The Little Book of Bulletproof Investing by Ben Stein, Phil DeMuth

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Book Overview

“The Little Book of Bulletproof Investing” by Ben Stein and Phil DeMuth stands as a practical, highly readable guide for investors seeking to protect and grow their wealth in an unpredictable world. Ben Stein, a renowned economist, actor, and commentator, brings decades of financial wisdom and a unique ability to distill complex ideas into accessible language. His co-author, Phil DeMuth, is a respected investment advisor with a Ph.D. in psychology, known for his evidence-based, client-focused approach. Together, Stein and DeMuth blend academic rigor with real-world practicality, making this book a standout in the crowded field of personal finance literature.

The main theme of the book centers on “bulletproofing” your investments—structuring your financial life to withstand market volatility, economic downturns, and the psychological traps that derail so many investors. The authors argue that successful investing is less about chasing hot stocks or timing the market, and more about building robust, diversified portfolios and cultivating the right habits. Their philosophy is grounded in behavioral finance, passive investing, and risk management, all presented in an engaging, often humorous style. The book’s purpose is to arm everyday investors with actionable tools and a mindset that guards against both Wall Street’s excesses and their own worst impulses.

This book is especially valuable for individual investors—whether beginners or seasoned market participants—who want a clear, actionable framework for managing their money. It is equally relevant for those who have been burned by market bubbles, high-fee advisors, or the temptation to “do something” in turbulent times. Stein and DeMuth’s advice is timeless, rooted in decades of market research and behavioral science. They debunk common myths, warn against the hidden costs of financial products, and encourage readers to take control of their financial destiny.

What sets “The Little Book of Bulletproof Investing” apart is its blend of psychological insight, practical checklists, and straightforward portfolio construction strategies. The authors don’t just tell you what to do—they explain why, using vivid examples from history, personal anecdotes, and clear data. The book’s unique “Tangent Portfolio” concept, focus on human capital, and frank discussion of the true costs of homeownership and retirement planning make it a comprehensive guide for building real, lasting wealth. It’s a book that doesn’t just survive booms and busts—it thrives through them.

Key Concepts and Ideas

At the core of “The Little Book of Bulletproof Investing” is a philosophy that blends behavioral finance with practical, risk-aware investing. Stein and DeMuth argue that most investors are their own worst enemies, falling prey to emotional impulses and industry marketing. The book’s approach is to build systems and habits that minimize these human weaknesses, favoring evidence-based strategies over speculation or market timing. The authors emphasize that true wealth is built through discipline, diversification, and a relentless focus on minimizing costs and maximizing long-term returns.

The book’s investment philosophy is rooted in the belief that markets are unpredictable and that no one—least of all Wall Street professionals—can consistently beat the market. Instead, the key to “bulletproof” investing is to construct portfolios that are resilient to shocks, avoid behavioral pitfalls, and align with the investor’s unique goals and risk tolerance. Throughout, Stein and DeMuth stress that financial success is as much about self-management as it is about picking the right assets.

- Behavioral Finance Awareness: The book opens with a deep dive into behavioral finance, showing how emotions like greed and fear drive poor investment decisions. Stein and DeMuth use real-world examples of market panics and bubbles to illustrate how crowd psychology can lead to irrational outcomes. Investors are encouraged to recognize these impulses and develop self-discipline, using tools like written investment policies and automatic investment plans to stay on track.

- Wall Street Skepticism: Stein and DeMuth caution readers against trusting financial advisors or products that promise too much. They explain how Wall Street profits from complexity and investor ignorance, highlighting the dangers of high fees, hidden commissions, and conflicted advice. The book urges investors to educate themselves and take control of their financial decisions, rather than outsourcing critical choices to others.

- Avoiding Common Pitfalls: The authors catalog classic investment mistakes, such as market timing, excessive leverage, and chasing hot trends. They use vivid anecdotes and data to show how these strategies almost always end badly. Instead, the book advocates for a “boring” approach—slow, steady, and grounded in fundamentals.

- Simple, Diversified Portfolios: Stein and DeMuth are champions of simplicity and diversification. They recommend building portfolios with a mix of stocks, bonds, and sometimes alternatives, using low-cost index funds as the primary vehicles. The book explains how diversification reduces risk and why simple portfolios often outperform more complex ones over time.

- Passive Investing and Cost Minimization: A core tenet is to favor passive, low-cost investment vehicles. The authors provide data showing that index funds regularly beat actively managed funds after fees. They stress the importance of minimizing taxes and costs, which can erode returns dramatically over decades.

- Risk and Reward Balance: The “Holy Grail” of investing, according to Stein and DeMuth, is achieving high returns with minimal risk. This is accomplished through strategic diversification, regular rebalancing, and a focus on long-term goals. The book provides frameworks for balancing risk and reward in practical, actionable ways.

- Tangent Portfolio Construction: One of the book’s unique contributions is the “Tangent Portfolio”—a model portfolio designed to maximize returns for a given level of risk. The authors provide step-by-step instructions for building, rebalancing, and maintaining such a portfolio, including recommendations for asset allocation based on age and risk tolerance.

- Human Capital Investment: Stein and DeMuth argue that an individual’s skills, education, and earning power—what they call “human capital”—are just as important as financial capital. They encourage readers to invest in themselves through education, skill development, and career growth, aligning personal development with financial goals.

- Realistic Retirement and Homeownership Planning: The book challenges common assumptions about retirement and homeownership, showing that these milestones are not always the best financial decisions. Stein and DeMuth provide frameworks for evaluating whether to buy a home, how much to save for retirement, and how to adapt plans as circumstances change.

- Contingency and Adaptability: Finally, the authors stress the inevitability of economic cycles and the need for contingency planning. Investors are encouraged to maintain flexibility, keep diversified portfolios, and be prepared to adjust strategies as markets evolve. Prudent, forward-thinking management is the ultimate “bulletproof” strategy.

Practical Strategies for Investors

Applying the lessons from “The Little Book of Bulletproof Investing” requires more than just understanding theory—it demands concrete action. Stein and DeMuth provide a toolkit of strategies designed to help investors build resilient portfolios, avoid costly mistakes, and stay focused on long-term goals. Their approach is refreshingly practical, emphasizing simple steps that anyone can implement, regardless of experience or wealth level.

The book’s strategies are built around the idea that successful investing is about process, not prediction. By automating good habits, diversifying broadly, and keeping costs low, investors can “bulletproof” their financial futures. Stein and DeMuth’s advice is especially relevant in today’s volatile markets, where emotional decision-making, media noise, and new financial products can easily derail even the most disciplined investor.

- Write an Investment Policy Statement (IPS): Create a written document outlining your investment goals, risk tolerance, asset allocation, and rules for buying and selling. This acts as a behavioral anchor during market turbulence. Action step: Set aside an hour to draft your IPS, and review it annually or after major life events.

- Automate Investments and Savings: Use automatic transfers to contribute regularly to investment and savings accounts. This removes emotion from the process and ensures consistency. Action step: Set up monthly auto-deposits into retirement accounts and emergency funds.

- Build a Tangent Portfolio: Construct a diversified portfolio using low-cost index funds across stocks, bonds, and alternatives. Adjust the mix based on your age, risk tolerance, and goals. Action step: Use a free online asset allocation tool, or follow the book’s sample portfolios to get started.

- Rebalance Regularly: Schedule periodic (e.g., annual or semi-annual) rebalancing to maintain your desired asset allocation. This forces you to sell high and buy low, counteracting behavioral biases. Action step: Mark a recurring calendar reminder to rebalance your portfolio at set intervals.

- Minimize Fees and Taxes: Choose index funds and ETFs with the lowest possible expense ratios. Invest through tax-advantaged accounts (e.g., IRAs, 401(k)s) whenever possible. Action step: Review your current holdings and switch out high-cost funds for low-cost alternatives.

- Invest in Human Capital: Allocate time and resources to developing new skills, education, and career opportunities. This can have a higher return than any financial asset. Action step: Set annual goals for professional development, such as taking a course or earning a certification.

- Practice Frugality and Mindful Spending: Track expenses, cut unnecessary costs, and prioritize saving. Small changes compound over time. Action step: Use a budgeting app to identify and eliminate three recurring expenses this month.

- Plan for Contingency: Build an emergency fund, maintain insurance, and have a plan for economic downturns or unexpected events. Action step: Calculate three to six months of living expenses and set this as your emergency fund target.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Chapter-by-Chapter Insights

“The Little Book of Bulletproof Investing” is structured as a logical progression from the psychological foundations of investing to practical portfolio construction, personal finance, and long-term wealth management. Each chapter builds on the last, weaving together behavioral science, market history, and actionable advice. The book’s 13 chapters cover everything from emotional bias and Wall Street’s incentives to the mechanics of saving, homeownership, and retirement planning. Below, we provide a detailed, chapter-by-chapter analysis, unpacking the book’s most important lessons and how they can be applied in today’s market.

Each chapter is packed with concrete examples, memorable quotes, and step-by-step guidance. Stein and DeMuth’s writing is both accessible and rigorous—they demystify complex topics without dumbing them down. The structure allows readers to move from high-level principles to granular tactics, making the book useful as both a primer for beginners and a reference for experienced investors. The following deep-dive will explore the core ideas, practical applications, and real-world relevance of each chapter.

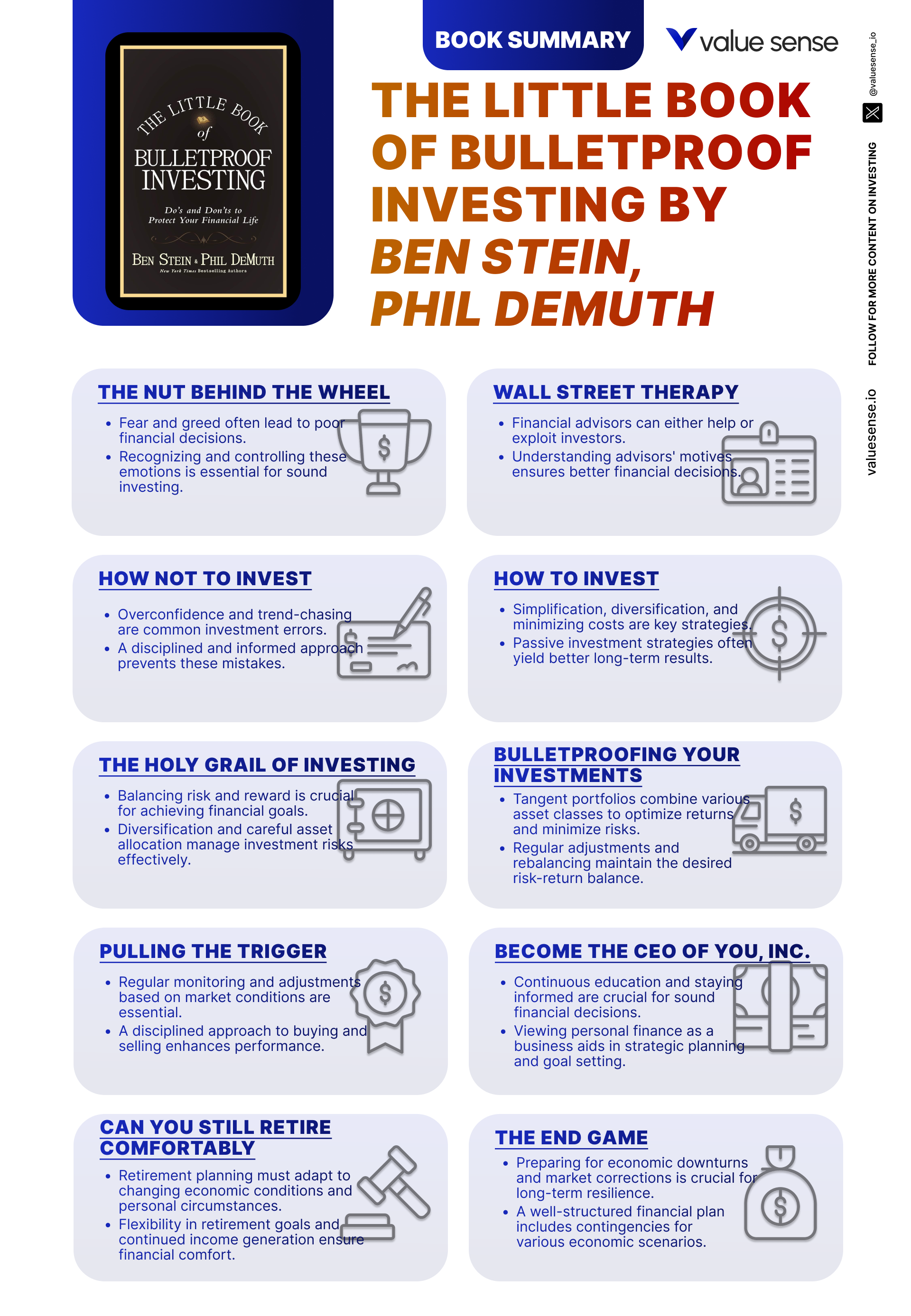

Chapter 1: The Nut Behind the Wheel – Behavioral Finance in One Lesson

In the opening chapter, Stein and DeMuth tackle the most formidable obstacle to investment success: the investor’s own mind. They introduce behavioral finance as the study of how psychological biases—particularly fear and greed—lead to irrational decisions. The authors describe how these emotions are hardwired into our brains, tracing their origins to evolutionary survival mechanisms. They use vivid examples from market history, such as the dot-com bubble of the late 1990s and the 2008 financial crisis, to show how collective panic and euphoria can drive prices far from intrinsic value. The chapter’s central message is that recognizing and managing these emotions is the foundation of “bulletproof” investing.

Stein and DeMuth illustrate how crowd psychology amplifies risk. For instance, during the tech bubble, investors who followed the herd into high-flying internet stocks suffered catastrophic losses when the bubble burst. The authors quote behavioral finance pioneers like Daniel Kahneman, emphasizing that “emotions are often a contrary indicator”—when you feel most confident, it may be time to worry. Data from DALBAR studies is cited, showing that the average investor underperforms the market by several percentage points annually due to poor timing and emotional decisions. The chapter is rich with anecdotes, including stories of investors who sold at the bottom in 2008 out of fear, only to miss the subsequent recovery.

To apply these lessons, Stein and DeMuth recommend practical tools such as writing down investment goals, automating contributions, and creating “rules-based” strategies that remove emotion from decision-making. They advocate for self-awareness and reflection—investors should ask themselves if their actions are motivated by fear, greed, or sound analysis. The authors suggest keeping a diary of investment decisions and reviewing them periodically to identify patterns of emotional bias. They also recommend using “contrarian” signals—when everyone is bullish, be cautious; when panic is widespread, look for opportunity.

Historically, these behavioral principles have been validated in every market cycle. During the 2000-2002 bear market, disciplined investors who stuck to their plans recovered faster than those who capitulated. The 2020 pandemic crash provided another case study: investors who sold in March missed a record-breaking rebound. Stein and DeMuth’s behavioral framework is more relevant than ever in an era of social media-driven hype and 24/7 news cycles. Their call to “be the nut behind the wheel—just not a crazy one” is a timeless reminder that self-mastery is the ultimate edge in investing.

Chapter 2: Wall Street Therapy – For Good and for Evil

This chapter shifts focus from internal psychology to the external environment—specifically, the relationship between individual investors and Wall Street. Stein and DeMuth argue that the financial industry is designed to profit from investor ignorance and emotion, not necessarily to serve clients’ best interests. They describe how brokers, advisors, and fund managers often present themselves as trusted authorities, but their incentives are frequently misaligned with those of their clients. The authors dissect the business model of Wall Street, explaining how fees, commissions, and complex products generate profits for the industry at the expense of investors.

The authors provide concrete examples of costly advice, such as high-fee mutual funds and “hot” investment products that promise the moon but deliver little. They cite data from Morningstar and SPIVA reports, showing that the vast majority of actively managed funds underperform their benchmarks after fees. Stein and DeMuth recount stories of investors lured into variable annuities, structured notes, and other opaque products, only to discover hidden costs and poor returns. The chapter includes memorable quotes, such as, “Wall Street’s primary goal is profit—not your financial security.”

To counter these risks, Stein and DeMuth urge readers to become critical consumers of financial advice. They recommend asking advisors about all sources of compensation, reading prospectuses, and comparing fees across products. The authors stress the importance of self-education—investors should take responsibility for their financial decisions rather than blindly trusting “experts.” They also advocate for seeking out fiduciary advisors who are legally obligated to act in the client’s best interest, rather than commission-driven salespeople.

In historical context, the 2008 financial crisis exposed the dangers of relying on conflicted advice, as many investors lost money in products they didn’t understand. In today’s world of robo-advisors and online platforms, the principles in this chapter remain vital. The democratization of information has empowered investors, but also increased the risk of falling for sophisticated marketing. Stein and DeMuth’s message: trust, but verify—and always know whose interests are being served.

Chapter 3: How Not to Invest – Kids, Don’t Try This at Home

Chapter 3 is a catalog of the most common—and costly—investment mistakes. Stein and DeMuth open with the observation that most investors fail not because they lack intelligence, but because they can’t resist the temptation to “do something” in pursuit of quick profits. The chapter lists classic blunders: trying to time the market, using leverage, chasing hot stocks, and falling for investment fads. The authors argue that these behaviors are driven by a combination of greed, fear, and a desire for excitement, all of which are antithetical to long-term wealth building.

The authors back up their warnings with data and stories. For example, they reference studies showing that market timers routinely underperform buy-and-hold investors by several percentage points per year. They recount the fate of investors who borrowed to buy tech stocks in 1999, only to be wiped out when the bubble burst. Stein and DeMuth also discuss the dangers of complex products like leveraged ETFs and structured notes, which often carry hidden risks and costs. The chapter includes memorable anecdotes of investors who lost fortunes chasing the latest trend, from dot-coms to cryptocurrencies.

To avoid these pitfalls, Stein and DeMuth recommend a “boring” approach: stick to simple, well-understood investments such as index funds, avoid leverage, and resist the urge to make frequent trades. They suggest creating a checklist of forbidden behaviors—for example, “I will not try to time the market” or “I will not invest in anything I don’t fully understand.” The authors also advocate for periodic self-assessment to ensure adherence to these rules. By focusing on fundamentals and ignoring short-term noise, investors can sidestep most of the traps that ensnare the unwary.

Historically, the wisdom of this approach is borne out by the experiences of legendary investors like Warren Buffett, who famously avoids leverage and complex products. During the 2008 crisis, those who stuck to simple, diversified portfolios fared far better than those who chased exotic strategies. In the current era of meme stocks and financial engineering, Stein and DeMuth’s admonition to “keep it simple, keep it boring” is more relevant than ever.

Chapter 4: How to Invest – It’s Not as Fun as It Used to Be

In this chapter, Stein and DeMuth lay out the nuts and bolts of sound investing. They acknowledge that the process may seem less exciting than chasing the latest hot tip, but argue that simplicity, diversification, and patience are the real keys to wealth. The authors advocate for building portfolios with a mix of stocks and bonds, primarily through low-cost index funds. They explain that, while the thrill of speculation is alluring, it almost always leads to disappointment in the long run.

The authors provide specific asset allocation models based on age and risk tolerance. For example, younger investors might allocate 70% to stocks and 30% to bonds, while retirees might reverse that ratio. Stein and DeMuth cite data from Vanguard and other research showing that diversified portfolios outperform concentrated bets and reduce volatility. They also discuss the importance of minimizing fees and taxes, noting that a 1% annual fee can reduce wealth by over 20% over a 30-year horizon. The chapter includes step-by-step instructions for building a diversified portfolio using index funds and ETFs.

To implement these ideas, the authors recommend setting up automatic investment plans, rebalancing portfolios annually, and ignoring short-term market movements. They stress that investors should focus on their own goals and risk tolerance, rather than comparing themselves to others. Stein and DeMuth also suggest periodically reviewing asset allocation to ensure it remains aligned with life changes and market conditions. The key is to create a system that runs on autopilot, reducing the temptation to tinker or react emotionally.

Historically, the power of this approach is evident in the long-term outperformance of index funds over actively managed funds. During periods of market turmoil, diversified portfolios have proven more resilient, allowing investors to sleep at night and stay the course. In today’s world of robo-advisors and commission-free trading, the tools for building simple, diversified portfolios are more accessible than ever. Stein and DeMuth’s advice is a reminder that the “boring” path is often the most rewarding.

Chapter 5: The Holy Grail of Investing: Having Your Cake and Eating It, Too

Chapter 5 delves into the quest for the “Holy Grail” of investing: achieving high returns with minimal risk. Stein and DeMuth argue that, while there is no magic bullet, the closest thing is strategic diversification across asset classes. They explain the concept of the efficient frontier and how combining uncorrelated investments can produce a portfolio with better risk-adjusted returns. The authors use historical data to show that portfolios blending stocks, bonds, and sometimes alternatives have outperformed those concentrated in a single asset class, with less volatility.

The chapter includes detailed examples of model portfolios, such as a classic 60/40 stock-bond mix, and discusses the benefits of adding asset classes like real estate or commodities. Stein and DeMuth highlight the importance of using low-cost index funds to implement these strategies, pointing out that fees and expenses are among the few variables investors can control. They also discuss the dangers of chasing yield or “guaranteed” products, warning that these often come with hidden risks.

For practical implementation, the authors recommend starting with a target asset allocation based on one’s goals and risk tolerance, then diversifying broadly within each asset class. They suggest reviewing and adjusting the portfolio periodically, but caution against making changes in response to short-term market movements. Stein and DeMuth also emphasize the importance of staying focused on long-term objectives, rather than being distracted by the latest financial innovation or market fad.

Historically, diversified portfolios have weathered market storms far better than concentrated bets. During the 2008 financial crisis, investors with balanced portfolios suffered smaller losses and recovered more quickly than those all-in on equities. In the low-interest-rate environment of the 2010s and 2020s, the need for thoughtful diversification and cost control has only increased. Stein and DeMuth’s “Holy Grail” is not a secret formula, but a disciplined application of timeless principles.

---

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

---

Chapter 6: Bulletproofing Your Investments: A Recipe for Setting Up Your Tangent Portfolios

This chapter introduces one of the book’s most distinctive contributions: the Tangent Portfolio. Stein and DeMuth explain that the Tangent Portfolio is designed to maximize return for a given level of risk, using principles from modern portfolio theory. They provide a step-by-step guide to constructing such a portfolio, including recommended allocations to stocks, bonds, and alternatives. The authors stress that the key to bulletproofing investments is not eliminating risk, but managing it intelligently through diversification and periodic rebalancing.

Stein and DeMuth offer sample Tangent Portfolios for different investor profiles, such as aggressive, balanced, and conservative. They use historical return and volatility data to demonstrate how these portfolios have performed over time. The authors explain the importance of rebalancing—selling assets that have appreciated and buying those that have lagged—to maintain the desired risk profile. They also discuss the role of alternative investments, such as REITs or commodities, in enhancing diversification.

To implement a Tangent Portfolio, the authors recommend starting with a clear assessment of risk tolerance and investment horizon. They suggest using low-cost index funds or ETFs to represent each asset class, and setting up automatic contributions and rebalancing schedules. Stein and DeMuth also advise keeping records of portfolio changes and performance, to facilitate periodic review and adjustment. The goal is to create a resilient structure that can weather market storms and capitalize on long-term growth opportunities.

Historically, portfolios constructed along these lines have delivered superior risk-adjusted returns. During the dot-com crash, for example, diversified portfolios with regular rebalancing suffered smaller drawdowns and recovered faster than concentrated tech-heavy portfolios. In the wake of the 2008 crisis, Tangent Portfolios that included bonds and alternatives provided crucial ballast. Stein and DeMuth’s recipe for bulletproofing is grounded in decades of empirical research and remains highly relevant in today’s unpredictable markets.

Chapter 7: Pulling the Trigger: Practicing Portfolio Management at Home for Fun and Profit

In Chapter 7, Stein and DeMuth turn to the practicalities of managing a portfolio on your own. They argue that, with the right tools and mindset, individual investors can achieve results comparable to professionals. The authors emphasize discipline and consistency, noting that the biggest threat to portfolio performance is often the investor’s own behavior. They discuss the importance of regular monitoring, systematic rebalancing, and sticking to a predetermined strategy, rather than reacting to market noise.

The chapter provides detailed guidance on when to buy, hold, and sell investments. Stein and DeMuth recommend setting clear criteria for each action—for example, rebalancing when an asset class drifts more than 5% from its target allocation. They also discuss the psychological challenges of executing trades, especially during periods of market turmoil. The authors share anecdotes of investors who panicked during downturns, only to regret their decisions later. They stress that patience is essential, and that most successful investors achieve their results by doing less, not more.

To apply these lessons, the authors suggest using checklists and reminders to enforce discipline. For example, create a calendar for quarterly or annual portfolio reviews, and set rules for when to make changes. Stein and DeMuth also advocate for ongoing education—reading books, following reputable financial news, and learning from mistakes. They caution against overconfidence, noting that even experienced investors can fall prey to behavioral biases.

Historically, self-managed portfolios that adhere to these principles have matched or exceeded the performance of professionally managed accounts, especially after accounting for fees. The rise of online brokerages and robo-advisors has made it easier than ever for individuals to implement disciplined strategies. Stein and DeMuth’s advice is a call to action: take control, build good habits, and let the process work over time.

Chapter 8: Become the CEO of You, Inc.: Get Wise, Get Smart, Get (Further) Educated

This chapter is a manifesto for financial self-empowerment. Stein and DeMuth argue that every investor should think of themselves as the CEO of their own financial life. This means taking responsibility for decisions, seeking out reliable information, and committing to lifelong learning. The authors stress that financial literacy is not a one-time achievement, but an ongoing process that requires curiosity and discipline. They provide practical advice for building knowledge, such as reading widely, attending seminars, and consulting multiple sources before making major decisions.

The authors highlight the dangers of complacency and overreliance on “experts.” They share stories of investors who delegated responsibility to advisors or family members, only to suffer losses due to mismanagement or fraud. Stein and DeMuth encourage readers to ask tough questions, demand transparency, and never invest in something they don’t understand. They also discuss the value of networking—learning from peers, mentors, and online communities.

For practical implementation, the authors recommend setting annual education goals, such as reading one investment book per quarter or taking an online course. They suggest keeping a journal of lessons learned and mistakes made, to facilitate continuous improvement. Stein and DeMuth also advocate for teaching others—sharing knowledge with family and friends is both rewarding and reinforces one’s own understanding.

Historically, the most successful investors are those who never stop learning. Warren Buffett, for example, famously spends hours each day reading and studying. In today’s rapidly changing world, the ability to adapt and acquire new skills is more important than ever. Stein and DeMuth’s call to “be the CEO of You, Inc.” is a powerful reminder that financial independence is built on a foundation of knowledge and self-reliance.

Chapter 9: Human Capital 411: Your Personal Human Potential Movement

Chapter 9 explores the concept of human capital—the value of one’s skills, knowledge, and experience. Stein and DeMuth argue that, for most people, the ability to earn income is their most important asset. They stress that investing in oneself—through education, skill development, and career advancement—can yield returns far greater than any financial asset. The authors provide frameworks for assessing and enhancing human capital, such as identifying strengths, seeking out training opportunities, and pursuing side projects or entrepreneurial ventures.

The chapter includes examples of individuals who transformed their financial lives by investing in education or switching careers. Stein and DeMuth cite research showing that higher levels of education and skill correlate with greater lifetime earnings and lower unemployment risk. They also discuss the importance of aligning personal growth with long-term financial goals, arguing that a strategic approach to career development can provide both security and fulfillment.

To apply these lessons, the authors recommend setting specific goals for personal development—such as earning a certification, learning a new language, or building a professional network. They suggest allocating a portion of annual income to education and training, and regularly reviewing progress. Stein and DeMuth also emphasize the value of resilience and adaptability, noting that the job market is constantly evolving and that continuous improvement is essential for long-term success.

Historically, investment in human capital has been the primary driver of upward mobility and wealth creation. In the modern economy, where technology and globalization are reshaping industries, the ability to learn and adapt is more valuable than ever. Stein and DeMuth’s focus on human capital is a crucial addition to the traditional focus on financial assets, reminding readers that true wealth is built from the inside out.

Chapter 10: Save ’Til You Drop: Topping off Your Piggy Bank

This chapter returns to the basics of personal finance: the importance of saving. Stein and DeMuth argue that consistent saving is the cornerstone of financial security, providing the foundation for investment and long-term growth. They emphasize that even small, regular contributions can accumulate into significant wealth over time, thanks to the power of compounding. The authors provide practical strategies for increasing savings, such as automating contributions, tracking expenses, and cutting unnecessary costs.

The chapter includes examples of savers who built substantial nest eggs through discipline and frugality. Stein and DeMuth discuss the psychological benefits of saving, such as peace of mind and reduced financial stress. They cite research showing that people with emergency funds are less likely to experience anxiety and more likely to take calculated risks in their careers. The authors also warn against lifestyle inflation—the tendency to increase spending as income rises—and suggest setting clear savings targets as a percentage of income.

For practical implementation, the authors recommend setting up automatic transfers to savings and investment accounts, reviewing spending monthly, and identifying three expenses to cut or reduce. They also suggest using “windfalls”—such as tax refunds or bonuses—to boost savings rather than spending. Stein and DeMuth advocate for celebrating milestones, such as reaching a certain savings threshold, to reinforce positive habits.

Historically, the most financially secure individuals and families are those with strong savings habits. During economic downturns, those with cash reserves are able to weather storms and take advantage of opportunities. In a world of easy credit and consumer temptation, Stein and DeMuth’s advice to “save ’til you drop” is a powerful antidote to instant gratification culture.

Chapter 11: Houses of Blues: Welcome to the Neighborhood of Poverty

Chapter 11 offers a contrarian perspective on homeownership. Stein and DeMuth caution that owning a home is not always the best investment, and can even become a financial burden if not managed carefully. They dissect the true costs of homeownership, including maintenance, taxes, insurance, and the risk of declining property values. The authors argue that many people overextend themselves to buy homes, only to find themselves “house poor”—unable to save, invest, or pursue other opportunities due to high fixed costs.

The authors provide case studies of individuals who suffered financial setbacks due to overleveraged home purchases or unexpected expenses. They cite data from the Federal Reserve showing that, in some markets, home prices have stagnated or declined for years, undermining the assumption that real estate always appreciates. Stein and DeMuth also discuss the risks of using adjustable-rate mortgages or tapping home equity for consumption, warning that these strategies can lead to long-term financial strain.

To apply these lessons, the authors recommend conducting a thorough cost-benefit analysis before buying a home. This includes factoring in all expenses, assessing the stability of income, and considering alternative uses for capital. Stein and DeMuth suggest renting as a viable option for those who value flexibility or are uncertain about their long-term plans. They also advocate for keeping housing costs below 30% of gross income and maintaining a robust emergency fund to cover unexpected repairs or downturns in property value.

Historically, the 2008 housing crisis stands as a stark reminder of the dangers of overleveraged homeownership. In the years since, many have reconsidered the role of real estate in their financial plans. Stein and DeMuth’s nuanced analysis challenges conventional wisdom and encourages readers to make homeownership decisions based on facts, not myths.

Chapter 12: Can You Still Retire Comfortably?: Retirement Was Overrated, Anyway

This chapter tackles the evolving landscape of retirement planning. Stein and DeMuth argue that traditional assumptions about retirement—such as retiring at 65 with a paid-off home and a generous pension—are increasingly outdated. They highlight the challenges posed by longer life expectancies, rising healthcare costs, and the decline of defined-benefit pensions. The authors stress the importance of realistic planning, flexibility, and diversification of income sources in achieving a secure retirement.

The authors provide frameworks for estimating retirement needs, including projecting expenses, accounting for inflation, and considering the role of Social Security and other benefits. They discuss strategies for increasing retirement security, such as delaying retirement, working part-time, or pursuing entrepreneurial ventures. Stein and DeMuth also emphasize the importance of adjusting spending habits and maintaining a frugal lifestyle to ensure that savings last throughout retirement.

For practical implementation, the authors recommend starting retirement planning early, maximizing contributions to tax-advantaged accounts, and periodically reviewing assumptions as circumstances change. They suggest creating multiple income streams—such as rental income, dividends, or consulting work—to reduce reliance on any one source. Stein and DeMuth also advocate for maintaining flexibility, being willing to adjust plans in response to market conditions or personal health.

Historically, those who adapt to changing realities fare better than those who cling to outdated models. The 2008 crisis forced many to delay retirement or return to work, while the COVID-19 pandemic has accelerated shifts toward remote and flexible work. Stein and DeMuth’s advice is a call to embrace change, plan conservatively, and prioritize resilience over rigid adherence to past norms.

Chapter 13: The End Game: “If Something Cannot Go on Forever, It Will Stop”

The final chapter is a meditation on the inevitability of economic cycles and the importance of preparation. Stein and DeMuth remind readers that unsustainable trends—whether bull markets, low interest rates, or government deficits—will eventually end. They argue that the key to long-term financial security is vigilance, diversification, and contingency planning. The authors discuss the role of scenario analysis, emergency funds, and insurance in mitigating the impact of downturns.

The authors provide examples from history, such as the bursting of the dot-com and housing bubbles, to illustrate how quickly fortunes can change. They cite research showing that diversified portfolios recover faster from bear markets than concentrated ones. Stein and DeMuth also discuss the psychological challenges of navigating uncertainty, urging readers to stay focused on long-term goals and avoid panic-driven decisions.

For practical application, the authors recommend maintaining a diversified portfolio, regularly reviewing risk exposure, and having a written contingency plan for financial shocks. They suggest stress-testing portfolios against various scenarios, such as rising interest rates or market crashes. Stein and DeMuth also advocate for maintaining liquidity—keeping cash reserves to cover emergencies or take advantage of opportunities during downturns.

Historically, those who prepare for the unexpected are best positioned to survive and thrive through economic cycles. The COVID-19 pandemic and subsequent market volatility have underscored the importance of resilience and adaptability. Stein and DeMuth’s closing message is clear: prudent, forward-thinking management is the ultimate “bulletproof” strategy for investors in any era.

Advanced Strategies from the Book

Beyond the foundational principles, “The Little Book of Bulletproof Investing” offers several advanced strategies for investors seeking to further optimize their portfolios and financial lives. Stein and DeMuth draw on modern portfolio theory, behavioral economics, and real-world case studies to equip readers with tools for navigating complex markets. These techniques are designed for those who have mastered the basics and want to enhance returns, manage risk more precisely, or exploit unique opportunities.

The advanced strategies focus on portfolio construction, tax optimization, behavioral safeguards, and leveraging human capital. Each is grounded in empirical research and can be tailored to individual circumstances. Below, we explore five advanced techniques, complete with examples and actionable steps.

Strategy 1: Tax-Efficient Asset Location

Stein and DeMuth emphasize the importance of placing the right assets in the right accounts to minimize taxes. For example, they recommend holding tax-inefficient investments such as bonds or REITs in tax-advantaged accounts (e.g., IRAs, 401(k)s), while placing tax-efficient assets like broad-market stock index funds in taxable accounts. This approach can boost after-tax returns by 0.5% to 1% per year—a significant edge over decades. The authors provide a step-by-step guide: inventory your accounts, categorize assets by tax efficiency, and reallocate as needed. They also discuss the importance of tax-loss harvesting and capital gains management, especially for high-net-worth investors. By optimizing asset location, investors can keep more of what they earn and accelerate wealth accumulation.

Strategy 2: Dynamic Rebalancing and Glide Paths

The book introduces the concept of dynamic rebalancing—adjusting asset allocation not just at fixed intervals, but in response to market movements or changes in personal circumstances. Stein and DeMuth suggest using “glide paths,” gradually shifting from higher-risk assets (stocks) to lower-risk ones (bonds) as retirement approaches. They provide examples of target-date funds that implement these strategies automatically, but also encourage DIY investors to set their own rules. For instance, an investor might rebalance when any asset class drifts more than 5% from its target, or when a major life event occurs. The authors caution against overreacting to short-term volatility, but argue that flexible rebalancing can enhance risk management and capitalize on market opportunities.

Strategy 3: Behavioral Guardrails—Pre-Commitment Devices

Recognizing the power of emotion, Stein and DeMuth advocate for pre-commitment devices—systems that lock in good behavior and make it harder to act on impulse. Examples include automatic investment plans, written trading rules, and “cooling-off” periods before making major changes. The authors cite research from behavioral economics showing that such guardrails can reduce costly mistakes and improve long-term results. They suggest setting up automatic contributions, requiring a 48-hour waiting period before executing non-routine trades, and sharing investment decisions with a trusted accountability partner. These techniques are especially valuable during periods of market stress, when the temptation to panic or chase trends is greatest.

Strategy 4: Human Capital Hedging

Stein and DeMuth extend the concept of diversification to human capital, recommending that investors align their financial portfolios with their career risk. For example, someone employed in the tech sector—whose income is closely tied to the performance of tech stocks—should consider underweighting tech in their investment portfolio to avoid “double jeopardy.” The authors provide frameworks for assessing industry exposure and adjusting asset allocation accordingly. They also discuss the value of career insurance, such as maintaining emergency savings, pursuing continuous education, and developing transferable skills. By hedging human capital risk, investors can reduce overall volatility and enhance resilience.

Strategy 5: Opportunistic Rebalancing and Crisis Investing

The book encourages investors to take advantage of market dislocations by rebalancing into beaten-down asset classes during crises. Stein and DeMuth provide historical examples, such as buying stocks during the 2008-2009 bear market or increasing bond allocations when yields spike. They caution that this strategy requires discipline and a clear plan—otherwise, the risk of “catching a falling knife” is high. The authors suggest setting predefined thresholds for opportunistic rebalancing (e.g., when stocks fall 20% from recent highs) and maintaining liquidity to act when opportunities arise. This approach can enhance returns and reduce regret, but only if executed within a disciplined framework.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Implementation Guide

Turning the lessons of “The Little Book of Bulletproof Investing” into action requires a systematic approach. Stein and DeMuth stress that the journey to financial security is not about one-time decisions, but about building habits, systems, and a resilient mindset. They encourage readers to start small, automate good behavior, and review progress regularly. The following steps provide a roadmap for implementing the book’s core principles.

First, assess your current financial situation—inventory assets, liabilities, income, and expenses. Next, define your goals, risk tolerance, and investment horizon. With this foundation, you can build a diversified, low-cost portfolio tailored to your needs. Finally, commit to ongoing education and periodic review, making adjustments as life and markets evolve.

- Start by writing a personal Investment Policy Statement (IPS) that outlines your goals, risk tolerance, and asset allocation.

- Automate monthly contributions to investment and savings accounts to enforce discipline and consistency.

- Build a diversified portfolio using low-cost index funds and ETFs, allocating across stocks, bonds, and alternatives as appropriate.

- Schedule regular (e.g., annual) portfolio reviews and rebalancing sessions to maintain your desired risk profile.

- Track expenses and savings, using budgeting tools to identify opportunities for increased saving and reduced waste.

- Invest in your human capital by setting annual goals for education, skill development, and career advancement.

- Maintain an emergency fund with three to six months of living expenses, and review insurance coverage to protect against major risks.

- Stay informed by reading books, following reputable financial news, and participating in financial education programs.

Critical Analysis

“The Little Book of Bulletproof Investing” excels at translating complex financial concepts into actionable advice without sacrificing rigor. Stein and DeMuth’s backgrounds in economics and psychology lend authority to their arguments, and their writing is both engaging and accessible. The book’s greatest strength is its holistic approach—combining behavioral finance, portfolio theory, and personal development into a unified framework. The Tangent Portfolio concept and emphasis on human capital are especially noteworthy, offering readers tools often overlooked in mainstream finance books.

However, the book is not without limitations. Some readers may find the advice on asset allocation or rebalancing too general, wishing for more specific model portfolios or detailed case studies. The focus on index funds and passive investing, while well-supported by evidence, may not appeal to those seeking more active or alternative strategies. Additionally, the book’s warnings against homeownership and traditional retirement may feel contrarian or unsettling to readers deeply invested in these goals. Nonetheless, these provocations force readers to question assumptions and consider the real trade-offs involved.

In the current market environment—characterized by low interest rates, high volatility, and rapid technological change—the book’s emphasis on resilience, adaptability, and cost control is more relevant than ever. Stein and DeMuth’s advice is timeless, grounded in decades of research and market experience. Whether you are a novice investor or a seasoned professional, “The Little Book of Bulletproof Investing” offers a toolkit for navigating uncertainty and building lasting wealth.

Conclusion

“The Little Book of Bulletproof Investing” is a masterclass in practical, evidence-based investing. Stein and DeMuth blend behavioral science, portfolio theory, and real-world wisdom into a guide that is both comprehensive and accessible. The book’s core message—that successful investing is about discipline, diversification, and self-management—rings true across market cycles and economic environments.

Key takeaways include the importance of recognizing and managing emotional biases, building simple and diversified portfolios, minimizing costs, and investing in both financial and human capital. The book’s actionable strategies, such as the Tangent Portfolio and behavioral guardrails, provide a roadmap for investors at all stages. Stein and DeMuth’s willingness to challenge conventional wisdom—on Wall Street, homeownership, and retirement—makes this a thought-provoking and essential read.

For anyone seeking to “bulletproof” their financial future, this book is an invaluable resource. It offers not just tactics, but a mindset and philosophy for thriving through booms and busts alike. We highly recommend “The Little Book of Bulletproof Investing” for investors who want to build wealth with confidence, clarity, and resilience.

--- ---

10+ Free intrinsic value tools

For investors looking to find a stock's fair value, our analytics team has you covered with intrinsic value tools:

📍 Free Intrinsic Value Calculator

📍 Reverse DCF & DCF value tools

📍 Peter Lynch Fair Value Calculator

📍 Ben Graham Fair Value Calculator

📍 Relative Value tool

...and plenty more.

🔍 Explore all these tools for free on the Value Sense platform and start discovering what your favorite stocks are really worth.

FAQ: Common Questions About The Little Book of Bulletproof Investing

1. Who are Ben Stein and Phil DeMuth, and why are they credible?

Ben Stein is an economist, author, and commentator known for making complex financial concepts accessible. Phil DeMuth is a Ph.D. psychologist and respected investment advisor. Together, they combine academic rigor with real-world financial experience, making their advice trustworthy and practical for individual investors.

2. What is the main philosophy of “The Little Book of Bulletproof Investing”?

The book’s core philosophy is that successful investing is about discipline, diversification, and minimizing costs—not market timing or chasing hot stocks. Stein and DeMuth emphasize behavioral finance, passive investing, and risk management as the pillars of “bulletproof” wealth building.

3. How does the Tangent Portfolio work, and who should use it?

The Tangent Portfolio is a diversified mix of stocks, bonds, and alternatives designed to maximize returns for a given level of risk. It uses principles from modern portfolio theory and is suitable for investors who want a simple, evidence-based approach to asset allocation and rebalancing.

4. What are the biggest mistakes investors make, according to the book?

Common mistakes include trying to time the market, using leverage, chasing trends, and investing in complex or high-fee products. The book argues that these behaviors are driven by emotion and often result in subpar returns or significant losses over time.

5. Does the book recommend active or passive investing?

Stein and DeMuth strongly advocate for passive investing using low-cost index funds and ETFs. They present data showing that passive strategies outperform most active managers after fees, and they emphasize the importance of minimizing costs and taxes.

6. How does the book address the role of human capital in investing?

The authors argue that an individual’s skills, education, and earning potential—human capital—are just as important as financial investments. They recommend investing in personal development, continuous education, and career advancement as part of a holistic wealth strategy.

7. What does the book say about homeownership as an investment?

Stein and DeMuth challenge the assumption that owning a home is always a good investment. They highlight the true costs—maintenance, taxes, risk of declining value—and advise readers to conduct a thorough analysis before buying. Renting is presented as a sensible alternative in many cases.

8. How can investors protect themselves during market downturns?

The book recommends maintaining a diversified portfolio, having an emergency fund, and following a written investment plan. Regular rebalancing and contingency planning are emphasized as ways to reduce risk and take advantage of opportunities during crises.

9. Is this book suitable for beginners or only experienced investors?

The book is accessible to beginners but also offers advanced strategies for experienced investors. Its clear explanations, practical checklists, and actionable steps make it valuable for readers at all levels of experience.

10. How can I start applying the book’s lessons today?

Begin by writing an investment policy statement, automating savings and investments, and building a diversified portfolio with low-cost index funds. Commit to ongoing education and review your plan regularly to stay on track and adapt as your goals or circumstances change.