The Little Book of Commodity Investing by John Stephenson

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Book Overview

John Stephenson’s “The Little Book of Commodity Investing” stands as a modern classic for investors eager to understand and profit from the world of commodities. Stephenson, a seasoned portfolio manager with decades of experience in global resource markets, brings a wealth of practical knowledge and analytical rigor. He is a senior vice president and portfolio manager at First Asset Investment Management Inc., and his insights have been featured in leading financial publications and television networks. This credibility is evident throughout the book, as Stephenson distills complex commodity market mechanics into accessible, actionable guidance for both novice and experienced investors.

The main theme of the book is the critical role that commodities—ranging from oil and natural gas to gold, grains, and industrial metals—play in the global economy and in building robust, diversified investment portfolios. Stephenson argues that commodities are not merely speculative “side bets,” but essential assets that can hedge against inflation, provide diversification, and capture growth from secular trends like urbanization, technological advancement, and emerging market development. The book’s purpose is to demystify commodity investing, explain its unique risks and rewards, and provide a practical framework for integrating commodities into a modern portfolio.

“The Little Book of Commodity Investing” is ideal for a broad audience. New investors will appreciate its clear explanations and step-by-step approach, while seasoned investors will find value in Stephenson’s advanced strategies and real-world case studies. The book is especially relevant for those seeking to protect their wealth from inflation, diversify beyond traditional stocks and bonds, or capitalize on the global shifts reshaping resource demand. Its practical orientation makes it a must-read for anyone who wants to understand the “why” and “how” of commodity investing, rather than just following market trends blindly.

What sets this book apart is its blend of macroeconomic insight, historical perspective, and hands-on advice. Stephenson weaves together stories of economic transformation in China and India, the rise and fall of oil prices, and the impact of technological innovation on resource extraction. He provides detailed breakdowns of investment vehicles—futures, ETFs, mining stocks—and highlights the importance of risk management, timing, and diversification. With its concise, engaging style and focus on actionable takeaways, “The Little Book of Commodity Investing” is both an educational resource and a practical toolkit, empowering investors to make informed decisions in a volatile asset class.

Throughout its chapters, the book offers not only theoretical frameworks but also concrete examples, such as how investors profited from the 2000s commodity supercycle or weathered the volatility of the 2008 financial crisis. Stephenson’s guidance is rooted in real-world experience, making the book a valuable companion whether you’re managing your own portfolio or advising clients. Its enduring relevance is underscored by ongoing global shifts—such as the energy transition, climate change, and supply chain disruptions—that continue to shape commodity markets today.

Key Concepts and Ideas

At the heart of “The Little Book of Commodity Investing” is a philosophy that commodities are indispensable to both economic progress and portfolio resilience. Stephenson emphasizes that commodities—unlike stocks or bonds—are physical resources with intrinsic value, subject to unique supply-demand dynamics, geopolitical influences, and macroeconomic cycles. The book’s central argument is that a well-constructed commodity allocation can serve as both a growth engine and a risk mitigator, especially in uncertain or inflationary environments.

The book further explores how secular trends—urbanization, population growth, technological innovation, and the rise of emerging markets—drive long-term demand for resources. Stephenson insists that understanding these trends is crucial for identifying attractive entry points and avoiding common pitfalls. He also underscores the importance of choosing the right investment vehicles, managing leverage, and diversifying across commodity types and geographies to optimize risk-adjusted returns.

- Economic Shift and Growth: The book highlights the ongoing shift in global economic power toward developing nations, particularly China and India. This shift fuels unprecedented demand for commodities, as these economies industrialize and urbanize. Stephenson provides data on how China’s share of global steel consumption rose from 15% in 2000 to over 50% by 2010, illustrating the transformative impact of emerging markets on commodity prices.

- Inflation Hedge: Commodities are presented as a natural hedge against inflation. Stephenson explains that when inflation rises, the prices of physical goods like oil, gold, and grains typically increase as well. He cites historical periods—such as the 1970s oil shocks—when commodity investments outperformed stocks and bonds, protecting investors’ purchasing power.

- Diversification Benefits: The book demonstrates that commodities often have low or negative correlations with traditional asset classes. This means that when stocks and bonds falter, commodities may perform well, reducing overall portfolio volatility. Stephenson provides portfolio analysis examples showing that adding a 10-15% commodity allocation can improve risk-adjusted returns.

- Direct vs. Indirect Investment: Stephenson contrasts direct commodity exposure (via futures contracts) with indirect exposure (via commodity-producing companies or ETFs). He explains the risks and rewards of each, noting that futures offer pure price exposure but require expertise, while stocks and ETFs are more accessible but may not perfectly track commodity prices.

- Leverage and Risk Management: The book discusses the use of leverage in futures markets, emphasizing that while leverage can amplify gains, it also increases the risk of significant losses. Stephenson warns that inexperienced investors can be wiped out by margin calls if they don’t manage risk carefully, and he provides examples of both successful and disastrous leveraged trades.

- Understanding Market Dynamics: Stephenson stresses the importance of monitoring supply-demand fundamentals, geopolitical developments, and technological changes. He uses the example of the U.S. shale revolution, which dramatically increased natural gas and oil supplies, reshaping global energy markets and investment strategies.

- Investment Vehicles: The book provides a detailed overview of investment vehicles—physical commodities, futures, ETFs, mining and energy stocks, and commodity indices. Stephenson explains how each vehicle works, their respective risks, and how to select the right mix based on investment goals and risk tolerance.

- Timing and Cyclicality: Commodities are highly cyclical, with prices often swinging sharply in response to supply disruptions, demand surges, or macro shocks. Stephenson encourages investors to pay attention to market cycles, citing examples like the 2000s commodity boom and the 2014 oil price crash, and to use technical and fundamental analysis to time entry and exit points.

- Sector-Specific Strategies: The book breaks down strategies for different commodity sectors—energy, precious metals, industrial metals, and agriculture. Stephenson explains, for example, why gold behaves differently from copper, or why natural gas prices are more volatile than oil, and tailors investment approaches accordingly.

- Portfolio Construction and Rebalancing: Stephenson advocates for a disciplined approach to building and maintaining a commodity allocation. He recommends periodic rebalancing, diversification across sectors, and alignment with long-term financial objectives. The book includes sample portfolios and guidelines for adjusting allocations as market conditions change.

Practical Strategies for Investors

Applying the teachings of “The Little Book of Commodity Investing” requires more than just theoretical understanding—it demands disciplined, actionable steps tailored to individual goals and risk profiles. Stephenson provides a toolkit of practical strategies that investors can implement immediately, regardless of their level of experience. The book emphasizes that successful commodity investing is about balancing risk and reward, staying informed on global trends, and choosing the right vehicles for exposure.

Stephenson’s approach is grounded in real-world market conditions, encouraging investors to blend macroeconomic awareness with tactical execution. He advocates for starting small, learning the mechanics of each commodity sector, and gradually building confidence through research and portfolio experimentation. The strategies outlined below are designed to help investors capture opportunities while managing the inherent volatility and complexity of commodity markets.

- Diversify Commodity Exposure: Build a portfolio that includes a mix of energy, metals, and agricultural commodities. Action step: Allocate 10-15% of your total portfolio to a diversified commodity ETF or a basket of sector-specific ETFs, such as SPDR Gold Shares (GLD) for gold, United States Oil Fund (USO) for oil, and Invesco DB Agriculture Fund (DBA) for agriculture.

- Use Commodity ETFs for Accessibility: For those new to commodities, start with broad-based ETFs that track commodity indices. Action step: Research and invest in ETFs like the iShares S&P GSCI Commodity-Indexed Trust (GSG) or Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC) to gain diversified exposure without the complexity of futures contracts.

- Invest Indirectly via Resource Companies: Gain exposure to commodities through stocks of mining, energy, or agribusiness companies. Action step: Analyze leading firms like BHP Group (industrial metals), ExxonMobil (oil), or Archer Daniels Midland (agriculture) for their sensitivity to commodity price movements and financial strength.

- Hedge Against Inflation: Use commodities as a portfolio hedge during periods of rising inflation. Action step: Monitor inflation indicators (CPI, PPI) and increase your commodity allocation when inflation expectations rise, as commodity prices typically respond positively to inflationary pressures.

- Monitor Global Trends and News: Stay updated on geopolitical developments, technological advances, and supply-demand shifts. Action step: Set up alerts for OPEC meetings, major weather events, or regulatory changes affecting key commodities, and adjust your positions accordingly.

- Manage Leverage Carefully: If using futures or leveraged ETFs, strictly control position sizes and use stop-loss orders. Action step: Limit leveraged positions to no more than 2-3% of your portfolio and set automatic stop-losses at 10-15% below entry price to contain potential losses.

- Time Entries and Exits: Use technical and fundamental analysis to identify attractive entry and exit points. Action step: Track moving averages, support/resistance levels, and key macro indicators (like inventory reports or planting forecasts) to inform your trades.

- Rebalance Regularly: Periodically review and adjust your commodity allocation to maintain target weights and risk levels. Action step: Schedule quarterly portfolio reviews to rebalance commodity holdings, trimming winners and adding to laggards as needed.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Chapter-by-Chapter Insights

“The Little Book of Commodity Investing” is structured as a comprehensive guide that moves from foundational concepts to sector-specific strategies, culminating in a blueprint for building a resilient, diversified commodity portfolio. Each chapter focuses on a different aspect of commodity investing, blending macroeconomic analysis, historical perspective, and actionable advice. Stephenson’s approach is to demystify the asset class, break down its unique risks, and provide readers with the tools to succeed in a volatile market.

The book’s organization allows readers to progress logically from understanding why commodities matter, to how to access them, to the intricacies of specific sectors—energy, precious metals, industrial metals, agriculture, and bulk commodities. Each chapter is packed with real-world examples, market data, and case studies, ensuring that readers can translate theory into practice. Below, we provide an in-depth analysis of each major chapter, highlighting key lessons, practical applications, and historical context.

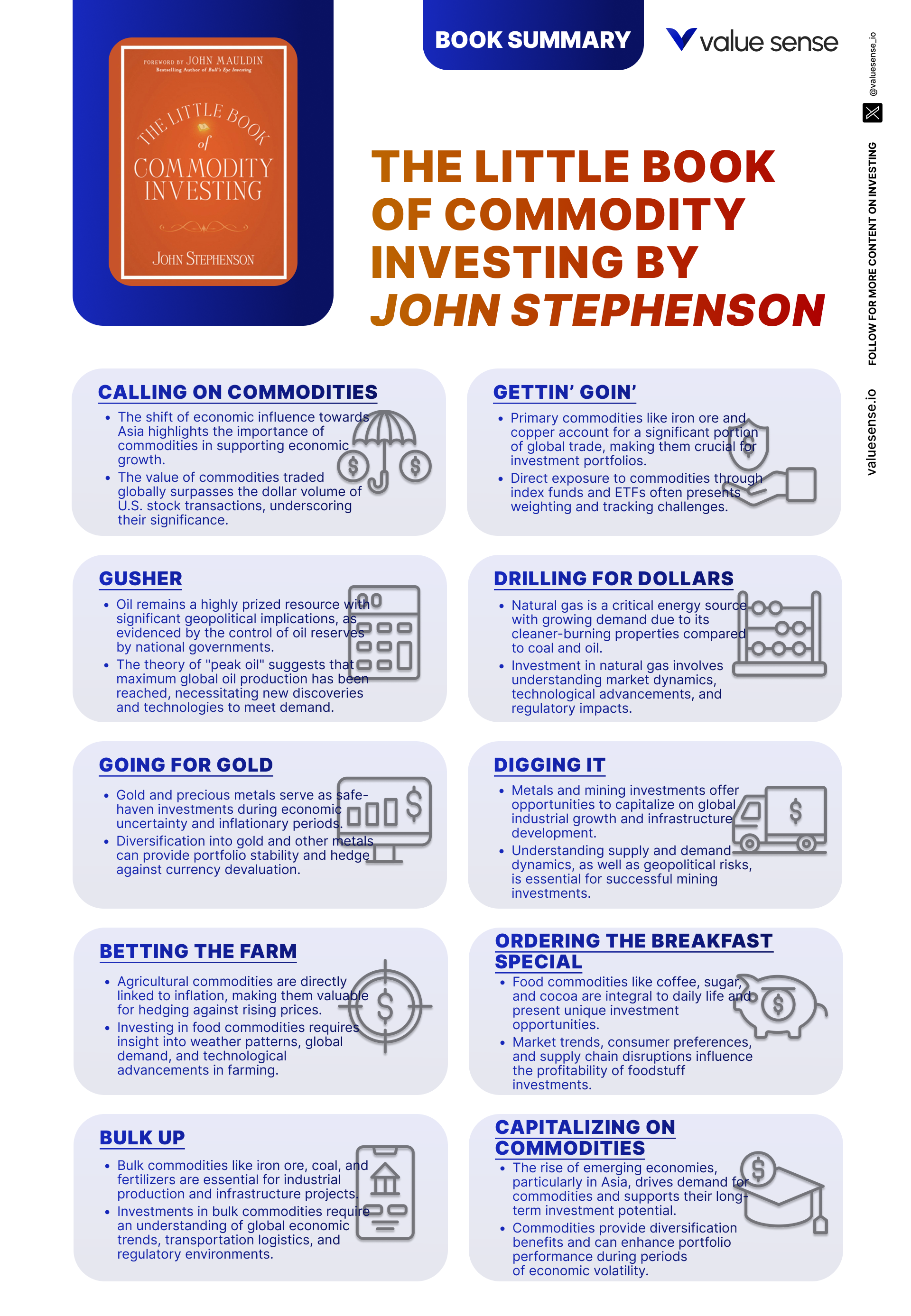

Chapter 1: Calling on Commodities: Why Commodity Investing Is a Savvy Bet

The opening chapter lays the foundation for Stephenson’s core thesis: commodities are not just peripheral assets, but central to economic growth and portfolio construction. He begins by describing the global economic shift toward emerging markets, with China and India as prime examples. By 2010, China accounted for more than 40% of global copper demand and over half of global steel consumption—a seismic change from just a decade earlier. Stephenson references how infrastructure booms, urbanization, and rising middle classes in Asia have triggered a “supercycle” in commodity demand, fundamentally altering global markets.

Stephenson provides concrete data to underscore his points. For instance, he notes that global oil consumption increased from 77 million barrels per day in 2000 to over 90 million by 2014, largely driven by emerging economies. He also highlights how commodity prices surged during the 2000s, with gold rising from $275 an ounce in 2000 to over $1,200 by 2010, and copper quadrupling in price over the same period. These examples illustrate commodities’ capacity for outsized returns during periods of robust demand growth.

The chapter emphasizes the inflation-hedging power of commodities. Stephenson explains that when inflation accelerates, the prices of physical goods—oil, wheat, metals—tend to rise, preserving investors’ purchasing power. He cites the 1970s oil crisis as a historical example, when commodities outperformed stocks and bonds. Investors can apply this lesson by ensuring that a portion of their portfolio is allocated to commodities, particularly during inflationary cycles or periods of currency debasement.

Historically, commodities have also served as a diversification tool. Stephenson points out that during the 2008 financial crisis, commodities initially fell with other asset classes but rebounded more quickly, as stimulus measures reignited demand for physical goods. He argues that a well-diversified portfolio including commodities can reduce overall volatility and enhance long-term returns. The chapter closes by urging investors to recognize the secular trends—urbanization, industrialization, and population growth—that will continue to drive commodity demand for decades to come.

Chapter 2: Gettin’ Goin’: Companies or Commodities?

In the second chapter, Stephenson explores the various avenues for gaining commodity exposure, contrasting direct investments—such as futures contracts—with indirect investments in commodity-producing companies or related ETFs. He explains that while futures offer pure exposure to price movements, they are complex instruments that require expertise and involve significant leverage. For example, a single crude oil futures contract controls 1,000 barrels of oil, meaning small price moves can lead to large gains or losses. Stephenson warns that inexperienced investors can be wiped out by margin calls if they don’t manage risk rigorously.

The chapter also covers the indirect route: investing in companies involved in commodity production, such as mining giants BHP Group or oil majors like ExxonMobil. These stocks provide leveraged exposure to rising commodity prices, as company profits typically rise faster than the underlying commodity. However, Stephenson notes that company-specific risks—management decisions, cost overruns, geopolitical exposure—can also affect returns. He provides examples of both spectacular successes and failures in the mining and energy sectors, emphasizing the need for careful analysis.

Stephenson introduces commodity indices and ETFs as accessible alternatives for most investors. He explains that while ETFs like SPDR Gold Shares (GLD) or United States Oil Fund (USO) track commodity prices, they may not always perfectly mirror spot prices due to factors like contango and roll costs. He cautions investors to research the structure and fees of these products before investing, and to use them as part of a broader, diversified strategy rather than as a one-way bet on a single commodity.

The chapter concludes with practical guidance on choosing the right approach based on risk tolerance, expertise, and investment goals. Stephenson recommends that beginners start with ETFs or commodity-producing stocks, while more advanced investors can experiment with futures once they understand the mechanics. He stresses the importance of managing leverage and using position sizing to control risk, and suggests a blended approach—combining direct and indirect exposure—to optimize returns and reduce volatility.

Chapter 3: Gusher: Investing in Oil

This chapter delves into the oil industry, which Stephenson describes as “the world’s most important commodity.” He details oil’s centrality to transportation, industry, and energy production, and explains how oil prices ripple through the global economy. Stephenson uses the example of the 2008 oil price spike—when crude surged to $147 per barrel—to illustrate how supply disruptions or geopolitical tensions can trigger dramatic price swings. He also discusses the subsequent collapse to $40 per barrel during the financial crisis, highlighting oil’s volatility and the opportunities and risks it presents.

Stephenson explores the concept of “peak oil”—the idea that global oil production will eventually reach a maximum and then decline, leading to higher prices. He notes that while new technologies like fracking have delayed peak oil, the underlying issue of finite reserves remains. The chapter includes data on declining production rates in mature fields, rising extraction costs, and the growing importance of unconventional sources like shale and deepwater drilling. Stephenson argues that these dynamics create long-term investment opportunities, especially as demand from emerging markets continues to grow.

The author emphasizes the geopolitical risks associated with oil investing. He cites the example of Middle Eastern conflicts, OPEC production decisions, and sanctions on countries like Iran and Venezuela, all of which can disrupt supply and cause price spikes. Stephenson advises investors to monitor geopolitical developments closely and to diversify their oil exposure across regions and companies to mitigate these risks. He also discusses the role of national oil companies and the trend toward resource nationalism, which can affect investment returns.

For practical application, Stephenson recommends a mix of investment vehicles: direct oil futures for experienced traders, oil ETFs for broad exposure, and energy stocks for leveraged upside. He highlights companies like ExxonMobil, Chevron, and Royal Dutch Shell as examples of firms with global operations and diversified asset bases. The chapter closes with a reminder that oil’s volatility can be both a risk and an opportunity, and that disciplined risk management is essential for success in this sector.

Chapter 4: Drilling for Dollars: Profiting from Natural Gas

Chapter four shifts focus to natural gas, which Stephenson describes as “the fuel of the future” due to its cleaner-burning properties and growing role in global energy markets. He explains that natural gas demand is rising rapidly, especially in the U.S., China, and Europe, as countries seek to reduce carbon emissions and transition away from coal and oil. The chapter provides data on global natural gas consumption, which increased by over 30% between 2000 and 2015, and highlights the impact of technological advances like hydraulic fracturing (“fracking”) and horizontal drilling.

Stephenson details how these extraction technologies have unlocked vast new reserves, particularly in North America, transforming the U.S. into a leading natural gas producer and exporter. He discusses the implications for global energy markets, including the rise of liquefied natural gas (LNG) trade and the increasing integration of regional gas markets. The chapter also covers the volatility of natural gas prices, which are influenced by factors such as weather patterns, storage levels, and geopolitical events. For example, cold winters can cause price spikes as heating demand surges, while mild weather can lead to oversupply and price declines.

The author highlights the risks associated with natural gas investing, including regulatory scrutiny over environmental impacts, particularly related to fracking and methane emissions. He advises investors to stay informed about regulatory developments and to consider the long-term sustainability of gas producers’ business models. Stephenson also discusses the cyclical nature of natural gas markets, noting that prices can swing dramatically in response to supply-demand imbalances.

For investors, Stephenson recommends a diversified approach. He suggests using ETFs like the United States Natural Gas Fund (UNG) for broad exposure, investing in leading gas producers such as Chesapeake Energy or EQT Corporation, and considering LNG infrastructure companies. He emphasizes the importance of understanding the underlying drivers of natural gas prices and of managing position sizes to account for volatility. The chapter’s key takeaway is that natural gas offers significant growth potential, but requires careful analysis and risk management.

Chapter 5: Going for Gold: Prospering with Gold and Precious Metals

This chapter explores the enduring appeal of gold and other precious metals as stores of value and hedges against economic instability. Stephenson begins by recounting gold’s historical role as money and its performance during crises, such as the 2008 financial meltdown when gold prices soared as investors sought safe havens. He cites data showing that gold outperformed the S&P 500 during the 2000–2010 decade, delivering annualized returns of over 15% compared to the stock market’s flat performance.

Stephenson discusses the various ways to invest in gold: physical bullion, gold ETFs, mining stocks, and futures contracts. He explains the pros and cons of each approach, noting that physical gold offers security but incurs storage and insurance costs, while ETFs like GLD provide liquidity and ease of trading. Mining stocks, such as Barrick Gold and Newmont Corporation, offer leveraged exposure to rising gold prices but are subject to company-specific risks. Futures contracts allow for pure price exposure but require expertise and carry significant leverage risk.

The chapter also addresses the market dynamics that drive gold prices, including central bank policies, inflation expectations, and geopolitical tensions. Stephenson points out that gold often moves independently of other asset classes, making it a valuable diversification tool. He provides examples of how gold prices have responded to events like the European debt crisis, U.S. dollar fluctuations, and changes in real interest rates.

For practical application, Stephenson recommends including gold and precious metals as a core component of a diversified portfolio, especially during periods of heightened uncertainty or inflation. He suggests allocating 5-10% of total assets to gold, using a mix of physical holdings, ETFs, and mining stocks. The chapter concludes with a reminder that while gold can provide stability, it should be balanced with other assets to optimize risk-adjusted returns.

---

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

---

Chapter 6: Digging It: Making Metals and Mines Work for You

Stephenson turns his attention to industrial metals—copper, aluminum, iron ore—which are vital for infrastructure and technological advancement. He explains that demand for these metals is closely tied to global economic growth, particularly in emerging markets undergoing rapid urbanization. The chapter provides data on copper’s role in electrical wiring, aluminum’s use in transportation and packaging, and iron ore’s centrality to steel production, highlighting how these commodities underpin modern economies.

The author discusses the investment vehicles available for industrial metals exposure: mining company stocks, sector-specific ETFs, and futures contracts. He notes that mining giants like Rio Tinto and Vale are leveraged plays on rising metal prices, but their shares can be volatile due to operational risks, regulatory changes, and commodity price swings. ETFs tracking metal indices offer diversification, while futures contracts provide direct price exposure but require expertise and risk management.

Stephenson emphasizes the cyclical nature of industrial metals, with prices often rising during economic expansions and falling during recessions. He provides examples of the 2000s commodity boom, when copper prices quadrupled as China’s infrastructure spending surged, and the subsequent bust during the 2008 crisis. The chapter also covers supply-side risks, such as labor strikes, environmental regulations, and technological disruptions that can affect production and prices.

For investors, Stephenson recommends monitoring global economic indicators—such as infrastructure spending, manufacturing activity, and technological trends—to anticipate shifts in metal demand. He advises diversifying across multiple metals and companies, using ETFs for broad exposure, and timing entries and exits based on macroeconomic signals. The chapter’s key lesson is that industrial metals offer significant upside in growth cycles, but require careful analysis and timing to manage volatility.

Chapter 7: Betting the Farm: Bingeing on Food Inflation

This chapter examines the agricultural sector, focusing on food commodities like corn, soybeans, and livestock. Stephenson highlights the factors driving food inflation: population growth, rising incomes in emerging markets, and climate change impacts on agriculture. He provides data showing that global food demand is projected to increase by 70% by 2050, with shifting dietary habits in Asia and Africa fueling demand for grains and proteins.

Stephenson discusses the investment opportunities in agriculture, including direct commodity investments, agricultural ETFs, and stocks of food production companies like Archer Daniels Midland and Bunge Limited. He explains that agricultural prices are highly volatile, influenced by weather events (droughts, floods), disease outbreaks, and government policies such as subsidies and trade restrictions. The chapter provides examples of how weather-related crop failures have triggered price spikes, as seen in the 2012 U.S. drought.

The author emphasizes the risks of agricultural investing, including unpredictable weather, regulatory changes, and the cyclical nature of farm incomes. He advises investors to diversify within the agricultural sector, using a mix of commodities, ETFs, and company stocks to spread risk. Stephenson also highlights the role of technological innovation—such as precision agriculture and genetically modified crops—in improving yields and mitigating some risks.

For practical application, Stephenson recommends monitoring global food trends, staying informed about weather forecasts and policy developments, and using agricultural ETFs for diversified exposure. He suggests allocating a portion of the portfolio to agriculture as a hedge against food inflation and as a play on long-term demographic trends. The chapter’s key takeaway is that agriculture offers both defensive and growth opportunities, but requires vigilance and diversification to manage its unique risks.

Chapter 8: Ordering the Breakfast Special: Finding Profits in Foodstuffs

Building on the previous chapter, Stephenson zooms in on specific foodstuffs—coffee, sugar, cocoa—that are integral to the global food supply chain. He explains that these commodities are subject to unique price drivers, including weather patterns (El Niño, droughts), geopolitical events (trade embargoes, civil unrest), and shifts in consumer preferences (rising demand for specialty coffee or organic chocolate).

The chapter provides detailed examples of price volatility in these markets. For instance, coffee prices doubled in 2014 due to a severe drought in Brazil, the world’s largest producer. Similarly, sugar prices have swung dramatically in response to changes in Indian export policies and fluctuations in global inventory levels. Stephenson highlights how investors can profit from such volatility by staying informed about supply chain dynamics and anticipating market-moving events.

Stephenson discusses the investment vehicles available for foodstuffs: futures contracts for direct exposure, ETFs like iPath Bloomberg Coffee Subindex Total Return ETN (JO) for diversified access, and stocks of companies involved in production and distribution, such as Starbucks or Hershey. He emphasizes the importance of understanding the entire value chain—from farm to consumer—to identify investment opportunities and risks.

For investors, Stephenson recommends a multifaceted approach: use futures or ETFs for targeted bets on specific commodities, and consider company stocks for broader, more stable exposure. He advises monitoring weather forecasts, crop reports, and trade policies, and suggests that investors allocate a small portion of their portfolio to foodstuffs to capture upside while managing volatility. The chapter’s key message is that informed, agile investors can profit from the dynamic and often unpredictable world of food commodities.

Chapter 9: Gaining in Grains: Investing in Grains

This chapter zeroes in on grain commodities—wheat, corn, soybeans—which are staples of the global food supply and subject to intense price volatility. Stephenson explains that grain prices are driven by a combination of weather conditions, global demand, and government policies. He provides data showing how droughts, floods, and pest infestations can cause sudden supply shortages, leading to price spikes, as seen in the 2007–2008 food crisis.

Stephenson discusses the various investment vehicles for grains: futures contracts for direct exposure, ETFs like Teucrium Corn Fund (CORN) or Teucrium Wheat Fund (WEAT) for diversified access, and stocks of agribusiness companies involved in grain production, processing, and distribution. He explains that each vehicle has different risk and reward profiles, and that investors should choose based on their objectives and risk tolerance.

The author emphasizes the importance of timing and market analysis in grain investing. He advises monitoring planting and harvest reports, weather forecasts, and global inventory levels to anticipate price movements. Stephenson also highlights the role of government policies—such as ethanol mandates or export restrictions—in shaping grain markets. He provides examples of how policy changes in the U.S., China, or Brazil have affected global grain prices.

For practical application, Stephenson recommends conducting thorough market analysis, staying informed about global agricultural trends, and diversifying across multiple grains and investment vehicles. He suggests that investors allocate a portion of their portfolio to grains as both a defensive play and a source of potential upside during periods of supply disruption or rising demand. The chapter’s key lesson is that success in grain investing requires vigilance, research, and a flexible approach to changing market conditions.

Chapter 10: Bulk Up: Benefitting from Bulk Commodities

Stephenson’s analysis of bulk commodities—coal, iron ore, steel—centers on their essential role in industrial production and infrastructure development. He explains that demand for these commodities is driven by urbanization, economic growth, and technological advancements, particularly in emerging markets. The chapter provides data showing that global steel production doubled between 2000 and 2015, with China accounting for more than half of that growth.

The author discusses the investment opportunities in bulk commodities, including direct investments, ETFs like VanEck Vectors Steel ETF (SLX), and stocks of companies involved in production and distribution, such as ArcelorMittal and Vale. He explains that each option has a different risk profile, with direct investments offering pure price exposure but higher volatility, while company stocks provide leveraged upside but add operational and management risks.

Stephenson emphasizes the risks associated with bulk commodity investing, including price volatility due to supply-demand imbalances, geopolitical events, and regulatory changes. He provides examples of how environmental regulations—such as China’s efforts to reduce coal consumption—can impact production and profitability. The chapter also covers the impact of technological innovation, such as advances in steelmaking or alternative materials, on demand for bulk commodities.

For investors, Stephenson recommends a diversified approach, combining direct and indirect exposure across multiple commodities and companies. He advises monitoring global economic indicators, regulatory developments, and technological trends to anticipate shifts in demand and supply. The chapter’s key takeaway is that bulk commodities offer significant upside during periods of economic expansion, but require careful analysis and risk management to navigate their inherent volatility.

Chapter 11: Capitalizing on Commodities: Why Commodities Are Happening

The final chapter synthesizes the book’s key themes, making a compelling case for commodities as a core component of diversified portfolios. Stephenson summarizes the long-term trends—population growth, urbanization, technological advancement—that are driving sustained demand for resources. He argues that commodities are uniquely positioned to benefit from these macro forces, providing both growth potential and protection against inflation and market volatility.

Stephenson revisits the role of commodities as a hedge against inflation, citing historical data showing that commodity prices typically rise during periods of economic instability. He provides examples from the 1970s and 2000s when commodities outperformed traditional asset classes, preserving investors’ wealth during turbulent times. The chapter also highlights the diversification benefits of commodities, which often move independently of stocks and bonds.

The author offers practical guidance on building a commodity portfolio, recommending a mix of direct investments, ETFs, and commodity-related stocks tailored to individual financial goals and risk tolerance. He advises periodic rebalancing and ongoing research to adapt to changing market conditions. Stephenson provides sample portfolio allocations and suggests starting with a 10-15% commodity allocation, adjusting as needed based on market outlook and personal objectives.

The chapter concludes with a call to action: investors must recognize the enduring importance of commodities and proactively incorporate them into their portfolios. Stephenson’s final message is that, with the right knowledge and discipline, commodities can be a powerful engine for growth, diversification, and risk management, positioning investors for long-term success in a rapidly changing world.

Advanced Strategies from the Book

Beyond the foundational concepts and practical strategies, Stephenson’s book offers a suite of advanced techniques for investors seeking to maximize returns and minimize risks in the commodity markets. These strategies are designed for those with a solid grasp of commodity fundamentals, a willingness to engage in deeper research, and a disciplined approach to risk management. By leveraging advanced tools and analytical frameworks, investors can capture nuanced opportunities and navigate the inherent volatility of commodities more effectively.

Stephenson emphasizes that advanced strategies require ongoing education, active monitoring of market trends, and the judicious use of leverage and derivatives. He encourages investors to blend macroeconomic analysis with sector-specific insights, and to use quantitative tools to optimize portfolio construction and risk control. The following advanced techniques, drawn from the book, can help investors achieve superior risk-adjusted returns in commodity markets.

Strategy 1: Tactical Asset Allocation Based on Macroeconomic Signals

This strategy involves adjusting commodity exposure dynamically in response to macroeconomic indicators such as inflation rates, GDP growth, interest rates, and currency movements. Stephenson explains that commodities tend to outperform during periods of rising inflation and strong global growth, while underperforming during deflationary or recessionary environments. For example, during the 2003–2008 commodity supercycle, investors who increased their commodity allocations in response to accelerating global growth captured outsized returns. Action steps include monitoring economic data releases, using leading indicators (such as the ISM Manufacturing Index), and rebalancing commodity allocations quarterly to reflect changing macro conditions.

Strategy 2: Spread Trading and Relative Value Approaches

Stephenson describes spread trading as a sophisticated technique that involves taking offsetting positions in related commodities—such as long gold/short silver or long wheat/short corn—to profit from price differentials rather than outright price moves. This approach can reduce directional risk and capitalize on temporary mispricings caused by supply disruptions, policy changes, or seasonal factors. For example, during the 2012 U.S. drought, the corn-wheat spread widened dramatically due to divergent weather impacts, offering profitable opportunities for spread traders. Stephenson recommends using futures or options to implement these trades, with strict risk controls and ongoing monitoring of fundamental drivers.

Strategy 3: Leveraging Commodity Cycles with Sector Rotation

Commodity markets are highly cyclical, with different sectors (energy, metals, agriculture) outperforming at various stages of the economic cycle. Stephenson advocates for sector rotation strategies, shifting allocations among commodity groups based on leading indicators and economic forecasts. For instance, energy commodities may lead during early-cycle recoveries, while precious metals outperform during late-cycle inflationary periods. The book provides historical examples of sector rotation, such as the outperformance of industrial metals during China’s infrastructure boom, and offers guidance on using ETFs and sector-specific funds to implement this strategy.

Strategy 4: Using Options and Structured Products for Risk Management

Options and structured products offer advanced tools for managing commodity risk and enhancing returns. Stephenson explains how investors can use call and put options to hedge downside risk or generate income through covered call strategies. For example, selling covered calls on gold mining stocks can provide additional yield during flat or moderately rising markets. The book also discusses the use of structured notes and commodity-linked bonds as ways to gain exposure with built-in risk controls. Stephenson cautions that these instruments require a solid understanding of options pricing and risk/reward trade-offs, and advises starting small and using them as complements to core holdings.

Strategy 5: Integrating ESG and Sustainability Trends in Commodity Selection

Stephenson recognizes the growing importance of environmental, social, and governance (ESG) factors in commodity investing. He suggests that investors can enhance returns and reduce risks by favoring companies and commodities aligned with sustainability trends—such as copper (critical for renewable energy infrastructure), lithium (for electric vehicles), or sustainably managed timber. The book provides examples of how regulatory changes and consumer preferences are shifting capital flows toward “green” commodities, and recommends integrating ESG analysis into commodity selection and portfolio construction for long-term success.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Implementation Guide

Translating the insights from “The Little Book of Commodity Investing” into actionable steps requires a methodical approach. Stephenson advocates for starting with a clear understanding of personal financial goals, risk tolerance, and investment horizon. He encourages investors to educate themselves on the unique characteristics of each commodity sector, experiment with small allocations, and gradually build expertise through research and disciplined practice. The implementation process should be iterative, with regular reviews and adjustments based on market conditions and personal objectives.

Stephenson also emphasizes the importance of using the right tools and resources—such as commodity ETFs, sector-specific research, and portfolio analytics platforms—to streamline decision-making and risk management. He suggests leveraging online platforms (including Value Sense) to access real-time data, screen for undervalued companies, and monitor portfolio performance. The following step-by-step guide can help investors get started and build a resilient, diversified commodity portfolio.

- First step investors should take: Assess your financial goals, risk tolerance, and time horizon. Decide what role commodities will play in your portfolio (growth, inflation hedge, diversification).

- Second step for building the strategy: Research different commodity sectors (energy, metals, agriculture), select appropriate investment vehicles (ETFs, stocks, futures), and start with small, diversified allocations.

- Third step for long-term success: Monitor macroeconomic trends, rebalance your portfolio quarterly, and continuously educate yourself on commodity market developments. Use tools like Value Sense to track performance and identify new opportunities.

Critical Analysis

“The Little Book of Commodity Investing” excels in making a complex and often intimidating asset class accessible to a broad audience. Stephenson’s clear writing, practical frameworks, and real-world examples demystify commodity markets, empowering readers to take informed action. The book’s structure—moving from foundational concepts to sector-specific strategies—ensures that readers can build knowledge systematically, while its emphasis on risk management and portfolio construction is especially valuable in today’s volatile markets.

One of the book’s strengths is its balanced perspective on the risks and rewards of commodity investing. Stephenson does not oversell the asset class; instead, he provides a nuanced view of both the opportunities (inflation hedging, diversification, secular growth) and the pitfalls (volatility, leverage, sector-specific risks). The inclusion of advanced strategies and ESG considerations adds depth and relevance, especially given the ongoing energy transition and regulatory changes shaping global resource markets.

However, the book has some limitations. Its publication date means that certain examples—such as the shale revolution or the 2000s commodity supercycle—may not fully capture the latest market developments, such as the rise of lithium and rare earths or the impact of climate policy on fossil fuels. Readers seeking detailed coverage of emerging trends like carbon credits or digital commodities may need to supplement the book with more recent research. Nonetheless, its core principles remain highly relevant, and its practical orientation makes it a timeless resource for investors navigating the ever-evolving world of commodities.

Conclusion

“The Little Book of Commodity Investing” is a comprehensive, practical, and engaging guide that equips investors with the knowledge and tools to succeed in commodity markets. Stephenson’s blend of macroeconomic insight, historical perspective, and actionable advice makes the book a valuable resource for both beginners and experienced investors. By demystifying commodities and providing clear frameworks for risk management, portfolio construction, and sector-specific strategies, the book empowers readers to capture the unique benefits of this asset class.

The key takeaways are clear: commodities are essential for diversification, inflation protection, and capturing growth from global economic trends. Stephenson’s guidance on choosing the right investment vehicles, managing leverage, and staying informed about market dynamics is both practical and actionable. For anyone seeking to enhance their portfolio’s resilience and tap into the opportunities of the 21st-century resource economy, “The Little Book of Commodity Investing” is a must-read.

--- ---

10+ Free intrinsic value tools

For investors looking to find a stock's fair value, our analytics team has you covered with intrinsic value tools:

📍 Free Intrinsic Value Calculator

📍 Reverse DCF & DCF value tools

📍 Peter Lynch Fair Value Calculator

📍 Ben Graham Fair Value Calculator

📍 Relative Value tool

...and plenty more.

🔍 Explore all these tools for free on the Value Sense platform and start discovering what your favorite stocks are really worth.

FAQ: Common Questions About The Little Book of Commodity Investing

1. Who is John Stephenson, and why is he credible in commodity investing?

John Stephenson is a veteran portfolio manager and senior vice president at First Asset Investment Management. He has decades of experience managing resource-focused investment funds and is recognized for his deep expertise in global commodity markets. His insights have been featured in major financial media, and his practical, data-driven approach underpins the credibility of his book.

2. What makes commodities different from stocks and bonds in a portfolio?

Commodities are physical assets—like oil, gold, or wheat—whose prices are driven by supply-demand dynamics, geopolitical events, and macroeconomic trends. Unlike stocks and bonds, commodities often have low or negative correlations with traditional assets, making them powerful tools for diversification and inflation protection.

3. Is commodity investing suitable for beginners?

Yes, Stephenson’s book is designed to make commodity investing accessible to beginners. He recommends starting with commodity ETFs or resource company stocks, which are easier to understand and manage than futures contracts. The book provides step-by-step guidance and practical examples to help new investors build confidence and avoid common pitfalls.

4. How much of my portfolio should be allocated to commodities?

Stephenson suggests that a 10-15% allocation to commodities can provide meaningful diversification and inflation protection. The exact percentage depends on your risk tolerance, investment goals, and market outlook. He also recommends periodic rebalancing to maintain target allocations as market conditions change.

5. What are the main risks of commodity investing?

Commodity investing carries risks such as high price volatility, leverage-related losses (especially with futures), sector-specific risks (like weather for agriculture or geopolitical events for oil), and regulatory changes. Stephenson emphasizes the importance of diversification, risk management, and ongoing research to mitigate these risks.

6. What are the best vehicles for commodity exposure?

The book covers a range of vehicles: direct futures contracts (for advanced investors), commodity ETFs, resource company stocks, and commodity indices. For most investors, Stephenson recommends ETFs and stocks as accessible, low-cost ways to gain exposure while managing complexity and risk.

7. How do commodities hedge against inflation?

Commodities tend to rise in price when inflation increases, as the cost of goods and raw materials goes up. Stephenson provides historical examples—such as the 1970s oil shocks—when commodities outperformed other asset classes and preserved purchasing power during inflationary periods.

8. How can I stay informed about commodity market trends?

Stephenson advises monitoring macroeconomic indicators (like GDP growth and inflation), sector-specific news (such as OPEC meetings or crop reports), and technological or regulatory developments. He recommends using financial news services, commodity analytics platforms, and tools like Value Sense to track trends and identify opportunities.

9. Are there ESG or sustainability considerations in commodity investing?

Yes, Stephenson highlights the growing importance of ESG factors. Investors can focus on commodities and companies aligned with sustainability trends—such as copper for renewable energy or lithium for electric vehicles. ESG analysis can help identify long-term winners and reduce regulatory or reputational risks in commodity portfolios.

10. Can I apply the book’s strategies in today’s market environment?

Absolutely. While some examples date from earlier market cycles, the book’s core principles—diversification, inflation hedging, risk management, and sector analysis—remain highly relevant. Stephenson’s frameworks can be adapted to current trends, such as the energy transition, supply chain disruptions, and the rise of new commodity markets like lithium and rare earths.