investors

Translating Mauldin’s philosophy into actionable steps, the book offers a range of practical strategies for investors seeking to navigate volatile markets and build wealth over time. Mauldin’s advice is grounded in real-world experience and supported by data, making it especially useful for those eager to move beyond theory and implement effective investment practices. He encourages readers to be proactive, disciplined, and flexible, emphasizing that successful investing is as much about managing risk and emotions as it is about identifying opportunities.

Mauldin’s strategies are designed to help investors avoid common pitfalls—such as chasing performance, succumbing to herd mentality, or failing to adapt to changing conditions. By following these approaches, investors can enhance their decision-making, reduce the impact of market downturns, and position themselves for long-term success. The book provides step-by-step guidance on portfolio construction, risk management, and behavioral discipline, ensuring that readers have a clear roadmap for implementation.

- Develop a Written Investment Plan: Start by clearly defining your investment goals, risk tolerance, and time horizon. Mauldin recommends documenting your strategy and reviewing it regularly to ensure discipline. Action steps include writing down your asset allocation targets, rebalancing schedules, and rules for buying or selling assets.

- Diversify Across Asset Classes: Allocate your portfolio among stocks, bonds, commodities, real estate, and alternative assets. Mauldin suggests including global equities and macro funds to reduce correlation and enhance resilience. Action steps: use tools like Value Sense or online screeners to identify opportunities in different asset classes and regions.

- Monitor and Adapt to Market Trends: Stay informed about macroeconomic trends, sector rotations, and emerging opportunities. Mauldin advises setting up alerts for economic indicators, reading reputable market analysis, and being prepared to adjust allocations when trends shift. Action steps: subscribe to financial newsletters, track leading economic indicators, and periodically reassess sector exposures.

- Practice Risk Management: Use stop-loss orders, position sizing, and hedging strategies to protect against large losses. Mauldin recommends setting maximum loss thresholds for each holding and using tools like options or inverse ETFs for downside protection. Action steps: determine your maximum acceptable loss per position and implement stop-losses accordingly.

- Avoid Emotional Decision-Making: Create systems to counteract behavioral biases. Mauldin suggests using checklists, setting pre-defined rules for buying/selling, and taking time to reflect before making major decisions. Action steps: develop a checklist for evaluating investments and require a cooling-off period before executing trades.

- Focus on Value and Fundamentals: Screen for companies with strong balance sheets, consistent earnings, and attractive valuations. Mauldin recommends using metrics like price-to-earnings, price-to-book, and free cash flow yield. Action steps: build watchlists of value stocks and review financial statements before investing.

- Maintain a Long-Term Perspective: Resist the urge to react to short-term volatility. Mauldin encourages regular portfolio reviews (quarterly or annually) rather than daily monitoring. Action steps: set calendar reminders for portfolio reviews and avoid checking prices more than once a week.

- Continuously Educate Yourself: Stay curious and keep learning about markets, behavioral finance, and new investment vehicles. Mauldin advises reading books, attending seminars, and joining investment communities. Action steps: allocate time each month for financial education and engage with platforms like Value Sense for ongoing insights.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Chapter-by-Chapter Insights

Mauldin structures The Little Book of Bull’s Eye Investing to guide readers from foundational concepts to advanced strategies. Each chapter builds upon the last, starting with big-picture investment philosophy and moving toward practical application. The book covers topics such as market cycles, risk management, behavioral finance, and portfolio construction, providing a comprehensive toolkit for investors. Each chapter offers detailed examples, case studies, and actionable takeaways, ensuring that the reader can apply the lessons in real-world scenarios.

The following chapter-by-chapter analysis delves into the core ideas, supporting data, and practical implications of each section. We explore how Mauldin’s advice can be implemented by individual investors, referencing historical events, notable companies, and market data to provide a rich, contextual understanding. Whether you are a beginner or a seasoned investor, these insights will help you refine your strategy and navigate market turbulence with greater confidence.

Chapter 1: An Introduction to Bull’s Eye Investing

Mauldin opens the book by introducing the central concept of “Bull’s Eye Investing”—the idea that successful investors target their strategies with precision, aligning them with long-term trends rather than simply reacting to current conditions. He argues that the most effective investors are those who anticipate where the market is heading, rather than where it currently stands. Citing historical examples, Mauldin notes that investors who recognized the shift toward technology in the early 2000s or the rise of emerging markets in the 2010s achieved superior returns. He emphasizes that understanding broad market trends and adjusting strategies accordingly is crucial for sustained success, especially in turbulent economic environments.

To illustrate his point, Mauldin references the aftermath of the dot-com bubble and the 2008 financial crisis. He explains that investors who clung to outdated models or failed to adapt suffered significant losses, while those who identified new trends—such as the growth of cloud computing or the resurgence of commodities—were able to recover and thrive. Mauldin quotes legendary investor Peter Lynch, who said, “Far more money has been lost by investors preparing for corrections than has been lost in corrections themselves.” This underscores the importance of a forward-looking approach and the dangers of excessive caution or rigidity.

For practical application, Mauldin recommends that investors regularly review macroeconomic indicators, demographic shifts, and technological innovations to identify emerging opportunities. He suggests setting aside time each quarter to assess whether your portfolio is aligned with long-term trends and adjusting allocations as needed. Tools like sector rotation strategies, thematic ETFs, and global macro analysis can help investors stay ahead of the curve. By focusing on targeted, well-researched investments, readers can avoid the pitfalls of herd mentality and position themselves for long-term growth.

Historically, this approach has proven effective. For example, investors who recognized the shift from manufacturing to technology in the 1990s and early 2000s—by investing in companies like Microsoft, Apple, and Cisco—outperformed those who remained concentrated in traditional industries. Similarly, the rise of emerging markets in the 2000s provided outsized returns for those who anticipated global economic shifts. Mauldin’s framework encourages investors to be both analytical and adaptable, blending historical awareness with a willingness to embrace new opportunities.

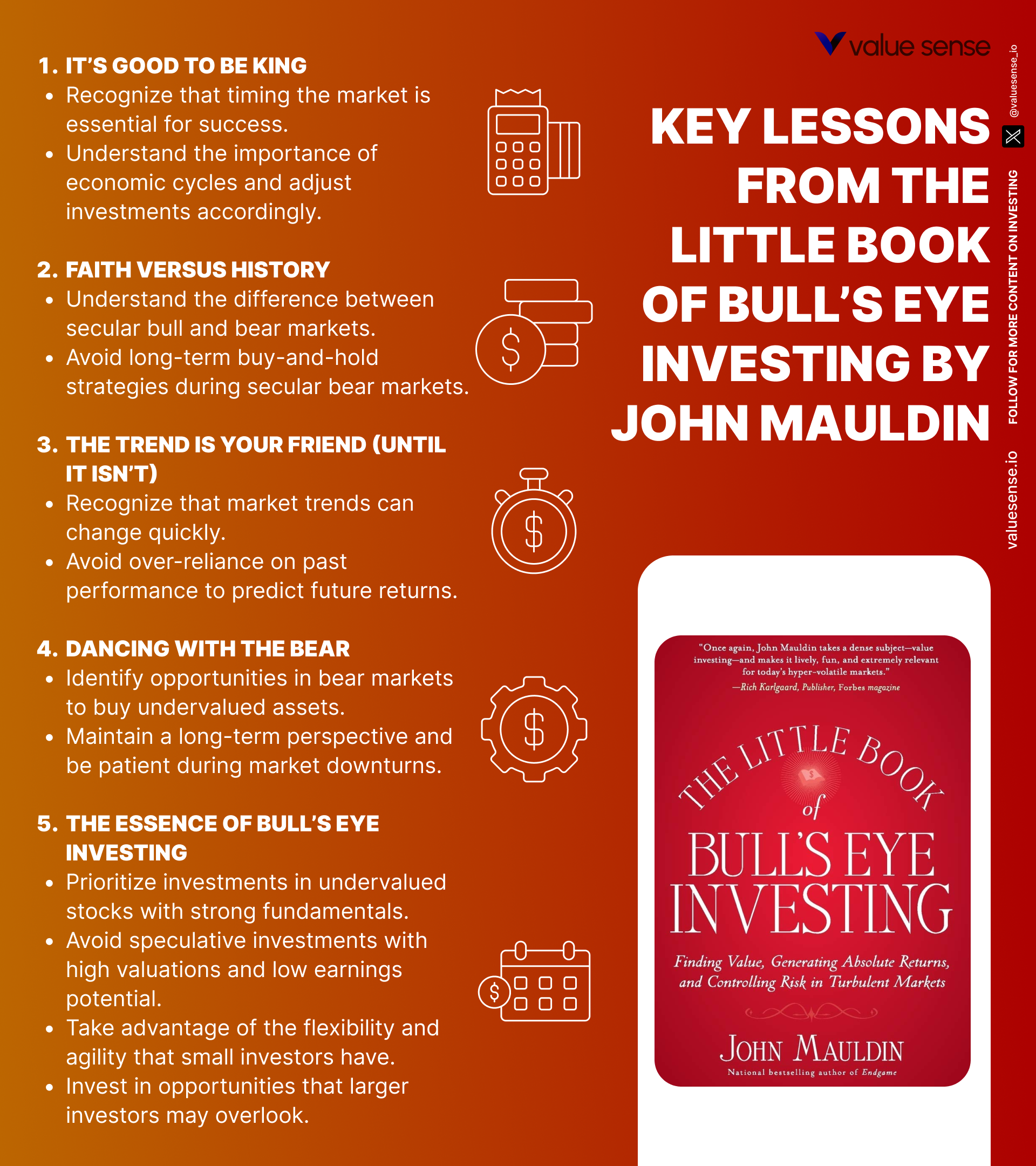

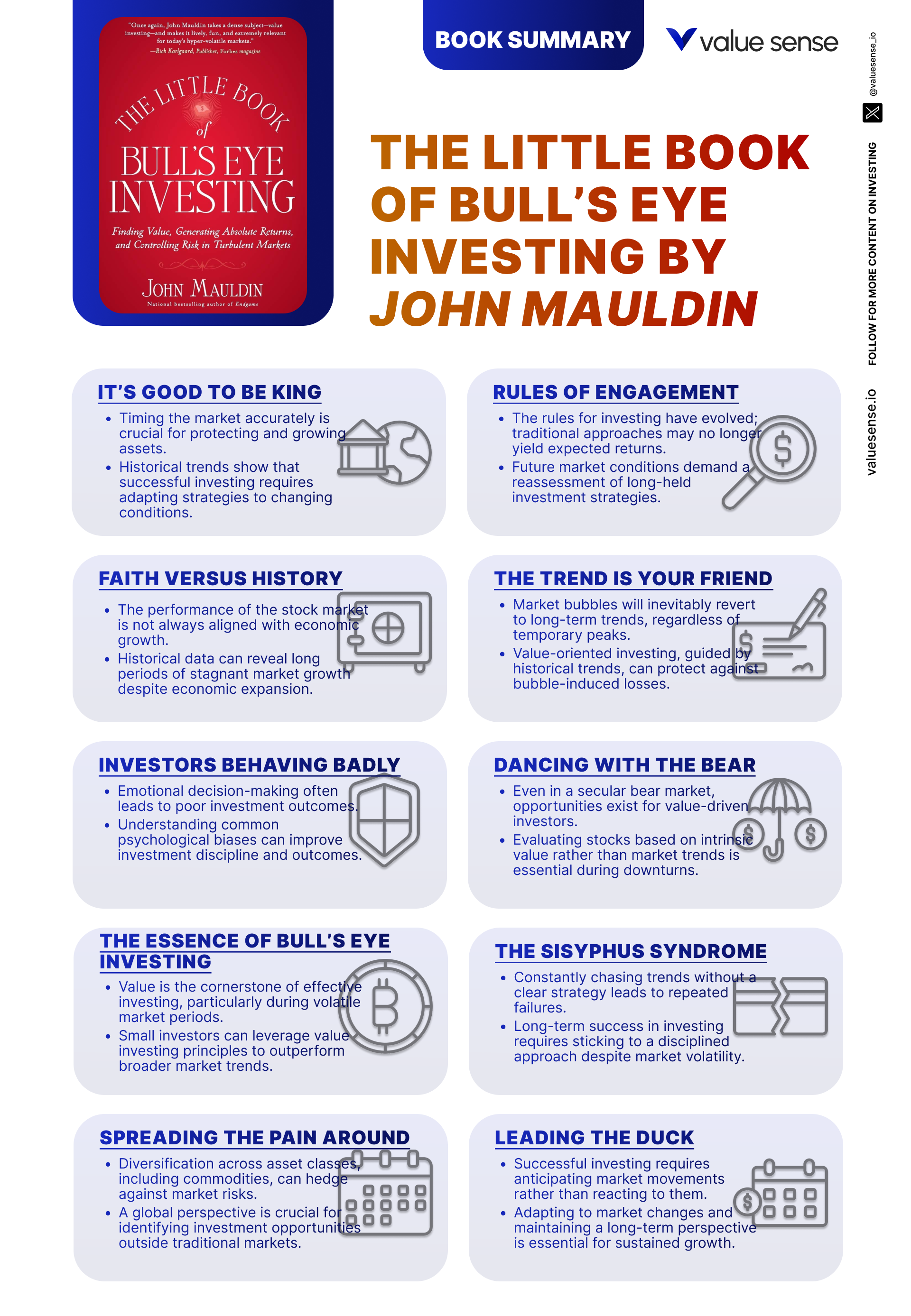

Chapter 2: It’s Good to Be King

In the second chapter, Mauldin emphasizes the importance of taking personal responsibility for investment decisions. He challenges the notion that investors should rely exclusively on financial advisors or external experts, arguing that those who educate themselves and remain actively engaged achieve better outcomes. Mauldin points out that many investors delegate decision-making to advisors without fully understanding their own goals, risk tolerance, or the strategies being employed. This passive approach, he warns, often leads to disappointment, especially when markets turn volatile or advisors’ interests are misaligned with those of the client.

Mauldin supports his argument with examples of investors who suffered losses during the 2008 financial crisis because they blindly followed the advice of professionals who were themselves unprepared for the scale of the downturn. He cites research showing that self-directed investors who take the time to educate themselves tend to achieve higher returns, as they are more likely to question overly optimistic forecasts and avoid herd behavior. The chapter includes anecdotes of individuals who successfully navigated market turbulence by staying informed and making independent decisions.

To apply these lessons, Mauldin encourages readers to invest in their own financial education. He recommends reading widely, attending seminars, and engaging with reputable investment communities. Investors should regularly review their portfolios, ask probing questions of advisors, and never be afraid to challenge consensus views. By developing critical thinking skills and maintaining a healthy skepticism toward market predictions, investors can better protect their capital and seize opportunities that others overlook.

The historical context of this chapter is particularly relevant in periods of market euphoria or panic. For example, during the late 1990s tech bubble, many investors were swept up by the hype and failed to question the sustainability of sky-high valuations. Similarly, the housing bubble of the mid-2000s was fueled by widespread complacency and a lack of critical scrutiny. Mauldin’s call for personal responsibility and proactive engagement is a timely reminder that, in the end, each investor is the “king” of their own financial destiny.

Chapter 3: Rules of Engagement

This chapter lays out the “rules of engagement” for investing in uncertain and volatile markets. Mauldin argues that traditional investment models—such as Modern Portfolio Theory (MPT)—are often inadequate in today’s environment, where correlations between asset classes can spike unexpectedly and market dynamics shift rapidly. He critiques the rigid application of MPT, noting that it failed to protect investors during the 2008 crisis, when both stocks and bonds declined in tandem. Instead, Mauldin advocates for a more flexible, adaptive approach that prioritizes risk management and the ability to revise strategies as conditions change.

Mauldin provides concrete guidelines for navigating turbulent markets. He recommends setting realistic expectations for returns, diversifying beyond traditional asset classes, and being willing to adjust allocations in response to new information. The chapter includes examples of investors who suffered losses by clinging to outdated models or failing to recognize structural changes in the market. Mauldin also discusses the importance of scenario planning and stress testing portfolios to identify potential vulnerabilities.

For practical implementation, Mauldin suggests that investors conduct regular portfolio reviews, use forward-looking risk models, and remain open to alternative investments such as commodities, real estate, or macro funds. He advises against rigid adherence to static allocations, recommending instead a dynamic approach that adjusts to evolving market realities. Investors should also be prepared to reduce risk exposure during periods of heightened volatility and to rebalance portfolios in response to significant market moves.

The limitations of traditional models became evident during the dot-com crash and the global financial crisis, when many supposedly “diversified” portfolios experienced large drawdowns. By adopting Mauldin’s rules of engagement—focused on flexibility, risk management, and continuous learning—investors can better navigate periods of uncertainty and avoid the complacency that often precedes major market corrections.

Chapter 4: Faith versus History

Mauldin explores the tension between relying on historical market trends and recognizing the unique factors influencing today’s economic environment. He cautions against the blind extrapolation of past performance, arguing that while history can offer valuable insights, it is not a foolproof guide to the future. The chapter highlights the dangers of assuming that market cycles will repeat in predictable ways, especially when structural changes—such as technological disruption, demographic shifts, or unprecedented monetary policy—alter the investment landscape.

To illustrate this point, Mauldin references the Japanese stock market, which peaked in 1989 and has yet to recover its former highs decades later. He also discusses the U.S. experience in the 1970s, when inflation and stagnation upended traditional investment strategies. Mauldin quotes Mark Twain: “History doesn’t repeat itself, but it often rhymes,” emphasizing the need for a balanced approach that considers both historical data and current market dynamics. He encourages investors to question assumptions and remain open to new information that may challenge established norms.

Practically, Mauldin advises investors to blend historical analysis with a keen awareness of present-day realities. This involves regularly questioning whether the factors that drove past returns are still in play and being willing to revise strategies when conditions change. Investors should avoid over-reliance on back-tested models or performance charts and instead focus on understanding the drivers of current trends.

Historical context is crucial here. For example, the widespread belief in the “permanent” outperformance of U.S. equities was challenged by the lost decade of 2000–2010, when international markets and alternative assets outperformed. Similarly, the 2008 crisis exposed the limitations of models based solely on historical correlations. Mauldin’s advice is to maintain a healthy skepticism, blend historical perspective with present-day analysis, and be ready to adapt as new realities emerge.

Chapter 5: The Trend Is Your Friend (Until It Isn’t)

This chapter delves into the popular investment adage, “the trend is your friend,” while cautioning that trends are not infallible and can reverse without warning. Mauldin explains that while trend-following strategies can be effective—especially during strong bull markets—they can also lead to significant losses when trends lose momentum or abruptly change direction. He references the rapid unwinding of the tech bubble in 2000 and the sudden reversal of the housing market in 2007 as examples of how quickly fortunes can change.

Mauldin provides data on the performance of trend-following funds and highlights the risks of becoming complacent or overconfident in the persistence of trends. He discusses the importance of monitoring key indicators—such as momentum, volume, and macroeconomic signals—to recognize when a trend may be weakening. The chapter includes anecdotes of investors who suffered large losses by failing to adjust their strategies when trends reversed, emphasizing the need for vigilance and flexibility.

For practical application, Mauldin recommends setting clear exit rules and regularly reviewing trend indicators. He suggests using trailing stop-losses to protect gains and being prepared to reduce exposure when warning signs emerge. Investors should avoid overconcentration in hot sectors and maintain a diversified portfolio to buffer against sudden reversals.

Historically, the dangers of trend-following without adequate risk controls have been evident in episodes like the 1987 crash, the bursting of the dot-com bubble, and the 2020 pandemic-induced selloff. Mauldin’s advice is to respect trends but remain alert to their limitations, combining trend-following with robust risk management and a willingness to pivot when conditions change.

---

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

---

Chapter 6: Investors Behaving Badly

Mauldin turns his attention to the psychological factors that often undermine investment success. He explores common behavioral biases—including overconfidence, herd mentality, and loss aversion—that can lead investors to make poor decisions. Drawing on research from behavioral finance, Mauldin explains how these biases manifest in real-world scenarios, such as the tendency to chase hot stocks during bubbles or to panic sell during market downturns.

The chapter provides specific examples of how emotional reactions can derail even the most carefully constructed investment plans. Mauldin cites studies showing that individual investors often underperform the market by several percentage points annually due to poor timing decisions driven by fear or greed. He also discusses the role of media hype and groupthink in amplifying market swings, referencing the dot-com and housing bubbles as cautionary tales.

To combat these biases, Mauldin recommends developing self-awareness and discipline. He suggests creating written investment plans, using checklists to guide decision-making, and establishing rules to limit impulsive actions. Investors should strive to make independent, fact-based decisions rather than following the crowd or reacting emotionally to market news.

In historical context, behavioral biases have played a central role in every major market bubble and crash. The South Sea Bubble, the Great Depression, the tech bubble, and the global financial crisis all featured widespread irrational exuberance or panic. Mauldin’s practical advice—grounded in both psychology and market history—offers a roadmap for avoiding these pitfalls and making more rational, informed investment choices.

Chapter 7: Dancing with the Bear

This chapter focuses on strategies for investing during bear markets, when asset prices are falling and investor sentiment is pessimistic. Mauldin explains that bear markets require a different approach than bull markets, with a greater emphasis on capital preservation, risk management, and patience. He notes that rushing into investments during downturns can lead to significant losses, as markets often experience multiple false bottoms before recovering.

Mauldin provides examples of defensive sectors—such as consumer staples, healthcare, and utilities—that tend to perform better during bear markets. He also discusses the value of holding cash or short-term bonds to reduce volatility and preserve capital. The chapter includes case studies of investors who successfully navigated bear markets by focusing on value stocks, dividend payers, and assets with low correlation to equities.

For practical implementation, Mauldin suggests regularly reviewing portfolio risk exposures, increasing allocations to defensive assets during downturns, and being patient in waiting for attractive entry points. He advises against trying to “catch falling knives” or predict market bottoms, instead recommending a disciplined, gradual approach to re-entering the market as conditions improve.

Historically, bear markets have presented both challenges and opportunities. The 2000–2002 and 2007–2009 bear markets were marked by sharp declines and prolonged recoveries, but investors who maintained discipline and focused on quality assets were able to emerge stronger. Mauldin’s guidance is to stay cautious, preserve capital, and keep a long-term perspective during turbulent periods.

Chapter 8: The Essence of Bull’s Eye Investing

In this pivotal chapter, Mauldin distills the core principles of Bull’s Eye Investing. He champions value investing—seeking out assets with strong fundamentals and attractive valuations—as the foundation of long-term success. Mauldin explains that value investing requires patience, discipline, and a willingness to go against the crowd. He highlights the advantages of being a small investor, such as greater agility and the ability to capitalize on niche opportunities that larger institutions might overlook.

Mauldin provides examples of successful value investors, including Warren Buffett and Benjamin Graham, who achieved superior returns by focusing on intrinsic value rather than market sentiment. He discusses the importance of thorough analysis, including reviewing financial statements, assessing management quality, and evaluating competitive advantages. The chapter includes practical tips for identifying undervalued stocks, such as screening for low price-to-earnings ratios, strong cash flow, and sustainable dividends.

For practical application, Mauldin recommends building a watchlist of potential investments, conducting in-depth research, and waiting for attractive entry points. He advises small investors to leverage their flexibility by investing in smaller companies or less-followed sectors where mispricings are more common. Maintaining a long-term focus and resisting the urge to chase short-term gains are key to this approach.

Historically, value investing has delivered strong results across multiple market cycles. The success of investors like Buffett, who famously bought shares of American Express during a panic in the 1960s and held for decades, illustrates the power of patience and discipline. Mauldin’s framework encourages readers to adopt a value-oriented mindset, emphasizing analysis, patience, and a willingness to act independently.

Chapter 9: The Sisyphus Syndrome

Mauldin uses the myth of Sisyphus—condemned to eternally roll a boulder uphill only to see it roll back down—to describe the cyclical nature of markets and the frustrations many investors face in achieving consistent returns. He argues that chasing performance—jumping from one hot sector or strategy to another—often leads to disappointment and subpar results. Instead, Mauldin advocates for setting realistic expectations and developing a well-thought-out investment strategy that accounts for market cycles.

The chapter provides examples of investors who became trapped in the cycle of performance chasing, only to suffer losses when trends reversed. Mauldin cites studies showing that mutual fund investors, on average, underperform the funds they invest in due to poor timing decisions—buying after strong performance and selling after declines. He emphasizes the importance of consistency, patience, and a focus on long-term goals.

For practical implementation, Mauldin recommends creating a written investment plan that outlines specific objectives, risk parameters, and rebalancing schedules. He advises investors to avoid making changes based on short-term performance or market noise, instead reviewing strategies annually and making adjustments only when justified by changes in fundamentals or personal circumstances.

Historically, the temptation to chase performance has been a persistent source of investor frustration. The rotation from tech stocks to real estate to commodities and back again has left many investors with lackluster returns. Mauldin’s advice—to focus on steady, sustainable growth and to avoid the cycle of frustration—is a powerful antidote to the Sisyphus syndrome that plagues so many market participants.

Chapter 10: Spreading the Pain Around

In this chapter, Mauldin discusses the critical importance of diversification in managing risk and minimizing losses. He explains that spreading investments across different asset classes, sectors, and geographic regions can help protect portfolios from market downturns and economic shocks. Mauldin provides practical advice on building a diversified portfolio, including the benefits of including alternative investments like commodities, real estate, and global macro funds.

The chapter includes data on the performance of diversified versus concentrated portfolios during market crises, showing that those with broader exposure experienced smaller drawdowns and faster recoveries. Mauldin highlights the value of global diversification, noting that international markets and emerging economies often provide growth opportunities when domestic markets are struggling. He also discusses the role of alternative assets in reducing correlation and enhancing portfolio resilience.

For practical application, Mauldin recommends assessing your current portfolio for concentration risks and identifying areas where diversification can be improved. He suggests using tools like correlation matrices and scenario analysis to evaluate how different assets respond to market shocks. Investors should also consider rebalancing portfolios periodically to maintain desired risk levels and take advantage of changing market conditions.

Historically, diversification has proven to be one of the most effective risk management tools available to investors. During the 2008 crisis, portfolios that included commodities, global equities, and alternative assets fared significantly better than those concentrated in U.S. stocks and bonds. Mauldin’s emphasis on “spreading the pain around” is a practical reminder that no single asset class is immune to downturns, and that diversification is essential for long-term success.

Chapter 11: Leading the Duck

The final chapter reinforces the importance of forward-looking strategies in investing. Mauldin uses the analogy of “leading the duck”—anticipating where the target will be, rather than where it is now—to illustrate the need for proactive, anticipatory investment decisions. He argues that successful investors are those who position themselves ahead of major trends, rather than reacting to events after they unfold.

Mauldin summarizes the core principles of Bull’s Eye Investing: patience, discipline, adaptability, and optimism. He encourages readers to stay focused on long-term goals, avoid being swayed by short-term market noise, and be prepared for future opportunities. The chapter includes examples of investors who benefited from anticipating trends in technology, demographics, and globalization, as well as those who suffered by clinging to outdated models.

For practical implementation, Mauldin recommends regularly reviewing macroeconomic and industry trends, maintaining a watchlist of potential investments, and being willing to adjust strategies as new information becomes available. He advises investors to cultivate patience and discipline, recognizing that opportunities often require time to materialize and that overreacting to short-term volatility can be costly.

Historically, the most successful investors have been those who anticipated major shifts—such as the rise of the internet, the globalization of supply chains, or the transition to renewable energy—and positioned themselves accordingly. Mauldin’s closing message is one of optimism and empowerment: by leading the duck, investors can navigate uncertainty, capitalize on emerging trends, and achieve their long-term financial goals.

Advanced Strategies from the Book

Beyond the foundational principles, Mauldin introduces advanced strategies for investors who want to further refine their approach. These techniques are designed to help sophisticated investors manage risk, exploit market inefficiencies, and enhance returns in both bull and bear markets. Mauldin draws on his experience as a macro strategist and advisor to offer nuanced advice on topics such as tactical asset allocation, alternative investments, and behavioral discipline.

The following advanced strategies build on the core lessons of Bull’s Eye Investing, providing investors with additional tools to navigate complex markets. Each technique is illustrated with real-world examples and actionable steps, ensuring that readers can implement these ideas in their own portfolios.

Strategy 1: Tactical Asset Allocation

Tactical asset allocation involves actively adjusting portfolio weights in response to changing market conditions, rather than sticking to a static allocation. Mauldin recommends using macroeconomic indicators—such as GDP growth, inflation trends, and central bank policy—to inform tactical shifts. For example, during periods of rising inflation, increasing exposure to commodities and inflation-protected securities can enhance returns. Conversely, in deflationary environments, overweighting bonds and defensive equities may be prudent. Investors can implement this strategy by setting predefined triggers for rebalancing, such as moving 10% of the portfolio into cash when volatility exceeds a certain threshold.

Strategy 2: Incorporating Alternative Investments

Mauldin advocates for including alternative assets—such as commodities, real estate, hedge funds, and global macro funds—in a diversified portfolio. These assets often have low correlation with traditional stocks and bonds, providing valuable diversification benefits. For instance, during the 2008 financial crisis, gold and certain macro funds delivered positive returns while equities plummeted. Investors can access alternatives through ETFs, mutual funds, or direct investments, but should conduct thorough due diligence to assess liquidity, fees, and risk profiles.

Strategy 3: Behavioral Risk Controls

To counteract common behavioral biases, Mauldin suggests implementing systematic risk controls. This includes using checklists for investment decisions, setting maximum loss thresholds, and automating rebalancing processes. For example, an investor might establish a rule to sell any position that declines by more than 20% from its peak, regardless of market sentiment. By codifying these rules in advance, investors can reduce the influence of emotions and make more rational, consistent decisions during periods of stress.

Strategy 4: Global Diversification and Currency Hedging

Mauldin emphasizes the importance of global diversification, not just for growth but also for risk management. Investing in international equities, emerging markets, and foreign currencies can reduce exposure to domestic economic shocks. However, currency risk must be managed. Mauldin recommends using currency-hedged ETFs or forward contracts to mitigate currency fluctuations, especially when investing in volatile markets. By combining global diversification with currency risk management, investors can access new opportunities while protecting against adverse movements in exchange rates.

Strategy 5: Opportunistic Value Investing in Niche Markets

Small investors have the advantage of agility, allowing them to exploit inefficiencies in niche markets or less-followed sectors. Mauldin suggests screening for undervalued companies in micro-cap stocks, special situations, or emerging industries where institutional investors are less active. For example, investing in small-cap technology firms during the early stages of the cloud computing revolution yielded substantial returns for those willing to do the research. To implement this strategy, investors should use specialized screeners, conduct in-depth analysis, and be prepared for higher volatility.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Implementation Guide

Applying the lessons from The Little Book of Bull’s Eye Investing requires a structured, disciplined approach. Mauldin’s advice is actionable for investors at all levels, but the key to success lies in consistent execution and ongoing learning. By following a step-by-step process, investors can build resilient portfolios, avoid common pitfalls, and position themselves for long-term growth.

Start by assessing your current portfolio and identifying areas where Mauldin’s principles can be integrated. This might involve increasing diversification, refining your investment plan, or incorporating new asset classes. Regular reviews and adjustments are essential to ensure that your strategy remains aligned with changing market conditions and personal goals.

- First step investors should take: Develop a written investment plan that outlines your goals, risk tolerance, asset allocation, and decision-making rules. This serves as a roadmap and helps maintain discipline during periods of market stress.

- Second step for building the strategy: Diversify your portfolio across asset classes, sectors, and geographies. Use tools and screeners to identify opportunities in undervalued stocks, alternative assets, and global markets.

- Third step for long-term success: Regularly review and adjust your portfolio in response to changing market conditions, new information, and evolving personal objectives. Continuously educate yourself and remain open to refining your strategy as you gain experience.

Critical Analysis

The Little Book of Bull’s Eye Investing excels at distilling complex investment concepts into accessible, actionable advice. Mauldin’s blend of historical perspective, behavioral finance, and practical strategy is both educational and empowering. The book’s greatest strength lies in its emphasis on adaptability, risk management, and the importance of personal responsibility. Mauldin’s candid discussion of market cycles, diversification, and behavioral pitfalls resonates with readers who have experienced the frustrations of volatile markets.

However, the book’s focus on flexibility and adaptation may leave some readers seeking more concrete, step-by-step instructions for portfolio construction. While Mauldin provides numerous examples and guidelines, the lack of specific model portfolios or quantitative frameworks may be a limitation for those who prefer prescriptive advice. Additionally, some advanced strategies—such as tactical asset allocation or alternative investments—require a higher level of sophistication and may not be suitable for all investors.

In the current market environment, characterized by rapid technological change, geopolitical uncertainty, and low interest rates, Mauldin’s principles are more relevant than ever. His call for skepticism, discipline, and continuous learning provides a valuable antidote to the noise and hype that often dominate financial media. By encouraging investors to focus on long-term trends, manage risk, and avoid emotional decision-making, the book offers a timeless framework for navigating uncertainty and building lasting wealth.

Conclusion

The Little Book of Bull’s Eye Investing is an indispensable resource for investors seeking to improve their results in an unpredictable world. Mauldin’s emphasis on targeted investing, risk management, and behavioral discipline provides a solid foundation for building resilient portfolios. The book’s blend of philosophy and practical advice ensures that readers come away with both a mindset and a toolkit for success.

Key takeaways include the importance of anticipating market trends, maintaining a long-term perspective, diversifying across asset classes, and avoiding common behavioral traps. Mauldin’s advice is grounded in decades of experience and supported by historical data, making it both credible and actionable. Whether you are a novice or a seasoned investor, the lessons in this book will help you navigate market turbulence with greater confidence and achieve your financial goals.

For those looking to take their investing to the next level, platforms like Value Sense offer the tools and insights needed to identify undervalued opportunities and build robust portfolios. By combining Mauldin’s principles with cutting-edge analytics, investors can maximize their potential for long-term success.

--- ---

10+ Free intrinsic value tools

For investors looking to find a stock's fair value, our analytics team has you covered with intrinsic value tools:

📍 Free Intrinsic Value Calculator

📍 Reverse DCF & DCF value tools

📍 Peter Lynch Fair Value Calculator

📍 Ben Graham Fair Value Calculator

📍 Relative Value tool

...and plenty more.

🔍 Explore all these tools for free on the Value Sense platform and start discovering what your favorite stocks are really worth.

FAQ: Common Questions About The Little Book of Bull’s Eye Investing

1. Who is John Mauldin and why should I trust his investment advice?

John Mauldin is a respected financial writer, economist, and investment advisor with decades of experience in analyzing global markets. He is best known for his “Thoughts from the Frontline” newsletter and has advised institutional and individual investors worldwide. His deep understanding of market cycles, behavioral finance, and risk management makes his advice both credible and practical.

2. What is the main message of The Little Book of Bull’s Eye Investing?

The book’s central message is that successful investing requires targeting your strategy to align with long-term trends, managing risk, and avoiding common behavioral traps. Mauldin emphasizes the importance of adaptability, discipline, and personal responsibility, encouraging investors to look ahead rather than simply reacting to current market conditions.

3. Is the book suitable for beginners or only advanced investors?

The book is accessible to both beginners and experienced investors. Mauldin explains complex concepts in simple language and provides actionable advice for readers at all levels. Beginners will benefit from the foundational lessons, while advanced investors can apply the more sophisticated strategies discussed in later chapters.

4. How does Bull’s Eye Investing differ from traditional buy-and-hold strategies?

Bull’s Eye Investing goes beyond traditional buy-and-hold by emphasizing the need to adapt to changing market conditions, diversify across asset classes, and manage risk actively. Mauldin encourages investors to anticipate long-term trends and avoid complacency, rather than relying solely on historical returns or passive index investing.

5. Can I apply the book’s lessons if I use a financial advisor?

Absolutely. Mauldin encourages all investors to take personal responsibility for their portfolios, even if they work with advisors. The book’s principles—such as diversification, risk management, and critical thinking—are valuable whether you manage your investments directly or collaborate with professionals.

6. What are some practical steps to start implementing Bull’s Eye Investing?

Start by developing a written investment plan, diversifying your portfolio across asset classes, and setting clear rules for risk management. Regularly review your strategy, stay informed about market trends, and continuously educate yourself to refine your approach. Using tools like Value Sense can help identify undervalued opportunities and track performance.

7. How does the book address market bubbles and downturns?

Mauldin discusses the cyclical nature of markets and provides strategies for navigating bubbles and bear markets. He emphasizes the importance of caution, patience, and a focus on value and defensive assets during downturns. The book includes historical examples and practical advice for preserving capital and identifying opportunities in challenging environments.

8. Does the book recommend specific stocks or sectors?

While Mauldin discusses the characteristics of attractive investments and sectors that tend to perform well in different market environments, he does not provide specific stock picks. Instead, he equips readers with the tools and frameworks needed to identify undervalued opportunities and build resilient portfolios tailored to their individual goals.

9. How important is diversification according to the book?

Diversification is a cornerstone of Bull’s Eye Investing. Mauldin advocates for spreading investments across asset classes, sectors, and geographies to manage risk and enhance portfolio resilience. He also highlights the benefits of including alternative assets and global exposure to reduce correlation and capture new growth opportunities.

10. What is the biggest mistake investors make, according to Mauldin?

Mauldin believes the biggest mistake is failing to adapt—whether by chasing performance, ignoring risk, or relying too heavily on past trends. He urges investors to remain flexible, disciplined, and focused on long-term goals, avoiding emotional decisions and the temptation to follow the crowd during periods of market turbulence.